Author: danny

Who would have thought that the modern multinational tax information system was triggered by a tube of "toothpaste"? A UBS banker smuggled diamonds by hiding them in a toothpaste tube, a scene straight out of Hollywood, which unexpectedly sounded the death knell for Swiss banking secrecy laws. Now, the wheels of history are ruthlessly grinding towards the crypto world—once a secret "tax haven," it is about to face its reckoning.

This article will unveil the mystery of CARF: a global tax hunt is underway. From Binance's strategic move to the UAE, trading space for time, to the harsh reality that "crypto-to-crypto trading" is no longer tax-exempt; from the compliance countdown in Hong Kong to the shattered hopes of mainland investors.

This is not only a reshaping of the industry landscape but also a survival guide that every crypto asset holder must confront—after all, in this algorithm-woven cage, no one can continue to be an ostrich with their head buried in the sand.

Introduction: What is CARF?

CARF stands for Crypto-Asset Reporting Framework. Its core mechanism is that reporting-obligated crypto asset service providers (RCASPs) collect tax-related information about customers and relevant transactions and report it to the tax authorities in their jurisdiction, which will then automatically exchange international intelligence among tax authorities. This is similar to the traditional financial sector's CRS but specifically focuses on the buying, selling, exchanging, custody, and transfer of crypto assets.

In simple terms, previously, when users traded cryptocurrencies on exchanges, the tax authorities in their resident countries found it difficult to comprehensively grasp the relevant information. Now, CARF connects the user's tax residency country with the jurisdiction of the exchange, and once they establish a CARF cooperation relationship, the user's tax residency country can obtain detailed information about its residents trading cryptocurrencies abroad and conduct tax collection accordingly.

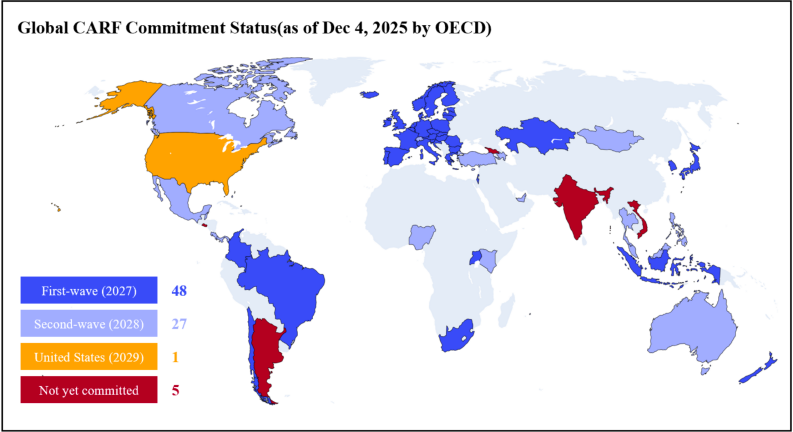

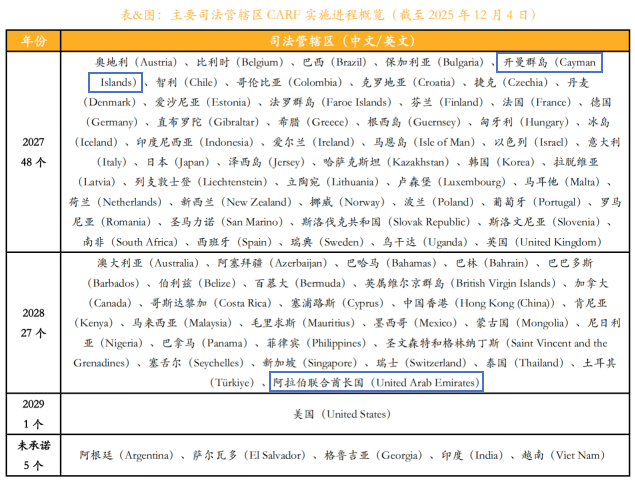

By the end of 2025, more than 75 jurisdictions have committed to implementing CARF in 2027 or 2028, with over half having signed relevant agreements with competent authorities. Starting from January 1, 2026, the CARF framework will take effect in the first 48 jurisdictions, covering the UK, EU, Japan, South Korea, Singapore, and others.

