Author: Shijun

On February 6, 2026, the People's Bank of China, in conjunction with eight departments, released document [Yin Fa [2026] No. 42]. There have been many interpretations in the market, and this article aims to provide a vertical analysis by combining RWA with the current state of the on-chain market.

1. How to Understand Document No. 42

In my view, when looking at the original text in conjunction with the attached document "Regulatory Guidelines for the Issuance of Asset-Backed Securities Tokens for Domestic Assets Overseas," it reveals significant insights. The core point is that Document No. 42 dedicates a substantial portion to defining and regulating "Real World Asset Tokenization" (RWA), which essentially means that the regulatory authorities have formally recognized RWA as a business form and provided a path for compliant application and filing.

The key information can be summarized in three points, which I will present in the original text and then provide contextual interpretation.

First, RWA is accurately defined:

"Real World Asset Tokenization refers to the activities of converting ownership rights, income rights, and other rights of assets into tokens (certificates) or other rights and bond certificates with token characteristics using cryptographic technology and distributed ledger or similar technology, and issuing and trading them."

With a definition in place, how can it be applied? The text continues:

"Except for relevant business activities conducted based on specific financial infrastructure with the approval of the business regulatory authority in accordance with laws and regulations."

So, who can specifically participate? There are now clear procedural regulations for applying and utilizing RWA assets:

Domestic entities that actually control the underlying assets must file with the China Securities Regulatory Commission, submitting a filing report, complete overseas issuance materials, and fully explaining the information of the domestic filing entity, underlying asset information, token issuance plan, and other details.

Therefore, in my view, the combination of the two makes it clear that RWA assets have been separated from the virtual currencies that were previously strictly suppressed, and the two do not fit under the same management approach.

2. Global Evolution of RWA Standards

With the institutional definition in mainland China, how is the global RWA market developing now? As regulatory issues ease, subsequent applications become a reality that must be faced.

In fact, the current market has long been in an era of chaotic Token standards.

This complexity has led to industry-level compatibility challenges for RWA, prompting us to take a closer look at the current mainstream RWA token application standards.

This article will start with the HK ABT (asset-backed token) from 2022, then discuss the bond-related ERC-3525 and ERC-3475, and finally examine how the leading on-chain stock platforms Ondo and xStock respond to the characteristics of stock tokenization.

2.1 HK and ABT

On October 31, 2022, the Hong Kong government released the "Policy Declaration on the Development of Virtual Assets in Hong Kong," which specifically mentioned asset-backed tokens (ABT).

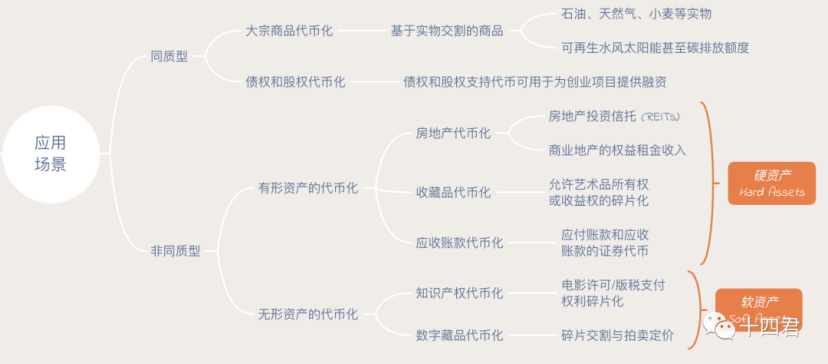

Generally, tokens are categorized into four major types, distinguished by their use and source of value.

In fact, the thinking in the current mainland documents and the practices previously conducted in HK are continuous, both inevitably having off-chain physical assets or rights as value benchmarks.

Thus, through compliant tokenization, the characteristics of assets on-chain gain enhancement:

Fragmentation: Refers to dividing ownership into several small pieces for the purpose of sale, making it easier to trade, price, and circulate.

Liquidity: Liquidity is defined by the speed at which assets can be converted into cash, with order books broadcasted and shared on-chain.

Cost Efficiency: When trading based on blockchain smart contracts, the costs of external third parties will be eliminated or significantly reduced.

