Abstract

Stock perpetual contracts are gradually becoming one of the most promising directions for growth in the on-chain derivatives market. These products combine the price fluctuations of traditional stocks (represented by U.S. stocks) with the mature funding rates, margin, and clearing mechanisms of perpetual contracts, allowing users to gain synthetic risk exposure close to stock prices without actually holding the stocks and without being restricted by traditional trading hours. As oracle designs, index pricing methods, and on-chain liquidity infrastructure continue to improve, stock perpetuals have moved from the conceptual stage to practical implementation, leading to scaled trading on leading Perp DEXs.

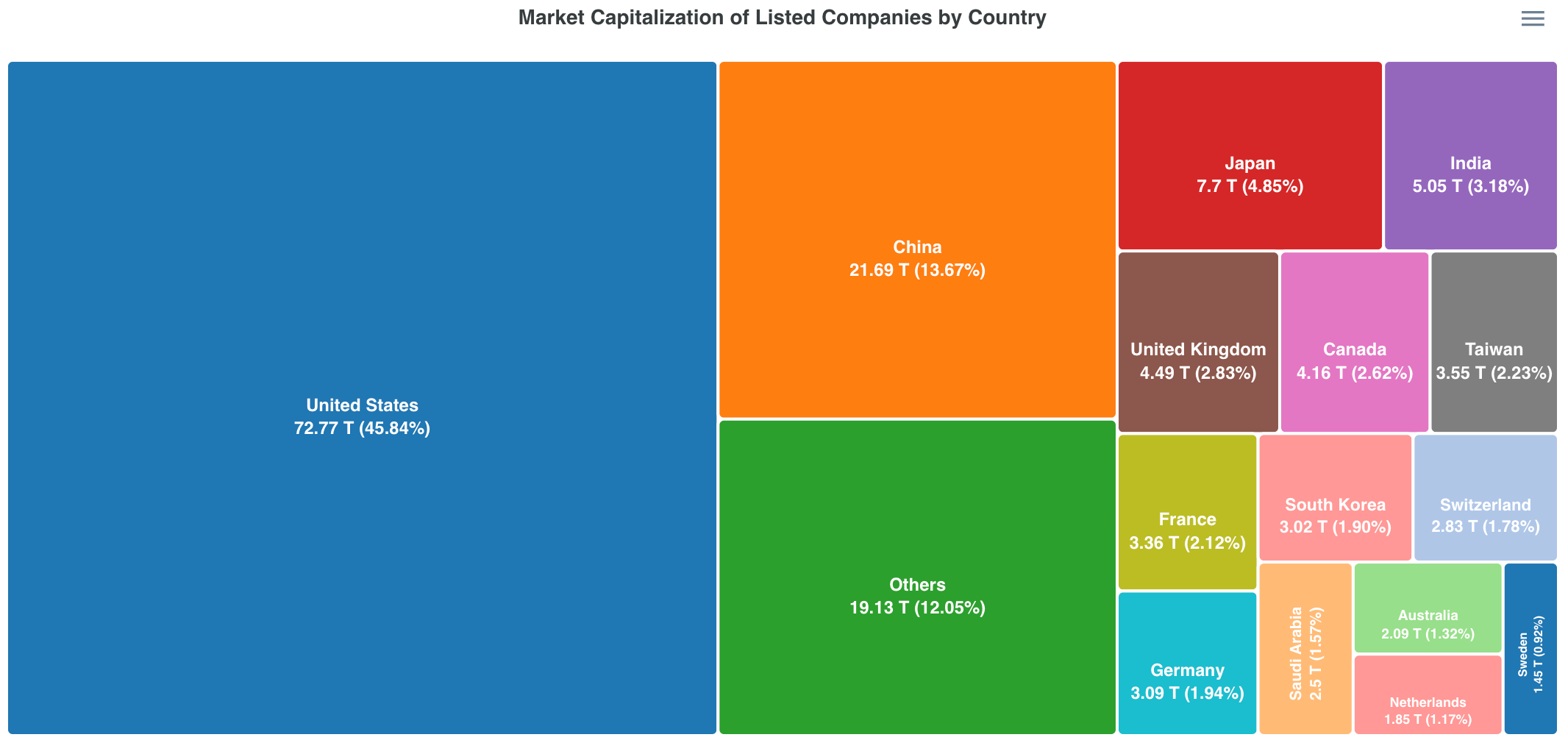

The emergence of stock perpetuals is not coincidental but is based on a clear structural background. On one hand, the global stock market itself has an extremely large asset base, with the total market capitalization of listed stocks approaching $160 trillion by early 2026, more than half of which comes from non-U.S. markets. On the other hand, the trading structure of perpetual contracts has been fully validated in the crypto market, with the global annual trading volume of crypto perpetual contracts reaching $61.7 trillion in 2025, significantly higher than spot trading volumes. This provides a mature trading paradigm and realistic reference for the "perpetualization" of traditional assets.

In terms of specific implementation paths, stock perpetuals are advancing along both DEX and CEX routes. Leading Perp DEXs such as Hyperliquid, Aster, and Lighter have taken the lead in launching native on-chain stock perpetual contracts, achieving 24/7 trading and on-chain clearing through oracles or internal pricing mechanisms, demonstrating significant advantages in transparency and composability. Meanwhile, some centralized exchanges (such as Bitget) have also begun to launch Stock Futures products based on tokenized stock indices, introducing perpetual structures, funding rates, and margin mechanisms within a centralized framework. Their trading experience is already highly similar to stock perpetuals at the functional level, but they are still limited by a 5/24 trading system and centralized clearing architecture.

From a more macro perspective, stock perpetuals reflect the accelerated integration of real-world assets (RWA) with the on-chain derivatives system, pushing the crypto trading market from being centered on crypto-native assets towards a trading paradigm of "full asset perpetualization." In this process, Perp DEXs are expected to evolve into comprehensive trading gateways covering a wider range of asset types with stronger global attributes; meanwhile, mainstream CEXs, constrained by licensing requirements and increasingly stringent securities regulatory frameworks, will still find it difficult to launch such products on a large scale in the foreseeable future, which objectively further strengthens the first-mover advantage of Perp DEXs in the stock perpetual space.

Currently, the biggest uncertainty facing stock perpetuals still comes from the regulatory side. Although there are no clear regulatory rules for stock perpetual contracts globally, regulators generally maintain a cautious attitude towards on-chain products that are highly correlated with stock prices, often leaning towards categorizing them as securities derivatives or contracts for difference (CFDs). Even though stock perpetuals do not involve stock custody or actual equity delivery, the potential compliance risks cannot be ignored due to their anchoring to traditional securities assets. Future regulatory focus may increasingly center on front-end operating entities, price indices and oracle data sources, as well as centralized aspects related to payment or technology services, while simultaneously strengthening requirements for KYC, leverage limits, geographic restrictions, and risk disclosures.

Stock perpetuals are at a critical stage of rapid expansion alongside regulatory uncertainty. On one hand, they open up a potential growth space in the on-chain derivatives market built on a pool of hundreds of trillions of dollars in stock assets; on the other hand, their long-term development still depends on whether a balance can be achieved between product innovation efficiency, risk control capabilities, and compliance pathways. Those protocols and platforms that first achieve this balance are more likely to occupy a core position in the future global on-chain and quasi-on-chain trading systems.

This article will systematically analyze the underlying operational mechanisms and product structures of stock perpetual contracts, focusing on price formation mechanisms (oracle design), synthetic asset construction methods, clearing and risk control systems, funding rates, and leverage models, while combining representative leading projects to conduct an in-depth analysis and outlook on the current market landscape, potential risks, and future development trends.

Table of Contents

Abstract

1. What are Stock Perpetual Contracts?

2. Growth Drivers and Research Value

3. The Underlying Mechanisms of Stock Perpetual Contracts

3.1 Price Sources (Oracle)

3.2 Synthetic Asset Minting

3.3 Clearing Mechanism

3.4 Leverage Mechanism

4. Market Landscape

4.1 Stock Perpetuals of Hyperliquid

4.2 Aster: Simple vs. Pro Mode

4.3 Stock Perpetuals of Lighter

4.4 Stock Perpetuals of ApeX

4.5 Multi-Entry Integration is Expanding the Traffic Boundaries of Stock Perpetuals

4.6 Stock Perpetuals of Leading CEXs

4.7 Comparative Analysis of Market Landscape

4.8 Traditional Financial Infrastructure on Chain May Reshape the Long-Term Logic of Stock Perpetuals

5. Risks and Regulation

5.1 Current Regulatory Status and Potential Compliance Risks

5.2 Other Potential Risks

6. Trends and Outlook

6.1 Market Size and Potential Space of Stock Perpetuals

6.2 Trends and Outlook

References

1. What are Stock Perpetual Contracts?

The "stock perpetual contracts" that have emerged on-chain are essentially synthetic derivatives that follow the price fluctuations of U.S. stocks. They allow users to trade the trends of stocks like Apple, Tesla, and Nvidia 24/7, but you do not actually own shares in these companies, have no dividends, no voting rights, and will not appear on the shareholder register. It is more like "betting on the U.S. stock price index" rather than the stocks themselves. Its price is synchronized with U.S. stock market trends through oracles, allowing you to go long, short, or leverage. However, the biggest difference between you and traditional stock investors is that you do not hold any stocks; you are merely trading price fluctuations.

To better understand stock perpetual contracts, we need to distinguish them from RWA stock tokens. RWA stock tokens are tokenized products that are actually held by custodians in the real world, representing real equity relationships, including dividends, voting rights, and even regulatory securities attributes. In contrast, stock perpetual contracts do not correspond to real holdings and do not provide any rights; their sole purpose is to allow users to participate more conveniently and directly in the price fluctuations of U.S. stocks on-chain. Therefore, in terms of use, compliance framework, and risk attributes, the two are in completely different tracks.

The positioning of stock perpetual contracts is very clear: they are not "on-chain U.S. stocks," but rather "on-chain U.S. stock trading tools." For users who wish to participate in the U.S. stock market globally with lower barriers and higher efficiency, these products provide a new entry method; for DeFi protocols, they also represent a potential trend of further on-chaining traditional financial derivatives.

2. Growth Drivers and Research Value

The reason stock perpetuals have become one of the most noteworthy new tracks in 2025 is that they are at an accelerated window where narrative, demand, and technology are all rising simultaneously. Over the past two years, competition among Perp DEXs has led to a high degree of homogenization of BTC, ETH, mainstream tokens, and even MEME perpetuals, creating an urgent need for a new asset class that can truly differentiate itself. "Stock perpetuals" have emerged at this time, becoming one of the few categories that are both innovative and have clear incremental demand.

Its rise primarily stems from genuine user demand. Global users have long wanted to trade U.S. stocks conveniently, but traditional financial channels have too high a barrier: cumbersome account opening, troublesome cross-border fund flows, lengthy regulatory processes, and U.S. stock trading itself has long been limited to fixed trading hours. These experiences are at odds with crypto users' habits of "going long or short at any time, settling in stablecoins." On-chain stock perpetual contracts thus provide a risk trading path different from the traditional securities system. During the off-hours of the U.S. stock market, contract prices are no longer anchored to real spot transactions, but under the premise of having external price references (such as related futures, indices, or synthetic prices) and basic liquidity, they may still fluctuate based on the supply and demand relationships and market expectations of global traders; meanwhile, mechanisms such as funding rates and mark prices continue to operate, causing prices to converge in the long term towards the market consensus pricing of the risk exposure of that stock. Whether to allow new positions to be opened during off-hours is not determined by whether the U.S. stock market is open, but more by the platform's own risk control design, which often balances pricing continuity and risk control by limiting leverage, position size, or only opening partial trading permissions. In terms of trading, these products break through the limitations of fixed trading hours, allowing users to manage and hedge their risk exposure to U.S. stock assets in a nearly 24/7 manner. Users only need to use stablecoins to go long or short on TSLA, NVDA, and other U.S. stock targets at any time, without KYC or a brokerage account, significantly lowering the trading barrier. For many crypto users, this is the first time they can continuously participate in and price U.S. stock-related risks without relying on the traditional financial system, thus releasing long-suppressed demand.

