Key Points

The on-chain lending function is gradually transforming from an early focus on leverage to becoming a foundational infrastructure for capital allocation. On-chain lending has become an important part of the DeFi ecosystem. Currently, the TVL of on-chain lending protocols is approximately $64.3 billion, accounting for about 53.54% of the total DeFi TVL.

Aave has become the leading protocol in the on-chain lending space, with a TVL of about $32.9 billion, representing around 50% of the total TVL in the lending sector. Meanwhile, Morphos and others continue to consolidate their market share, resulting in a structure characterized by one dominant player and many strong competitors.

Credit assets have become an important part of on-chain RWA. As more types of debt claims are introduced on-chain, and with the increasing demand from institutions for compliant and traceable collateral, RWA lending is expected to become another significant growth engine. At the same time, the dual improvement of the macro monetary environment and regulatory framework is collectively reducing the costs of capital flow and compliance, creating smoother external conditions for market development.

On-chain lending protocols also face multiple risks. First, they are highly dependent on the value of collateral and market liquidity, with market fluctuations easily triggering liquidations. Second, the introduction of unsecured lending and RWA increases credit default and counterparty risks. Additionally, there is an excessive reliance on token incentives that artificially inflate scale; the security of bridging in cross-chain expansion also exposes high risks. Therefore, on-chain lending protocols must balance safety, liquidity, and compliance while pursuing growth.

As securities tokenization and compliant assets like U.S. Treasury bonds gradually enter the on-chain space, on-chain lending is evolving from a crypto-native financing tool to mainstream financial infrastructure, with a more robust collateral base. In this process, inter-institutional on-chain lending is expected to become an important incremental source. Meanwhile, the coexistence of fixed and floating interest rates will drive the continuous maturation of the on-chain interest rate system, and regulatory and capital logic may also prompt the market to differentiate into a structure with a compliant and stable layer alongside a high-risk innovation layer, accelerating the integration of on-chain lending into the global capital market through asset compliance and institutional connections.

Table of Contents

I. Overview of the On-Chain Lending Market

1.1. Market Size and Capital Flow

1.2. Macro and Industry Driving Factors

1.3. Regulatory Dynamics and Compliance

II. Classification of the On-Chain Lending Market

2.1. Collateralized Lending Protocols

2.2. Unsecured Lending Protocols

2.3. Modular Lending Protocols

2.4. RWA and Lending Integration

III. Competitive Landscape

3.1. Leading Protocols and TVL Changes

3.2. Revenue Structure and Profit Model Comparison

3.3. User Profiles and Asset Structures

3.4. Multi-Chain Deployment and Ecosystem Integration

IV. Risk Dilemmas and Challenges

4.1. Liquidity Risk

4.2. Credit Default Risk

4.3. Illusions of Incentives and Growth

4.4. Cross-Chain Risks

V. Possible Development Trends

5.1. On-Chain Lending for Inter-Institutional Transactions

5.2. Tokenization of Securities and Collateral Potential

5.3. U.S. Treasury Bonds as Core Lending Assets

5.4. Coexistence of Fixed and Floating Interest Rates

5.5. Dual-Layer Structural Differentiation in the Lending Market

VI. Conclusion

References

On-chain lending protocols have become an important part of the DeFi ecosystem. From the initial leverage expansion tools, they have now expanded to encompass stablecoins, RWAs, and other diversified capital markets. On-chain lending protocols not only stably carry liquidity but are increasingly becoming important hubs for capital pricing and allocation. Currently, the TVL of on-chain lending protocols is approximately $64.3 billion, accounting for about 53.54% of the total DeFi TVL (nearly $120.2 billion). Specifically, Aave alone accounts for about 50% of the lending TVL, approximately $32.9 billion, while Morphos and others occupy certain market shares.

In addition, the diversity of funding sources and asset classes in on-chain lending is also increasing, with RWA becoming a new engine for the growth of lending protocols. The structure of the on-chain lending market faces a situation of both growth and challenges. On one hand, the TVL of lending protocols has gradually rebounded, showing signs of overall market recovery. On the other hand, the market still faces structural challenges, with severe liquidity fragmentation, dispersed funds between protocols and chains, and a lack of efficient liquidity integration mechanisms; traditional stablecoin lending is nearing saturation, while RWA and institutional credit remain in short supply, leading to interest rate differentiation and differences in risk preferences. In the following sections, this report will systematically analyze the operational logic, current development status, and trends of the on-chain lending sector from dimensions such as market overview, market classification, and competitive landscape.

I. Overview of the On-Chain Lending Market

1.1. Market Size and Capital Flow

As of now, the TVL of the lending sector is approximately $64.3 billion. Among them, Aave's TVL is about $32.9 billion, exceeding 50%, making it the leading protocol in on-chain lending. In the second tier, Morphos and others continue to consolidate their shares, resulting in a structure characterized by one dominant player and many strong competitors. Overall, capital is concentrating around leading pools that have deep liquidity, multi-network coverage, and compliant asset support. The structural characteristics of capital flow are becoming more pronounced, with RWA capital pools becoming the main line of new growth.

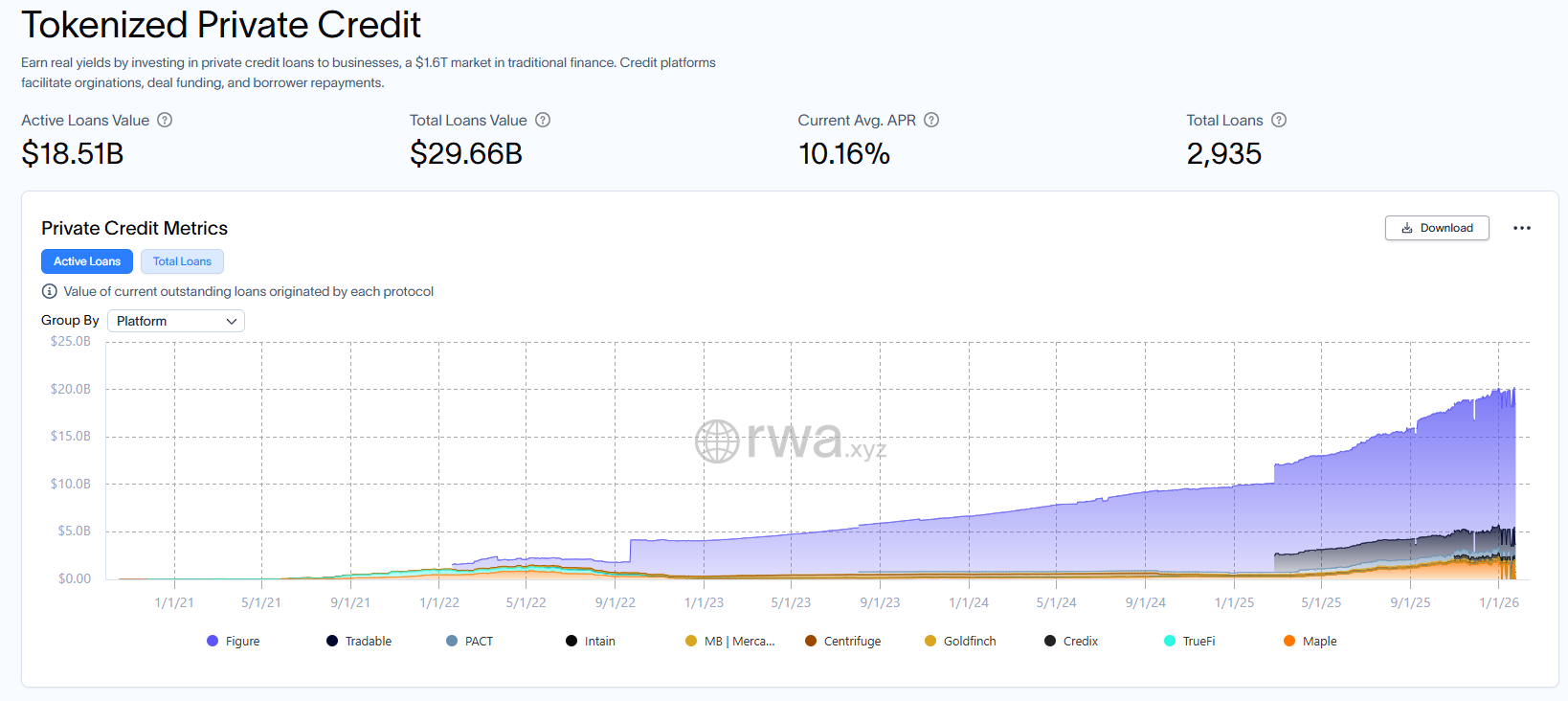

Currently, the leading lending protocol Aave has launched a permissioned platform called Horizon for institutions, allowing KYC-compliant institutions to borrow USDC, RLUSD, and GHO by using compliant tokenized fund shares as collateral, further bridging traditional funds with on-chain liquidity. Meanwhile, the scale of private credit for RWA has reached $18.5 billion, which also opens a new entry point for on-chain lending protocols to attract institutional funds.

Source:rwa.xyz ,RWA.xyz | Private Credit

1.2. Macro and Industry Driving Factors

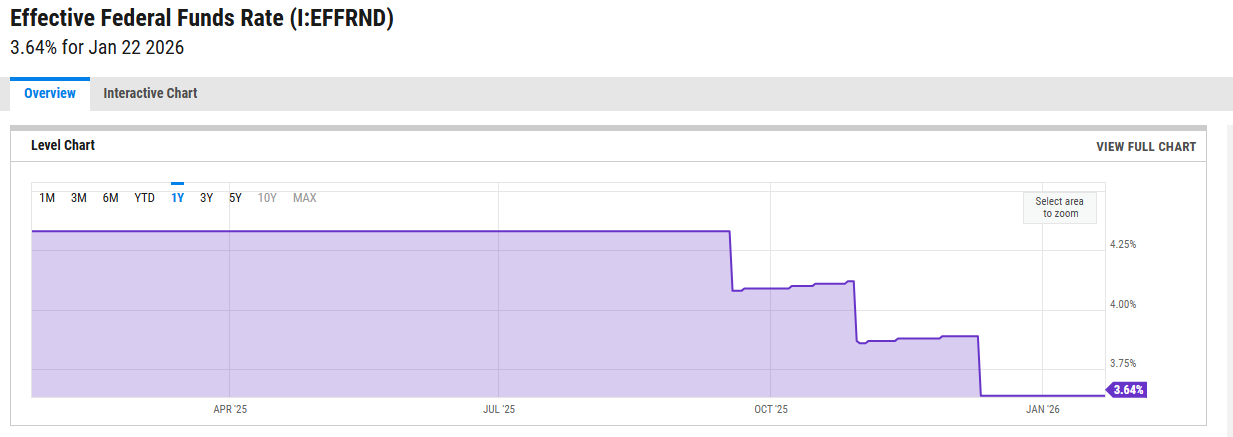

From a macro perspective, the federal funds rate has fallen from its peak of around 3.6% at the end of 2024, and the market generally expects a continued moderate easing trend in the future. The European Central Bank has also released signals for interest rate cuts, promoting liquidity easing in the Eurozone. Against this backdrop, for institutions and high-net-worth funds seeking alternative dollar yields, the on-chain market not only provides excess spreads but also features real-time settlement, on-chain transparency, and asset composability—characteristics that traditional money market funds cannot replicate. This macro interest rate differential effect is driving institutional funds to systematically enter compliant platforms like Aave, enhancing the strategic value of on-chain lending in the global capital allocation landscape.

