Written by: Michael Nadeau, The DeFi Report

Translated by: Glendon, Techub News

In May 2023, the L1 blockchain project Sui officially launched. Positioned as a high-throughput chain, it aims to compete directly with Solana on performance, earning it the title of "Solana Killer" in the market. However, since reaching a fully diluted valuation of $40 billion in 2025, its token Sui has dropped over 73%. Is Sui's development currently in trouble, or are we witnessing a great buying opportunity? This article will explore this question.

Team

Founding Team

The founding team members of Sui all come from Facebook/Meta, as the Sui network was spun off from Diem—Diem was the blockchain network launched by Facebook in June 2019 (formerly known as Libra).

Evan Cheng: Co-founder and CEO. Evan is responsible for Sui's overall strategy and vision. He previously served as the head of R&D at Novi (Meta's cryptocurrency division) and held technical positions at Meta and Apple.

Sam Blackshear: Co-founder and CTO. Sam is the creator of the MOVE programming language, which is used for Sui's smart contracts. He was previously a chief engineer at Meta.

Adeniyi Abiodun: Co-founder and CPO. Adeniyi oversees product development for Sui. He was previously the head of product at Novi.

Kostas Danezis: Co-founder and chief cryptographer. Kostas leads Sui's cryptography efforts and was previously the chief cryptographer at Meta.

George Danezis: Co-founder and chief scientist. George is responsible for Sui's research efforts and was previously a research scientist at Facebook.

Key Points Summary

A technically capable and experienced leadership team that has worked together for a long time and collaborates well.

Maintains a low profile in the crypto industry.

Mysten Labs

The core development team of Sui, Mysten Labs, is located in Palo Alto, California. According to LinkedIn data, Mysten Labs currently has 203 employees.

Sui Foundation

The Sui Foundation is an independent entity focused on promoting network development through ecosystem funding, adoption promotion, and community building. The Sui Foundation is registered in the Cayman Islands and has 217 affiliated members according to LinkedIn data.

Open Source Developers

According to Electric Capital's developer report, Sui currently has:

954 monthly active developers. This is a decrease from the peak of 1,896 in June 2025 (a drop of about 50%).

455 single-chain developers (focusing on Sui itself). This is a decrease from the peak of 1,156 in June 2025 (a drop of about 60%).

Sui has 291 full-time developers, ranking it as the 10th largest crypto network by the number of full-time developers.

For reference, Solana currently has 4,250 monthly active developers, with 2,171 focusing on Solana itself (a 55% decrease from the peak in June 2025), and 1,172 full-time developers; Ethereum has 10,897 monthly active developers, with 5,148 focusing on Ethereum itself (a 50% decrease from the peak in June 2025), and 3,719 full-time developers.

Capital Raising + Investors

Total funds raised: $336 million (Mysten Labs) + $49 million raised by the Sui Foundation through the March 2023 ICO.

Investors

Series A funding (June 2021): Raised $36 million, led by a16z. Other investors include Redpoint Ventures, Lightspeed Venture Partners, Coinbase Ventures, Electric Capital, Standard Crypto, and Scribble Ventures.

Series B funding (August 2022): Raised $300 million, led by FTX Ventures (now defunct). Other investors include a16z, Jump Crypto, Lightspeed Ventures Partners, Circle Venture Capital, Franklin Templeton Investments, Binance, Sino Global Capital, Dentsu Ventures, Kevin O'Leary, Coinbase Ventures, and Apollo Global Management.

Community/Network Influence

Sui on X: 1.1 million followers

Discord: 915,000 members

Reddit: 31,000 members

LinkedIn: 56,000 followers

In addition to Sui's direct influence on major social platforms, it also has a strong online community led by Raoul Pal on X (with 1.2 million followers). However, this is not "free," as Raoul Pal has received token allocations from the Sui Foundation as part of ecosystem building efforts.

Finally, compared to the leadership teams of Ethereum, Solana, and Hyperliquid, Sui's founding team has lower market participation. While difficult to quantify, we believe this is a disadvantage, as protocols led by "celebrities" often have better control over market awareness.

Investment Product Integration

Bitwise includes SUI in its top cryptocurrency index ETF products, as well as the Bitwise 10 ex-BTC index fund.

21 Shares includes SUI in its Crypto 10 index ETF and offers a 2x long SUI ETF.

CoinDesk 20 index products include SUI.

S&P Digital Market 50 index includes SUI.

Grayscale has launched a SUI trust product, allowing investors to invest in SUI through their brokerage accounts (currently managing $4.3 million in assets).

Products

Like all L1s, Sui is committed to integrating next-generation financial and consumer services into its network. Unlike other L1 service providers, Sui reimagines data storage/processing methods through the MOVE programming language, achieving parallel execution via an object-centric data model and explicit object ownership, thereby addressing the blockchain trilemma and achieving high throughput without the need for global transaction ordering.

Object-Centric Data Model

Unlike the account-centric model (Ethereum), where state is tied to accounts and a global ledger, Sui treats everything (tokens, NFTs, data) as programmable objects with clear ownership, each identified by a unique ID and attributes.

