Original link: https://x.com/ryanwatkins/status/2014385390371602546?s=46_

Translation: Ken, Chaincatcher

Core Insights

In 2021, this asset class overextended market expectations; since then, valuations have been returning to rationality, and the pricing of quality assets has become reasonable.

With the easing of the regulatory environment in the U.S., the issues of token alignment of interests and value capture have finally reached a turning point, making them more attractive for investment.

The growth of the crypto economy is shifting from cyclical to long-term structural trends, with a number of practical use cases emerging beyond Bitcoin.

Winning blockchains are gradually establishing their status as the standard for startups and large enterprises, becoming the cradle of the fastest-growing companies globally.

After a four-year bear market for altcoins, market sentiment has hit rock bottom. The long-term opportunities of top projects have been mispriced (underestimated), with few analysts predicting their exponential growth in models.

While top projects may thrive in the new era of the crypto economy, increasing delivery expectations and intensified competition from traditional businesses will eliminate weaker participants.

Few forces can compete with a well-timed idea; the crypto economy has never seemed more unstoppable than it does now.

The crypto economy is undergoing the largest transformation I have seen in my eight years in the industry. Institutions are hoarding tokens, while early crypto-punk pioneers are diversifying their wealth; companies are positioning for S-curve growth, while disillusioned crypto natives feel deep fatigue; governments are guiding the global financial system towards a blockchain trajectory, while day traders are still fretting over fluctuations on candlestick charts; emerging markets are celebrating financial democratization, while cynical voices in the U.S. lament that it’s all just a casino game.

Recently, many articles have explored which historical period today’s crypto economy resembles the most. Optimists liken it to the post-burst of the internet bubble, believing that the speculative era of the industry is over, and long-term winners like Google and Amazon will emerge, climbing the S-curve. Pessimists compare it to emerging markets like China in the 2010s, arguing that weak investor protections and impatient “long-only” capital could lead to poor asset price performance, even as the industry itself thrives.

Both viewpoints have merit. After all, aside from personal experience, history is the best guide for investors. However, analogies are ultimately limited. We need to understand the crypto economy from the context of macroeconomics and technology. The market is not a monolith but is composed of numerous interconnected yet independently functioning individuals and stories.

Here is my best assessment of where we have been and where we are headed.

The Red Queen’s Cycle

“You see, here, you have to run as fast as you can just to stay in the same place. If you want to get somewhere else, you must run at least twice as fast!” — Lewis Carroll

In financial markets, “expectations” often mean everything. Exceed expectations, and prices rise; fall short of expectations, and prices drop. Over time, expectations swing like a pendulum, and long-term returns are often negatively correlated with current expectations.

