Original Author: Castle Labs & Vincent

Translation: LlamaC

(Portfolio: Burning Man 2017, about Tomo: illustrator for the Ethereum Foundation)

"Recommendation: This article mainly explores the positioning of Bitcoin as 'digital gold', comparing its reserve value and liquidity with traditional gold, and discussing Bitcoin's status in the financial system.

From the legend of the Golden Fleece to the mines of South Africa, humanity has been in an endless pursuit of this noble and mysterious treasure.

It seems like captured sunlight, perhaps truly from the depths of the universe, as scientists believe that gold is born from the collision of dying stars, known as supernova explosions. While the vast majority of gold on Earth is locked within the core, the rest is brought to the surface by meteorites.

Throughout human history, gold has been the cornerstone of commercial activity and hard currency.

If all the gold ever mined by humanity were collected, it would form a cube with a side length of about 20 meters, weighing approximately 176,000 tons.

It is indeed perplexing that such immense wealth can fit into a single warehouse. While stocks, artworks, oil, or collectibles require vast geographical space or management resources, gold possesses the unique quality of portability.

Gold has become the ultimate means of value storage because it carries no counterparty risk. It is the only asset that does not belong to someone else's liabilities. J. P. Morgan once said, 'Gold is money; everything else is credit.' Its extremely high stock-to-flow ratio not only ensures scarcity but also protects it from arbitrary fiat currency devaluation. From the ancient Lydian coins to modern central bank reserves, gold has defended its status as a means of value storage for thousands of years, serving as a highly liquid and immutable anchor in times of financial, political, and social turmoil.

However, recently, a new competitor has emerged to vie for the title of 'currency.'

Despite being distinct from traditional precious metals due to its volatility and cryptographic characteristics, cryptocurrencies like Bitcoin are still referred to as 'gold killers.'

Bitcoin is often called digital gold. Can it replace gold in the future? If so, is it advisable to abandon this ancient asset?

This article examines gold and Bitcoin in the context of modern economics, decentralized finance (DeFi), and monetary attributes. We will then conduct a comparative analysis to determine whether these two assets can coexist in a competitive macro environment and analyze current trends to assess whether Bitcoin possesses the attributes of 'digital gold.'

Ultimately, asset diversification will only benefit the global economy. Fiat currency—an asset whose value primarily depends on arbitrary monetary policy—may indeed be replaced by a purer form of currency. Whether it is gold or some yet-to-be-invented new asset, there is potential to escape the inherent devaluation fate of fiat currency, especially given the fatal flaws of fiat currency in our current debt-dependent economic system.

The Historical Legacy of Gold in Finance

For centuries, gold has been the pillar of this system, the only reserve asset. This status is not established by legislation but is reinforced by the physical laws of the universe. As former Federal Reserve Chairman Alan Greenspan famously testified in 1999, 'Gold still represents the ultimate form of payment in the world. In extreme circumstances, no one will accept fiat currency, but gold will always be accepted.'

Gold's widespread acceptance stems from its intrinsic qualities that distinguish it from all other materials. It is these qualities that establish its enduring status as a means of value storage, what Aristotle referred to as sound money:

Durability: Gold is a precious metal that is resistant to most chemical reactions. Unlike silver, it neither oxidizes nor tarnishes, ensuring that its physical properties remain stable over time. This unique chemical characteristic makes it highly reliable in economic reserves and high-tech infrastructure (such as electric vehicles, drones, defense systems, rockets). Additionally, gold does not rust.

Interchangeability: Due to its softness and malleability, gold is easy to shape, cast, and divide. This allows gold to be standardized into interchangeable coins or bars; as long as the weight (traditionally measured in ounces or grams) and purity (most commonly 14k, 18k, and 24k) are the same, one unit of gold is essentially identical to another.

Stability: Gold is a reliable means of value storage. Its scarcity and utility (despite its high cost, it remains the best choice for key industrial applications) allow it to maintain value over time, unlike fiat currency, which is often subject to inflationary erosion. Furthermore, gold's status as the ultimate means of value storage is also due to its lack of counterparty risk.

Portability: As a dense and expensive metal, even a small amount of gold holds significant value. This extremely high value-to-weight ratio makes it easy to transport large amounts of wealth efficiently, unlike silver, artworks, or other bulk commodities. A person can easily carry half a kilogram of gold in their pocket.

