Original: 《Internet Capital Markets - From the Trenches to Wall Street》

Translation: Ken, Chaincatcher

"Internet Capital Markets" (ICM) is one of the hottest buzzwords of the past year. But what does it actually refer to? People often lump everything into this broad concept—ranging from Pumpfun to Sonar to xStocks, and sometimes even including stablecoin payments, new banks, and lending protocols! This confuses fundamentally different financial instruments, each with its own value capture logic and ownership structure.

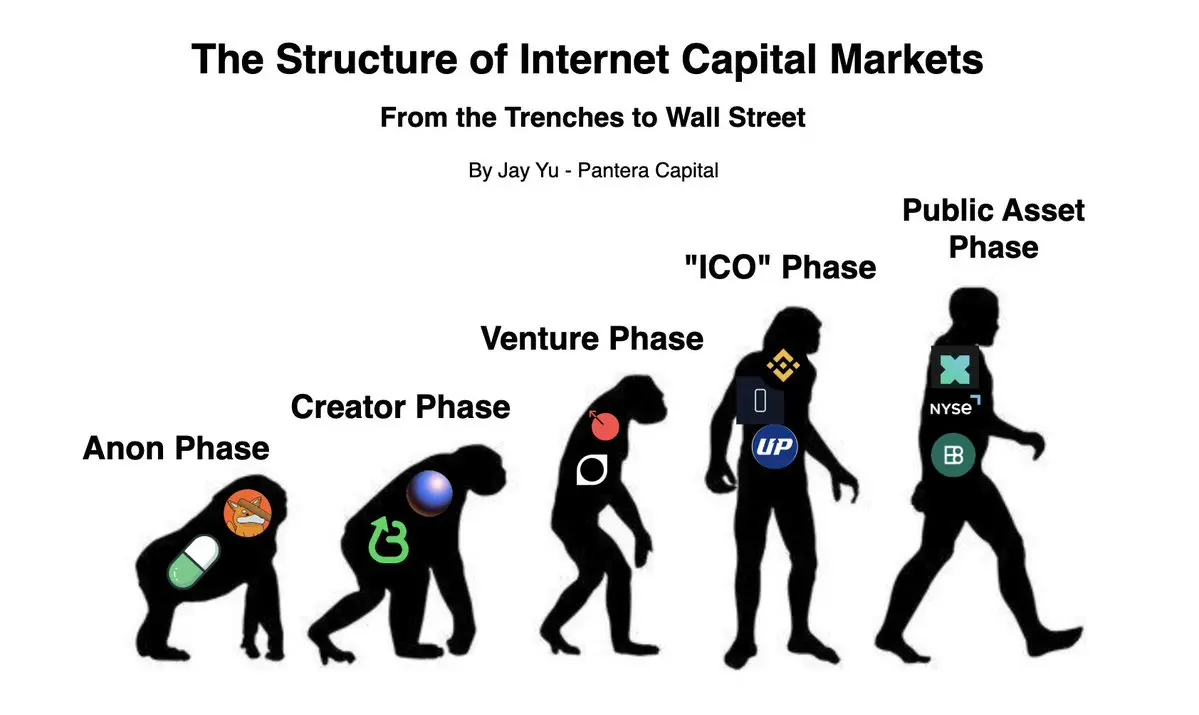

In my view, "Internet Capital Markets" is another way of saying "financing through tokens"—regardless of whether the financing target is a meme coin or tokenized stock. I suggest categorizing the ICM asset class in a "lifecycle" manner based on the following points:

How mature is the tokenized project?

What type of underlying asset is the financing activity backing (attention, reputation, product, revenue, or governance rights)?

How does value flow and accumulate between the platform and the asset itself?

1 - Lifecycle of ICM Platforms

The allure of public chains lies in the fact that anyone can issue tokens, regardless of project maturity. As a result, various issuance and tokenization platforms have emerged to meet the needs of projects at different stages. I believe ICM projects can generally be divided into the following five maturity stages:

Stage One - Anonymous Stage

Representative Platforms: Pumpfun, Bonk Launchpad

Representative Assets: Fartcoin, WIF, MOODENG

At this stage, most tokens issued are purely meme coins. Tokens issued on Pumpfun or Bonk typically lack any strong "fundamentals" or "team" backing. The pricing of tokens at this stage is entirely driven by the zeitgeist, financial engineering, and the "animal spirits" in the attention market.

Stage Two - Creator Stage

Representative Platforms: Zora, Believe App

Representative Assets: JESSE, BALAJI, PASTERNAK

In the creator stage, there are usually well-known creators or teams supporting the tokens, which can be seen as a financialized form of the creator's (or claimed creator's) "attention" or "reputation." For example, on Zora, the top two tokens, JESSE and BALAJI, are associated with real-world individuals. However, unlike early-stage venture capital (which has both project concepts and founding teams), these "creator stage" token issuance platforms typically do not have specific fundraising project entities. In this sense, tokens in the creator stage are more like the "real-name" versions of Pumpfun-style tokens.

