Written by: Wu Says Blockchain

Regarding the severe fluctuations in the crypto market on October 11, OKX founder and CEO Star recently pointed out that the event was related to the activities surrounding USDe on Binance and the resulting structural leverage; Dragonfly partner Haseeb directly refuted this judgment, believing that the narrative fails to hold up in terms of timeline and cross-exchange impact. CZ and Ethena founder Guy Young also participated in the discussion of the event. Below are the details of the discussions.

Star's Tweet on January 31

There is no complexity. No surprises.

10/10 was caused by irresponsible marketing activities from certain companies.

On October 10, hundreds of billions of dollars were liquidated. As the CEO of OKX, we clearly observed that after that day, the microstructure of the crypto market underwent fundamental changes.

Many industry participants believe that the damage caused this time is more severe than the FTX collapse. Since then, there has been extensive discussion about why it happened and how to prevent it from happening again. The root cause is not difficult to identify.

What Exactly Happened

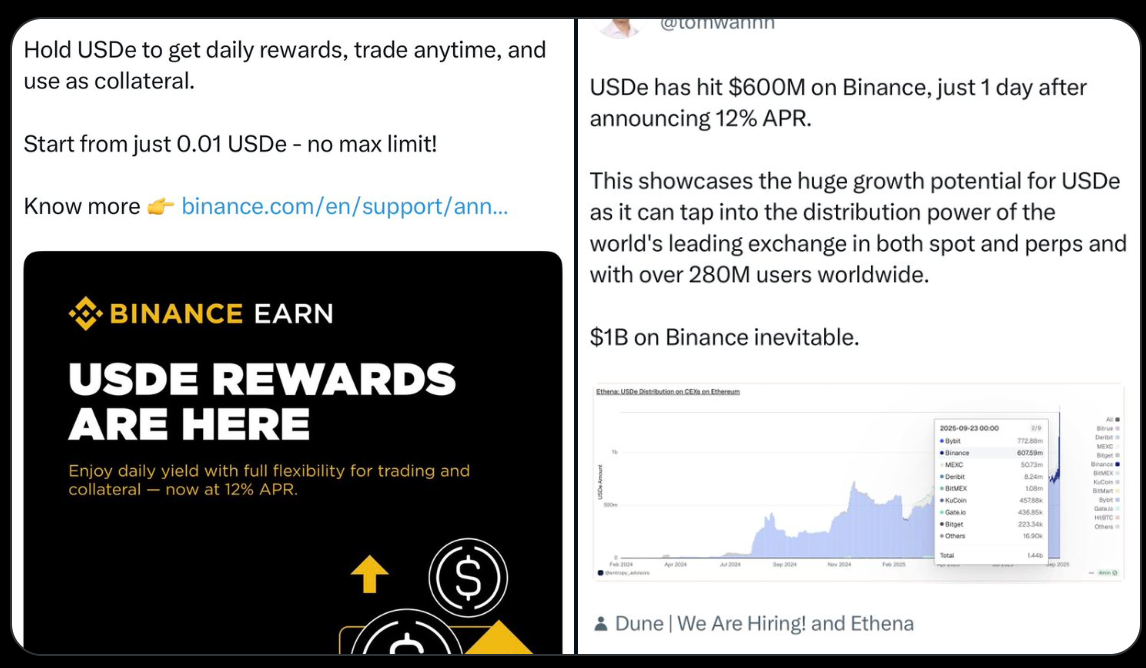

Binance launched a temporary user acquisition campaign, offering 12% APY for USDe while allowing USDe to be used as collateral, enjoying the same treatment as USDT and USDC, with no effective restrictions.

USDe is a tokenized hedge fund product.

Ethena raised funds through a so-called "stablecoin," investing it in index arbitrage and algorithmic trading strategies, and tokenizing the generated funds. The token can then be deposited on exchanges to earn returns.

- USDe is fundamentally different from products like BlackRock's BUIDL and Franklin Templeton's BENJI, which are tokenized money market funds with low-risk characteristics.

In contrast, USDe embeds hedge fund-level risks. This difference is structural, not superficial.

