Author: Jae, PANews

In 2026, Ethereum had a magical start. On one side, there was a prosperous scene with indicators such as staking scale, TVL, and stablecoin share reaching new highs; on the other side, there was a serious "decoupling" between token prices and the ecological fundamentals.

At this moment, Ethereum may be at a "dammed lake" moment. Upstream are the technical dividends from native DVT, Fusaka upgrades, and deep asset accumulation, while downstream are concerns about centralization, failures in value capture, and mismatched market pricing.

A Staking Scale of Hundreds of Billions Cannot Hide Centralization Risks, Vitalik Aims to Counterattack with DVT Solutions

With staking hitting new highs and exits clearing out, the Ethereum staking ecosystem has recently delivered what seems to be a perfect report card.

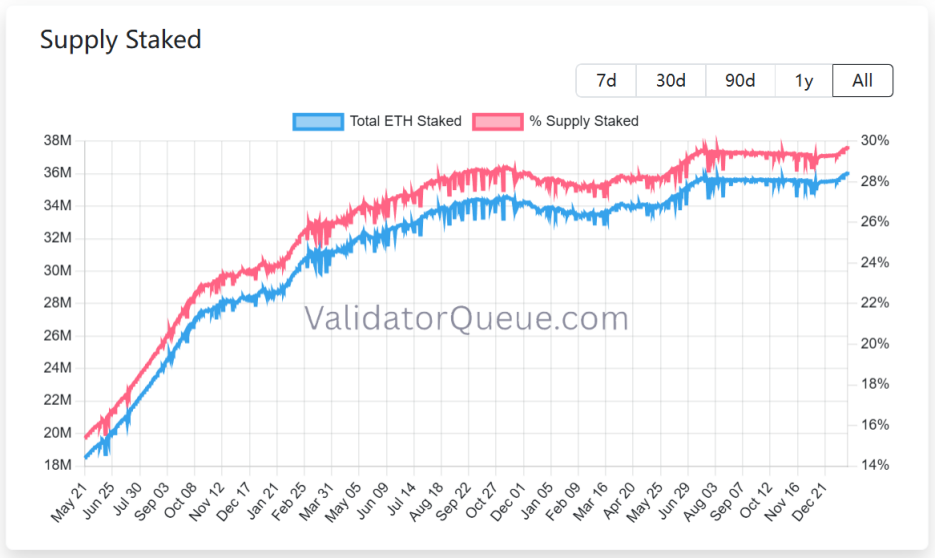

According to ValidatorQueue data, as of January 22, 2026, the Ethereum staking scale reached a historic high of nearly $120 billion, with over 36 million ETH staked, accounting for about 30% of the circulating supply.

