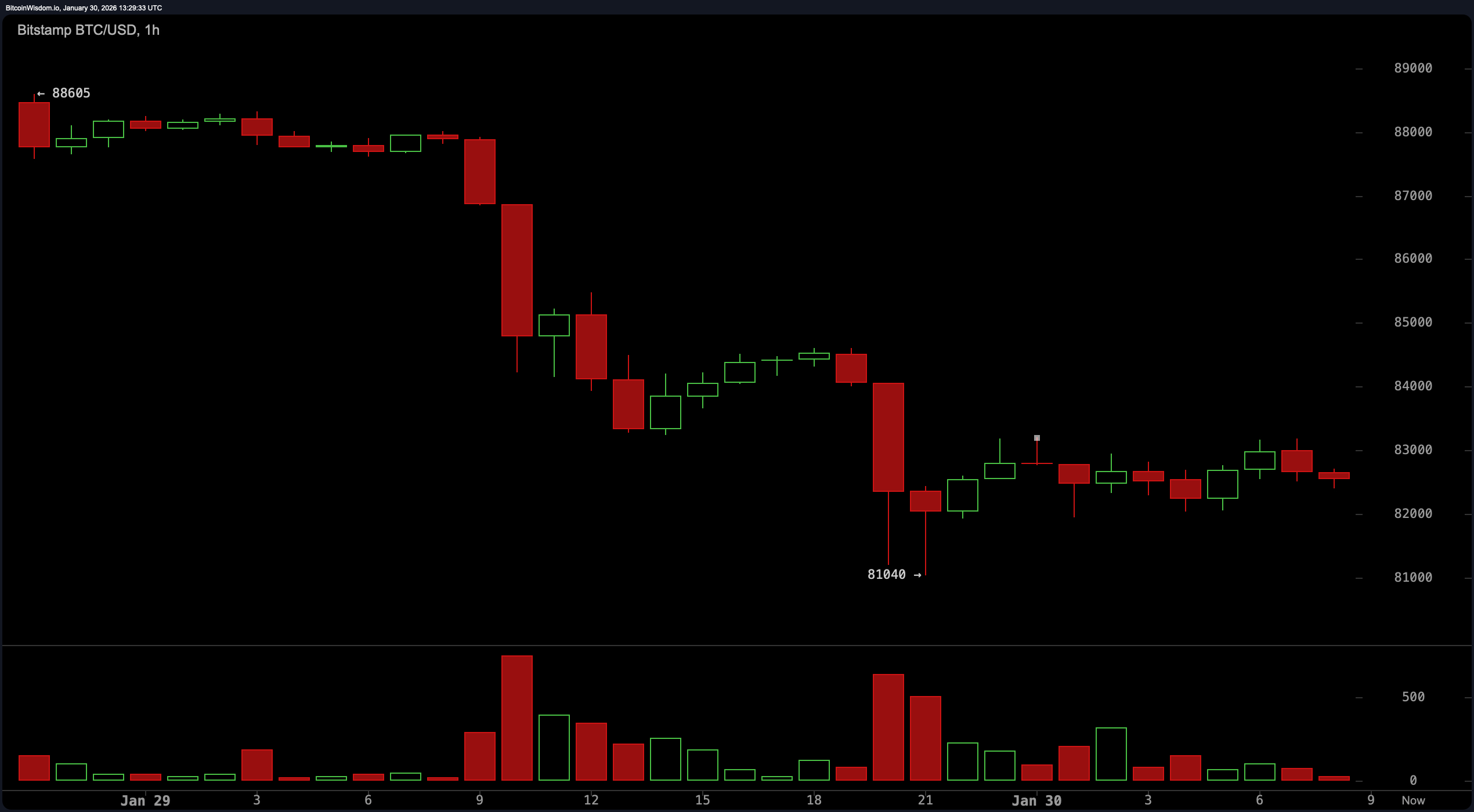

The hour-by-hour chart tells a story of short-term resolve testing long-term gravity. After cascading down from $88,600 to a twice-defended base near $81,040, bitcoin now ambles through choppy, indecisive candles.

