Written by: cosmo_jiang

Translated by: Baihua Blockchain

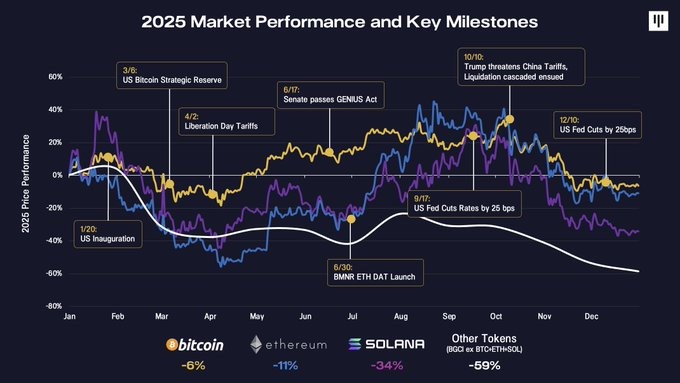

2025 was not a year driven by fundamentals for crypto market returns. Instead, the dominant factors of the year were macroeconomic environment, position distribution, capital flows, and market structure effects—especially for assets outside of Bitcoin. Reflecting on the major macro and policy turning points of the year helps to understand why the market seemed so discontinuous.

The year began with the inauguration of the U.S. President, but this ultimately proved to be a classic "buy the rumor, sell the news" moment, becoming an early warning for volatility. In the following months, risk appetite experienced a tug-of-war: from optimism over the U.S. strategic Bitcoin reserve announcement to new pressures from "Liberation Day" tariffs. Some constructive progress was made mid-year, including the passage of the GENIUS Act, the rise of Digital Asset Treasuries (DATs) (such as Bitmine Immersion), and the Federal Reserve beginning to cut interest rates, which stabilized market sentiment for a few months.

The fourth quarter marked a decisive turning point, with multiple challenges emerging. The October 10 sell-off triggered the largest liquidation chain reaction in cryptocurrency history—surpassing the scale of the Terra/Luna collapse and the FTX crash—with over $20 billion in nominal positions being wiped out. The market needed time to digest this shock. Meanwhile, key marginal buyers (DATs) throughout the year began to exhaust their incremental purchasing power. This downward momentum was exacerbated by seasonal pressures, including tax-loss selling (especially in the ETF and DATs space), portfolio rebalancing, and year-end systematic CTA fund flows.

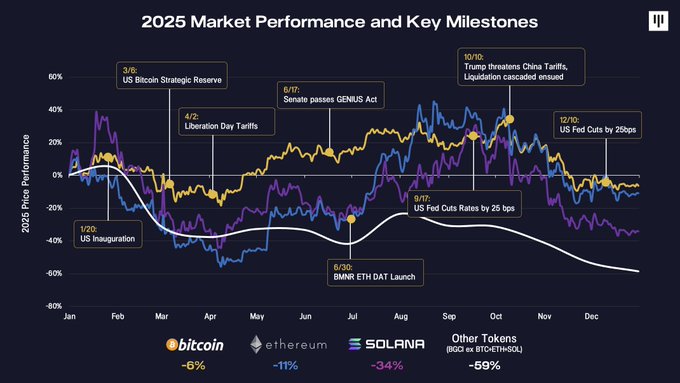

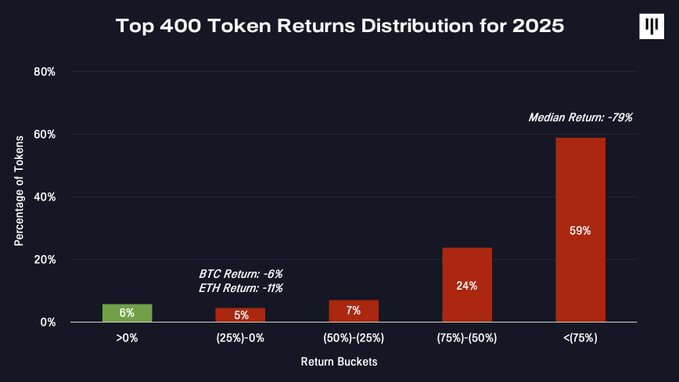

Bitcoin closed the year down about 6%. Ethereum fell about 11%. After that, performance began to deteriorate sharply. Solana dropped 34%, while the broader Token space (BGCI index excluding BTC, ETH, and SOL) saw a decline of nearly 60%. This was an extremely narrow market. When examining the return distribution across the entire Token space, this dispersion characteristic became even more striking.

Only a very small number of Tokens generated positive returns. The vast majority experienced deep drawdowns—with a median drop of 79%.