Chapter 1: Diamonds in Toothpaste, the End of Secrecy, and the Arrival of CRS

To understand CARF as a "new sickle," we must first look at the "old fishing net"—CRS (Common Reporting Standard).

The protagonist of the story is Bradley Birkenfeld, a former senior client manager at UBS. To discreetly bring back $200 million in untaxed assets belonging to his client, American real estate mogul Igor Olenicoff, Birkenfeld devised a plot that only a Hollywood screenwriter would dare to use: he bought diamonds, stuffed them into a tube of ordinary toothpaste, evaded customs' X-ray machines, and boldly flew across the Atlantic to cash in the diamonds with Olenicoff.

In 2007, when Birkenfeld discovered in an internal bank report that he might become a scapegoat for internal compliance cleansing, he made a decision that went against the traditions of Swiss banking: he turned whistleblower. He walked into the U.S. Department of Justice with a dossier containing top-secret internal emails and client lists.

Birkenfeld's testimony directly led to UBS paying a staggering $780 million fine in 2009 and unprecedentedly handing over the names of over 4,000 American clients. This marked the death of Swiss banking secrecy laws. (Interestingly, Birkenfeld ultimately walked away with a $104 million bounty.)

The U.S. Congress realized that relying on informants like Birkenfeld was far from sufficient; an automated monitoring mechanism had to be established. Thus, in 2010, the most draconian tax law in history, the Foreign Account Tax Compliance Act (FATCA), emerged. Its logic was simple and brutal: "All banks worldwide that want to do business with the U.S. must report the account balances of Americans to us every year."

The OECD saw the immediate effect of this move by the U.S. and began to replicate it. In 2014, the global version of the standard based on FATCA—CRS—was officially born.

This is why the underlying logic of CRS resembles checking bank statements: it assumes that wealth ultimately settles in bank accounts, generating interest and forming balances. It is a monitoring system tailored for the "fiat currency era," aimed at making invisible wealthy individuals have nowhere to hide through annual "balance snapshots."

Just when everything seemed to be progressing towards regulatory hopes, a new entity called Bitcoin was quietly growing. The CRS system, based on "balance monitoring," was about to face a new opponent it had never envisioned.

Chapter 2: The Holes in the Old Hunting Net—Why CARF When CRS Exists?

Using an AI analogy, CARF is like a high-definition camera set up at the entrance of every compliant exchange, operating 24/7.

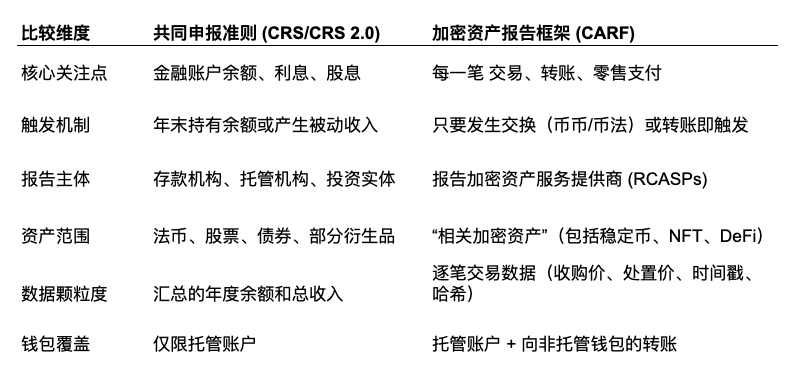

The biggest difference between CARF and CRS is that CRS checks "how much money you have," while CARF checks "where your money is flowing."

2.1 The Origin and Strategic Intent of CARF

CARF was born out of the G20 countries' fear of tax base erosion. Although traditional CRS has been effective in combating offshore tax evasion, it primarily targets traditional bank accounts and custody accounts. Due to the decentralized nature of crypto assets, which can be transferred peer-to-peer without intermediaries, they have become a blind spot for CRS.