Lower highs, no bullish momentum, and a clear lack of urgency suggest buyers have left the chat—or at least muted it. Despite short-term structure forming a support zone, there’s no impulsive buying strength to suggest a power shift. The market seems caught in a holding pattern, not gathering strength—just catching its breath after a sprint down the stairs.

BTC/USD 1-hour chart via Bitstamp on Jan. 30, 2026.

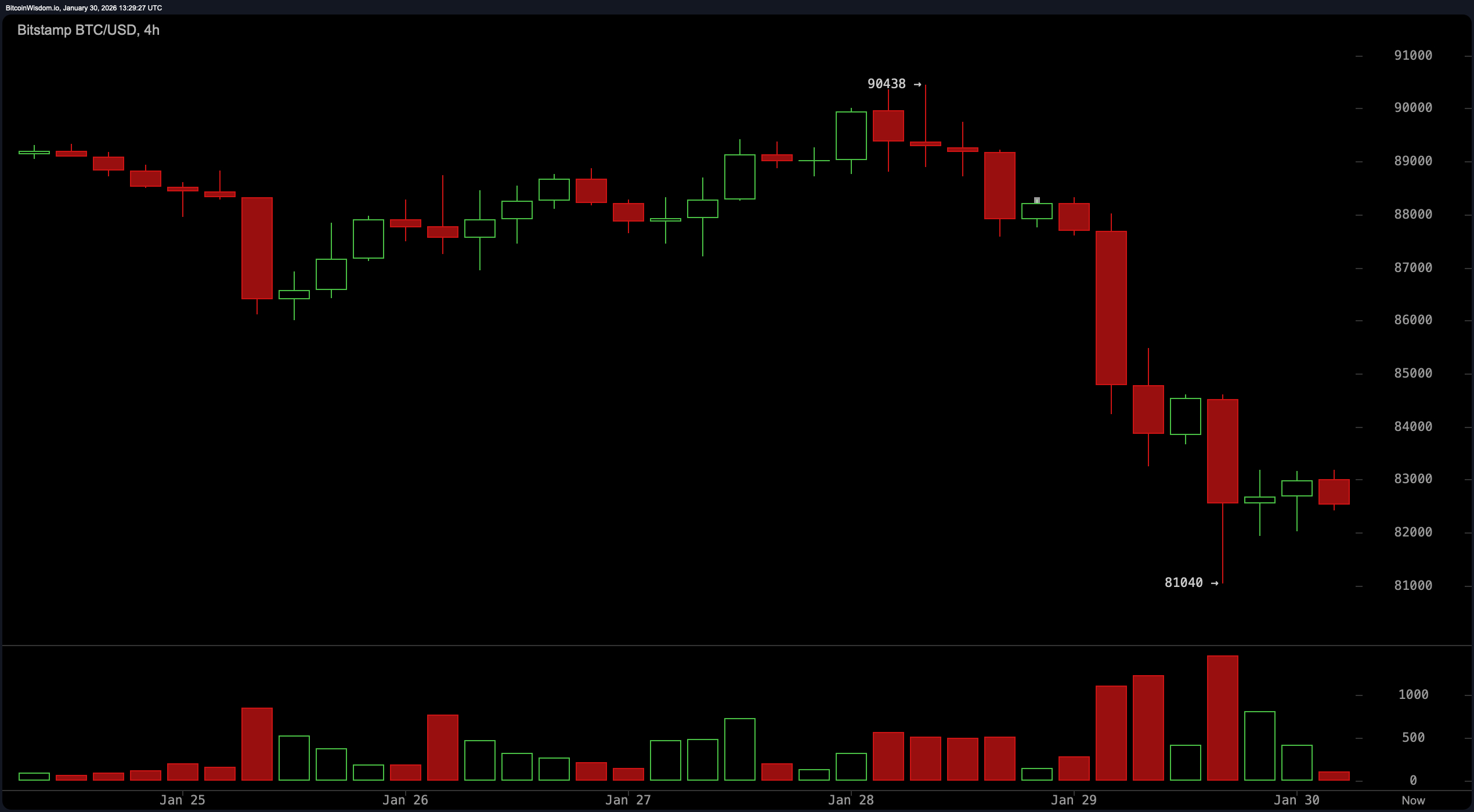

The 4-hour chart frames the recent action in a bear-market consolidation box. Price sold off violently from ~$90,400, with a liquidation-driven volume spike sending it careening to ~$81,000. It now floats between support at $81,000–$82,000 and resistance near $85,500, staging a range that screams stabilization, not salvation. The recent candles are compressed, momentum has fizzled, and all signs point to this being a classic “dead cat nap” instead of a bounce.

BTC/USD 4-hour chart via Bitstamp on Jan. 30, 2026.

