Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

Against the backdrop of complex macroeconomic and geopolitical intertwinements, global markets are experiencing severe turbulence. Driven by strong buying from Chinese investors, copper prices recorded the largest single-day increase in sixteen years, soaring 11% to break the historical high of $14,500 per ton, before closing at $13,618. Former trader Mark Thompson exclaimed this was a "once-in-a-lifetime market," predicting that a supply disruption could bring prices to $20,000. Gold and silver also experienced a rollercoaster market, with spot gold hitting a historic high of $5,596.7, but then, influenced by profit-taking and a rebound in the dollar, saw a daily fluctuation of nearly $500, plummeting almost 9% in 30 minutes, nearly falling below $5,100, before recovering again. Spot silver also fell to a low of $106 after reaching a high of $121.

Additionally, the Asian market's fervor for physical assets is intense. According to the World Gold Council, global gold demand is expected to exceed 5,000 tons by 2025, with investment demand (2,175 tons) surpassing gold jewelry (1,542 tons) for the first time. Asian investors injected a net $7.1 billion into gold ETFs in January, raising concerns among some market participants about "peak frenzy." Although institutions like UBS are optimistic about gold prices reaching $6,200 by 2026, Goldman Sachs' Trina Chen warned that metal prices have outpaced real demand, and the market may face a "technical adjustment," indicating that high volatility will persist. Precious metals analyst Bill Holter also issued a stern warning, noting that COMEX silver delivery applications surged to 40 million ounces in January, and if March delivery demand depletes inventory, physical defaults could occur as early as March 2026, triggering a chain reaction in the financial system.

On the policy and political front, Trump announced a national emergency and threatened to impose tariffs on oil suppliers from Cuba and Canadian aircraft, while revealing he personally requested Putin to agree to a one-week ceasefire in Ukraine during the cold season; regarding the Federal Reserve Chair candidate, Kevin Warsh, due to his deep connections with Trump through his father-in-law Ronald Lauder (of the Estée Lauder family), saw the probability of him becoming Fed Chair rise to 95% on Polymarket, while BlackRock executive Rick Rieder has been ruled out. Trump is expected to announce the final candidate tomorrow morning and reiterated his hope for the new leadership to significantly lower interest rates.

In the stock market, Microsoft faced a nearly 10% drop in its stock price due to concerns over its AI investment return cycle, resulting in a market cap loss of $430 billion, marking the largest single-day decline since 2020, dragging down the entire software sector. In contrast, Meta surged over 10% due to its robust earnings outlook.

The Bitcoin market also faced a sharp decline, with prices dropping to a nine-month low near $81,000, a 35% retracement from its historical high of $126,000. This triggered massive liquidations for nearly 270,000 traders across the network, amounting to $1.66 billion, with the "1011 insider whale" losing as much as $138 million in two weeks, nearly wiping out profits. Despite the extremely bearish market sentiment, renowned trader Eugene has re-entered the market, believing it is at the tail end of weakness, with long positions having been cleared, and currently, the risk-reward ratio is excellent, setting a stop-loss below $80,000. However, technical analysts generally remain cautious; Murphy pointed out that BTC has broken through the $83,000-$92,000 accumulation zone, leading to 3.88 million BTC becoming trapped, with significant resistance above. If it falls below $82,000 again, the next support level is at $73,000-$78,000; Joao Wedson and Ardi both warned that if $81,000 cannot be held, a capitulation-style crash similar to 2022 could occur, targeting $65,500 or even lower; Ali Charts indicated key support levels at $75,804 and $56,196, with resistance at $98,643; Greeny noted that the 200-day moving average support is around $68.4k, while Castillo Trading believes that shorting at this time is chasing the decline, posing significant risks. Open4profit summarized this plunge as a coordinated deleveraging across metals, stocks, and the crypto market, rather than being driven by a single event. Milk Road data further showed that compared to the rapid recovery of gold and U.S. stocks, BTC only rebounded by $22 billion, indicating weak buying power and a need for market confidence to be restored.

Ethereum also did not escape the turmoil, with prices falling below the $2,700 mark. Yili Hua's Trend Research has utilized $109 million to reduce lending risks. Cointelegraph traders stated that the technical pattern confirmed a triangle breakdown, and if key moving averages cannot be reclaimed, the downward target could be as low as $2,250. In contrast to price volatility, Ethereum's technical ecosystem is making significant progress. On January 29, Davide Crapis, head of AI at the Ethereum Foundation, announced that the ERC-8004 standard has been launched on the mainnet. This standard provides decentralized trust infrastructure for AI agents, breaking the monopoly of centralized APIs through on-chain identity, reputation, and verification mechanisms. Combined with technical components like the x402 payment protocol, Oasis ROFL framework, and ERC-6551 token-bound accounts, ERC-8004 will promote the construction of the "Agent protocol stack," enabling AI agents to engage in autonomous economic activities. (Related reading: When Agents Have "On-Chain Business Cards," How ERC-8004 Becomes a Decentralized "AI Yellow Pages"?)