Source:ycharts ,https://ycharts.com/indicators/effective_federal_funds_rate

1.3. Regulatory Dynamics and Compliance

The passage of the GENIUS Stablecoin Act is significant as it establishes a legal status for stablecoins. For on-chain lending protocols, this means a reduction in the legal risks associated with collateral, which can attract more banks, funds, and qualified institutions to participate in the lending market. Meanwhile, the advancement of the Anti-CBDC Act has, to some extent, prevented the official digital dollar from directly replacing market stablecoins, thereby ensuring the core position of stablecoins in the digital financial system. This policy effectively reserves broader space for the long-term development of the on-chain lending market.

Of particular note is that in June 2025, the new chairman of the SEC, Paul Atkins, emphasized the self-operating and risk-resistant capabilities of DeFi protocols during the fifth roundtable on "DeFi and the American Spirit," stating that he would continue to promote "innovation exemptions" to lower compliance thresholds for on-chain products. As the regulatory framework gradually becomes more detailed and institutionalized, cross-border funds are expected to enter compliantly through permissioned lending pools, which not only expands the participants in on-chain lending but also promotes its upgrade from a crypto-native market to a foundational financial platform capable of deep integration with global capital markets.

II. Classification of the On-Chain Lending Market

This report will analyze the current mainstream lending protocols from four core directions: collateralized lending, unsecured lending, modular lending, and the integration of RWA and lending. In assessing the development level and efficiency of the protocols, we will focus on active loan volume, protocol revenue, and token incentive mechanisms to measure the operational efficiency and risk exposure of the platforms. Among these, active loans can intuitively reflect the real borrowing demand in the market; protocol revenue reflects capital utilization and sustainability; while token incentives reveal the attractiveness of the protocol in competition and its long-term incentive structure. Through multi-dimensional comparative analysis, this report aims to present the true face and operational logic of on-chain lending protocols.

2.1. Collateralized Lending Protocols

Collateralized lending protocols are the earliest financial applications to achieve large-scale implementation in the DeFi space. Their core mechanism allows users to obtain borrowing limits by over-collateralizing assets, while the protocol ensures system stability through liquidation mechanisms and risk parameters. In this model, credit risk is transformed into collateral risk, and the flow of funds is completely transparent, making collateralized lending protocols one of the most fundamental markets on-chain. Current representative projects include Aave, Compound, and Sky.

2.1.1 Aave

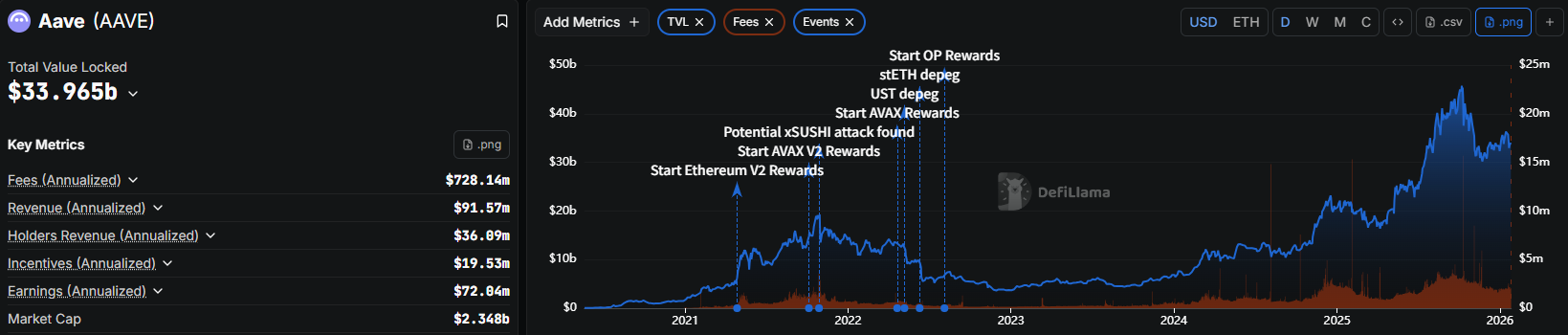

Since its launch, Aave has never experienced security vulnerabilities at the smart contract level, which is a core factor in its emergence as the largest lending platform. As of now, Aave's protocol TVL is approximately $32.9 billion, with an annual revenue of about $100 million, reflecting a year-on-year growth of about 28%. Aave's market share in the lending sector has also grown to 50%, leading the entire DeFi lending field. Its cross-chain layout covers multiple public chains, including Ethereum, Arbitrum, and Base.

The technological evolution of Aave is also a core driver of its growth. In June 2025, during the Ethereum community meeting, Aave founder Stani Kulechov introduced the Aave V4 upgrade. This V4 upgrade introduces a "centralized radial" liquidity architecture, which unifies the management of multi-chain liquidity in a central pool while supporting modular expansion and on-chain developer custom deployments, and optimizes cross-chain lending and dynamic risk control. Additionally, it will achieve deeper integration with Aave's native stablecoin GHO. One of the core innovations of Aave V4 is its deep integration with Horizon. Horizon officially launched in August 2025, aiming to systematically incorporate RWA into the Aave lending system.

Currently, Horizon has introduced some short-term government bonds and fund-type assets, allowing them to be used as collateral for lending. From a strategic positioning perspective, Aave officially stated in its community communication in Q2 2025 that the combination of V4 and Horizon is just the starting point. Future plans will gradually expand to include RWA staking modules, risk customization products, and a broader capital market infrastructure for on-chain fund routing. Through this series of iterations, Aave is expected to build a complete asset access and liquidity distribution system at the intersection of DeFi and traditional finance, bringing more stable cash flow and deeper institutional participation to the protocol.

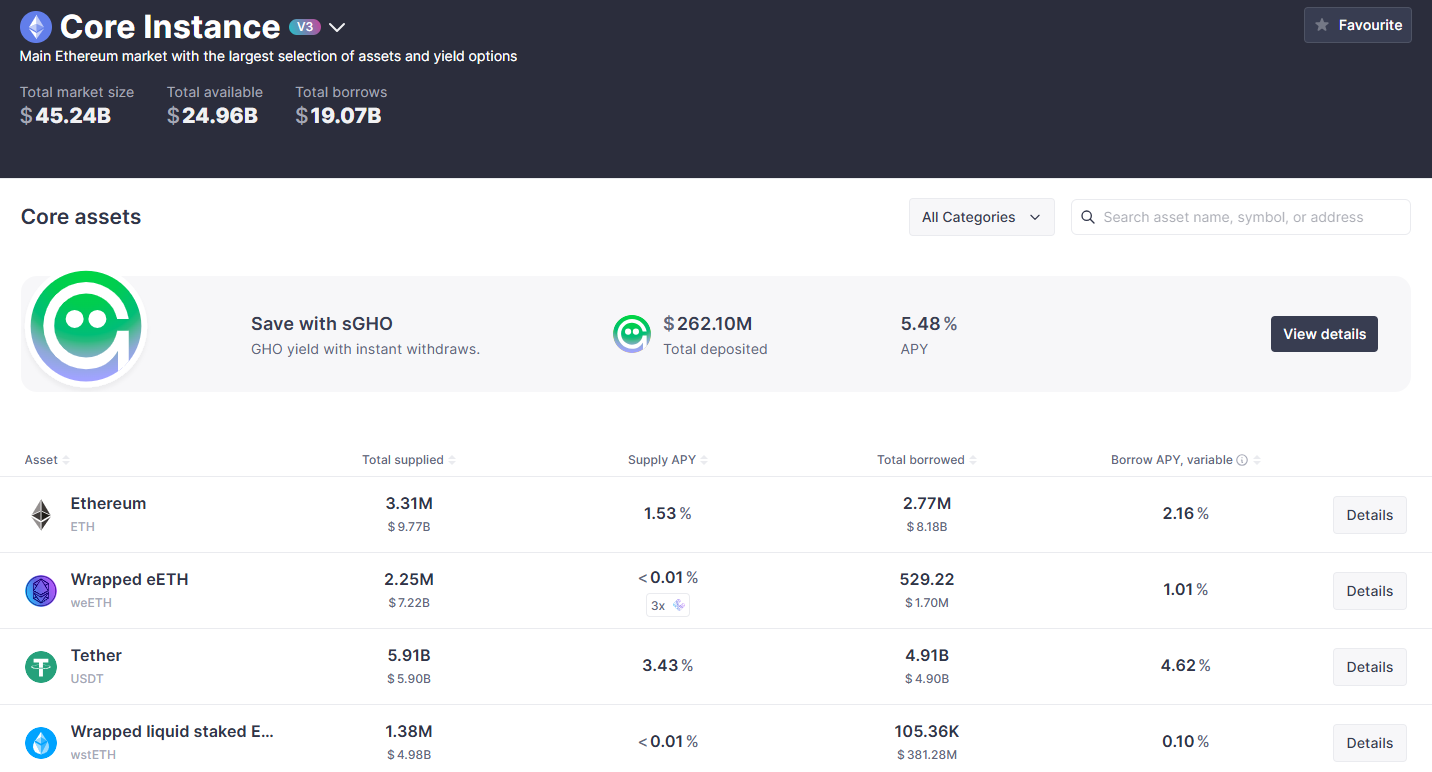

In terms of asset structure, ETH and its liquid staking derivatives (such as weETH, wstETH, rsETH, etc.) constitute the main collateral asset pool, with a total supply of approximately $9.8 billion and a borrowing amount of about $8.2 billion, maintaining a borrowing interest rate of around 2.16%. Stablecoins USDT and USDC are the primary lending targets, with borrowing scales of approximately $4.9 billion and $3.9 billion, respectively, corresponding to annualized borrowing rates of about 4.62% and 4.9%.

Additionally, strategic assets like GHO (sGHO) and BTC-type assets like WBTC also hold a certain proportion, indicating that Aave is gradually expanding into a diversified range of asset types and risk-return combinations. Overall, Aave's asset supply and demand structure remains robust, with the distribution of borrowing rates matching the risk characteristics of the assets. ETH dominates the ecosystem while continuously introducing native stablecoins and diversified LSD derivatives to meet more flexible DeFi lending needs.

Source:app.aave ,https://app.aave.com/markets/

2.1.1.1 Active Loans

Aave's active loans are primarily concentrated on the Ethereum mainnet and mainstream Layer 2s (such as Arbitrum and Base), with assets mainly consisting of USDC, USDT, and wETH. Over the past year, Aave's total active lending amount has steadily increased from approximately $10 billion to the current $23.7 billion, setting a new annual high with an overall increase of over 120%. Especially since May 2025, the lending amount has shown a steady rise, with user leverage demand and market liquidity recovering simultaneously, likely driven by multi-chain expansion and the growth of stablecoin GHO applications. However, rapid growth also comes with potential risks, such as the concentration of high-leverage assets that may amplify liquidation risks during market fluctuations. Aave needs to stabilize protocol security by optimizing risk parameters and incentive mechanisms.