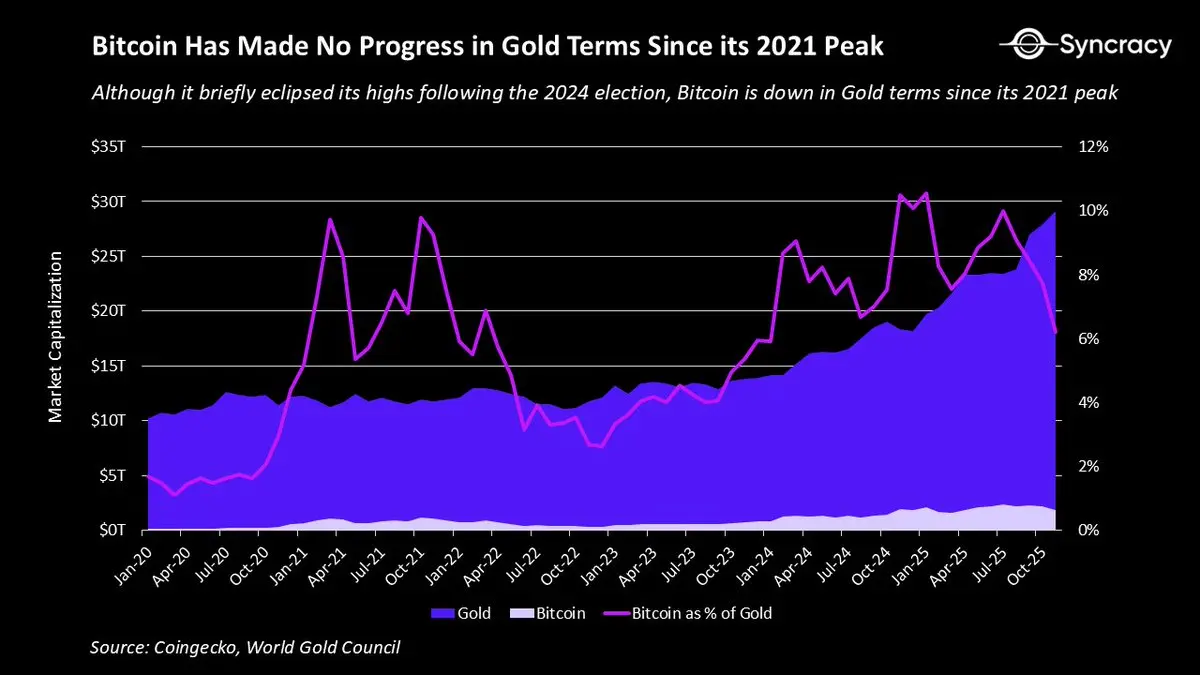

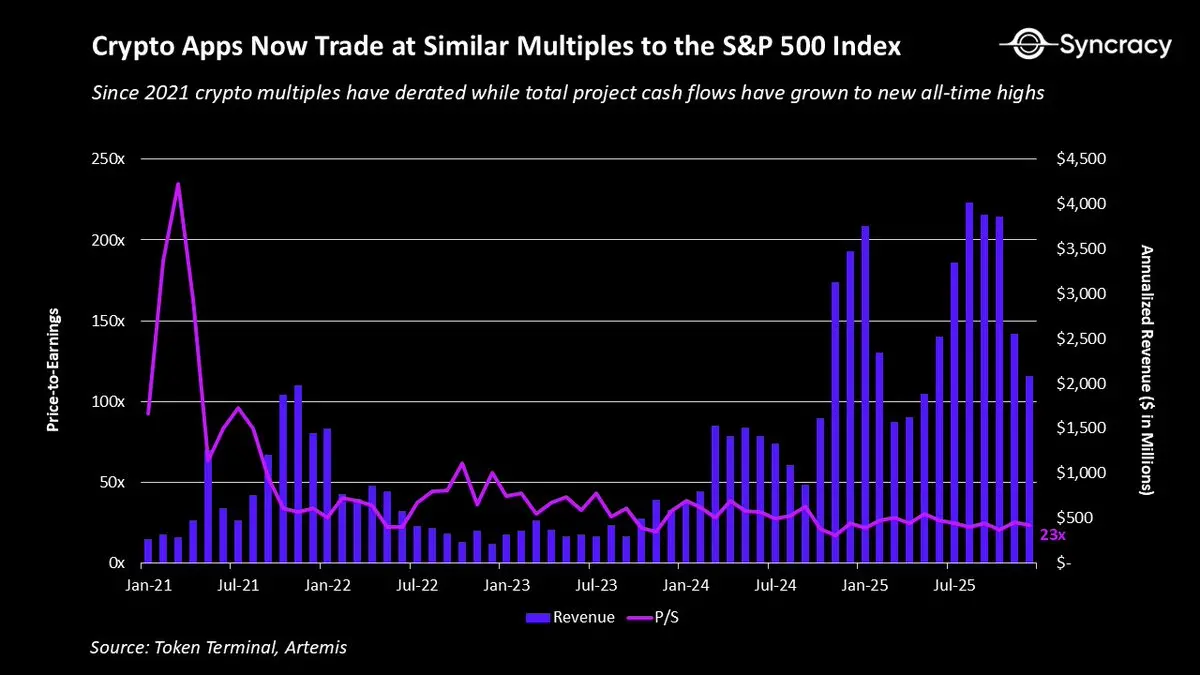

In 2021, the extent to which the crypto economy overextended expectations far exceeded most people's comprehension. Some aspects were obvious, such as DeFi blue-chip projects having price-to-sales ratios as high as 500 times, or the valuations of eight smart contract platforms exceeding $100 billion, not to mention the absurd bubbles surrounding the metaverse and NFTs. But the most sobering chart is the “Bitcoin/Gold” ratio.

