Original Title: Crypto Winter Started in January 2025

Original Author: @Matt_Hougan

Translated by: Peggy, BlockBeats

Editor's Note: Amid a backdrop of positive news yet continuously declining prices, Bitwise Chief Investment Officer (CIO) Matt Hougan points out that this is not a normal pullback in a bull market, but rather a crypto winter that began as early as January 2025, and was temporarily masked by institutional funds.

Bitwise is one of the largest cryptocurrency index fund providers in the world, managing assets exceeding $3 billion. Hougan previously served as CEO of ETF.com and Inside ETFs, and is one of the main architects of the institutional ETF classification and rating system.

Through comparisons of different asset performances, the article further reveals that institutional investability is determining who can survive the winter, while the market dominated by retail investors has, in fact, already fallen into a deep bear market. Historical experience shows that crypto winters often end in exhaustion rather than reversing in excitement. When pessimism becomes the mainstream narrative, the turning point of the cycle is often not far away.

The following is the original text:

We have actually been in a crypto winter since January 2025. Likely, we are now closer to the end than to the beginning.

This is a thorough crypto winter.

Crypto Twitter has only recently begun to realize this, but the facts are clear: Bitcoin has dropped 39% from its historical high in October 2025, Ethereum has fallen 53%, and many other crypto assets have suffered even more severe declines.

This is not a so-called "bull market pullback," nor is it a "temporary retracement." This is a full-blown crypto winter, comparable to that of 2022—a survival state akin to Leonardo's in "The Revenant." It has been triggered by multiple factors: excessive leverage, large-scale profit-taking by early holders (OGs), and so on.

Truly recognizing and accepting this makes the thought process exceptionally clear.

Why, in the context of continuous positive developments in adoption, regulation, and various advancements, are crypto asset prices still falling?

Because we are deep in a crypto winter.

Why, with a new Federal Reserve chair who is a Bitcoin supporter, is the crypto market's "Fear and Greed Index" still close to the historically high fear zone?

Because we are in a crypto winter.

If you have experienced previous winters, whether in 2018 or 2022, you surely remember that during the deepest parts of winter, positive news is useless. Even if Wall Street is aggressively hiring and Morgan Stanley is accelerating its crypto business layout, the market will not rebound because of this. These factors are certainly important in the long term, but not right now.

Crypto winters do not end in excitement; they end in complete exhaustion.

So, when will the end come?

The good news is: it is closer than you think.

History of Crypto Winters

Historically, crypto winters typically last about 13 months. For example, Bitcoin peaked in December 2017 and bottomed out in December 2018; it peaked again in October 2021 and bottomed out in November 2022.

At this pace, the road ahead still seems tough. After all, Bitcoin peaked in October 2025. Should we expect to disappear until next November?

I do not think so.

The more I analyze this round of "winter," the more I realize that it actually began back in January 2025. We just did not notice it at the time—because the inflow of ETF funds and the allocation behavior of Digital Asset Trusts (DAT) masked the true market conditions.