Source:tokenterminal ,https://tokenterminal.com/explorer/projects/aave

2.1.1.2 Protocol Revenue

Currently, Aave's revenue mainly comes from the lending business of Aave (V3), with revenue related to the stablecoin GHO still accounting for a small proportion of the total protocol revenue. Aave's cumulative revenue has continued to grow since 2022 and has accelerated significantly after 2024. In just the past year, Aave's cumulative protocol revenue has increased by approximately $150 million, with the revenue curve showing a relatively flat early stage followed by an upward trend. The second half of 2024 to early 2025 is the most concentrated phase of revenue growth, with a noticeable upward slope in cumulative revenue, reflecting the simultaneous increase in lending scale and on-chain capital utilization activity.

Although there have been brief slowdowns in cumulative revenue growth during certain periods, the overall trend has not reversed, and cumulative revenue has continued to rise steadily after 2025. Overall, Aave's revenue growth pace is highly correlated with market cycles, but its core lending business consistently contributes stable cash flow across multiple cycles, demonstrating the long-term resilience and sustainability of a mature DeFi lending protocol.

Aave's revenue remains highly concentrated on the Ethereum mainnet, and although there has been some decline between quarters, its volume still far exceeds that of other chains. Meanwhile, Arbitrum and Polygon, as leading scaling networks, have shown revenue fluctuations but maintain secondary importance in the multi-chain layout; contributions from chains like Base and Avalanche are relatively limited. Notably, emerging chains like Sonic and Linea began contributing revenue in 2025, although the amounts are still small, reflecting Aave's intention to continue expanding in the multi-chain ecosystem. The overall pattern shows a hierarchy where the mainnet holds absolute dominance, a few scaling networks provide support, and other new chains explore growth.

Source:aave.tokenlogic.xyz ,https://aave.tokenlogic.xyz/revenue

At the same time, Aave DAO launched a six-month AAVE buyback plan starting in April 2025, with a maximum weekly investment of $1 million for market buybacks, having repurchased over 50,000 AAVE to date. This plan relies on the real income generated from core businesses such as loan spreads, reflecting Aave's robust cash flow and sustainable profitability. Unlike platforms that rely on subsidy-driven models, Aave enhances token value support through a revenue-sharing mechanism, making it more transparent and attractive to institutional investors in the long term.

Aave founder Stani Kulechov stated that in the future, Aave's revenue structure will consist of three core businesses: first, traditional DeFi lending services, relying on stable interest income; second, the GHO stablecoin business, which brings stable minting spread income through over-collateralized minting mechanisms; and third, the newly launched Horizon, which supports RWA as collateral, expanding the institutional user market and bringing new sources of income such as collateral management fees and cross-border settlement.

2.1.1.3 Token Incentives

Aave's token incentive mechanism was initially implemented through a security module, where users stake AAVE into the security module to provide a buffer pool for the protocol to handle bad debts. In the event of a shortfall, the staked funds may be reduced to cover losses, and as compensation for bearing the risk, stakers can earn AAVE token rewards. This mechanism has helped the protocol quickly accumulate security redundancy in the past, but it has also brought high token inflation costs.

In 2025, Aave's Umbrella upgrade reformed this model. Umbrella automates the execution of bad debt protection and incentive distribution, introducing a 20-day cooling-off period and a 2-day withdrawal window to prevent large-scale runs during risk events. It also adopts a dynamic incentive model, where reward levels are linked to whether the staked amount meets target coverage. When coverage is insufficient, rewards increase to attract liquidity; when coverage is excessive, rewards gradually decrease. With the launch of Umbrella, Aave is gradually reducing its reliance on traditional security modules.

According to Aave DAO data, the daily rewards for stkAAVE have decreased from 360 to 315, corresponding to an annualized return rate of about 3.9%, but the staking rate remains around 19%, indicating that the protocol's security redundancy remains robust even under lower incentives. This suggests that the previously high incentive levels have ample room for adjustment, and as Umbrella directly binds risk coverage and rewards to the target coverage needs of various assets, the model based on AAVE inflation subsidies is gradually being marginalized, with future token incentives reflecting real risk compensation rather than purely subsidy-driven mechanisms.

2.1.2 Compound

Compound is one of the earliest and most representative protocols in the DeFi lending space, with its core contribution being the replacement of peer-to-peer matching with a liquidity pool model. Compound launched V2 in 2019, first proposing the concept of liquidity markets, allowing users to freely deposit and withdraw assets and achieve automated lending. In 2020, Compound launched the governance token COMP, initiating a liquidity mining craze that directly ignited DeFi Summer and solidified its industry position.

As of now, Compound's core products have fully transitioned to V3, with a total TVL of approximately $1.9 billion, where the Ethereum mainnet still dominates. Over the past year, Compound has added new asset markets such as pufETH, tBTC, and deUSD, but the overall expansion pace has been relatively cautious. In terms of governance, the community has passed a proposal to establish the Compound Foundation to promote the long-term and institutional development of the protocol and continues to collaborate with security agencies. Overall, Compound's current characteristics are robust risk management, a simple structure, and conservative expansion.

2.1.2.1 Active Loans

As of now, Compound's total active borrowing amount is approximately $860 million. From the trend, Compound experienced a noticeable decline in the latter half of 2024 but regained strength from the end of 2024 to early 2025. Over the past year, its lending scale started from about $900 million in mid-2024 and reached a peak of approximately $1.15 billion in the third quarter of 2025, before declining to around $800 million due to fluctuations in the crypto market and intensified competition among leading lending protocols. By the end of 2025, although the total borrowing amount has adjusted from its peak, it has remained within the $800 million range, indicating that Compound's lending demand possesses strong resilience.

Source:tokenterminal ,https://tokenterminal.com/explorer/projects/compound

2.1.2.2 Protocol Revenue

Compound's revenue primarily comes from lending interest spreads, and its V3 architecture introduces more flexible parameter configurations to improve capital efficiency, achieving a better balance between high TVL and sustainable income. On the other hand, the protocol also drives user behavior through the release of COMP governance token incentives and, when necessary, converts part of the COMP into community treasury revenue, forming an indirect source of income. This mechanism combines incentives with governance budget control, further strengthening the protocol's financial structure and growth strategy.

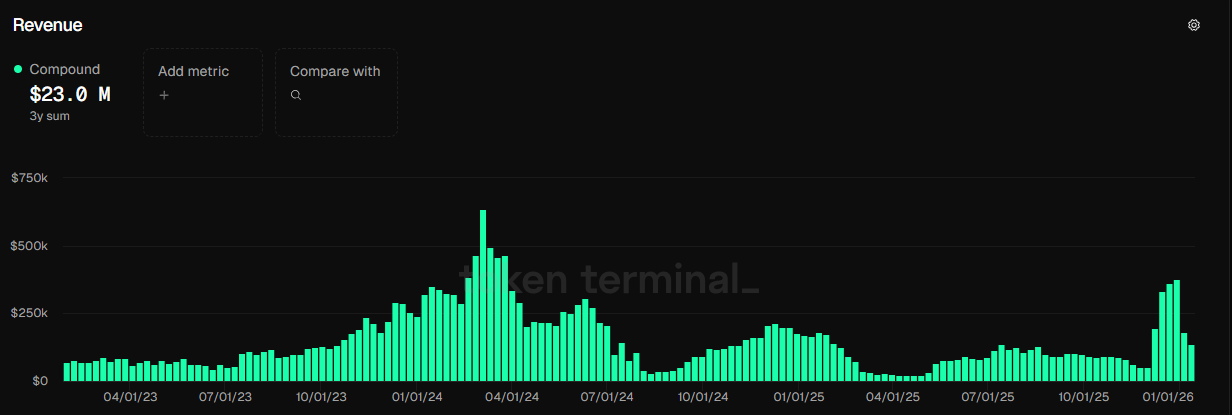

In terms of revenue, Compound has accumulated approximately $23 million in protocol revenue over the past three years, showing a volatility characteristic highly correlated with market cycles. In the first half of 2023, Compound's revenue level was relatively low and stable, with monthly revenue mostly maintained in the range of $100,000 to $500,000. In the second half of 2023, as the crypto market warmed up and on-chain lending demand rebounded, the protocol's revenue gradually increased, reaching a significant volume in Q1 2024, with monthly revenue approaching $600,000, forming a peak.

Subsequently, affected by market cooling, a decline in risk appetite, and decreased lending activity, Compound's revenue experienced a rapid decline in mid-2024 and remained in a lower range of fluctuation from the second half of 2024 to early 2025. In the second half of 2025, with improved market sentiment and a rebound in lending demand, the protocol's revenue showed signs of recovery again, but overall has not returned to the peak levels of early 2024, indicating that Compound's profitability still heavily relies on the macro market environment and on-chain capital activity.

Source:tokenterminal ,https://tokenterminal.com/explorer/projects/compound

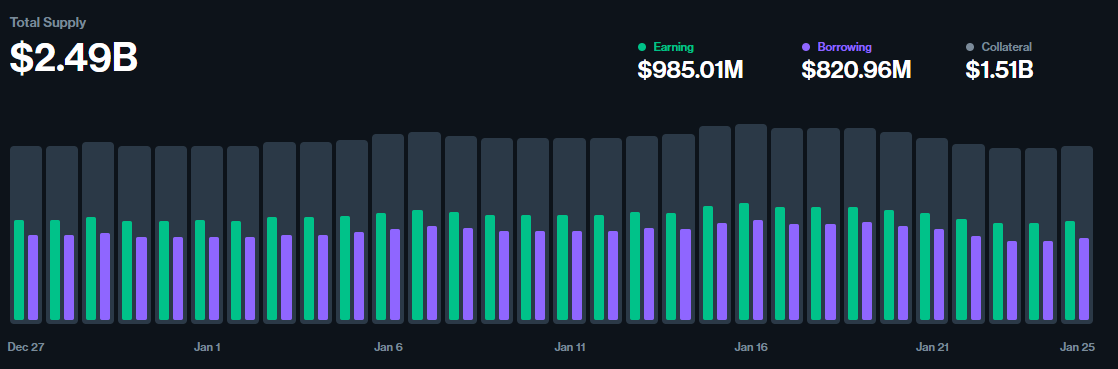

In terms of capital utilization efficiency, Compound's overall capital utilization level remains high. Currently, the total supply of the protocol is approximately $2.49 billion, with deposits generating interest income of about $985 million, corresponding to a borrowing scale of approximately $821 million, indicating that the proportion of lending assets in available liquidity remains stable. Stablecoins continue to be the core source of Compound's capital utilization efficiency, maintaining near full-load lending status across multiple markets, reflecting sustained and robust real lending demand.