This model allows for non-conflicting transactions to be executed in parallel, reducing global congestion and enabling low fees and fast final confirmations even at scale.

MOVE Programming Language

Sui uses a customized version of the MOVE function (originally from Meta's Diem), which is a resource-oriented and asset-oriented programming language. The main advantages compared to Solidity/Rust are:

Built-in security mechanisms to prevent common vulnerabilities.

Resources are immutable and cannot be copied.

A programming language friendly to Web2 developers.

Parallel Processing

For simple transactions involving single-owner objects, Sui's architecture supports parallel execution without global transaction ordering. These transactions bypass the shared object consensus path, achieving sub-second final confirmations and low fees even under high network load. Transactions involving shared objects still use full consensus to ensure correct ordering.

Fees are stable and low, and the storage fund mechanism ensures long-term sustainability of data. These features are designed to make Sui widely accepted in the mass market. Sui is particularly suitable for real-time application scenarios, such as gaming, micropayments, and consumer applications, where other payment methods may be more costly or slower.

Decentralization

Sui currently has 125 validators in the network. Many may be supported by the Sui Foundation, which allocates some SUI tokens as "validator subsidies."

Are 125 validator nodes "sufficiently decentralized"? I think not. Just weeks ago, its network went down for six hours.

For reference, Solana has 808 validator nodes—primarily located in the US and Europe, which we consider "fairly decentralized"; Ethereum has 9,425 execution layer clients and nearly a million validator node clients, which we consider "fully decentralized."

Therefore, for Sui to truly achieve decentralization, it needs more validators and an economic model that can genuinely benefit them beyond foundation subsidies. Currently, the threshold of 30 million SUI for validators is clearly a barrier to entry and a significant obstacle to decentralization.

Target Market

Sui's target market includes DeFi, gaming, consumer applications, AI integration, payments, and institutional applications. It aims at the same markets as Ethereum, Solana, and others.

Key Points Summary

The current total market capitalization (circulating market cap) of the top ten L1 companies is $695 billion. Sui currently holds less than 1% of the market share.

Is this price reasonable? The answer will be found later in the report.

Financial Situation

Real Economic Value

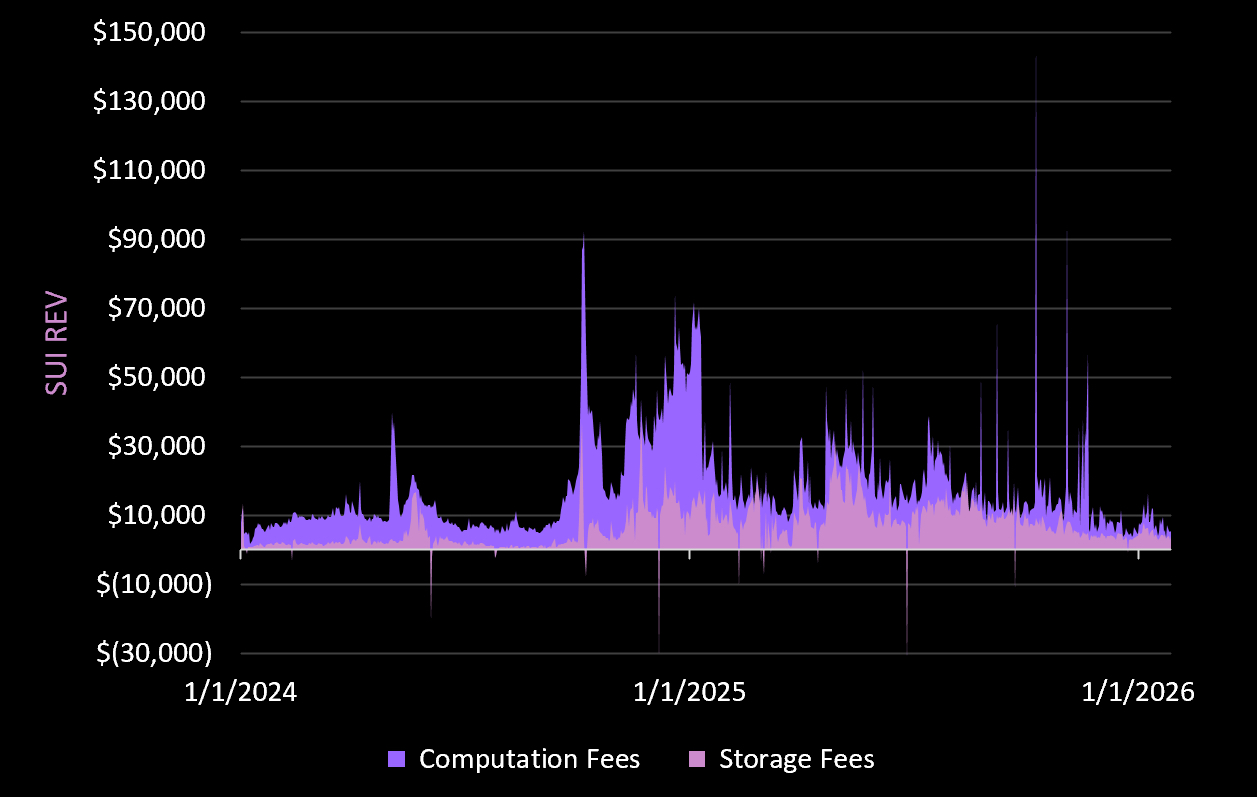

The Real Economic Value (REV) of Sui consists of two components:

Computation Fees: The fees that users need to pay when transactions execute logic on Sui (such as smart contracts, read/write operations, and state transitions). These fees are owned by Sui validators.