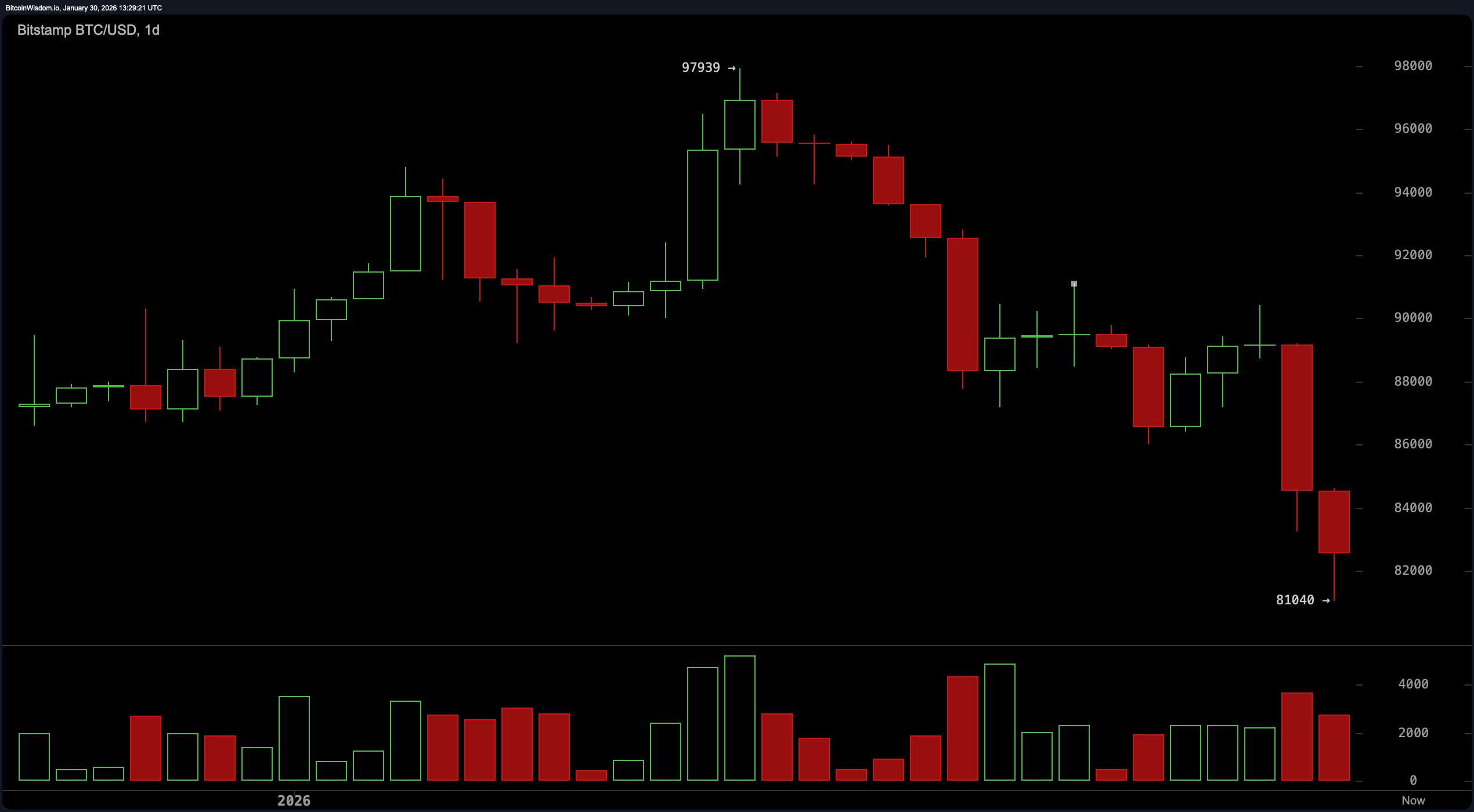

On the daily chart, trend damage is pronounced. The rejection from $97,939 was not subtle—back-to-back red candles and weakening upside volume reflect a market in the post-distribution phase. Failed rallies, weak follow-through, and a declining structure mark bitcoin’s descent into the $81,000 demand zone. Critical support lies at $80,500–$81,500, with resistance looming large between $88,500 and $90,000. Until $90,000 is reclaimed on a daily close with conviction, the bias remains bearish-to-neutral—not hopeful.

BTC/USD 1-day chart via Bitstamp on Jan. 30, 2026.

Technical indicators across the board echo the malaise. Oscillators are anything but exuberant: relative strength index ( RSI) sits at 31, the Stochastic at 16, and the commodity channel index (CCI) languishes at −181—each marking neutral readings, but certainly not momentum-driven strength. Even the average directional index (ADX) at 26 suggests a weak trend environment.

The Awesome oscillator is negative at −3,565, and the MACD ( moving average convergence divergence) confirms downward bias at −1,468. Momentum is the only indicator flashing green—but it’s a lonely candle in the wind. Moving averages—from the 10-period exponential moving average (EMA) to the 200-period simple moving average (SMA)—all signal downside pressure, with not a single moving average offering bullish shelter.

Sentiment is locked in extreme fear mode. The Crypto Fear and Greed Index sits at a grim 16, dropping from 26 the day prior, and lower than last week’s 24 and last month’s 21. This is no panic—it’s persistent despair. A staggering $752 million in bitcoin long liquidations paints a vivid picture: this wasn’t a sell-off—it was a forced eviction of overleveraged positions. Ethereum, XRP, solana, and even gold-linked tokens weren’t spared, underscoring that this is systemic deleveraging, not isolated drama.