In contrast, non-stable assets like WBTC and wstETH occupy an important share of the overall supply, but their primary function still leans towards high-quality collateral and system risk buffering, with relatively limited actual lending utilization. Compound's asset structure is primarily composed of stablecoins and ETH-type assets, with funds mainly distributed across mainstream chains like Ethereum and Base, achieving high utilization efficiency and sustainable interest income while ensuring system security.

Source:app.compound.finance ,https://app.compound.finance/markets

2.1.2.3 Token Incentives

Compound's token incentive mechanism has undergone significant transformation since the launch of COMP. Initially relying on large-scale COMP subsidies to enhance liquidity, this model has gradually been improved with the launch of the V3 architecture and the stable growth of protocol fees. The design of V3 allows for flexible configuration of reward rates for different markets, even using any ERC-20 as incentive assets, along with external subsidies provided by ecosystem funds like Arbitrum to promote Layer 2 markets. This makes Compound's incentives more targeted and cost-efficient, resulting in a noticeable improvement in the protocol's unit economics.

However, compared to Aave's established income buyback token closed loop, Compound still lacks in the token value return mechanism. The governance direction proposed is to periodically allocate about 30% of the protocol reserves to staked COMP holders through the stCOMP module. However, this is essentially a dividend-style distribution rather than directly using income to buy back tokens in the secondary market. Although this method can reduce inflation pressure and increase governance participation, its long-term incentive certainty and capital return strength are not as strong as Aave's, limiting its appeal to institutional funds.

At the same time, Compound's reliance on external ecosystem subsidies introduces certain volatility risks to its TVL stability. The token incentive path of Compound reflects a conservative and prudent orientation, improving the protocol's financial health but lacking a strong narrative in terms of value capture. This report believes that this is also one of the important reasons why Compound is gradually falling behind Aave in competition.

2.1.3 Sky (formerly MakerDAO)

Sky is also one of the most representative protocols in DeFi history, with its predecessor MakerDAO launching the over-collateralized stablecoin DAI in 2017, pioneering the decentralized stablecoin track. In 2024, MakerDAO completed a brand and governance structure reconstruction, rebranding as Sky and launching a new governance token SKY and stablecoin USDS. Subsequently, its governance structure shifted to a multi-sub-DAO decentralized operation, with the protocol's asset-liability management, risk control, and product distribution system fully upgraded, forming a multi-layer structure centered on stablecoin issuance and savings rate tools. In the new structure, Sky is responsible for the underlying capital pool and the issuance and management of stablecoins, especially maintaining the dual-token system of USDS and DAI and its corresponding savings rate mechanism.

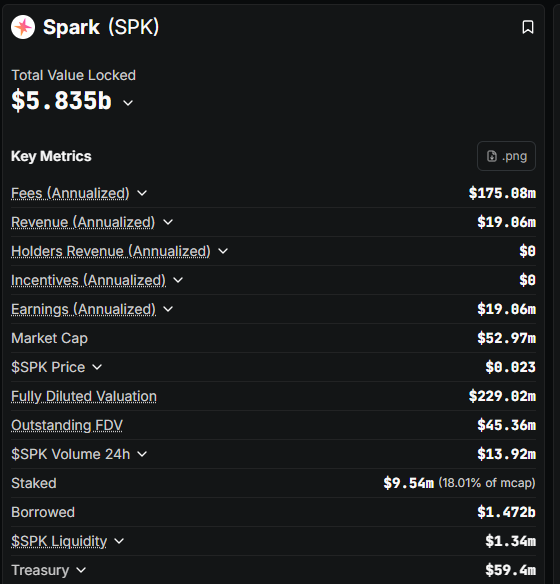

Notably, Spark is the core lending of the Sky ecosystem, operated by an independent team. Spark's unique advantage comes from the Spark Liquidity Layer (SLL), which directly connects to Sky's stablecoin reserves, allocating USDS, sUSDS, and USDC to the lending market as needed. Unlike traditional DeFi protocols that rely on market supply and demand to automatically adjust interest rates, Spark's borrowing rates are set by governance and maintained stable through SLL, allowing it to maintain low volatility and predictable capital costs even in fluctuating environments.

As of now, Spark's total TVL is approximately $5.8 billion, with a loan balance of about $1.5 billion. In terms of revenue, annualized fees generated by Spark are approximately $175 million, with attributable income (referring to the net income of Spark after deducting costs payable to depositors, belonging to the protocol treasury) around $19.06 million, while the income and incentive expenditures for token holders are currently both zero. This means that Spark no longer relies on large-scale token subsidies to maintain business expansion, and protocol revenue can directly accumulate at the system level. Spark is gradually transitioning from the early stage of relying on incentives to drive scale to a growth model centered on real lending demand and sustainable cash flow, with significant improvements in its financial structure and profitability quality compared to earlier stages.

Source:defillama ,https://defillama.com/protocol/spark

2.1.3.1 Active Loans

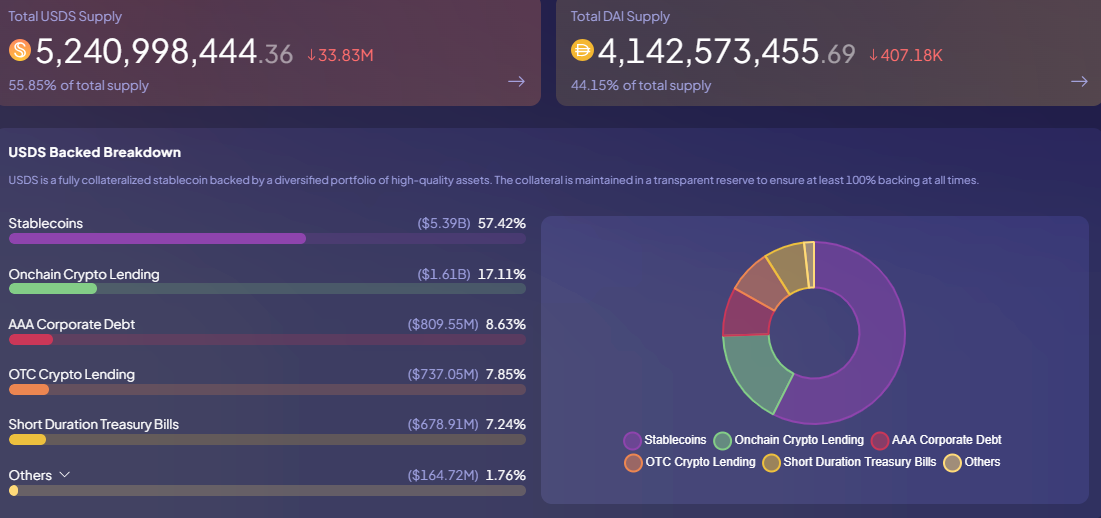

After rebranding, Sky's active loan scale is primarily composed of the circulation of DAI and USDS stablecoins and collateralized lending demand. However, unlike Aave and Compound, which completely rely on matching supply and demand in the lending market, Sky's loans essentially combine the protocol's issuance of stablecoins with market collateralized borrowing. For Sky, the scale of stablecoins is equivalent to the overall borrowing scale of the protocol.

Currently, Sky's total supply of stablecoins is approximately $9.384 billion, with USDS accounting for 55.85% (about $5.241 billion) and DAI accounting for 44.15% (about $4.143 billion). The collateral asset composition of USDS shows a diversified distribution, with stablecoin-type assets accounting for the highest proportion (57.42%, about $5.3 billion), followed by on-chain crypto lending assets (17.11%, about $1.61 billion), and other assets accounting for a total of 25.48%. This asset allocation structure indicates that Sky does not rely on a single asset but combines a diverse mix of stablecoins, on-chain credit, and traditional low-risk assets, achieving a balance between security and liquidity.

Source:info.sky.money ,https://info.sky.money/supply

2.1.3.2 Protocol Revenue

As of now, Sky's annual USDS profit is approximately $176 million. In terms of revenue structure, the protocol's income primarily still comes from core channels such as stability fees and staking reward distributions. Among them, stability fees remain the main source of income, with current annualized stability fee income of about $404 million, which comes from the interest paid by users when borrowing USDS against collateral assets, representing the core profit model of the Sky protocol. Additionally, the annualized scale of SPK staking reward distribution is approximately $11.14 million, serving as a supplementary source within the protocol's revenue system.

On the expenditure side, Sky's cost structure mainly includes savings rate expenditures, operational expenses, and incentive-related expenditures. Among them, savings-related expenditures are approximately $175 million annually, which is the interest cost paid by users holding USDS and participating in the protocol's savings mechanism; operational expenses are approximately $41.8 million annually, covering the protocol's daily operations, R&D investments, and security expenditures.

Furthermore, expenditures related to stUSDS are about $15.05 million, and SKY reward expenditures are about $8.06 million, mainly used to maintain ecological incentives and user participation. Overall, Sky's current profit model still heavily relies on stability fee income, supported by high-scale lending demand, demonstrating strong cash flow generation capability; at the same time, through dynamic adjustments of savings rates and incentive expenditures, the protocol gradually achieves sustainable positive profitability while maintaining the attractiveness of USDS and the stability of the system.

Source:info.sky.money ,https://info.sky.money/

2.1.3.3 Token Incentives

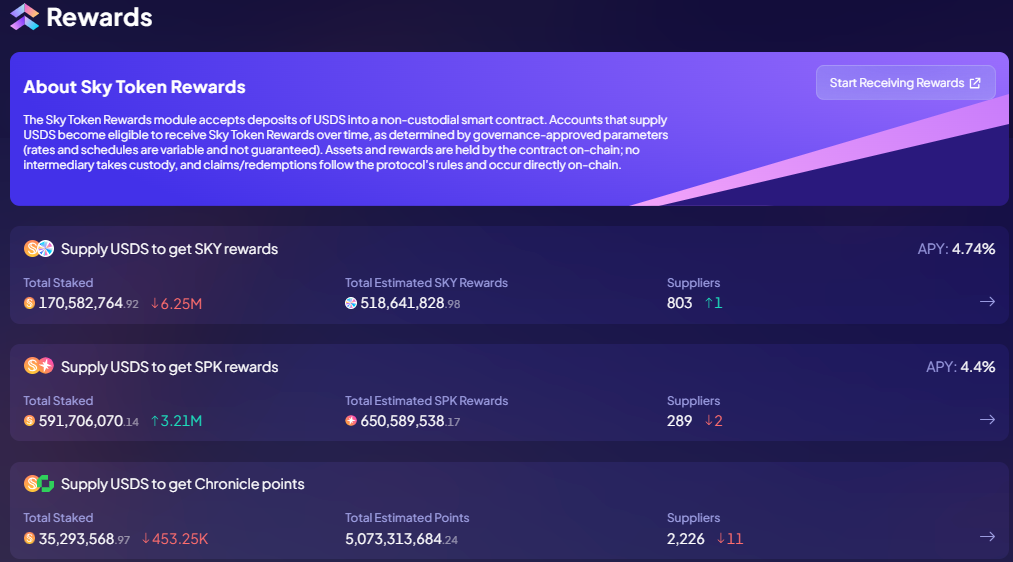

As of now, the Sky protocol's reward system encompasses various token incentive models. From the perspective of the token incentive structure, users can earn three main types of returns by depositing USDS.

