Author: Matt Hougan, Chief Information Officer of Bitwise

Translation by: Hu Tao, ChainCatcher

We have been in a cryptocurrency winter since January 2025. It is likely that we are closer to the end of this winter than to its beginning.

We are in a full-blown cryptocurrency winter.

The crypto Twitter community has only recently begun to realize this, but it is undeniable. Bitcoin has dropped 39% from its historical peak in October 2025, Ethereum has fallen 53%, and many other crypto assets have seen even larger declines.

This is not a "bull market correction" or a "slight dip." This is a full-blown cryptocurrency winter, akin to the character played by Leonardo DiCaprio in the 2022 film "The Revenant"—caused by factors such as excessive leverage and profit-taking by seasoned players.

Recognizing and accepting this is enlightening.

Why, despite the positive news regarding the adoption of cryptocurrencies, regulation, and other areas, are cryptocurrency prices still falling? Because we are in the depths of a cryptocurrency winter.

Why is the new Federal Reserve Chair a proponent of Bitcoin, yet the cryptocurrency fear and greed index is near historical highs? Because we are in a cryptocurrency winter.

Those who have experienced the last few winters (whether in 2018 or 2022) should remember that during the deepest parts of winter, good news is meaningless. Wall Street actively hiring or Morgan Stanley increasing its investment in cryptocurrencies will not drive a rebound in the crypto market. These factors may be important in the long run, but now is not the time. The end of the cryptocurrency winter is not exciting; it is exhausting.

So, when will the winter end?

The good news is: we are closer to the end than you think.

The History of Cryptocurrency Winters

Cryptocurrency winters typically last about 13 months. For example, Bitcoin peaked in December 2017 and bottomed out in December 2018. It peaked again in October 2021 and bottomed out in November 2022.

By this measure, we are about to face a tough period. After all, Bitcoin's peak occurred in October 2025. Are we going to wait until November next year to enter the market again?

I don't think so.

The more time I spend analyzing the current "winter," the more I realize it actually began back in January 2025. We just couldn't see it because the flows from ETFs and Digital Asset Trusts (DAT) obscured the truth.

