Author: Zen, PANews

After much speculation, the candidate for Trump's Federal Reserve Chair is expected to be officially announced in about a week. This dramatic "draft" has taken a surprising turn as it reaches the final stages.

"The Federal Reserve must lower interest rates to 3%, which is closer to equilibrium," said Rick Rieder, Chief Investment Officer of Fixed Income at BlackRock, in an interview with CNBC on January 13. He stated that rates must drop to 3% before considering the current situation.

Rieder's remarks have officially sounded the horn for the dark horse's charge.

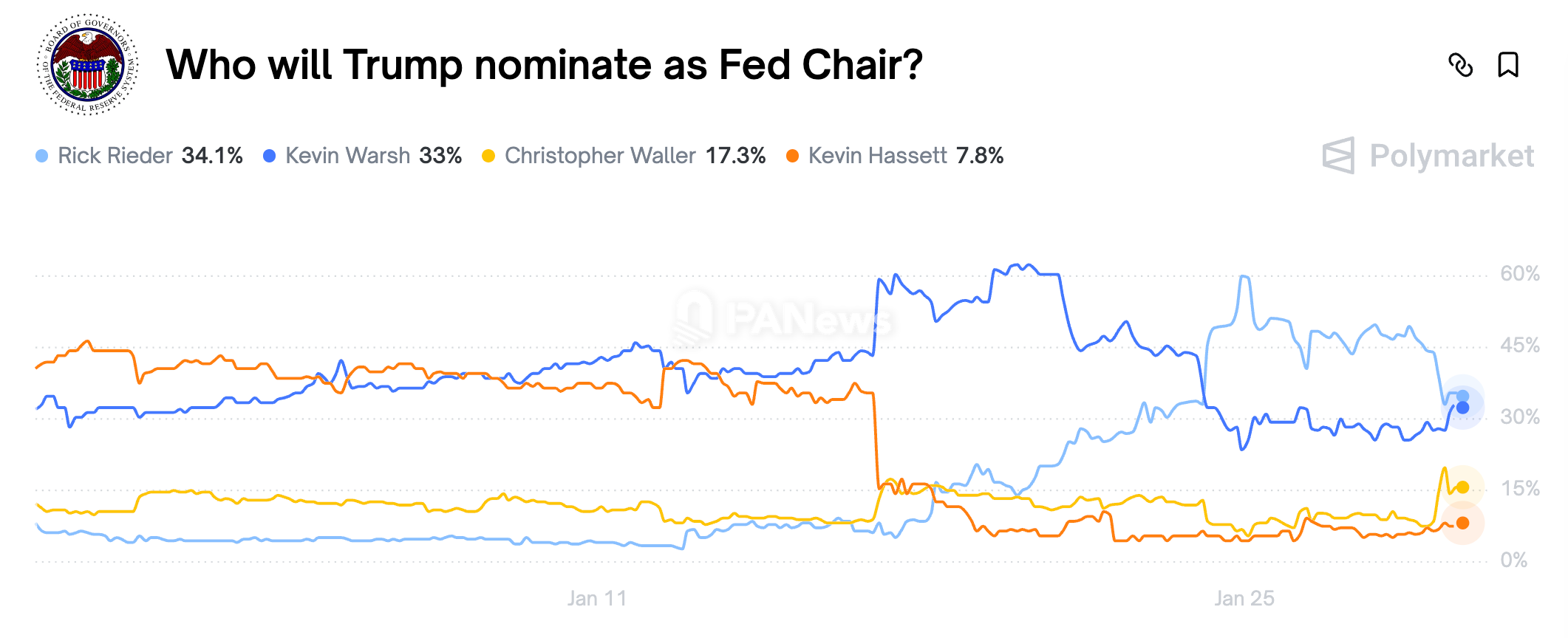

On that day, his winning probability on prediction markets like Polymarket doubled from 3% to 6%; after Trump praised him at the Davos Forum, Rieder's odds soared to 60%. As of January 29, Rieder was neck and neck with former Federal Reserve Governor Kevin Walsh, both having probabilities around 33%.

The reason this Wall Street veteran has unexpectedly risen to become one of the top contenders for the 2026 Federal Reserve Chair position is twofold: Rieder's monetary policy stance aligns with Trump's preference for rapid and significant interest rate cuts to boost economic growth; additionally, his extensive Wall Street experience lends him credibility, making his nomination more acceptable to the market and the Senate.

Moreover, Rieder's open attitude towards digital assets has also garnered attention in the cryptocurrency space. He has publicly stated multiple times in recent years that Bitcoin should be part of an investment portfolio, serving as a "ballast" alongside gold.

Two Mergers Create Rieder's Top Wall Street Resume

Everyone has their own talents, and Rieder is naturally suited for investing.

In the early 1970s, while still in elementary school, Rieder began studying sports betting. He would analyze various detailed statistics of the NFL team, the Oakland Raiders, such as the differences in performance on artificial turf versus natural grass. Rieder would bet all his lunch money; if he won, 25 cents would turn into 50 cents; if he lost, he would have to go hungry.

This passion for investing and near-obsession with data has run throughout Rieder's career. Today, he boasts over 30 years of experience in financial markets and the richest investment management background.

In 1987, shortly after graduating from Emory University's business school, Rieder joined the well-known investment bank E.F. Hutton. A few months later, the stock market crash known as "Black Monday" nearly brought the company to its knees. By the end of the year, the 80-year-old firm was "sold off" to Lehman Brothers. Rieder was fortunate to remain employed due to a vacancy and served at Lehman for nearly 20 years, holding senior positions including head of global credit business.