Recognizability: Gold's unique physical properties make it relatively easy to verify authenticity. Modern instruments like Sigma can instantly detect fake gold.

Thus, gold is the perfect means of value storage, with one exception. Gold is not a replaceable credit card or a line of code. Transporting gold, even for ordinary citizens holding small bars, is as cumbersome as transporting uranium; if one forgets to fill out the declaration documents, customs officials have the right to seize the gold and confiscate most of it as a fine. It can be stolen, cut, hidden, misappropriated, and so on. Moreover, due to human error, it can also be lost.

The 'Operation Fish' initiated in 1940 is a famous case of this logistical nightmare. As Nazi Germany approached, Britain was forced to secretly transport its £2.5 billion worth of gold to Canada to prevent it from falling into enemy hands, marking the largest physical wealth transfer in history. Today, however, with just a click of a mouse, trillions of dollars can be transferred instantly.

One of the most notorious examples of state plunder is Executive Order 6102, issued by Franklin D. Roosevelt in 1933, which made it illegal for American citizens to hold monetary gold. Unlike passwords or mnemonic phrases, you cannot store gold in your memory; it must be physically held, and once it can be found, it can be stolen. Gold not only yields no return, pays no dividends, but also incurs high storage and insurance costs. Most of the world's gold is stored in vaults in London, Switzerland, Singapore, or Manhattan, like an ancient and forgotten mythological Sphinx, quietly lurking in the dark.

Indeed, because humans are both error-prone and ingenious, they will inevitably come up with a better alternative than that 'relic of the barbaric era.' While gold itself is nearly perfect, the astonishing pace of evolution in our financial system makes it necessary to create a modern alternative. Born out of disappointment with the outdated access mechanisms of traditional finance and the desire to renovate it, Bitcoin was originally invented to combat the existing system. However, it quickly pioneered a powerful new paradigm that far exceeded its original intent: one that could be seen as an equivalent to digital gold!

The Emergence of Cryptocurrency

In 2008, during the global financial crisis, Satoshi Nakamoto published a white paper titled 'Bitcoin: A Peer-to-Peer Electronic Cash System.' This paper proposed a solution to the double-spending problem without the need for a centralized trust institution.

If gold is inherently currency, then Bitcoin is a currency created through computer engineering. It is scarce, difficult to mine, has a limited total supply, and is indestructible. The invention of blockchain triggered a 'Cambrian explosion' of various digital assets, some of which are intriguing, while others are worthless.

While Bitcoin quickly established its status as 'digital gold' due to its fixed supply of 21 million coins, other tokens have emerged to fill different economic niches.