The first is SKY token rewards: currently, the amount of USDS staked to earn SKY rewards is approximately 171 million USDS, with an estimated total allocation of about 519 million SKY, corresponding to an annualized yield of about 4.74%; the second is SPK token rewards: the amount of USDS staked to earn SPK is approximately 592 million USDS, with an estimated total allocation of about 651 million SPK, currently yielding about 4.4%; the third is Chronicle points incentives: the current amount of USDS staked to earn Chronicle points is approximately 35.29 million USDS, with an estimated total of about 5.073 billion Chronicle points. These points serve as the official incentive certificates within the Sky ecosystem and can be used for governance or ecological rights distribution in the future, further enhancing user retention.

Overall, the Sky protocol constructs a multi-layered incentive combination around USDS, SKY, and SPK, deeply binding stablecoin liquidity, governance token value, and ecological token incentives, gradually forming an incentive closed loop with endogenous circulation characteristics without relying on a single subsidy method, thereby enhancing the protocol's capital stickiness and ecological sustainability.

Source:info.sky.money ,https://info.sky.money/

2.2. Unsecured Lending Protocols

The core logic of unsecured lending protocols lies in managing risks through credit assessments and off-chain legal frameworks, allowing enterprises or projects to obtain financing even without providing on-chain collateral. This model essentially represents on-chain credit loans, but its risk management relies on off-chain legal contracts and human risk control mechanisms, thus having a stronger compliance orientation, primarily serving users with traditional credit backgrounds off-chain. In this field, Maple Finance is a typical representative, with its product design usually introducing roles such as pool managers or credit approvers, responsible for borrower screening, post-loan monitoring, and risk disposal, thereby replicating the core aspects of traditional credit markets in an on-chain environment.

2.2.1 Maple Finance

Founded in 2019, Maple Finance aims to provide compliant, transparent, and efficient on-chain lending solutions for the institutional market. In December 2022, Maple Finance faced a severe credit default incident when its borrower, Orthogonal Trading, failed to fulfill repayment obligations after the FTX collapse, ultimately defaulting on approximately $36 million in loans on Maple. The root cause of the incident was the borrower's failure in risk management, overly relying on centralized exchange funds, which exposed credit gaps during a sudden drop in market liquidity.

Maple quickly removed Orthogonal Trading from its borrower list and initiated recovery and bad debt isolation mechanisms, while also adjusting the risk review process for credit pools, requiring stricter borrower information disclosure to prevent similar risks from occurring again. Although the incident temporarily impacted Maple's funding trust and TVL, it also prompted its governance to iterate on the on-chain lending risk control system.

Currently, Maple Finance's business layout is divided into two main lines: Maple Institutional, which targets institutional clients, providing KYC-compliant fixed-rate, over-collateralized loans; and Syrup, an open on-chain lending protocol that allows broader capital entry, but borrowers still need to pass Maple's credit review, thus combining CeFi's risk control with DeFi's openness. Based on this, Maple launched the BTC Yield product in 2025, which, in collaboration with the Core Foundation, allows for dual staking of BTC and CORE tokens, creating robust returns for investors denominated in BTC.

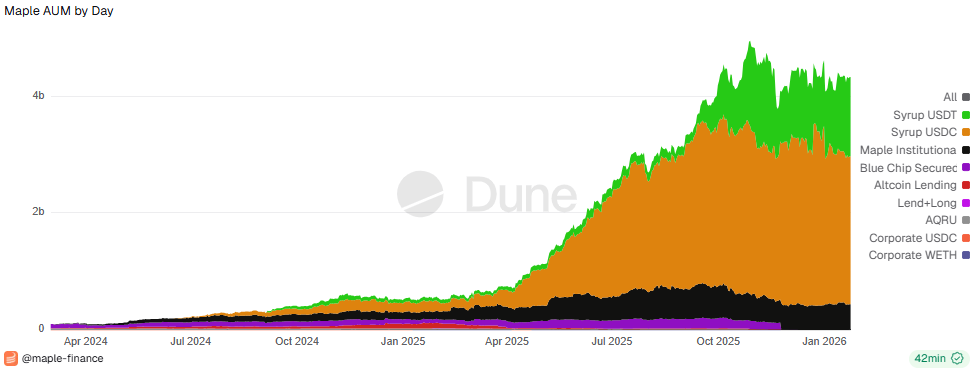

Maple's managed asset scale experienced an accelerated growth cycle in early 2024, rising rapidly from less than $100 million to over $4 billion. Among them, Syrup USDC and Syrup USDT still occupy the largest share of managed assets, followed by institutional credit pools and other secured products. This indicates that Maple has made progress in diversifying its product offerings. Especially after the second quarter of 2025, multiple new product lines were launched almost simultaneously, driving the managed asset scale into an explosive growth phase, reflecting that Maple has evolved from an early single platform primarily focused on institutional lending to a comprehensive on-chain credit ecosystem driven by a multi-product matrix.

Source:Dune ,https://dune.com/maple-finance/maple-finance

2.2.1.1 Active Loans

Maple's lending business has formed advantages in scale and diversification, with its outstanding loans exceeding $1.2 billion, covering blue-chip collateral (APR about 10-12%) and high-yield collateral (APR about 15-20%). The collaboration between Maple Institutional and the well-known U.S. asset management company Bitwise in 2025 further indicates that large traditional asset managers are gradually accepting these compliant and transparent on-chain credit products.

On the retail and on-chain capital side, Syrup has become Maple's growth engine. Its TVL peaked at $2 billion, exceeding Maple Institutional's by ten times, and provides instant liquidity, composable yields, and collateral functions through syrupUSDC. Users can perform instant exchanges on Uniswap or lock yields on Pendle, and use syrupUSDC as collateral in Morpho lending, greatly enhancing capital efficiency.

2.2.1.2 Protocol Revenue

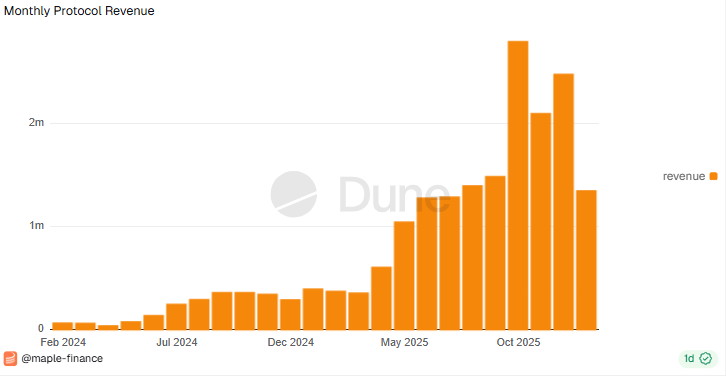

Maple's revenue entered a rapid growth phase starting in early 2024. In the first half of 2024, the platform's monthly revenue remained at a low range of over $100,000 until mid-2024, when a noticeable upward trend began to emerge. In the second half of 2024, monthly protocol revenue stabilized at around $400,000. After the first quarter of 2025, the revenue growth rate significantly accelerated, with a notable increase in April, where monthly revenue surpassed $1 million, and continued to rise in May and subsequent months, reaching a peak of about $2.5 million in the third quarter of 2025.

Although current revenue has retreated from its peak, it remains above the million-dollar level, indicating that Maple has a solid cash flow foundation and scalable profitability. Overall, Maple has transitioned from the early exploratory phase to a high-revenue growth cycle driven by the Syrup series products, yield-based credit, and institutional lending.

Source:Dune ,https://dune.com/maple-finance/maple-finance

2.2.1.3 Token Incentives

Maple has established a token buyback mechanism based on protocol revenue as its core incentive method. Starting in January 2025, Maple retains 20% of protocol fee revenue for market buybacks of SYRUP, and the repurchased tokens are then distributed proportionally to stSYRUP (governance staking token) holders. The Maple community proposed in the MIP-018 proposal to increase the buyback ratio from 20% to 25% of protocol revenue to further enhance token value capture capabilities. According to the data disclosed in this proposal, during the execution from Q1 to Q2, Maple has cumulatively used approximately 830,000 USDC for buybacks, purchasing a total of about 3.5 million SYRUP. This means that SYRUP token holders will have a stronger binding relationship with the protocol's operational results, further strengthening the token value accumulation mechanism.

It is worth noting that unsecured on-chain lending is still in its early stages, with high market concentration. Apart from Maple Finance, other projects have relatively small market sizes, such as TrueFi's TVL being only around $20,000, and overall, a significant scale has yet to be formed. Therefore, this report believes that unsecured lending is still in the validation and accumulation stage, and currently, this report only conducts a systematic study of Maple, while other protocols remain under observation.

2.3. Modular Lending Protocols

The core of modular lending lies in systematically breaking down various core functions within lending protocols, achieving independent development and flexible combinations of functions through interface standardization. This architecture no longer relies on a single protocol to implement all lending logic but treats the lending system as a stack of pluggable and replaceable modules, allowing for higher scalability, security, and adaptability of the protocol. Compared to traditional all-in-one protocols, modular design not only helps reduce the complexity of technical development and security audits but also provides highly flexible structural support for diverse assets, differentiated risk strategies, and institutional customization needs.

2.3.1 Morpho

Morpho introduces a modular aggregation lending architecture, regarded as a typical case of DeFi money markets transitioning from monolithic to modular. Simply put, Morpho allows anyone to create new lending markets without permission, with each market configured with one lending asset and one collateral asset. However, from existing data, the truly active market numbers are mainly concentrated on mainstream asset pairs such as USDC, DAI, ETH, and cbBTC.

Currently, Morpho's product system consists of two main modules: Morpho Markets and Morpho Vaults. Morpho Markets provides immutable single-asset lending markets, where each market supports only one type of collateral and one type of lending asset, employing an adaptive interest rate model to dynamically adjust rates while allowing for higher collateral ratios. The advantage of this isolated market design is that risks do not cross over; even if individual markets experience bad debts, the losses are borne solely by the liquidity providers of that market and do not affect other markets.

On the other hand, Morpho Vaults are initiated and managed by external professional teams or institutions, offering a diversified mix of risks and returns. Each vault focuses on a specific lending asset, and the managers can charge a certain percentage of the vault's loan income (up to 50%). For users, the same asset may correspond to multiple vaults with different styles, each with varying risk and return characteristics, allowing users to flexibly choose suitable vaults based on their preferences and risk tolerance to earn returns.

In June 2025, Morpho launched Morpho V2. The core innovation of this version is the support for fixed-rate, fixed-term peer-to-peer lending markets, achieving breakthroughs in compliance and cross-chain capabilities. In terms of product architecture, Morpho V2 includes Markets V2 and Vaults V2 as its two main components. Unlike the previous pooled model, V2 no longer requires users to first deposit funds into a pool; instead, it allows lenders and borrowers to directly post quotes, facilitating more flexible and efficient matching. The formation of interest rates is also determined by market supply and demand, making it closer to the price discovery mechanism of real financial markets.