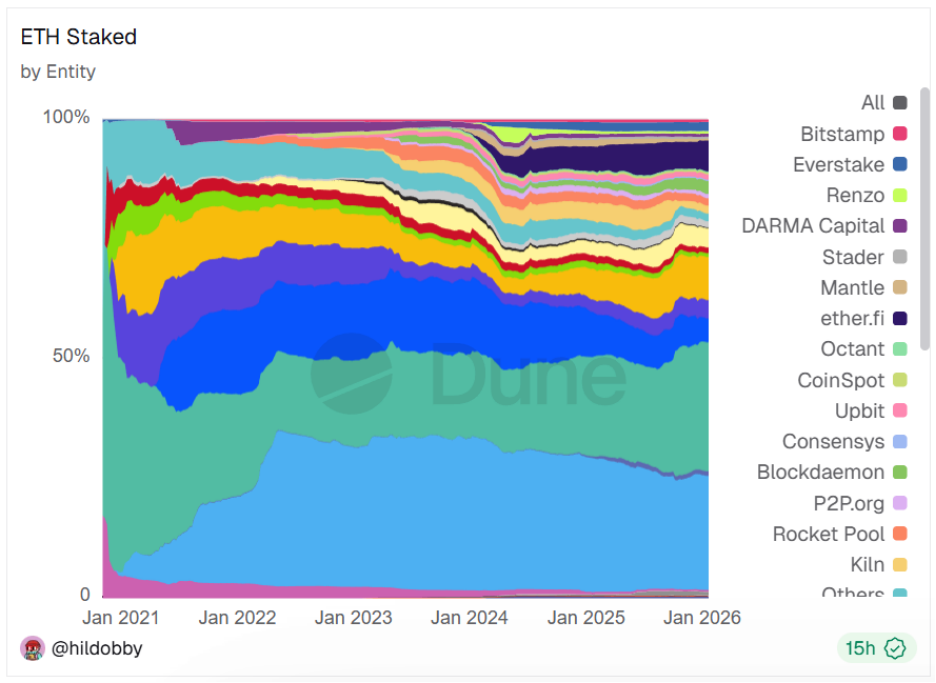

However, behind the prosperous scene lies hidden centralization risks. The staking volume of just the top five liquid staking providers controls nearly 18 million ETH, holding 48% of the market share. This high concentration not only contradicts the original intention of decentralization but also exposes the network to single points of failure and censorship risks, thereby affecting network security and the healthy development of the ecosystem.

On January 21, Vitalik officially proposed the "native DVT (Distributed Validator Technology) staking" solution at the Ethereum research forum, aiming to address the persistent issues of single points of failure for validators and staking centralization, enhancing Ethereum's security and degree of decentralization.

First, Vitalik admitted that in the past, Ethereum pursued user growth at the expense of excessive centralization in node operation and block construction. Native DVT will focus on eliminating reliance on a single physical node or a single cloud service provider like AWS.

Secondly, the high market share of liquid staking providers like Lido has always been a major concern for the community. Native DVT aims to further lower the staking threshold, allowing small and medium validators to participate, thereby increasing Ethereum's Nakamoto coefficient.

Finally, Vitalik indicated that there would be more focus on anti-censorship and resistance to quantum threats. Native DVT allows validators to distribute nodes across different geographical locations and clients, significantly enhancing the network's resilience against geopolitical risks or specific client vulnerabilities.

Related Reading: Ethereum at a Crossroads: Quantum Threats Looming, Wall Street Capital Under Double Pressure

The native DVT proposal outlines four major technical pillars:

- Multi-key cluster management: Allows a validator identity to register up to 16 independent private keys.

- Threshold signature mechanism: A block proposal or proof is considered valid only when more than 2/3 of the associated nodes (e.g., 11 out of 16) sign simultaneously.

- Protocol-level integration: Unlike third-party DVT solutions like SSV or Obol, native DVT runs directly at the consensus layer without the need for a complex external coordination layer, reducing operational thresholds.

- Low performance loss: This design only adds one round of delay during block production, with no impact on proof speed, and is compatible with any signature scheme.

If the native DVT solution is implemented, it will have a profound impact on the validator ecosystem, reducing single point of failure risks and improving the redundancy and fault tolerance of validators.

For individual stakers, they can team up or rent multiple inexpensive servers to achieve "no downtime" operation at a lower cost, significantly reducing the pressure of being penalized.

For institutional validators, they will no longer need to build expensive and complex customized failover systems; native DVT will provide a standardized fault-tolerant solution, thereby reducing operational costs.

For the entire staking track, the native DVT solution may reshape the landscape of Ethereum's liquid staking market. Small service providers and independent validators will gain a fairer competitive environment, while the advantages of large service providers may be weakened.

Although the native DVT proposal is still in the conceptual stage and needs the consent of the Ethereum community for implementation, it clearly points out the future direction of Ethereum, no longer sacrificing security for short-term efficiency and adoption rates, but instead using native technological means to reclaim lost ground in autonomy and trustlessness, which is also Vitalik's vision for this year.