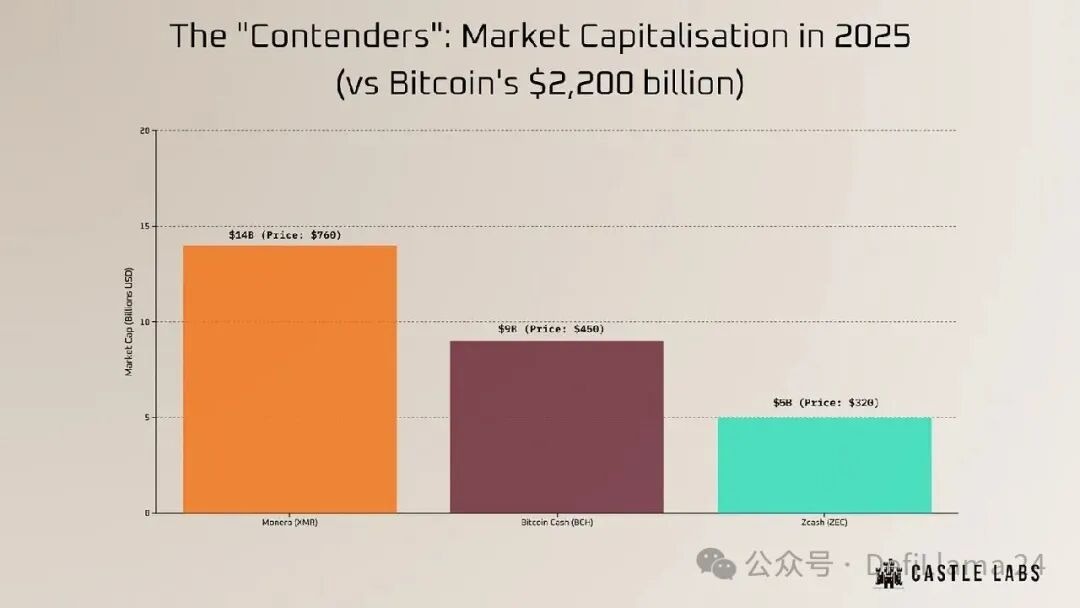

In 2011, Litecoin positioned itself as 'Bitcoin's silver,' promoting its faster and lower-cost transaction features. Four years later, in 2015, Ethereum introduced the concept of a world computer, replacing gold's passive value storage function with active, programmable smart contracts. Today, it has become the second-largest cryptocurrency by market capitalization, and despite its disappointing price performance, its status remains unshakable. Privacy tokens like Monero (XMR) and Zcash (ZEC) attempt to replicate the anonymity of physical cash and gold, a characteristic lacking in Bitcoin's public ledger. This year, driven by the narrative of privacy, they surged while traditional tokens collapsed.

As altcoins, mainstream coins, and Bitcoin all fell, ZEC and subsequently Monero began to rise, costing many bears dearly. However, the total market capitalization of these tokens remains insignificant, insufficient to pose a serious challenge to Bitcoin.

Finally, high-performance blockchains like Solana or MegaETH sacrifice decentralization for speed, aiming to achieve transaction processing speeds akin to Nasdaq, no longer satisfied with traditional wire transfer speeds (internet capital markets). While they have successfully attracted entrepreneurs, investment institutions, and banks, the current L1/L2 landscape has become so vast that it is difficult to assert which one will survive in the long run. The core narrative of the 2010s was not coexistence but mutual annihilation, as each new trend erased the old.

The industry's fervent desire to erase precious metals was perfectly exemplified in Grayscale's controversial 2019 'Drop Gold' advertising campaign. This campaign depicted gold investors as weary suit-clad individuals dragging heavy stones (shiny rocks), while trendy millennials rushed past them carrying digital wealth.

Gold is heavy, tangible, and primitive, while cryptocurrency is lightweight, digital, and in short, the currency of the future. However, when Bitcoin largely still belongs to a niche geek asset, promoting the idea that 'gold is dead' is likely just a cheap and poorly considered marketing gimmick, but after the outbreak of the COVID-19 pandemic, the public blindly followed this notion. While Grayscale took some time to clear its name, the next Bitcoin cycle gave them reason.

This newfound appetite for risk assets indicates that scarcity can be designed, not just mined.

It is currently unclear whether this artificial, human-designed commodity is meant to replace physical assets in the eyes of sovereign nations, but the performance in the 2020s suggests that investors have come to believe it.

The Maturation Period of Bitcoin

From 2010 to 2025, Bitcoin emerged from the mysterious circles of cypherpunks to become a hot topic in Wall Street offices, transforming from a worthless novelty asset into a trillion-dollar behemoth. These fifteen years were not smooth sailing, but every time Bitcoin crashed, it ultimately managed to resurrect and set new historical highs.

The media has been deeply skeptical, declaring Bitcoin "dead" approximately 450 times. Therefore, this narrative arc is anything but straightforward. The story began with the retail frenzy in 2017, when some even sold their homes to invest more. At that time, driven by retail enthusiasm, ICO speculation, and perhaps a general reckless mindset, Bitcoin skyrocketed from under $1,000 to nearly $20,000. However, it eventually crashed later that year, dragging down the entire cryptocurrency market (which at the time indeed seemed like it was completely over). The macro hedging era of 2020, propelled by legendary figures like Paul Tudor Jones and Michael Saylor, reactivated this controversial asset. Bitcoin found the advocates it needed and became a macro asset capable of challenging gold. The real breakthrough occurred in January 2024 when the U.S. Securities and Exchange Commission (SEC) approved a Bitcoin spot ETF.

