Original: 《Robinhood’s Tokenized Stocks: The Good, The Bad, and The Fix》

Translation: Ken, Chaincatcher

Legendary investor Warren Buffett holds an almost religious and firm opposition to the concept of "stock splits."

The reason Berkshire Hathaway's Class A shares trade for over $700,000 each is that Buffett believes stock splits are merely a superficial measure that does not change the fundamental value of a business. In Buffett's world, if you cut a pizza into eight slices instead of four, you do not get more pizza. You just have to wash more plates.

While stock splits may not be considered a "big deal" from a valuation perspective, they are a highly regulated activity overseen by the U.S. Securities and Exchange Commission and enforced by exchanges.

When a company announces a stock split, it must file an 8-K form and notify shareholders in advance before the change takes effect. This critical time window allows transfer agents to adjust the share register, brokers to update their internal systems, and data providers like Bloomberg to update their data streams—so that a $500 stock does not suddenly appear to drop to $50 overnight after a 10-for-1 split.

Stock splits are not the only corporate actions that require this high level of coordination. Dividend distributions also bring similar complexities.

On the ex-dividend date, stock prices are adjusted downward based on the dividend amount. Some funds, especially high-yield funds, take this practice to the extreme. They frequently distribute earnings, but most of these distributions are classified as return of capital, effectively returning investors' principal rather than paying out investment profits. While the number of shares remains unchanged, the fund's net asset value steadily erodes over time.

Tracking the performance of these funds requires a clear distinction between price return and total return.

Suppose you hold 100 shares of a high-yield ETF, with a price of $100 per share (a total investment of $10,000). The fund distributes $5 per share monthly, with 90% classified as return of capital. After 12 months, you have received $60 per share in cash (a total of $6,000), but the fund's net asset value has dropped from $100 to $46. At this point, the total price return is negative $5,400, but the total return is $10,600 (remaining net value of $4,600 plus the distributed $6,000), resulting in a positive return of 6%.

These are precisely the issues that blockchain should address.

A single shared ledger that can atomically update and is simultaneously visible to everyone. If everyone reads data recorded on the same chain, corporate actions like stock splits and dividends will instantly propagate throughout the system, eliminating the cumbersome and chaotic reconciliation work currently done between isolated intermediaries.

It is this promise that led Robinhood (@RobinhoodApp) CEO Vlad Tenev to be warmly welcomed by the market when he announced the launch of a tokenized stock strategy in June 2025.

Six months have passed, and Robinhood's tokens have officially launched, with data continuously flowing. Unfortunately, some issues have begun to surface.

Advantages

Robinhood's announcement became a catalyst for the market.

Other issuers quickly took action to launch competing products. Backed Finance (acquired by Kraken) launched xStocks (@xStocksFi) on Solana, followed by Ondo Global Markets (@OndoFinance) with its own tokenized stock product.

RWA.xyz data as of January 23, 2026

Tokenized stocks have ushered in a year of true explosion. In the second half of 2025 alone, this asset class grew by 128%, pushing the total asset value to nearly $1 billion.

RWA.xyz data as of January 23, 2026

Robinhood's tokenized U.S. stocks and ETFs are now available to European customers. Each token is issued on the Arbitrum network, fully backed by stocks held by Robinhood, and can be traded 24/5 with zero commission. Relevant data can be found on RWA.xyz.

However, it turns out that accurately capturing the metrics of Robinhood's tokenized stocks is far more complex than expected.

Disadvantages

Most blockchain data platforms assume that tokens follow standard practices when indexing them. For ERC-20 tokens, this means tracking minting and burning, accumulating supply from zero, and calculating market capitalization as supply multiplied by price.

This works for thousands of tokens on Ethereum and other EVM networks. However, the design of ERC-20 was not intended for securities that would undergo corporate actions. The standard does not natively support stock splits, reverse splits, or benchmark adjustments driven by dividends.

