Key Points

The total market capitalization of cryptocurrencies is $2.7 trillion, down from $3.05 trillion last week, representing a decrease of approximately 11.5% this week. As of the time of writing, the cumulative net inflow of U.S. Bitcoin spot is approximately $55.01 billion, with a net outflow of $1.49 billion this week; the cumulative net inflow of U.S. Ethereum spot is approximately $11.97 billion, with a net outflow of $327 million this week.

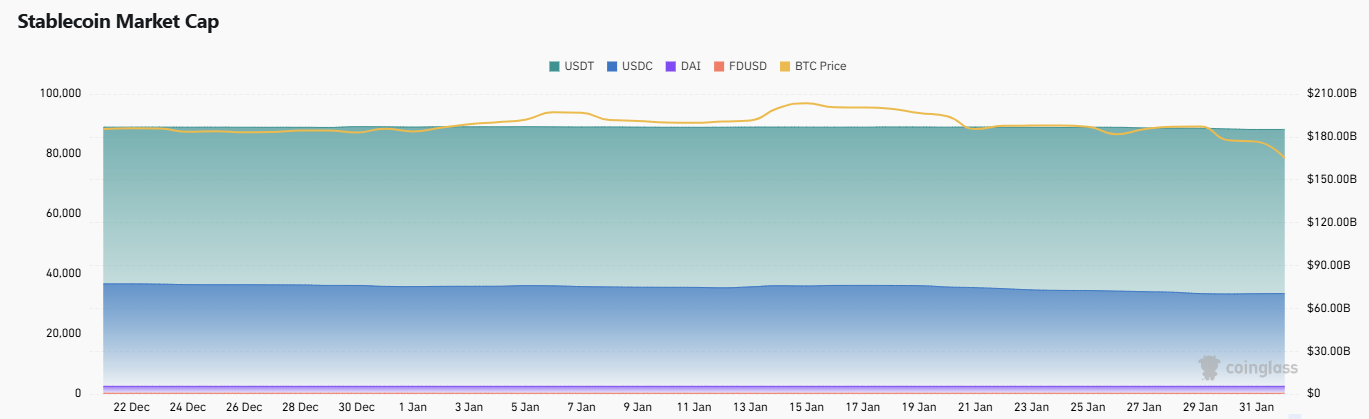

The total market capitalization of stablecoins is $310 billion, down from $310.8 billion last week, a decrease of approximately 0.26%; among them, the market capitalization of USDT is $185.1 billion, accounting for 59.7% of the total stablecoin market capitalization, down from $186.7 billion last week, a slight decrease of about 0.86%; followed by USDC with a market capitalization of $70.2 billion, accounting for 1.7% of the total stablecoin market capitalization, down from $72.4 billion last week, a decrease of about 3%; DAI has a market capitalization of $5.36 billion, accounting for 1.7% of the total stablecoin market capitalization, remaining flat compared to last week.

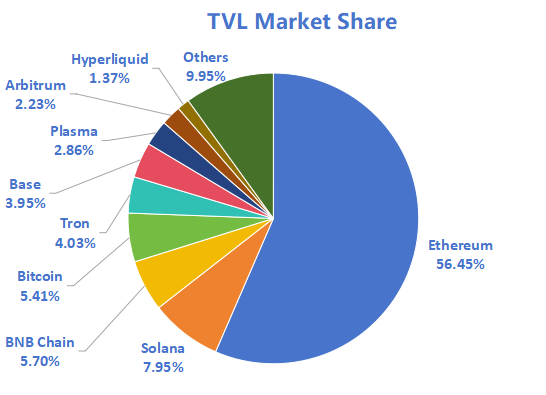

According to DeFiLlama data, the total TVL of DeFi this week is $10.59 billion, down from $11.72 billion last week, a decrease of approximately 9.6%. By public chain classification, the top three public chains by TVL are Ethereum, accounting for 56.45%; Solana, accounting for 7.95%; and BNB Chain, accounting for 5.7%.

