Author: Jianwei Zhizhu Zatan

Recently, I was recommended several small metals, and looking back, I can only say they are indeed appealing. We should not conduct research only after being trapped, but rather do our research beforehand. Therefore, I am starting a new series on metal mineral research to examine the patterns of various small metals.

Sometimes I find short essays quite interesting. For example, a few days ago, it was mentioned that the import of explosives in Wa State, Myanmar, had increased, and shortly after, tin prices dropped a bit, indicating a potential supply logic.

【Reminder: The fundamentals are just fundamentals and should not guide trading.】

The so-called small metals are not necessarily small, especially in the context of industrial transformation. Once there is a technological breakthrough, small metals can easily become strategic metals.

For instance, before lithium became known as an "energy metal," its market size was not large, mainly used in glass ceramics, lubricants, and other fields. However, with the explosive growth of the new energy vehicle and energy storage industries, lithium, as a core material for power batteries, has seen a dramatic increase in demand and market size, fundamentally changing its status.

Magnesium is currently a clear potential candidate for the next futures variety among small metals. The global market size for magnesium is about one million tons, mainly used in aluminum alloy additives, die-cast parts, and other fields. In the future, if magnesium undergoes significant changes in lightweight materials (such as automotive and aerospace) or batteries, leading to an exponential increase in its production and consumption, it could very well upgrade to a base metal or an independent category.

I vividly remember a segment from a previous dialogue between Huaxia and Everbright regarding the color market:

"Strategic small metals, such as rare earths, tungsten, molybdenum, cobalt, nickel, and tin, will continue to be re-evaluated in value in the future. The core logic is the backdrop of global competition. Even if the Sino-U.S. competition slows down temporarily, in the long run, the competitive attributes of strategic metals will only strengthen. These metals must meet two conditions: either they are highly scarce or their supply chains are concentrated.

For example, cobalt, where the Democratic Republic of the Congo is the main supplying country, treats cobalt supply as an important bargaining chip, with strong political factors in pricing; similarly, Indonesia's nickel and tin, where global dependence on Indonesia is very high, and its scarcity is prominent, could likely become core varieties in the next round of competition. These varieties are either at the bottom or their value has not been fully realized, leaving significant room for future re-evaluation."

This year, the non-ferrous metals market has been strong, and aside from macro reasons related to funding, a significant reason is the tremendous challenge to global supply chain security (especially regarding resource and mineral security).

As early as 2016, China clarified its strategic mineral layout through top-level design: The State Council issued the "National Mineral Resource Planning (2016-2020)," with the core principle of "ensuring national economic security, national defense security, and the development needs of strategic emerging industries," officially including 24 minerals such as chromium, aluminum, nickel, tungsten, tin, antimony, cobalt, lithium, rare earths, zirconium, crystalline graphite, oil, natural gas, shale gas, coal, coalbed methane, uranium, gold, iron, molybdenum, copper, phosphorus, potassium salts, and fluorite in the strategic mineral catalog, which includes several core strategic metals, laying a solid resource guarantee foundation for the high-quality development of related industries.

China has "resource endowment + capacity advantage" in the fields of tungsten, antimony, tin, and molybdenum. Tungsten, antimony, tin, and molybdenum are China's four strategically advantageous minerals. Let's take a look at the supply of these four types of minerals.

- Tin Supply Source Types

The main source of tin supply is cassiterite (SnO₂, tin oxide), which is the primary form of tin found in nature, accounting for over 95% of global tin ore resources. There are also small amounts of stannite (Cu₂FeSnS₄) and other sulfide ores, but their economic value is relatively low. Cassiterite is processed to obtain tin concentrate, which is then refined through pyrometallurgical or hydrometallurgical methods to produce refined tin.

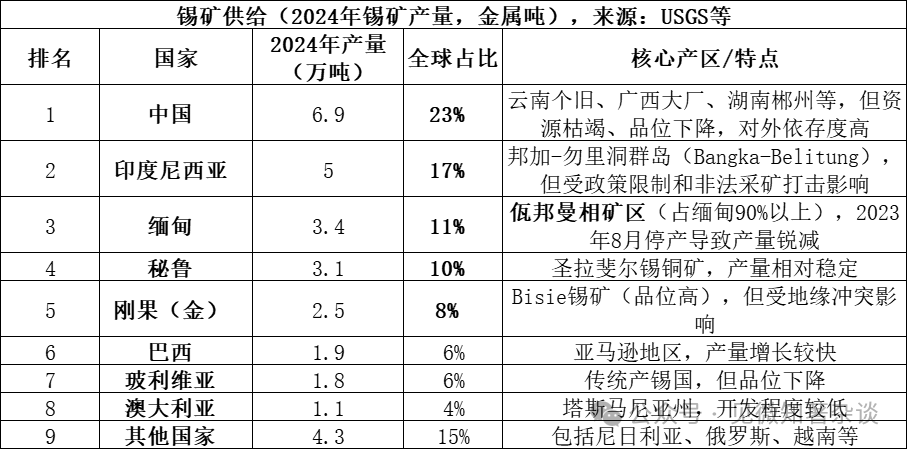

Data for 2025 has not yet been fully released, but due to the ongoing production halt in Wa State, Myanmar, output is expected to drop further to below 20,000 tons, with its share falling to around 7%. The top five producing countries account for 69% of the total, and the top eight countries account for 85%, indicating a highly concentrated supply.

