Author: Xia Fanjie, CITIC Construction Investment

After a wave of selling in broad-based ETFs and significant fluctuations in international gold and silver prices, market sentiment has noticeably cooled. The market faces short-term correction pressure; however, the overall A-share index has limited adjustment space and is expected to stabilize before the Spring Festival, ushering in a new round of upward momentum before and after the holiday. In terms of industry allocation, we continue to favor the dual main lines of "technology + resource products" in the long term. In the short term, market style rotation is accelerating, and sectors such as technology, finance, and midstream manufacturing, which have already seen corrections, are expected to perform well in the near term. Key industries to focus on include: power equipment (energy storage, ultra-high voltage, photovoltaics, solid-state batteries, etc.), non-bank financials, banks, AI (optical communication, storage, etc.), coal power, home appliances, automobiles, and steel.

Summary

Behind the fluctuations in gold and silver, "weak dollar trades" take profits and exit

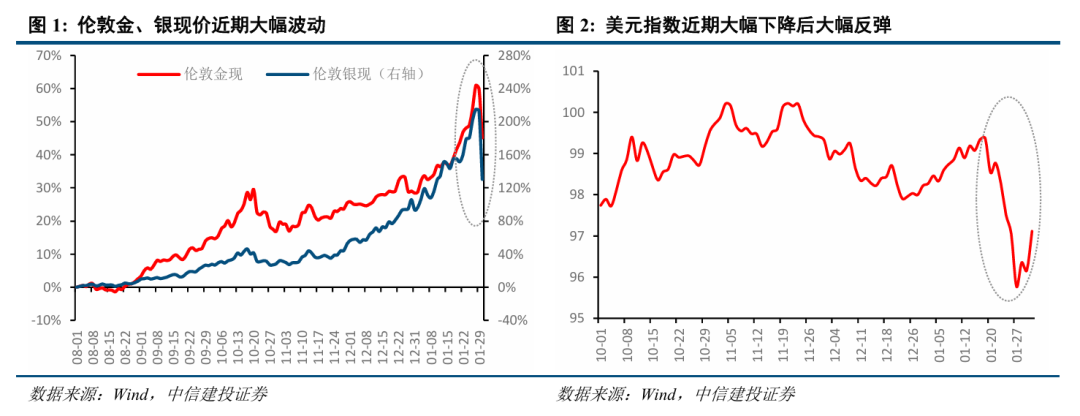

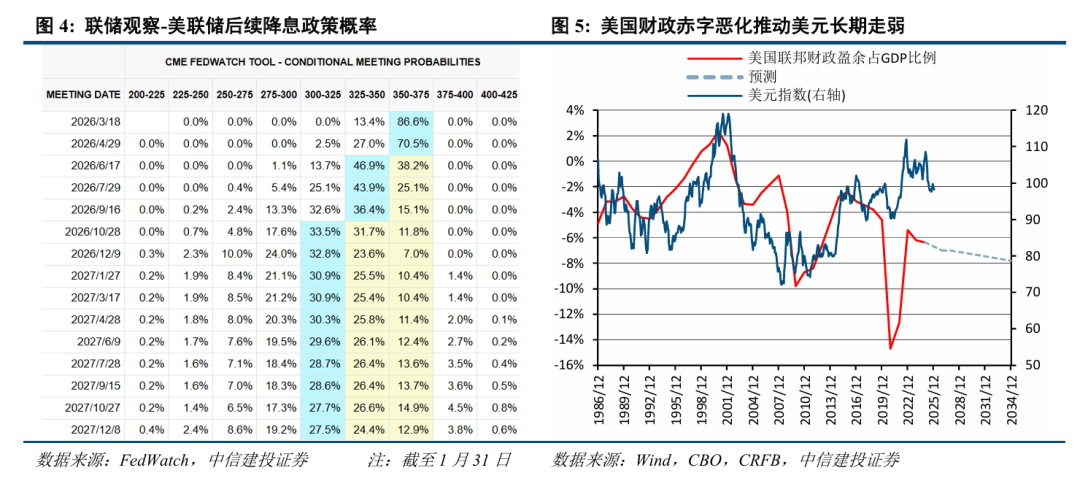

The recent sharp fluctuations in international precious metal prices are attributed to several factors, including the Federal Reserve chair nomination breaking market dovish expectations, short-term profit-taking, leveraged funds' sell-off, and the strong speculative nature of silver amplifying volatility. The expected next chair of the Federal Reserve, Kevin Warsh, is anticipated to focus on "balance sheet reduction and interest rate cuts" as core policies, which may lead to a steepening yield curve. Under this expectation, "weak dollar trades" are taking profits and exiting, but the overall volatility in U.S. stocks remains low, and high-growth industries like AI are expected to benefit from subsequent interest rate cuts, with the financial sector also likely to gain.