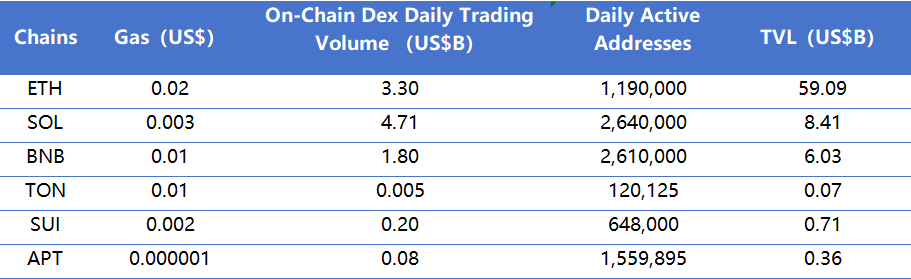

In terms of daily trading volume on on-chain DEXs this week, there is a clear differentiation among leading public chains. Ethereum has a trading volume of $3.3 billion, up approximately 192.7%; Solana has $4.71 billion, up approximately 49.4%; BNB Chain has $1.8 billion, up approximately 13.2%. Sui rebounded to $200 million, up approximately 65.3%; Aptos rose to $80 million, up approximately 14.7%; TON fell to $5 million, down approximately 26.5%. In terms of transaction fees, Ethereum rose to $0.02, Solana rose to $0.003; Sui fell to $0.002, Aptos fell to $0.000001; BNB Chain and TON remained at $0.01.

This week, in terms of daily active addresses, some public chains showed significant recovery in activity. Ethereum has 1.19 million, up approximately 78%; Aptos rose to 1.5599 million, up approximately 63.3%. Meanwhile, Solana has 2.64 million, down approximately 2.6%; BNB Chain has 2.61 million, down approximately 3.3%; Sui has 648,000, down approximately 2.5%; TON fell to 120,000, down approximately 2.8%. Overall, TVL is under pressure, with Ethereum at $59.09 billion, down approximately 12.3%; Solana at $8.41 billion, up approximately 6.9%; BNB Chain at $6.03 billion, down approximately 9.2%; Sui at $710 million, down approximately 16.5%; Aptos at $360 million, down approximately 14.3%; and TON at $7 million, down approximately 11.4%.

New Project Focus: Polaris is a self-expanding stablecoin operating system aimed at DeFi, with the core goal of addressing the issues of stablecoins relying on external incentives and unsustainable yields; Probable is a prediction market protocol deployed on BNB Chain, aiming to allow users to price and trade around event outcomes in a decentralized manner, thus converting market expectations into quantifiable price signals; SectorOne is a native decentralized exchange within the MegaETH ecosystem, which refines capital allocation within price ranges through a dynamic liquidity market-making mechanism, enhancing capital efficiency and trading depth.