In May 2008, just before Lehman Brothers' bankruptcy, Rieder chose to leave and start his own hedge fund, R3 Capital. A year later, his fate took another significant turn during a merger when BlackRock's CEO, Larry Fink, acquired R3 and brought Rieder on board with significant responsibilities. Since then, Rieder has entered BlackRock's executive team, gradually leading the company's vast fixed income investment platform.

In 2013, Rieder at BlackRock

Today, Rieder serves as BlackRock's Chief Investment Officer for Global Fixed Income, managing approximately $2.4 trillion in assets, making him one of the most important decision-makers at the world's largest asset management company. Additionally, Rieder is a member of BlackRock's Global Executive Committee and Chairman of the company's Investment Council.

Notably, while serving as a corporate executive, he has also been invited to serve as Vice Chairman of the U.S. Treasury Borrowing Advisory Committee and a member of the Federal Reserve's Financial Markets Advisory Committee, providing professional consulting to the government.

These top-tier credentials give Rieder both market insight and a certain policy perspective, enhancing his candidacy for the Federal Reserve Chair position. Many foreign media outlets like to refer to him as having the "temperament of a Federal Reserve Chair."

Winning Probability Soars Nearly 20 Times, "Dark Horse" Rieder Becomes the Top Contender

As a leading candidate for Federal Reserve Chair, Rieder's stance on monetary policy is the most closely watched topic. Rieder has consistently advocated for a more accommodative policy approach, repeatedly emphasizing that current U.S. interest rates are too high and should be quickly lowered to around 3% to balance economic risks.

In a January interview, Rieder stated that the Federal Reserve needs to lower rates to 3% to get closer to equilibrium. Analysts point out that Rieder's stance is quite dovish; if he takes office, the Federal Reserve may cut rates three times within the year to stimulate growth.

In Rieder's view, the U.S. economy is experiencing phenomena such as rising productivity, gradually fading inflation due to tariffs, and pressure on labor and low-income consumers, so early rate cuts would help alleviate these cyclical and structural challenges, safeguarding economic growth.

Clearly, Rieder's monetary policy proposals align with the Trump administration's urgent desire for rate cuts following the election. Trump has repeatedly criticized the Federal Reserve and current Chair Powell for not cutting rates quickly enough, even publicly pressuring them at the cost of undermining the Fed's independence.

As the current hottest candidate, Rieder meets Trump's demand for "easing monetary policy" while not lacking a compelling resume like the previously popular "two Kevins," particularly Hassett, whose economic policies were disappointing and were widely viewed as a puppet of Trump. Last week, Trump publicly expressed his hope for Hassett to remain as the Director of the White House National Economic Council, effectively announcing his exit.

Another candidate on the shortlist, former Federal Reserve Governor Kevin Walsh, has also expressed support for rate cuts, but as an inflation hawk, he would not pursue the significant and rapid rate cuts that Trump desires. Additionally, Walsh has criticized the Federal Reserve's structure during his campaign, calling for a change in mechanisms and strict reforms, but the specific details of the reforms remain unclear. Given Walsh's background, his outspoken attitude may raise Trump's concerns about him being too radical and lacking cooperativeness.

Compared to Walsh and Hassett, current Federal Reserve Governor Christopher Waller is considered an "establishment candidate." He has some influence within the Fed's decision-making body and supports a more conservative role for the central bank. However, Waller has not garnered much favor from Trump in this "draft." Notably, Waller opposed the Federal Reserve's decision at the end of January, supporting a 25 basis point rate cut, which caused his winning probability in prediction markets to double to about 15%.

During an interview at the Davos Forum, Trump praised Rieder, stating that he performed exceptionally well in the interview. Trump also mentioned that, in his view, there might only be "one real candidate left." This caused Rieder's chances of being elected to soar from less than 3% to 60% on January 24, surpassing the previously leading "two Kevins."

The First Bitcoin-Friendly Federal Reserve Chair May Take Office

Unlike most central bank officials, Rieder has maintained a relatively friendly and open attitude towards Bitcoin and other crypto assets. As an investment executive at one of the world's largest asset management companies, he has repeatedly expressed recognition of the potential of digital assets.

As early as November 2020, Rieder boldly asserted in an interview with CNBC that Bitcoin could take over gold as the new reserve asset of the 21st century, reasoning that "it is much more convenient as a store of value than transferring physical gold bars."

In the following years, Rieder's actions have aligned with his views. In early 2021, he revealed that BlackRock had "begun to slightly dabble in Bitcoin" investments, and in 2023, BlackRock was the first to submit an application for a Bitcoin spot ETF to the U.S. Securities and Exchange Commission, prompting other financial giants to follow suit. Rieder himself has repeatedly emphasized that Bitcoin should be part of a long-term investment portfolio.

In a recent interview, Rieder suggested that investors hold Bitcoin alongside gold to hedge against inflation and enhance portfolio stability. Even when Bitcoin's price reached $112,000 in September 2025, Rieder stated, "it will continue to rise," firmly optimistic about the future performance of this digital asset.

If such a cryptocurrency-embracing market-oriented individual were to become Federal Reserve Chair, it would be an unprecedented situation, also meaning that Bitcoin would gain unprecedented influence at the highest levels of the Federal Reserve.

Of course, the Federal Reserve Chair is not a direct regulator of the crypto industry; specific regulatory rules are mainly set by agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), while discussions on digital assets within the Federal Reserve are typically led by the Vice Chair responsible for financial regulation. Therefore, Rieder's stance on crypto may not immediately translate into significant policy changes.

However, the personal views of the Federal Reserve Chair have a crucial guiding effect on the market and regulatory atmosphere, influencing how regulators view financial innovation and its systemic impacts. For the crypto industry, having a Federal Reserve Chair who understands Bitcoin's value and comes from the intersection of traditional finance and digital assets on Wall Street is undoubtedly a significant incentive signal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。