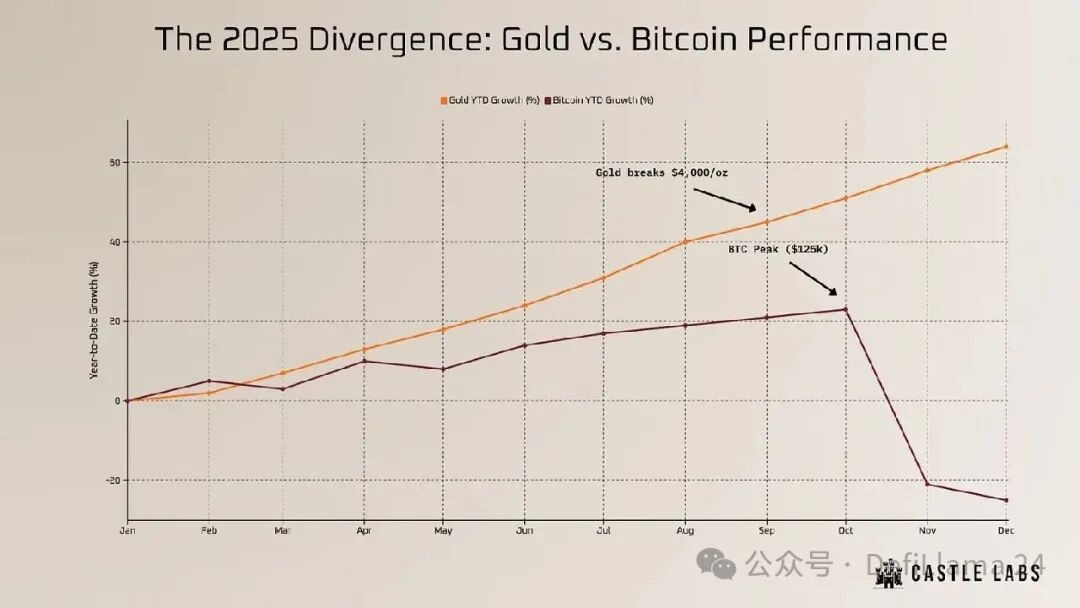

In just 15 years, Bitcoin evolved from a libertarian internet token into an ETF (exchange-traded fund) capable of stirring billions of dollars in regulated funds. BlackRock, Fidelity, and VanEck ultimately became the advocates for Bitcoin; those who once huddled in basements as geeks may now be billionaires, and their past anti-capitalist ideologies may have been cast aside in favor of buying one or two yachts. Institutional acceptance propelled Bitcoin to break through the psychological barrier of $100,000 in December 2024 and ultimately reach a frenzied peak of $125,000 in October 2025. At that moment, the supercycle theory seemed irrefutable. The U.S. had even explored strategic Bitcoin reserves, which thrilled cryptocurrency traders.

However, by October, a pricing glitch in Binance's USDe led to the collapse of all leveraged long positions. Although the market began to rebound shortly thereafter, the previous price wicks were ultimately filled, and Bitcoin entered a slow downward trend, sliding toward a possible critical point; whispers began circulating about a drop to $67,000. The cycle that was supposed to be endless suddenly presented a starkly different picture by the end of 2025.

While Bitcoin set new highs, the rest of the market, including blue-chip projects like Aave, Ethereum, Solana, and Ethena, never regained their vitality. Bitcoin stood undefeated once again, yet its relative strength did not translate into broad market support. This divergence reinforced Bitcoin's status: it is not only a novel asset but also a reliable and enduring one. Through absolute scarcity, especially its first-mover advantage, it successfully replicated the monetary premium of precious metals. Unlike fiat currencies, which can be endlessly devalued, Bitcoin offers a decentralized beacon with durability, divisibility, and instant portability. Despite its high volatility due to its immaturity, it has effectively digitized the inherent qualities of gold and achieved complete monopoly among similar assets.

By November 2025, a brutal correction caused Bitcoin to retreat to $80,000, dragging the rest of the market down with it. What frustrated everyone was that stocks, gold, silver, collectibles, and all assets in between were experiencing parabolic rises. This time, had cryptocurrency, especially parts other than Bitcoin, truly come to an end?

Did we trade a promise of real currency for an ETF code and a farce of price manipulation? Was the narrative of institutions arriving merely a marketing gimmick? An asset that is regulated, taxed, and closely monitored now seems even duller than gold, unable to keep pace with the market.

