The precious metals market, led by gold and silver, might be nearing the end of its historic bullrun.

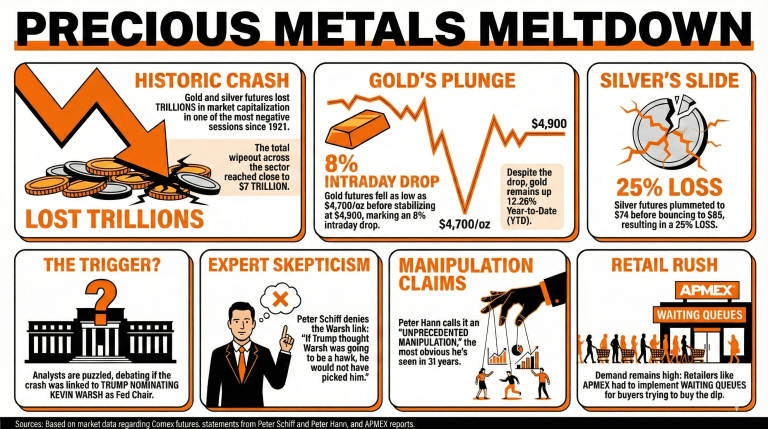

In a movement that has shaken markets, gold and silver prices experienced a meltdown on Friday, with futures losing trillions in market capitalization in one of the most negative sessions for precious metals since 1921.

Gold futures fell as low as $4,700 per ounce on Comex, rising to stabilize at $4,900 later, marking an intraday decline of nearly 8%. Nonetheless, even with this cliff drop, gold retains a good performance in 2026, rising 12.28% year-to-date (YTD).

Silver’s drop was relentless, with Comex futures contracts reaching as low as $74 intraday. Nonetheless, it bounced back to $85 mid-session, discounting losses to 25%. Other metals, including platinum and palladium, were also hit with similar losses.

The move, which wiped close to $7 trillion from trading markets, has left analysts puzzled. While some linked this drawback to the announcement of Kevin Warsh as Trump’s pick to succeed Jerome Powell as Fed Chairman, others are not so sure.

Peter Schiff, Chief Economist and Global Strategist at Europac, stated:

“The ‘crash’ in gold and silver today has nothing to do with Trump nominating Kevin Warsh to be Fed chair. If Trump thought Warsh was going to be a hawk, he would not have picked him.”

Peter Hann, a seasoned market analyst, stated that this unprecedented selloff might be the result of a market manipulation scheme. “In my 31 years of watching and trading markets, I have never seen a month-end manipulation as obvious, as ham-fisted, as totally unbelievable as what I am seeing in metals today,” he assessed.

Nevertheless, it seems demand is still there, as reports indicate that retailers like APMEX had to implement waiting queues to manage the demand from new buyers trying to capitalize on this price decrease.

Read more: Trump’s Fed Chairman Pick Revealed: Kevin Warsh to Succeed Jerome Powell

What recent event has impacted gold and silver prices significantly?

Gold and silver prices plummeted on Friday, marking one of the worst trading sessions for the sector since 1921, with trillions lost in market capitalization.What were the intraday price fluctuations for gold and silver?

Gold futures fell to $4,000 per ounce before stabilizing at around $4,900, while silver futures dropped to $74 before bouncing back to $85.What are analysts attributing the selloff in precious metals to?

Some analysts suggest the selloff may be linked to the announcement of Kevin Warsh as Trump’s nominee for Fed Chairman, but others believe it could be market manipulation.Is there still demand for precious metals despite the price drop?

Yes, retailers like APMEX report increased demand, requiring waiting queues for new buyers looking to take advantage of lower prices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。