Of course, the existence of demand alone is not enough to trigger the natural explosion of a new category; the maturity of the supply side is equally critical. The industry environment in 2025 precisely fulfills these conditions. On the narrative side, RWA policy space is beginning to loosen, and on-chain products linked to real-world assets are gradually shifting from "sensitive" to "discussable." On the technology side, the decreasing costs and increasing accuracy of oracles make it easier for protocols to track real-time prices of AAPL, TSLA, and other U.S. stocks. On the infrastructure side, the proliferation of high-performance chains (Solana, BNB Chain, Hyperliquid's self-developed chain) has upgraded the on-chain trading experience from "usable" to "close to CEX's smoothness." The simultaneous maturity of both supply and demand sides has made stock perpetuals a differentiated breakthrough for Perp DEXs.

More importantly, this track simultaneously hits the two strongest narrative lines of 2025: RWA × on-chain derivatives. RWA prompts the market to rethink how real assets transition to on-chain; on-chain derivatives are the fastest-growing segment in trading volume in 2025. Stock perpetuals are at the intersection of these two narratives: they have the intuitive appeal of "on-chain U.S. stock trading" while also possessing the high frequency, leverage, and long/short attributes of perpetual contracts, naturally becoming a focal point of interest for institutions, retail investors, and protocols alike.

From the perspective of actual implementation maturity, stock perpetual contracts are not merely at the conceptual level. Platforms such as Aster, Hyperliquid (Trade.xyz), Lighter, and ApeX have taken the lead in launching mainstream U.S. stock targets like AAPL, TSLA, and NVDA, and have validated the ability of such products to drive user activity and trading volume in actual trading. Relevant cases indicate that stock perpetuals are not just a narrative innovation but a type of derivative form that already possesses the capability for scaled trading and can operate effectively in real markets.

Finally, its regulatory position also makes this track more valuable for research. Stock perpetuals do not correspond to real stock rights but closely follow U.S. stock prices, inevitably sparking discussions about whether they fall under unregistered securities derivatives. How protocols design sustainable synthetic asset models within regulatory frameworks, how to avoid securities attributes, and how to explain risk exposure may become hot topics in the coming year, on par with USDT and RWA.

In summary, stock perpetual contracts are at the intersection of strong narratives, strong demand, mature technology, and discussable regulation, making them one of the most imaginative and worthy tracks for in-depth research in on-chain finance in 2026.

3. The Underlying Mechanisms of Stock Perpetual Contracts

To understand how stock perpetual contracts operate on-chain, several core modules are essential: price sources (oracles), synthetic asset minting and pairing logic, clearing mechanisms, and leverage and risk control.

3.1 Price Sources (Oracle)

For stock perpetual contracts, oracles act like their "eyes," responsible for bringing the prices of real-world U.S. stocks onto the chain. Since the protocol itself cannot directly access NASDAQ or the NYSE, the quality of the oracle almost determines the overall security of the product: prices must be real, updates must be fast enough, they must not be manipulable, and they must align with real-world trading rules (such as trading halts and market closing times). Therefore, the requirements for oracles in stock perpetual contracts are more stringent than those for traditional crypto perpetuals.

3.1.1 Common Oracle Solutions

Currently, commonly used solutions in the industry include Pyth Network, Switchboard, Chainlink, and a few protocols with self-developed oracles. They each address the challenge of "how to securely see U.S. stock prices on-chain" from different angles. For example, Pyth collaborates directly with numerous market makers, exchanges, and financial institutions, allowing these entities to publish their first-hand quotes directly onto the chain. The prices are not sourced from publicly available websites as second-hand data but come from professional quotes in real trading environments, aggregated and verified by multiple institutions, making them less susceptible to single-point manipulation. More importantly, Pyth synchronizes with real-world trading hours, ensuring that no "fictional prices" are pushed after the U.S. stock market closes, allowing the protocol to implement stricter night-time risk rules, such as increasing margin requirements or limiting new positions, keeping the on-chain process as close to the real market as possible.

Switchboard offers another approach: allowing the protocol to have a "customizable pricing system." Protocols can flexibly set price sources, aggregation methods, and update frequencies, and even switch strategies based on different time periods, such as using high-frequency updates during the day and low-frequency or TWAP (Time-Weighted Average Price) at night, to fit the market structure of U.S. stocks. For platforms wishing to incorporate "trading halt logic," "extreme market condition filtering," and "event-triggered updates" into their models, this highly programmable oracle can provide more granular control.

Chainlink represents a more robust oracle path. Its price sources typically come from multiple trusted data providers and trading infrastructures, aggregated and weighted through a decentralized node network, emphasizing resistance to manipulation, continuity, and verifiability. In the context of stock perpetual contracts, Chainlink is often used for marking prices, settlement prices, or risk control reference prices, rather than for high-frequency matching pricing itself. Even during off-hours of the U.S. stock market, Chainlink does not simply generate fictional transaction prices but instead transmits more "risk-anchored" price signals to the protocol based on verifiable reference sources and update rules, helping the system maintain stable operation of clearing and margin mechanisms. Chainlink is currently applied in some on-chain stock perpetual contract oracle solutions, such as BitMEX's Equity Perps. Chainlink's Price Feeds and Data Streams provide important pricing inputs for on-chain derivatives but are also used in conjunction with other oracles (like Pyth) in the industry.

In the stock perpetual space, there are not many protocols that choose to develop their own pricing and oracle systems, with Hyperliquid being the most representative case. Its approach is not simply to call third-party oracles but to build a price index and risk control judgment system off-chain by integrating multiple external price sources and combining its own matching and liquidity data, then pushing the results, which have undergone multiple verifications, onto the chain as the core basis for marking prices, triggering settlements, and calculating funding rates. This highly integrated design allows the platform to handle price delays, extreme market conditions, trading halts, or abnormal fluctuations more precisely, while maintaining higher controllability in clearing logic and risk filtering models. However, developing a self-built oracle also means higher system complexity and operational costs. The protocol must take on the responsibility for the quality of market data, system stability, and security maintenance, while also facing higher compliance and liability boundary requirements when it involves anchoring to traditional stock prices. Therefore, this path poses higher thresholds for technical capabilities, financial strength, and risk control experience, with only a few leading protocols like Hyperliquid currently capable of long-term implementation and continuous optimization of this model.

3.1.2 Core Issues Addressed by Oracles

Despite the different sources of oracles, they ultimately strive to address several core risks. The first is "data manipulation," especially since U.S. stock prices are high liquidity assets; if the on-chain version of the price significantly deviates from the real market, it could lead to widespread liquidations. Multi-source aggregation, outlier filtering, and signature verification mechanisms can make prices more robust and less susceptible to single-point manipulation. The second issue is "latency and update frequency." Stock perpetuals often involve high leverage and real-time clearing, requiring sub-second price pushes; solutions like Pyth, which emphasize high-frequency updates, essentially resolve this pain point, while Switchboard and self-developed oracles ensure that critical moments receive the latest market data through event-triggered mechanisms.

Handling U.S. stock market closures, after-hours trading, and trading halts presents another unique challenge. Real-world stocks have limited trading hours each day, while on-chain operations run 24 hours. To avoid the generation of "fictitious prices" after the U.S. stock market closes, mainstream oracles will constrain data quality through market session identification. For example, Pyth attaches real-time market open/close markers to each price feed, allowing the protocol to automatically switch to more conservative, lower-volatility parameters during off-hours; Switchboard allows platforms to set custom session logic, actively reducing weight or limiting price update frequency during periods of extremely low after-hours trading volume. This way, when the real market lacks genuine transactions, the on-chain system will not trigger liquidation risks due to sporadic quotes or malicious updates.

When dealing with halted stocks, the situation becomes even more sensitive. A trading halt means that prices are completely frozen in the real market, and any price fluctuations derived on-chain could be distorted or even manipulated. Therefore, most trading protocols will immediately pause new positions or switch the pricing mechanism to a more robust TWAP mode upon receiving "halt status" feedback from the oracle, ensuring that liquidations are not triggered by a single anomalous data point. More importantly, these mechanisms ensure that users can continue trading even during U.S. stock market closures, but the risk system will automatically enter a "night protection mode": price updates become more cautious, liquidation thresholds are slightly raised, and funding rate buffers are wider. This design retains the advantage of 24/7 Web3 trading while remaining anchored to the realities of the market.

Extreme market conditions (such as CPI announcements or earnings report crashes) also test the stability of oracles. Mainstream solutions generally employ cross-source verification, TWAP buffering, and price deviation protection to prevent "flash crash prices" from being directly transmitted to on-chain prices. Thanks to these designs, the oracles for stock perpetuals can achieve high speed and low latency while ensuring that risks remain controllable, making it possible to track real-world prices on-chain.

The reason oracles can become a key underlying force driving the explosion of stock perpetuals in 2025 is that the industry has finally built a set of pricing infrastructure that "understands on-chain rhythms while respecting real market rules." This has resolved a series of practical challenges, such as price sourcing, trading session handling, resistance to manipulation, and high-frequency updates, enabling on-chain protocols to obtain U.S. stock prices stably, accurately, and with low latency. It is precisely this capability that supports the safe clearing, high leverage, low slippage, and around-the-clock trading experience of stock perpetual contracts, forming the foundational basis for their scalable expansion.

3.2 Synthetic Asset Minting

The core of on-chain stock perpetual contracts is not to bring real stocks onto the chain but to abstract their price risks into a set of synthetic risk exposures that can be settled in smart contracts. Since real-world stock assets cannot be directly held or cleared by on-chain contracts, protocols typically construct a virtual contract system linked to the price of the underlying asset based on stock price data provided by oracles. In this mechanism, the contracts themselves do not represent any real stock holdings but are purely price-tracking tools: users deposit stablecoins as margin to gain long or short exposure to the price fluctuations of specific stocks or indices, with their profits and losses entirely determined by the contract price and settlement rules. Whether the protocol uses a liquidity pool, order book, or a hybrid structure provided by professional market makers, the underlying logic remains consistent: to "synthesize" tradable stock risks through smart contracts rather than minting or holding real assets. Therefore, on-chain stock perpetual contracts allow users to gain highly correlated returns and risk exposures related to assets like Apple, Tesla, or the Nasdaq ETF without directly buying or holding U.S. stocks or accessing traditional brokerage and settlement systems.

To maintain the stability of prices and trading structures, balancing long and short positions becomes extremely important. If market sentiment at a given moment leads to significantly stronger long demand than short, the liquidity pool must bear higher risks, and the system is more likely to deviate. To address this imbalance pressure, protocols typically introduce automatic adjustment mechanisms: when positions in one direction become excessively piled up, the liquidity pool will guide new users to naturally flow toward the other side through funding rates, risk parameters, or discount coefficients. The ultimate goal is not to lock in balance but to allow long and short forces to fluctuate around a controllable range, enabling the liquidity pool to provide liquidity with a relatively stable delta-neutral posture.

The funding rate serves as an important metronome for on-chain perpetuals, regulating market sentiment and acting as a risk management tool. When long demand is extremely strong, the funding rate rises, prompting long users to pay fees to shorts or the liquidity pool; conversely, the opposite occurs. Unlike crypto-native perpetuals, the funding rate for stock perpetuals needs to consider the overnight costs of U.S. stocks, the trading rhythm of the real market, and the on-chain position structure, often exhibiting stronger periodicity. For example, during U.S. stock market closures, if oracle price fluctuations diminish while on-chain positions continue to lean to one side, the protocol may slow down funding rate updates to avoid unnecessary fee shifts caused by "false fluctuations."