Table of Contents

Key Points

I. Market Overview

Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-Chain Data

Stablecoin Market Capitalization and Issuance

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. Industry News

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

IV. Reference Links

I. Market Overview

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio

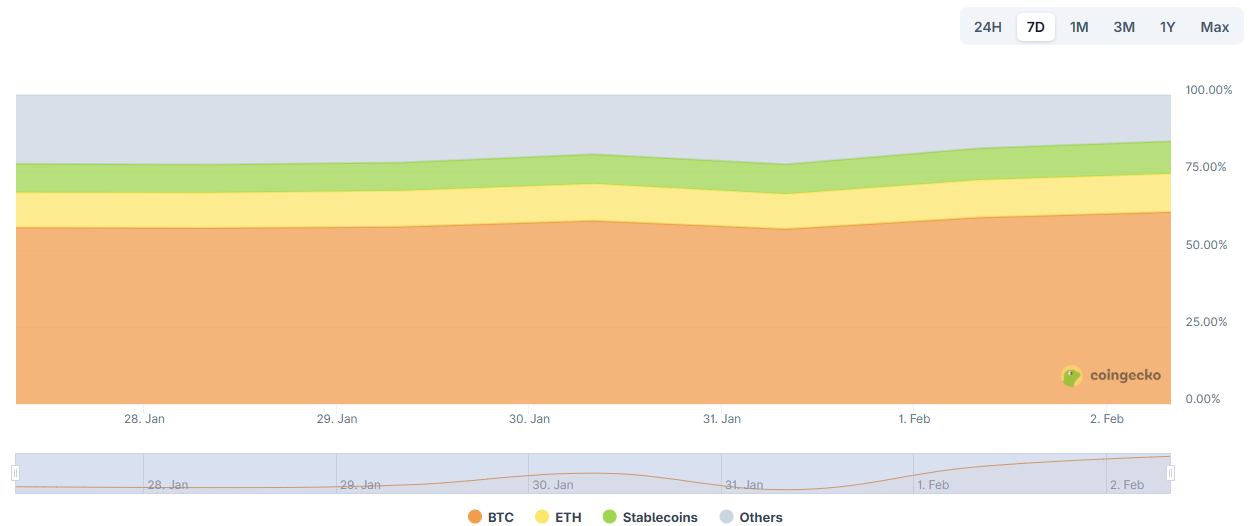

The total market capitalization of cryptocurrencies is $2.7 trillion, down from $3.05 trillion last week, representing a decrease of approximately 11.5% this week.

Data Source: Cryptorank, https://cryptorank.io/charts/btc-dominance

Data as of February 1, 2026

As of the time of writing, the market capitalization of Bitcoin is $1.56 trillion, accounting for 57.76% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $310 billion, accounting for 11.48% of the total cryptocurrency market capitalization.

Data Source: Coingecko, https://www.coingecko.com/en/charts

Data as of February 1, 2026

2. Fear Index

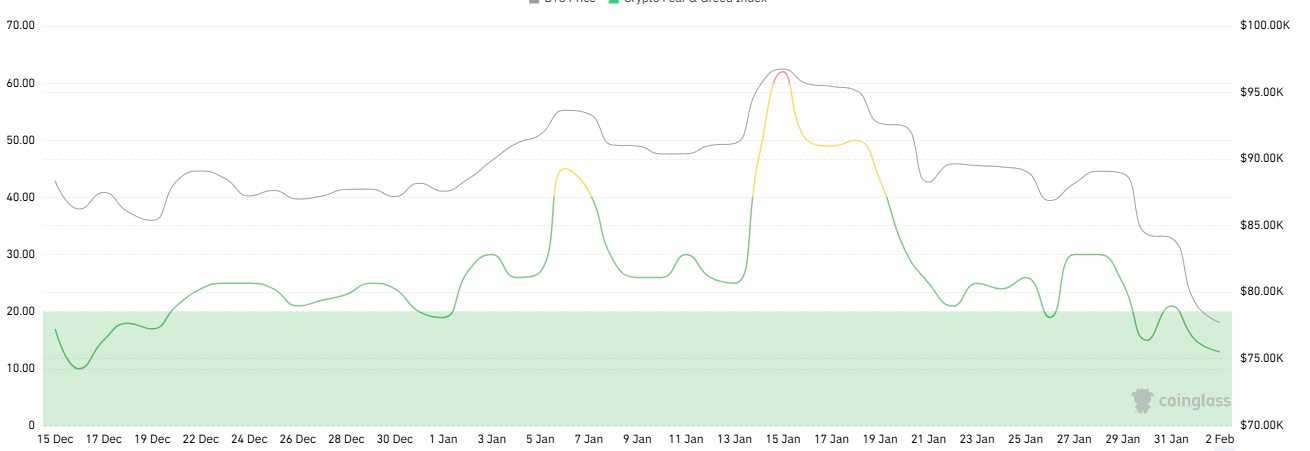

The cryptocurrency fear index is 13, indicating extreme fear.

Data Source: Coinglass, https://www.coinglass.com/pro/i/FearGreedIndex

Data as of February 1, 2026

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of U.S. Bitcoin spot ETFs is approximately $55.01 billion, with a net outflow of $1.49 billion this week; the cumulative net inflow of U.S. Ethereum spot ETFs is approximately $11.97 billion, with a net outflow of $327 million this week.