Functionally, V2 offers richer loan customization options, supporting long-tail asset collateral and composite collateral, covering a wider range of asset types and lending needs. At the same time, V2 introduces on-chain KYC and whitelist mechanisms to help meet institutional and compliance requirements, and technically supports cross-chain quoting and settlement, expanding the coverage of funds and assets. These upgrades enhance Morpho's flexibility and scalability, particularly meeting the demand of institutional investors for predictable and compliant lending tools.

2.3.1.1 Active Loans

As of now, the total deposit scale of the Morpho protocol is approximately $10.58 billion. Since the beginning of 2024, the total deposits of Morpho have shown a continuous upward trend, experiencing a significant acceleration in the second half of 2025, peaking at over $12 billion. Although there was a subsequent pullback, it rebounded to over $10 billion in early 2026, demonstrating strong capital stickiness and recovery ability.

On the capital utilization side, Morpho's current active loan scale is approximately $3.895 billion, corresponding to a TVL of about $7.142 billion, with an overall capital utilization rate remaining in a relatively healthy range. As the protocol continues to deepen its deployment on core chains like Ethereum and Base, gradually expanding to more on-chain ecosystems while introducing more flexible customized markets and modular lending engines, Morpho's capital carrying capacity and efficiency are expected to further improve.

Source:app.morpho.org ,https://app.morpho.org/ethereum/explore

2.3.1.2 Protocol Revenue

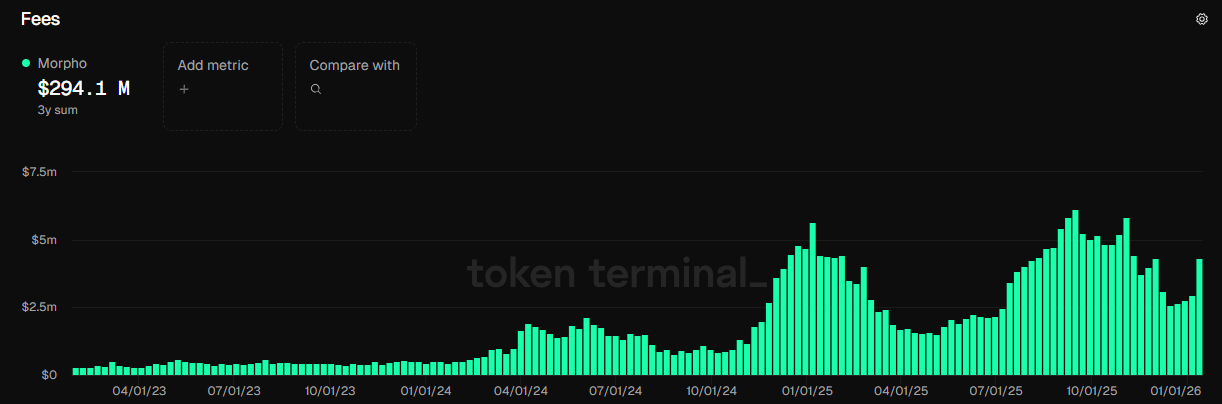

The Morpho protocol currently adopts a zero-protocol revenue model, meaning it neither extracts borrowing interest nor charges fees from market creation or liquidation; all revenues are entirely allocated to market participants and the creators of the lending market. This lightweight protocol design enhances user trust in the system and increases developers' freedom and institutional compatibility.

In terms of operational mechanisms, Morpho outsources core operations to any willing network participants. Once on-chain conditions are met, executors can initiate transactions and receive rewards from a pre-set execution reward pool. Recent data shows that executor fees for Morpho have increased, indicating that market interactions are becoming more active, with higher frequencies of lending operations and liquidations. However, it is important to note that these fees are not protocol revenue but rather an incentive mechanism designed by Morpho to maintain the normal operation of the modular lending market.

Source:tokenterminal ,https://tokenterminal.com/explorer/projects/morpho/metrics/fees

2.3.1.3 Token Incentives

According to Morpho dashboard data, the current token incentive distribution features high liquidity and low subsidy rates. In the main pools, the Seamless USDC Vault (APR 0.94%) and Seamless WETH Vault (APR 0.89%) still maintain several tens of thousands of dollars in remaining rewards, while the Moonwell Flagship EURC and Jarvis series pools have virtually no incentives. Overall, the mainstream stablecoins and ETH top pools at the Vault level have subsidy rates mostly below 1%.

In terms of trends, Morpho's incentive strategy is gradually tightening; although the total pool size remains large, most pools have zero reward balances, retaining only a small number of core markets that provide limited subsidies. This approach aligns with the incentive reduction path previously promoted by the Morpho community, which aims to gradually reduce token subsidies in user lending activities to avoid excessive reliance on external rewards to maintain liquidity. Considering the current market situation, it can be inferred that Morpho's actual annual subsidy expenditure has decreased compared to earlier stages. Moving forward, Morpho may continue to advance depopulation, relying on the protocol's own interest rate mechanism and scale effects to maintain competitiveness.

2.3.2 Euler Finance

Euler Finance was launched by Euler Labs on the Ethereum mainnet in 2021 with V1, allowing users to create new asset lending markets without permission and employing a three-tier asset risk classification mechanism to manage risks. Although this model is more flexible than Aave and Compound, it is still limited by the systemic risks of a single liquidity pool.

In March 2023, Euler encountered a flash loan attack of approximately $197 million and temporarily suspended protocol operations; fortunately, most of the funds were recovered with the assistance of security experts. The team recognized the limitations of the monolithic architecture and halted V1 to launch a completely modular, risk-isolated lending infrastructure with Euler V2.

Euler V2 officially launched on the Ethereum mainnet in September 2024, consisting primarily of the Euler Vault Kit (EVK) and the Ethereum Vault Connector (EVC). The EVK allows anyone to deploy independent asset vaults using the ERC-4626 standard, customizing parameters such as collateral, interest rate curves, and borrowing limits; each vault is associated with a single token, isolating liquidity and reducing systemic risk; the EVC acts as a connector between different vaults, allowing users to deposit assets in Vault A as collateral and borrow another asset from Vault B while maintaining the health and liquidation rules across vault accounts.

2.3.2.1 Active Loans

As of now, Euler Finance's total TVL is approximately $630 million. In terms of on-chain distribution, the Ethereum mainnet remains Euler's core deployment network, accounting for about one-third of the total TVL. Throughout most of 2024, Euler's lending scale remained at a low level, but it continued to expand during the recovery process, peaking at about $1.4 billion in the second half of 2025. Subsequently, due to market fluctuations, the active loan scale has retreated from its high, currently standing at approximately $578 million. Overall, although there has been a pullback from the peak, Euler's current lending scale is still significantly higher than in the early recovery phase, indicating that its lending demand and protocol stability have been partially restored.

Source:tokenterminal ,https://tokenterminal.com/explorer/projects/euler

2.3.2.2 Protocol Revenue

Euler Finance's protocol revenue primarily comes from the interest share paid by borrowers, meaning a portion of the lending rate is captured as protocol fees at the protocol layer. According to current data, Euler's annualized protocol fees are approximately $50.53 million, with annualized protocol revenue around $3.02 million, corresponding to an estimated monthly protocol revenue of about $250,000; simultaneously, approximately $1.62 million of annual revenue is distributed to token holders.

In terms of monthly performance, Euler's protocol revenue has stabilized at over $200,000 in recent cycles, showing a significant increase compared to the early recovery phase. This reflects the advantages of the V2 modular architecture in capital allocation and risk isolation; the new structure not only improves capital utilization efficiency but also enhances user participation. Additionally, Euler allocates a portion of the protocol layer revenue to the treasury and incentive pools for long-term ecological development and potential token buyback arrangements, which helps enhance the financial sustainability of the protocol and reserves space for future governance and value capture mechanisms.

2.3.2.3 Token Incentives

Euler's native token EUL serves both governance and value capture functions. After the security incident in 2023, the team launched a new rEUL incentive program upon the launch of Euler V2 to revive liquidity and user trust. rEUL is a form of locked token that rewards EUL, with plans to distribute up to 5% of the total EUL supply as rEUL to early V2 users over one year. rEUL will gradually unlock to EUL at a 1:1 ratio, with 20% unlocking immediately upon issuance and the remaining 80% unlocking linearly over the next six months. Users can withdraw the unlocked portion at any time, but any shares that are not unlocked and withdrawn early will be forfeited and destroyed, thereby reducing the total supply.

The incentive program has been running well since its launch at the end of 2024. The incentive committee established by the Euler community evaluates the distribution of rEUL rewards to strategic markets on a monthly and quarterly basis. Specifically, Euler has implemented two types of rEUL distribution activities: one is reactive rewards for core markets to accelerate their depth; the other is to introduce supporting incentive mechanisms that allow external partners to co-fund incentives.

In addition, the protocol has introduced a revenue buyback mechanism, using 50% of the protocol transaction fees to repurchase EUL in the secondary market, thereby increasing token value through continuous destruction or treasury reserves, thus solidifying the interests of users, risk control administrators, and the DAO. Overall, the security incident in 2023 has made Euler more cautious, shifting from simple liquidity mining to a strategy that combines locked rewards and buybacks, ensuring the sustainability and security of incentives while rebuilding market confidence.

2.4. RWA and Lending Integration

Credit assets have become an important part of on-chain RWA. As more types of debt claims are introduced on-chain and the demand from institutions for compliant and traceable collateral continues to rise, RWA lending is expected to become another significant growth engine for DeFi. The current market size may only be in its initial stage, and with the diversification of asset types and the opening of cross-border lending channels in the future, the development space for RWA lending remains vast.

2.4.1 Classification

This report categorizes relevant projects based on the current methods of RWA integration into on-chain lending into three categories: the first category is collateral-based, where tokenized cash equivalents or government bond assets are used as collateral to obtain stablecoin loans in an over-collateralized manner; the second category involves asset-side on-chain integration, where offline credit, real estate, or fund shares are standardized into on-chain pool shares or vault shares, allowing investors to earn returns based on fund net value and distribution records; the third category is yield-based, where the protocol allocates part of the vault assets to RWA, injecting interest into savings rates and stablecoin rates. The specific differences among these three categories are shown in the table below:

Source:CoinW Research Institute

2.4.2 Key Cases

2.4.2.1 Collateral-Based

Representative Project: Aave Horizon

Operational Logic: Aave Horizon is a compliant RWA lending market launched by Aave Labs on Ethereum, with the core logic of bringing traditional low-risk assets on-chain as collateral. Institutional users can deposit compliant tokenized assets, such as government bonds and money market funds, into the platform and obtain over-collateralized stablecoin loans based on real-time net value, currently including USDC, RLUSD, and GHO. These collateral assets are provided by compliant issuers like Centrifuge, and the lending process is automatically executed through smart contracts, ensuring transparency of funds and over-collateralization. To avoid asset liquidity and risk, Horizon issues non-transferable aToken collateral certificates to lenders and sets loan parameters in conjunction with Chainlink price feeds and third-party risk control teams, effectively incorporating low-volatility, redeemable traditional assets into the on-chain collateral pool.