February A-share outlook: short-term correction pressure, spring rally not over

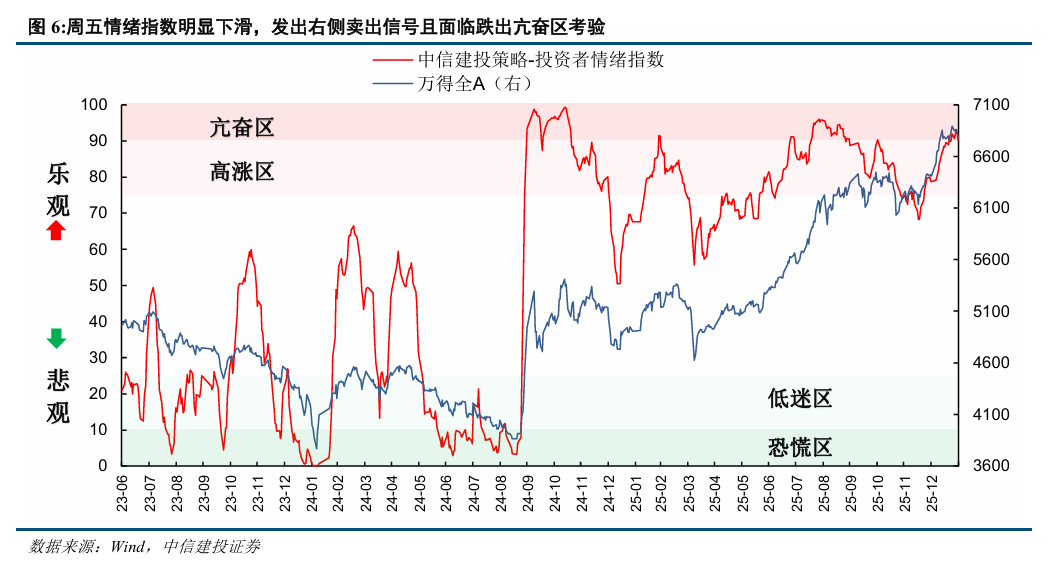

On January 30, due to the severe fluctuations in international precious metal prices and the recent large-scale sell-off of broad-based ETFs in A-shares leading to liquidity pressure, the sentiment index showed a significant decline, issuing a right-side sell signal and facing a test of falling out of the exuberance zone. Considering the rising risk aversion before the Spring Festival and the seasonal effect of the sentiment index's decline, we expect the market to face short-term cooling of sentiment and index correction pressure. Taking into account the current incremental funds in the market and various sub-indicators of the sentiment index, we anticipate that the overall A-share index has limited adjustment space and is likely to stabilize before the Spring Festival, with a new round of upward momentum expected before and after the holiday.

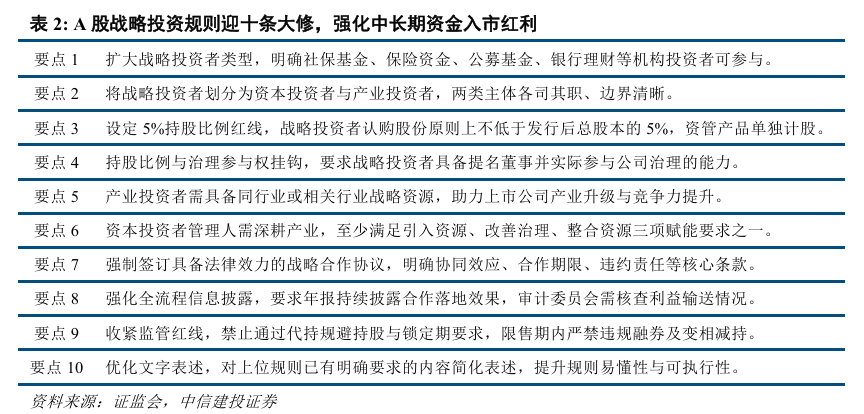

We are optimistic about the continuation of the spring rally, as incremental funds in the first quarter are relatively abundant. As the wave of selling in broad-based ETFs gradually ends, the market's incremental funds are expected to improve significantly. Additionally, recent favorable policies (new regulations on strategic investment) and industrial catalysts (introduction of national capacity electricity pricing policy, highlights from AI large models) are numerous. From a seasonal effect perspective, February typically has a higher win rate and better profit-making effect.

Long-term adherence to the dual main lines of "technology + resource products," with accelerated short-term style switching

We continue to be optimistic about the dual main lines of "technology + resource products" in the long term. In the short term, market style rotation is accelerating, and the technology sector, which has already seen corrections, will benefit from ample funds and heightened risk appetite during the spring rally. Additionally, policy dividends from the strategic investment system, the introduction of the national capacity electricity pricing policy, and industrial catalysts like AI large models will support the rise of the technology growth style. Financials and midstream manufacturing, which have seen significant declines, are also expected to experience a rebound.

Considering industry prosperity, industry catalysts, and external influences, recent industry allocation should focus on: power equipment (energy storage, ultra-high voltage, photovoltaics, solid-state batteries, etc.), non-bank financials, banks, AI (optical communication, storage, etc.), coal power, home appliances, automobiles, and steel.

Behind the fluctuations in gold and silver, "weak dollar trades" take profits and exit

On Friday, the A-share market experienced significant volatility, with major indices fluctuating over 2%. The Shenzhen Component Index had a fluctuation of 2.57%, the Shanghai Composite Index fluctuated by 2.12%, and the Wind All A Index fluctuated by 2.34%. The market overall closed lower, with the Shanghai Composite Index, Shenzhen Component Index, and CSI 300 down 0.96%, 0.66%, and 1.00%, respectively. The core driving factor was the severe fluctuations in international precious metal prices leading to a sharp decline in the non-ferrous metal sector, compounded by rising risk aversion and the withdrawal of leveraged funds, which collectively intensified market volatility.

Why have international precious metal prices recently fluctuated sharply? How will this continue to affect the market? We attempt to analyze as follows:

Expectation shift, gold and silver prices go from soaring to plummeting

We believe that the recent sharp fluctuations in international precious metal prices can be attributed to three main points, with the Federal Reserve chair nomination breaking market dovish expectations being the core.

The shift in Federal Reserve policy expectations has led to a stronger dollar: U.S. President nominated "hawkish" figure Kevin Warsh to serve as Federal Reserve chair, whose policy inclination towards "balance sheet reduction + interest rate cuts" broke market dovish expectations and quickly strengthened the dollar index. The attractiveness of precious metals priced in dollars decreased, directly suppressing prices. Additionally, the market's expectations for a March interest rate cut by the Federal Reserve weakened, further reinforcing short-term bearish sentiment.

Short-term profit-taking and leveraged fund sell-off: In January 2026, precious metal prices surged rapidly, with gold accumulating over 30% and silver reaching 60%, entering a severely overbought zone technically (gold RSI index hitting a 40-year peak). Early speculative funds had strong profit-taking demands, and the triggering of programmed stop-losses from leveraged funds led to a chain sell-off.

Silver's strong speculative nature causes more severe fluctuations: Silver, due to its dual financial and industrial attributes, experiences more volatile swings. On one hand, demand in sectors like photovoltaics, electric vehicles, and AI data centers has exploded, with inventories dropping to a ten-year low; on the other hand, high prices stimulate technological substitutions (using copper instead of silver), raising market concerns about the sustainability of demand and exacerbating price fluctuations. Additionally, the silver market is smaller than gold and is not a traditional asset for capital allocation, with speculative funds, especially leveraged funds, being more prevalent, further intensifying silver price volatility.