As a result, Robinhood had to use custom contracts to properly handle these events to ensure the rights of its end users. These tokens operate correctly within the Robinhood App, but their mechanisms are opaque to external data platforms and incompatible with DeFi protocols—because both assume that the objects are ERC-20 compliant tokens.

When we compare the token supply calculated using standard ERC-20 logic with actual on-chain data, the discrepancies are too significant to ignore. Some tokens have data deviations of 10 times, and some even reach 100 times.

Almost all errors can be attributed to two types of reasons: (1) net asset value erosion caused by dividends and (2) reverse stock splits.

Net Asset Value Erosion from High-Yield ETF Dividends

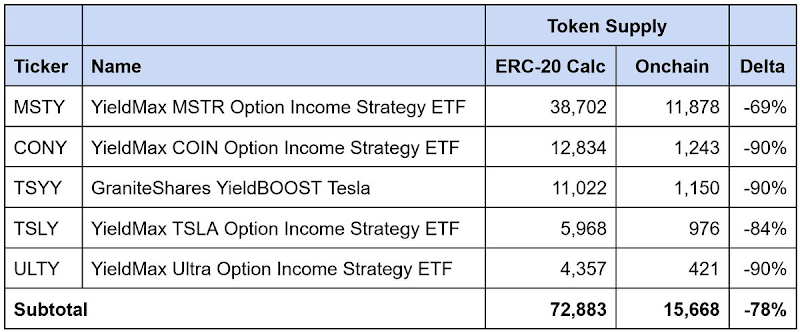

Data as of January 23, 2026

These are high-yield option income ETFs that frequently distribute dividends, with 90% or more of the distributions classified as "return of capital." Each distribution returns cash to investors, but this is primarily a return of principal rather than investment income. The number of shares remains unchanged, while the net asset value steadily declines over time.

Robinhood's contracts address this issue by separating "shares" from "tokens." The number of shares held remains constant, but an internal multiplier adjusts the reported token supply downward as the return of capital accumulates to reflect the shrinkage of the underlying net asset value.

However, data platforms following the standard ERC-20 model simply add up the minting and burning amounts. This approach fails to capture this re-basing adjustment, leading to an overestimation of the circulating token supply and, consequently, an overestimation of the reported market capitalization.

Reverse Stock Splits

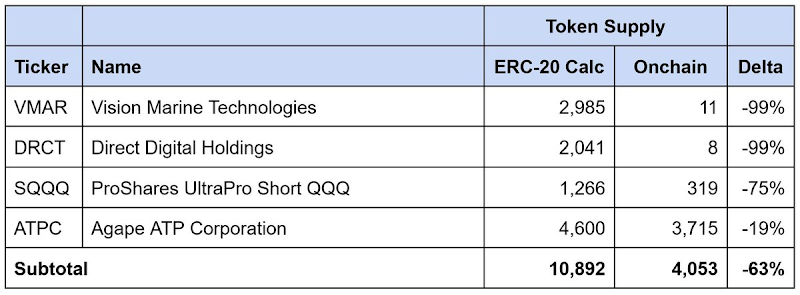

Data as of January 23, 2026

The same issue arises with reverse stock splits. Reverse splits increase the price per share by consolidating shares, usually to meet exchange listing requirements. The number of shares decreases proportionally, but the price per share increases proportionally, keeping the total value unchanged.

Similarly, Robinhood's contracts adjust the token supply to reflect the reverse split, while third-party platforms following the standard ERC-20 model will overestimate the circulating supply and reported market capitalization.