Despite our many advancements, since 2021, the price of Bitcoin against gold has not reached new highs; in fact, it has decreased. Who would have thought that in the “world crypto capital” as described by Trump, after the most successful ETF launch in history, and against the backdrop of systematic devaluation of the dollar, Bitcoin's performance as digital gold would be worse than four years ago?

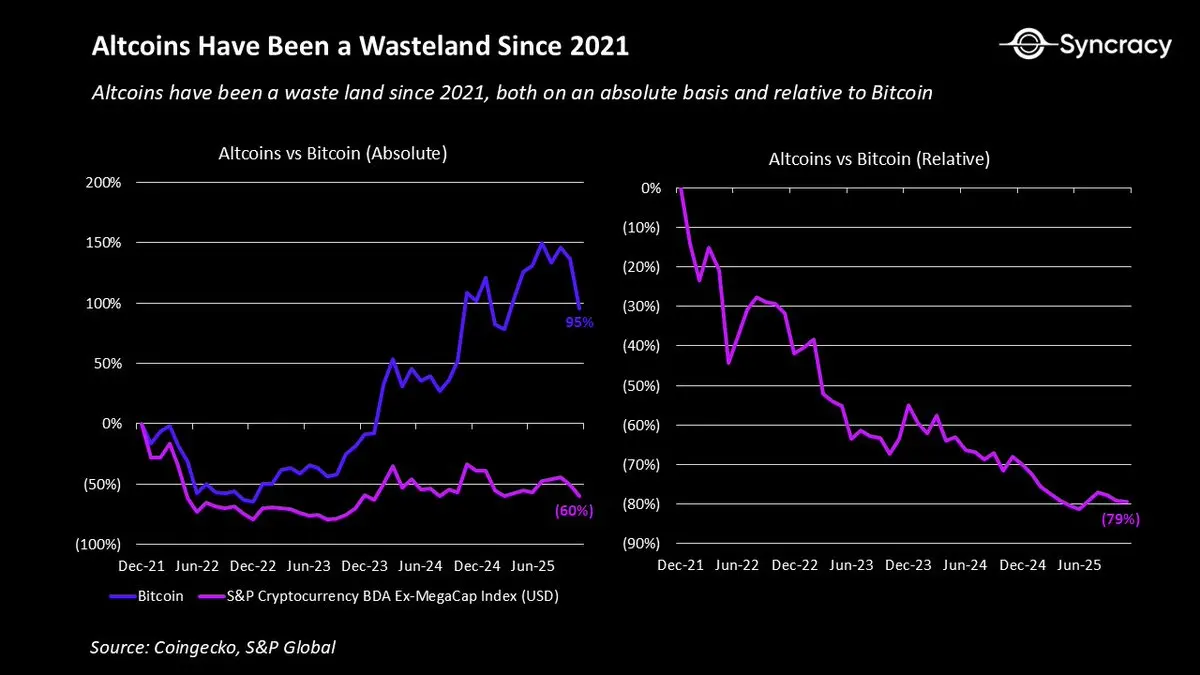

For other assets, the situation is much worse. Most projects entered this cycle with numerous structural issues, exacerbating the challenge of meeting extremely high expectations:

Most projects have cyclical revenues and are highly dependent on continuously rising asset prices.

Regulatory uncertainty has hindered participation from institutions and enterprises.

Dual ownership structures have led to misaligned incentives between equity insiders and public token investors.

Poor information disclosure has resulted in severe information asymmetry between project teams and the community.

The lack of a unified valuation framework has led to excessive market volatility, with no fundamental price support.

These issues combined have led to a significant drop in the prices of most tokens, with only a very few barely reaching the highs of 2021. This has had a tremendous impact on market psychology, as nothing is more frustrating in life than “working hard without reward.”