Can "weak dollar trades" continue?

Recently, the prices of gold, silver, and even copper, aluminum, and crude oil have risen significantly, essentially reflecting concentrated "weak dollar trades." In the long term, this indicates a lack of trust in U.S. fiscal discipline and the dollar monetary system. The mid-term logic stems from the impact of "buying Greenland" on the U.S. ally system and new trends of European capital "selling America." In the short term, this is triggered by the change in the Federal Reserve chair and Trump's indifference towards dollar depreciation, with Trump even suggesting he could manipulate the dollar exchange rate, stating, "I can make it rise and fall like a yo-yo." (Source: First Financial)

As a result, we have seen the dollar index accelerate its decline since late January, quickly dropping from 99.37 on the 16th to 95.77 on the 27th, the lowest level since March 2022. Global funds are eagerly engaging in "weak dollar trades," going long on precious metals and other physical assets, pushing this long-term trend that is expected to unfold over the next few decades to its extreme within a week, only to face immediate backlash.

The turning point came on January 30, when U.S. President Trump finally announced the next Federal Reserve chair nominee: former Federal Reserve governor Kevin Warsh. Warsh has long been known for his hawkish stance, and his change in tone last year in response to Trump's calls for significant interest rate cuts was seen as key to his nomination. For the market, due to Warsh's long-standing hawkish position, investors believe he is more capable of maintaining the Federal Reserve's independence compared to other candidates, which clearly altered previous market expectations of a rapid decline in the dollar index, leading to a swift profit-taking in global "weak dollar trades," resulting in a stronger dollar and a sharp drop in precious metals.

How will Warsh change the Federal Reserve?

After a brief period of expectation confusion, we must focus on a key question: How will Warsh change the Federal Reserve's policies, and what impact will this have on the market?

In 2006, Warsh was nominated by President George W. Bush and became a Federal Reserve governor, making him the youngest governor in Federal Reserve history. During his tenure, the global financial crisis erupted, and he leveraged his experience on Wall Street to help then-Federal Reserve Chair Ben Bernanke connect with Wall Street financial institutions. In 2010, when the Federal Reserve launched its second round of quantitative easing (QE), Warsh expressed opposition. He resigned from the Federal Reserve in March 2011.

In the more than 14 years since leaving the Federal Reserve, Warsh has become a critic of the institution. He has particularly criticized Powell's monetary policy. Warsh's criticisms of the Federal Reserve mainly include: first, the role of the Federal Reserve has become increasingly broad, even encroaching on national governance and shaping social values, leading to a "drift" in institutional functions. He believes that the Federal Reserve's overly expanded role undermines the important and reasonable claim of "monetary policy independence." Second, since 2008, the Federal Reserve has become the largest buyer of U.S. government bonds, with a balance sheet exceeding $7 trillion, distorting the market. He believes that after the crisis, the Federal Reserve should "return to its original boundaries."

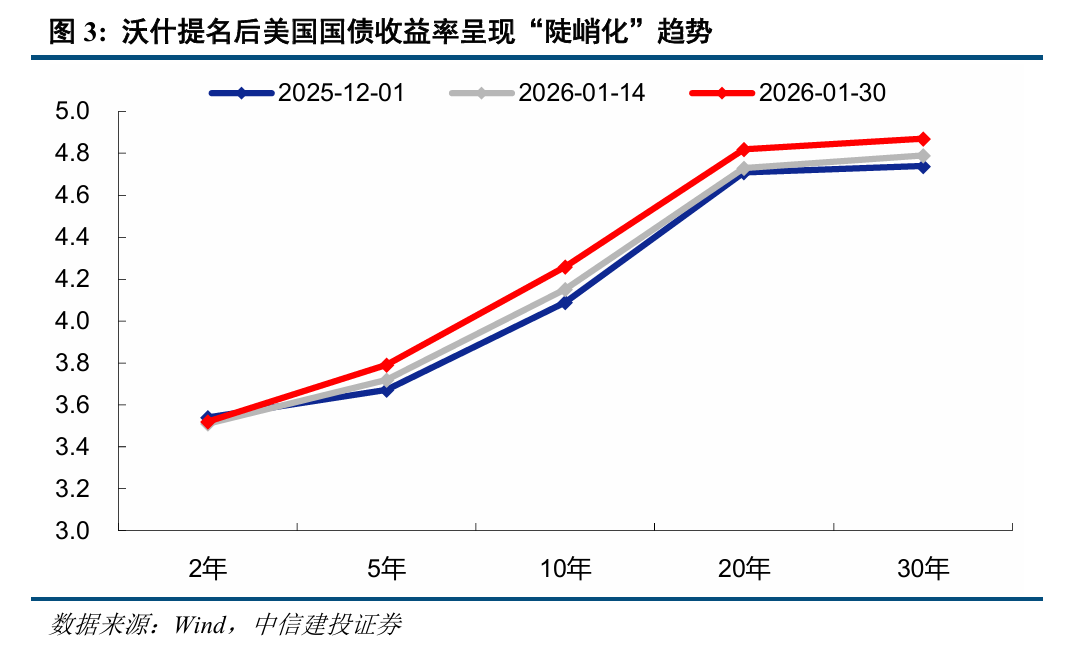

Warsh's policy core: balance sheet reduction + interest rate cuts

Balance sheet reduction is the core of Warsh's policy, and he has clearly identified reforming the Federal Reserve's $6.6 trillion balance sheet as a primary goal. Warsh believes that the Federal Reserve's asset scale is too large and should reach a new coordination mechanism with the Treasury to weaken the Federal Reserve's direct influence on the money market. This alleviates investor concerns about a weakening dollar and has led to the recent sharp decline in non-ferrous metals. If the balance sheet reduction policy is implemented, overseas dollar liquidity may tighten, leading to periodic strengthening of the dollar. Additionally, balance sheet reduction will affect the demand for U.S. government bonds, causing market disturbances. In the long term, balance sheet reduction may eliminate the "Federal Reserve put," which is the psychological reliance that the Federal Reserve will stop tightening and switch to easing during significant market declines, potentially allowing risks to return to their inherent nature, meaning that risk assets may experience significant declines when fundamentals worsen. At the same time, balance sheet reduction will raise long-term interest rates, limiting government debt expansion and economic bubbles.