ETF and DAT Fund Flows Masked the Winter of 2025

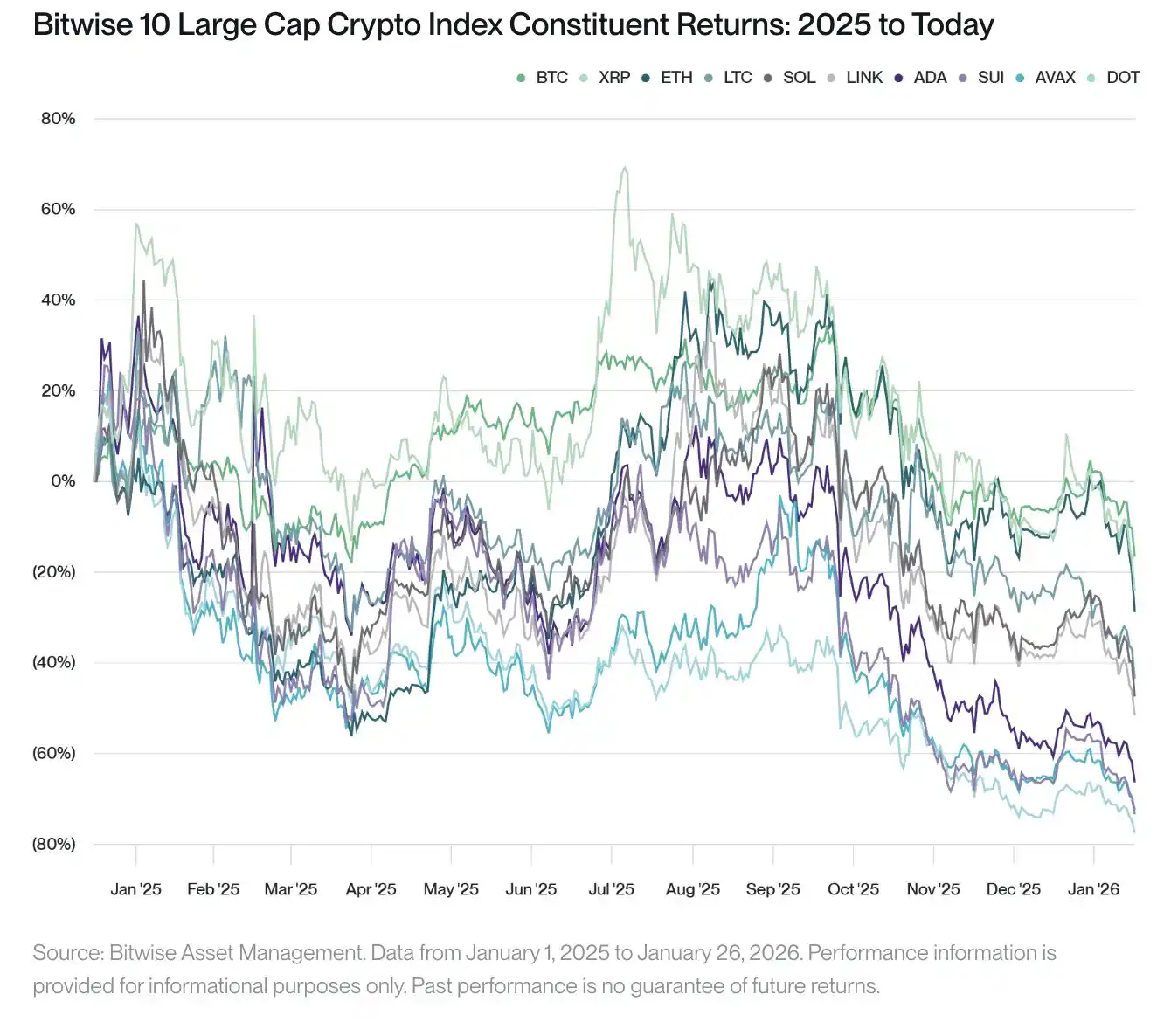

Take a close look at this chart: it shows the performance of the Bitwise 10 Large Cap Crypto Index's constituent assets since January 1, 2025.

It can be clearly divided into three groups of assets.

The first group of assets (BTC, ETH, XRP) performed relatively well, with declines between 10.3% and 19.9%.

The second group of assets (SOL, LTC, LINK) experienced a standard bear market, dropping 36.9% to 46.2%.

The third group of assets (ADA, AVAX, SUI, DOT) suffered a "massacre" decline, with drops as high as 61.9% to 74.7%.

The core factor distinguishing these three groups of assets is essentially one: whether institutions can invest in them.

The first group of assets benefited throughout the year from massive ETF/DAT support (XRP also benefited from winning its lawsuit against the SEC); the second group only received ETF approval in 2025; while the third group has never had such channels.

Just look at the third group—you can see that they rely entirely on support from crypto-native funds.

The institutional support received by the first group of assets is historically significant. For example, during the time period shown in this chart, ETFs and DATs collectively purchased 744,417 Bitcoins, worth about $7.5 billion. Imagine, without this $7.5 billion support, where would Bitcoin have fallen? My judgment is: it could have dropped by about 60%.

Since January 2025, the retail-dominated crypto market has been in a brutal winter. It was just that institutional funds temporarily "beautified" this reality for certain assets.

The darkest hour is just before dawn

One thing to remember right now is that there is indeed a lot of positive news in the crypto industry.

Regulatory progress is real; institutional adoption is real; stablecoins and asset tokenization are real; Wall Street's acceptance is also real.

In a bear market, positive news gets ignored, but it does not disappear; rather, it is stored as potential energy. Once the gloom dissipates and sentiment returns to normal, this accumulated energy often releases in a powerful way.

So, what might cause the clouds to clear?

Strong economic growth triggering a radical risk appetite rebound; positive policy surprises from the Clarity Act; signs of sovereign nations adopting Bitcoin; or simply the passage of time itself.

As a veteran who has experienced multiple crypto winters, I can tell you: the feeling before a winter ends often feels like it does now—despair, powerlessness, and a general sense of fatigue. But this market correction has not changed any fundamental facts about the crypto industry.

I believe the rebound will come sooner than most expect. After all, it has been winter since January 2025—spring cannot be too far away.

Risk Warning and Important Disclaimer

Not investment advice; there is a risk of loss: Before making any investment decisions, every investor should conduct their own independent review and research, comprehensively assess the returns and risks of the investment, and make investment decisions based on these reviews and research results (including determining whether the investment is suitable for their own situation).

Cryptographic assets are a digital expression of value and can serve as a medium of exchange, unit of account, or store of value, but do not have legal tender status. Although cryptographic assets can be exchanged for dollars or other currencies in some parts of the world, they are currently not endorsed or supported by any government or central bank, and their value is entirely determined by market supply and demand, with volatility significantly higher than traditional currencies, stocks, or bonds.

Trading in cryptographic assets carries significant risks, including severe price volatility or "flash crashes," market manipulation risks, cybersecurity risks, and the risk of partial or total loss of principal. Furthermore, the crypto asset market and exchanges are not regulated to the same extent as stock, options, futures, or foreign exchange markets, and do not offer the same level of investor protection.

Trading in cryptographic assets requires a thorough understanding of the relevant markets. When attempting to profit from trading cryptographic assets, you will be competing directly with traders around the world. Before engaging in large-scale trading of cryptographic assets, you should possess the necessary knowledge and experience. Trading in cryptographic assets can lead to rapid and substantial financial losses; under certain market conditions, you may find it difficult or impossible to quickly close positions at reasonable prices.

The views expressed in this article reflect a judgment of the market environment at a specific point in time and do not constitute a prediction of future events or a guarantee of future outcomes, and may be supplemented, revised, or adjusted as discussions deepen. The information in this article does not constitute, and should not be construed as, accounting, legal, tax, or investment advice. For matters discussed in the article, please consult your own accountant, lawyer, tax advisor, or other professional advisors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。