The impact of Wa State in Myanmar on the tin industry chain is significant, primarily due to:

1) Historical supply volume: Before the production halt in August 2023, Myanmar's normal annual output was about 50,000-60,000 tons (accounting for 15-20% of global supply), with Wa State contributing over 90% of Myanmar's total output, equating to an annual supply of about 45,000-54,000 tons. This volume is equivalent to one-sixth of global supply, and the sudden halt has created a massive gap.

2) Critical for China's tin exports: China is the world's largest producer of refined tin (accounting for 45% of global production), but domestic mine resources are depleted, leading to a heavy reliance on imports. Myanmar was once China's largest source of tin ore imports, with approximately 36,000 metal tons imported from Myanmar in 2022, accounting for 60-70% of China's total imports. The production halt in Wa State directly led to shortages in Chinese smelters.

3) High uncertainty in resumption of production: Although Wa State is expected to begin resumption processes in 2025, the actual progress is far below expectations due to multiple factors such as policies, equipment, and rainy seasons. By the end of 2025, the average monthly export volume is only expected to be 2,000-3,000 physical tons (about 1,000-1,500 metal tons), significantly lower than the pre-halt average of 3,000 metal tons per month.

4) Amplifying global supply-demand tight balance: The global tin market has long been in a state of tight supply-demand balance (with a reserve-to-production ratio of only 15 years), and any minor fluctuations from major supplying countries will be magnified by the market. The "halt-slow resumption" process in Wa State has become the core driving factor for continuously rising tin prices in 2024-2025.

Tin ore rarely occurs in isolation and is often found alongside various metals and non-metallic minerals.

Deposits related to intermediate-acidic granite: This is the most important type of tin ore. In skarn-type (such as the Shizhuan mine in Hunan) and cassiterite-sulfide type (such as the Gejiu mine in Yunnan and the Dachang mine in Guangxi), tin is often closely associated with tungsten, molybdenum, bismuth, copper, lead, zinc, silver, and other metals, forming large polymetallic ore fields. In pegmatite-type deposits, tin tends to be associated with rare elements such as niobium, tantalum, lithium, beryllium, rubidium, and cesium.

Alluvial tin ore: Formed by the weathering and transportation of primary tin ore. In addition to cassiterite, alluvial deposits often also concentrate various heavy minerals such as natural gold, black tungsten ore, scheelite, rutile, and brown yttrium niobium ore, making the comprehensive utilization value of alluvial tin ore very considerable.

- Antimony Supply Source Types

The main source of antimony supply is stibnite (Sb₂S₃, antimony sulfide), which is the primary antimony ore in nature, accounting for over 80% of global antimony ore resources. There are also small amounts of antimony oxide (Sb₂O₃) and other secondary minerals. Stibnite is processed to obtain antimony concentrate, which is then refined through pyrometallurgical or hydrometallurgical methods to produce metallic antimony or antimony compounds.

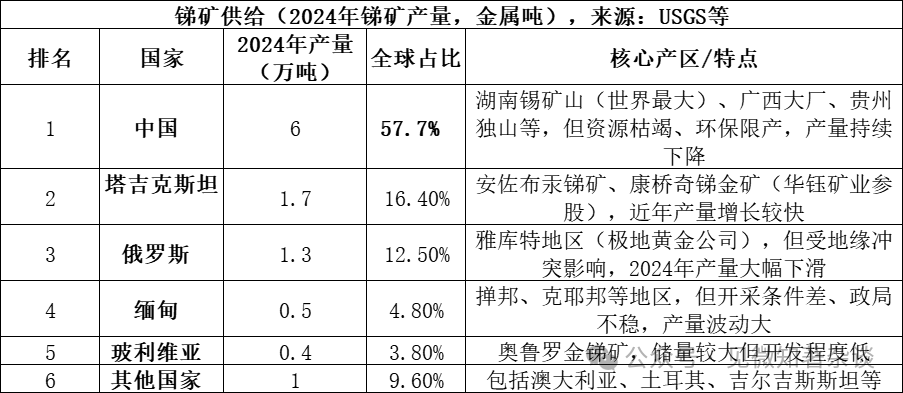

The top three producing countries (China, Tajikistan, Russia) account for 86.6% of the total, indicating a highly concentrated supply. Although China accounts for more than half of the production, its share has significantly decreased from 90% in 2010, primarily due to tightening environmental policies and resource depletion.

