In 2025, the feast of traditional financial markets and the harshness of the crypto winter sketch an unprecedented picture of capital migration—crypto players are collectively turning their attention to the revitalized US and Hong Kong stock markets.

The road seems open, but in reality, there are numerous obstacles: cumbersome account opening processes, complex paths for converting cryptocurrencies to fiat, and hidden regulatory "pits"… Who can build a bridge that is both compliant and smooth for this group of "new immigrants" carrying digital assets and eager to enter the vast world of traditional finance?

The market's answer points to a disruptor that redefines the rules from a unique perspective—Zhuorui Securities. It has keenly captured the core pain points in this historic turning point and has taken the lead in constructing a seamless "cross-border" infrastructure, quietly becoming the preferred channel and trusted hub for crypto funds flowing into the Hong Kong and US stock markets.

This is not just a business story of a brokerage; it is the beginning of a profound narrative about how financial paradigms merge and how a new generation of investors is empowered.

Hong Kong and US Stocks Continue to Heat Up, Crypto Investors Flood In

In 2025, the global traditional financial market continues its strong performance, with both the US and Hong Kong stock markets becoming popular targets for investors.

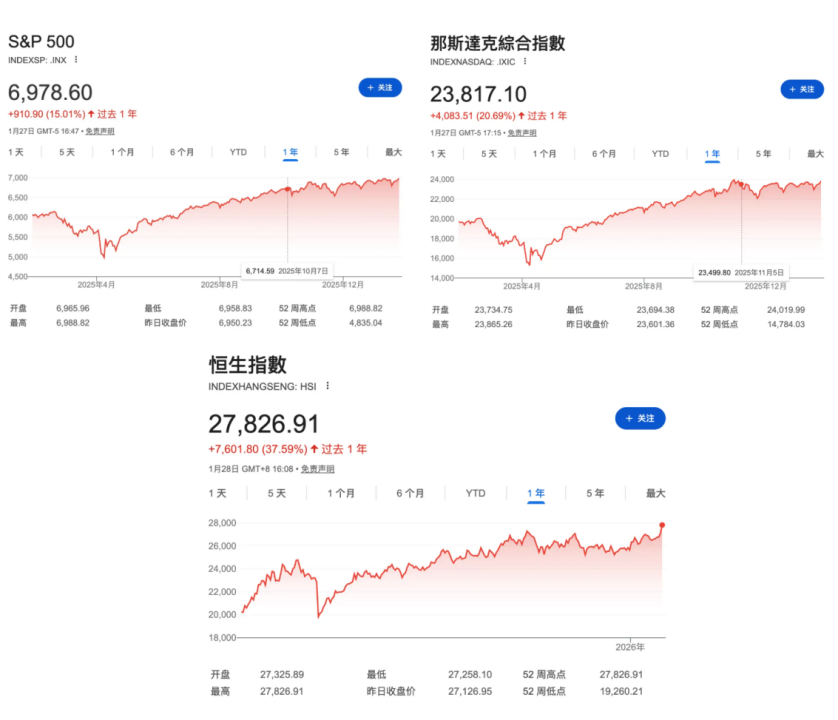

The S&P 500 index rose 17.9% for the year, while the Nasdaq index set multiple historical highs, with an annual increase of over 20%; the Hong Kong stock market also performed well, with the Hang Seng Index rising nearly 30%, revitalizing its status as an international financial center.

In stark contrast to the vibrant traditional financial markets, the cryptocurrency market has undergone deep adjustments over the past year. Bitcoin has significantly retreated from its historical high of $126,000, while many altcoins have halved, with countless others experiencing declines of 90%. The uncertainty of the regulatory environment, the withdrawal of institutional funds, and the depletion of market liquidity have led once-enthusiastic crypto investors to reassess their portfolios.

Against this backdrop, an interesting phenomenon has begun to emerge: more and more crypto investors are turning their attention to traditional financial markets. Crypto KOLs (Key Opinion Leaders) who once focused on various Web3 projects are now recommending IPOs in Hong Kong and trading in US stocks.

Notable crypto KOL "Chuanmu" achieved millions of dollars in profits in July 2025 by trading US stocks Sharplink Gaming (NASDAQ: SBET) and Circle (NYSE: CRCL). Many KOLs have also shared their success in participating in Hong Kong stock IPOs, with returns far exceeding those of crypto investments during the same period.