Gold prices soared parabolically, silver prices followed closely, and even copper—this cheap metal used in electronics and weapon manufacturing—had seen its price spiral out of control.

Has gold always been the only sound currency?

The Triumph of Gold in 2025

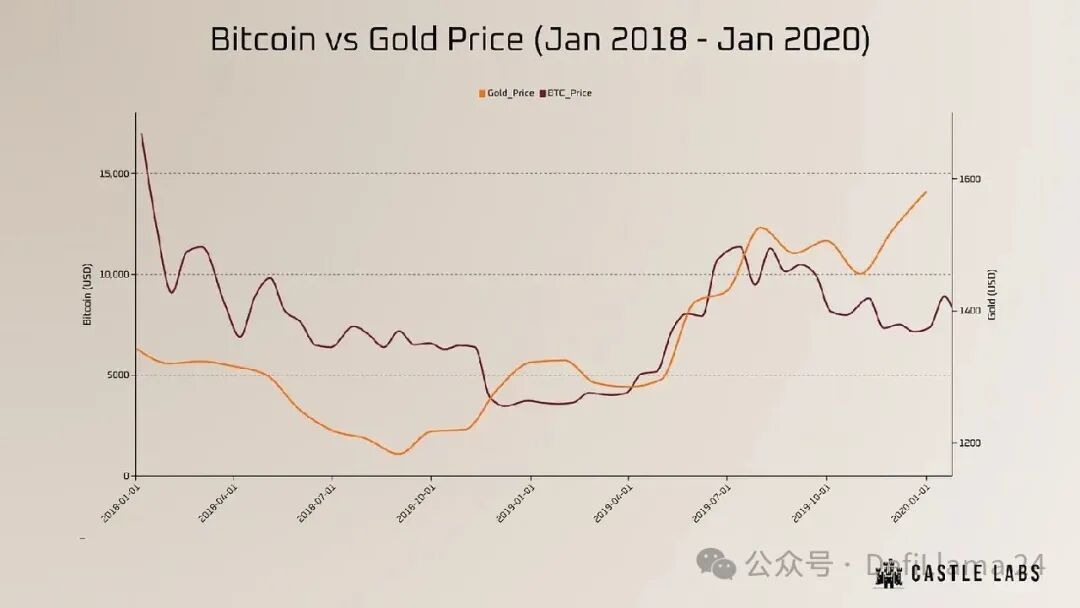

Although Bitcoin meets the standards of sound money, recent developments indicate that it has yet to exhibit the characteristics of digital gold.

In 2025, as a hedge against inflation, geopolitical turmoil, and war, and most importantly as an excellent investment, gold outperformed Bitcoin.

The global gold rush was characterized by massive accumulation of official reserves, with the aggressive purchases by the National Bank of Poland, along with the ongoing buying by the Reserve Bank of India, Turkey, and China leading this trend, and Brazil joining in at the end of the year for asset diversification. Although central banks shifted their gold strategy focus from the West to the East, China and India still had the highest demand for jewelry and physical gold bars, followed by the U.S., Turkey, and Iran, where citizens preferred gold as a hedge against their local currency devaluation and economic instability.

In 2025 alone, the currencies of Turkey, Argentina, and Iran fell to historic lows. If you think this round of market activity has ended, the institutional attitude has shifted from "gold is dead" to "gold will rise to $5,000." VanEck has now stated that ongoing geopolitical turmoil, fiscal instability, and inflation could drive gold prices to $5,000 per ounce by 2030, and undervalued gold mining stocks will inevitably see explosive growth as a result. Wall Street giant JPMorgan predicts that driven by a non-temporary structural shift, the average gold price will reach $5,055 per ounce by the end of 2026.

The bank pointed out two main reasons driving this increase:

First, central banks are accelerating their gold purchases (continuing the trend of 2025) to diversify assets and reduce dependence on the dollar;

Second, the Federal Reserve's interest rate cuts are causing a wave of capital backflow into Western ETFs.

Gold is actively traded as an inflation hedge against currency devaluation, once again proving that ancient customs may stem from wisdom. Gold indeed serves as a way to bet on fear. For cryptocurrencies, the tightening of global regulatory constraints is becoming increasingly evident, from the comprehensive implementation of the EU's Markets in Crypto-Assets Regulation (MiCA) to the U.S. Treasury's aggressive crackdown on privacy coins and non-compliant stablecoins. Ultimately, the illusion has shattered.