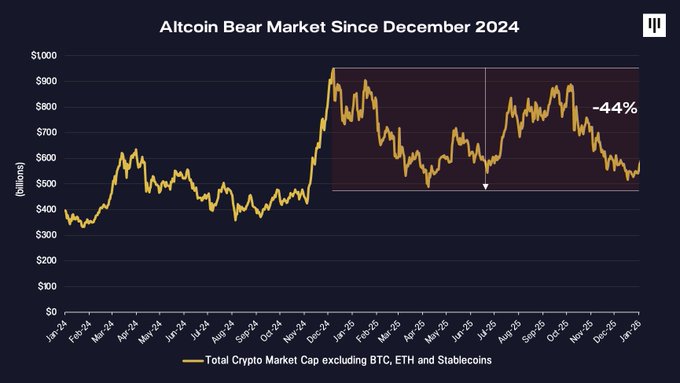

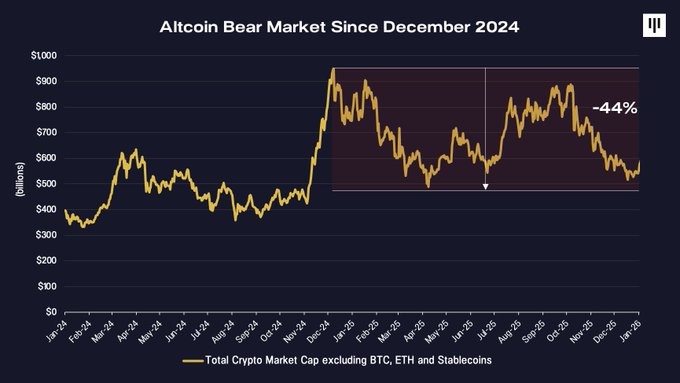

A Year-Long Altcoin Bear Market

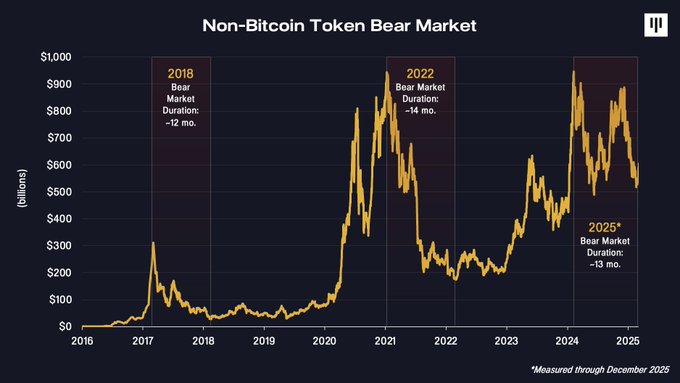

The most underestimated reality of 2025 is that the non-Bitcoin Token market has actually been in a bear market since December 2024.

Excluding Bitcoin, Ethereum, and stablecoins, the total market capitalization of cryptocurrencies peaked at the end of 2024 and has been in a downward trend since then—with a decline of about 44% by the end of 2025. From this perspective, what sometimes appeared to be a constructive year for Bitcoin was, for other parts of the market, a continuation of an unresolved bear market. Portfolios holding significant positions in mid- to small-cap Tokens struggled structurally.

The divergence between Bitcoin and the broader Token market reflects fundamental differences. Bitcoin benefits from a single, widely recognized narrative—digital gold—and mechanical demand from sovereign nations, governments, ETFs, and corporate treasuries. In contrast, other Tokens represent a set of heterogeneous disruptive technologies, with non-standardized entry barriers, a lack of institutional support, and more complex value capture mechanisms. This divergence is clearly reflected in prices.

Structural Resistance Facing Tokens

In 2025, several forces collectively pressured the broad Token complex:

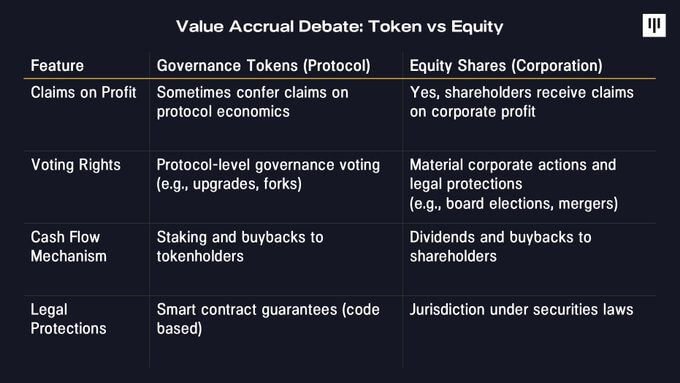

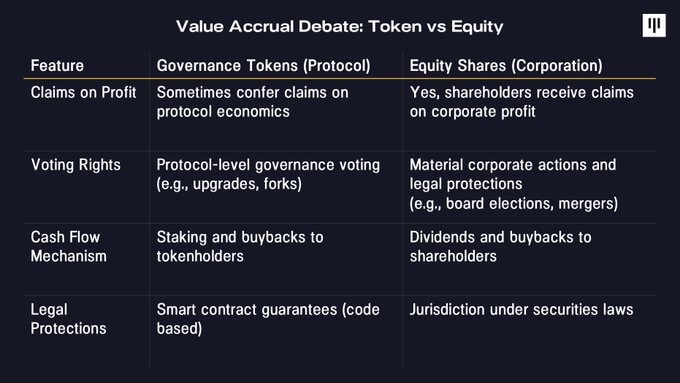

1. Value Accumulation and Investor Rights One of the most enduring challenges is the unresolved value accumulation issue. In traditional stock markets, shareholders have clear legal recourse to cash flows, governance, and residual value. In contrast, Tokens often rely on protocol-level mechanisms executed by code rather than protected by law.

This year, several high-profile cases brought this tension to the forefront, particularly some tokenized ecosystems being acquired or restructured without directly compensating Token holders, including Aave, Tensor, and Axelar. These events created ripples in the market, undermining investor confidence in projects with strong Token economics. In this context, digital asset stocks outperformed Tokens, as stocks have a clearer value capture path when investors seek defensiveness.

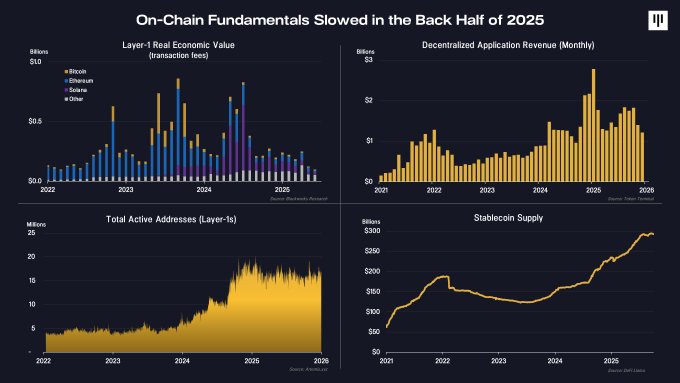

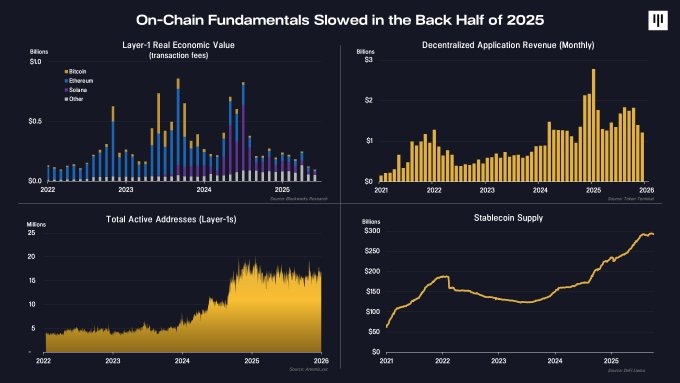

2. On-Chain Activity Slowing On-chain fundamentals also weakened in the second half of the year.

Key metrics, including primary network revenue, decentralized application (dApp) fees, and active addresses, showed a slowdown in activity. Notably, the supply of stablecoins continued to grow, signaling that blockchain applications in payments and settlements are still ongoing. However, the economic value associated with stablecoins largely flowed into off-chain equity-based businesses, rather than tokenized protocols.

