Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

Trump's policy direction has become the core source of uncertainty in the market. His flip-flopping on the sovereignty issue of Greenland and threats of tariffs on Europe, although ultimately leading to a framework agreement that temporarily eased tensions, have significantly shaken global investors' confidence in dollar assets. Against this backdrop, the global trend of "de-dollarization" has become increasingly evident, with many central banks and sovereign funds accelerating the diversification of their foreign exchange reserves. India's holdings of U.S. Treasury bonds have fallen to a five-year low, down 26% from the peak in 2023, with the proportion of U.S. bonds in its foreign exchange reserves dropping from 40% to one-third, while continuously increasing gold holdings. This move resonates with the Ontario Teachers' Pension Plan in Canada reducing its exposure to U.S. dollars and Treasuries, and the Greenland pension fund considering withdrawing from the U.S. stock market, collectively reflecting market concerns over U.S. policy risks.

These concerns have driven a surge in the prices of safe-haven assets, with gold prices nearing the $5,000 mark, up 14.72% year-to-date; silver is just a step away from the $100 mark, peaking at $99.375, with a year-to-date increase of 38.32%. Goldman Sachs has raised its 2026 gold price target to $5,400, noting that in addition to central bank gold purchases, the "sticky" long-term allocations by the private sector to hedge macro risks have become a new force driving up gold prices. Additionally, due to an extreme cold wave, U.S. natural gas prices surged 63% within a week, reaching the highest level since December 2022, but have since retreated today. Meanwhile, the Bank of Japan has maintained its benchmark interest rate at 0.75%, but the surge in its government bond yields is being interpreted by the market as a pressure signal. On the corporate side, Intel released its earnings report after hours; although its fourth-quarter performance exceeded expectations, the weak guidance for the first quarter due to supply bottlenecks caused its stock price to plummet over 13% in after-hours trading.

Bitcoin has been oscillating around $90,000 after recently dropping to around $87,200. Delphi Digital analyst that1618guy pointed out that Bitcoin is currently negatively correlated with the yield on Japanese 10-year government bonds. Several analysts view $90,300 as a key resistance level, while $87,000 has become a widely watched support area. Trader Eugene has exited his positions due to poor cyclical patterns and is bearish on the market, stating that he originally hoped BTC would break $100,000 at the start of the year, but this expectation now seems unlikely. Killa expects the price to retreat to the $84,000-$86,000 range; Man of Bitcoin believes that if the price can hold above $87,256, it may be at the fourth wave peak or about to break through, with resistance at $91,616; while Jelle thinks that if it falls below $87,200, it may return to $80,000, needing to break above $93,000 to establish an upward trend. Glassnode analysis indicates that short-term holders (cost basis around $98,400) are facing selling pressure, while holders with positions of 3-6 months (cost basis around $112,600) have increased selling when prices rise, creating upward resistance. The cash allocation ratio of global fund managers has dropped to a historic low of 3.2%, indicating that the market is operating at full capacity. If a negative shock occurs, the lack of buffer funds may trigger a chain sell-off, increasing market vulnerability.

Regarding Ethereum, although the price has barely returned above $3,000 temporarily, market demand is weak, facing severe technical challenges. Coinglass data shows that if it falls below $2,850, it will trigger $771 million in long liquidations, while breaking above $3,050 will face $1.083 billion in short liquidations. Capriole Investments data shows that Ethereum's apparent demand has dropped to a 10-month low, similar to levels before the significant drop in March 2025. Man of Bitcoin points out that ETH is maintaining a triangular formation, and if it falls below $2,867, it will be a dangerous signal; Batman warns that the current $2,800-$3,000 area is the "last line of defense," and if breached, it may trigger a bearish flag target towards $1,850. However, there are also positive signals in the market, with Kriptoholder observing a dense institutional buy wall in the $2,500-$2,600 range, and mortgage giant Newrez announcing it will accept ETH as proof of assets, seen as an important step towards mainstream adoption.

In the altcoin market, the prediction market project Space has faced serious "overfunding" controversies, raising $20 million far exceeding its $2.5 million target. The team stated it would retain about $14 million and only refund part of the funds. Such behavior has been deemed malicious by the community and compared to the previously controversial Trove project.