3.3 Clearing Mechanism

In stock perpetuals, the clearing mechanism is more complex than in traditional crypto perpetuals because it overlays two completely different sources of volatility: one from the price fluctuations of U.S. stocks themselves and the other from the intense volatility of the crypto market operating 24/7. When stocks like TSLA and NVDA have already closed in the real world and their prices remain static, on-chain BTC and SOL may experience significant rises or falls late at night, causing the value of user collateral to shrink instantly, making stock perpetual positions appear "risk amplified." It is precisely because of this cross-market volatility difference that the clearing engine for stock perpetuals must be more sensitive and intelligent than ordinary perpetuals.

The mainstream approach of on-chain stock perpetual protocols is to introduce a cross-asset risk engine that conducts a unified assessment of the overall position risk for users, rather than isolating the monitoring to a single stock perpetual. This system dynamically adjusts risk tolerance based on external market conditions to avoid lagging responses of on-chain contracts to real market changes. For example, during the U.S. stock market closure, when spot prices are no longer continuously traded, the protocol typically does not directly freeze the long and short positions established by users but instead automatically switches to a more conservative set of risk parameters: maintaining an increased margin rate, allowing a lower maximum leverage, and triggering liquidation thresholds earlier. The original positions of users remain valid, but the system's buffer space for risk is significantly compressed, making high-leverage positions closer to the liquidation line.

For users, this rule switch does not necessarily lead to immediate forced liquidations of positions, but it may result in additional margin requirements. If the position originally has a sufficient safety cushion and remains within an acceptable range after the risk parameter adjustment, no action is needed; however, if the position is close to the risk boundary before the market closes, additional margin may be required, and liquidation could be triggered even before any significant price fluctuations occur.

The purpose of this design is not to amplify volatility but to prevent the on-chain system from bearing excessive tail risk during periods when external markets cannot be hedged immediately. Once the U.S. stock market reopens and the real price discovery mechanism resumes, the risk engine will relax constraints accordingly, gradually returning margin requirements, leverage limits, and liquidation parameters to normal levels. Through this dynamic switching mechanism, on-chain stock perpetual protocols aim to keep the risk management logic aligned with real financial markets without forcibly intervening in user positions, thereby reducing systemic risks arising from mismatched trading sessions.

The core of cross-asset clearing is a risk assessment framework based on "unified margin + multi-asset risk weights." Theoretically, this framework allows protocols to simultaneously assess risk exposures from different asset classes, such as the combined risks of stock perpetuals and crypto perpetuals, and set different risk weights based on the volatility, correlation, and liquidity differences of each asset. However, in most current on-chain stock perpetual protocols, due to considerations of risk control safety and implementation complexity, the margin assets available for users are still primarily stablecoins like USDC, and may even be the only option.

The so-called "multi-asset margin" reflects more the design capability of the risk engine at the position assessment level rather than a fully open user function. On this basis, the system will conduct a unified assessment of users' long and short positions in stock perpetuals and crypto perpetuals: when the crypto market experiences severe volatility first, while the U.S. stock market is temporarily closed and prices are frozen, the risk engine will prioritize the safety of margin and overall position exposure, triggering partial or full liquidation if necessary to avoid extreme fluctuations in a single market from breaching the entire account through the unified margin mechanism.

The clearing mechanism of stock perpetuals resembles a "risk translator between dual time zones and dual markets." It must understand the rhythm of the U.S. stock market while adapting to the 24-hour volatility of the crypto market; it must ensure that there are no delays in liquidation due to market closures while also preventing excessive sensitivity that could lead to users being frequently liquidated.

3.4 Leverage Mechanism

In terms of leverage mechanisms, stock perpetual contracts exhibit a very distinct product characteristic: while users may desire extremely high leverage, protocols must exercise considerable restraint, allowing leading perp DEXs to open leverage of dozens or even hundreds of times on crypto assets like Bitcoin and Ethereum, but generally keeping the upper limit for stock perpetuals between 5x and 25x. Stock prices are anchored to real-world assets and are more affected by trading hours, cross-market volatility, and pre-market and after-hours expectation changes, necessitating that protocols leave ample risk buffers.

Aster's Simple mode supports a maximum leverage of 1001x, sparking market discussions, but currently, this only applies to perpetual contracts for crypto assets, with stock permissions capped at a maximum of 25x leverage, significantly lower than for crypto assets. In stock perpetuals, even if the interface states a maximum of 20x or 25x, this does not mean users can utilize such high multiples at any moment. The risk engine will tighten leverage in real-time based on market conditions; during U.S. stock market closures, the risk of price gaps due to discontinuous information increases, prompting the protocol to automatically raise margin requirements; before and after significant events, volatility may intensify, further compressing the leverage limit. This means that the leverage in stock perpetuals is essentially a "dynamic leverage under strict risk control," aimed at maximizing the avoidance of systemic risks while maintaining the trading experience.

Regulatory bodies have always taken a cautious stance towards high leverage, and stock perpetuals, being highly correlated with U.S. stock prices, are more likely to be viewed as products approaching the form of securities derivatives. Therefore, the industry as a whole tends to maintain restraint in leverage. This is not only to avoid the gray area of "excessive speculation" but also to actively reduce potential regulatory pressures in the future. Consequently, the leverage design of stock perpetuals follows a prudent route: it retains a certain degree of flexibility on the surface, allowing users to open positions conveniently, but strictly constrains actual risk exposure through underlying risk modules. It attempts to continue the "lightweight and smooth" trading experience of the crypto market while addressing the inherent structural risks associated with stocks.

4. Market Landscape

4.1 Hyperliquid's Stock Perpetuals

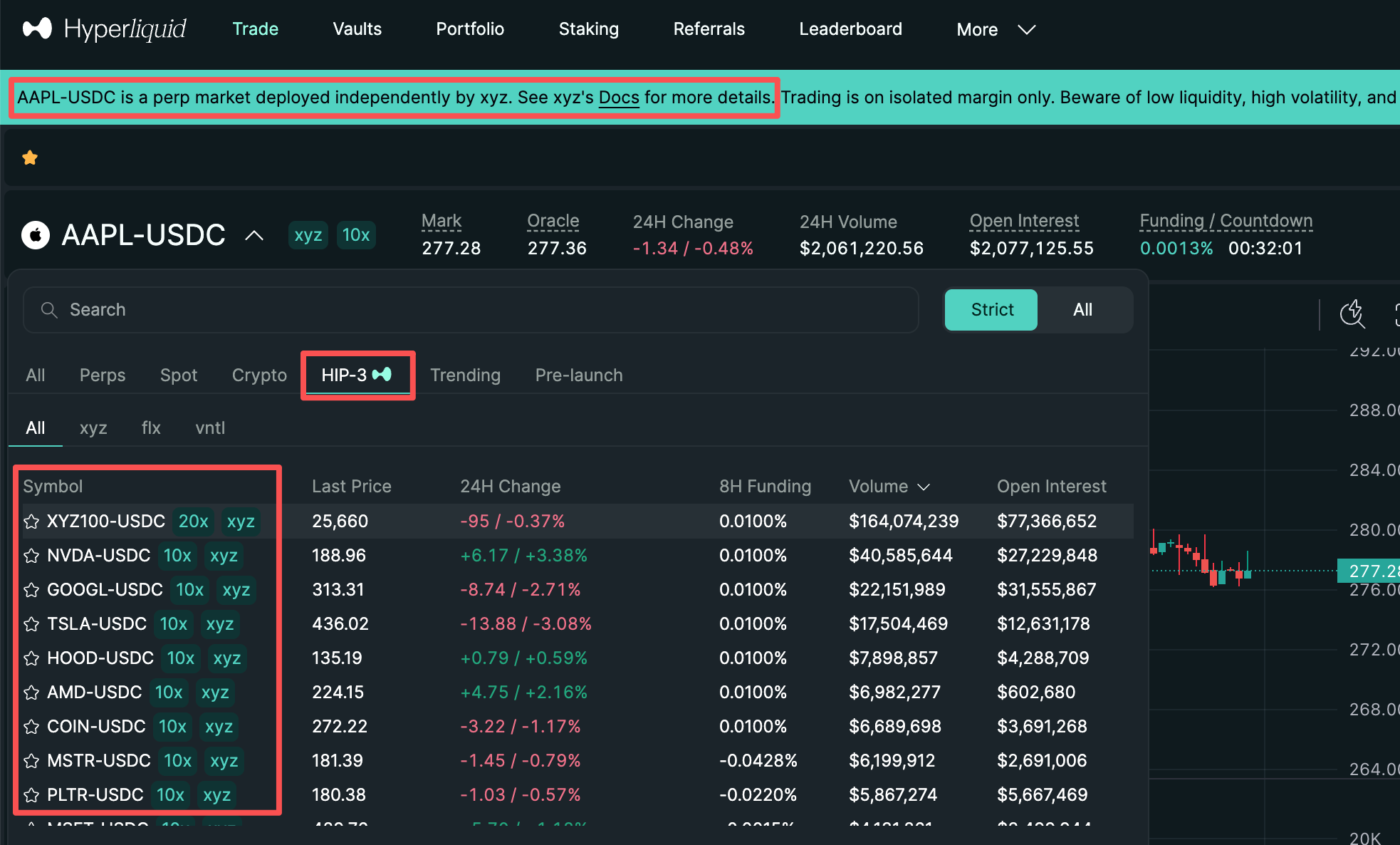

In the on-chain stock perpetual space, Hyperliquid is currently one of the fastest-expanding and most ecosystem-integrated infrastructures. It is important to emphasize that Hyperliquid does not directly launch stock perpetuals in the form of official contracts but instead introduces third-party builders to deploy stock perpetual products on its underlying trading system through the HIP-3 (Hyperliquid Improvement Proposal-3) framework.

Currently, the stock perpetuals in the Hyperliquid ecosystem are mainly provided by projects such as Trade.xyz, Flx (Felix-deployed Perps), and Vntl (Ventuals, Builder-deployed Perps), among which Trade.xyz is the most core source of stock perpetuals, with the highest trading volume and product maturity. Trade.xyz is built on Hyperliquid's HIP-3 protocol, directly operating on Hyperliquid's self-developed chain, matching engine, and order book system, allowing Hyperliquid to further expand into non-crypto asset categories such as stocks and stock indices while natively supporting crypto asset perpetuals. At the product level, the Hyperliquid main site has set up entry points related to stock perpetuals and directs users to markets provided by builders like Trade.xyz, indicating that stock perpetuals have become a strategic expansion direction within the Hyperliquid ecosystem rather than a marginal experimental product.

Figure 1. Hyperliquid stocks perp page. Source: https://app.hyperliquid.xyz/trade

4.1.1 Core Implementation of Hyperliquid Stock Perpetuals: Trade.xyz

In terms of pricing mechanisms, Trade.xyz introduces external professional stock price sources to accommodate the non-24/7 trading characteristics of stock assets, combined with an internal continuous pricing mechanism to support an around-the-clock trading experience for stock perpetuals. During normal U.S. stock market hours, Trade.xyz references stock prices provided by professional oracles like Pyth Network to ensure that on-chain perpetual prices closely align with real stock market trading prices; during nighttime, weekends, and holidays when the U.S. stock market is closed, external prices are no longer updated, and the system bases its pricing on the last effective reference price, combined with the supply and demand situation in the on-chain order book, generating an internal reference price through smoothing algorithms like EMA (Exponential Moving Average) to ensure price continuity and market tradability while avoiding fictional prices that deviate from the real market.

In terms of risk control, Trade.xyz employs a robust marking price mechanism for its stock perpetuals. The marking price is not a single price source but a composite of external reference prices, their EMA smoothed values, and market prices reflected in the order book, taking a relatively stable midpoint within a defined range as the basis for liquidation and margin calculations. This multi-source marking price design helps filter out short-term abnormal fluctuations, reducing the risk of erroneous liquidations caused by insufficient liquidity or instantaneous price shifts, making it particularly suitable for high-leverage perpetual contract scenarios.

