Digital asset markets began 2026 on steadier footing after last year’s broad deleveraging reset risk across the sector. According to the Charting Crypto Q1 2026 report, produced by Glassnode and Coinbase Institutional, leverage has fallen, derivatives positioning has become more conservative, and market participants are repricing risk.

Bitcoin continues to anchor the market. BTC dominance has held near 59%, even as mid- and small-cap tokens struggled to sustain gains made earlier in the cycle. Institutional survey responses cited in the report show a clear preference for large-cap exposure, reflecting ongoing geopolitical uncertainty and a cautious approach to risk.

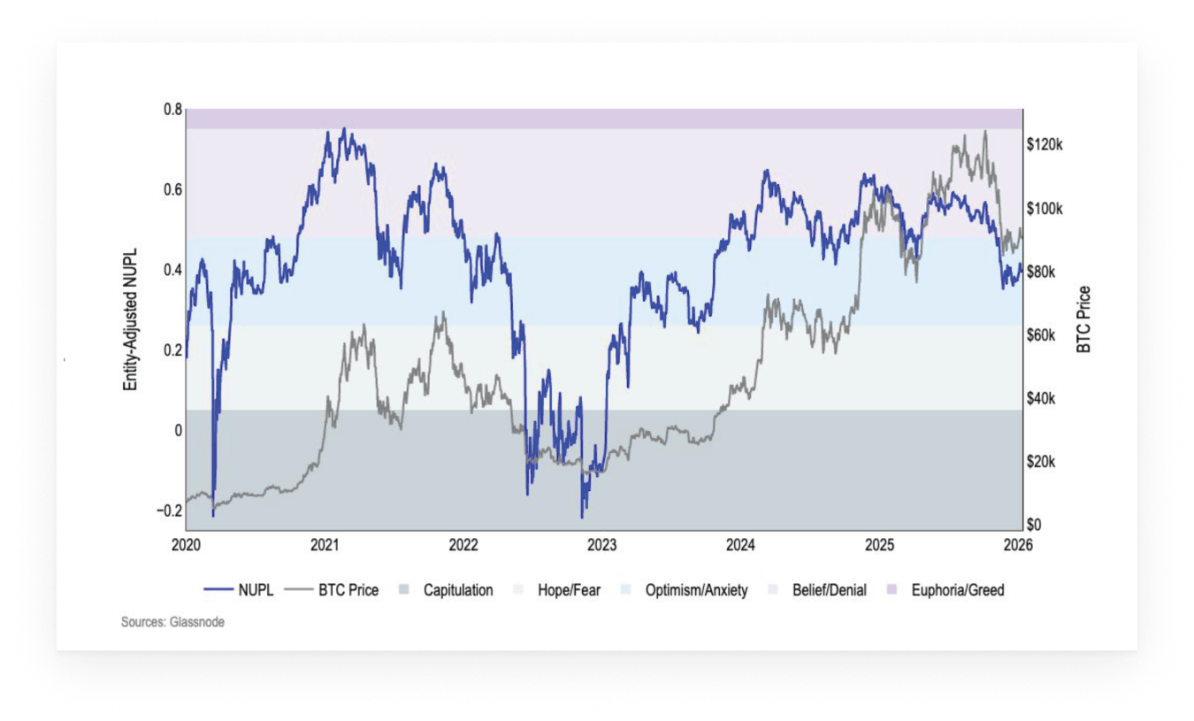

Sentiment around bitcoin remains restrained. The Net Unrealized Profit/Loss (NUPL) metric has stabilized at lower levels after October’s massive liquidation event. Structurally, this leaves room for sentiment to improve if volatility compresses or macro conditions remain supportive.

One of the most notable changes has occurred in derivatives markets. October’s deleveraging materially reduced systemic leverage, with the leverage ratio in perpetual futures falling to around 3% of total crypto market capitalization, excluding stablecoins. Rather than exiting entirely, traders migrated toward options.

One of the most notable changes has occurred in derivatives markets. October’s deleveraging materially reduced systemic leverage, with the leverage ratio in perpetual futures falling to around 3% of total crypto market capitalization, excluding stablecoins. Rather than exiting entirely, traders migrated toward options.

Bitcoin options open interest now exceeds perpetual futures, with positioning increasingly focused on downside protection and defined-risk structures. This shift points to a more resilient market structure, even if near-term conviction remains muted.

The report also highlights signs of distribution in bitcoin. Supply that has been active within the past three months rose to 37% in the fourth quarter of 2025, while long-dormant supply declined modestly, suggesting some reallocation by longer-term holders.

Read more: Bitcoin’s $85K Floor: Research Flags 4 Factors That Could Force a Break

Ethereum, meanwhile, appears to be entering a late-stage phase of its current cycle, which began in mid-2022. However, the report argues that traditional cycle signals are losing predictive power as ethereum’s economics evolve. Fee compression on Layer 2 networks and shifting usage patterns mean future performance is likely to be driven more by liquidity conditions and positioning than by historical cycle timing alone.

Overall, the report concludes that while sentiment remains cautious, crypto markets are structurally healthier than in past cycle transitions, with discipline replacing excess.

- Why are institutions turning defensive in crypto?

Lower leverage and macro uncertainty are pushing institutions toward cautious, risk-managed positioning. - Which assets are institutions favoring most?

Bitcoin and other large-cap assets lead portfolios as mid- and small-caps lose favor. - What changed in crypto derivatives markets?

Traders reduced leverage and shifted from perpetuals to options for downside protection. - What does this mean for crypto in 2026?

Markets look structurally stronger, with disciplined risk-taking replacing speculative excess.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。