Original Title: "The Most Unbelievable 'Heist' in Ethereum's History Reaches a $220 Million Security Line"

Original Author: KarenZ, Foresight News

In the development of Ethereum, nothing is more iconic than the 2016 "The DAO" incident. It was not only the most outrageous crowdfunding project in Ethereum's history but also the main event that led to the split in the Ethereum community and the birth of "Ethereum Classic (ETC)" due to a hacker attack.

Ten years later, the name that nearly destroyed Ethereum—The DAO—is returning in another way, launching "TheDAO Security Fund," which will convert over 75,109 Ethereum (worth over $220 million) left over from that incident into a long-term fund focused on Ethereum security development.

Historical Review: A Crowdfunding Myth Leading to an Ecological Crisis

Let's go back to 2016. At that time, The DAO set a crowdfunding record with $150 million in funding, attracting as much as 14% of the Ethereum supply.

The vision of this decentralized autonomous organization excited the entire crypto ecosystem, but it soon faced a catastrophic attack. Hackers exploited a recursive call vulnerability in the smart contract to steal a large amount of funds, prompting the Ethereum community to make a highly controversial decision—to implement a hard fork to recover the stolen assets. This move directly led to a split in community ideology, resulting in the birth of Ethereum Classic (ETC).

However, recovering funds has never been a simple matter. While the hard fork resolved the redemption issue for standard DAO tokens, it could not address all edge cases. Thus, a group of senior members from the Ethereum community voluntarily formed the "TheDAO Curator Multisig" to take on the responsibility of resolving these complex legacy issues.

TheDAO Security Fund Emerges

Griff Green, who served as the community manager for The DAO and is now a co-founder of Giveth, was one of the core members of the "TheDAO Management Multisig Wallet" back then. According to an official announcement, as early as August 2016, these core administrators made a significant intention clear: if the leftover funds from these edge cases remained unclaimed after January 31, 2017, they would be used to support Ethereum smart contract security development.

Then, these funds quietly "slept" for nearly ten years. Griff Green stated in an interview with Unchained, "As of today in 2026, we have never touched this fund, and the rise in Ethereum's price has significantly increased its value. This is a dramatic turn of events—what was once 'leftover funds' is now worth far more than The DAO's original $150 million crowdfunding total."