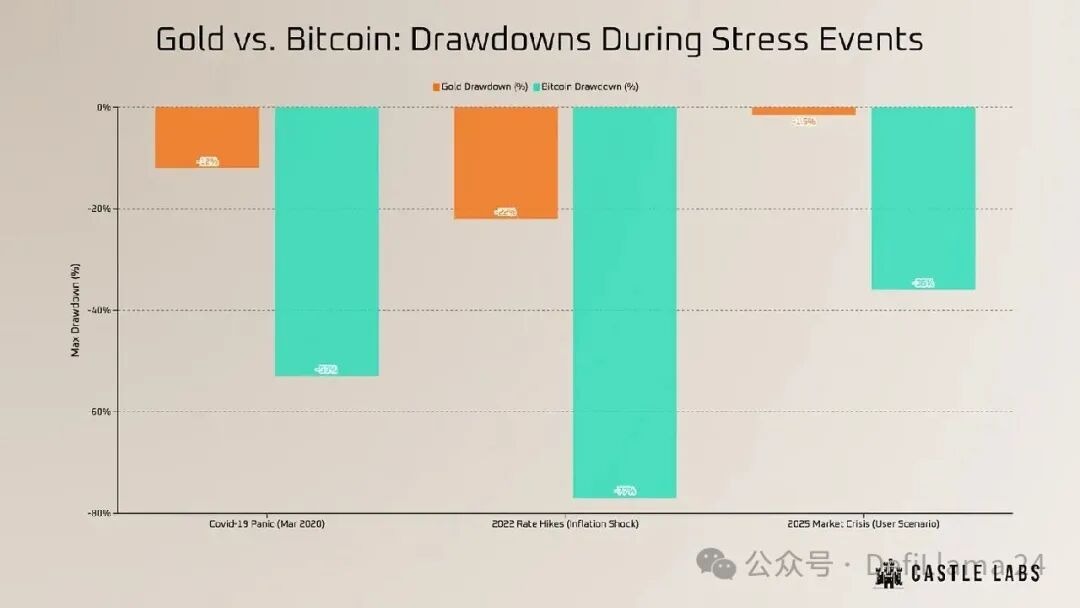

As we are still in a turbulent transitional period, assessing the current situation is quite difficult. One can cynically argue that Bitcoin's test as "digital gold" has been declared a failure, and we are merely returning to the mean. After a long experiment, in the eyes of public and private institutions, Bitcoin has not passed the test of "sound money." Although these institutions hold a positive view of the concept of "digital gold," they ultimately lean towards returning to a familiar, reliable asset that is heavily held by central banks.

For risk-averse investors, the relatively stable price of traditional gold may be another advantage over Bitcoin; although precious metal prices also fluctuate with global economic conditions, they rarely experience crashes. Part of the reason is that influencing the price of such a large asset is not easy, even for institutions with enough capital to leverage the precious metals market through derivatives. Moreover, most of gold's market value is dormant (such as in jewelry, central bank vaults, and private hoards) and does not circulate in the market.

In contrast, Bitcoin is naturally leveraged by retail and institutional investors to capture intraday volatility. Indeed, it is much easier to influence an asset whose direction is determined by dynamic liquidity than to manipulate a commodity that presents inert physical forms. Although investors believe in the anti-inflation narrative, Bitcoin behaves like an immature asset characterized by high volatility and unpredictable price swings. The expected performance of a reserve asset does not align with Bitcoin's actual performance. The panic surrounding the de-pegging of various stablecoins reminds us: if you cannot physically hold it, you do not truly own it.

On one hand, gold is the ultimate physical asset; on the other hand, it is difficult to store.

It would be overly hasty to outright deny Bitcoin, but to solely regard gold as the only sound currency in the digital age would be shortsighted.

Currently, the bulls have returned to rest, while the "baby boomer generation" has taken all the profits. It can be said that no one could have predicted that after 15 years of maturation and fervent popularity, Bitcoin would not exhibit the attributes expected of a reserve asset. Meanwhile, a titan that has dominated our imagination, senses, and desires for thousands of years is destined to awaken from its slumber one day.

