Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.8 trillion, with BTC accounting for 59.2%, or $1.65 trillion. The market capitalization of stablecoins is $30.58 billion, which has decreased by 0.99% in the last 7 days, with USDT making up 60.59%.

Among the top 200 projects on CoinMarketCap, most have declined while a few have risen. Specifically: BTC has decreased by 7.44% over the past 7 days, ETH has decreased by 10.91%, SOL has decreased by 8.68%, HYPE has increased by 29.78%, and SENT has increased by 40.03%.

This week, the net outflow from U.S. Bitcoin spot ETFs was $1.487 billion; the net outflow from U.S. Ethereum spot ETFs was $327.5 million.

Market Forecast (February 2 - February 8) :

The current RSI index is 35.17 (weak zone), and the fear and greed index is 21 (fear zone), while the altcoin season index is 41 (neutral, higher than last week).

This week, gold and silver, along with BTC, surged wildly before the Federal Reserve's announcement, then quickly retreated afterward. The market is currently at a highly sensitive key point where technical and macro factors intertwine. Any predictions should be viewed as probability tests of key positions rather than deterministic paths. As investors, one should observe cautiously:

- Technical Lifeline: BTC's 50-week Moving Average

This is the most closely watched technical indicator at present. If BTC's price can sustain above this moving average for a period (e.g., 2-3 weeks), it may reverse the short-term downtrend; if it continues to fail to recover, the adjustment pressure will increase.

- Capital Flow Indicator: U.S. Spot Bitcoin ETF Fund Flows

This is a window to observe institutional sentiment. Last week, the market was pressured by institutional outflows; if the trend of net inflows can continue next week, it will provide important support for the market.

- Macroeconomic Environment: Federal Reserve Policy Expectations

After last week's Federal Reserve meeting, changes in market expectations regarding interest rate cuts will continue to affect all risk assets. Any comments or data regarding interest rates may trigger volatility.

Understanding Now

Review of Major Events of the Week

On January 26, the U.S. aircraft carrier strike group "Lincoln" arrived in the Middle East, and spot gold broke through $5,000 per ounce for the first time in history;

On January 26, according to the Seoul Economic Daily, Cha Myung-hoon, the major shareholder and chairman of the board of the South Korean cryptocurrency exchange Coinone, is considering selling part of his shares. He holds a total of 53.44% of the shares through his personal company The One Group (3.430% ownership) and personal holdings (19.14%). Coinone representatives stated they are discussing equity investment and cooperation plans with overseas exchanges and domestic financial institutions, but specific methods have not yet been determined;

On January 30, geopolitical tensions escalated! The U.S. military deployed more warships to the Middle East;

On January 30, the "Cryptocurrency Market Structure Act" (CLARITY Act) was passed by the Senate Agriculture Committee on Thursday local time, but the divide between the Democratic and Republican parties has become more severe;

On January 29, the Bitcoin ZK-rollup project Citrea, backed by Founders Fund and Galaxy Ventures, officially launched its mainnet, introducing DeFi lending, structured products, and the native USD stablecoin ctUSD, using BTC as collateral, aiming to bring "idle Bitcoin" into a complete DeFi and payment system;

On January 30, Binance announced it would gradually convert its original $1 billion stablecoin reserve into Bitcoin, planning to complete this within 30 days; if the market value falls below $800 million due to volatility, it will supplement BTC to restore it to $1 billion;

Behind the surge in gold prices, the secretive player: "money printer" Tether has hoarded 140 tons of gold;

On January 29, it was disclosed that SEC Chairman Paul Atkins stated in an interview with CNBC, "Now is the time to allow" the inclusion of crypto assets in 401(k) retirement account allocations. This statement has drawn market attention to the further integration of crypto assets into the mainstream financial system;

On January 30, Trump announced on Truth that he would nominate experienced economist and former Federal Reserve Governor Kevin Walsh as the chairman of the Federal Reserve.

Macroeconomic

On January 28 at 22:45, the Bank of Canada announced it would maintain the benchmark interest rate at 2.25%;

On January 29 at 03:00, the Federal Reserve announced it would maintain the benchmark interest rate at 3.75%;

On January 29, the number of initial jobless claims in the U.S. for the week ending January 24 was 209,000, with an expectation of 205,000, and the previous value was revised from 200,000 to 210,000.

On January 30, according to CME's "FedWatch": The probability of the Federal Reserve cutting rates by 25 basis points by March is 15.3%, while the probability of maintaining the current rate is 84.7%. The probability of a cumulative 25 basis point cut by April is 29.7%, with a 67.2% chance of maintaining the current rate, and a 3.2% chance of a cumulative 50 basis point cut. The probability of a cumulative 25 basis point cut by June is 48.3%, with a 33.7% chance of maintaining the current rate, and a 16.4% chance of a cumulative 50 basis point cut.