The DAO Fund's Goal: Safeguarding Ethereum's Security

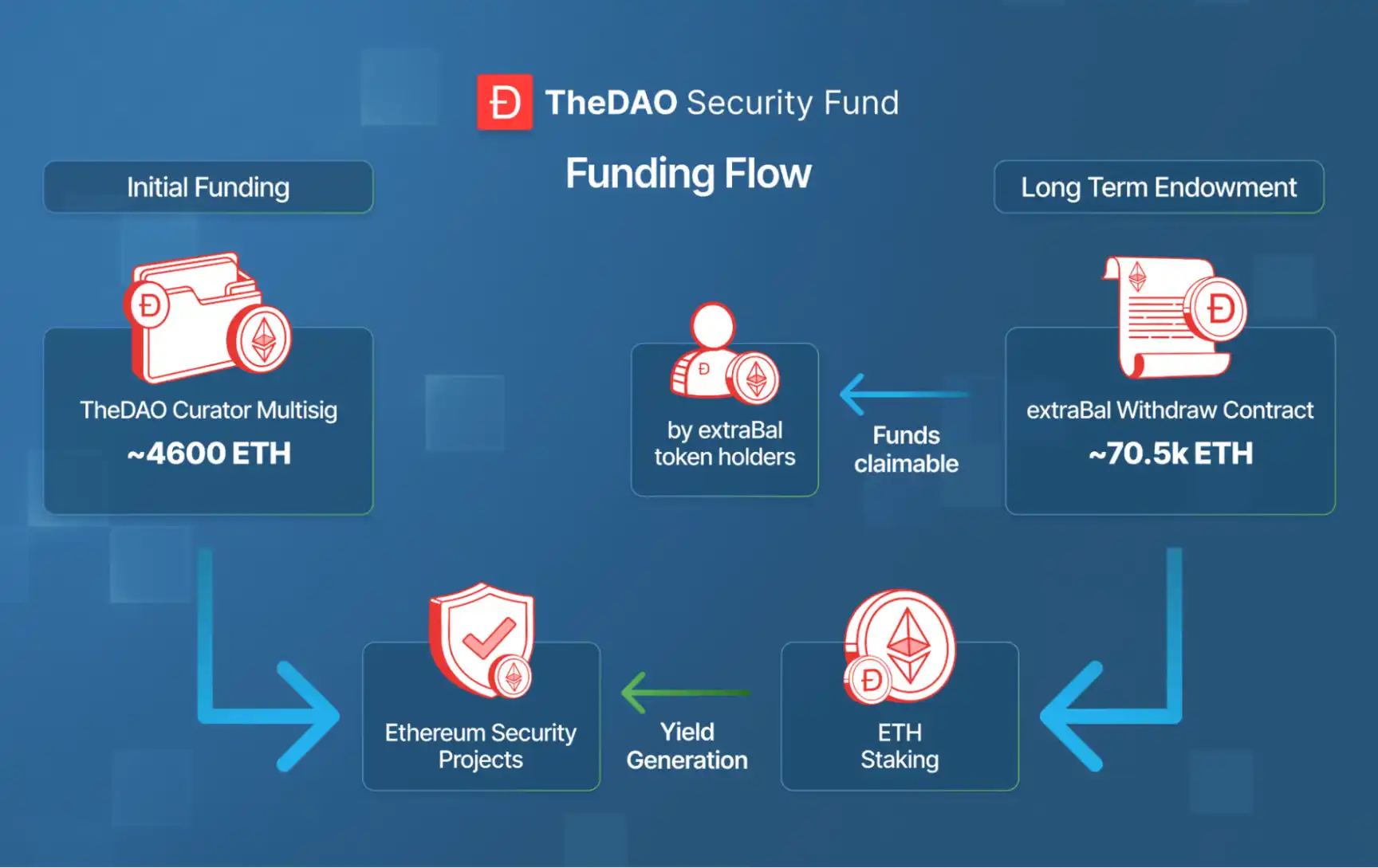

According to the official announcement, the funding sources for TheDAO Security Fund are mainly divided into two parts, totaling over 75,109 ETH (worth $220 million):

· Approximately 70,500 ETH in the ExtraBalance contract, which can still be claimed by eligible individuals.

· About 4,600 ETH and some DAO tokens in TheDAO Curator Multisig, valued at approximately $13.5 million, which do not have a clear claimant.

The funding operation and usage plan for TheDAO Security Fund are clear: 69,420 ETH drawn from the ExtraBalance contract will be staked, and the staking rewards will form a perpetual donation fund to provide long-term financial support for Ethereum security development; the staking rewards will be combined with the 4,600 ETH in TheDAO Curator Multisig to jointly fund various Ethereum security-related projects. Meanwhile, the ExtraBalance withdrawal contract will retain a portion of ETH to ensure that the rights of legitimate claimants are not affected.

In terms of funding scope, the core goal of TheDAO Security Fund is very clear—prioritizing the security of the entire Ethereum ecosystem, covering all-dimensional scenarios of security development: from wallet user experience optimization, smart contract security audits, to emergency response for security incidents, core protocol security upgrades, and security protection for layer two networks and cross-chain bridge ecosystems. All efforts to enhance Ethereum's security level fall within the scope of the fund's support.

Additionally, the fund will rely on the optimization directions and opportunities identified in the current security field by the Ethereum Foundation's Trillion Dollar Security initiative, combined with ongoing communication with ecosystem partners, to determine the specific scope and focus of each funding round.

In terms of the funding allocation mechanism, TheDAO Security Fund adheres to open, bottom-up governance principles, employing diverse methods such as quadratic funding, retrospective funding, and request for proposal (RFP) ranking voting to conduct funding work in rounds, allowing ecosystem participants to jointly participate in funding allocation decisions.

Currently, the fund has formed a professional guardian team to provide professional guidance and oversight for fund operations and funding decisions. Team members are all seasoned practitioners and security experts in the crypto ecosystem, including Ethereum founder Vitalik, MetaMask security engineer Taylor Monahan, Zisk, Giveth co-founder Jordi Baylina, security expert pcaversaccio, ENS co-founder Alex Van de Sande, and Dappnode CEO Pol Lanski.

Summary

TheDAO Security Fund is not without controversy, with its core disputes revolving around two main issues: the "legitimacy of the use" of these leftover funds for the security fund and the "degree of decentralization" of the fund's governance mechanism.

Should this massive asset be viewed as "private property" belonging to all original token holders, or has it been deemed abandoned and thus used for "public benefit"?

These disputes not only continue the ideological differences in the Ethereum community sparked by the 2016 The DAO incident but also reflect the deep-seated contradictions in the current crypto ecosystem regarding governance—balancing the ideals of decentralization with operational efficiency and compliance in asset disposal remains a topic that the entire industry needs to explore continuously.

However, setting aside the controversies, from the crowdfunding myth and ecological crisis of 2016 to the security fund and ecological guardianship of 2026, The DAO's ten-year cycle itself is a microcosm of Ethereum's ecological development, witnessing Ethereum's growth from infancy to maturity and validating the resilience of the crypto ecosystem and the power of community.

References:

1>https://en.wikipedia.org/wiki/The_DAO

2>https://www.gemini.com/cryptopedia/the-dao-hack-makerdao

3>https://unchainedcrypto.com/exclusive-thedao-to-become-new-220-million-ethereum-security-fund/

4>https://paragraph.com/@thedao.fund/thedao-security-fund-activating-75000-eth-for-ethereum-security

5>https://medium.com/curator-multisig-phf-official-channel/thedao-curator-multisig-a-decade-later-572796549d70

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。