This disappointment is particularly acute for speculators and opportunists who believe cryptocurrencies are a shortcut to wealth. Over time, this struggle has led to widespread professional burnout across the industry.

This is certainly a healthy process of natural selection. Mediocre efforts should not continue to yield astonishing returns as they did in the past; the era of making huge wealth through “air tokens” before 2022 is clearly unsustainable.

However, there is a glimmer of hope: the aforementioned issues are widely understood, and prices have reacted accordingly. Today, aside from Bitcoin, very few crypto natives are willing to discuss the long-term fundamentals of other assets. After four years of growing pains, this asset class now possesses the necessary conditions to bring about upward surprises again.

The Awakening Crypto Economy

As mentioned earlier, the crypto economy entered this cycle with many structural issues. The good news is that everyone is now aware of this, and many problems are becoming a thing of the past.

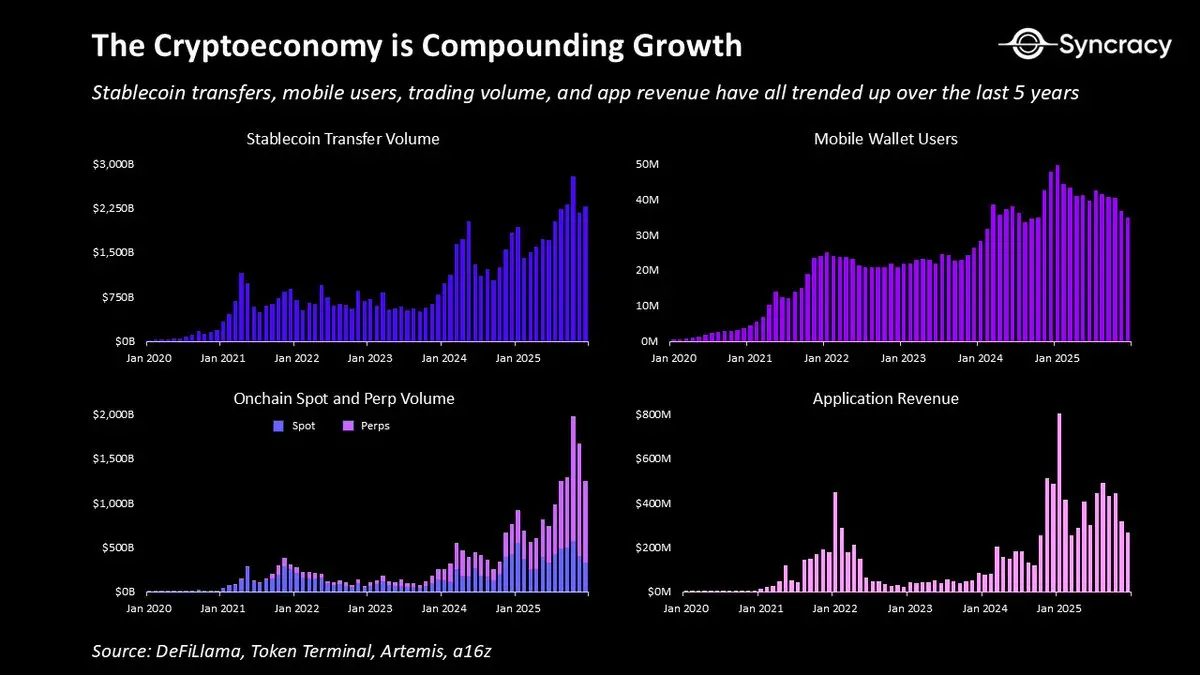

First, beyond digital gold, many use cases are demonstrating compound growth, with more use cases undergoing transformation. Over the past few years, the crypto economy has birthed:

Peer-to-peer internet platforms: Enabling users to transact and execute contractual relationships without government or corporate intermediaries.

Digital dollars: Allowing storage and transfer anywhere on Earth with internet access, providing cheap and reliable currency for billions.

Permissionless exchanges: Allowing anyone, anywhere, to trade the world’s top assets on a transparent single platform, 24/7.

New derivative tools: Such as event contracts (prediction markets) and perpetual contracts, providing valuable predictive information and more efficient price discovery mechanisms.