Storage Fees: The fees paid by users when writing and storing data on-chain. Sui validators receive 20% of these fees, while the remaining 80% goes into a "storage fund." The fees entering the "storage fund" will be used to reward users, incentivizing them to reduce on-chain data by deleting objects, burning tokens, closing positions, etc. Additionally, the "storage fund" is also used to compensate future validators.

You may notice that storage fees on Sui sometimes appear as negative values. This is due to the "storage fund" issuing rewards to users.

MEV

Compared to Ethereum and Solana, MEV on Sui is structurally lower. This is due to:

Object-Centric Execution: Sui transactions explicitly declare which objects they involve, eliminating ambiguous global state and general memory pool ordering issues. This significantly reduces the likelihood of attacks such as sandwich attacks, backrunning, and memory pool sniping. If two transactions do not involve the same object, they cannot conflict and cannot be reordered for profit.

Parallel Processing: Unlike Ethereum's single-threaded execution, Sui can execute non-conflicting transactions in parallel. Therefore, validators benefit little from transaction reordering, and MEV is essentially limited to explicit object contention scenarios.

However, this does not mean that MEV is completely eliminated (it still exists on decentralized exchanges (DEXs) used for arbitrage), but harmful MEV (such as sandwich attacks and front-running) has been significantly reduced. This design aims to enhance user experience while shifting value capture from extraction at the block level to the application layer.

For Sui holders and validators, the implied "real yield" is relatively low.

REV Performance (Daily Average)

Q3 2025: $30,000

Q4 2025: $20,000

Since October 10, 2025: $18,600

Last 30 days: $12,000

Peak: $70,000/day

In 2025, Sui generated REV of $10.6 million, up from $7.8 million in 2024 (a year-on-year increase of 36%). Currently, on-chain fees have decreased by about 83% from the peak levels at the end of 2024.

Key Points Summary

Compared to more mature L1 tokens like Ethereum, Solana, and BNB, Sui's REV is negligible. Therefore, Sui validators' rewards rely almost entirely on newly issued Sui tokens.

Sui launched in May 2023 (32 months ago). The network generated $368,000 in fees over the past 30 days. In contrast, approximately 35 months after launch (early 2023, after the FTX collapse), Solana generated over $1 million in monthly fees and maintained this level throughout 2023, followed by explosive growth in 2024.

From a purely economic perspective, Sui's performance at its current development stage lags behind Solana's performance at a similar stage. The same is true for Ethereum—during a similar development stage (mid-2018), it generated monthly fee revenues of $2 million to $10 million.