Regarding funding rates, Trade.xyz adopts the standard perpetual contract funding rate model, guiding contract prices to fluctuate around the reference value of the underlying asset through periodic funding exchanges between long and short parties in a continuous trading environment, avoiding long-term deviations. The liquidation system is triggered around the marking price, with positions automatically liquidated when the margin falls below the maintenance margin level; if extreme market conditions occur and liquidation cannot fully cover losses, an ADL (Automatic Deleveraging) mechanism is further activated to ensure the overall system operates without bad debts.

When users trade stock perpetual assets through the Hyperliquid platform on Trade.xyz, all transactions are priced in U.S. dollars, using USDC as the margin and profit/loss settlement asset. This design is highly consistent with the experience of centralized exchanges for U.S. stock perpetuals and lowers the barrier for traditional users to enter the on-chain perpetual market. Leveraging the high performance of its self-developed chain, the high liquidity of order book matching, the stability of multi-source pricing, and a complete risk control system, Hyperliquid has become one of the most systematic projects in current on-chain stock perpetuals, rapidly widening the gap with similar products.

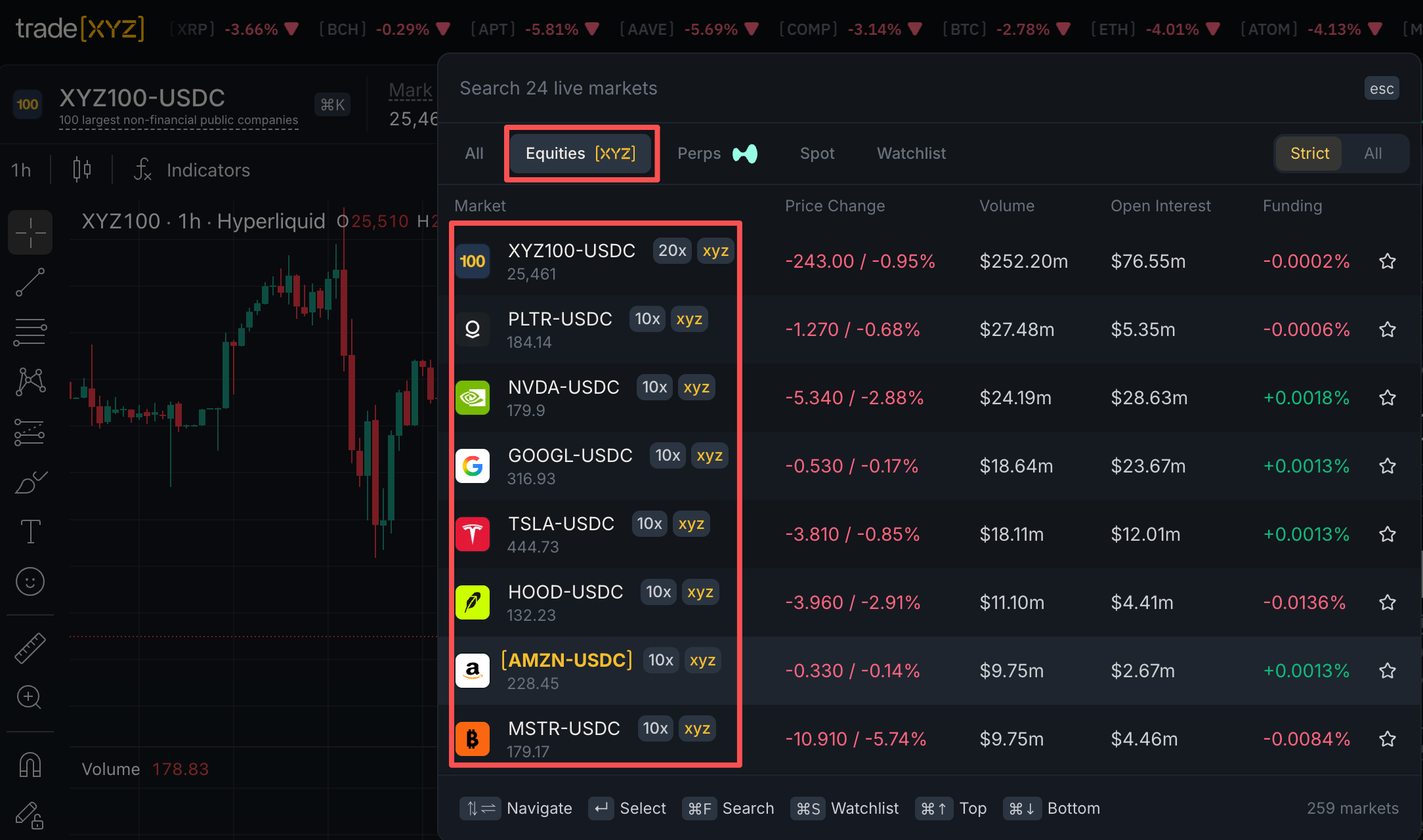

Figure 2. Trasw[xyz] stock perps. Source: https://app.trade.xyz/trade?market=XYZ100

4.1.2 Market Performance

By the end of 2025, the Hyperliquid platform supported over 20 stock perpetual contracts, with the overall leverage level primarily concentrated around 10 times, and only a few assets supporting a maximum leverage of 20 times. With the official launch of Trade.xyz in November 2025, the stock perpetual trading segment began to show significant growth momentum. According to data from Dune, as of December 24, 2025, the peak daily trading volume of stock perpetual contracts on Hyperliquid was approximately $526 million (occurring on November 25, 2025). On that day, the platform's overall trading volume was about $9.867 billion, with stock perpetual trading volume accounting for approximately 5.33%. During relatively quiet trading periods, the daily trading volume of stock perpetuals still maintained at tens of millions of dollars, while the overall trading volume on the Hyperliquid platform remained consistently above $1.3 billion.

Overall, the stock perpetual segment has become one of the new marginal growth sources for Hyperliquid, attracting new traffic from users with non-pure crypto backgrounds to some extent. However, in terms of overall structure, stock perpetuals still occupy an early stage in the total perpetual contracts on Hyperliquid. Currently, crypto asset perpetual contracts remain the absolute mainstay of the platform's trading volume, while stock perpetuals play a more supplementary role. Their core value lies in broadening the boundaries of tradable assets on the platform and gradually enhancing Hyperliquid's appeal to a wider user base.

Within the Hyperliquid ecosystem, Trade.xyz has launched various index perpetual contracts, among which the comprehensive index product represented by XYZ100 is particularly active. XYZ100 is designed to track the overall trend of the NASDAQ-100 index, covering the 100 largest non-financial publicly traded companies in the U.S. It does not directly anchor to U.S. stock spot prices but uses the Chicago Mercantile Exchange (CME) NASDAQ-100 index futures (NQ) as the core price reference. Through an algorithmic model, the futures prices are mapped to a reference price that closely resembles the spot index, thus providing continuous index trading capabilities even during U.S. stock market closures. This product prices based on on-chain trading behavior and market weights, reflecting the overall trend of multiple assets within a single contract. According to publicly available trading data, during active market phases, the 24-hour trading volume of XYZ100 can reach approximately $300 million, making it one of the important liquidity carriers for stock and index perpetual contracts on Hyperliquid.

In terms of single-stock assets, according to data displayed on the official website as of January 19, 2026, commodities like SILVER and GOLD constitute the second layer of liquidity center on the platform. Among them, SILVER has a 24-hour trading volume of about $65 million, with an open interest of $67 million, indicating significant capital participation depth; GOLD has a 24-hour trading volume of about $16 million, with an open interest of approximately $31 million, also demonstrating strong position-carrying capacity. These two assets are also perpetual contracts on Hyperliquid that maintain a trading scale of tens of millions of dollars, indicating that related products have attracted a large number of day traders, quantitative strategies, and some institutional funds, promoting the platform to form a relatively stable medium to high active trading cycle.

The daily trading volume of mid-tier assets is mainly distributed in the range of $4 million to $10 million, providing relatively balanced liquidity and execution environments for the market. For example, on January 19, 2026, the official website showed that COPPER had a 24-hour trading volume of about $8.2 million, NVDA about $4.5 million, and TSLA about $4.4 million. In contrast, the trading activity of tail assets is significantly lacking, with RIVN's 24-hour trading volume being only about $50,000 and open interest around $100,000. This distribution characteristic reflects that the decentralized stock and commodity perpetual market also exhibits a typical long-tail structure, with traders overall more inclined to choose core assets with higher volatility and deeper liquidity for trading.

It should be noted that the trading volume and open interest (OI) data of stock perpetual contracts on Hyperliquid fluctuate significantly, easily influenced by market sentiment, underlying volatility, and periodic capital concentration trading. Relevant data may show significant changes between different trading days, and short-term high activity does not equate to long-term liquidity advantages. Additionally, there is currently no dedicated third-party data platform for long-term, unified statistics on the decentralized stock perpetual market; relevant data mainly comes from the platform's front-end real-time display. Therefore, the data cited in this article is more for describing the platform's liquidity structure and trading preferences within a specific time window rather than making absolute judgments on long-term rankings.

Overall, the stock perpetual market on Hyperliquid exhibits typical characteristics of "concentration at the top, clear structure, and significant long tail." Although stock perpetuals have not yet become the main trading force on the platform, as an important component of the ecosystem, they maintain rapid growth driven by Trade.xyz. In the future, as the number of underlying assets increases, leverage products diversify, and pricing mechanisms improve, the proportion of stock perpetuals in the overall trading structure is expected to continue to rise, further consolidating Hyperliquid's leading position in the on-chain U.S. stock derivatives field.

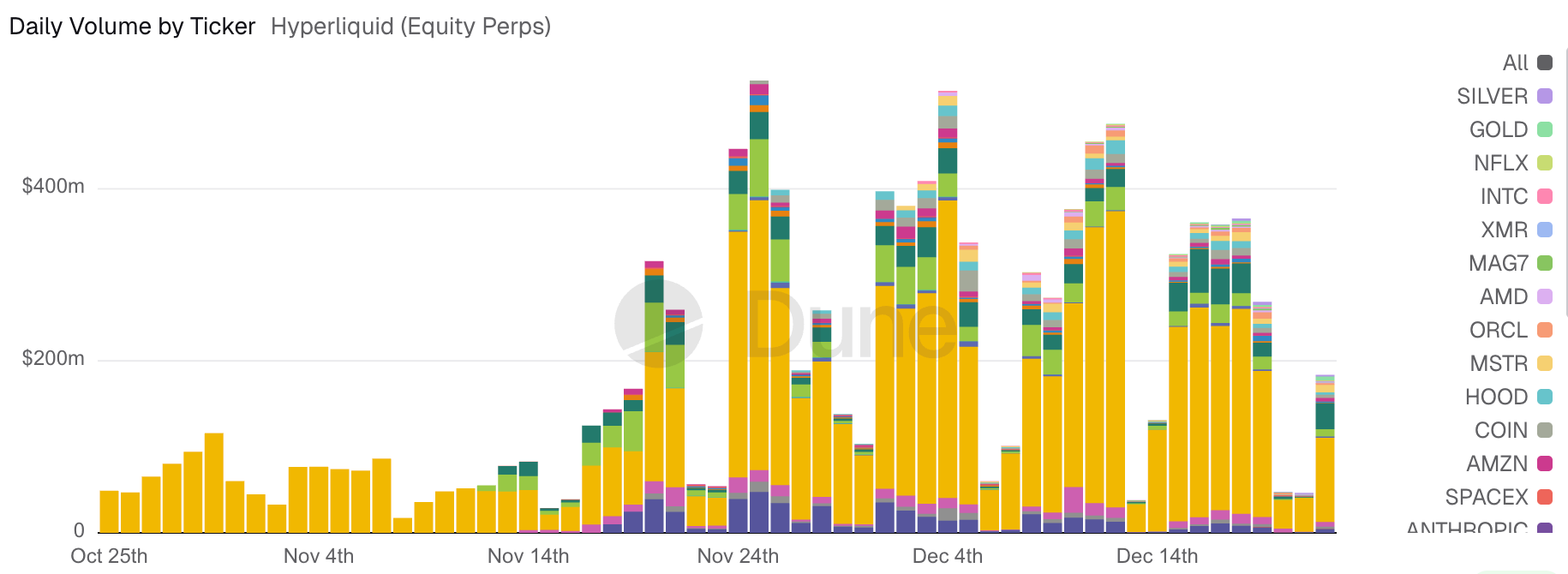

Figure 3. Hyperliquid perp volume. Source: https://dune.com/queries/6406768/10176988

