Written by: Clow

The first crypto storm of 2026 is more intense than ever before.

Bitcoin has plummeted from its historical high of $126,000 to around $74,000, a drop of over 40%. Ethereum has been cut in half, and Solana has returned to double digits. The daily liquidation amount once exceeded $2.5 billion.

The Fear and Greed Index jumped directly from "Extreme Greed" to "Extreme Fear," with almost no transition.

Social media is filled with lamentations; some say the bull market is over, while others claim this time is different.

However, if we penetrate the short-term panic and examine the market's microstructure, macro environment, and institutional progress, we will find a different answer: this crash is more like a structural clearing rather than the end of a long-term bull market.

01 The Truth Behind the Brutal Decline

The trigger for this round of collapse is the resonance of multiple negative factors.

First is the profit-taking by long-term holders. According to on-chain data from Glassnode, long-term holders sold an average of over 12,000 BTC daily in the past 30 days, totaling about 370,000 BTC per month. During the peak in Q4 2025, this number exceeded 53,000 BTC daily. This sustained supply pressure has created a persistent selling wall, making it difficult to stop the price from declining even when the fundamentals remain robust.

Second is the backlash from leverage. A liquidation event in October 2025 caused losses of $19 billion, leading to long-term damage to market liquidity. As we entered 2026, the market faced another brutal leverage washout. The high-leverage long positions accumulated over the past few months were sequentially liquidated in the panic.

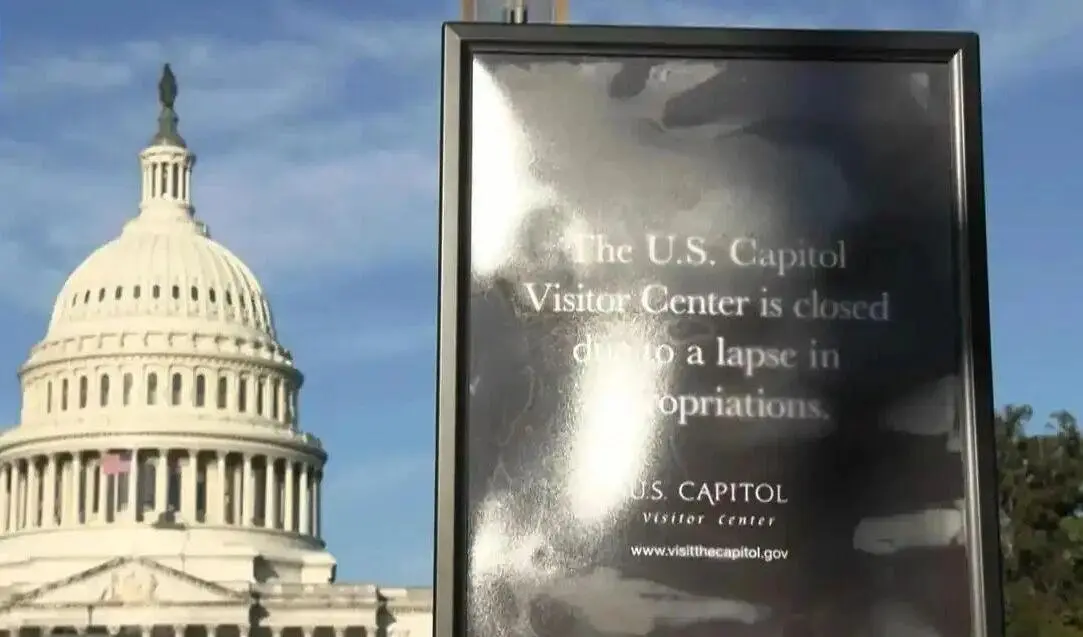

Finally, there was a sudden shift in macro expectations. Kevin Warsh was nominated to succeed the Federal Reserve Chair, shattering the market's fantasy of continued interest rate cuts. This "inflation hawk" has publicly criticized the Fed's forward guidance multiple times, arguing that it is misleading in a complex inflation environment. Coupled with the partial government shutdown due to political deadlock, investors' preference for risk assets quickly cooled, causing gold, silver, and Bitcoin to plunge.

From the data, the severity of this pullback is comparable to any in history: Bitcoin fell about 41%, Ethereum about 58%, Solana about 64%, and the total crypto market cap shrank from about $4 trillion to $2.55 trillion.

02 Positive Factors Silently Accumulating

However, beneath the surface of the price crash, the crypto market in 2026 is welcoming unprecedented positive factors. These elements are constructing a market bottom that is more solid than in any previous cycle.

Comprehensive Release of Regulatory Dividends

The U.S. government is committed to fulfilling its promise to build the U.S. into the "world's crypto capital."

The SEC and CFTC have launched a joint initiative called "Project Crypto," aimed at eliminating regulatory arbitrage and jurisdictional conflicts between institutions. This project plans to establish a clear asset classification system, reduce redundant compliance requirements, and allow tokenized collateral, perpetual futures, and prediction markets to operate within a regulated legal framework.

