Author: Bill Sun

Compiled by: ChainCatcher

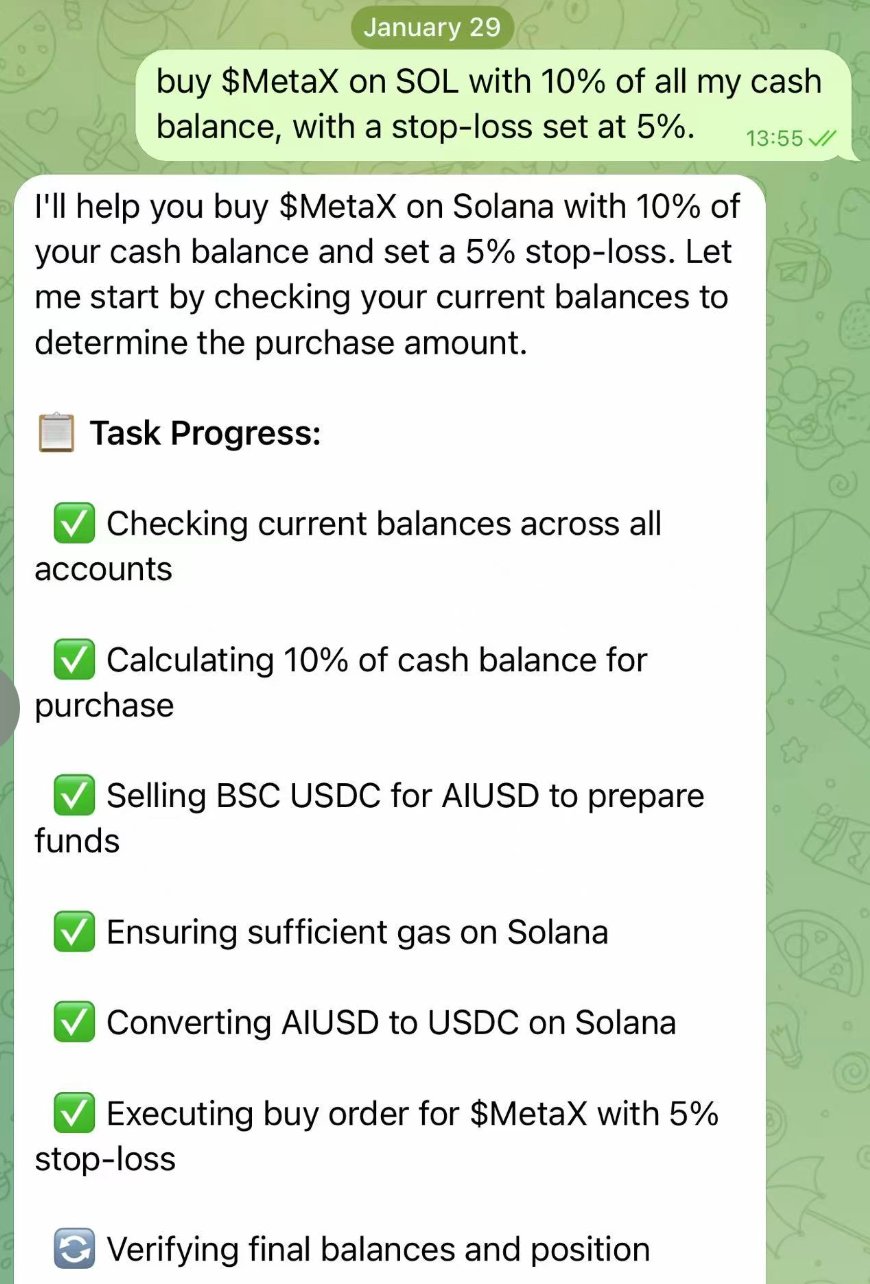

Now everyone is fascinated by Clawdbot -> Molty -> Openclaw. Screenshots like these are everywhere:

"Cleared the inbox while sleeping."

"Automatically scheduled meetings."