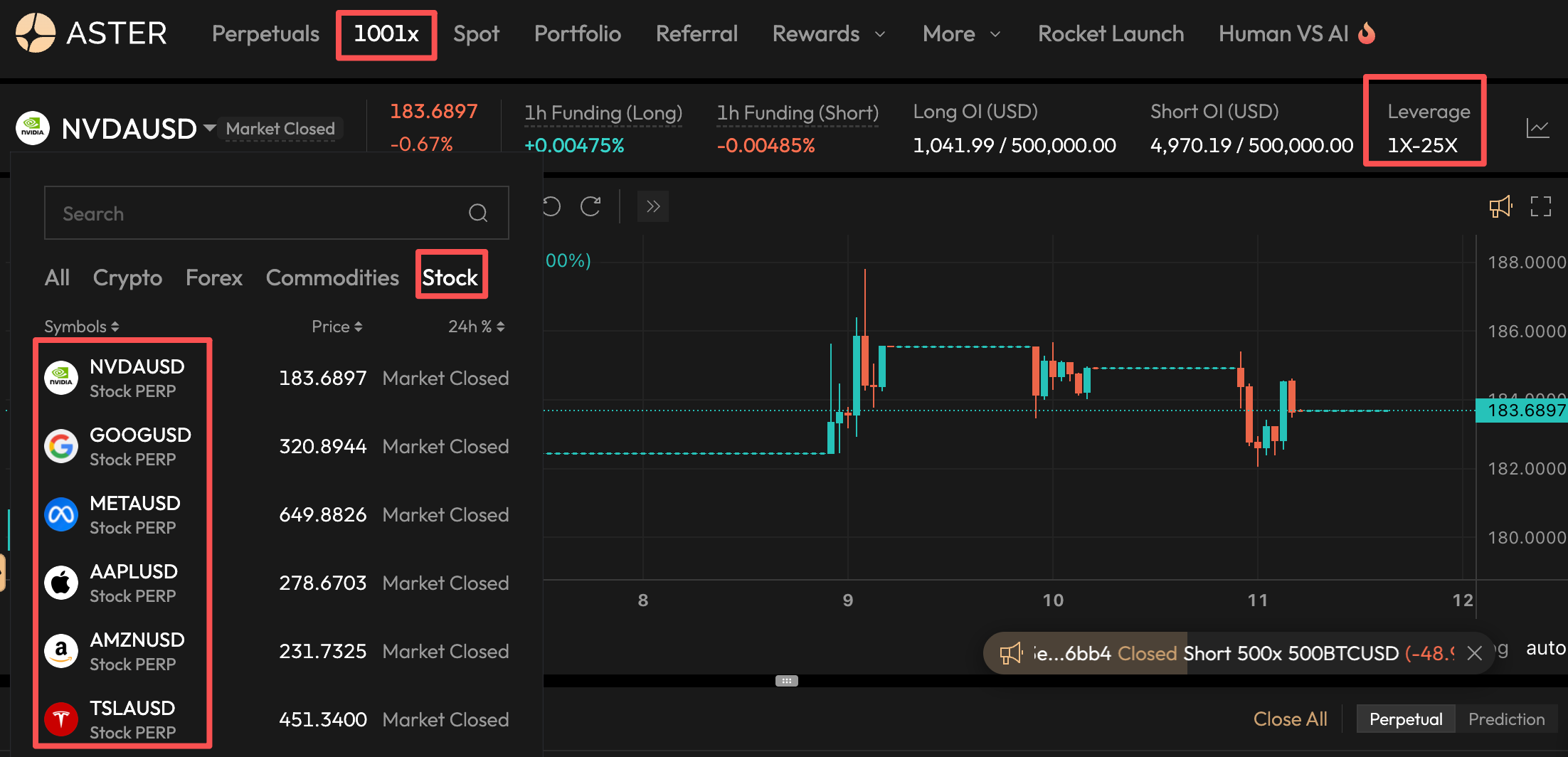

4.2 Aster: Simple vs. Pro Mode

In the current competitive environment of decentralized perpetual contracts (perp DEX), one of Aster's greatest advantages is that it does not force all users into a single product model but instead operates through a dual-track system of Simple Mode and Pro Mode, serving both users who want quick trades and convenience, as well as institutions and quantitative traders who prefer deep liquidity and flexible strategies. In this way, Aster effectively positions itself as a "universal platform covering everyone from retail to institutional."

4.2.1 Aster's Simple Mode

In Simple Mode, Aster's goal is to make trading as simple as pressing a button, with one-click position opening and closing, fully on-chain, without the need for order placement. Here, liquidity comes from its own liquidity pool (ALP, Aster Liquidity Pool), meaning users are not trading against another order but directly interacting with the liquidity pool. Because there is no order book and no complex order structures, this design is essentially similar to AMM + oracle pricing + pool market making, resulting in almost no slippage and extremely fast execution. For many users who wish to enter and exit quickly, engage in short-term trading, or simply want to experience leveraged trading, this extremely simplified operation is very user-friendly. To meet this demand, Aster even offers a "Degen Mode" with up to 1001x leverage for the most familiar crypto asset trading pairs (such as BTC/USDT). However, for stock perpetuals, the maximum leverage in this mode is only 25 times.

At the same time, this pool + oracle + on-chain pricing mechanism has a significant advantage: it allows users to use assets that would otherwise be idle in their wallets as collateral, and these assets may even be staked or yield-bearing, thus solving a long-standing capital efficiency problem for many: your money can be used for trading while not sitting idle. "Earning with an umbrella + placing orders" is seen by Aster as one of its core selling points.

However, Simple Mode is not a one-size-fits-all solution for all users. It is more suitable for those pursuing simplicity, high-frequency, short-term trading, who want to quickly enter and exit, experience the impact of leverage, or simply enjoy the thrill of instant opening and closing. The result of this experience may be high trading volume and frequency, but it also comes with high volatility and risk, especially in situations where the liquidity pool is tight, the market is turbulent, or there are deviations in the oracle or market makers withdraw liquidity.

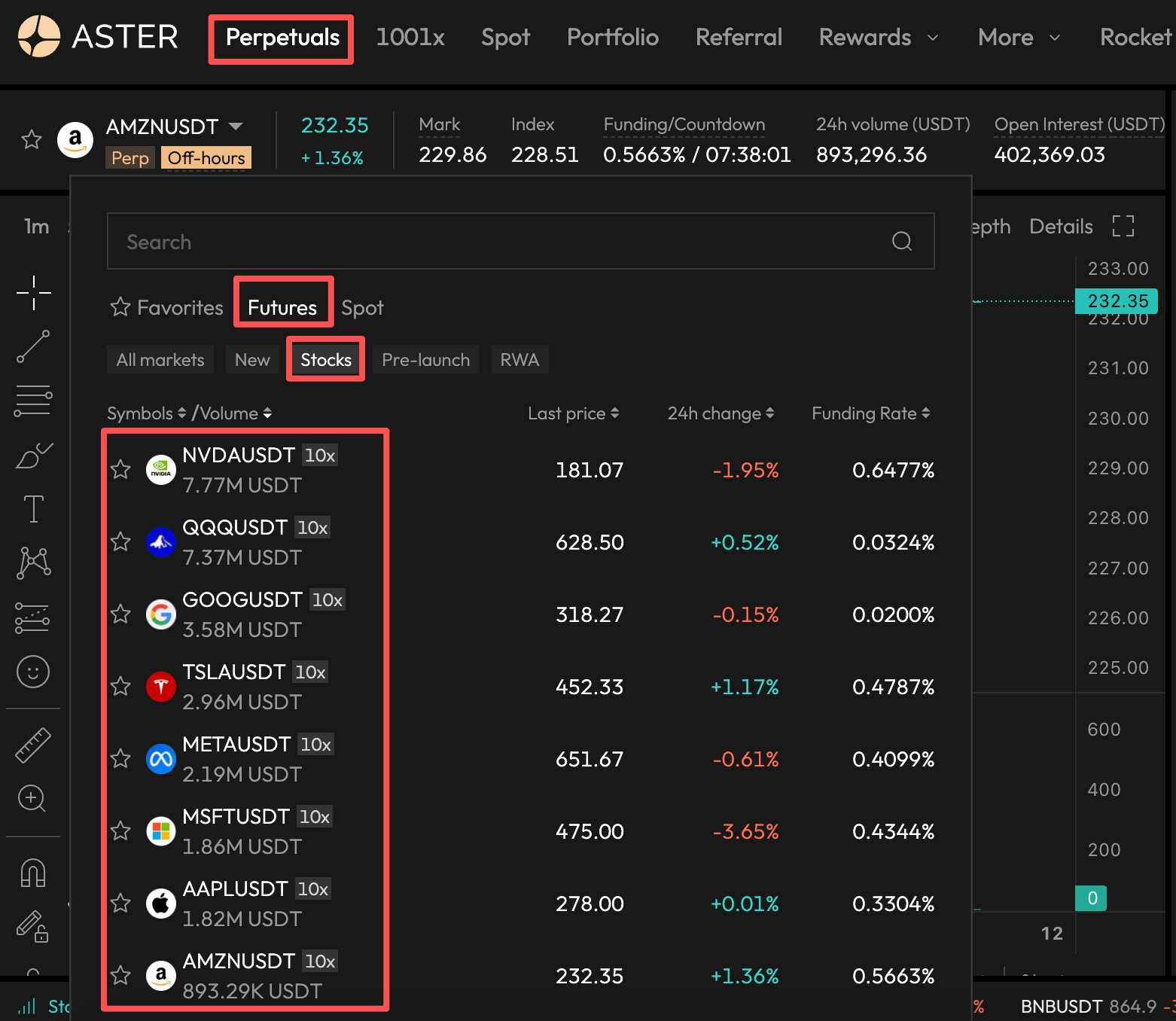

Figure 4. Aster simple mode stock perps. Source: https://www.asterdex.com/en/trade/1001x/futures/NVDAUSD

4.2.2 Aster's Pro Mode

In contrast, Pro Mode takes a more professional and robust approach. It is based on a centralized limit order book (CLOB), mirroring the matching and depth mechanisms of traditional centralized exchanges. Users can place limit orders, hidden orders, and grid orders, making it easier to execute large trades, build positions in batches, and implement complex strategies, suitable for quantitative trading, institutional orders, and scenarios sensitive to liquidity and slippage. In Pro Mode, the trading fee structure is also clearer, with maker/taker rates as low as 0.01% / 0.035% (or similar levels), and it supports multi-asset margin and staked assets (such as asBNB, USDF, ASTER itself) as collateral to improve capital efficiency.

More importantly, when Aster incorporates stock perpetuals into its trading range (e.g., blue-chip U.S. stocks), it is also launched through Pro Mode. This ensures that the order book depth comes from market makers + real orders, suitable for institutions and medium to long-term holders; on the other hand, it can also avoid the short-term risks and liquidity pressures brought by the high-leverage pool + oracle pricing + high-frequency liquidation mechanisms of Simple Mode. Currently, this mode supports 8 different stock perpetuals, with a maximum leverage of 10 times.