Data Source: Sosovalue, https://sosovalue.com/assets/etf

Data as of February 1, 2026

4. ETH/BTC and ETH/USD Exchange Rates

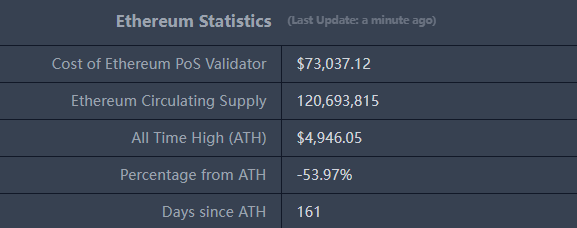

ETHUSD: Current price $2,278, historical highest price $4,946.05, down approximately 53.97% from the highest price.

ETHBTC: Currently at 0.029515, historical highest at 0.1238.

Data Source: Ratiogang, https://ratiogang.com/

Data as of February 1, 2026

5. Decentralized Finance (DeFi)

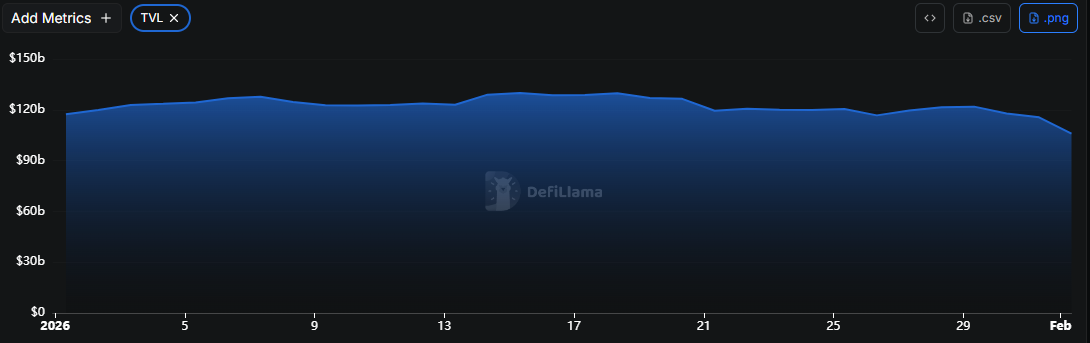

According to DeFiLlama data, the total TVL of DeFi this week is $10.59 billion, down from $11.72 billion last week, a decrease of approximately 9.6%.

Data Source: Defillama, https://defillama.com

Data as of February 1, 2026

By public chain classification, the top three public chains by TVL are Ethereum, accounting for 56.45%; Solana, accounting for 7.95%; and BNB Chain, accounting for 5.7%.

Data Source: CoinW Research Institute, Defillama, https://defillama.com

Data as of February 1, 2026

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on on-chain DEX daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, Defillama, https://defillama.com

Data as of February 1, 2026

On-Chain DEX Daily Trading Volume and Transaction Fees: The daily trading volume and transaction fees of on-chain DEXs are core indicators of public chain activity and user experience. This week, the overall daily trading volume of on-chain DEXs strengthened, with clear differentiation among leading public chains. Ethereum had a trading volume of $3.3 billion, up approximately 192.7%; Solana had $4.71 billion, up approximately 49.4%; BNB Chain had $1.8 billion, up approximately 13.2%. Sui rebounded to $200 million, up approximately 65.3%; Aptos rose to $80 million, up approximately 14.7%; TON fell to $5 million, down approximately 26.5%. In terms of transaction fees, Ethereum rose to $0.02, Solana rose to $0.003; Sui fell to $0.002, Aptos fell to $0.000001; BNB Chain and TON remained at $0.01 this week, with overall changes being limited.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects users' trust in the platform. In terms of daily active addresses, some public chains showed significant recovery in activity. Ethereum had 1.19 million, up approximately 78%; Aptos rose to 1.5599 million, up approximately 63.3%. Meanwhile, Solana had 2.64 million, down approximately 2.6%; BNB Chain had 2.61 million, down approximately 3.3%; Sui had 648,000, down approximately 2.5%; TON fell to 120,000, down approximately 2.8%. Overall, TVL is under pressure, with Ethereum at $59.09 billion, down approximately 12.3%; Solana at $8.41 billion, up approximately 6.9%; BNB Chain at $6.03 billion, down approximately 9.2%; Sui at $710 million, down approximately 16.5%; Aptos at $360 million, down approximately 14.3%; and TON at $7 million, down approximately 11.4%.