"Completed research before having coffee."

It feels like Jarvis has finally arrived. But after using Openclaw and Claude Code for a while, I've realized one very clear thing: Most AI agents currently provide emotional value rather than financial results.

They can think, analyze, explain, and then… just stop. Because when it comes to actually mobilizing funds, humans are still the bottleneck.

The Real Problem No One Wants to Admit

Openclaw can tell you:

"Meta's sentiment is reversing."

"NVDA's (NVIDIA) volatility is mispriced."

"TSLA's (Tesla) momentum is about to break out."

But what happens next? You might be busy with other things, with no time to open brokerage accounts like Charles Schwab to click "trade." By the time you finish clicking, the excess returns (Alpha) have already disappeared.

The trading experience for Tokenized Assets is even more fragmented. Assets are spread across different chains, and you have to:

Open multiple wallets.

Figure out where the liquidity is.

Bridge across chains.

Deal with gas fees, slippage, and timing of execution.

Manually set risk controls.

The bottleneck is not intelligence, but execution. AI has a brain but no hands.

When We Stop "Asking" and Start "Authorizing"

I no longer seek advice from AI; instead, I start giving it intent. No longer asking "What do you think?" but commanding "Do this."

For example:

"Transfer idle funds into NVDA exposure."

"Automatically reduce risk if volatility spikes."

"Switch configuration if TSLA breaks the trend."

This is where AIUSD opened my eyes. It's like I hired a trader sitting in a room, monitoring the market 24/7, waiting for my commands, executing immediately through smart order routing and minimizing trading impact.

Real Case: Meta vs Gold (Tokenized Assets Executed by Agent)

This is a simple yet powerful scenario. We ran an Openclaw agent powered by Claude Opus 4.5, tasked with: monitoring NVDA, TSLA, Meta, BTC, gold, and silver for earnings-driven volatility.

The agent detected on January 29:

Meta has a strong continuation potential post-earnings.

Gold and silver show higher downside volatility and headline risk.

Considering the on-chain liquidity of tokenized assets and the current portfolio, the agent decided: "Reduce exposure to tokenized gold (PAXG) and rotate funds into tokenized Meta."

The process executed using AIUSD:

Aggregate funds spread across various EVM chains.

Automatically reduce PAXGOLD on Ethereum.

Convert to a unified funding layer.

Buy tokenized Meta on Solana.

Attach downside protection at the execution level.

No need to switch apps, no need to cross chains, no need for manual operations in the middle of the night. The agent didn't notify me; it completed the reallocation directly.

Why Tokenized Stocks Change Everything

This is evident five years after the GameStop incident. The failure in 2021 was not due to retail investors, but because of infrastructure. The market changes in real-time, but settlement does not.

Robinhood CEO Vlad Tenev recently wrote: "Real-time markets need real-time settlement." This means tokenization.

Advantages of Tokenized Stocks:

Instant settlement.

24/7 trading.

Machine-readable.

Can be executed directly by agents without intermediaries.

This is no longer an ideology of cryptocurrency, but financial physics.

AI Agents and Tokenization Are Inseparable

Operational characteristics of AI agents: Continuous, global, emotionless, zero tolerance for delay.

Operational characteristics of traditional finance: Time-limited trading, delayed settlement, manual intervention required at every step.

These two systems are incompatible. Tokenized assets are the only tools that can move at machine speed, be programmed into combinations, and be fully delegated to agents.

The Mission of AIUSD

AIUSD does not want to be just a better trading app. We are building the monetary layer for AI agents:

Fund unification.

Execution abstraction.

Risk programization.

End-to-end actions by agents.

Openclaw proves that AI can think; tokenization makes the market machine-native; AIUSD is responsible for connecting the two.

In the age of AI, Alpha does not belong to the smartest humans, but to those who hand over control of funds to machines.

Welcome to join the official ChainCatcher community

Telegram subscription: https://t.me/chaincatcher;

Official Twitter account: https://x.com/ChainCatcher_

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。