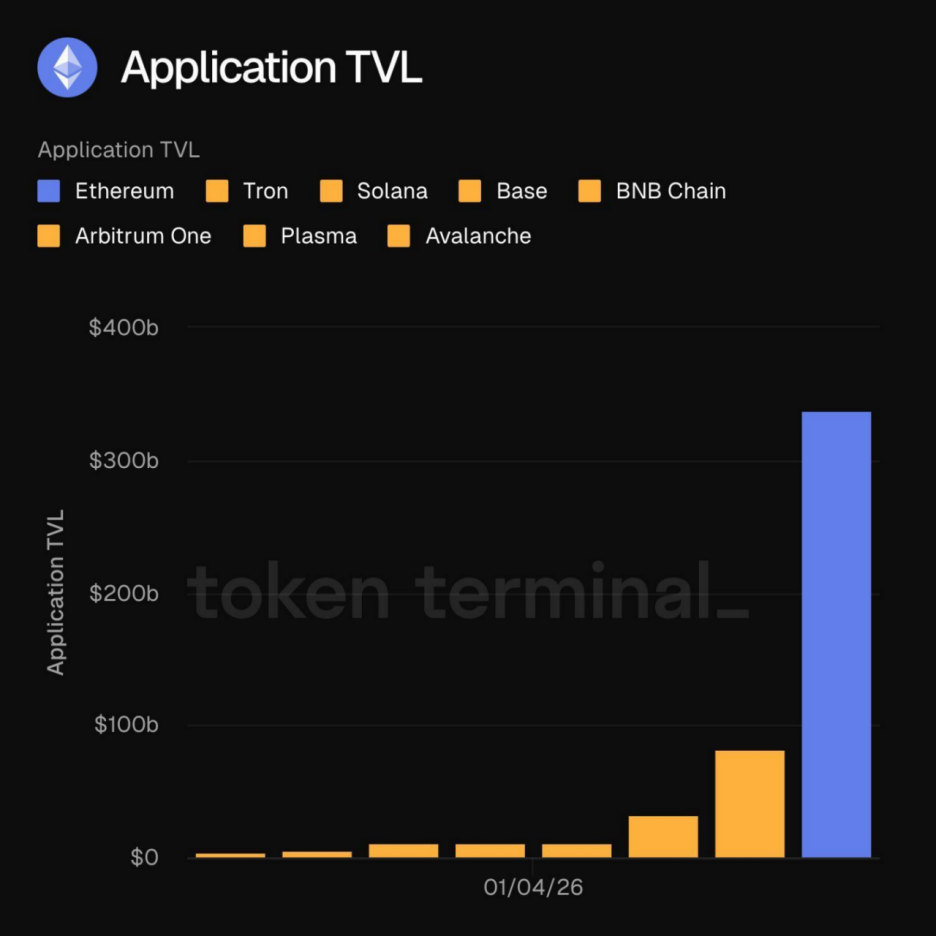

TVL Breaks $300 Billion, Firmly Guarding the Capital Base

At the beginning of 2026, Ethereum welcomed a historic moment as the TVL of on-chain applications broke the $300 billion mark. This milestone leap is not just a numerical increase but represents that Ethereum's ecological structure is becoming increasingly diversified.

The funds settled in the Ethereum ecosystem are no longer just speculative bubbles. According to Onchain's research director Leon Waidmann, these funds are active in DeFi, stablecoins, RWA, and staking, representing real economic activity. Ethereum leads other networks in terms of liquidity depth, composability, predictability, and user and capital reserves, and the network effect is becoming evident.

The funds settled in the Ethereum ecosystem are no longer just speculative bubbles. According to Onchain's research director Leon Waidmann, these funds are active in DeFi, stablecoins, RWA, and staking, representing real economic activity. Ethereum leads other networks in terms of liquidity depth, composability, predictability, and user and capital reserves, and the network effect is becoming evident.

As the TVL scale crosses the $300 billion threshold, Ethereum is no longer just a simple application platform but a global settlement protocol capable of carrying sovereign-level assets. This scale means that any competitor attempting to challenge Ethereum's position must not only compete on performance but also match Ethereum's liquidity depth.

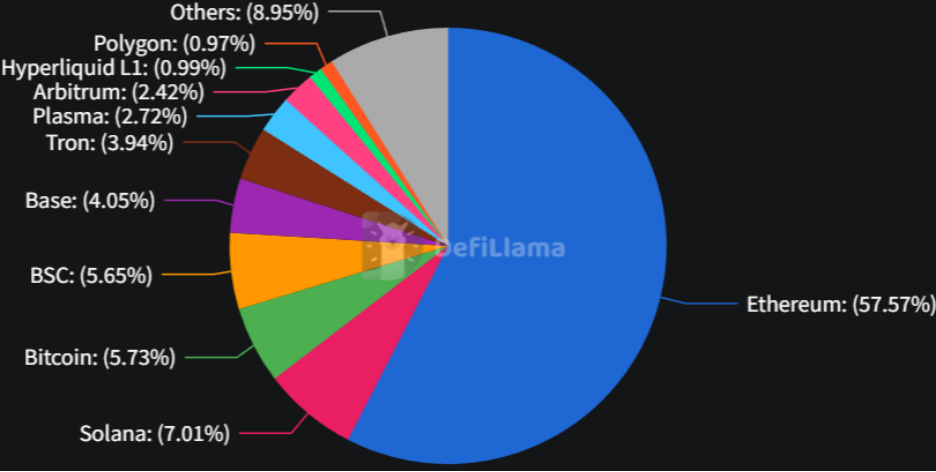

If TVL is Ethereum's "muscle," then stablecoins are its "blood." As of January 22, the Ethereum network's market share in the stablecoin sector has reached about 58%. Against the backdrop of growing global on-chain dollar demand, Ethereum, as the primary launchpad for stablecoins, has built a deep liquidity moat for its ecosystem.

