Author: Chen Xiaomeng

The era of DeFi, which once shouted for financial equality, has actually come to an end.

A few years ago, we were still complaining that the Gas fees on the Ethereum mainnet, which were in the tens of dollars, blocked the way for retail investors. Now, Layer 2 has become ghost chains, and even after the mainnet upgrade, Gas fees have dropped to a level that is almost negligible.

The barriers are gone, and we thought it would usher in a carnival for retail investors, but instead, it has turned into a silent mass retreat.

Why? Because everyone has finally come to their senses:

In this market, we have the mindset of selling drugs, but we can only earn money as if we were selling flour.

1. The Low Gas Trap: From Noble Chains to Assembly Lines

When Gas was expensive, it at least helped filter out some low-quality interactions, forcing you to think carefully about every operation. Now that Gas is cheap, DeFi has turned into a massive electronic assembly line.

When Gas was expensive, it at least helped filter out some low-quality interactions, forcing you to think carefully about every operation. Now that Gas is cheap, DeFi has turned into a massive electronic assembly line.

Because the cost of interaction is low, project teams assume you should engage in massive interactions. Thus, for that little bit of potential airdrop expectation, retail investors are forced to become skilled workers on the chain: cross-chain, Swap, stake, form LP… repeating mechanically hundreds of times a day.

But this has not led to higher returns. On the contrary, low Gas has become a tool for project teams to infinitely inflate activity data.

This is on-chain labor.

2. The Capricious Dictator: Code is No Longer Law

“Code is Law” was once the most charming narrative of DeFi. However, the current DeFi protocols not only have backdoors in their code, but the words of the project teams are also a sickle that can fall at any time.

This is the most detested pain point for retail investors—uncertainty of rules.

Current project teams have long learned how to act unethically. They have invented an unredeemable "points system," like a carrot dangling in front of a donkey, enticing you to continuously invest time and money. When you have worked hard for half a year to accumulate points, eagerly waiting for redemption, the project team suddenly issues an announcement:

“To ensure community fairness, we will severely crack down on witch attacks.”

“Our VE model is going to be modified.”

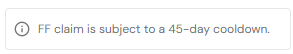

“For the development of the community, we have added a 45-day cooling-off period.”

Yesterday, you were their early supporter, and today, just because your IP address changed slightly, or your funds were held for one day less, you are labeled a witch. The interpretation of the rules is entirely in the hands of the project team; they can change them as they wish.

This feeling is like going to work, where the boss originally promised daily pay. After you finish the work, the boss suddenly says, “For the long-term development of the company, the salary will be withheld for now, and we will see how you perform next year.”

This feeling is like going to work, where the boss originally promised daily pay. After you finish the work, the boss suddenly says, “For the long-term development of the company, the salary will be withheld for now, and we will see how you perform next year.”

In traditional business, this is called fraud; in DeFi, it is called DAO governance.

3. The Prisoner of Locked Assets: Capital Hunting Under High APY

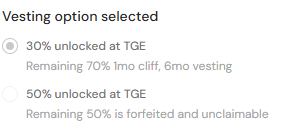

To maintain token prices, current DeFi protocols are extremely keen on getting users to lock their assets. Various Ve models are emerging, often locking assets for one, two, or even four years.

To maintain token prices, current DeFi protocols are extremely keen on getting users to lock their assets. Various Ve models are emerging, often locking assets for one, two, or even four years.

Project teams will lure you with extremely attractive APYs. It seems the returns are high, but the ending has long been written:

Liquidity depletion: Your principal is locked up, unable to move.

Big players running away: The tokens held by project teams, early investors, and whales often have special release rhythms, or they can lock in profits through off-market hedging.

Token price dropping to zero: When you can unlock, you will find that although you earned a 50% return in token terms, the token price has already dropped by 90%.

The essence of locking assets is that retail investors use their liquidity to provide an exit for whales. You are enamored with that little interest, while they are eyeing your principal.

4. Extreme Mismatch of Risk and Reward

Let’s do a very realistic calculation.

Currently, in DeFi protocols, excluding those sketchy projects that could run away at any time, the stablecoin yields of mainstream top protocols are only maintained between 5% - 10%. This seems higher than banks, but what are the risks behind it?

Smart contract vulnerabilities: Hackers can empty the pool at any time.

Front-end hijacking: Phishing websites are hard to guard against.

Decoupling risk: Algorithmic stablecoins or cross-chain bridge assets can drop to zero in an instant.

Project team rug pulls: Even projects with hundreds of millions in TVL can run away overnight.

Holding a 5% return while bearing a 100% risk of losing your principal. This is a typical case of high risk with low reward. This yield doesn’t even cover the mental distress you experience while operating. In comparison, simply buying and holding Bitcoin, or even putting it in a centralized exchange for investment, offers far better value than messing around on-chain.

Conclusion: Refuse to Be On-Chain Fuel

DeFi's innovation has stagnated, but the harvesting methods have evolved.

At this stage, for most retail investors with a capital of less than $100,000, DeFi has lost its golden attributes. It is no longer a wilderness full of opportunities but a playground meticulously designed by whales and unscrupulous project teams.

Every button here, every rule, every suggestion to lock assets is enticing you to give up your tokens.

So, perhaps the best strategy now is just one: acknowledge that DeFi is indeed not working anymore. Stop those meaningless interactions, stop locking assets for meager returns. Protect your principal, convert it into truly valuable core assets, and then watch this battle between whales with a cold eye.

Don’t be an on-chain laborer anymore; your time and principal deserve a better place.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。