Stage Three - Venture Capital Stage

Representative Platforms: MetaDAO, StreetApp

Representative Assets: Avici, Umbra, Kled

In the venture capital stage, these tokens no longer resemble "meme coins" but are closer to traditional venture capital fundraising mechanisms. Projects on MetaDAO and Street (such as Avici, Umbra, and Kled) are qualitatively similar to the projects that blue-chip VCs typically support from seed to Series A rounds. They have established teams, roadmaps, viable product proposals, and potential governance rights. The real tension and issue here gradually evolve into how to balance the relationship between equity holders (and traditional venture capital) and token issuance—while token issuance expands capital access, it cannot provide the same legal protections and governance oversight.

Stage Four - "ICO" Stage

Representative Platforms: Binance, Upbit, Sonar

Representative Assets: MegaETH, Plasma, Octra

The fourth stage is the "ICO" stage, where projects typically gain significant market traction, achieve venture-scale financing, and may have stable revenue sources. Similar to an "IPO," token issuance at this stage represents the launch of a more mature, stable product that has demonstrated certain market performance. Centralized exchanges like Binance, Coinbase, and Upbit, as well as specialized ICO platforms like Sonar, typically operate at this stage. At this stage, the tension between tokens and equity becomes more apparent—existing venture capital often gains token rights, but tokens may only have specific revenue streams, IP, or governance rights of contracts, rather than equity, leading to a disconnection in asset ownership, and tokens are often viewed as "second-class citizens" compared to equity.

Stage Five - Public Asset Stage

Representative Platforms: xStocks, NYSE Tokenized Securities

Representative Assets: xNVIDIA, BENJI, PAXG

The final stage is the public asset stage, which is the tokenization of existing financial instruments. Discussions about RWA are numerous and will not be elaborated here. The core logic is that "tokenized" assets (such as xNVIDIA, BENJI, PAXG) are "mirrors" of existing "real" financial instruments, with the tokenized versions expanding access for on-chain audiences, while the "real" assets retain all governance rights and legal entitlements.

2 - Where Does Value Accumulate in Internet Capital Markets?

After analyzing the platforms and assets at various "stages" of the Internet Capital Markets, a natural question arises—where does value actually accumulate? My working hypothesis is that this largely depends on the stage of the market—the earlier the stage, the more value tends to belong to the platform; the later the stage, the more value tends to belong to the asset.

In the early stages (first and second stages), I believe value flows to the platform itself—such as Pumpfun or Zora. This is because the token assets themselves lack any fundamental support, and their viral spread has a certain randomness. The rules of the game in the early stages revolve around the frequency and massive scale of project issuance on the platform. Pumpfun has generated over $800 million in revenue through its trading fees and "graduation fees," thanks to the large number of tokens issued on its platform.

However, in the later stages of the Internet Capital Markets lifecycle (third stage and beyond), I believe that holding the actual assets themselves (such as Avici, Kled, MegaETH, xNVIDIA) may capture more value than holding the underlying tokenized platform. In these later stages, projects typically have "fundamentals," with clear roadmaps, products, and potential monetization paths, and holding the assets (rather than platform tokens) can capture these upside gains. In this case, the issuing platform is merely an access medium, and in the "ICO" and "public asset" stages, it is often not the only way to gain exposure to the asset. Moreover, the better the fundamentals of the asset, the stronger the bargaining power against the issuing platform. For example, the groundbreaking crowdsourced AI data market project Kled initially launched on Believe but migrated to Street after experiencing token disputes, which confirms this point.

However, centralized exchanges (CEX) are exceptions to this rule, as they are typically highly profitable businesses. However, for major CEXs like Binance and Coinbase, their business moat lies not just in listing tokens, but more importantly in the liquidity and trading volume of specific assets. It can be said that their moat is having a large potential user base to trade your tokens (thus earning transaction fees), rather than just the token listing process itself.

3 - What’s Next for ICM Projects?

Over the past year, I believe that innovations in the ICM space have generally presented a "dumbbell" structure. On one end are Launchpads like Pumpfun industrially mass-producing tokens and driving trading volume on chains like Solana; on the other end are banks and other traditional financial institutions tokenizing traditional assets (from money market instruments to stocks to commodities) to leverage the access advantages of global liquidity.

However, I find it more interesting to observe how these two phenomena converge in the middle ground of the ICM lifecycle—namely, the third and fourth stages (venture capital and ICO stages). Currently, through mechanisms like Street's ERC-S and MetaDAO's ownership tokens based on Futarchy, we have seen how token financing expands upside exposure to venture-stage projects (such as Umbra, Avici, Kled) and potentially captures the value of projects with socially productive use cases.

Certainly, how this "venture-capital-ownership-token" relationship will evolve in the long term remains uncertain, depending on multiple legal, economic, and governance uncertainties. For example, I personally remain unconvinced that Futarchy is a necessary or scalable solution for the governance of "ownership token" projects, and the SPV structure used by Street for ERC-S still has an experimental nature legally. If given a choice, for regulatory peace of mind, I might still prefer to hold equity. However, I believe the trend indicates that tokens will increasingly be tied to productive venture capital, helping to create companies with real-world value. As this process advances, they may ultimately help the Internet Capital Markets realize the Silicon Valley adage—"to make the world a better place."

Disclaimer: The information presented in this article represents the personal views of Jay Yu and does not reflect the views of Pantera Capital or any other individual or entity. The information provided is believed to come from reliable sources, but no responsibility is assumed for any inaccuracies. This article is for reference only and should not be considered investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。