Electrical Capital emphasized in a report that stablecoins on Ethereum are not only a medium of exchange but also serve as collateral supporting over $19 billion in DeFi loans.

The introduction of regulatory frameworks such as the "Genius Act" is a shot in the arm, and mainstream payment companies and traditional financial institutions will enter a period of explosive adoption of stablecoins.

USDC's share on Ethereum continues to rise, further solidifying its status as a compliant "pass" while yield-bearing stablecoin protocols like Ethena weave ETH staking yields into the underlying returns of stablecoins, and their large-scale adoption has also strengthened the deep coupling between ETH and the stablecoin ecosystem.

Despite challenges from public chains like Solana, Polygon, and Tron in the fields of small payments and high-frequency transfers in 2025, Ethereum's dominance in institutional funds, large transactions, and DeFi integration remains difficult to shake.

As long as Ethereum maintains its position as the "settlement hub" for stablecoins, even if other chains excel in transaction numbers, their "liquidity black hole" effect will continue to play a role.

21shares predicts that the stablecoin market size may reach $1 trillion by 2026. This means that as a foundational settlement asset, the stablecoin liquidity settled on Ethereum will directly translate into long-term demand for ETH.

Reduced to a "Toxic Paradise," L2 Diverts Mainnet Revenue

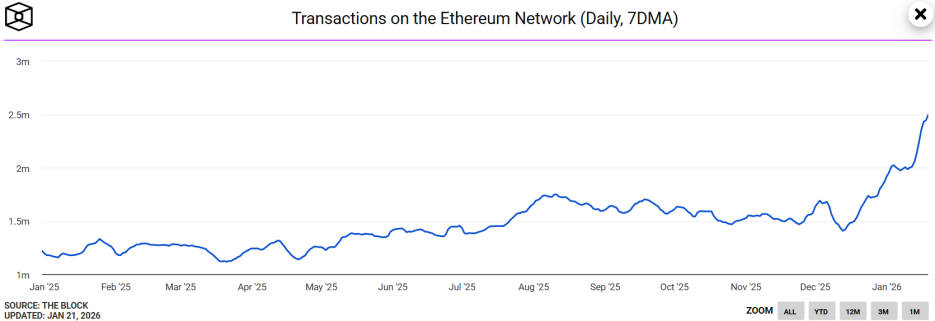

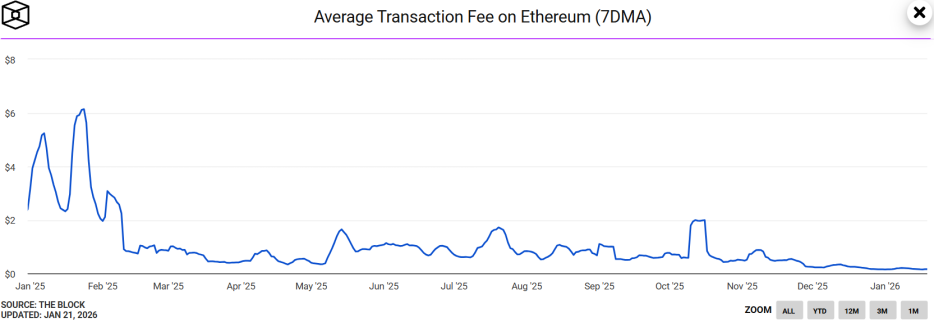

Recently, Ethereum staged a counterintuitive spectacular show, with its 7-day moving average transaction count reaching 2.49 million, setting a historical high, more than double that of the same period last year.

At the same time, Ethereum's 7-day moving average gas fees dropped to a historical low of below 0.03 Gwei, with the cost of a single transfer being only about $0.15.