Binance users were encouraged to convert USDT and USDC into USDe for high returns, but the emphasis on underlying risks was insufficient. From the user's perspective, trading with USDe was no different from using traditional stablecoins—yet the actual risk level was significantly higher.

As users engaged in the following actions, the risks escalated further:

• Converting USDT/USDC to USDe,

• Using USDe as collateral to borrow USDT,

• Converting the borrowed USDT back into USDe,

• And continuously repeating this cycle.

This leverage cycle created apparent APYs of 24%, 36%, or even over 70%, which were widely regarded as "low risk" since these returns were provided by large platforms. Systemic risks rapidly accumulated in the global crypto market.

- At that time, even a slight market shock was enough to trigger a collapse.

When volatility hit, USDe quickly de-pegged, leading to a chain liquidation, while risk management flaws surrounding assets like WETH and BNSOL further amplified the crash. Some tokens approached zero trading.

The damage caused to global users and companies (including OKX customers) was severe, and recovery will take time.

Why This Matters

I am discussing the root causes, not blaming or attacking Binance. Publicly discussing systemic risks can sometimes be uncomfortable, but it is necessary if the industry is to mature responsibly.

I expect there may be a lot of misinformation and organized FUD targeting OKX in the near future. Even so, it is still the right thing to honestly discuss systemic risks—and we will continue to do so.

As the largest trading platform globally, Binance has a disproportionate influence—and correspondingly bears the responsibility of being an industry leader. Long-term trust in the crypto industry cannot be built on short-term profit games, excessive leverage, or marketing practices that obscure risks.

The industry needs leaders who prioritize market stability, transparency, and responsible innovation—not a winner-takes-all mentality that views criticism as hostility.

The crypto industry is still in its early stages.

The choices we make today to normalize things will determine whether this industry earns lasting trust—or repeats past mistakes.

Dragonfly Partner Haseeb's Rebuttal Tweet

With all due respect, Star's statement is frankly absurd.

Star attempts to claim that the root cause of 10/10 was Binance initiating Ethena's yield activity, leading traders to excessively leverage USDe on Binance through circular operations, which ultimately resulted in a chain collapse due to a slight price fluctuation.

The problem with this narrative is:

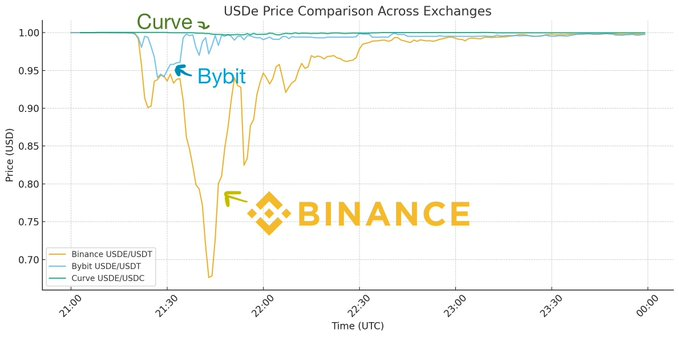

1) The timeline of this narrative does not align. The bottom of BTC was affected 30 minutes earlier than the price of USDe on Binance. Therefore, USDe clearly could not have "caused" the cascade of liquidations. This is a clear reversal of causality.

2) The price deviation of USDe only occurred on Binance, with no deviation on other exchanges. However, the liquidation spiral was happening everywhere. So if USDe's "de-pegging" did not spread throughout the market, it cannot explain why every exchange experienced massive liquidations. This is very different from Terra, which de-pegged everywhere and caused the same destruction at every venue.

So you might patch Star's viewpoint by saying, "Well, maybe Ethena didn't cause 10/10, but it amplified it." But even as an amplifier, USDe does not hold up under scrutiny because it did not spread across exchanges. We know what a good explanation for a collapse should look like—Terra, 3AC, and FTX all had global balance sheet effects felt everywhere. USDe did not do that; it was more like an isolated incident in Binance's order book.

3) This raises the question: why is Star only now "revealing" this, months later? Star has not provided any new evidence that people did not already know or that has not been repeatedly analyzed. All order book data has been public for over four months, yet he suddenly says this now? This feels more like Star is provoking CZ and using this simple story as an excuse to make it seem like CZ was involved or that his irresponsibility led to 10/10.