Interest rate cuts are another major policy direction for Warsh, which can satisfy Trump's demands while also echoing Warsh's criticisms of Powell's monetary policy in recent years. According to reports during the midday trading session of U.S. stocks on January 30, Trump stated in the White House office that Warsh would lower interest rates without pressure from the White House. Trump said that Warsh had not committed to him to cut rates, but "he certainly wants to cut rates." However, unlike Trump's aim for significant interest rate cuts to stimulate the economy and boost mid-term election prospects, Warsh's interest rate cut policy is not aimed at stimulating demand but is more supply-side oriented, with the core goal being to reduce the burdens on all entities, including the government, and encourage productive investment (rather than financial speculation).

Warsh's policy impact: steepening yield curve

Unlike the current market's habit of "flooding the market," Warsh's combination of "balance sheet reduction + interest rate cuts" may lead to a steepening yield curve and "liquidity stratification." Its main impacts include:

Profit-taking in "weak dollar trades" leads to panic selling in non-ferrous metals in the short term, and long-term upside potential may also be limited.

Balance sheet reduction is expected to significantly lower U.S. inflation levels.

Funds flow out of junk assets and financial speculation into the real economy, raising financing costs for high-debt economies while favoring high-growth economies.

Market volatility increases, and risks return.

Although non-ferrous financials have seen significant declines, U.S. stocks overall remain relatively stable, and high-growth industries like AI are expected to benefit from subsequent interest rate cut policies.

A steepening yield curve is favorable for the financial sector (especially banks benefiting from rising net interest margins).

The benefits for technology growth and the financial sector may influence China's A-share and Hong Kong stock markets through global yield curve linkages.

Challenges facing Warsh:

Warsh still requires approval from the U.S. Senate before officially taking office, which may face some uncertainty, but overall it is limited.

Warsh needs to simultaneously meet Trump's expectations for the Federal Reserve to comply with his will and the market's expectations for the Federal Reserve to maintain policy independence.

The interest rate decision is voted on by 12 members of the Monetary Policy Committee (FOMC). Although the Federal Reserve Chair has significant influence, they do not have unilateral decision-making power. Warsh's past public criticisms of the Federal Reserve leadership may put him to the test of trust among his new colleagues.

Warsh has committed to breaking this tradition by thoroughly rethinking the Federal Reserve's asset holdings, policy framework, economic role, and relationship with the executive branch. In fact, to implement the "balance sheet reduction + interest rate cuts" policy combination, Warsh will also need to adjust the current monetary policy rules and implementation framework of the Federal Reserve and gain the majority approval of the Monetary Policy Committee members.

Warsh's policies have reversed the current weak dollar expectations, aligning with Bessenet's strong dollar policy inclination (which also aligns with Wall Street interests given their backgrounds), but seemingly diverging from Trump's weak dollar policy.

He must assess the impact of Trump's reshaping of the global trade landscape, judge the profound changes that artificial intelligence brings to productivity and the labor market, and also address the potential impact of the rise of digital assets on the banking regulatory system.

February A-share outlook: short-term correction pressure, spring rally not over

Cooling sentiment issues a right-side sell signal, and the market faces short-term correction pressure.

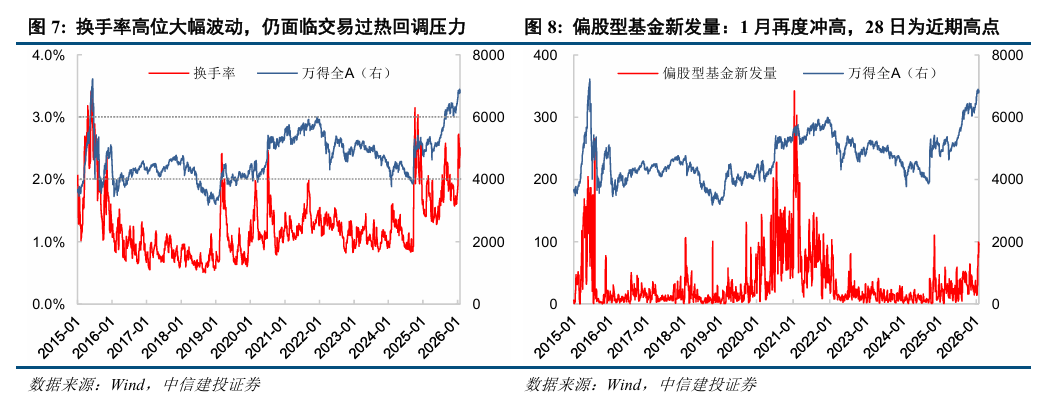

The investor sentiment index we have constructed and continuously tracked shows that after the start of the year, market sentiment rapidly warmed, rising from below 80 at the end of last year to above 88 by mid-month. The "stability first" policy orientation has suppressed the "crazy rise" of stock prices, but abundant incremental funds still indicate high investor sentiment, with the Wind All A Index maintaining a high level. By January 20, the sentiment index broke through 90 again, entering the exuberance zone, and thereafter oscillated in a narrow range between 90-93, reflecting the tug-of-war between the market's "accelerated topping" impulse and regulatory "active cooling." On January 30, due to severe fluctuations in international precious metal prices and large-scale sell-offs of broad-based ETFs in A-shares leading to liquidity pressure, the sentiment index showed a significant decline, issuing a right-side sell signal and facing a test of falling out of the exuberance zone. Considering the rising risk aversion before the Spring Festival and the seasonal effect of the sentiment index's decline, we expect the market to face short-term cooling of sentiment and index correction pressure.

Some sub-indicators of sentiment also suggest that the market faces short-term correction pressure, such as the turnover rate remaining high at over 2%, indicating that the current market is still overheated, and subsequent corrections may be significant. The issuance volume of equity funds has also surged recently, reaching a recent peak on the 28th, which often corresponds to market phase peaks. However, other sub-indicators reflecting market strength and weakness, such as exceeding MA60 and overbought/oversold conditions, have retreated from high levels, indicating that the overall adjustment pressure on A-shares is limited. (See "After the Big Rise at the Beginning of the Year, Active Cooling: What is the Market Sentiment? — Market Sentiment Tracking January Report")

Considering the current market incremental funds and various sub-indicators of the sentiment index, we expect the overall A-share index to have limited adjustment space and is likely to stabilize before the Spring Festival, with a new round of upward momentum expected before and after the holiday.