What is puzzling is that although on-chain activity on the Ethereum network has surged, the price of ETH has reacted tepidly. Security researcher Andrey Sergeenkov noted that this may stem from large-scale "address poisoning" attacks rather than real demand growth.

Research has found that about 80% of the abnormal growth in new addresses on Ethereum is related to stablecoins, with about 67% of new active addresses making initial transfers of less than $1, consistent with the characteristics of "dust attacks."

This phenomenon is attributed to the arrival of the Fusaka upgrade in December last year.

The Fusaka upgrade is considered a "technical gift package" from Ethereum to its ecosystem, with the main innovation being the introduction of PeerDAS (Peer Data Availability Sampling), which effectively performed a "data reduction surgery" on the network.

PeerDAS allows nodes to verify the data availability of an entire block by sampling only part of the data, significantly enhancing the network's capacity to handle Blob data (L2 data storage space).

Related Reading: Ethereum Activates Fusaka Upgrade, L2 Gas Fees Drop by Another 60%

As the Fusaka upgrade significantly reduces transaction costs, low-cost attacks like dust attacks become feasible. This indicates that Ethereum's record transaction volume may be exaggerated by junk transactions, undermining the credibility of demand enhancement and leading the market not to view it as a catalyst for ETH price increases.

Misfortunes do not come alone; in addition to the demand illusion caused by "address poisoning attacks," Ethereum is also experiencing "growing pains" in capturing the value of the mainnet.

To nurture the expansion of the L2 ecosystem, Ethereum's mainnet actively reduced fees in 2025, significantly lowering the "toll" that L2 pays to the mainnet.

Growthepie data indicates that L2's total revenue in 2025 was $129 million, but the fees paid to the mainnet plummeted to only $10 million. This means that Ethereum's mainnet sacrificed over $100 million in potential revenue.

While this subsidy strategy has promoted the growth of the L2 ecosystem, it has also raised community concerns about ETH's value capture ability. If mainnet revenue cannot grow in the long term, the amount of ETH burned will significantly decline, thereby affecting its deflationary expectations.

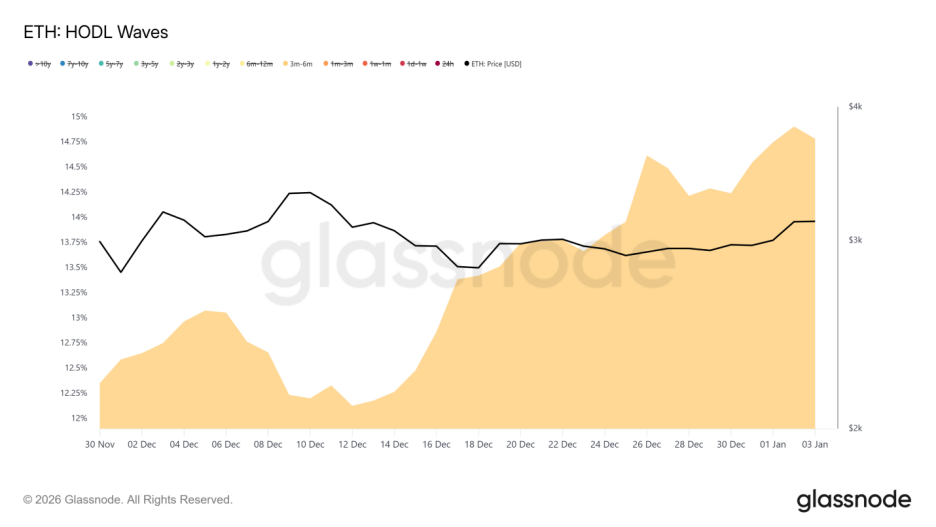

In addition, the HODL Waves indicator shows that a large number of new holdings occurred between July and October 2025. These medium- to long-term holders exhibited a significant willingness to exit at breakeven when prices approached $3,200, which also partially explains why on-chain data performed well, but the ETH price faced resistance in the short term.

"Digital Oil Field" Under Valuation Inversion

On one hand, there is extreme prosperity in ecological data, while on the other hand, there is a serious lag in market pricing, and ETH is deeply mired in the "valuation inversion" quagmire.