The OECD explicitly stated that CARF's goal is to eliminate this blind spot by including crypto asset service providers (CASPs) under the same reporting obligations as banks. By the end of 2025, more than 50 jurisdictions (including the UK, Canada, France, Germany, Japan, the Cayman Islands, etc.) have committed to implementing CARF, and this framework has quietly started data collection in places like the Cayman Islands on January 1, 2026, with the first information exchange scheduled for 2027.

2.2 Comparison of CARF and CRS 2.0: From "Stock" to "Flow"

The core logic of CRS is to monitor "stock wealth," while the core logic of CARF is to monitor the flow of wealth.

Under the CRS framework, apart from year-end balances, tax authorities can hardly see the intermediate processes. However, under CARF, if an investor exchanges Bitcoin for USDT or transfers USDT to their cold wallet, or even uses cryptocurrency to purchase over $50,000 worth of $PUNDIAI (retail payment transactions), each action will generate a report record. CARF effectively elevates the perspective from a "static balance sheet" to a "dynamic cash flow statement."

2.3 The Scope of "Relevant Crypto Assets"

CARF's definition of "relevant crypto assets" covers most crypto assets:

Stablecoins: Although many stablecoins claim to be alternatives to fiat currencies, under CARF, they are explicitly regarded as crypto assets. This means that the exchange between USDT and USD may no longer be considered a "currency exchange" but rather a taxable event.

NFTs: While CARF primarily focuses on assets used for payment or investment, most high-value NFTs are likely to be included in the reporting scope due to their secondary market trading attributes.

Tokenized securities: Even tokenized stocks or bonds that are already regulated in traditional financial markets may simultaneously be subject to both CRS and CARF (although the OECD is attempting to avoid duplicate reporting by amending CRS, such overlap is difficult to avoid according to the tax operational principle of "better to kill wrongly than to let go").

Chapter 3: The Delusions, Luck, and Ruin of Retail Investors

3.1 Crypto-to-Crypto Trading: Mandatory "Fair Pricing" Mechanism

CARF stipulates that all exchanges between crypto assets must record their fair market value in fiat currency at the moment the transaction occurs.

In the eyes of tax authorities, "crypto-to-crypto trading" is equivalent to "selling first and buying later." Many people have a misconception: "If I exchange Bitcoin for Ethereum, as long as I don't convert it to fiat (USD/RMB), it doesn't count as a sale, and I don't have to pay taxes." But that's just wishful thinking.

CARF requires exchanges to record: "On a certain date, Zhang San exchanged 1 Bitcoin for 20 Ethereum, and at that time, that 1 Bitcoin was worth $50,000." In the eyes of tax authorities, this is a taxable event of "selling Bitcoin for $50,000." Even if you don't have cash in hand, your tax bill has already been generated.

CARF completely ends the tax evasion strategy of "using crypto to earn crypto." After 2026 (or in some regions, 2027), every crypto-to-crypto swap will be recorded as an asset disposal event, leaving a definite "fiat gain record" in your tax file, regardless of whether you convert it to fiat/stablecoin.

3.2 Penetrating Wallets: Transaction Hash and Address Scrubbing

In CARF's XML Schema, RCASPs are required to report the specific types and values of transactions. Although the final rules, under strong lobbying from the industry, removed the mandatory requirement to report all non-custodial wallet receiving addresses, internal systems must collect and retain this address and its associated beneficiary information for at least five years (aka "retention rule").

This means that tax authorities have the right to access data at any time. If tax authorities discover that a taxpayer has a large "withdrawal" record in 2026 but has not reported subsequent gains, they can issue bulk information requests to exchanges to accurately obtain these external wallet addresses.

When you withdraw crypto from an exchange to your wallet plugin or cold wallet, the exchange must record and report (if requested) "which address it was withdrawn to." This is akin to withdrawing cash from a bank, where the bank not only records how much you withdrew but also sends someone to track you, noting which safe you stuffed the money into. Once your wallet address is linked to your real identity in the tax authority's database, all your DeFi operations on-chain are essentially "exposed."