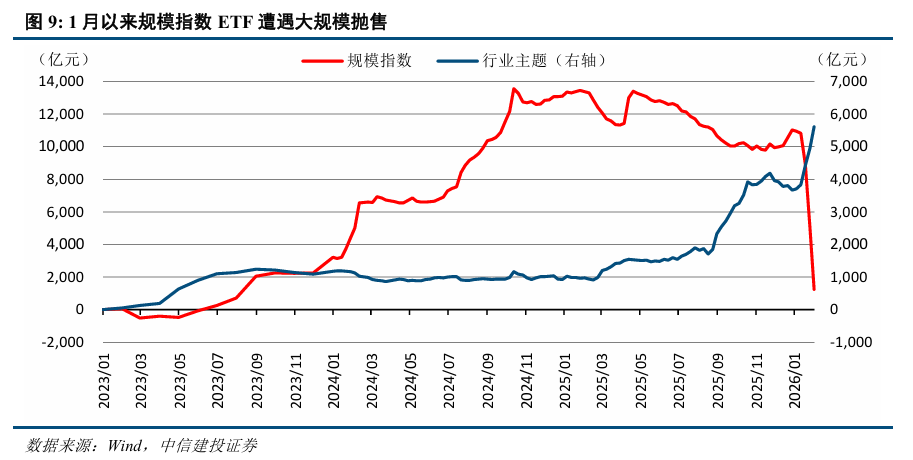

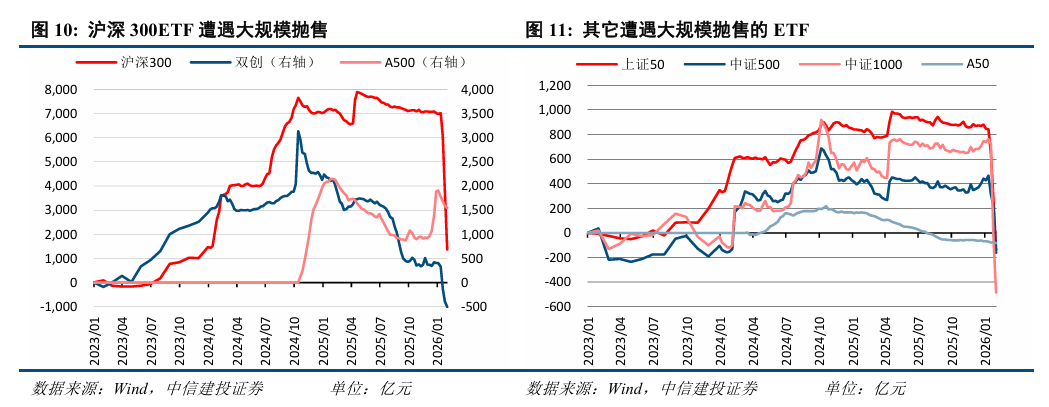

Will the wave of selling in broad-based ETFs continue?

On January 15, the China Securities Regulatory Commission held a system work meeting for 2026, proposing to "adhere to stability first and timely carry out counter-cyclical adjustments." Subsequently, major scale index ETFs in the market faced a large-scale sell-off, suppressing the market's upward momentum and gradually cooling market sentiment. According to our monitoring of major ETF products in the market, the recent targets of significant sell-offs include the CSI 300, CSI 1000, SSE 50, and CSI 500 ETFs, while the ChiNext and A500 ETFs also faced small-scale sell-offs.

If we focus on the recent trends of the ETFs held by the National Social Security Fund, we can see that approximately 53-66% of the shares of the CSI 300 ETF held by the fund have recently (from January 15 to 29) decreased, about 73-91% of the shares of the CSI 1000 ETF have decreased, and the proportion of shares of the SSE Sci-Tech 50 ETF has even decreased by as much as 94%. The estimated outflow of funds is approximately 913.4 billion.

Will the wave of selling in broad-based ETFs continue? We believe that the scale of broad-based ETF sell-offs is expected to decrease significantly or even completely stop next week. The reasons are: 1) According to our monitoring data, market sentiment has shown a significant cooling, and the previous ETF sell-offs have begun to show effects on tightening market liquidity; 2) The severe fluctuations in international gold and silver prices have led to a phase shift in global weak dollar expectations, with rising risk aversion and cautious sentiment in the market, compounded by the approaching Spring Festival, further increasing the willingness to seek safety, making further cooling unnecessary; 3) The scale of the National Social Security Fund's ETFs has already decreased by about 60%, and a certain scale of ETFs still needs to be retained as a tool for future adjustments. Therefore, for the A-share market, although it still faces short-term cooling of sentiment and correction pressure, the market is expected to stabilize and accumulate energy for the next round of upward movement as the ETF sell-offs cease.

Optimistic about the continuation of the spring rally

Although there is short-term correction pressure, we remain optimistic about the continuation of the spring rally for three reasons:

Abundant incremental funds: In the previous in-depth report "Funds Safeguarding, Prosperity as the Guideline — 2026 A-share Fund Outlook (Part 2)," we pointed out that this year will see a wave of maturing time deposits, with approximately 45 trillion yuan of time deposits maturing, particularly concentrated in the first quarter, making it the most abundant point for incremental funds throughout the year. As the wave of selling in broad-based ETFs gradually ends, the market's incremental funds are expected to improve significantly.

Numerous policy benefits and industrial catalysts: On January 30, the CSRC publicly solicited opinions on amending "Securities and Futures Legal Application Opinion No. 18," which essentially represents a systematic improvement of the strategic investment system. By clarifying the scope of subjects, shareholding requirements, empowerment responsibilities, disclosure obligations, and regulatory bottom lines, it opens a channel for medium- and long-term funds to enter the market while preventing institutional abuse through strict regulation. The new system is a significant benefit for attracting medium- and long-term funds to deeply participate in the operations of listed companies and industrial upgrades, which is expected to activate A-share mergers and acquisitions and boost market risk appetite. Additionally, the introduction of the national capacity electricity pricing policy completes the last piece of the energy storage puzzle. Recently, AI large model hotspots have emerged: Silicon Valley's Clawdbot has gained attention both overseas and domestically, becoming the most notable AI product at the start of 2026. Domestic AI large models such as DeepSeek-OCR2, Kimi K2.5, and Alibaba's Qwen3-Max-Thinking have also made significant advancements.