Antimony ore associations:

Mainly produced in medium to low-temperature hydrothermal environments: Most economically valuable antimony deposits form under medium to low-temperature hydrothermal conditions. In this environment, stibnite often precipitates alongside minerals such as cinnabar (mercury), pyrite, and quartz, forming typical low-temperature hydrothermal deposits.

Different types of characteristic associations: 1) In the famous Hunan tin mine, stibnite coexists with pyrite, realgar, orpiment, cinnabar, calcite, and quartz; 2) When antimony mineralization overlaps with gold or tungsten mineralization, it can form more valuable complex deposits such as antimony-gold-tungsten.

- Tungsten Supply Source Types

The main sources of tungsten supply are scheelite (CaWO₄, calcium tungstate) and wolframite ((Fe,Mn)WO₄, tungsten manganese iron ore), which are the two primary forms of tungsten ore in nature. Among them, scheelite accounts for over 70% of global tungsten resources, while wolframite accounts for about 25-30%. Scheelite is mostly found in skarn-type deposits, while wolframite is commonly found in high-temperature hydrothermal quartz vein-type deposits. Both are processed to obtain tungsten concentrate (WO₃ content ≥ 65%), which is then refined through pyrometallurgical or hydrometallurgical methods to produce ammonium paratungstate (APT), tungsten oxide, or metallic tungsten.

Tungsten market supply pattern:

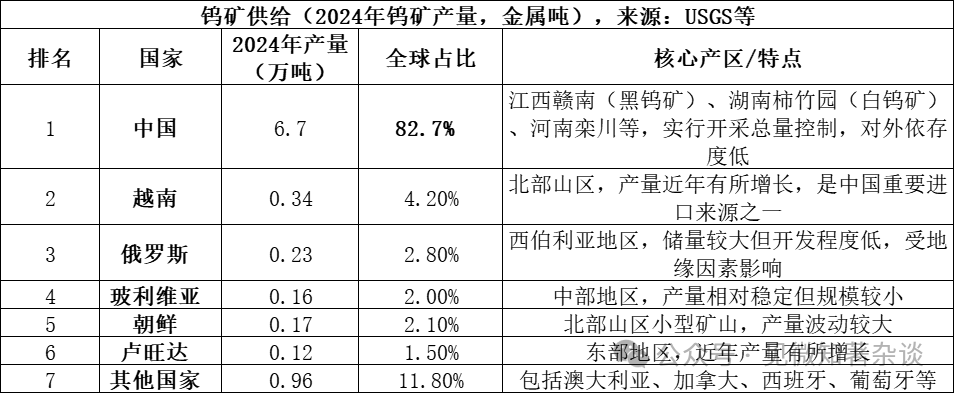

1) China dominates supply but growth is weak: China is not only the largest tungsten producer (accounting for 83% of global production) but also holds about 52% of global tungsten ore reserves. However, domestic tungsten mining is subject to strict total control indicators. Although the mining target for 2024 is set at 114,000 tons, the actual output is 127,000 tons, indicating that over-extraction has been effectively controlled. At the same time, long-term mining has led to the depletion of high-grade ores, continuously lowering the grade of raw ores, which restricts supply growth from the source.

2) Limited new supply overseas: In 2024, global tungsten production outside of China is expected to be about 14,000 metal tons, with sources being dispersed. Significant new supply mainly comes from projects like the Bakuta tungsten mine in Kazakhstan, but it accounts for a small proportion of global supply, making it difficult to change the supply pattern dominated by China in the short term.

3) Recycled tungsten is an important supplement: In addition to raw ores, recycled tungsten (such as from used hard alloys) is also an important source of supply. Currently, about 35% of tungsten supply comes from recycled materials, but China's recycling rate and product quality still lag behind international advanced levels.

Tungsten ore associations:

Quartz vein-type and greisen-type deposits: These deposits are usually related to granite intrusions. The associated minerals are very rich; in addition to wolframite, common minerals include cassiterite, molybdenite, bismuthinite, tourmaline, and topaz. They are often found at the top of granite bodies or in quartz veins in the surrounding rocks.

Skarn-type deposits: These deposits form at the contact zone between intermediate-acid intrusive rocks and carbonate rocks (such as limestone), primarily featuring scheelite. Their associated mineral combinations differ from those of quartz vein-type deposits, often coexisting closely with sulfides such as chalcopyrite, galena, sphalerite, and molybdenite. The Shizhuan mine in Chenzhou, Hunan, is a world-class example in this regard, rich in tungsten, tin, molybdenum, bismuth, beryllium, fluorite, and other resources.