So, what’s next? Bitcoin may have found a temporary footing in the low-$80,000s, but there’s no conclusive reversal on the horizon. Price stability, not bounce fantasy, is what matters now. Until volume returns and resistance zones are reclaimed, traders may want to keep their seat belts fastened—and their expectations parked.

Bull Verdict:

If this were the leverage flush that clears the board, bitcoin might be primed for a strategic reload. With weak hands wrung out and support holding in the $81,000–$82,000 range, a reclaim of $85,500—then $90,000—could shift the mood. But it would require real spot buying, rising volume, and enough conviction to override the current sentiment drought.

Bear Verdict:

This isn’t a dip—it’s a slow-motion unwind. Lower highs, neutral-to- bearish indicators, and broad liquidation pain show a market still bleeding leverage and confidence. Until bitcoin reclaims $90,000 with authority, every bounce risks becoming just another short entry in disguise.

- What is bitcoin’s current price?

Bitcoin is trading at $82,564 as of January 30, 2026. - Why did bitcoin drop recently?

A massive $752 million in long liquidations triggered a sharp selloff. - What support levels are critical now?

Key support lies between $81,000 and $82,000, with $80,500 as the next major floor. - Is bitcoin in a bullish or bearish trend?

Charts show a bearish-to-neutral bias unless $90,000 is reclaimed with volume.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。