3.3 Standardization of Valuation Anchoring

What if the transaction involves two extremely obscure tokens (for example, exchanging "air token A" for "air token B") with no fiat trading pairs? CARF stipulates a "cascade valuation method": if asset A has no fiat price, refer to the fiat price of asset B; if neither has one, the service provider must use reasonable valuation methods to enforce pricing. In short, a fiat value must be generated in the system and sent to the tax authorities. This eliminates the space for users to use price fluctuations for vague reporting when filing taxes.

3.4 Mandatory Taxpayer Identification Number (TIN)

CARF requires RCASPs to collect users' tax residency status and corresponding taxpayer identification numbers (TINs). However, if a user only declares a jurisdiction with a lower tax rate (such as Dubai) but the exchange discovers through IP addresses, phone area codes, or login logs that they frequently operate in a jurisdiction with a higher tax rate (such as France), the exchange has an obligation to question the validity of that self-certification.

Chapter 4: The Traps of Retrospection: 2026 as the "Year of Exposure"

Many old OGs believe that as long as they handle their assets before the first information exchange in 2027, everything will be fine. This is incorrect. Because everyone overlooks the "retrospective effect" of CARF, meaning that the 2027 information exchange implies the submission of 2026 information.

4.1 "Beginning Balance" and Historical Audits

When tax authorities receive the CARF data for the entire year of 2026 in 2027, they will first focus on the "beginning balance" or "annual transaction total."

Scenario Simulation:

Assume Mr. Nakamoto, a Chinese investor, sold $10 million worth of $PUNDIAI tokens through a compliant platform in Hong Kong in 2026. This platform reports the data to the tax authorities according to CARF. The tax authority's AI system will immediately compare Mr. Nakamoto's personal income tax declaration records from 2025 and earlier. If Mr. Nakamoto has never declared holding overseas crypto assets before, then the source of this $10 million becomes a huge question mark.

The tax authority will trace back through the hash of this transaction to determine when these $PUNDIAI tokens were purchased. If they were bought in 2024, then all the unreported appreciation from 2024 to 2026 will be fully exposed.

It is worth noting that many countries' tax authorities have deployed AI-based big data analysis systems specifically designed to identify anomalies where asset holdings do not match reported income. We anticipate that 2026 will see a "tax recovery heist" for crypto millionaires.

4.2 The Compliance Window in 2026

For investors who have not yet complied, 2026 is effectively the last window period. Before the data gates close, investors face difficult choices:

Proactively report historical assets to the tax authorities, which can often lead to reduced penalties.

Restructure asset holdings under compliant frameworks (such as family trusts or offshore companies) or seek assistance from professional tax institutions to reasonably plan crypto assets. (There should be an advertisement here; advertising space is hotly contested~)

Chapter 5: The Move of Binance: Trading Space for Time

Among the many regulatory-friendly jurisdictions, why did Binance ultimately choose Abu Dhabi? In addition to local policy support and funding channel advantages, an important factor is the compliance time difference.

Binance's original location in the Cayman Islands is among the jurisdictions committed to being the first to implement CARF, with the first information exchange expected in 2027. This means that crypto service providers (RCASPs) obligated to report under CARF need to start collecting and preserving information for reporting from 2026. If Binance remained in the Cayman Islands, it would have to immediately initiate a comprehensive CARF compliance system.

In contrast, the UAE, according to the CARF implementation timeline, is in the second batch of jurisdictions to implement CARF, with information exchange planned to start in 2028.

By moving from the Cayman Islands to the UAE, Binance has secured a strategic buffer period of one year. For Binance, which serves over 300 million users, this time is significant:

First, avoiding early risks. They can observe how the first batch of jurisdictions like the UK and the Cayman Islands operate, learn from the experiences and lessons of other exchanges, and optimize their own compliance plans.

Second, participating in rule-making. Currently, the UAE's local CARF legislation and implementation details are still being formulated. As a prominent exchange with a certain voice, Binance has the opportunity to express opinions and consult with authorities during this process, exerting a favorable influence on the formation of localized rules.

Third, completing system upgrades. This year allows Binance ample time to deploy and debug a data reporting and management system that meets CARF's complex requirements.