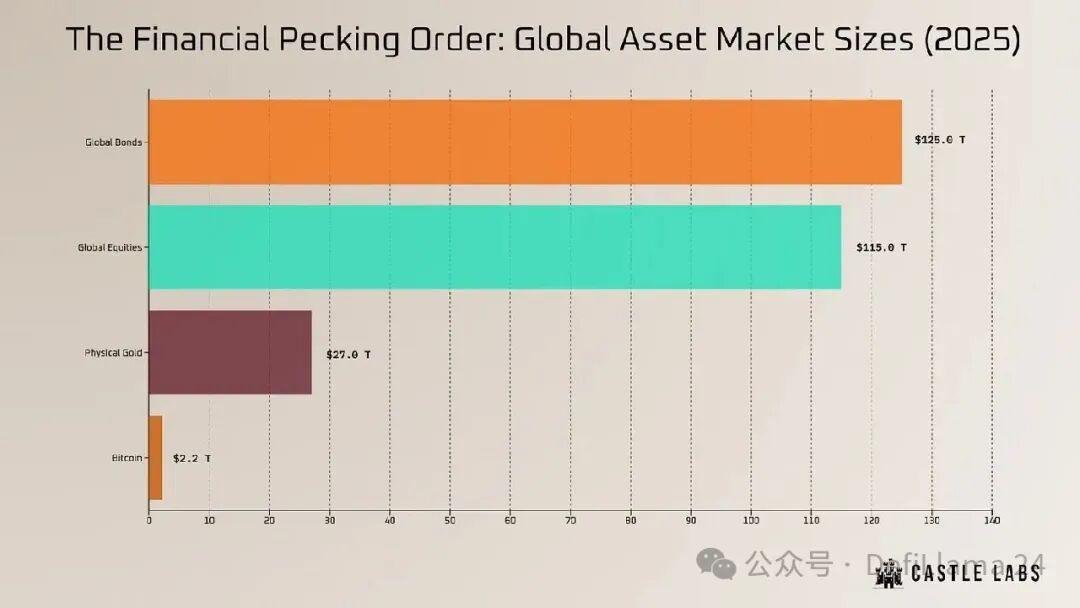

Deposing Bitcoin: A Daunting Task

The idea that privacy tokens or Bitcoin forks could replace gold as the global means of value storage resurfaced at the end of 2025, but the data reveals a different reality: while gold has a market capitalization of about $32 trillion, the combined market cap of Monero (XMR) and Zcash (ZEC) struggles to break through the $20 billion ceiling—an amount that is merely a tiny fluctuation in Nvidia's stock price on its hourly chart.

In the fourth quarter of 2025, Zcash briefly attracted the attention of the crypto Twitter (CT) community, not for its sound money attributes, but due to a narrative shift: amid a wave of cleansing against privacy assets on compliant exchanges, Zcash successfully survived under the EU's MiCA framework and the U.S. GENIUS Act due to its auditable characteristics. Moreover, the founders of Solana launched a marketing campaign that sparked a certain degree of spontaneous ZEC buying frenzy.

When comparing ZEC's vitality to gold, silver, stocks, or private equity, such price movements are hard to characterize as sound money; rather, they seem to fall into the category of "pump-and-dump." Conversely, privacy coins became regulatory contraband in 2025. They catered to the niche market demand of short-lived narratives but may prove insignificant in the current cycle of boom and bust. Even if fears of surveillance and potential aversion to state intrusion trigger sporadic rebounds, these tokens cannot attract the sustained institutional capital that cryptocurrencies are currently trying to absorb.

Ironically, tokens designed to circumvent institutions may only survive by relying on the funds held by these institutions, but long-term survival comes at the cost of transparency. It is unimaginable for funds and banks to support an asset that aims to bypass them. These alternatives completely fail the test of sound money: Bitcoin Cash lost its narrative status as a "store of value" years ago; it is a payment network that has been more or less forgotten by both institutions and retail investors. With the rise of stablecoins, Bitcoin Cash has become irrelevant, replaced by those well-capitalized tokens specifically designed for payments.