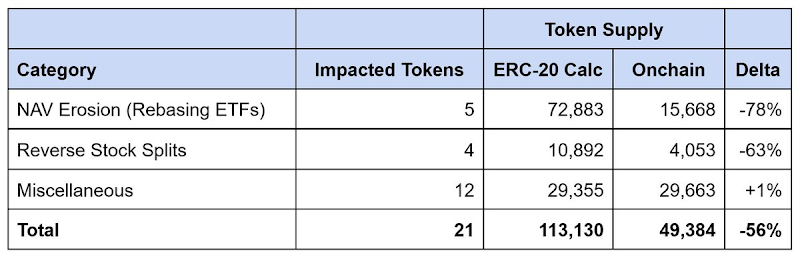

Total Data Discrepancies for Robinhood

Data as of January 23, 2026

Among the 21 tokens with identified data mismatches, the reported supply was overestimated by approximately 64,000 tokens, with discrepancies reaching up to 56%. The net asset value erosion caused by high-yield ETFs accounts for about 90% of this gap, while reverse stock splits explain the remainder.

Any data platform relying on standard ERC-20 logic to calculate supply will severely overestimate the market capitalization of Robinhood's tokenized stocks, often by multiples.

Solutions

Taxonomy of Tokenized Stocks: Models and Infrastructure

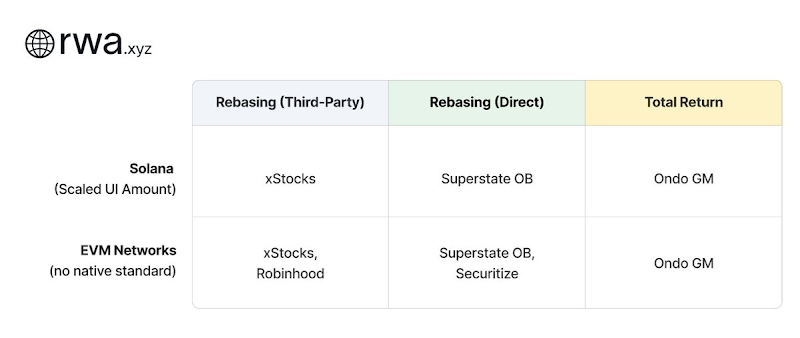

Tokenized stock issuers have taken different approaches to handling corporate actions. They can be broadly divided into two categories.

Rebasing Models

Rebasing models maintain parity with the spot price: that is, 1 token should always trade at a price close to 1 share of the underlying stock. When corporate actions occur, the token balance automatically adjusts to maintain this relationship. Issuers using this approach are divided into two camps based on their relationship with the underlying asset issuer:

- Rebasing (Third-Party): The issuer operates independently of the company whose stock is being tokenized. xStocks (@xStocksFi, part of Backed Finance / Kraken) and Robinhood (@RobinhoodApp) both take this approach. The tokens are backed by custodied shares, but since there is no direct relationship with the underlying issuer, they only replicate economic exposure without conferring legal ownership.

- Rebasing (Direct): The issuer collaborates with the listed company to tokenize its shares. Superstate's Opening Bell (@SuperstateInc) and Securitize (@Securitize) operate as SEC-registered transfer agents and serve as official shareholder registrars. Since the tokens are issued in coordination with the company, they are legitimate securities, and holders enjoy actual shareholder rights that the third-party model cannot provide.

Both structures require multiplier infrastructure to reflect corporate actions on-chain.

Solana's Token-2022 standard natively provides scaling UI amount expansion. Issuers only need to update a multiplier, which can adjust the balance displayed in the user interface without changing the original token quantity. For example, a 2-for-1 stock split would change the multiplier from 1.0 to 2.0; the wallet would display double the balance while the underlying original token count remains unchanged. Since this standard is native to Solana, data platforms can directly query changes in the multiplier.

EVM networks currently lack an equivalent standard. Issuers like xStocks and Robinhood have had to build their own multiplier mechanisms. While balance adjustments are correct and wallets can display prices consistent with the spot, these implementations are all customized. Third parties relying on standard ERC-20 calls cannot detect when multipliers change or query their current values. Therefore, each issuer's specific implementation must be understood separately.

For this reason, Chris Ridmann of Superstate and Gilbert Shih of Robinhood jointly drafted ERC-8056, a proposal aimed at introducing standardized "scaling UI amount expansion" for ERC-20 tokens. This will provide data platforms with a unified interface for tracking corporate actions across issuers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。