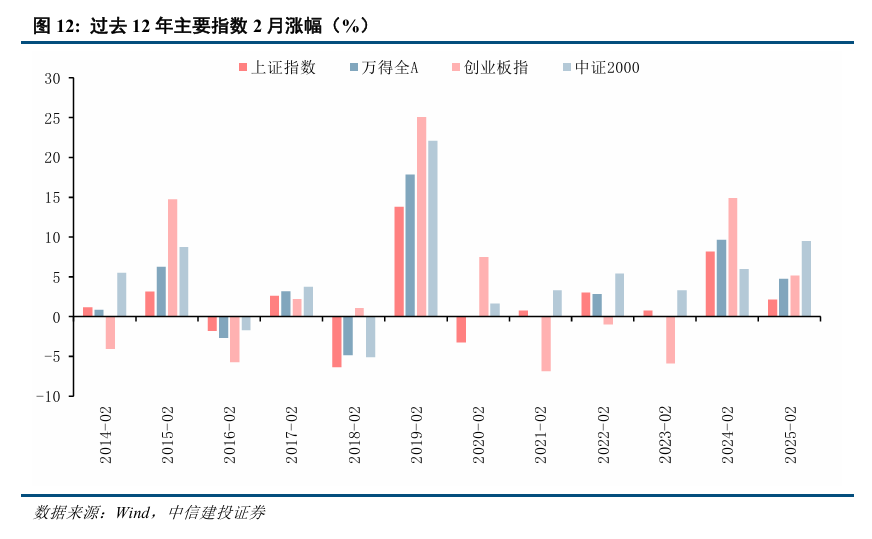

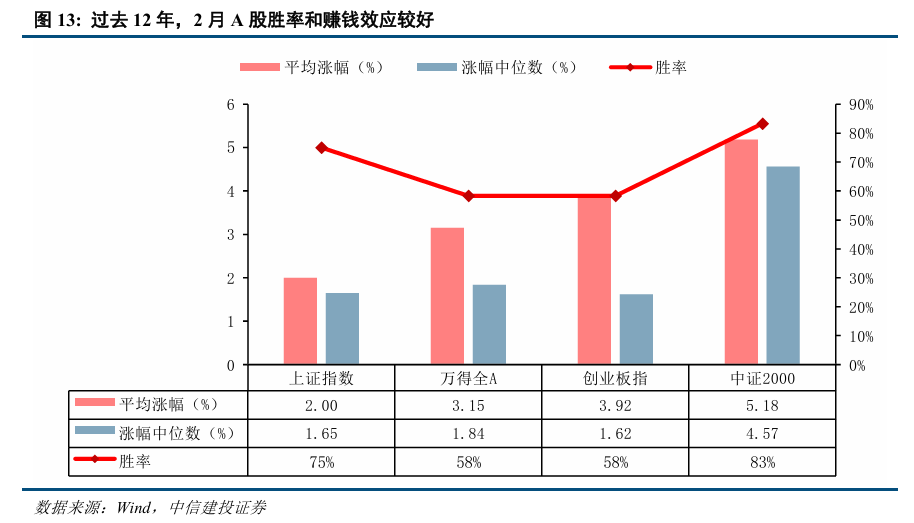

From a seasonal effect perspective, February typically has a high win rate and good profit-making effect: We have statistically analyzed the performance of major indices in February over the past 12 years, finding that the win rates for the Shanghai Composite Index and the CSI 2000 are 75% and 83%, respectively, while the win rates for the Wind All A and ChiNext indices also reach 58%. In terms of average gains, small-cap and technology growth styles dominate, with the average gains for the CSI 2000 and ChiNext indices being 5.18% and 3.92%, respectively, while the average gains for the Shanghai Composite Index and Wind All A reach 2.00% and 3.15%. Overall, February serves as a key period for the spring rally (between the Spring Festival and the Two Sessions), where investor enthusiasm for buying is often high. Combined with the current bullish atmosphere in the market, we expect a new round of upward movement after the Spring Festival.

Long-term adherence to the dual main lines of "technology + resource products," with accelerated short-term style switching

In the November 2026 A-share strategy outlook "Slow Bull New Journey: Betting on the Present, Layout for the Future," we pointed out that A-shares are entering a critical period for verifying prosperity in 2026, with intensified industry style rotation. We are optimistic about the technology growth main line, while resource products are likely to become a new main line direction for A-shares following the technology main line. Recently, the characteristics of the "technology + resource products" dual main line have become evident, with accelerated style rotation: Starting in late December, the technology sector represented by commercial aerospace has rapidly strengthened, leading the A-share market; as the CSRC implements "counter-cyclical adjustments," technology hotspots have adjusted, and funds have shifted towards cyclical products represented by non-ferrous metals and chemicals, while sectors like home appliances, automobiles, and photovoltaics have significantly declined due to rising raw material cost concerns. However, with the recent severe fluctuations in international precious metal prices, funds have once again shifted towards the technology growth style, leading to significant declines in cyclical sectors. Looking ahead, we continue to be optimistic about the long-term performance of the "technology + resource products" dual main line, with short-term fund flows influenced by prosperity (such as annual report performance forecasts), industrial catalysts, and external environments.