Automation: Blockchain-based smart contracts do not require manual interactions, having a trusted technological foundation.

Transparency: One of the most significant features of on-chain transactions is the immutable record preservation.

From the audience's perspective:

For institutions, the fragmentation of large orders brings efficiency and cost benefits in liquidity.

For users, having a transparent and automated trusted environment ensures their rights.

Currently, the most intuitively valuable applications are stocks and bonds, as both can perfectly adapt to the liquidity, automation, and fragmentation characteristics mentioned earlier.

3. Bond Scene Standards: ERC-3525 and ERC-3475

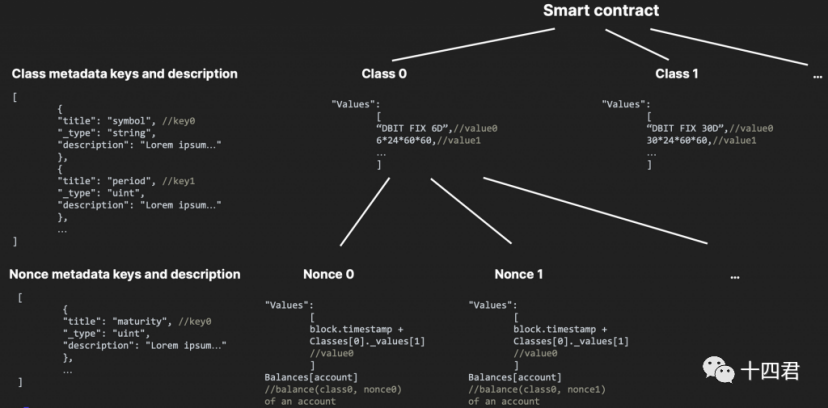

This type of asset has seen several explosions in activity around the time of HK ABT, forming industry standards such as ERC-3525 and ERC-3475:

ERC-3525 focuses on the management of semi-fungible tokens, improving the numerical aspects of asset combinations and splits, emphasizing traditional financial assets on-chain.

ERC-3475 emphasizes the definition of semi-fungible tokens, providing more standardized definitions for contracts with lower standardization, focusing on traditional commercial contracts on-chain.

Objectively speaking, the actual application of both standards is quite limited because they were established as standards first, and then business models emerged, rather than summarizing standards based on existing businesses. Thus, their actual prominence is decreasing (far less than the Atoken and stETH mentioned later).

In my view, this is still because the original intention of such design standards was to be comprehensive, for example, ERC-3475 (as shown below) is a representative of inclusivity, which directly leads to a high threshold for user understanding and a high threshold for app compatibility.

Ultimately, taking too big a step and writing everything is equivalent to writing nothing, and it is understandable that there is little application in the market.

For detailed interpretation, see: Can the five major Token standards support the pilot development of Hong Kong's Web3?

4. Bond Scene Applications: AToken & stETH

Compared to establishing standards first, let's look at the paradigm of applying first and then standardizing.

4.1 Real-Time Compound Interest Model: Aave's AToken

Aave is one of the leading DeFi infrastructures in the web3 industry, engaging in on-chain asset staking, lending, and earning business, while AToken serves as a staking certificate with the following core functions:

Proof of Deposit: Holding aToken is equivalent to the user owning a corresponding amount of assets in the Aave protocol, and these assets automatically earn interest over time.

Lending Mechanism: aToken can be used to assess the user's deposit amount and determine the loan limit.

Automatic Interest Distribution: The quantity of aToken will automatically increase based on the current deposit interest rate.

Transferability and Liquidity: Users can transfer or pledge aToken to other protocols to earn more returns or use it in other DeFi products.

From this perspective, it can be said that each point is also the path that RWA will take in the future.

Looking at its market status, it continues to thrive, with the total assets of aToken reaching approximately $30 billion.

Why is AToken so successful?

Clearly, with nearly 100% annual growth, it can be considered a successful model.

At its core, this is because aToken is already very well adapted to the existing market, as it originates from Aave, which understands that adaptability in the blockchain market is a key developmental path. The two standards mentioned earlier ultimately falter on adaptability, as existing asset dashboards and wallets do not easily integrate with this type of asset.