Global collateral markets: Enabling users to access credit permissionlessly through transparent, automated infrastructure, significantly reducing counterparty risk.

Democratized asset issuance platforms: Allowing anyone (individuals or institutions) to issue publicly tradable assets at very low costs.

Open financing platforms: Enabling people worldwide to raise funds for their businesses, overcoming local economic constraints.

Physical infrastructure networks: Creating more scalable and resilient infrastructure through crowdfunding and decentralized operations by independent operators.

This is not an exhaustive list of all valuable use cases in the industry to date. The key point is that many of these use cases have proven their practical value and continue to grow regardless of price fluctuations.

Meanwhile, as regulatory pressures ease and founders realize the costs of misalignment, the dual “equity-token” model is being corrected. Many existing projects are integrating assets and revenues into a single token, while others are clearly delineating: on-chain revenues belong to token holders, while off-chain revenues belong to equity holders. Additionally, as third-party data providers mature, information disclosure practices are improving, reducing information asymmetry and supporting better analysis.

At the same time, the market is gradually reaching a consensus to return to a simple and time-tested principle: 99.9% of assets need to generate cash flow, with only value storage assets like BTC and ETH being rare exceptions. As more fundamental investors enter, these frameworks will be reinforced, and market rationality will strengthen over time.

In fact, given time, the concept of “self-ownership” of on-chain cash flow may be understood as a unlocking of equal scale to “self-sovereign digital value storage.” After all, when in history has it been allowed to hold digital bearer assets that automatically reward users wherever they are on Earth, as long as the program is in use?