2.4.2.2 Asset-Side On-Chain

Representative Project 1: Goldfinch Prime

Operational Logic: Goldfinch Prime is a compliant credit investment product launched by Goldfinch in 2025, specifically open to qualified investors. Users can subscribe to Prime pool shares on-chain using USDC, which correspond to notes issued by Heron entities, backed by well-known private credit fund equities. The offline portion is managed by large managers responsible for lending and repayments, while the on-chain records shares and income distribution, establishing a direct connection between traditional private credit funds and DeFi investors.

Unlike general on-chain lending, Goldfinch Prime's underlying assets cover over a thousand loan exposures, with a total managed scale exceeding $1 trillion, primarily consisting of senior loans with relatively controllable default risks. Currently, the shares held by investors on-chain can yield approximately 10% annualized net returns, with distribution frequencies being monthly or quarterly, and allowing quarterly redemptions without a multi-year lock-up period. Goldfinch Prime provides a channel for investors to access the institutional credit market by tokenizing offline credit fund shares, achieving transparency and tradability on-chain.

Representative Project 2: Centrifuge V3

Operational Logic: The core of Centrifuge V3 is to standardize offline credit, funds, or government bond assets into on-chain vault shares after compliance processing. Investors only need to subscribe with stablecoins to directly hold these shares on-chain, with returns settled periodically based on fund net value and distribution records. The offline portion is still managed by asset managers responsible for due diligence, lending, and repayments, while the on-chain portion undertakes rights confirmation, liquidation, and transparent disclosure functions, transforming originally closed offline assets into on-chain tradable and combinable financial instruments.

Representative Project 3: Ondo GM

Operational Logic: Ondo Global Markets (referred to as Ondo GM) focuses on the tokenization of publicly traded securities such as US stocks and ETFs, with each token fully backed by 1:1 underlying assets held by regulated US broker-dealers or custodians. After completing KYC, institutional investors can use USDC on the platform to exchange for the stablecoin USDon and subscribe to target assets. The system will purchase securities in the traditional market and instantly mint equivalent tokens. The tokens immediately enter an on-chain address, where they can be transferred, collateralized, or used in DeFi applications. Upon redemption, the tokens are destroyed, and USDon is returned, which is then exchanged 1:1 for USDC. Ondo GM does not rely on on-chain market making but leverages the depth and liquidity of the traditional market's spot to maintain the consistency of token prices with underlying net values through minting and redemption arbitrage, thereby directly mapping traditional on-chain liquidity.

2.4.2.3 Yield-Based

Representative Project: Frax

Operational Logic: Frax V3 has begun to introduce approximately $1 billion in RWA assets as a source of yield for the stablecoin system. The protocol collaborates with partners like FinresPBC to allocate low-risk assets such as US government bonds and money market funds, with the AMO module automatically managing the asset portfolio and cash flow. The interest generated from these assets flows back into the protocol treasury and is then distributed to users through the yield-bearing stablecoin sFRAX. In this model, users do not need to purchase or manage government bonds themselves; by holding Frax stablecoins, they can indirectly enjoy the yields brought by RWA.

3. Competitive Landscape

3.1 Leading Protocol Landscape and TVL Changes

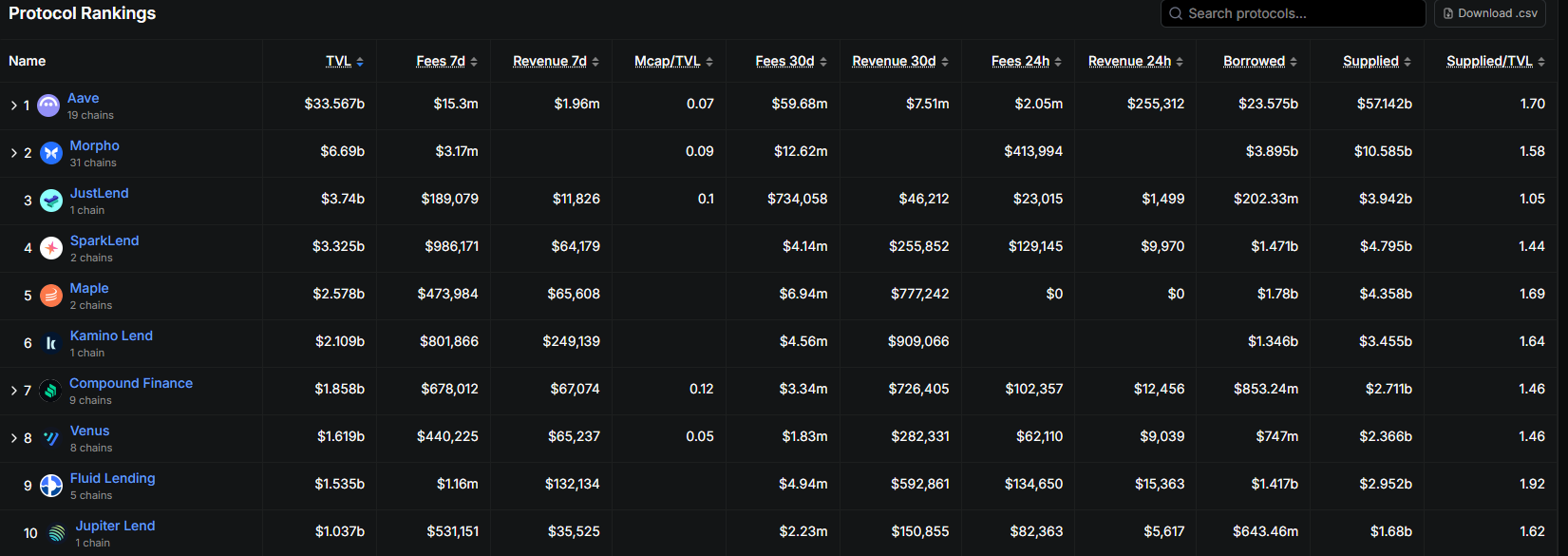

The on-chain lending space is currently dominated by a few leading protocols, with Aave holding over 50% of the lending market share. On-chain, the active loan scale of the lending market has shown a clear growth trend over the past year. Ethereum still occupies an absolute dominant position, followed by Base and Solana. In the non-Ethereum ecosystem, Tron’s JustLend has reached a TVL of approximately $3.7 billion, benefiting from the monopoly advantage of its local stablecoin, firmly holding the top position on the Tron chain. Venus on BSC and Kamino in the Solana ecosystem have also captured certain shares due to the traffic benefits of their respective public chains.

Source:defillama ,https://defillama.com/protocols/lending

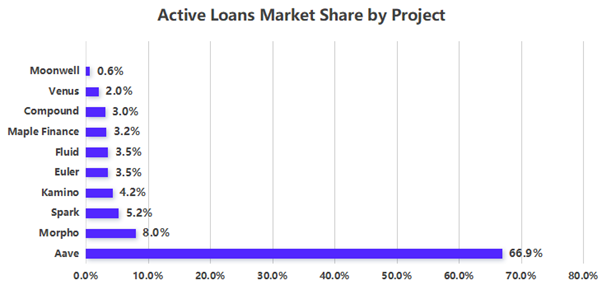

From the perspective of active loan share, Aave dominates with approximately 70% market share, holding an absolute leading position; followed by Morpho (about 8%) and Spark (about 5%), with the two combined nearing 10%; Kamino, Euler, Fluid, Maple Finance, and Compound each account for 2%–4%; while Venus, Moonwell, and others have shares below 2%, indicating a smaller overall scale. The overall landscape shows a high concentration at the top and a dispersion in the middle, with Aave almost determining market trends.

Source:CoinW Research Institute, tokenterminal

3.2 Revenue Structure and Profit Model Comparison

The revenue of lending protocols primarily comes from interest paid by borrowers, liquidation penalties, flash loan service fees, and other fees charged by the platform. Different protocols exhibit significant differences in revenue distribution and profit models; some rely on real business income to form stable profits, while others depend on token incentives to support TVL over the long term. Below, we analyze the leading protocols Aave and Morpho.

Taking Aave as an example, its annualized total fees are approximately $728 million. Among these, the protocol retains revenue of about $91.57 million, accounting for approximately 12.6% of total fees; the majority is paid as interest to depositors and liquidity providers. On the other hand, Aave still incurs some incentive expenditures to attract and retain users, with annualized token incentives of about $19.53 million. After considering this cost, the protocol's annualized actual profit is approximately $72.04 million. This indicates that even with incentive expenses, Aave's core profitability remains robust, forming a positive revenue cycle.

Therefore, Aave does not overly rely on token incentives but primarily supports protocol operations through real lending interest income, ensuring returns for depositors while also accumulating a sustainable surplus for the protocol itself.

Source:defillama ,https://defillama.com/protocol/aave

Morpho's current annualized total fees are approximately $15.4 million; however, unlike other lending protocols, Morpho's annualized protocol revenue remains at 0, meaning the protocol does not extract any share from the interest paid by borrowers, instead passing all interest income to depositors and borrowers. Meanwhile, Morpho still incurs some incentive expenditures, with annualized token incentives of about $9.46 million. Due to the lack of retained revenue, this incentive cost directly leads to an annualized actual profit of approximately -$9.46 million.

Despite this, Morpho's current TVL is approximately $6.69 billion, with a lending scale of about $3.89 billion, indicating that its zero-fee and interest rate optimization mechanisms, supported by token incentives, still possess strong user and capital attraction in the short term. The advantage of this model lies in improving user experience, allowing depositors and borrowers to obtain nearly complete real interest rate returns; however, its disadvantages are also evident, as the protocol itself lacks a stable and sustainable revenue source. Once the market environment tightens or incentive intensity decreases, its long-term financial sustainability will face significant challenges.

Source:defillama ,https://defillama.com/protocol/morpho

3.3. User Profile and Asset Structure

3.3.1 User Characteristics

According to CoinLaw data, the number of global DeFi lending users exceeded 7.8 million by 2025, an increase of nearly eight times compared to less than one million in 2021. This indicates that more ordinary investors are beginning to engage in on-chain lending, enjoying permissionless financial services. Among them, young investors aged 20-35 account for nearly 59%, with North American and Asian users being the main force. In terms of capital scale, the average user deposit is about $3,000, suggesting that long-tail retail investors make up the majority of users.

Overall, the current on-chain lending user group shows polarization. On one hand, the number of users has significantly increased and diversified compared to a few years ago; on the other hand, capital volume is highly concentrated among top whales and institutional accounts. For instance, some analyses reveal that a certain institutional whale wallet managed a total of $5.5 billion in DeFi positions within 90 days, with 83.6% deployed in Aave V3, another 10% in Compound, and 7.5% in Spark. This single address accounts for a significant share of Aave's deposits, highlighting the high concentration of top capital.