The GENIUS Act, passed in 2025, is also about to enter a full implementation phase. This legislation not only establishes issuance and licensing standards for payment stablecoins but also allows stablecoin holders to earn returns similar to those of traditional assets through specific incentive mechanisms. The clarity of the regulatory foundation significantly reduces the risk costs for traditional financial institutions entering the market.

Sovereign Nations Entering the Market

The entry of sovereign national powers into the market is no longer a hypothesis but a reality in progress.

Fidelity points out that due to the evolution of "game theory," more and more countries are considering including Bitcoin in their national foreign exchange reserves. Kyrgyzstan has established a national cryptocurrency reserve framework through legislation, and Brazil is actively promoting related legislation.

Once one or more sovereign nations begin to formally establish Bitcoin reserves, due to the scarcity of total supply, other countries will face immense competitive pressure. This "buying pressure" could create a strong non-price-sensitive demand in the second half of 2026.

Qualitative Changes in Technical Foundations

Ethereum is entering another important cycle after its "calm." Two hard forks planned for 2026—Glamsterdam and Hegota—aim to address the core pain points that have long constrained network performance.

Glamsterdam focuses on introducing "native proposer-builder separation" (ePBS), reducing single-point censorship risks and optimizing gas efficiency. Hegota's core is the implementation of Verkle trees, which can reduce node storage requirements by up to 90%, marking a key step towards achieving "stateless clients."

Solana is betting on Firedancer—its second independent validator client. This upgrade aims to eliminate single-client risks and elevate network stability to industrial-grade levels. Through activities like the $500 million "Tokenized Great Regatta," Solana is attracting a large number of real-world assets on-chain, with the total value of RWA expected to exceed $10 billion by the end of 2026.

The Year of AI Agents

According to a16z's research report, 2026 will be the year of "AI agents." This is not just a narrative but a business logic that is being realized.

As the application of AI agents in financial services surges, their demand for identity and banking services becomes urgent. a16z suggests that the key missing primitive in 2026 is KYA: Know Your Agent. Agents need to obtain cryptographic signature credentials through blockchain to conduct legitimate business transactions without human intervention.

The combination of DePIN (Decentralized Physical Infrastructure Networks) and AI is redefining digital commerce. From decentralized GPU computing networks to real-time physical environment observation systems, blockchain is becoming the "control plane" for AI operations. This combination means that cryptocurrency valuations are no longer solely dependent on monetary premiums but increasingly on actual productivity output.

03 Institutional Structural Judgments

In the face of extreme market volatility, top institutions exhibit a "short-term cautious, long-term confident" perspective.

BlackRock has clearly stated in its 2026 outlook that stablecoins are no longer a "niche market" but have become a bridge between traditional finance and digital liquidity. Samara Cohen, its global head of market development, emphasized that stablecoins are reshaping the currency competition landscape in emerging markets, a process that will accelerate in 2026 due to the implementation of the GENIUS Act.

Fidelity is more focused on changes in the investor structure. Its research vice president, Chris Kuiper, believes that the traditional "four-year cycle theory" is facing challenges. The investor structure is undergoing fundamental changes—from short-term speculators to sovereign funds, corporate treasuries, and traditional asset management institutions. This "new paradigm" suggests that after experiencing a brutal pullback, the market is more likely to welcome a recovery driven by structure and liquidity rather than simple speculative impulses.

The deepening of spot ETFs is also noteworthy. Although there was significant capital outflow from January to February, the historical cumulative net inflow has exceeded $56 billion. Meanwhile, companies like Strategy hold about 3.4% of the circulating supply of Bitcoin, treating it as a long-term treasury asset rather than a short-term trading position, providing a substantial "structural buy" for the market.

04 Conclusion

The "brutal" decline currently exhibited in the crypto market is a correction based on macro expectations and a forced clearing of internal market leverage. Although this process has caused immense pain on paper, it has not fundamentally shaken the status of crypto assets as a "structural alternative asset."

On the contrary, the latent positives in 2026—from the convergence of U.S. institutional regulation to sovereign nations entering the strategic reserve competition; from Ethereum's technical upgrades to the full release of AI agents on-chain—are constructing a market system that is more mature than ever before.

The consensus among institutions clearly points to a transitional period in the cycle. The market is shifting from a purely speculative cycle to a new phase driven by regulations, institutions, and real productivity.

For investors who can penetrate short-term panic and perceive long-term structural changes, the current period of extreme fear not only marks the collapse of the old bubble but also heralds the emergence of a "new crypto era" centered on applications, sovereign adoption, and intelligent agents, taking shape in the darkness before dawn.

As the interest rate environment becomes clearer and key technological upgrades are implemented, the market is expected to reopen a more robust, fundamentally supported upward channel.

Only this time, the rules of the game have changed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。