- Molybdenum Supply Source Types

The main source of molybdenum supply comes from molybdenite (MoS₂, molybdenum disulfide), which is the most important and economically valuable molybdenum ore in nature. Molybdenite often coexists with copper, tungsten, and other metals in porphyry-type deposits. The ore is processed to obtain molybdenum concentrate (usually requiring MoS₂ content ≥ 85%), which is then roasted or refined through hydrometallurgical methods to produce molybdenum oxide (industrial molybdenum oxide), ferromolybdenum, or ammonium molybdate, which are used in steel alloys and chemical industries.

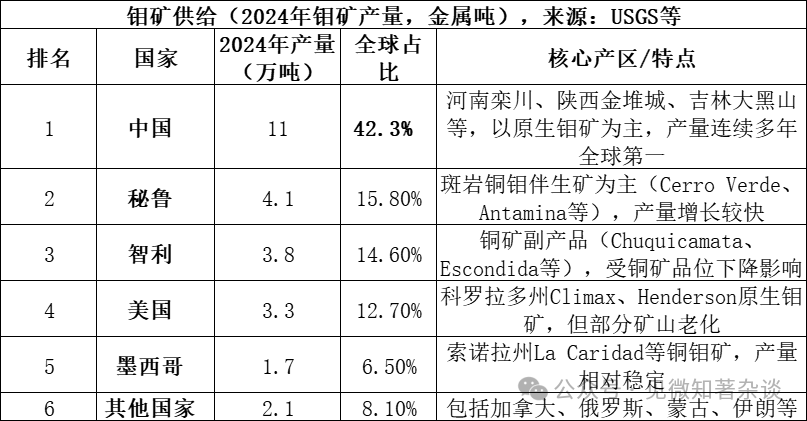

The top five producing countries (China, Peru, Chile, the United States, Mexico) account for 91.9% of the total, indicating a highly concentrated supply; in 2024, global molybdenum reserves are about 15 million tons, with China's reserves at 5.9 million tons (accounting for 39.3%), and a reserve-to-production ratio of about 57 years.

China holds a "resource + production + consumption" triple position in the molybdenum market:

1) Resource endowment advantage: China's molybdenum reserves account for nearly 40% of the global total (5.9 million tons in 2024), primarily consisting of primary molybdenum ores, with large deposit sizes and relatively high grades (e.g., the average grade of the Luanchuan molybdenum mine is about 0.1%), giving it a resource endowment superior to most countries.

2) Absolute production dominance: China's molybdenum production accounts for over 42% of the global total and has maintained the top position for many years. Unlike metals such as tin and antimony, the Chinese molybdenum industry does not rely on imports, with a self-sufficiency rate of over 90%, which is different from the tin market's reliance on imports from Myanmar.

3) Complete industrial chain: China has a complete industrial chain from mining, ore dressing to smelting and deep processing (ferromolybdenum, molybdenum powder, molybdenum chemicals). Leading companies such as Luoyang Molybdenum and Jinduicheng Molybdenum possess global competitiveness.

4) Consumer market center: China is also the largest consumer of molybdenum in the world (with a consumption of about 130,000 tons in 2024, accounting for over 45% of the global total), primarily used in steel alloys (accounting for over 70% of consumption), forming a closed-loop system of self-production and self-sale.

5) A significant portion of global molybdenum is a byproduct of copper mining: Many large porphyry copper mines are experiencing declining ore grades. Several major copper mines may reach the end of their mining life by the mid-2030s, which will constrain future growth in molybdenum supply.

Molybdenum ore associations:

Porphyry-type molybdenum ore/porphyry-type copper ore: This is the most important type of molybdenum ore in the world. In porphyry copper mines (such as the Dexing Copper Mine), molybdenum (molybdenite) coexists closely with copper sulfides as a byproduct. In porphyry molybdenum mines (such as those in Luanchuan, Henan, and Jinduicheng, Shaanxi), molybdenum is the main product but is often accompanied by tungsten, rhenium, and other elements.

Skarn-type deposits: These deposits form at the contact zone between intermediate-acid intrusive rocks and carbonate rocks. Here, molybdenite often coexists closely with scheelite, forming a molybdenum-tungsten combination (such as in the Shizhuan mine in Hunan), and may also be associated with various metal sulfides.

Quartz vein-type and greisen-type deposits: These deposits are usually related to granite, where molybdenite often coexists in black tungsten-quartz veins, and may also be accompanied by bismuthinite, arsenopyrite, and other minerals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。