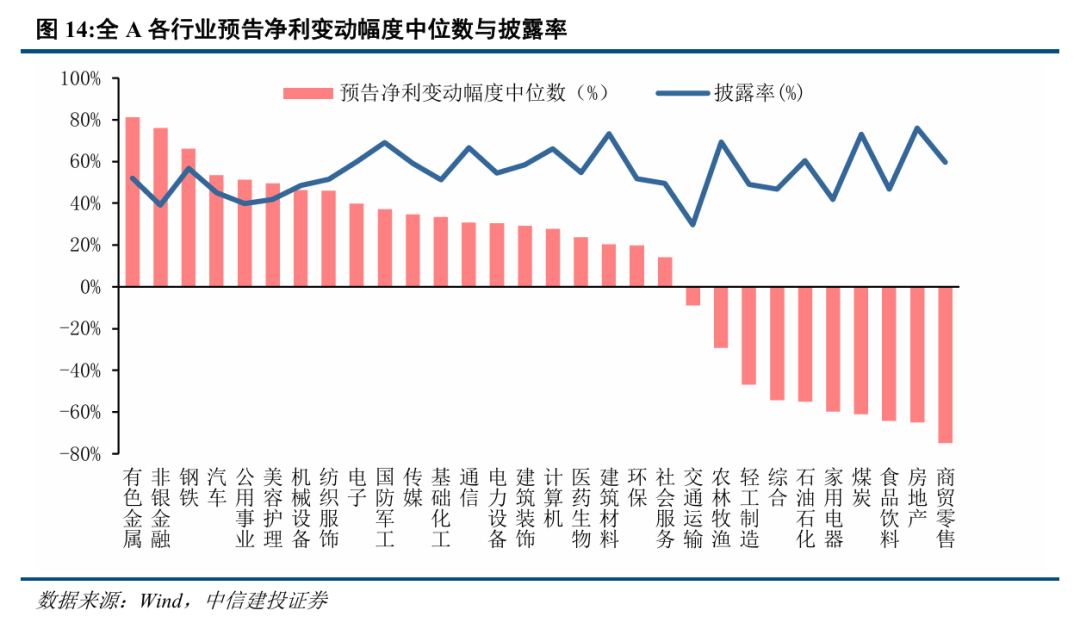

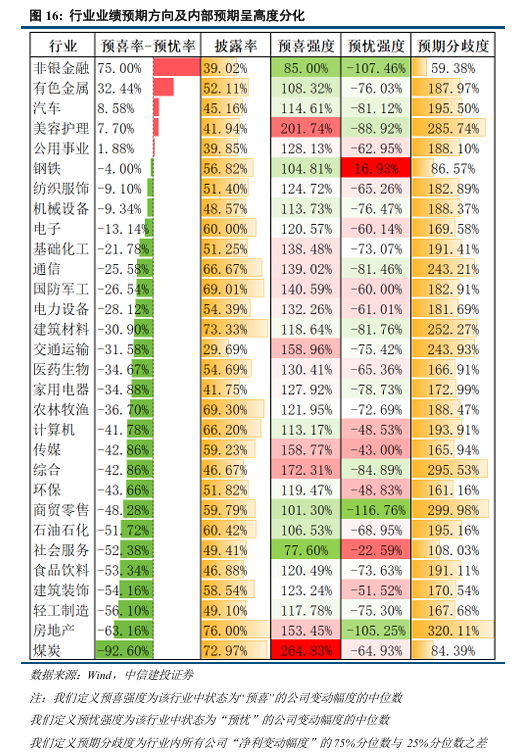

Annual report performance forecast situation: Significant industry differentiation, high prosperity in non-bank, non-ferrous, and automotive sectors

As of January 31, 2026, the disclosure of annual report performance forecasts for A-share listed companies for 2025 has been largely completed. From the overall performance of the disclosed samples, the median change in net profit forecast for the entire A-share market has reached 29%, indicating a mild recovery in corporate profitability. In terms of profit scale, if we estimate the current net profit attributable to the parent company based on the arithmetic average of the upper and lower limits of the forecasted net profit, the average profit scale of the disclosed companies is approximately 52.3 million yuan. The data indicates that despite the challenging macro environment, there is a trend of improvement in the profit center.

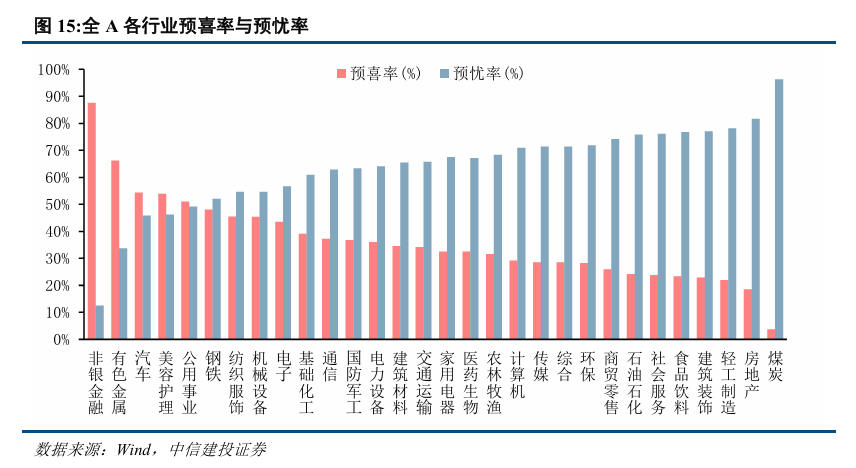

Industry prosperity shows significant differentiation, with resources and finance leading while domestic demand is under pressure. The distribution of performance revisions and growth shows a clear clustering effect: The non-ferrous metal industry leads the entire industry with a median change in forecasted net profit of 81%, and its positive forecast rate is as high as 66%, reflecting the strong pricing power of upstream resource products amid price fluctuations. The non-bank financial industry follows closely, with a median change in forecasted net profit of 76%, and its positive forecast rate reaches an absolute high of 88%, confirming the positive impact of the capital market's recovery on asset allocation and related business profits. In contrast, the median change in forecasted net profit for the real estate, commercial retail, and food and beverage industries is below -60%, with the negative forecast rate exceeding 70%, indicating that the consumption side and traditional industries like real estate still need to recover.

Overall, the median change in net profit for the non-ferrous metals, non-bank financial, steel, automotive, public utilities, beauty care, machinery, and textile and apparel sectors is the highest, with median net profit changes exceeding 45%. Among these, non-ferrous metals, non-bank financials, steel, and public utilities significantly exceed market expectations. The technology sector, including electronics, communications, computers, media, power equipment, and pharmaceuticals, also shows median net profit changes exceeding 23%, continuing a rapid growth trend.

