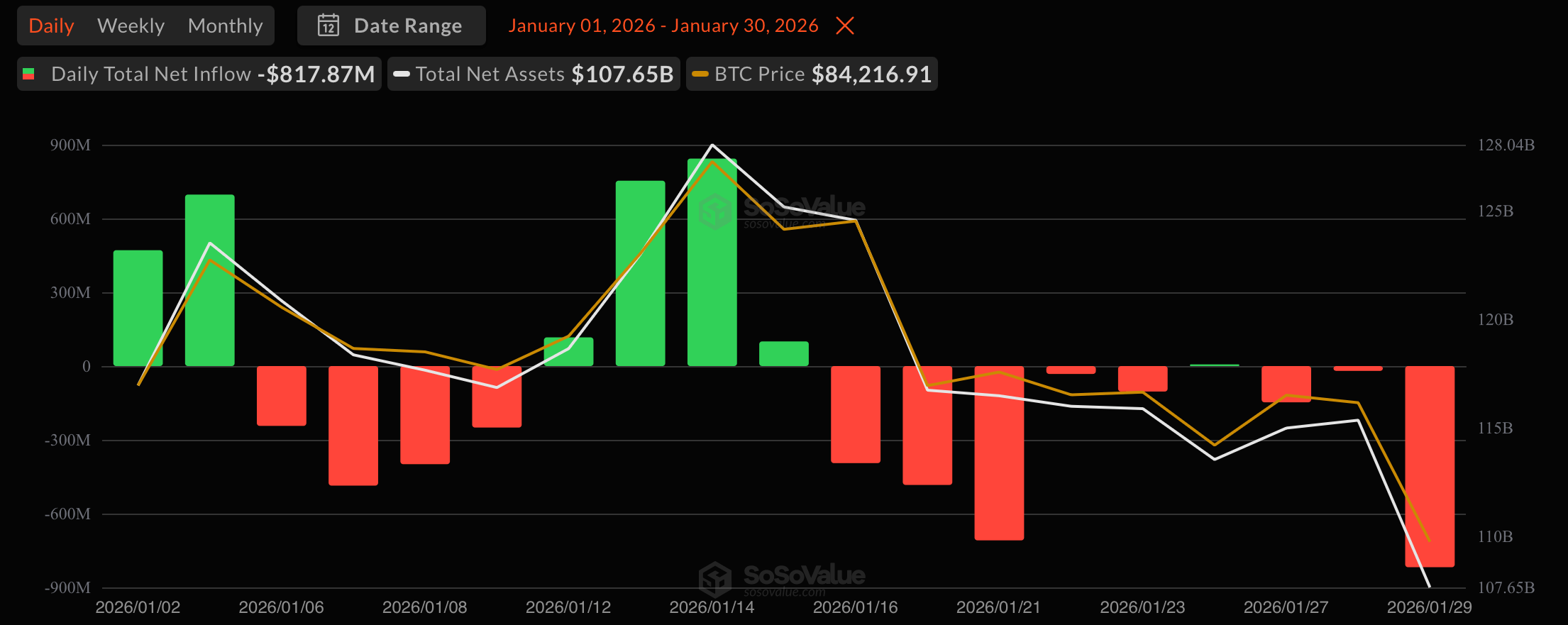

The crypto ETF market suffered a decisive risk-off session as investors headed for the exits across every major product with no asset spared. By the close of trading on Thursday, Jan. 29, the day had the unmistakable feel of capitulation.

Bitcoin spot ETFs bore the brunt of the selloff, recording a massive $817.87 million net outflow spread across eight funds. Blackrock’s IBIT led the retreat with $317.81 million in redemptions. Fidelity’s FBTC followed with $168.05 million, while Grayscale’s GBTC shed $119.44 million.

Additional pressure came from Bitwise’s BITB (-$88.88 million) and Ark & 21Shares’ ARKB (-$71.58 million). Smaller exits were logged by Grayscale’s Bitcoin Mini Trust (-$37.21 million), Invesco’s BTCO ($8.38 million), and Vaneck’s HODL (-$6.52 million). Trading activity surged to $7.51 billion, while total net assets plunged by more than $7 billion to $107.65 billion.

Torrid January so far for bitcoin ETFs, with only seven days of inflows.

Ether spot ETFs followed bitcoin lower, posting a $155.61 million net outflow across five funds. Fidelity’s FETH and Blackrock’s ETHA led the drawdown with exits of $59.19 million and $54.88 million, respectively.

Grayscale’s Ether Mini Trust and ETHE saw further redemptions of $26.49 million and $13.05 million, while Bitwise’s ETHW rounded out the day with a $2 million exit. Total value traded reached $2.15 billion, and net assets slid to $16.75 billion.

XRP ETFs also closed sharply lower, recording a $92.92 million net outflow. Small inflows into Bitwise’s XRP ($2.41 million), Canary’s XRPC ($2.10 million), and Franklin’s XRPZ ($972,760) were completely overwhelmed by a $98.39 million exit from Grayscale’s GXRP. Total value traded stood at $71.48 million, with net assets holding at $1.21 billion.

Read more: Crypto ETFs Falter as Bitcoin, Ether See Combined Exit of $211 Million

Solana ETFs joined the retreat with a $2.22 million outflow, driven by exits of $1.29 million from Grayscale’s GSOL and $929,630 from Bitwise’s BSOL. Trading activity reached $72.61 million, and net assets slipped below the $1 billion mark to $998.52 million.

In sum, Thursday marked the first time a synchronized selloff happened across all crypto ETFs. Bitcoin’s sharp drawdown set the tone, ether followed closely, and even recently resilient XRP and solana were pulled into the red, underscoring a decisive pause in investor risk appetite.

- What triggered the massive crypto ETF selloff?

A sharp risk-off shift led to heavy redemptions, with bitcoin driving the exits. - How large were Bitcoin ETF outflows?

Bitcoin ETFs saw an $818 million net outflow, the largest driver of the day’s losses. - Did any crypto ETFs avoid the decline?

No, Ether, XRP, and Solana ETFs all posted net outflows in a synchronized selloff. - What does this mean for market sentiment?

The across-the-board exits signal capitulation and a temporary pause in risk appetite.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。