Simple Mode serves as Aster's "traffic entry point" to capture retail and short-term trading volume, while Pro Mode lays the foundation for building a "professional, stable, and sustainable" trading infrastructure. The former attracts users looking for quick trades with "speed + lightweight + high frequency + low barriers," while the latter earns the trust of professional traders or institutions through "depth + flexible strategies + capital efficiency + risk control mechanisms." Together, these two paths form Aster's product matrix, allowing it to meet the needs of ordinary users for simple and fast trading while also catering to professional players with higher demands for liquidity, depth, and strategic flexibility.

Figure 5. Aster pro mode stock perps. Source: https://www.asterdex.com/en/trade/pro/futures/AMZNUSDT

4.2.3 Stock Perpetuals in Both Modes

In Aster's product system, stock perpetuals exhibit different positioning and liquidity structures under Simple and Pro modes. The Simple Mode currently supports 6 stocks, with a leverage cap of 25×, significantly lower than the extreme leverage of 1001× available for crypto assets in the same mode. The protocol clearly adopts a more conservative risk control strategy for stock assets, mainly due to structural risks such as gaps, pre-market and after-hours volatility, and counterparty pricing costs. Under the liquidity pool (AMM) mechanism in Simple Mode, the risk engine must maintain a higher safety margin, making stock perpetuals more like a "high-speed, ultra-simple, zero-slippage" traffic entry point. Currently, the official data does not display trading volume for stock perpetuals in Simple Mode, but based on the design logic, it can be inferred that this mode leans towards high-frequency, small orders, and short-term trading, catering to users looking for quick entry and repeated "instant opening/closing" scenarios rather than serving as an execution platform for large funds.

In contrast, Pro Mode supports 8 stocks with a leverage cap of 10×, utilizing a centralized limit order book (CLOB) mechanism, constructed by market makers, limit orders, and strategy commissions to build depth, creating a trading environment closer to traditional financial markets. From real-time data, Pro Mode has already formed a clear category distribution structure, with tech stocks occupying relatively active trading volumes. The most active contract is NVDAUSDT, with a 24-hour trading volume of approximately 7.78 million USDT and an open interest of 2.83 million USDT, indicating sufficient depth and sustained trading interest. Tail assets like AMZNUSDT have a 24-hour trading volume of about 890,000 USDT and an open interest of 400,000 USDT, showing significantly lower activity. This "head concentration, tail sparsity" structure aligns closely with the U.S. stock market itself, indicating that the user structure and natural trading tendencies of Aster Pro Mode are gradually taking shape: narrative-driven, highly volatile tech stocks like NVDA, QQQ, and TSLA have become natural trading centers.

Overall, Aster has formed a dual-track system for stock perpetuals: "Simple is responsible for traffic, Pro is responsible for depth." Simple Mode provides an ultra-simple experience, zero-slippage execution, and high-frequency liquidity, while Pro Mode carries real trading volume, strategic demands, and institutional liquidity. The leverage differences between the two (25× for Simple and 10× for Pro), along with significantly stricter constraints compared to crypto assets, reflect the protocol's cautious attitude towards risk spillover for traditional assets like stocks. As the number of underlying assets expands, the market maker ecosystem grows, and user structures further differentiate, the capital migration between Simple and Pro modes, pricing stability, and risk pool elasticity will become key indicators for assessing the long-term sustainability of Aster's stock perpetuals.

4.3 Lighter's Stock Perpetuals

4.3.1 Mechanisms Related to Lighter's Stock Perpetuals

Since its launch, Lighter has positioned itself as a technology-intensive, verifiable, and fair trading platform for perpetual contracts, building a self-developed zk-rollup verifiable matching system: all matching and settlement processes can be verified on-chain through zero-knowledge proof technology. This design not only improves matching efficiency but also enhances data transparency, which is particularly important for perpetual contracts that require high accuracy in pricing and timely matching. For derivatives like stock perpetuals, verifiable matching and settlement not only boost user confidence but also reduce risks arising from matching delays or data inconsistencies.

In terms of specific trading structure, Lighter employs an order book matching mechanism. Users' buy and sell orders are uniformly entered into the on-chain order book, matched according to price priority and time priority rules, with prices primarily formed by real limit orders and transaction behaviors. This model makes market depth, bid-ask spreads, and slippage more transparent and predictable, and it is closer to the trading experience of traditional exchanges. For stock perpetuals, which have high demands for price continuity and execution quality, the order book mechanism helps reduce abnormal pricing issues caused by automated market making or insufficient liquidity.

In terms of product strategy for stock perpetuals, Lighter continues the industry's more conservative risk control approach towards traditional assets. The leverage currently set for stock perpetuals is usually much lower than that for crypto perpetuals, aiming to avoid common risks associated with U.S. stock assets, such as gap risks, insufficient liquidity in pre-market and after-hours trading, and cross-market price discrepancies. Unlike some crypto perpetuals that can offer hundreds or even thousands of times leverage, Lighter typically sets a relatively stable level of around 10× for stock perpetuals.

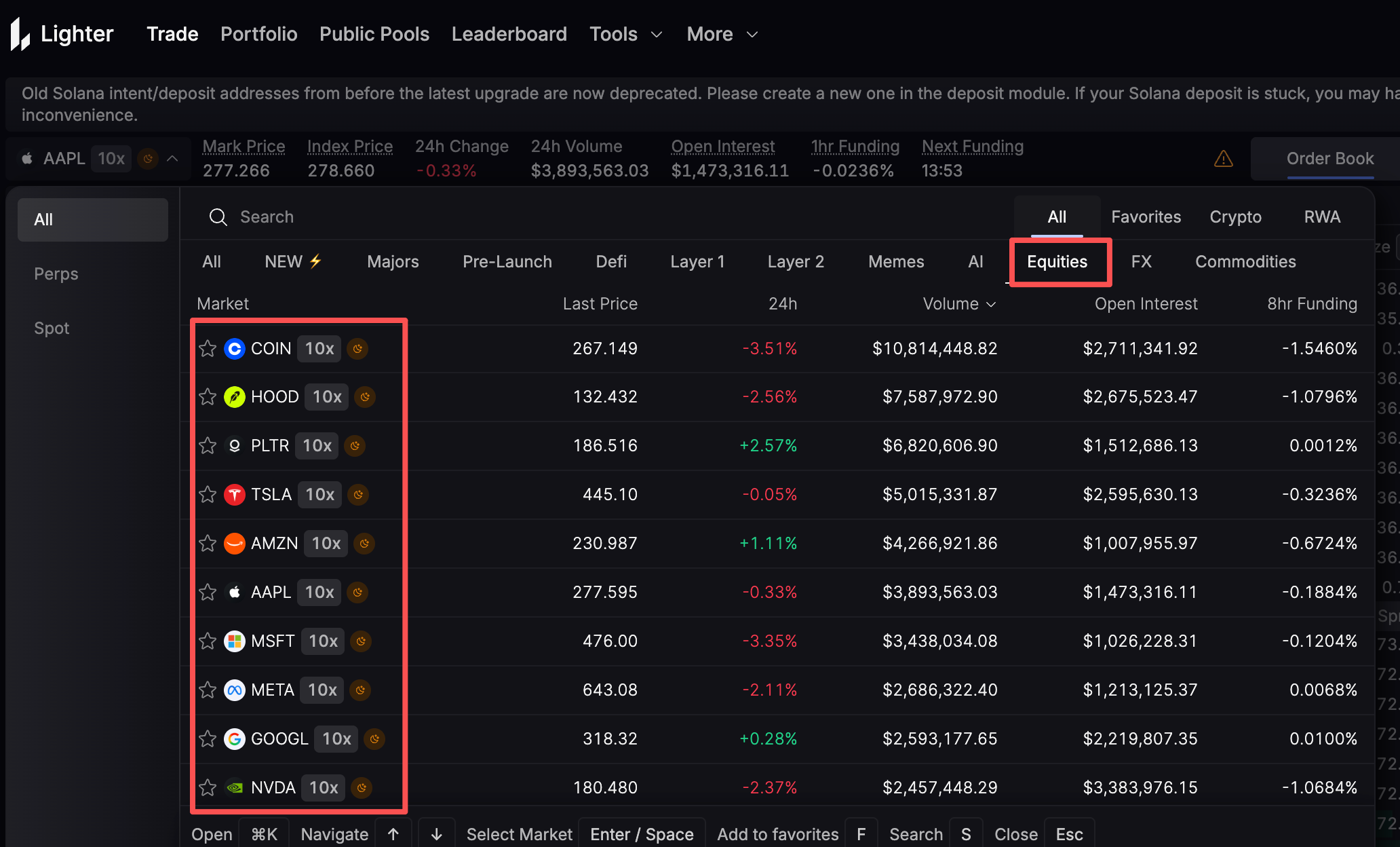

Currently, Lighter has included 10 popular U.S. stocks in its perpetual contract product line, including NVDA (NVIDIA), TSLA (Tesla), and PLTR (Palantir). These assets are actively traded and highly volatile, making it easier for market makers to build deep liquidity, thus attracting traders to participate. Additionally, these stocks have relatively mature price discovery mechanisms in the real market, making it easier to obtain stable data support for on-chain oracles.

In terms of risk control design and price anchoring mechanisms, Lighter has introduced a multi-source oracle mechanism in its risk engine, aggregating multiple on-chain external quotes (such as price data provided by mainstream oracle networks) to reduce the risk of distortion from a single data source. At the same time, it has set automatic stop-loss and circuit breaker thresholds for severe price deviations to avoid systemic liquidation chain reactions during extreme market fluctuations. Although specific parameter details have not been fully disclosed, this design approach is generally consistent with mainstream risk management frameworks in the industry. For stock perpetuals, this mechanism serves as an on-chain response to the "gap risk" present in traditional markets.

Lighter's technical architecture retains the real order book matching mechanism while abstracting the user interaction layer, lowering the usage threshold for retail users. For ordinary traders, the trading process does not require understanding or manually operating the details of a traditional order book; users only need to select the direction, position size, and leverage, and the system will automatically convert the instructions into optimal orders and send them to the underlying order book for matching. Relying on the high-speed matching and on-chain verifiable settlement under the zk-rollup architecture, the transaction and risk control feedback feel close to centralized exchanges, allowing newcomers to quickly get started.

At the same time, Lighter has not weakened its appeal to professional traders by simplifying the front-end experience. Its underlying rules still follow price and time priority in the order book, and matching results can be verified on-chain through zero-knowledge proofs. Coupled with configurable leverage limits, risk parameters, and multi-asset support, it provides a clear and predictable trading environment for institutions and quantitative traders. Therefore, Lighter possesses characteristics that attract high-frequency, small-scale trading users while gradually forming a robust market foundation suitable for stable entry and exit of medium to large funds.

Figure 6. Lighter stock perps. Source: https://app.lighter.xyz/trade/AAPL/

4.3.2 Performance Data of Lighter's Stock Perpetual Contracts

Lighter currently supports 10 stock perpetuals, covering major U.S. stocks from tech blue chips to narrative-driven growth stocks, such as NVDA, TSLA, PLTR, COIN, HOOD, AMZN, AAPL, MSFT, META, and GOOGL. The selection of these assets focuses on high liquidity and high attention assets, conducive to forming a sustainable trading ecosystem. The platform sets a uniform leverage cap of 10× for all stock perpetuals, which also aligns with the industry's risk consensus on traditional assets: in the presence of gaps, black swan events, and pre-market and after-hours volatility, lower leverage is more conducive to controlling liquidation risks and maintaining overall system stability.

From the 24-hour trading data at the end of 2025, Lighter's stock perpetuals show a clear market stratification. The standout asset is COIN, with a trading volume of approximately $10.81 million and an open interest of about $2.71 million, making it the most active stock perpetual on the platform. This reflects the preference of crypto-native users for exchange-like assets and highlights COIN's own high volatility and narrative characteristics, making it a primary battleground for short-term and high-frequency strategies. Similarly, sentiment-driven assets like HOOD and PLTR also maintain high activity levels, attracting day traders to frequently enter and exit.