The highly liberalized crypto market is shifting towards the mature and complex regulatory environments of the Hong Kong and US stock markets, and crypto investors are experiencing a challenging ecological leap. The first hurdle is the entry threshold: opening accounts in the Hong Kong and US markets requires detailed identity and asset verification, along with complex tax declarations, which starkly contrasts with the crypto users' habit of "one wallet to rule them all."

Next is the challenge of fund conversion. Crypto assets are often held in the form of Bitcoin, Ethereum, and stablecoins, and entering traditional markets requires first converting them to fiat currency, then depositing through bank channels. This process not only incurs exchange rate losses and fees but may also be hindered by banks' scrutiny of crypto funds, with users even being asked to provide proof of the source of funds.

Moreover, the rules of traditional financial markets are complex and diverse, with cognitive barriers existing from trading mechanisms to derivative instruments. Some unscrupulous brokerages profit through hidden fees and false advertising, leaving investors vulnerable.

Therefore, choosing a compliant, safe, and easy-to-operate brokerage has become key for crypto investors entering traditional markets. Against this backdrop, Zhuorui Securities, with its positioning and service model, is becoming an important bridge connecting the crypto world and traditional finance, and is the preferred bridge for crypto users entering traditional financial markets.

Crypto-Friendly: Zhuorui Securities Defines a New Standard for Hong Kong Crypto Brokerages

In August 2025, the Bitcoin Asia 2025 conference was successfully held in Hong Kong, gathering over 15,000 participants from around the world. Notably, Zhuorui Securities was the only invited Hong Kong brokerage at the conference, sharing the stage with global industry leaders, highlighting its unique position.

Zhuorui Securities stands out due to its extremely user-friendly service system for crypto users, specifically reflected in the following dimensions:

(1) User Friendliness: Simplifying the Experience to the Extreme

Compared to traditional brokerages that often require dozens of pages of account opening documents, Zhuorui Securities has optimized its account opening process. Users only need to submit basic identity information and a risk assessment questionnaire online through a mobile app, with account activation completed in as little as 24 hours. This "one-click account opening" experience is particularly appealing to users accustomed to the instant usability of crypto wallets.

Zhuorui Securities' self-developed one-stop digital financial service platform "ZR" takes product usability to the extreme. Whether checking Hong Kong stock market trends, participating in US stock trading, or purchasing virtual assets, everything can be done on one platform, significantly reducing users' learning and operational costs. The platform also integrates market data, financial news, and community interaction, making investment not just a cold numerical game, but a warm social experience.

(2) Deposit and Withdrawal Friendliness: Unblocking the Flow of Funds

Zhuorui Securities' most revolutionary innovation is its "deposit crypto to enter" model. Users can directly deposit cryptocurrencies (such as BTC, ETH, and mainstream US dollar stablecoins) into the platform to participate in various investments like Hong Kong IPOs, A-shares, US stocks, and money market funds, completely overturning the traditional lengthy process of "cryptocurrency → fiat currency → bank → brokerage," saving a significant amount of intermediary steps and costs.

More importantly, the platform has built a complete closed loop for fund flow: after users deposit fiat or crypto, it is directly converted into digital currency for withdrawal to personal wallets for on-chain transactions, truly achieving the convenience of "one account, investing in global stocks and currencies."

Since officially starting operations in April 2025, Zhuorui Securities has seen explosive growth in user numbers. This is attributed to its unique advantages following the upgrade of its license—very few brokerages in the market support direct purchases of cryptocurrencies within the app, especially those that support the "crypto in, crypto out" model, giving it a significant first-mover advantage. Since starting operations in April 2025, Zhuorui Securities has experienced a tenfold increase in user numbers within just a few months.

(3) Service Friendliness: Redefining the Warmth of Financial Services

Zhuorui Securities focuses on serving high-net-worth clients, providing care throughout the entire lifecycle. For example, it innovatively offers investment immigration solutions using virtual assets as proof of assets for clients with immigration needs, simplifying the traditional asset proof process.