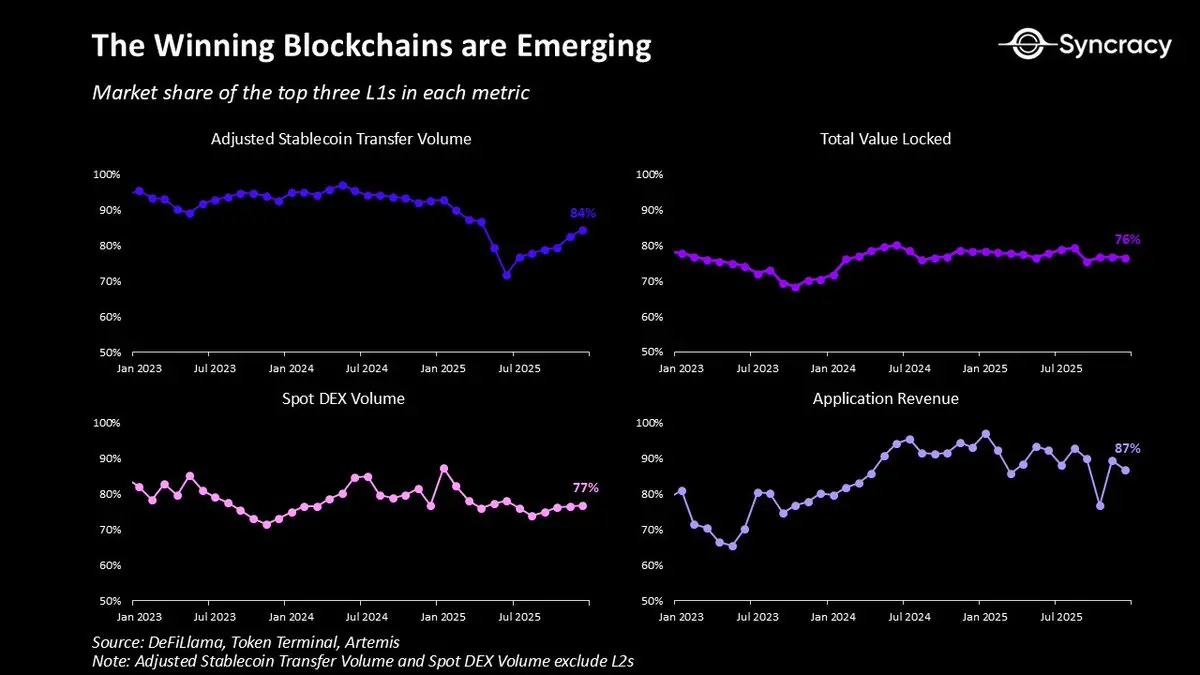

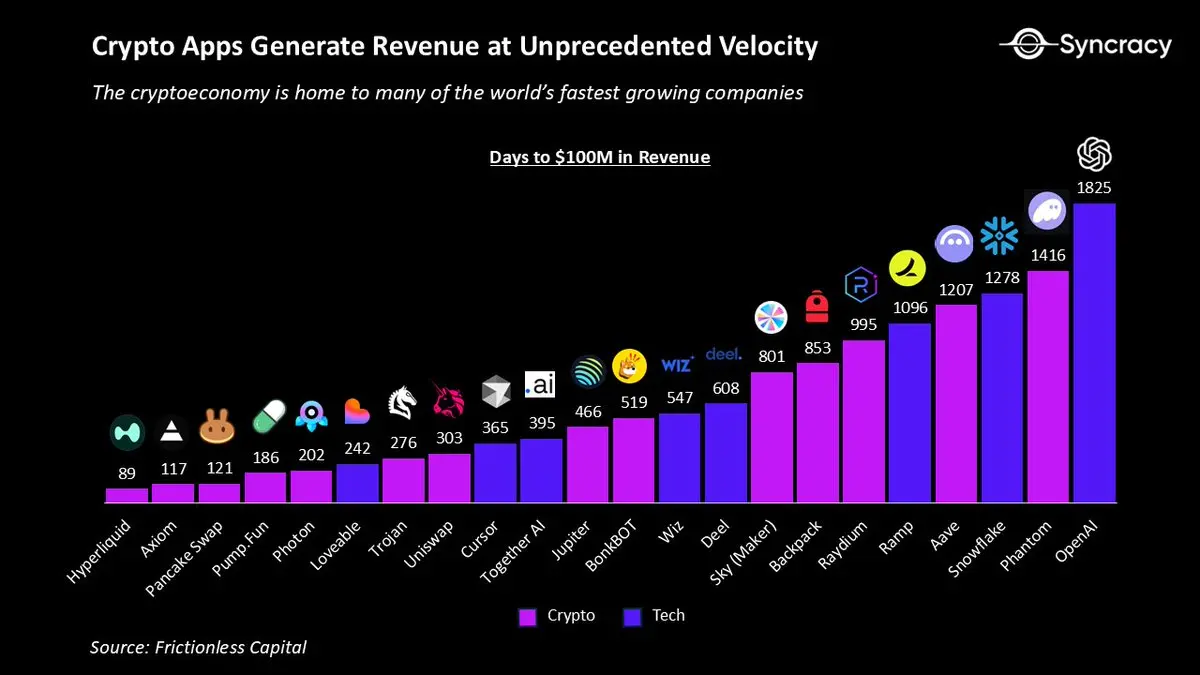

In this context, winning blockchains are rising to become the monetary and financial cornerstones of the internet. The network effects of Ethereum, Solana, and Hyperliquid are increasing daily, anchored by their ever-expanding ecosystems of assets, applications, businesses, and users. Their permissionless design and global distribution capabilities make their applications some of the fastest-growing businesses globally, with unparalleled capital efficiency and revenue turnover. In the long run, these platforms are likely to become the foundation supporting the potential market size of “financial super applications,” which nearly all leading fintech companies are competing to capture.

In this context, it is no surprise that giants from Wall Street and Silicon Valley are rapidly advancing blockchain initiatives. Almost every week, there is a new wave of product launches covering everything from tokenization to stablecoins and everything in between. Notably, unlike the early stages of the crypto economy, these efforts are no longer experiments but production-grade products, mostly built on public blockchains rather than isolated private systems.

As the lagging effects of regulatory changes continue to permeate the entire system in the coming quarters, this activity will only accelerate. With increased clarity, businesses and institutions can finally shift their focus from “Is this legal?” to “How can blockchain expand revenue, reduce costs, and unlock new business models?”