Adaptability is not a simple term, as it has a key issue to solve: if on-chain assets cannot earn interest, their practical significance is greatly diminished.

But if they are to earn interest, how should this interest be given to users?

After all, everyone's staking time is different, and the staking interest for each time period also varies. Different assets have different market demands, corresponding to different lending spreads.

If interest is simply distributed to users based on cycles, it would significantly increase the project's costs and management complexity, ultimately leading to a situation where the costs are borne by the users.

Some say this is a performance issue on-chain, so they have created new high-performance public chains to rival the server performance of web2, but they will also face the cost of user migration.

Aave's answer is to hide the interest within the user's daily transactions.

AToken essentially uses the Scaled Balance mechanism to calculate the user's actual balance:

Liquidity Index = Initial Index × (1 + Interest Rate × Time)

This logic allows interest to be automatically calculated and accumulated during transfers (whether sending or receiving), triggering new minting events to increase supply during transfers.

For the project, this reduces the need for a separate dividend transaction, and users' interest is seen unconsciously; even if not visible, it will be accounted for in the next operation, thus preventing any loss.

This clever design, requiring only a few lines of code, is very native in thinking.

Moreover, this approach has opened the door for the subsequent inheritance and evolution of on-chain asset standards like seETH and Ondo, xStock.

4.2 Rebase Model: Lido's seETH

Building on the previous interest, seETH simplifies the logic of staking and withdrawal, no longer calculating based on interest + time accumulation, but rather simplifying it to shares.

stETH = User's Staked ETH Amount × (Total Protocol Assets / Total Internal Shares)

You might wonder why it can operate without interest? Since everyone is staking to earn, if I stake for one day while someone else has staked for a year, shouldn't my share change?

This is due to Lido's daily automatic rebase mechanism. For example:

If I bought 1 ETH a year ago and joined a total of 100 ETH staked, my share is 1%.

Lido will daily obtain staking rewards from the Ethereum beacon chain and execute a rebase for the protocol.

Thus, when I withdraw a year later, I will naturally receive 4%.

If I were to buy that 1% share on the last day, it would be based on a share that has accumulated nearly 364 days, approaching a cost of 104%, and I would only benefit from one rebase.

Why design it this way?

Because making stETH's earnings automatically credited daily, without waiting or manual claiming, is its greatest convenience.

The previous AToken still requires a transaction to realize the earnings, while this can achieve daily automatic balance updates, making it easy for various wallets to be compatible.

Ultimately, it allows users to see the increase in interest on their accounts, which aligns with our conventional understanding of saving money—interest automatically credited daily, providing peace of mind.

At the core, the difference between the two lies in their scenarios.

Aave is focused on lending, where interest rates fluctuate significantly in real-time; during high-interest periods, one day can equate to a month. In contrast, Lido offers fixed returns, which are stable and smooth, making it less concerned about daily interest, thus allowing for further optimization of the user experience.

So, are these two suitable token standards for the RWA era?

I believe neither is suitable, but they can serve as references. Let’s look at the final main character today: the on-chain stock model.

5. On-Chain Stock RWA Scenario

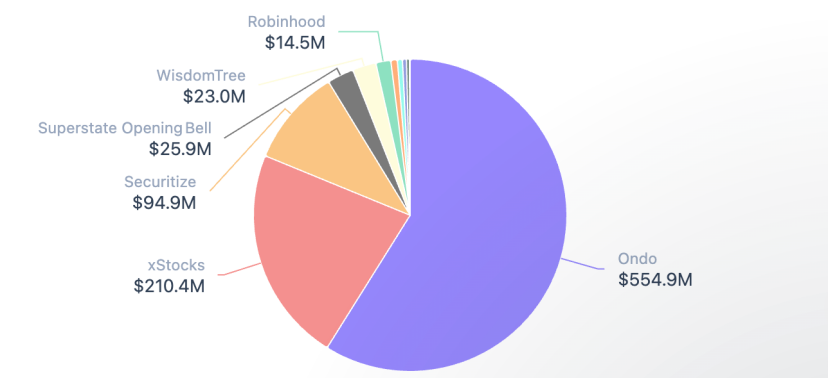

Although the overall market value of RWA is not large (900M vs 27B), due to the characteristics of stocks, it is one of the most liquid trading scenarios with potential for on-chain applications.