Fundamentals

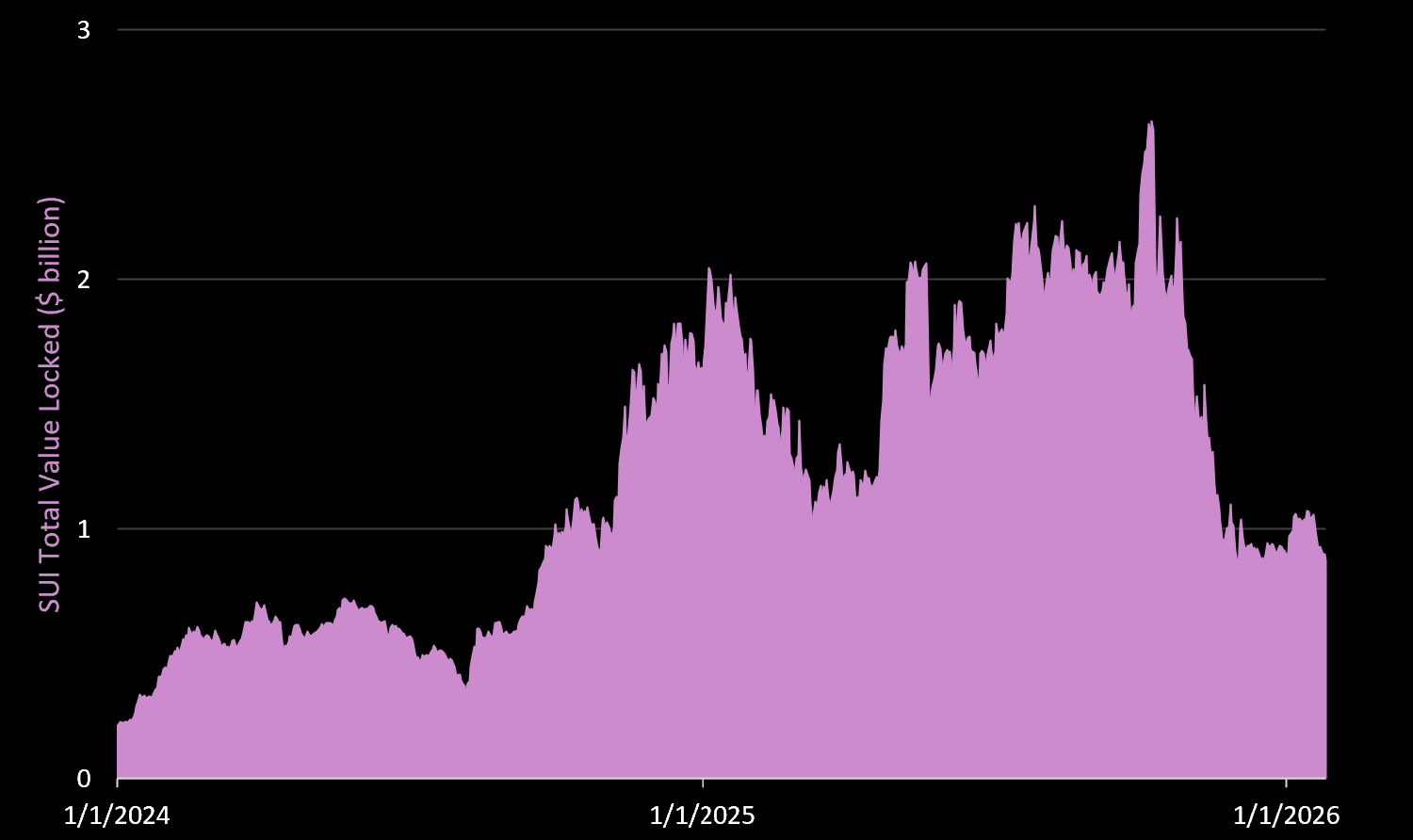

Total Value Locked

Sui's Total Value Locked (TVL) is currently just below $1 billion, down 61% from the peak of $2.6 billion on October 9, 2025. We believe that most of the decline can be attributed to the drop in the price of the SUI token, which has decreased by 73% during the same period.

The main protocols on Sui include:

NAVI Protocol (Lending and Staking): $274 million

Suilend (Lending): $227 million

Bluefin (DEX): $128 million

Key Points Summary

For an L1 blockchain to succeed and achieve "escape velocity," a phenomenon-level application needs to emerge. Ethereum achieved this with DeFi, NFTs, stablecoins, etc., while Solana exploded with Pump Fun and meme coins. We have yet to see a breakout application on the Sui platform, but that does not mean it is not worth investing in. Solana also did not have breakout applications in its early development.