Perhaps the most telling sign of the current situation is that very few industry analysts are predicting exponential growth in their models. From my observations, many of my peers (both sell-side and buy-side) are hesitant to forecast annual growth rates exceeding 20% for fear of appearing overly optimistic.

After four years of pain and valuation resets, it is now worth asking ourselves a question: What if this could indeed grow exponentially? What if dreaming again could actually yield returns?

The Yin-Yang Realm

“Light a candle, and it will cast a shadow.” — Ursula K. Le Guin

On a cool autumn day in 2018, before starting another grueling day in investment banking, I stopped by an old professor's office to discuss blockchain. As soon as I sat down, he recounted his conversation with a skeptical hedge fund manager. The manager claimed that cryptocurrencies were entering a nuclear winter, merely “looking for nails with a hammer” (solutions seeking non-existent problems).

After giving me a crash course on the unsustainable burden of sovereign debt and the collapse of institutional trust, he ultimately shared what he told that skeptic: “In ten years, the world will thank us for building this parallel system.”

Though it’s not yet ten years, his prediction now seems quite prescient, as cryptocurrencies increasingly resemble a concept whose time has come.

In a similar spirit, this is the crux of this article: to argue that the world still underestimates what is being built here. For all of us investors, the most critical point is that the multi-year investment opportunities in leading projects have been undervalued.

This last point is crucial. The future of cryptocurrencies may be inevitable, which means that the coin you like could go to zero. The flip side of cryptocurrencies becoming a certainty is that they are attracting fiercer competition, and the pressure to deliver results is unprecedented. As I mentioned earlier, as more institutions and enterprises enter the industry, they are likely to weed out many weaker players. This does not mean they will win everything and consume all, but it does mean that only a few players will become big winners.

The emphasis here is not to sell anxiety. In all emerging technology sectors, 90% of startups will fail. More public failures may emerge in the coming years, but this should not distract you from the bigger picture.

Perhaps no technology aligns better with today’s zeitgeist than cryptocurrencies: declining trust in institutions in developed societies, unsustainable government spending in G7 countries, the blatant devaluation of the currency by the world’s largest fiat issuer, de-globalization and the fragmentation of international order, and a yearning for a new system that is fairer than the old one. As software development continues to consume the world, and as the younger generation inherits the wealth of the older generation, the timing for the crypto economy to emerge from its own bubble is quite apt.

While many analysts interpret the current situation using classic frameworks like the Gartner hype cycle and Carlota Perez's late-stage enthusiasm, suggesting that the best return periods are over and that we are entering a dull practical phase, the reality is far more interesting.

The crypto economy is not a single market maturing synchronously; it is a collection of products and businesses at different stages of adoption curves. More importantly, speculation does not disappear as technology enters a growth phase; it merely fluctuates with changes in sentiment and the pace of innovation. Anyone telling you that “the era of speculation is over” is either disheartened or ignorant of history.

It is reasonable to remain skeptical, but do not be cynical. We are reconstructing the governance of money, finance, and, most importantly, economic institutions. This is both challenging and equally exciting.

Your next task is to figure out how to best leverage this emerging reality, rather than endlessly lamenting that it is all destined to fail.

Because within the fog of disillusionment and uncertainty lies a once-in-a-lifetime opportunity — but this is reserved for those willing to bet on the dawn of a new era, rather than mourn the twilight of the old one.

Important Legal Disclaimer

This publication is for informational purposes only and does not constitute investment advice, nor does it constitute an offer to sell or solicit the purchase of any securities or investment products. All investments involve risks, including the potential loss of principal. Past performance does not guarantee future results. Any forward-looking statements or hypothetical examples are subject to risks and uncertainties and do not constitute a guarantee of future performance. This material does not create any client-advisor relationship. Our company assumes no responsibility for the accuracy or completeness of third-party information mentioned in this article. Any recommendations or endorsements comply with the disclosure requirements regarding compensation and conflicts of interest under the U.S. Securities and Exchange Commission (SEC) marketing rules. Our company maintains documentation of all statements in accordance with regulatory obligations. All content is protected by intellectual property laws and may not be reproduced or distributed without permission.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。