The trading performance of tech blue chips like AAPL, AMZN, TSLA, and MSFT is more balanced. Their daily trading volumes mostly range between $2.5 million and $5 million, with open interest also maintaining at the million level, presenting a typical "robust depth + moderate activity" structure. These assets are more suitable for swing trading and quantitative strategies; although short-term sentiment is not as fervent as COIN, the market-making depth is more stable, and the execution experience is more controllable.

The most characteristic asset is NVDA. Despite having the lowest 24-hour trading volume on the platform, its open interest is the highest among all assets (over $3.3 million). This "low trading volume but large positions" structure typically represents strong directional and longer-term trading behavior, indicating that some users are building large-scale medium to long-term positions in NVDA rather than engaging in high-frequency intraday operations. As a core asset in the AI sector, this capital behavior aligns with its market role.

Lighter's stock perpetual market has formed a relatively mature layered structure: leading assets (such as COIN) bear the main trading volume; mid-tier blue chips (such as TSLA and AAPL) provide stable depth; and a few assets (such as NVDA) exhibit structural position characteristics. This distribution not only reflects user behavior but also indicates that Lighter's market-making and risk models are gradually taking shape. In the future, if the platform further enhances the scale of its liquidity pool, optimizes risk control parameters, and continues to expand its market maker lineup, the liquidity structure of its stock perpetuals is expected to become more robust, attracting more institutional and strategic users to participate.

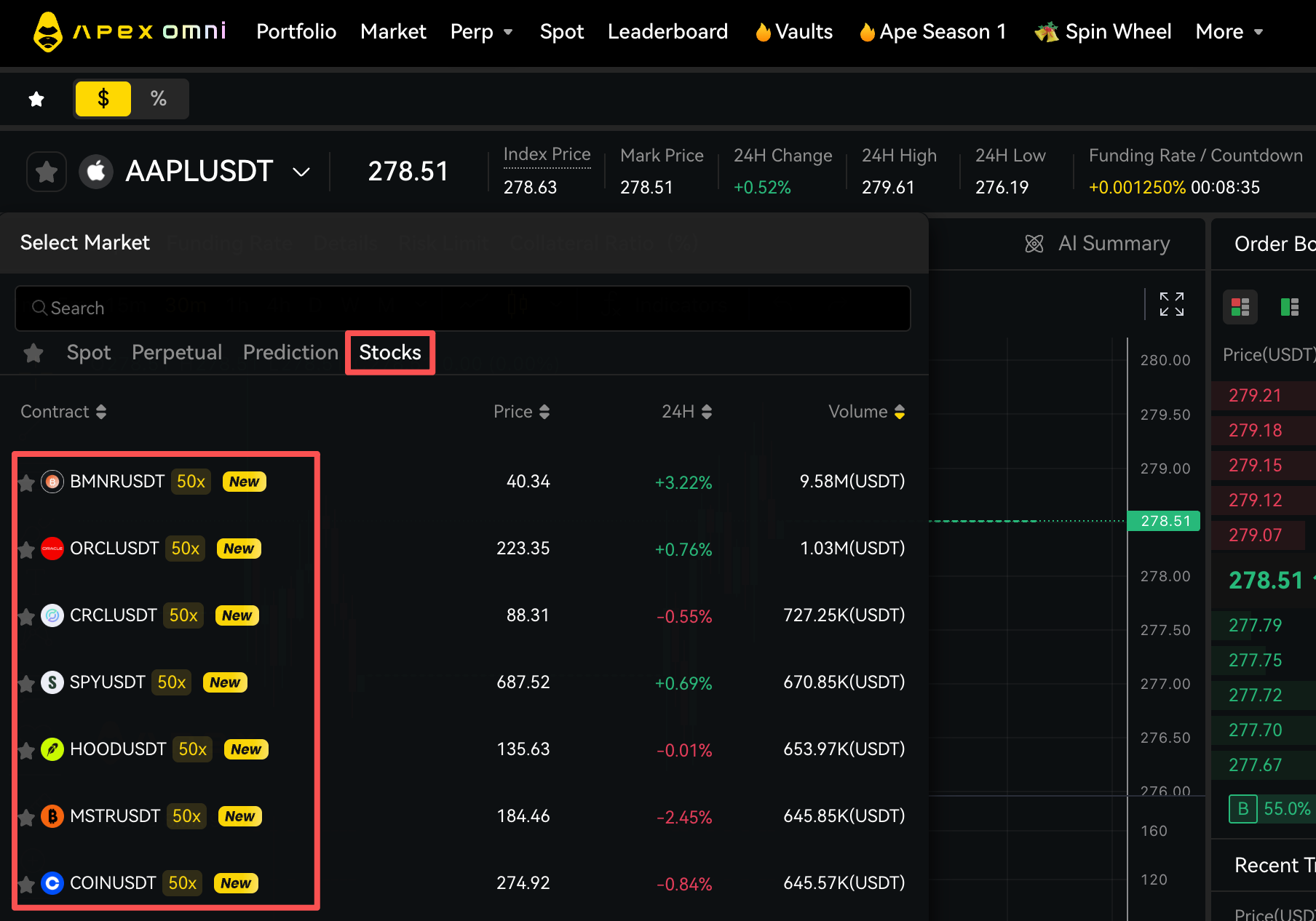

4.4 ApeX's Stock Perpetuals

4.4.1 Core Mechanisms

ApeX Omni has launched an innovative stock perpetual contract product, achieving a seamless connection between traditional stocks and decentralized finance. Users can directly trade high-growth stocks such as Tesla (TSLA), Meta (META), and NVIDIA (NVDA), as well as mainstream ETFs like the Nasdaq 100 Index ETF (QQQ) and the S&P 500 Index ETF (SPY) on the blockchain, covering core assets in technological innovation and the overall U.S. market. As of now, ApeX's stock perpetuals support 18 different assets, with a maximum leverage of up to 50 times, catering to traders with varying risk preferences.

To ensure trading security and flexibility, ApeX has established independent stock accounts for stock perpetuals, allowing free transfers between capital accounts and crypto perpetual accounts. The accounts adopt a cross-asset margin management model, but the risks and settlements of crypto assets and stock perpetual contracts are handled separately to avoid the transmission of volatility between different markets. During U.S. stock market closures, stock perpetual contracts will settle based on the last closing price, ensuring position safety and preventing abnormal risks.

Trading times strictly follow U.S. stock market hours, with trading paused and prices frozen on weekends and public holidays. ApeX utilizes Chainlink's decentralized oracle to integrate multiple authoritative data sources, ensuring fair, manipulation-resistant, and highly accurate pricing, allowing users to trust the on-chain stock prices.

In terms of fees, the trading fees for stock perpetual contracts are consistent with ApeX's existing perpetual contracts, with a maker fee rate of 0.02%, a taker fee rate of 0.05%, and funding fees settled hourly, with no funding fees charged during stock market closures. Although some advanced features such as automated trading and API interfaces are not yet available, ApeX is actively developing them and will gradually roll them out in the future to further enhance user experience.

ApeX's stock perpetual contracts provide users with a secure, efficient, and transparent channel, perfectly combining traditional stock investment with decentralized trading. With the introduction of more assets and features, ApeX is expected to occupy an important position in the stock perpetual market, attracting more institutional and individual traders to participate.

Figure 7. ApeX stock perps. Source: https://omni.apex.exchange/trade/AAPLUSDT

4.4.2 Performance Data of ApeX's Stock Perpetual Contracts

ApeX's stock perpetual contracts all utilize a maximum leverage of 50 times, covering multiple mainstream tech stocks, blue chips, and well-known ETFs.

It is particularly noteworthy that the trading volume and open interest data for ApeX's stock perpetual contracts exhibit significant fluctuations over time, with distinct structural characteristics between different dates. According to the data displayed on the platform's front end at the end of 2025, the 24-hour trading volume for most stock perpetual assets concentrated in the range of tens of thousands to hundreds of thousands of dollars, but certain assets (such as BMNR and ORCL) saw their trading volumes significantly amplified at specific points, reaching approximately $9.5 million and $1 million, respectively, creating a clear gap with other assets. This difference is not a simple linear distribution but resembles a phase of concentrated liquidity.

However, as of January 19, 2026, the data from ApeX's official website indicates that the market structure has changed significantly: the leading asset by trading volume has shifted to AAPL (with a 24-hour trading volume of approximately $8.4 million), while the 24-hour trading volumes of other stock perpetual assets have all fallen below $250,000; previously prominent BMNR and ORCL saw their trading volumes drop to about $30,000 and $10,000, respectively, on that day. The rapid switching of leading assets and the sharp contraction of non-core asset trading volumes suggest that the liquidity in ApeX's stock perpetual market is not a long-term stable accumulation but is more likely to be significantly influenced by short-term events, shifts in user preferences, adjustments in market-making strategies, or phase-based incentives from the platform.

At the current stage, due to the lack of authoritative third-party data platforms continuously tracking and verifying the historical trading volumes and open interests of ApeX's stock perpetuals, this analysis is primarily based on the data disclosed by the official front end, and it cannot further confirm whether these trading volumes include market-making spikes, internal matching, or phase-based liquidity incentives. Therefore, high trading volumes at a specific point should not be viewed as proof of long-term liquidity but rather understood as a reflection of the early stage of decentralized stock perpetuals, where liquidity is highly dependent on a few assets and short-term driving factors.

The current state of ApeX's stock perpetual market does not present a relatively stable mature structure but rather an early market form characterized by highly variable liquidity, continuous rotation of core assets, and rapid cooling of non-core assets. In this context, we maintain a necessary cautious attitude towards the platform's front-end data, avoiding excessive inferences about its long-term market depth and user stickiness in the absence of external validation.

4.5 Multi-Entry Integration is Expanding the Traffic Boundaries of Stock Perpetuals

Leading Perp DEXs are shifting from a model that primarily relies on official website visits to a broader application-level traffic layout. Through mobile applications, wallet entries, and super-app ecosystems, multi-layered entry points are significantly lowering the barriers for users to access stock perpetual contracts.