The main players here are: Ondo and xStock.

We can see that in the past six months, some of the leading DEXs and wallet markets have invested in this area. Objectively speaking, these top platforms seem to have remarkably consistent judgments regarding future trends.

On July 1, 2025, Jupiter supported xStock trading and began large-scale promotions.

On September 25, 2025, Solana officially launched a new RWA Twitter account.

On January 22, 2026, Jupiter partnered with Ondo Finance to launch over 200 tokenized stocks.

On January 24, 2026, Binance Wallet supported Ondo asset trading in professional mode.

On February 3, 2026, MetaMask launched tokenized US stocks and ETFs, stating that the market is shifting to on-chain.

They are actually based on a share Rebase model, which is a "on-chain share + Multiplier scaling" Rebase mechanism.

On the Solana chain, this mechanism is an extension of its mainstream token standard from 2022, where each token can have a parameter set by the project called Multiplier. The balance that users receive is referred to as the raw amount, which represents the share.

Then, if the project undergoes stock splits, dividends, etc., it dynamically adjusts the Multiplier in the token parameters, modifying the displayed amount.

This effectively creates a dividing line; if users use a wallet that does not support this parameter, they may feel that their assets seem somewhat off. In supported cases, they will see the UI amount, which is the amount presented on the client side.

6. Summary and Reflection

The previous text has already covered around four thousand words, reviewing the leading players and evolutionary paths of mainstream on-chain asset tokenization and real asset tokenization.

Various localized thoughts have been mentioned in each module, so now we need to return to the "cold reflection" theme.

Looking at it over a longer time frame, RWA has been around for nearly 10 years.

Early exploration, 2016-2019: The asset on-chain experimental phase was primarily focused on stablecoins.

Initial institutional phase, 2020-2022: RWA entered the DeFi lending space, with tokenized stocks attempted by BN/FTX, which soon shut down.

Compliance phase, 2023-present: Compliance has begun to clarify, and some RWA assets have rapidly expanded (stablecoins, US Treasury bonds, etc.), with new asset types and platforms showing promise.

From my perspective, the mainland's qualitative definition of RWA is objectively a positive development, but it is not entirely favorable; it can even be seen as a belated notification. Moreover, HK previously launched a similar ABT system, but has it developed?

Clearly, compared to the state of the other hemisphere, there has not been much progress, which is closely related to HK's cautious management of licenses. Whether to take bold steps or to proceed with cautious exploration and constraints can scare away many hopeful platform builders.

The new system has become more open, but openness does not necessarily mean that it aligns with what users truly want or what the market needs.

We can see that Aave's AToken is very successful because it addresses the issue of idle on-chain asset usage, allowing users to lend out their assets.

seETH is also excellent because it solves the pathway for POS (Proof of Stake); although there is a risk of Lido accumulating high amounts (of stakes), it genuinely provides stable returns for staking. Similarly, my article on Jito discusses another staking model.

Moreover, they both care about user experience, skillfully handling the nuances of compatibility and project costs.

Thus, issuance itself is not the goal; applying liquidity, fragmentation, transparency, and automation on-chain to tokens is where the value lies.

It is not about defining a perfect standard from the outset, but rather respecting rules and consensus, leveraging strengths step by step.

Just like common stocks, various exchanges are not open 24/7, but on-chain assets are.

Each market's gold has its own opening hours, but on-chain, there are none.

This gap in time is the true value of on-chain assets, as it can solve the value discovery problem in non-trading markets. Compared to pre-market trading, it is more sensitive, and compared to price differences across exchanges, it incurs lower friction. Moreover, the global liquidity presents a completely different perspective for value discovery; future company pricing may not necessarily rely on the NYSE but could instead look to on-chain data first.

Disclaimer

This article is dense with information, as many structural overviews are highly condensed, and the technology is not fully open-sourced, based on publicly available information analysis.

Additionally, the discussion is purely from a technical solution perspective, without any positive or negative evaluations of the products from various companies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。