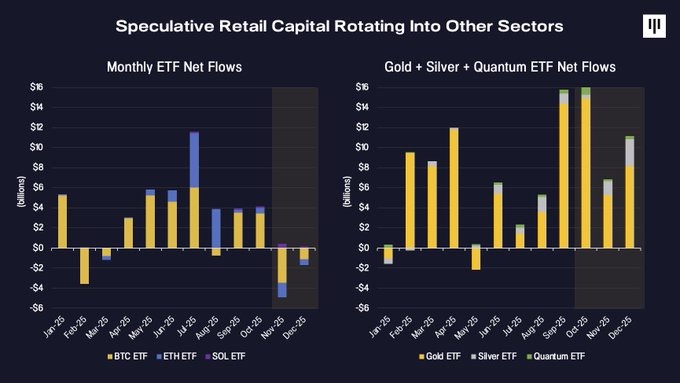

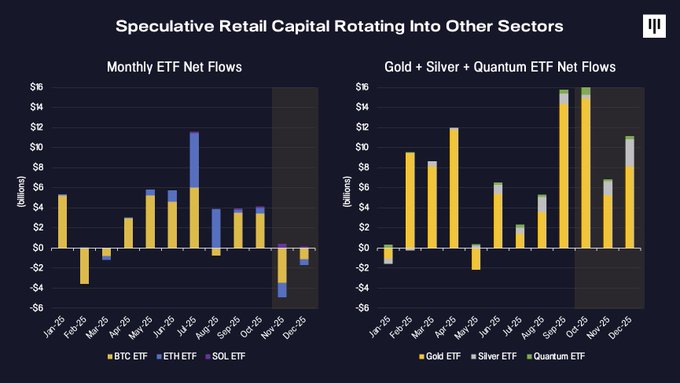

3. Rotation of Speculative Capital Finally, capital flows reversed. The marginal capital supporting the broad Token space has historically been retail speculative funds. While institutional adoption is increasing, it remains concentrated in ETF-format assets (BTC, ETH, and SOL added at year-end).

In 2025, speculative attention shifted to other areas. ETF funds flowed into emerging thematic trades such as gold, silver, and quantum computing, while digital asset ETF inflows slowed and turned negative by year-end. This rotation coincided with a deterioration in the breadth of the Token market, exacerbating the downward momentum.

Sentiment, Positions, and Historical Context

By the end of the year, market sentiment had compressed to levels historically associated with capitulation.

The Fear and Greed Index reached its lowest reading since extreme stress periods like the FTX collapse. At the same time, perpetual contract funding rates declined, indicating that leverage had decreased and speculative overheating had subsided.

Seasonal factors also played a role. December has historically been a weak month for Bitcoin and the broader crypto market.

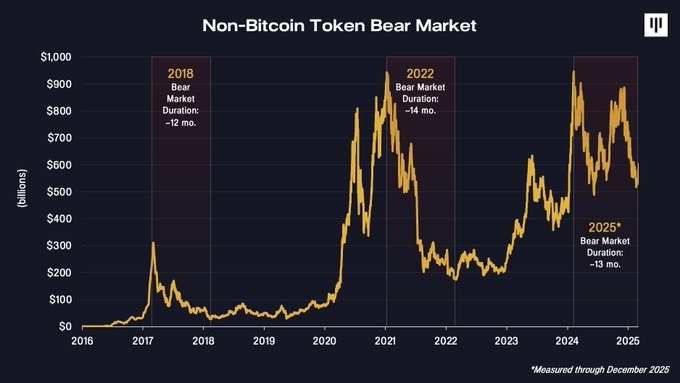

Importantly, from a longer cycle perspective, the current duration of the drawdown in non-Bitcoin assets is closely related to previous cycles.

The bear markets of 2018 and 2022 lasted about 12 to 14 months. Measured from the peak at the end of 2024, the current drawdown is now within this range. This does not guarantee that a bottom has been reached, but it does indicate that a significant amount of time and price compression has occurred.

Why the Outlook for the Future May Improve

Despite the challenges of 2025, there are still several reasons to maintain constructive optimism for the future:

First, institutional adoption continues to expand. Companies are integrating blockchain into their core products (from Robinhood launching tokenized stocks, to Stripe developing stablecoin infrastructure, to JPMorgan tokenizing deposits). On the capital side, sovereign reserves have been established, and large brokerage firms and pension platforms have significantly lowered the participation threshold.

Second, product-market fit (PMF) is becoming increasingly clear. Stablecoins and prediction markets emerged as prominent use cases in 2025, while broader tokenization and perpetual contracts also showed early signs of PMF.

Third, the macro backdrop is supportive. The U.S. economy remains resilient, and the Federal Reserve has stopped quantitative tightening (QT). The combination of interest rate cuts and improved capital flows has historically been favorable for risk assets, including digital assets.

Finally, penetration remains extremely low. As Tom Lee from Bitmine stated: there are only 4.4 million Bitcoin addresses holding over $10,000, while there are 900 million traditional investment accounts globally. According to a Bank of America survey, 67% of professional investment managers still have zero exposure to digital assets. Even a small shift in allocation represents a significant potential demand.

Conclusion

2025 was a challenging year for most of the Token market, characterized by extreme dispersion, strong performance of mainstream assets, and a prolonged weakness in areas outside of Bitcoin. However, it was also a year that advanced institutional adoption, clarified PMF, and compressed ecosystem valuations.

After a year-long bear market for altcoins, a strong fundamental backdrop may present opportunities. With sentiment being cleansed, leverage reduced, and prices significantly revalued, the forward-looking odds appear increasingly asymmetric—provided that fundamentals stabilize and market breadth returns. History shows that such periods of dislocation often lay the groundwork for the next phase of growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。