As mainstream assets fluctuate, market focus is on rumors of the integration of Musk's business empire. According to insiders and Reuters, SpaceX is considering a merger with Tesla or xAI, and Musk has established a merger entity in Nevada. If SpaceX merges with xAI, the valuation could reach $1.5 trillion, creating a "space + AI" system. Following this news, Tesla's stock price surged 4.5% in after-hours trading; additionally, billionaire Chamath Palihapitiya's prediction this morning about the merger of SpaceX and Tesla, along with his tweet "Just let me buy $ELON," ignited enthusiasm in the Meme market, leading to the rapid emergence of a meme coin named ELON, which saw its market cap soar to $17 million before dropping to around $9 million. Notably, Chamath had predicted earlier in January that SpaceX might reverse merge into Tesla, believing Musk would seize this opportunity to consolidate his two most important assets into one equity structure to strengthen his control. (Related reading: The 2026 Investment Scripts of Four Billionaire Tech Tycoons: Bullish on Copper Mines, Bearish on Oil, New Crypto Assets to Replace Gold and BTC)

2. Key Data (as of January 30, 13:00 HKT)

(Data source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

Bitcoin: $8,210 (YTD -6.2%), daily spot trading volume $86.77 billion

Ethereum: $2,709 (YTD -8.9%), daily spot trading volume $45.06 billion

Fear and Greed Index: 16 (Extreme Fear)

Average GAS: BTC: 1.75 sat/vB, ETH: 0.02 Gwei

Market share: BTC 59.2%, ETH 11.8%

Upbit 24-hour trading volume ranking: BTC, XRP, ETH, SENT, AXS

24-hour BTC long-short ratio: 47.45%/52.55%

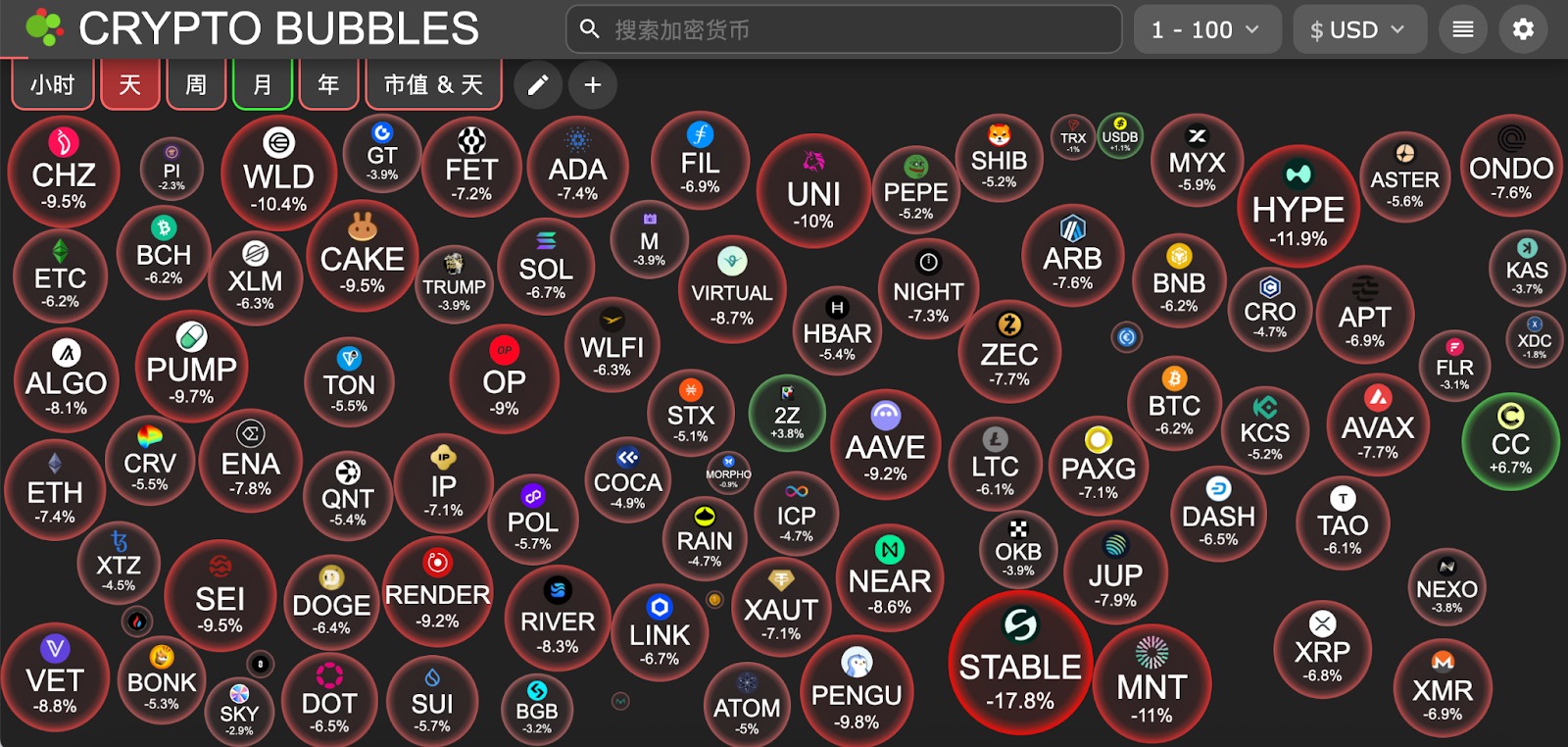

Sector performance: The crypto market generally retraced, with only AI, RWA, and CeFi sectors relatively resilient