In contrast, the behavior of ordinary users is much simpler. Most retail investors view on-chain lending as a savings and investment channel, depositing idle stablecoins or mainstream coins into Aave to earn interest, and then holding patiently; or when liquidity is needed, using their held coins as collateral to borrow stablecoins for emergency turnover. Unlike institutions, retail investors typically do not frequently adjust their positions, focusing more on pursuing stable returns.

Thus, we see the flow of user funds between protocols, with many users migrating from Compound to Aave; or when a new high-yield project appears on a certain chain, users will bridge their funds over to take advantage. However, due to the largest asset volume on the Ethereum mainnet and the most trusted top protocols, a significant amount of capital will ultimately flow back to the leading platforms on the mainnet.

3.3.2 Asset Structure

The collateral structure of on-chain lending has undergone significant changes in recent years. On one hand, stablecoins and mainstream crypto assets remain the primary collateral assets; on the other hand, the proportion of emerging asset types such as LSTs and RWA-related tokens is on the rise. According to statistics, as of 2025, stablecoins account for about 62% of the total value of collateral across various lending protocols. Meanwhile, large holders and institutions tend to use blue-chip assets like ETH and BTC as collateral to obtain stablecoin liquidity for investment operations. In terms of the structure of borrowed assets, stablecoins are undoubtedly the absolute main character. The vast majority of user loans are stablecoins like USDT and USDC, used for purposes including leveraged long positions on other assets and arbitrage trading.

Statistics show that since 2025, stablecoin lending rates have continued to decline, from an average of 11.6% at the beginning of the year to around 5%. This is partly due to ample market liquidity and partly because competition has lowered borrowing costs. The flourishing demand for stablecoin borrowing has also driven the supply of stablecoins, with many protocols introducing external liquidity or issuing their own stablecoins to meet borrowing needs, such as Aave issuing its native stablecoin GHO.

Overall, the typical model of on-chain lending remains to deposit volatile assets and borrow stablecoins for use. This means that lending protocols essentially act as decentralized stablecoin lending banks. Particularly, the development of RWA lending, which involves tokenizing real-world assets as lending objects, such as government bond tokens, is noteworthy. However, as of now, the RWA lending market size is still small.

3.4. Multi-Chain Deployment and Ecological Integration

On-chain lending protocols are developing towards multi-chain parallelism, with Aave being a pioneer in multi-chain deployment, having expanded to the Ethereum mainnet as well as over ten other networks including Polygon, Arbitrum, and Base. Aave V3 has also launched the Portal feature, allowing liquidity to be transferred across chains within controlled limits via cross-chain bridges, thereby adjusting funds between multiple chains. In terms of ecological integration, lending protocols have become an important part of DeFi infrastructure, widely integrated into various upper-layer applications.

For example, many yield aggregators automatically deposit funds into Aave to earn interest, and most decentralized exchanges also support users to collateralize LP tokens for lending. Aave's aToken, as an interest-accumulating token, is often accepted by other protocols as collateral or interest-bearing assets, forming asset interoperability between protocols. However, this deep integration also brings potential risk transmission; if underlying lending protocols encounter issues, it may affect other applications using their assets.

Overall, multi-chain deployment has broadened the user coverage and capital scale of lending protocols, and the rise of local on-chain liquidity has led to a trend of partitioned autonomy in the market, with each chain forming its own lending pool ecosystem. At the same time, various protocols are actively integrating into the DeFi Lego system, enhancing the capital efficiency and synergy of the entire ecosystem through standardized token interfaces and inter-protocol cooperation. Cross-chain bridging plays a double-edged role; on one hand, it brings capital flow, while on the other hand, it requires protocols to address security and latency challenges across different chains.

4. Risk Dilemmas and Challenges

4.1. Liquidity Risk

Lending protocols are highly dependent on the value of collateral assets and market liquidity, thus exhibiting a pro-cyclical amplification effect during market fluctuations. In a bull market, the rising value of collateral stimulates users to increase leverage in pursuit of higher returns, leading to increased capital utilization within the protocol and rising lending rates, which further attracts capital inflow, potentially creating overheating risks. Conversely, in a downturn, the depreciation of collateral value can trigger a chain of liquidations; once the price of collateral falls below the liquidation threshold, a large number of positions may be forcibly liquidated and sold off, further suppressing prices and causing a liquidation waterfall.

If market liquidity is insufficient, liquidators may be unable to sell collateral in a timely manner, potentially leading to the accumulation of bad debts, with the protocol's reserves unable to cover the losses. Additionally, a prominent market risk is the excessive concentration of collateral in staked derivatives, such as the high proportion of stETH and other LSTs in Aave, which are highly correlated with native ETH prices. If ETH experiences a sharp decline, stETH and other LSTs may also drop in value or even experience liquidity discounts, leading to simultaneous liquidations of many leveraged positions. To mitigate market and liquidity risks, lending protocols can adopt various risk control measures, such as implementing risk reserves and insurance, extracting a portion of interest income as risk reserves to cover losses during extreme market conditions.

4.2. Credit Default Risk

Traditional DeFi lending primarily relies on over-collateralization, but with the introduction of unsecured lending and RWA, borrower credit defaults have become a new concern. In unsecured lending platforms, investors lend funds to specific institutions, fully relying on the counterpart's credit for repayment. Once a borrower defaults, the protocol lacks sufficient collateral for liquidation and can only pursue legal recourse or insurance compensation, which often results in limited recovery and lengthy processes. Similarly, lending protocols investing in RWA also face counterparty risks. Whether off-chain borrowers can repay on time and whether underlying assets depreciate depends on real-world conditions. If a borrowing institution goes bankrupt or the underlying assets encounter a black swan event, the on-chain protocol will incur losses, and recovery can be complex and lengthy.

Moreover, the risk of credit concentration is worth noting, as some unsecured pools have only a few borrowers, leading to high borrower concentration. If a large borrower defaults, it could result in the entire pool losing more than half of its value. To address credit and counterparty risks, on-chain lending is beginning to adopt traditional risk control approaches. For instance, implementing stricter due diligence and information disclosure, requiring in-depth credit assessments during the borrower admission phase, including financial reports, operational status, collateral, etc., and mandating regular disclosures of financial changes.

4.3. Illusion of Incentives and Growth

In the early stages of on-chain lending, high token incentives were a primary tool for attracting capital and users, but this model often leads to false prosperity. Growth heavily relies on profit-seeking liquidity; once incentives weaken or token prices decline, capital quickly withdraws, leading to a sharp drop in scale, and protocol tokens face continuous selling pressure. As a result, the market has begun to adjust this strategy. Leading protocols are gradually shifting incentives to a supporting role, relying more on real interest rates, asset efficiency, and product experience to maintain growth.

However, for many emerging projects, the initial phase still heavily depends on token subsidies to rapidly gather liquidity, which in itself is a potential risk. If a sustainable revenue model and stable interest rate advantage are not established, excessive subsidies not only deplete token value but may also trigger a similar vicious cycle as seen before. Balancing incentives and endogenous growth remains a core challenge for on-chain lending. Given the above circumstances, emerging lending protocols may orient towards the actual revenue of the protocol and improve incentive efficiency, such as reducing inflation, sharing profits, gradually decreasing purely token-based liquidity incentives, and instead using actual protocol profits to reward users.

4.4. Cross-Chain Risks

In the multi-chain era, lending protocols inevitably involve cross-chain assets and message interactions, leading to cross-chain bridging risks. First, there are technical risks associated with cross-chain bridges; if bridging contracts are compromised, hackers can forge substantial assets. Another risk of cross-chain bridges is single point of failure; most bridges rely on multi-signature or relay networks, and if intermediaries fail, cross-chain messages may stagnate or even be tampered with. Additionally, the credibility of cross-chain messages is also a concern. Advanced scenarios such as cross-chain liquidation and cross-chain lending require the transmission of account states and instructions across chains, and any message tampering could be exploited for malicious operations. Given the high risks of cross-chain bridging, total volume and rate limits can be implemented, setting strict deposit caps and daily inflow and outflow limits for cross-chain assets that must be used as defensive measures.

5. Possible Development Trends

5.1. On-Chain Lending Between Institutions

Breakthroughs at the institutional level are opening the door for on-chain lending between institutions. In December 2025, the SEC issued a no-action letter regarding the securities tokenization service of DTC under the core infrastructure of the U.S. securities market, DTCC, allowing it to launch a tokenization pilot on a blockchain that meets technical standards. This permits the mapping of qualified securities' ownership rights within the DTC system to on-chain tokenized rights, supporting direct transfers between registered wallets of participating institutions, while the DTC system continuously tracks transfers as part of the official ledger records.

The core significance of this development lies in extending the existing securities market's custody and accounting structure to the blockchain, enabling institutional-level assets to possess on-chain transferability and programmability without altering their legal attributes, thereby opening up channels between securities on-chain and collateral financing, as well as securities financing transactions. For the lending market, this means that growth sources are no longer limited to retail or crypto-native asset collateral but begin to possess the foundational conditions to accommodate institutional capital market demands.

In the future, it may be observed that after most financial assets are tokenized, inter-institutional lending, especially the scheduling of overnight borrowing and repurchase agreements, may become the most promising incremental direction for on-chain lending, exhibiting characteristics that are significantly different from the current DeFi landscape. Institutional lending may present the following features: first, the term structure is greatly shortened, primarily focusing on overnight and cross-day transactions, with on-chain lending taking on more of a liquidity management function for the industry; second, the collateral structure becomes highly institutionalized, with core assets shifting from highly volatile crypto assets to tokenized government bonds, ETFs, and highly liquid stocks, with risk control logic more closely aligned with traditional markets; third, product forms trend towards permissioned access, centered around whitelisted institutions, compliant wallets, and automated collateral management through on-chain contracts.

Overall, inter-institutional on-chain lending is expected to drive the lending market from crypto financing tools to institutional-level liquidity infrastructure, with its long-term potential and systemic importance likely surpassing that of retail lending models.

5.2. Tokenization of Securities and Collateral Potential

The tokenization of securities is moving towards scale, with Ondo launching Ondo Global Markets in September 2025, providing compliant investors with on-chain access to over a hundred U.S. stocks and planning to expand to a thousand. This model differs from previous synthetic assets, as it directly tokenizes underlying securities through compliant channels, allowing stocks and ETFs to truly become collateralizable asset classes. This change is profoundly significant for lending protocols. In the past, on-chain lending primarily relied on crypto assets as collateral, with a relatively narrow asset type and collateral value that could fluctuate significantly with market movements.

When U.S. stocks and other securities enter the collateral pool in a compliant manner, protocols can design stock whitelist collateral pools, setting exclusive collateral ratios and liquidation rules for these compliant securities. For example, blue-chip stocks or index ETFs with lower volatility could be assigned higher collateral rates than crypto assets. Additionally, the introduction of stocks and ETFs allows lending protocols to directly integrate with equity strategies, providing users with more diversified collateral and lending scenarios. High-quality securities from traditional financial markets may become a new type of collateral for lending protocols, opening up a more robust and compliant growth space for on-chain lending.