Layer 2 Related Data

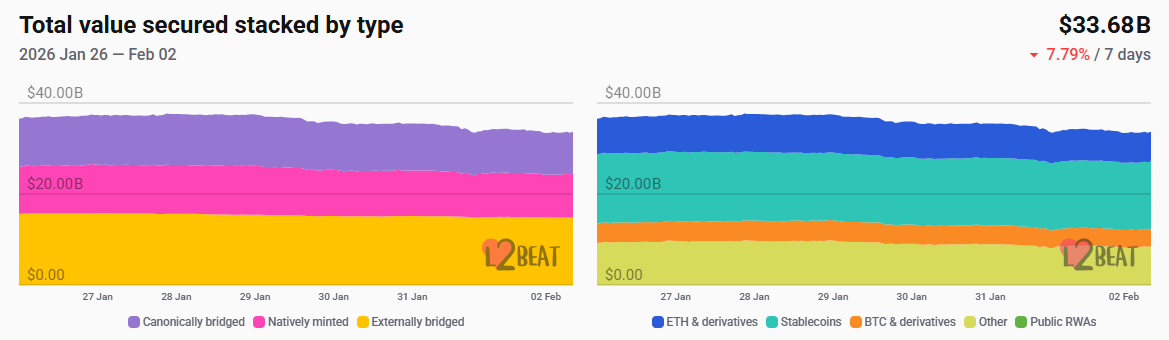

According to L2Beat data, the total TVL of Ethereum Layer 2 is $33.68 billion, down from $36.64 billion last week, a decrease of approximately 8.1%.