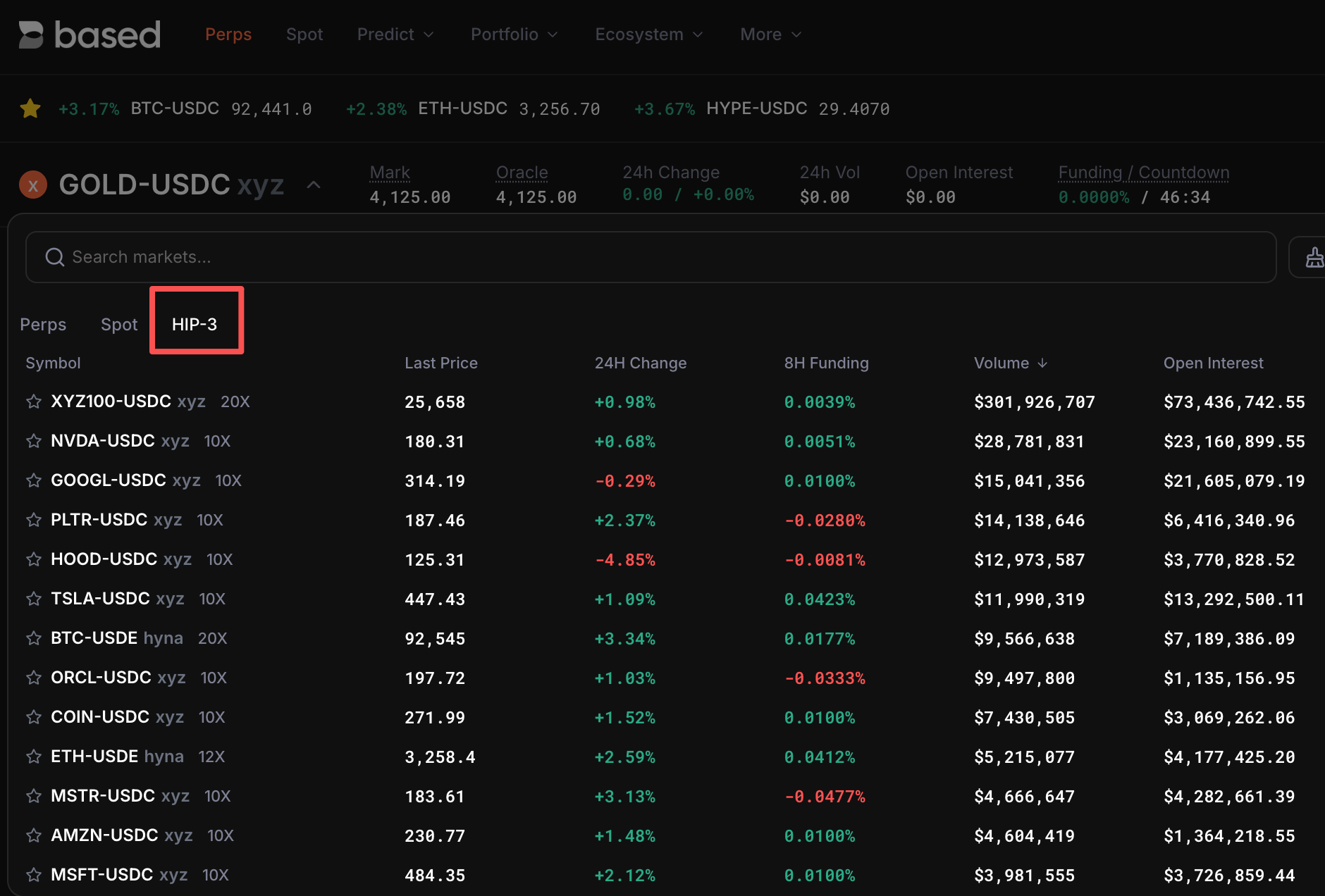

For example, Based.one has built a UI closer to consumer-grade applications by integrating the Hyperliquid contract engine and liquidity, allowing users to open stock perpetuals directly on its front end without needing to visit Hyperliquid or Trade.xyz websites. As an application layer aggregation platform supported by Ethena Labs, which integrates trading, prediction, and payment functions, it effectively embeds Hyperliquid's stock perpetuals into a more user-friendly entry point, making the experience for new users more natural and the conversion smoother.

Figure 8. Based's stock perps. Source: https://app.based.one/xyz:GOLD

Similar paths are also emerging in wallet and super-app ecosystems. Base.app now supports searching and opening Lighter directly within the app, allowing users to access the complete trading interface of Lighter internally and execute various contract trades, including stock perpetuals, with functionality almost indistinguishable from the official website. By embedding Lighter as a built-in entry point, Base.app helps achieve an integrated experience of "trading as a wallet": users can seamlessly enter Lighter to complete trades while managing daily asset management, cross-chain transactions, deposits, withdrawals, or NFT operations without leaving the application ecosystem. This model significantly reduces user transition costs, enabling derivatives like stock perpetuals to reach a broader, even non-professional user base.

UXUY represents another more radical integration approach. As a platform centered on mobile and super-app experiences, UXUY aggregates various trading capabilities on the front end, covering leveraged trading scenarios for crypto assets, some stock contracts, and traditional assets like forex. Users do not need to understand which chain or protocol the underlying contracts come from; instead, they complete operations through a unified trading entry. This model does not emphasize underlying technological innovation but simplifies the interaction path and prioritizes mobile design, packaging the originally complex on-chain derivative trading into an experience closer to Web2 financial applications.

The core difference of multi-entry integration is not only reflected in UI friendliness but also in the high emphasis on mobile. Native on-chain trading systems like Hyperliquid, while having clear advantages in performance, liquidity, and risk control, still lean towards desktop and professional users in their interaction methods; whereas upper-layer applications and wallets are inherently mobile-centric, significantly reducing the cognitive and operational complexity of on-chain trading through more intuitive operational logic, account abstraction, and transaction process encapsulation. The ongoing push for mobile is becoming a key bridge connecting professional-grade perpetual systems with mass trading demands.

The changes brought about by multi-entry integration in Perp DEXs are profound: traffic sources are more decentralized, and professional-level operations that could only be completed through official websites can now be easily accessed in wallets, aggregators, or even social applications; user acquisition costs are reduced, and protocols no longer need to bear all the pressure of attracting new users independently; the competition among more entry points is ultimately driving the gradual formation of a new "application layer ecosystem," allowing stock perpetuals to have a realistic path from professional trading products to mainstream trading tools.

4.6 Leading CEX's Stock Perpetuals

4.6.1 Bitget's Stock Perpetual Products

Bitget's stock perpetual contracts (referred to as "Stock Futures" or RWA index perpetual contracts on the platform) are perpetual derivatives based on tokenized indices of real-world stocks, allowing users to trade long and short on the price fluctuations of traditional assets like U.S. stocks in a crypto trading environment. Bitget constructs a composite index based on the trading prices of tokenized stocks like xStock and Ondo across multiple markets, using this index as the mark price to complete funding rate calculations, settlements, and risk control. For example, the contract prices for TSLA/USDT, NVDA/USDT, and AAPL/USDT are sourced from the corresponding tokenized stock composite index. The weights of this index are dynamically adjusted by Bitget based on factors such as liquidity and trading volume.

The trading settlement is priced in USDT and supports a maximum leverage of 25 times. Bitget's stock perpetual contracts typically offer continuous trading for 5×24 hours (UTC-0 timezone, from Monday 0:00 to Saturday 0:00) during the U.S. stock trading week, pausing market updates and funding rate settlements on weekends or traditional market holidays, but will not forcibly liquidate positions during market closures. The trading mechanism of the contracts is similar to that of crypto perpetual contracts, including isolated margin, per-position mode, hourly funding rate settlements, and features such as index price-based liquidation and risk control. In this way, Bitget introduces the price exposure of traditional stock markets into crypto contract trading, allowing users to participate in stock perpetual-like contract trading on the crypto platform without needing to open a traditional brokerage account.

4.6.2 Differences Between Bitget Stock Futures and On-Chain Stock Perpetual Contracts

Bitget's stock perpetual contracts have similar goals to current mainstream on-chain stock perpetual contracts, but there are differences in structure and implementation. Bitget's Stock Futures operate within a centralized exchange, not directly anchoring to real stock or on-chain oracle prices, but rather pricing based on a weighted index composed of tokenized stocks, with all trading, matching, clearing, and risk control handled by Bitget's centralized system. The trading time is also 5x24 hours, rather than 7x24 hours. In contrast, on-chain stock perpetual contracts (such as Trade.xyz, Aster, and Lighter) are derivatives that run natively in a blockchain environment. They obtain stock prices through oracles or internal pricing mechanisms, with trading executed by smart contracts or verifiable matching systems, emphasizing decentralization, transparency, and composability. The trading and clearing processes of these protocols can be verified on-chain, and some protocols maintain a 24/7 trading status through internal pricing or risk parameter adjustments, even during U.S. stock market closures.

4.6.3 Other Mainstream CEX Stock Perpetual Contract Products

In other centralized exchanges, current products related to stock-like assets still primarily consist of tokenized stocks or contracts for difference (CFDs), and have not yet truly entered the stock perpetual stage. Binance currently does not offer freely tradable tokenized stocks on its centralized exchange, providing only a limited amount of tokenized trading for mainstream stocks on the wallet side. OKX has introduced a batch of tokenized stocks and xStocks through its wallet ecosystem, but has also not launched stock perpetual contracts.

In contrast, Bybit has launched tradable U.S. stock CFDs in its "Traditional Finance (TradFi)" section, covering nearly 80 underlying assets, supporting long and short positions with a maximum leverage of 5X, and providing a 24-hour × 5-day trading experience. However, CFDs essentially remain a "price difference settlement" trading tool: there are no funding rates, no perpetual index pricing model, and they do not possess the 24/7 on-chain trading logic, so they do not strictly belong to "stock perpetual contracts," being closer to leveraged U.S. stock products from traditional brokerages.

4.6.4 Current Mainstream CEX Stock Perpetual Forms

Overall, CEXs are transitioning from tokenized stocks and CFD products to stock perpetual structures in the field of stock derivatives. Exchanges represented by Bitget have already built Stock Futures products within a centralized system that feature funding rates, perpetual structures, index pricing, margin, and clearing mechanisms. Their trading experience and risk framework are functionally very close to stock perpetual contracts, but execution, matching, and risk control are still entirely handled by centralized systems, and trading times are usually limited to 5×24 hours.

In contrast, leading Perp DEXs such as Hyperliquid, Aster, and Lighter continue to dominate the true stock perpetual market. These platforms achieve 24/7 trading through on-chain clearing, decentralized matching systems, and oracle mechanisms, with the trading process verifiable on-chain. DEXs have inherent advantages in building neutral indices, calculating funding rates, and perpetual clearing, and can handle 24/7 trading and on-chain transparency more flexibly, allowing them to develop rapidly in this space. Nevertheless, CEXs are gradually catching up and may combine more on-chain technologies with traditional centralized advantages in the future, further expanding their market share.

4.7 Market Landscape Comparative Analysis

From the current overall landscape of on-chain stock perpetuals, Hyperliquid, Aster, Apex, and Lighter constitute the "four typical systems" in this sector, representing order book-based deep platforms, dual-mode hybrid exchanges, high-performance CEX experiences with quasi-centralized matching, and native Perp DEXs characterized by minimal trading experiences and support for direct connections to standard EVM wallets. Although they all offer stock perpetual trading, there are clear layers in pricing mechanisms, trading experiences, liquidity structures, and overall positioning, forming a complementary yet differentiated competitive landscape.

From a data performance perspective, Hyperliquid occupies an absolute leading position with its deep order book and strong market-making system: its index contract XYZ100 achieves daily trading volumes of around $300 million, with daily trading of multiple mainstream tech stocks stabilizing in the range of millions of dollars, and some assets like SILVER having open interest (OI) reaching $67 million, indicating significant mid- to long-term positions and institutional strategies remain active. This "broad coverage + high depth" structure makes Hyperliquid the core hub of current stock perpetual liquidity.

Aster's scale, while smaller than Hyperliquid's, forms a combination of "high-frequency lightweight flow + professional deep liquidity" with its dual-mode design (Simple / Pro). The typical asset NVDA's Pro mode trades approximately $7.7 million in 24 hours, with OI exceeding $2.8 million, while tail assets maintain trading volumes in the hundreds of thousands to millions. Aster's advantage lies in its structured user profile: it can accommodate both novice traders and professional positions.

In contrast, Lighter's liquidity exhibits a characteristic of "significantly prominent leading assets." COIN's daily trading exceeds $10 million, while assets like NVDA have moderate trading volumes but higher OI, indicating a more stable long-term strategic capital. Overall, its total trading volume for stock perpetuals is lower than Hyperliquid's and closer to Aster's.

ApeX (Apex) sees most of its assets' 24-hour trading volumes concentrated in the range of tens of thousands to hundreds of thousands of dollars, but at specific points in time, certain assets may experience significant volume spikes, such as BMNR recording a single-day trading volume exceeding $9.5 million, creating a clear gap with other assets. However, the leading trading assets on ApeX switch rapidly between different phases, and the trading volume of non-core assets may also shrink quickly in a short time. This indicates that the liquidity in the ApeX stock perpetual market has not yet formed a long-term, stable accumulation structure, but is more likely influenced by short-term events, changes in user trading preferences, or adjustments in platform strategies.

Overall, the four platforms form a clear gradient in liquidity levels: Hyperliquid is significantly ahead, Aster is steadily growing, Lighter is concentrated on leading assets, and ApeX has relatively lower activity.