2. Key Data (as of January 23, 13:00 HKT)

(Data source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

Bitcoin: $89,596 (YTD +2.2%), daily spot trading volume $39.03 billion

Ethereum: $2,945 (YTD -0.46%), daily spot trading volume $29.06 billion

Fear and Greed Index: 24 (Fear)

Average GAS: BTC: 1.75 sat/vB, ETH: 0.02 Gwei

Market share: BTC 59.2%, ETH 11.8%

Upbit 24-hour trading volume ranking: ELSA, AXS, XRP, BTC, IP

24-hour BTC long-short ratio: 48.91% / 51.09%

Sector performance: The overall crypto market is down, with only GameFi, AI, and RWA sectors relatively strong

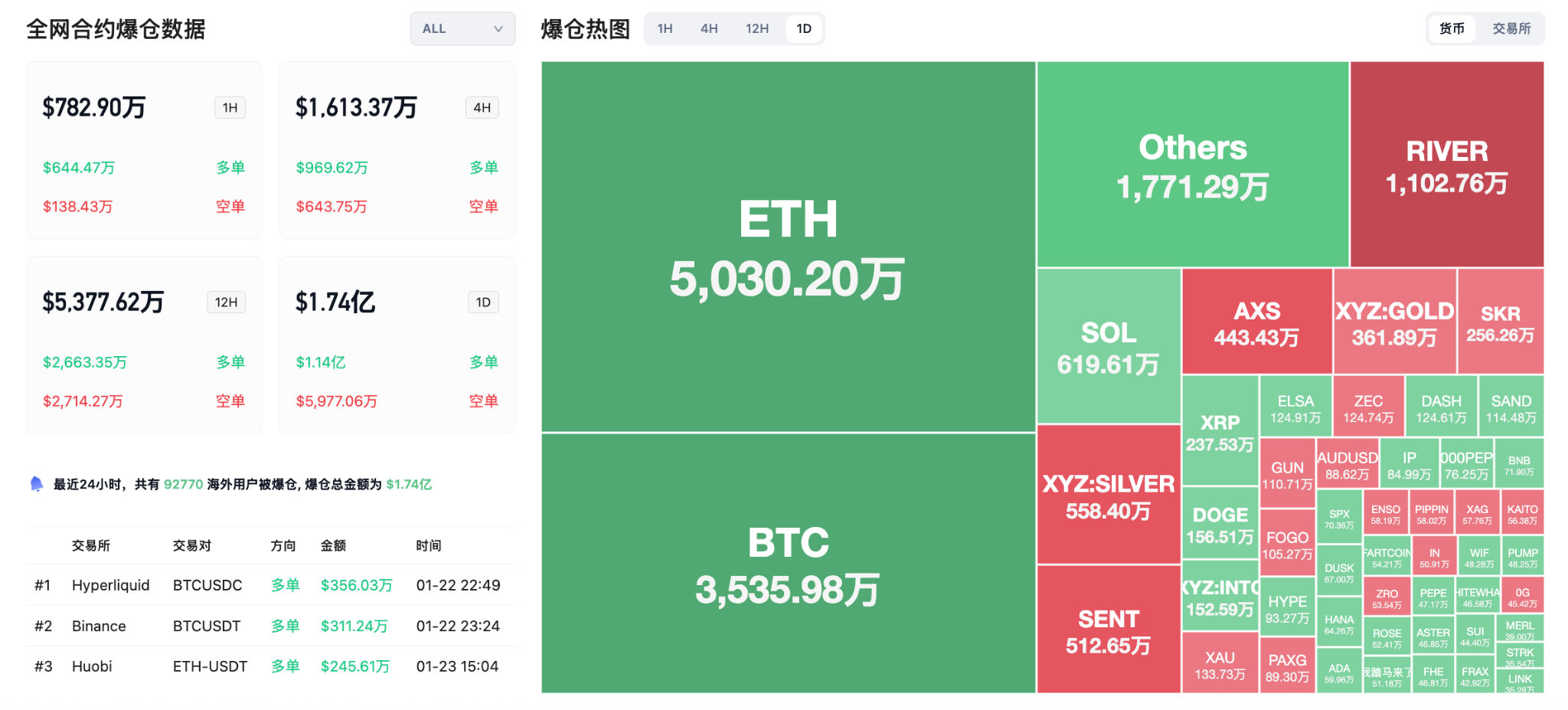

24-hour liquidation data: A total of 92,770 people were liquidated globally, with a total liquidation amount of $174 million, including $35.3598 million in BTC liquidations, $50.30 million in ETH liquidations, and $6.1961 million in SOL liquidations.

3. ETF Flows (as of January 22)

Bitcoin ETF: -$32.1081 million, continuing 4 days of net outflow

Ethereum ETF: -$41.9772 million, continuing 3 days of net outflow

XRP ETF: +$2.09 million

SOL ETF: +$1.71 million

4. Today's Outlook

Binance will delist multiple leveraged trading pairs including YGG/BTC on January 23

Kaito AI will launch on Bitway Capital Launchpad on January 24

SOON (SOON) will unlock approximately 21.88 million tokens at 4:30 PM on January 23, with a circulation ratio of 5.63%, valued at approximately $7.4 million;

Animecoin (ANIME) will unlock approximately 835 million tokens at 9 PM on January 23, with a circulation ratio of 13.84%, valued at approximately $6.3 million;

SoSoValue (SOSO) will unlock approximately 13.33 million tokens at 5 PM on January 24, with a circulation ratio of 5.00%, valued at approximately $7.4 million;