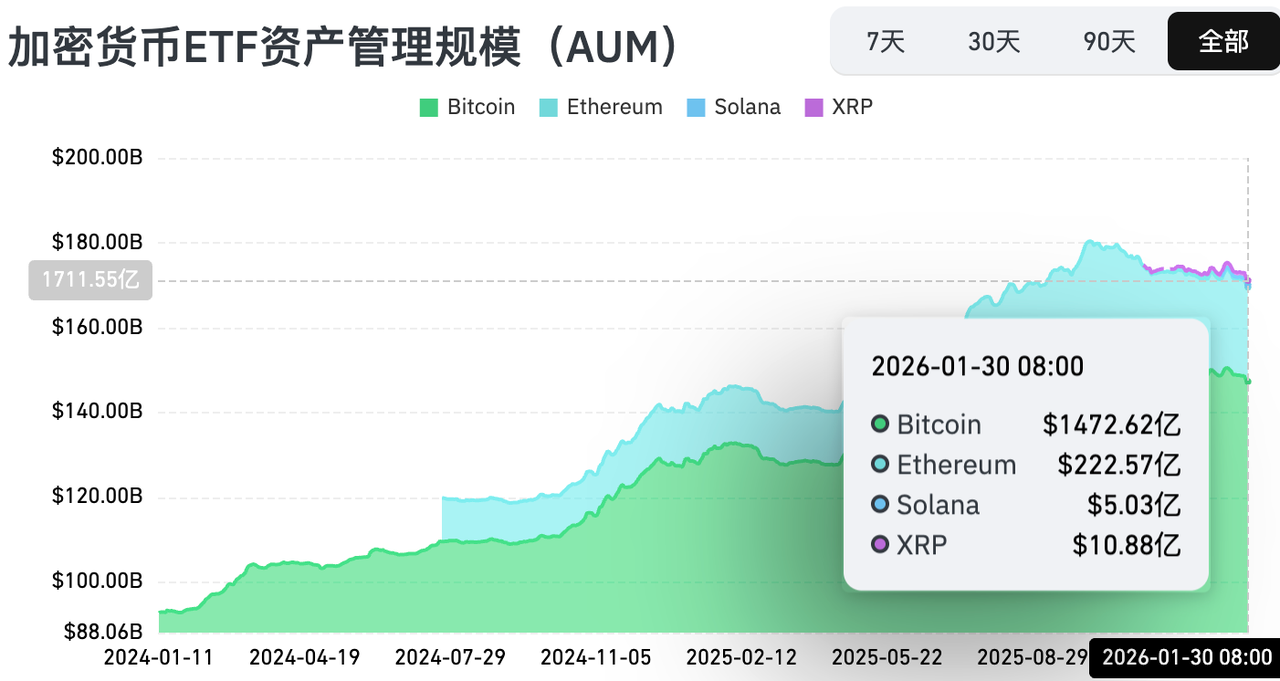

ETF

According to statistics, from January 26 to January 30, the net outflow from U.S. Bitcoin spot ETFs was $1.487 billion; as of January 30, GBTC (Grayscale) had a total outflow of $25.658 billion, currently holding $13.366 billion, while IBIT (BlackRock) currently holds $65.095 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $111.691 billion.

The net outflow from U.S. Ethereum spot ETFs was $327.5 million.

Envisioning the Future

Industry Conferences

Consensus Hong Kong 2026 will be held from February 11 to 12 in Hong Kong, China;

ETHDenver 2026 will be held from February 17 to 21 in Denver, USA;

EthCC 9 will be held from March 30 to April 2, 2026, in Cannes, France. The Ethereum Community Conference (EthCC) is one of the largest and longest-running annual Ethereum events in Europe, focusing on technology and community development.

Project Progress

Aster will launch its sixth phase airdrop event "Convergence" from February 2 to March 29, with the distribution amount accounting for 0.8% of the total supply (approximately 64 million ASTER);

The on-chain game engine MagicBlock will launch the BLOCK token presale on February 5;

Berachain granted special refund rights to the Nova Digital Fund under Brevan Howard in its Series B financing, allowing the fund to request a full refund within one year after the TGE, with a deadline of February 6, 2026. Crypto lawyers indicate this may violate most-favored-nation clauses and SEC anti-fraud requirements.

Important Events

The Hong Kong Securities and Futures Commission requires licensed virtual asset institutions to transition to a new suspicious transaction reporting system by February 2 to enhance automation and analytical capabilities, thereby improving the efficiency of analyzing suspicious transaction reports and issuing financial intelligence.

On February 4 at 21:15, the U.S. will announce January ADP employment numbers (in ten thousand);

On February 5 at 20:00, the UK will announce the central bank interest rate decision as of February 5;

On February 5 at 21:15, the Eurozone will announce the European Central Bank deposit facility rate as of February 5;

On February 5 at 21:30, the U.S. will announce initial jobless claims for the week ending January 31 (in ten thousand);

On February 6 at 21:30, the U.S. will announce the unemployment rate for January.

Token Unlocking

Ethena (ENA) will unlock 40.63 million tokens on February 2, valued at approximately $6.19 million, accounting for 0.55% of the circulating supply;

XDC Network (XDC) will unlock 840 million tokens on February 5, valued at approximately $30.61 million, accounting for 5% of the circulating supply;

Hyperliquid (HYPE) will unlock 9.92 million tokens on February 6, valued at approximately $308 million, accounting for 2.79% of the circulating supply;

Bouncebit (BB) will unlock 29.77 million tokens on February 7, valued at approximately $1.31 million, accounting for 2.97% of the circulating supply.

About Us

Hotcoin Research is the core research institution of Hotcoin Exchange, dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we identify potential assets and reduce trial-and-error costs. Each week, our researchers also engage with you face-to-face through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。