To be honest, the reality is: there is no "simple story" that can withstand scrutiny to explain 10/10. I don't have one either. If there were a simple story that could explain 10/10, the market would have long reached a broad consensus on the cause, just like the consensus on the reasons for the 3AC or FTX collapses.

In my view, the narrative that best explains 10/10 is:

- Trump scared the market with tariff threats on Friday night;

- This led to a severe sell-off, as crypto was the only thing that could still be traded at the time;

- The surge in activity caused Binance's API to crash, resulting in significant price dislocations and preventing market makers from balancing inventory between exchanges. This triggered a large number of unfillable liquidations, but the liquidation engine would continue to trigger regardless, and all of this was amplified by ADL activated everywhere, breaking hedges and risk control systems;

- This led to market makers being wiped out, as they could not clean up the mess—market makers need APIs to rebalance inventory, and without market makers, there are no "last buyers" to absorb many altcoins. Retail cannot rush in to bottom-fish on a chaotic Friday night;

- The crypto liquidation mechanism is not self-stabilizing like traditional finance (circuit breakers, etc.); crypto liquidation is purely to minimize bankruptcy risk;

- Altcoin prices are extremely path-dependent, and we walked into a very bad path.

That is my story. It is not satisfying, but the "Binance + Ethena did it" story is equally unsatisfying. A better root cause explanation is "the API crashed at the worst moment," but that doesn't sound as "conspiratorial."

When simple stories fail to hold, unfortunately, you have to choose a complex narrative. And I believe this complex narrative most accurately reflects the reality of 10/10. Fortunately, crypto history is a cycle of "bad things happened, and then the market recovered."

In the long run, I am not worried that 10/10 permanently damaged the market. It is just that price path dependence, retail and market makers were severely impacted on 10/10, and it will take time to recover.

Haseeb's Tweet Comments

Okay, this matter is much bigger than I expected, so let me disclose a few points:

Dragonfly is an early investor in Ethena. Binance and OKX are also early investors and have collaborated with Ethena for a long time. OKX also invested in Dragonfly, and a partner from Dragonfly (not Dragonfly itself) also invested in OKX—so we have business dealings with almost every party involved here, so there is no simple "X took money to do Y" story.

This debate is not about whether Binance is good or OKX is bad. The core of the debate is: what exactly caused 10/10.

Getting this answer right is very important because it will directly determine what we should change in the industry to prevent it from happening again. So if the answer is "don't do APY projects with Ethena," that would be great—if the answer were that simple. But that is almost certainly not the answer, and that is precisely what Star is hinting at here.

Other Comments

CZ first quoted and retweeted Haseeb's tweet, stating: Dragonfly was/now is one of OKX's largest investors. The data speaks for itself. The timeline does not align. I am glad to see someone starting to understand the facts. I will try not to comment further on this topic. Let others talk about us; we will focus on our work. There is still a lot to build.

However, this tweet has since been deleted by CZ.

Star's comment on CZ's remarks made the following reply:

However, it is still important to clarify the facts. The record is as follows:

- BTC began to decline approximately 30 minutes before USDe de-pegged.

This precisely supports the previous viewpoint: the initial volatility stemmed from a market shock.

Without the leverage cycle of USDe, the market would likely have stabilized at that time. The chain liquidation was not inevitable—it was amplified by structural leverage, as mentioned earlier.

- Dragonfly has never invested in OKX—neither small investments nor large investments.

In fact, OKX invested in Dragonfly before @hosseeb joined the organization.

Additionally, a partner's previous fund (not Dragonfly) had invested in OKX. These are independent and easily verifiable facts.

- I will not spend more time on this topic.

The facts are clear. I do not intend to engage in a long-term debate.

Ethena Founder Guy Young retweeted Haseeb's tweet and stated:

We all want simple explanations and scapegoats, but unfortunately, that is factually incorrect.

The data below clearly shows that the price deviation of USDe on the Binance order book occurred a full 30 minutes after BTC bottomed out from this crash.

Either you are wrong, or this is the first "root cause"—it happened after the event occurred.

You have a large audience that trusts your statements. Spend 5 minutes looking at the data before speaking. Do better.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。