Data Source: L2Beat, https://l2beat.com/scaling/tvs

Data as of February 1, 2026

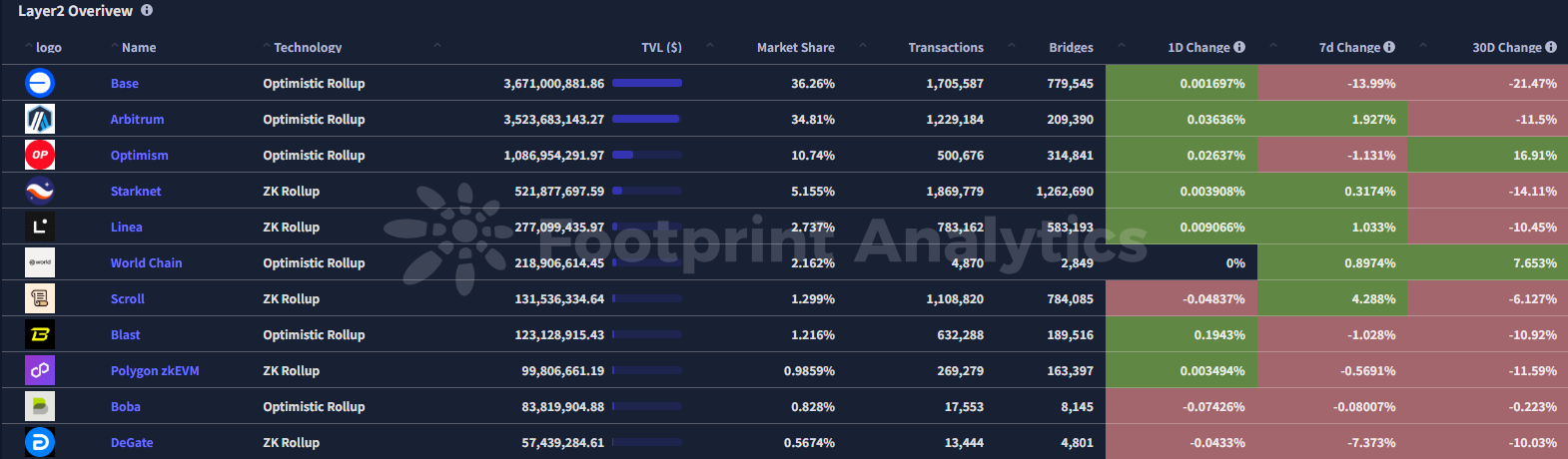

Base and Arbitrum occupy the top positions with market shares of 36.26% and 34.81%, respectively. This week, Base ranked first in TVL among Ethereum Layer 2.

Data Source: Footprint, https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Data as of February 1, 2026

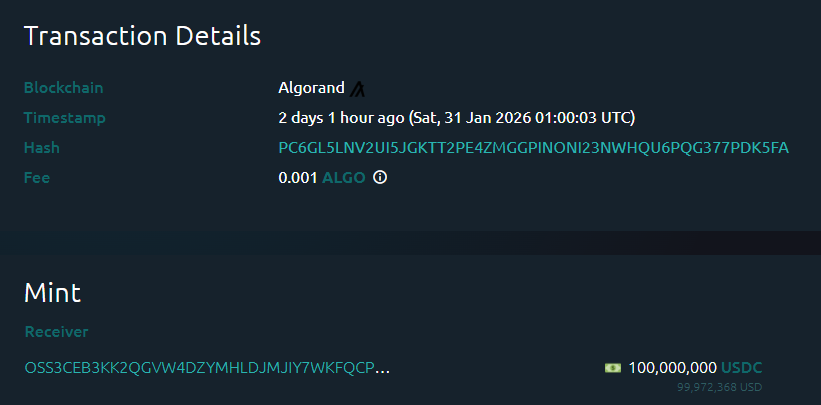

7. Stablecoin Market Capitalization and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $310 billion, down from $310.8 billion last week, a decrease of approximately 0.26%; among them, the market capitalization of USDT is $185.1 billion, accounting for 59.7% of the total stablecoin market capitalization, down from $186.7 billion last week, a slight decrease of about 0.86%; followed by USDC with a market capitalization of $70.2 billion, accounting for 1.7% of the total stablecoin market capitalization, down from $72.4 billion last week, a decrease of about 3%; DAI has a market capitalization of $5.36 billion, accounting for 1.7% of the total stablecoin market capitalization, remaining flat compared to last week.

Data Source: CoinW Research Institute, Coinglass, https://www.coinglass.com/pro/stablecoin

Data as of February 1, 2026

According to Whale Alert data, this week, USDC Treasury issued a total of 1.688 billion USDC, while Tether Treasury did not issue any USDT. The total issuance of stablecoins this week was 1.688 billion, down approximately 27.9% from last week's total issuance of 2.34 billion.