Performance confirms market main lines, with leading companies in various sectors showcasing distinct highlights.

There is a clear heterogeneity in industry expectations, with high growth and low divergence in prosperous sectors, while pressured areas face deep adjustments and chaotic expectations. Observing the overall direction and internal structure of performance forecasts across industries, each sector has its own characteristics under the general performance expectation. Non-bank financials and non-ferrous metals not only have significantly optimistic net expectations, but their companies with positive forecasts also show median net profit growth rates of 85% and 108%, respectively, while their expectation divergence is relatively low at 59% and 188%, indicating strong profit support and internal consensus for their optimistic outlook. On the other hand, most industries exhibit net pessimistic expectations, with real estate and coal sectors showing the deepest levels of net pessimism. Notably, some net pessimistic industries have significant internal structural differences: for example, the defense and military industry and the power equipment sector have relatively mild median net profit adjustments among their companies with negative forecasts, and their expectation divergence is lower than many other net pessimistic industries; although the steel industry has an overall pessimistic outlook, the net profits of companies with negative forecasts are rising strongly, indicating a recovery momentum; meanwhile, sectors like commercial retail and real estate face both deep net profit adjustments and extremely high expectation divergence.

Industry Catalysts: New Energy and AI Receive Positive Developments

The national capacity electricity pricing policy has been introduced, marking a key step towards the power system's transition to a high proportion of new energy.

The National Development and Reform Commission and the National Energy Administration recently jointly issued a notice on improving the capacity pricing mechanism on the generation side, officially launching the national capacity electricity pricing policy. We believe this marks a transition of China's electricity market from a "single electricity pricing" model to a multi-dimensional value system of "electricity + capacity + ancillary services." The policy clarifies the capacity compensation mechanism for coal power and new energy storage, ensuring the recovery of fixed costs for traditional power sources while establishing the systemic value of new energy storage at the national level for the first time, providing a stable source of income for the storage industry and promoting the transition of the power system to a high proportion of new energy.

The energy storage industry is accelerating expansion: The national unified capacity mechanism breaks local pilot differences, and the domestic energy storage industry chain is expected to experience an explosion in demand in 2026, with leading companies particularly benefiting from the growth in long-duration storage demand.

Reconstruction of power system value: The policy for the first time prices "reliable capacity" as an independent commodity, providing security for the integration of high proportions of new energy into the grid, which will promote the coordinated development of new energy and regulatory resources.

Deepening the transition of coal power: The capacity pricing guides coal power from "base load operation" to "peak shaving," increasing the demand for unit flexibility transformation, enhancing the profitability stability of thermal power companies with locational advantages.

Highlights in AI large models

Recently, the field of AI large models has shown a dual-driven characteristic of "technological architecture innovation and accelerated scene implementation." Internationally, Clawdbot (later renamed Moltbot) redefines the AI Agent form with a "local-first + reverse control" architecture; domestically, Alibaba's Qwen3-Max-Thinking achieves a leap in reasoning performance with its trillion-parameter scale and testing time expansion technology, rivaling GPT-5.2 and Gemini 3 Pro; DeepSeek-OCR2 breaks through the bottleneck of complex document understanding through a causal flow query mechanism; Kimi K2.5 enhances long text processing and agent cluster collaboration capabilities. Overall, lightweight, localized, and scenario-based approaches have become the main line of technological evolution, with the open-source ecosystem and commercial implementation forming a positive cycle, driving AI from "dialogue interaction" to "autonomous action."

External Influences: "Weak Dollar Trade" Pauses, Which Industries Benefit?

With Warsh receiving the nomination for the new Federal Reserve Chair, the "weak dollar trade" has taken profits and exited, leading to a rise in the dollar index and a steepening yield curve. Which industries stand to benefit the most?

Finance (Banking): If Warsh's "balance sheet reduction + interest rate cuts" policy combination is implemented, it will drive the steepening of the U.S. Treasury yield curve, which will also affect global yield curves. For A-shares and Hong Kong stocks, the financial sector, especially banks, will benefit from the increase in net interest margins and improved profit expectations.

Midstream Manufacturing (Home Appliances, Automotive, Photovoltaics): Recently, midstream manufacturing sectors such as home appliances, automotive, and photovoltaics have shown significant declines. One possible reason is that investors are concerned about a substantial rise in upstream raw material prices (such as copper and silver) without a noticeable improvement in downstream demand, impacting industry gross margins. With the significant drop in the non-ferrous sector on Friday, this concern is expected to ease significantly, benefiting the stock prices of related sectors to return to reasonable levels.

Overall, we remain optimistic about the long-term dual main lines of "technology + resource products." In the short term, market style rotation is accelerating, and the technology sector has already seen a correction. It will benefit from abundant funds and high risk appetite in the spring rally, while policy dividends such as the strategic investment system, the introduction of the national capacity electricity pricing policy, and industry catalysts like AI large models will also support the rise of the technology growth style. Financial and midstream manufacturing sectors, which have seen significant declines, are also expected to experience a rebound. Considering industry prosperity, industry catalysts, and external influences, recent industry allocation should focus on: power equipment (energy storage, ultra-high voltage, photovoltaics, solid-state batteries, etc.), non-bank financials, banks, AI (optical communication, storage, etc.), coal power, home appliances, automotive, and steel.

The effects of domestic demand support policies are below expectations. If subsequent domestic real estate sales, investment, and other data continue to struggle to recover, inflation remains persistently low, and consumption does not show significant improvement, leading to a continuous decline in corporate profit growth rates, the economic recovery may ultimately be discredited, putting overall market trends under pressure, and overly optimistic pricing expectations may face correction.

The risk of intensified Sino-U.S. strategic competition. We must be vigilant about the risks of the expansion and intensification of Sino-U.S. strategic competition. For example, the strategic competition has spread from trade to multiple fields such as technology, key resources, finance, shipping, logistics, and military, leading to comprehensive strategic conflicts that may affect normal economic activities and impact equity markets.

U.S. stock market volatility exceeds expectations. If the U.S. economy deteriorates beyond expectations, or if the Federal Reserve's easing measures are less than anticipated, it may lead to significant volatility in the U.S. stock market, which will also spill over to affect domestic market sentiment and risk appetite.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。