Humanity (H) will unlock approximately 105 million tokens at 8 AM on January 25, with a circulation ratio of 4.57%, valued at approximately $19.3 million;

Plasma (XPL) will unlock approximately 88.89 million tokens at 8 PM on January 25, with a circulation ratio of 4.33%, valued at approximately $12.4 million;

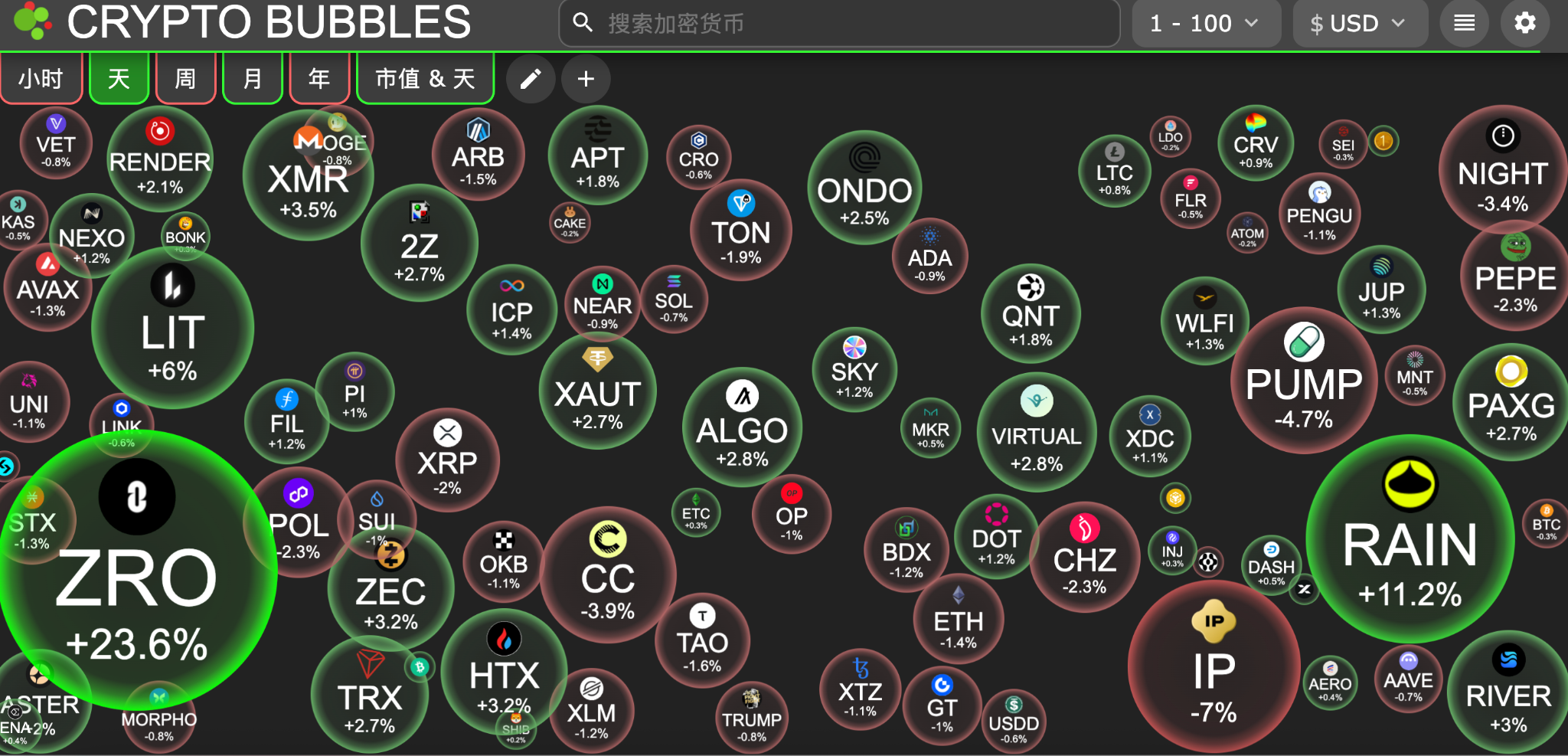

The largest gains among the top 100 cryptocurrencies today: LayerZero up 23.6%, Rain up 11.2%, Lighter up 5.8%, River up 4.1%, Monero up 4%.

5. Hot News

World Liberty Financial collaborates with crypto satellite company Spacecoin and exchanges tokens

Bitmine further stakes 171,264 ETH, with a total staking amount of approximately $5.73 billion

USD.AI approves a GPU financing limit of up to $500 million for Sharon AI

UBS believes the renminbi is expected to account for 10% of global reserves

Trump: A 25% tariff will be imposed on all countries trading with Iran

Mirana Ventures associated wallet deposits 13.65 million MNT into Bybit, valued at $12.2 million

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。