ETF and DAT Flows Obscured the Winter of 2025

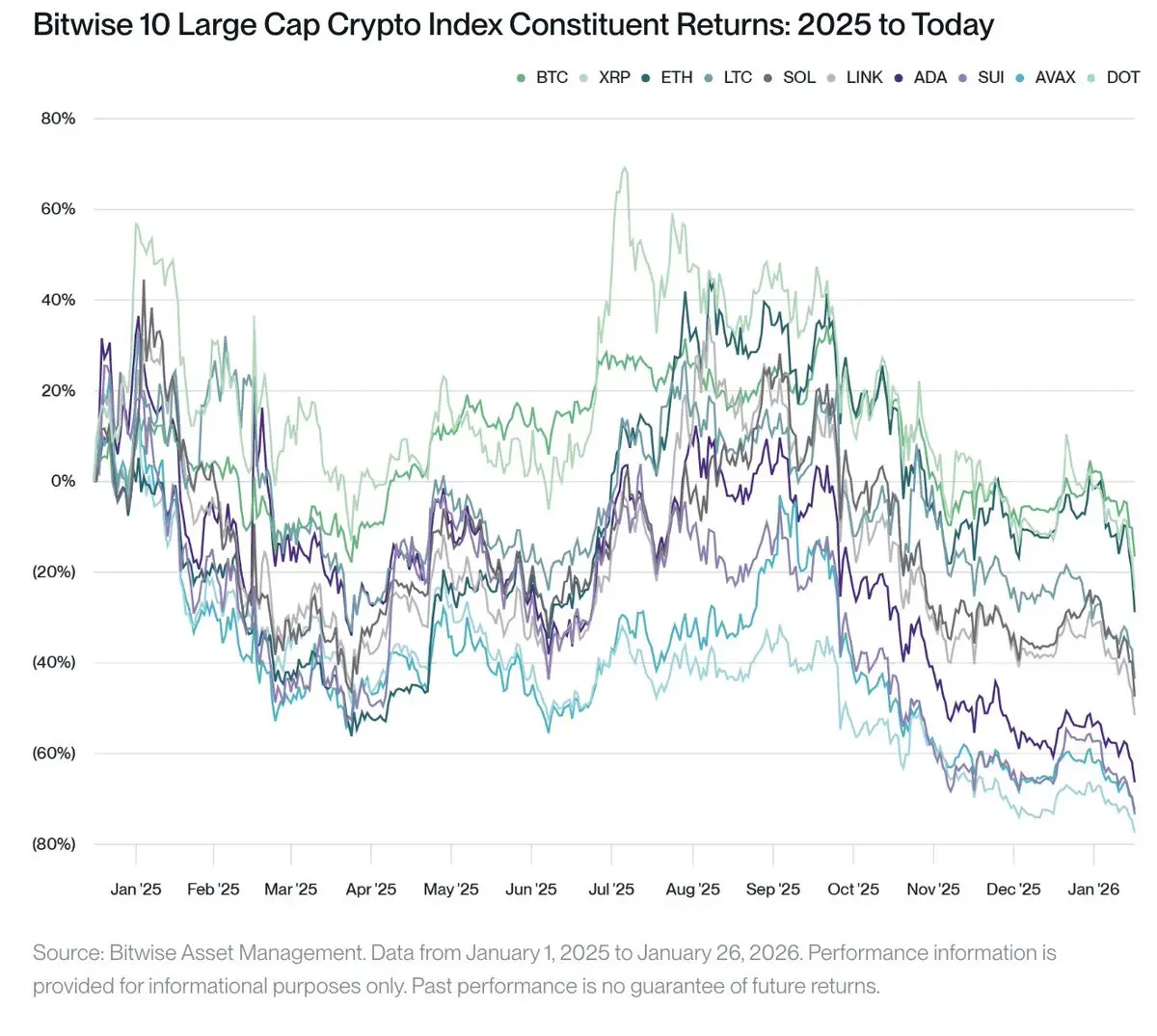

Take a close look at this chart of the Bitwise 10 largest market cap cryptocurrencies since January 1, 2025.

It clearly divides into three groups. The first group of assets (BTC, ETH, XRP) performed relatively well, down 10.3% to 19.9%. The second group of assets (SOL, LTC, LINK) experienced a standard bear market, down 36.9% to 46.2%. But the third group of assets (ADA, AVAX, SUI, DOT) was severely impacted, with declines of 61.9% to 74.7%.

The fundamental difference between these three groups of assets is whether institutional investors have the capacity to invest in them. The first group of assets benefited from strong support from ETFs/DAT throughout the year (or, in the case of XRP, from winning its lawsuit against the SEC); the second group is expected to receive ETF approval in 2025¹; while the third group has never received such support.

Look at the plight of the third group of assets; they rely solely on support from native cryptocurrency channels!

The institutional support for the first group of assets is unprecedented. For example, during the period shown in the chart, ETFs and DAT purchased 744,417 Bitcoins, worth about $75 billion. Imagine how far Bitcoin would have fallen without this $75 billion support? I estimate it would have dropped by about 60%.

Since January 2025, the retail cryptocurrency market has been in a deep winter. Institutional investors have only temporarily obscured this fact for certain assets.

The Darkest Hour is Just Before Dawn

What needs to be remembered now is that there is indeed a lot of good news in the cryptocurrency space. Progress in regulation is real. Institutional adoption is real. Stablecoins and tokenization are real. Wall Street's acceptance is also real.

Good news is often overlooked in a bear market, but it does not disappear. It is stored as potential energy. When the gloom lifts and market sentiment normalizes, this stored energy will return with force.

What can dispel the gloom? Strong economic growth could trigger a wave of aggressive risk appetite, positive surprises from the Clear Act, signs of Bitcoin gaining recognition from sovereign nations, or simply the passage of time.

As someone who has experienced multiple cryptocurrency winters, I can tell you that the feelings at the end of those winters are very similar to what we feel now: despair, frustration, and lethargy. But the current market correction has not fundamentally changed any characteristics of cryptocurrency.

I believe we will rebound strongly soon. After all, from January 2025 to now has felt like winter; spring will surely come soon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。