Data Source: Whale Alert, https://x.com/whale_alert

Data as of February 1, 2026

II. This Week's Hot Money Trends

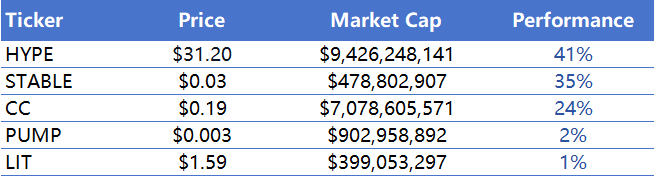

1. Top Five VC Coins and Meme Coins by Growth This Week

The top five VC coins by growth in the past week

Data Source: CoinW Research Institute, Coinmarketcap, https://coinmarketcap.com/

Data as of February 1, 2026

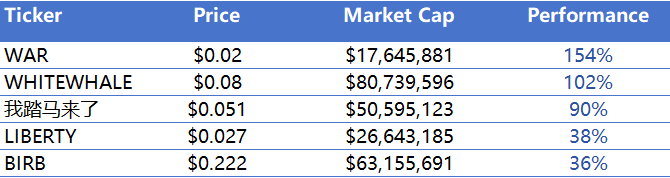

The top five Meme coins by growth in the past week

Data Source: CoinW Research Institute, Coinmarketcap, https://coinmarketcap.com/

Data as of February 1, 2026

2. New Project Insights

Polaris is a self-expanding stablecoin operating system aimed at DeFi, with the core goal of addressing the issues of stablecoins relying on external incentives and unsustainable yields. It achieves this through a triple-engine design consisting of a bonding curve, conversion mechanism, and CDP, which internalizes the price fluctuations of pETH into protocol revenue, allowing the system to automatically generate and amplify yields as usage scales up, thereby providing a more sustainable and systematic source of revenue for stablecoins without bearing counterparty or credit risk.

Probable is a prediction market protocol deployed on BNB Chain, aiming to allow users to price and trade around event outcomes in a decentralized manner, thus converting market expectations into quantifiable price signals. Probable is supported by the PancakeSwap ecosystem and backed by YZi Labs, positioning itself as the native prediction market infrastructure within the BNB Chain ecosystem, focusing on high-frequency, low-barrier event trading needs, and promoting the practical application and liquidity accumulation of prediction markets within the public chain ecosystem.

SectorOne is a native decentralized exchange within the MegaETH ecosystem, which refines capital allocation within price ranges through a dynamic liquidity market-making mechanism, enhancing capital efficiency and trading depth. SectorOne focuses on high-performance liquidity layers, balancing traders' needs for low slippage and high execution efficiency, as well as liquidity providers' goals of risk control and yield optimization, aiming to become the foundational DEX for spot trading and liquidity distribution within the MegaETH ecosystem.

III. Industry News

1. Major Industry Events This Week

The Bitcoin financial network Mezo has launched an airdrop distribution query portal, allowing users to connect and check the results of the first phase of MEZO token distribution. The total supply of MEZO tokens is 1 billion, of which 40% will be allocated to the community, 30% to investors and partners, 20% to the team, and 10% for the foundation. All tokens will be unlocked within 36 months after TGE. Investors and the team will have a 1-year lock-up period starting from TGE, followed by a 2-year linear unlocking period.

Flying Tulip has opened public fundraising, with a single token priced at $0.1 and no minimum purchase requirement, payable in ERC-20 USDT. The tokens will be 100% unlocked at TGE, and investors can apply for partial or full refunds at any time, with refunded tokens being burned. There are no team-reserved tokens, and the public fundraising period ends on February 5.

The NFT project Moonbirds has announced the BIRB token economic model, with 65% of the total supply allocated to the community, with specific allocation ratios as follows: 27% for NFT holder rewards, 12% for ecosystem partner expansion, 10% for value chain incentives, 8% for liquidity, 8% for innovation, 10% for the team, and 25% for investors and advisors. Additionally, Moonbirds has announced the launch of the Nesting 2.0 mechanism. Holders of Moonbirds, Mythics, and Oddities NFTs can obtain BIRB tokens through this mechanism.

The lending protocol HyperLend on HyperEVM announced that after the initial allocation of 300 million points, it will add an allocation of 150 million points to active users who maintain continuous participation. Additionally, participants who stake on the verification nodes at hypurr.co and remain active on HyperLend will receive a certain proportion of point bonuses.

The prediction market Limitless has announced that the LMTS second season airdrop claim is now open. Traders participating in its second season may be eligible to claim the airdrop, and they can visit the official claim page for more information.

2. Major Upcoming Events Next Week

The ZAMA Pre-TGE subscription will begin on February 2, providing participants who did not win in the auction with the opportunity to purchase ZAMA tokens at the auction settlement price, with a participation limit of $10,000. The token claim date is set for February 2.

The crypto wallet Rainbow will launch a CCA continuous liquidation auction on Uniswap on February 2, with the official TGE taking place on February 5. CCA achieves smoother and fairer price discovery by continuously aggregating buy and sell orders within a set period and settling at a unified price, helping to reduce front-running and short-term volatility risks, and improving distribution efficiency and market stability during the initial token issuance.