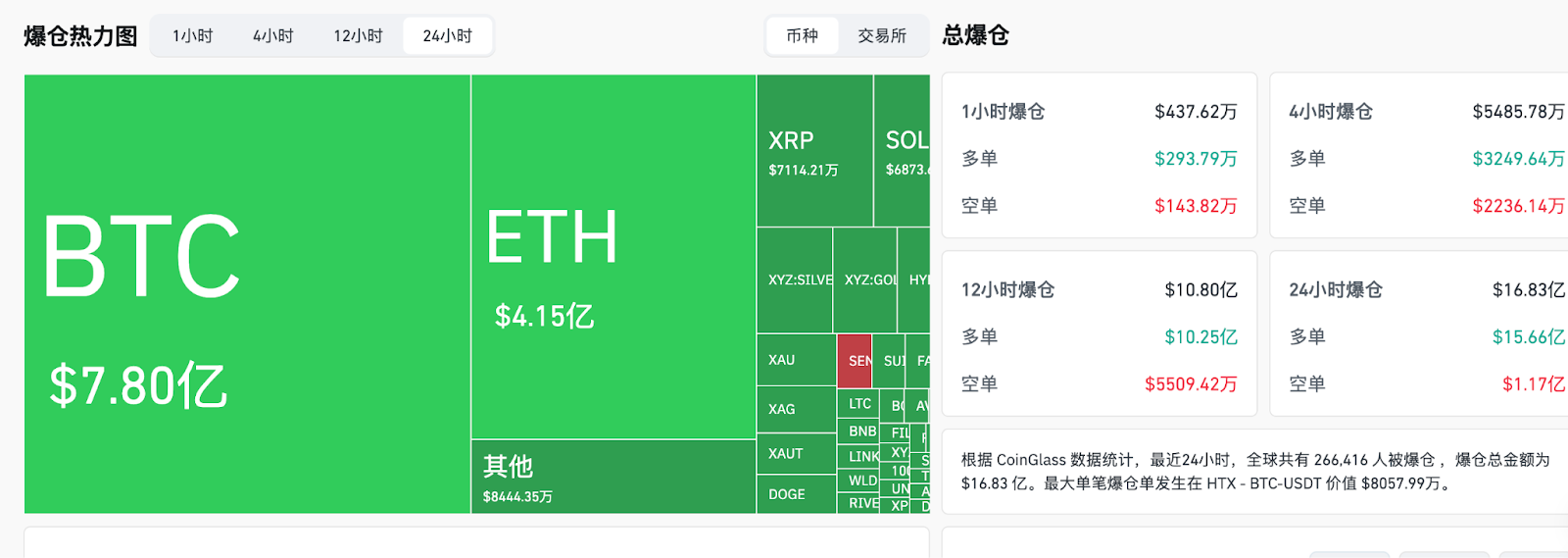

24-hour liquidation data: A total of 266,416 people were liquidated globally, with a total liquidation amount of $1.683 billion, including $780 million in BTC liquidations, $415 million in ETH liquidations, and $71.14 million in XRP liquidations.

3. ETF Flows (as of January 29)

Bitcoin ETF: -$818 million, continuing three days of net outflows

Ethereum ETF: -$156 million

XRP ETF: -$92.92 million

SOL ETF: -$2.22 million

4. Today's Outlook

Trump states he will announce the Federal Reserve Chair candidate tonight Beijing time

There is a risk of another government shutdown in the U.S. at the end of the month (January 31)

U.S. Treasury Secretary Yellen: After January 31, Milan can continue to serve as a Federal Reserve governor

Today's largest declines among the top 100 cryptocurrencies by market cap: Stable down 17.8%, Hyperliquid down 11.8%, Mantle down 11%, Worldcoin down 10.3%, Uniswap down 10%.

5. Hot News

Binance will convert the $1 billion stablecoin reserve of the SAFU fund into Bitcoin reserves

U.S. media: Trump "meeting + call" finalizes Warsh as the next Federal Reserve Chair candidate

SEC Chair: The time is ripe to allow cryptocurrencies into 401(k) retirement accounts

AI agent economic standard ERC-8004 has been launched on the Ethereum mainnet

U.S. government seizes over $400 million in assets related to dark web mixing service Helix

MegaETH lists four key KPI indicators that determine the release plan for 53% of MEGA token supply

The "1011 insider whale" lost approximately $53 million in 2 hours

Iran is reported to hold live-fire military exercises in the Strait of Hormuz

Spot gold nearly fell below $5,100, silver dropped nearly 9% in a day

U.S. stocks related to cryptocurrencies collectively fell, with BMNR down 8.4%

London copper prices broke through $14,400 per ton, rising over 10%

Solana on-chain meme coin BP briefly surpassed $14.9 million, rising 608% in 24 hours

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。