Having undergone two forks and lacking community attention, Bitcoin Cash appears insignificant in the face of Bitcoin. The value of Zcash lies in its confidentiality. No sovereign nation can build reserves on assets that global regulatory bodies attempt to stifle or that are highly susceptible to emotional fluctuations. This token is a tool for private transactions, not for public treasuries, as it lacks the liquidity and stability necessary to replace the $32 trillion gold market.

Although Zcash also has a cap of 21 million tokens, it still lives in the shadow of Bitcoin despite this enticing and familiar characteristic. Monero is an alternative to Zcash, but Monero's privacy is mandatory. In terms of scarcity, the number of newly minted XMR is fixed (0.6 per block), while the total supply continues to increase, leading to a declining inflation rate that approaches 0% but never fully reaches it.

At least in this attribute, Monero resembles physical gold more than Bitcoin, as it has a stable and low annual inflation rate, similar to gold (miners extract new gold). However, XMR cannot replace gold as a reserve asset because it lacks auditability. Its ledger is opaque, and without revealing private keys or compromising the privacy features on which the token relies, it cannot prove reserves to the public. In contrast, central banks require public trust and transparency regarding their reserves, even though the actual accountability of U.S. and Chinese currency reserves remains contentious.

From the analysis above, we can conclude that, structurally speaking, only Bitcoin can theoretically replace gold. It has withstood the test of sound money, is well-capitalized, and has gained widespread recognition at both institutional and individual levels.

Despite facing ongoing competition, it has clearly established itself as the core of cryptocurrency. It is the only digital asset recognized legally by the U.S. government: in March 2025, the U.S. issued an executive order designating over 200,000 confiscated BTC as national assets rather than auctioning them off, thereby establishing a Bitcoin Strategic Reserve (SBR).

This grants Bitcoin legal legitimacy, and other countries like El Salvador (approximately 6,000 BTC) and Bhutan (which mined about 13,000 BTC through hydropower) have also established SBRs that are more or less officially recognized. Currently, no asset enjoys the support of governments worldwide like Bitcoin does. However, replacing gold remains an unrealistic fervent dream, not only because of Bitcoin's extreme volatility (in 2025, Bitcoin's annualized volatility hovered around 45%, three times that of gold's 15%) but also because its current market capitalization pales in comparison to gold and silver. Sovereign nations require deep liquidity and substantial buffers to support their monetary policies; unless Bitcoin resumes growth and reaches $1 million per coin, it will never possess the dominance of gold.

A Win-Win Situation?

For fifteen years, the most intense debate has revolved around the conflict between massive precious metals and ambitious digital assets. The battle between gold and Bitcoin. A series of events in 2025 temporarily set this debate aside: gold remains true money, while Bitcoin is still a risk asset. If Bitcoin's volatility, at historical highs, has not plummeted to a level that warrants caution, then without exception, the entire ecosystem has suffered significant losses. Gold reaffirmed its status as the "king of wealth" with thousands of years of history. It is a national asset, the ultimate insurance that requires no electricity, no internet, and no permission to use.

Through Poland, China, and Brazil's massive purchases of gold, completely ignoring Bitcoin, we can see that during turbulent times, gold remains the most sought-after commodity. Bitcoin, on the other hand, has matured into an asset with a high beta coefficient that seemingly possesses institutional authority.

First and foremost, this asset is suitable for traders who profit from its extreme bidirectional volatility. Its high volatility, high portability, and high liquidity allow capital to achieve cross-border "instant transmission" in seconds, bypassing the outdated tracks of traditional banks. Although Bitcoin's image as a cutting-edge asset has diminished, gold's outstanding reputation has become increasingly solid: it is undoubtedly the winner of the past year. The daunting task of replacing gold has always been a false marketing gimmick. What the entire financial system needs now is coexistence of both, especially considering that Bitcoin has given rise to a trillion-dollar industry reliant on its steady development.

Nevertheless, cryptocurrencies remain the explosive assets we relentlessly pursue. In the turbulent years ahead, cautious investors will not make an either-or choice between gold and code, as the two cannot be conflated. If gold is the guarantee of generational wealth that builds family legacies and empires, then Bitcoin is the quirky pet asset; it is elusive, sometimes appears insane, yet possesses a mesmerizing charm. Whether it can transform into the reserve asset we long for will only be revealed through more stress tests and years of trial and error.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。