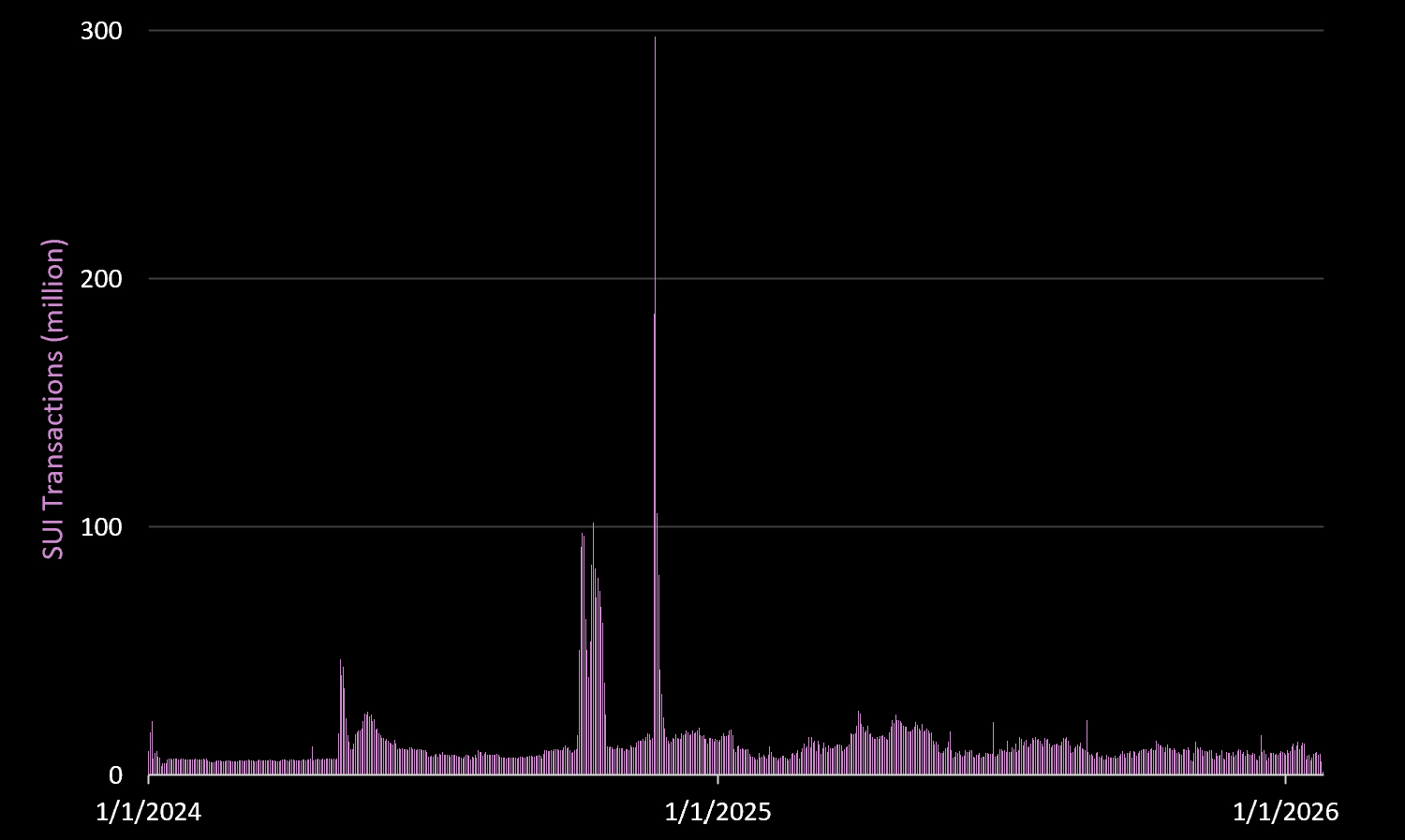

Transaction Volume

Performance:

2024: 14.7 million daily transactions

2025: 11.5 million daily transactions (a 22% decrease from 2024)

Since October 10, 2025: 9.3 million daily transactions

Peak: 45 million daily transactions

Last 30 days: 9.17 million daily transactions (an 80% decrease from peak)

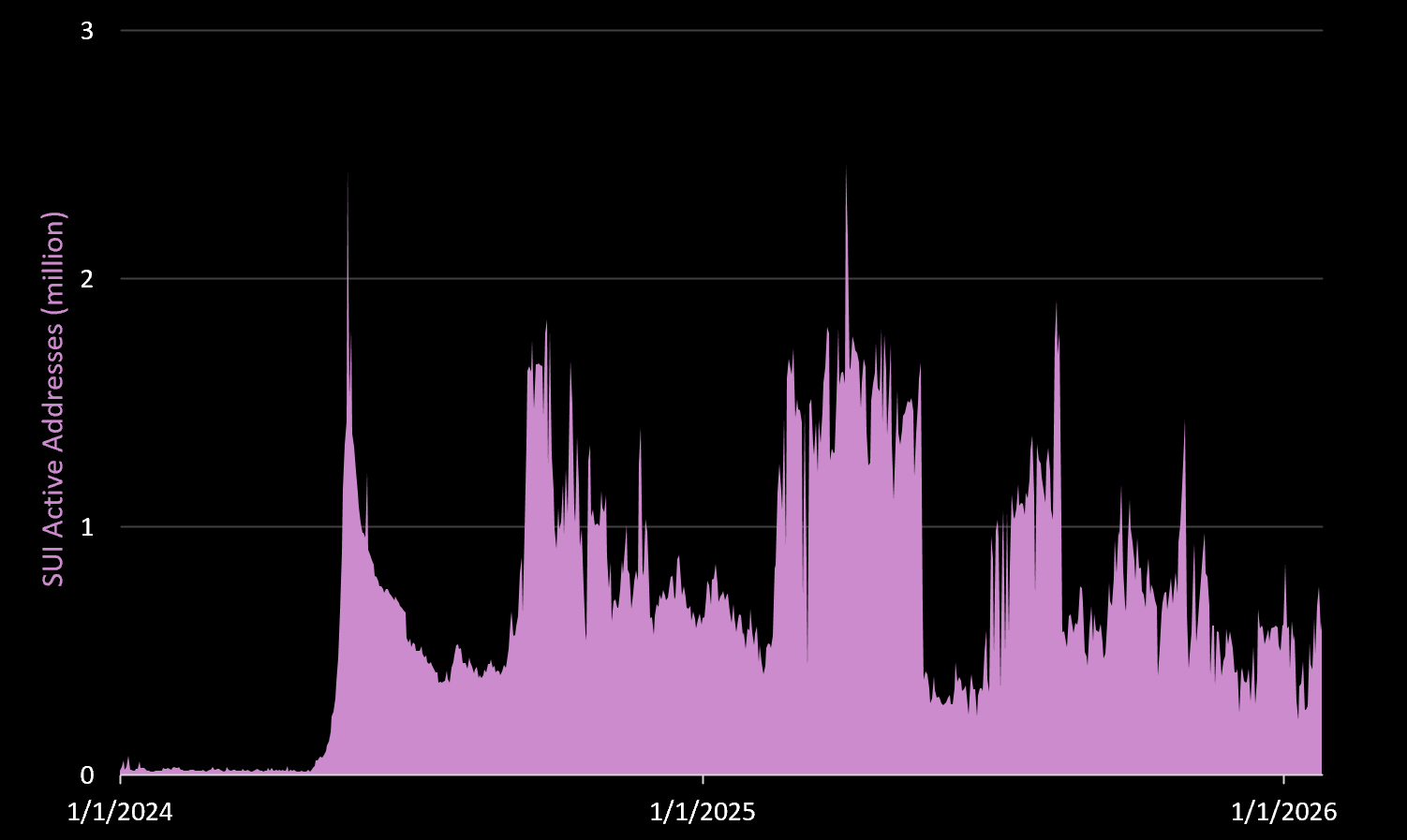

Active Addresses

Performance:

2024: 524,000 daily active addresses

2025: 879,000 daily active addresses

Since October 10, 2025: 588,000 daily active addresses

Peak: 1.7 million daily active addresses

Last 30 days: 509,000 daily active addresses (a 70% decrease from peak)

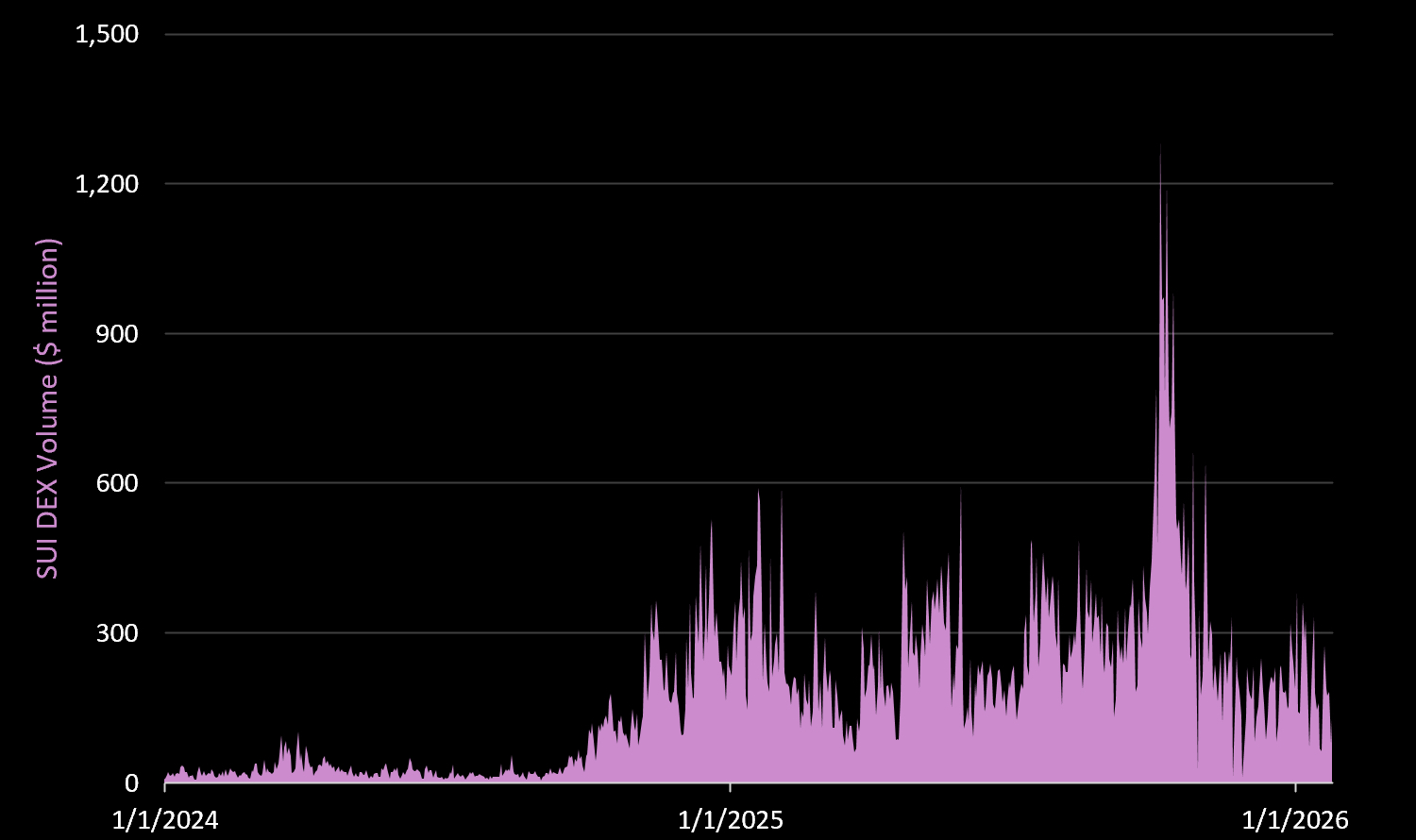

DEX Trading Volume

Performance:

2024: $70 million daily

2025: $281 million daily (a threefold year-on-year increase)

Since October 10, 2025: $273 million daily

Peak: $635 million daily

Last 30 days: $203 million daily (a 68% decrease from peak)

Currently, the largest decentralized exchange on Sui is Bluefin, with an average daily trading volume of $86 million over the past 30 days. Bluefin holds a 42% market share on Sui, followed by Cetus at 32%. For reference, Solana's current DEX average daily trading volume is approximately $3.2 billion, which is 15 times that of Sui.