In customer service, the platform utilizes AI and big data analysis to proactively identify potential issues for clients, providing early risk alerts and operational guidance, achieving a shift from "passive response" to "active companionship." Additionally, driven by technology and economies of scale, Zhuorui Securities is committed to providing the best trading costs in the market, helping frequent traders significantly reduce fees.

(4) Security Assurance: Compliance Licenses Build the Foundation of Trust

In the rapidly changing financial market, security remains the core concern for investors. Zhuorui Securities understands this well and has made compliance and security its foundation.

The clear regulatory framework in Hong Kong is not a constraint for Zhuorui Securities but an opportunity. As a licensed corporation regulated by the Hong Kong Securities and Futures Commission (Central Number: BRE865), Zhuorui Securities holds licenses for regulated activities in categories 1/2/4/5/9. This licensing system forms the core competitiveness for expanding institutional business. For crypto users, the significance of the Type 1 license (securities trading) and Type 4 license (providing advice on securities) is substantial. For investors transitioning from the crypto market to traditional finance, they need professional and compliant investment advice to mitigate risks and seize opportunities.

This comprehensive licensing coverage not only provides legal protection for users but, more importantly, establishes a foundation of trust. In an investment environment filled with uncertainty, regulatory transparency and predictability become scarce resources, and Zhuorui Securities stands out in a competitive market thanks to this regulatory advantage.

Building the Future: How Zhuorui Securities Defines a New Ecology for Hong Kong Crypto Finance

Having established a new standard for crypto-friendly brokerages, Zhuorui Securities' strategic vision has long surpassed the role of a mere trading service provider. Its true ambition is to become the core hub connecting traditional finance and the crypto world, building critical infrastructure for the Web3 financial ecosystem in Hong Kong and across Asia.

In the global competition for Web3 financial centers, Singapore is actively vying for market share with its flexible regulatory policies and favorable business environment, while Dubai is leveraging its zero-tax policy and government support. However, Hong Kong's unique advantage lies in having a safe, friendly, and efficient compliant entry point, a core soft power that is difficult for other competitors to replicate.

As an important shaper and representative of this compliant entry point, Zhuorui Securities' service experience directly impacts global investors' overall evaluation and confidence in Hong Kong's crypto financial environment. By providing transparent, professional, and efficient services, Zhuorui Securities not only secures its market position but also establishes a good market reputation for the entire Web3 financial ecosystem in Hong Kong.

Zhuorui Securities' successful practices set a benchmark for the entire financial industry in the integrated development of "traditional finance + crypto assets." This demonstration effect has begun to attract more talent, capital, and innovative projects to converge in Hong Kong, forming a healthy ecological cluster effect, thereby enhancing Hong Kong's overall competitiveness as an international financial center.

In terms of international cooperation, Zhuorui Securities has established strategic partnerships with several globally renowned financial institutions. By participating in international conferences like Bitcoin Asia, Zhuorui Securities not only showcases the innovative strength of Hong Kong's Web3 finance but also lays the groundwork for establishing an international cooperation network. This "going out" strategy helps to export Hong Kong's Web3 financial services to the global market, enhancing Hong Kong's international influence.

Conclusion: More Than Just a Brokerage, But a Financial Infrastructure for the New Era

Zhuorui Securities' professional position in the industry has been widely recognized by authoritative institutions, having won multiple important awards, including the "Outstanding Sci-Tech Financial Golden Hazelnut Award" (awarded by Caixin), "Best Performance in Wealth Management Award" (awarded by Zhitong Finance and Jiuku Finance, Hong Kong Chinese Securities Association), "Best Performance in Financial Technology Award" (awarded by Zhitong Finance and Jiuku Finance, Hong Kong Chinese Securities Association), and "Outstanding Securities Trading Service Brand" (awarded by New Town Finance Radio's "Hong Kong Enterprise Leader Brand 2024").

These awards not only recognize Zhuorui Securities' outstanding performance in the past but also affirm its contributions to the development of Hong Kong's Web3 financial ecosystem.

Looking ahead, as the global regulatory environment becomes clearer and traditional financial institutions increasingly accept digital assets, the "integration of stocks and currencies" will undoubtedly become the mainstream trend in the financial industry. At this historic turning point, Zhuorui Securities has already secured a favorable strategic position.

In this new era filled with opportunities and challenges, let us witness the future of financial services together and create a better investment experience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。