This is the so-called "trading space for time."

Chapter 6: CARF in China: Impact and Trends

As one of the largest crypto asset user markets in the world, China's situation is somewhat unique.

Some say that since mainland China is not on the OECD's first batch of CARF signatories, the mainland tax authorities cannot see crypto transactions conducted in Hong Kong—this is actually a misunderstanding.

Mainland China has not yet joined or committed to implementing CARF, so the mainland tax authorities will not obtain crypto asset transaction data of Chinese tax residents based on the CARF mechanism. However, this does not mean that mainland crypto millionaires can rest easy. In addition, mainland China has long been an active participant in CRS. Although CARF targets crypto assets, if crypto assets are exchanged for fiat currency and deposited in banks, or held in financial asset forms (such as ETFs), they are already within the monitoring network of CRS. Furthermore, the consultation documents also mention that CARF information will be exchanged with "partner jurisdictions."

Careful readers will notice that Hong Kong is in the second tier of jurisdictions implementing CARF, having already initiated legislative consultations regarding CARF and CRS revisions, and has developed a clear implementation roadmap, planning to complete legislative preparations in 2027 and conduct information exchanges in 2028.

In the context of a "dual-track" regulatory framework for crypto, the impact of CARF's implementation in China also needs to be viewed distinctly:

Crypto users with Hong Kong identities are obligated under the CARF framework to submit self-certification materials to exchanges. Subsequently, their crypto asset transaction data from overseas exchanges will be reported and exchanged with Hong Kong tax authorities through an automatic exchange mechanism. This means increased asset and transaction transparency, making it difficult for users to evade tax obligations based on the decentralized and anonymous characteristics of crypto trading.

At the same time, Hong Kong crypto exchanges, as RCASPs, must strengthen KYC in accordance with CARF requirements and build data collection and reporting systems. Any failure to register, report, conduct due diligence, or submit inaccurate information may trigger legal liabilities, with fines reaching up to one million Hong Kong dollars.

In contrast, the impact of CARF on mainland China is relatively limited in the short term. This is partly due to the mainland's classification of crypto assets as "illegal." However, the trend towards tax transparency in crypto is inevitable, and mainland tax residents cannot be complacent. As Hong Kong connects to the global information exchange network of CARF, it is not ruled out that mainland China may obtain relevant crypto transaction data from Hong Kong through other means or may join CARF in the future.

For mainland investors, the era of relying on Hong Kong as a "safe haven" has ended. Although automatic exchanges may have a time lag of a few years, the "on-demand exchange" channel is open, and data retention rules ensure that historical records can be accessed at any time.

Chapter 7: Survival Guide—Don't Be an Ostrich with Your Head in the Sand

If you ask a Korean oppa what three things in this world are unavoidable: life and death, Samsung, and taxes.

As individuals in the torrent of this era, what should we do?

Pay attention to the tax consequences of "crypto-to-crypto trading": Don't naively think that you won't pay taxes if you don't cash out. From now on, every time you click "buy/sell," there is a possibility of tax implications. (In countries with capital gains tax)

Organize your accounts: Quickly clean up those "zombie accounts" on unknown small exchanges or those registered with messy identities. Either close them or withdraw your crypto. Once the CARF net falls, these accounts will be the first to be targeted for risk control.

Understand cold wallets: Cold wallets are still your last bastion of data, but the bridges in and out have been monitored. When you transfer from Binance to a cold wallet, that operation itself is a record. Although tax authorities cannot see everything in the cold wallet, they know: "This address belongs to Nakamoto, and he transferred 10 Bitcoins into it in 2027."

Pay attention to the timelines of the UAE and Hong Kong: Both the UAE and Hong Kong are in the second batch (2028 exchange) of implementation. This means you have about one to two years of window to adapt and plan. Use this time to learn how to comply or find a professional tax advisor; this is much more practical than searching for the next "tax haven."

Postscript

This article thanks @FinTax_Official for their professional analysis of tax regulations and observations from various jurisdictions, enriching this article with practical operational perspectives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。