The unified on-chain financial system Flying Tulip, founded by Sonic Labs founder Andre Cronje, will launch its token sale on CoinList. This public sale aims to raise $200 million, accounting for 20% of the total supply of FT tokens, with a token price of $0.10, corresponding to a fully diluted valuation (FDV) of $1 billion. The public sale will start on February 3 and end on February 7, with a minimum purchase amount of $100. Tokens participating in this sale will be protected by a Perpetual PUT structure, and participants will receive FT NFTs that include redemption rights, allowing them to choose to hold, burn tokens to redeem funds at the original price, or unlock tokens for free trading.

The stablecoin protocol Usual announced that the USUALx unstaking window is now open and will last until February 3. According to the UIP-11 proposal, users can submit unlock requests during this period to reassess their positions. USD0 rewards will accumulate normally until February 1, and from February 2, rewards will stop accumulating for positions that are about to be unlocked. After the unlock window closes, all submitted unlock requests will be processed on February 3.

MegaETH will launch its public mainnet on February 9, 2026. At the same time, the founder of MegaETH stated that a KPI reward mechanism will be introduced to address the dilemma of low circulation and high FDV. More than 50% of the MEGA token supply will be gradually unlocked for high-confidence locked holders based on significant protocol milestones, with the release of supply linked to four KPIs. These include ecological growth, MegaETH decentralization, MegaETH performance, and Ethereum decentralization. When KPIs are achieved, rewards will be fully allocated to holders of locked MEGA, weighted by the duration of the lock-up. The foundation will internalize unallocated and locked rewards, expanding the treasury and maintaining the lock-up period.

3. Important Financing Events Last Week

Mesh completed a Series C financing round, raising $75 million, with a post-money valuation of approximately $1 billion, led by top institutions such as Dragonfly, Paradigm, and Coinbase Ventures, with follow-on investments from Liberty City Ventures and SBI Investment. Founded in 2020, Mesh is a global crypto payment network that connects exchanges, wallets, and various financial service platforms to build a unified digital asset payment and conversion network, aiming to create an open, interconnected, and secure digital financial infrastructure layer that reduces friction in cross-platform crypto asset circulation and payments. (January 27, 2026)

Talos completed a Series B financing round, raising $45 million, with a post-money valuation of approximately $1.5 billion, led by Andreessen Horowitz (a16z), with participation from QCP Capital, IMC Trading, Fidelity Investments, and Robinhood. Founded in 2018, Talos is a digital asset technology infrastructure provider for institutions, covering the entire trading lifecycle from liquidity acquisition, price discovery, and trade execution to clearing, settlement, and lending, connecting institutional investors, prime brokers, OTC market makers, and other market participants through a unified platform, becoming an important hub in the institutional crypto trading system. (January 29, 2026)

Flying Tulip completed a Series A financing round, raising $25.5 million, with a post-money valuation of approximately $1 billion, with participation from Amber Group, Paper Ventures, and other institutions. Flying Tulip is building an on-chain financial market that integrates spot, derivatives, credit, native stablecoins, and on-chain insurance into a unified cross-margin system, achieving more transparent and composable risk management while enhancing capital efficiency. (January 29, 2026)

### Reference Links

Coingecko: https://www.coingecko.com/en/charts

Sosovalue: https://sosovalue.com/assets/etf

Ratiogang: https://ratiogang.com/

Defillama: https://defillama.com

L2Beat: https://l2beat.com/scaling/tvs

Footprint: https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Coinglass: https://www.coinglass.com/pro/stablecoin

Whale Alert: https://x.com/whale_alert

Coinmarketcap: https://coinmarketcap.com/

Polaris: https://x.com/polarisfinance_/status/2016180350087549420

Probable: https://x.com/0xProbable

SectorOne: https://x.com/SectorOneDEX

Mesh: https://x.com/meshpay

Talos: https://x.com/talostrading

Flying Tulip: https://x.com/flyingtulip_

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。