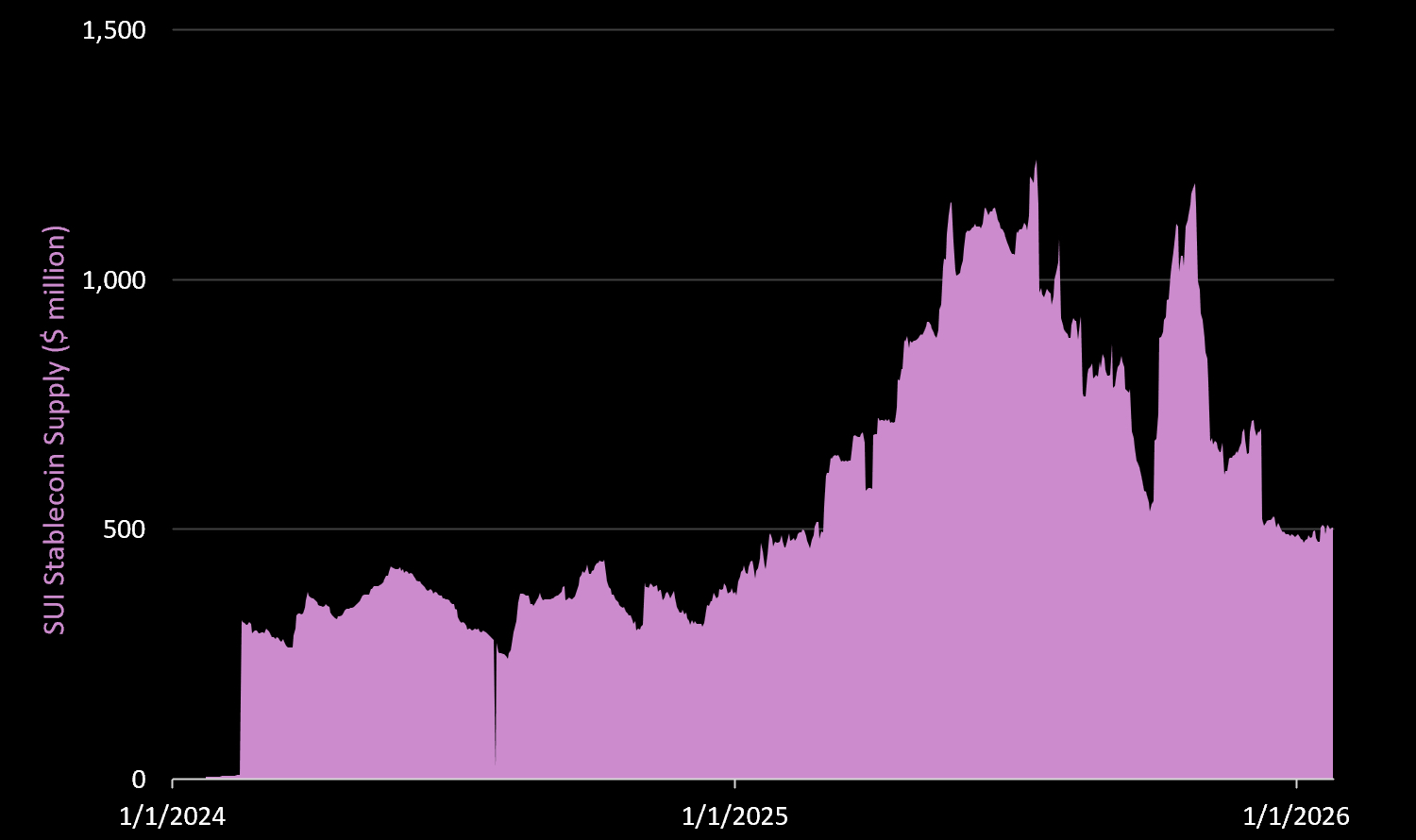

Stablecoin Supply

The current stablecoin supply on the Sui network is $503 million, down 58% from a peak of $1.2 billion. Among them, USDC accounts for 69%, First Digital FDUSD accounts for 13%, and USDT accounts for 9%.

Token Economics

Maximum Supply: 10 billion

Circulating Supply: 3.79 billion (38%)

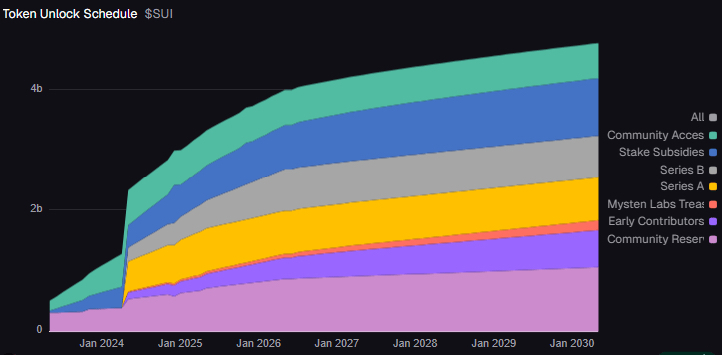

Token Distribution and Unlocking

Community Reserve: 10.6%. Currently, 12.6 million tokens are unlocking each month, continuing until May 2026 (approximately $16.4 million per month at current SUI prices). After May 2026, the unlocking amount will decrease to 4 million tokens per month, continuing until May 2030.