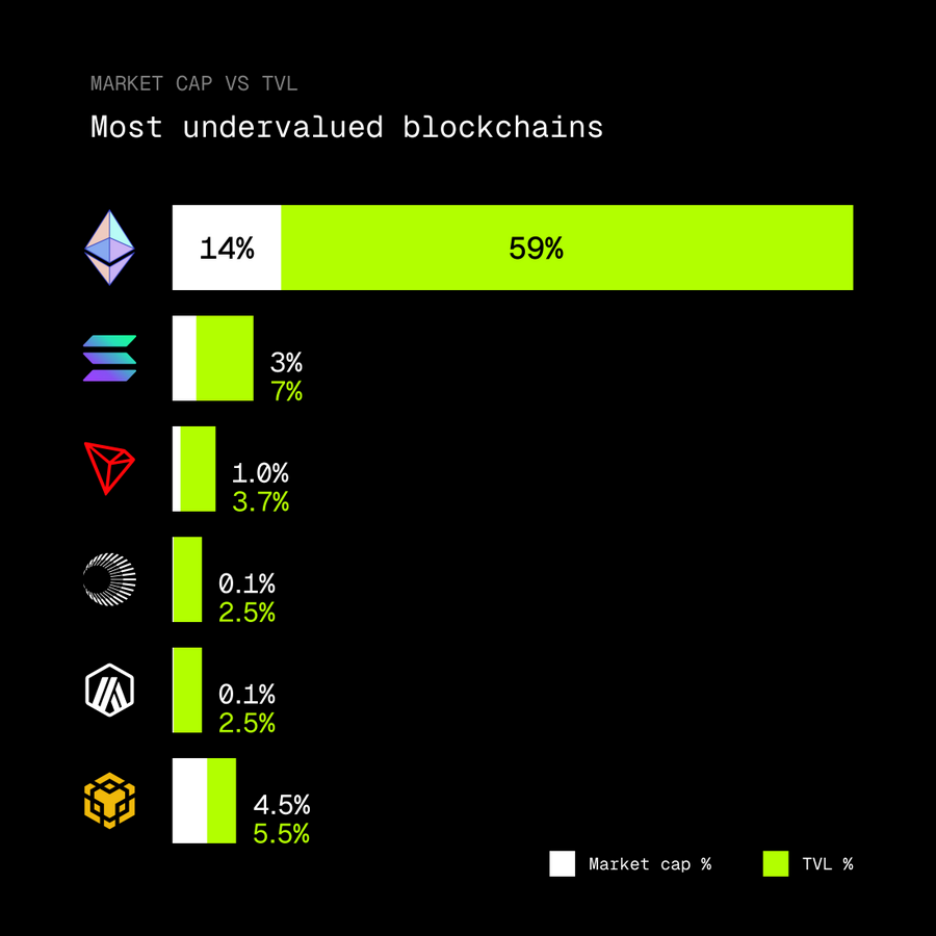

In the pricing logic of the crypto market, the ratio of the market capitalization of public chain tokens to the asset scale they carry is a key metric for measuring capital efficiency and valuation rationality of public chains.

However, as crypto KOL rip.eth pointed out, Ethereum currently carries 59% of the total TVL in the crypto market, but its native token ETH's market capitalization only accounts for 14% of the total crypto market capitalization.

This imbalance in ratio may indicate that Ethereum is in a value pit and is currently the most undervalued public chain.

The deeper reason for this inversion may be that Ethereum is undergoing a profound role transformation, gradually transitioning into a "digital oil field," but has not been adequately priced.

A large amount of TVL is locked in staking protocols, DeFi contracts, and the L2 ecosystem, leading to a change in liquidity logic. Currently, market funds are more inclined to chase oil (ecological applications) while neglecting the property value of the oil field itself (Ethereum).

At the same time, with the continuous expansion of RWA, Ethereum is becoming the settlement base for traditional financial assets, and this cash flow-generating capability will further drive its MC/TVL ratio back to a reasonable range.

In fact, behind Ethereum's prosperity is a "tightrope walk": while technological upgrades enhance performance, they may also distort real data; ecological subsidies are to some extent eroding the mainnet's value capture ability; and the native DVT proposal addressing the risks of staking centralization will be key to maintaining the baseline of decentralization.

It can be said that Ethereum's challenge is no longer simply about scaling but has upgraded to finding a dynamic balance point in the impossible triangle of maintaining decentralization, sustaining technological advantages, and strengthening value capture. However, as the market shifts its perception or enters a fundamental-driven repair cycle, this "valuation dam" may release tremendous energy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。