Early Contributors: 6.1%. 88 million tokens will be released by the end of the year (approximately 8 million per month, about $10.4 million per month at current SUI prices). The unlocking amount for early contributors decreases over time, ultimately unlocking completely by May 2030.

Investors: 14.1%. Series A investors have fully unlocked their tokens. Series B investors are currently unlocking at a rate of 19.3 million tokens per month, continuing until May 2026 (approximately $25 million per month).

Mysten Labs Treasury: 1.6%. Currently, 2.06 million tokens are unlocking each month, continuing until May 2030 (approximately $2.7 million per month at current SUI prices).

Community Access Program: 5.8%. These tokens have been fully unlocked.

Staking Subsidies: 9.5%. 99.9 million tokens will unlock by the end of the year (approximately $130 million). After that, the unlocking amount for staking subsidies will gradually decrease, ultimately unlocking completely by May 2030. * Investors should not view the unlocking of staking subsidies as potential "selling pressure," as these tokens are granted to validators for running Sui infrastructure and expanding network effects (these tokens are currently locked).

Pending: 52.3% to be released after 2030.

In total, approximately 41.9 million tokens will unlock each month until May 2026 (approximately $54.4 million per month). After May of this year, the monthly unlocking amount will decrease to about 14 million tokens (approximately $18.2 million at current SUI prices).

Token Buyback/Burn

The Sui network will not engage in token burns or buybacks like Ethereum, Solana, and Hyperliquid.

Issuance Mechanism

The Sui network currently issues approximately 55 million tokens per month to network validators (approximately $71.5 million at current SUI prices) as compensation for securing the network. Given the current REV is very low (around $12,000 per day), Sui validators' rewards rely almost entirely on the issuance/inflation of new tokens.

This means that the network currently incurs a cost of up to $198 for every $1 of REV generated. Spending $198 to earn $1 is clearly unsustainable.

The only way to address this issue is to increase user fees. However, due to the low fees and the protocol's design intent to mitigate MEV (market effect fluctuations), raising fees at this time would be counterproductive.

Key Points Summary

Sui's inflation rate in 2025 is 26%. Therefore, if you hold SUI but do not stake, the value of your holdings is being diluted at a rapid pace.

Competitive Landscape

Sui is currently the tenth largest smart contract network in the crypto space, but its market share is less than 1%. Like all other L1 blockchains, it is competing to become the largest decentralized settlement network in the future.

Our long-standing view is that the future may only require 4 to 5 L1 networks. The power law suggests that this is likely to be the eventual outcome, and networks with lower adoption will gradually fade away over time (as we currently see in the market).

Sui entered the market with its differentiated architecture and programming language, designed specifically for speed and high throughput. However, it remains unclear whether the market truly needs such a product.

Ethereum is by far the largest smart contract network. It is addressing its throughput limitations through L2 layers. Of course, Ethereum has a larger developer community, token standards, market attention, and institutional adoption rates. Solana has established itself as Ethereum's main competitor—standing out with its monolithic architecture (no L2), higher throughput, better user experience, strong developer onboarding programs, and a growing list of successful applications.

Meanwhile, Hyperliquid has become the leading perpetual contract decentralized exchange (Perps DEX) and is building its own L1 ecosystem. BNB and Tron have already captured the Asian market. Additionally, enterprise platforms like Tempo, under Stripe, have also entered the competition.

Thus, Sui faces intense competition.

Valuation

Sui's current fully diluted market capitalization is $13.16 billion (with a circulating market cap of $5 billion). Its 365-day network revenue is $9.7 million, which means the fully diluted price-to-sales ratio is 1,358 (the price-to-sales ratio based on circulating market cap is 516).

For comparison:

Ethereum generated $763 million in fees, with a fully diluted price-to-sales ratio of 441.9.

Solana generated $1.35 billion in fees, with a fully diluted price-to-sales ratio of 53.

Hyperliquid generated $915 million in fees, with a fully diluted price-to-sales ratio of 32.2.

Key Points Summary

Even though the trading price of the SUI token has dropped 73% from its peak, its valuation seems significantly high both in absolute and relative terms. We believe Sui's high price-to-sales ratio is a direct result of its economic design (low fees, delayed storage fees, and minimized MEV).

Conclusion

We are impressed with Sui's achievements since its launch in 2023. Breaking into the top ten L1 networks by market capitalization is no small feat.

However, we believe that competition among L1 blockchains is weakening over time. As network effects continue to accumulate, the power law is coming into play. In short, existing leading L1s currently have a significant advantage. The once blue ocean market is gradually turning into a red ocean, as the "cake" of new users entering the crypto space in each cycle is shrinking.

In addition to fierce competition, Sui seems to be entering a "no man's land" (bear market phase) in terms of adoption, while the unlocking of tokens for the team and investors also puts pressure on the SUI token. This feels reminiscent of what Solana experienced in the last bear market. Given that Sui has ample funding and developer support, we will closely monitor how the team responds to the upcoming challenges.

So, will Sui eventually rebound like Solana? As long as the team continues to deliver progress, there is still hope. In the short term, we will closely watch developer activity. As for the SUI token itself? We are looking for extreme oversold signals. If this occurs before the unlocking restrictions are adjusted in May this year, it could present a good buying opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。