Author: CoinFound,TradFi × Crypto Data Technology Company

On January 21, CoinFound officially released the "CoinFound Annual Report: TradFi x Crypto 2026 Outlook," which focuses on the deep integration trend between TradFi and Crypto. Below is a summary of the report's content:

2025 is the "fusion tipping point," and 2026 will enter the "programmable finance" acceleration phase.

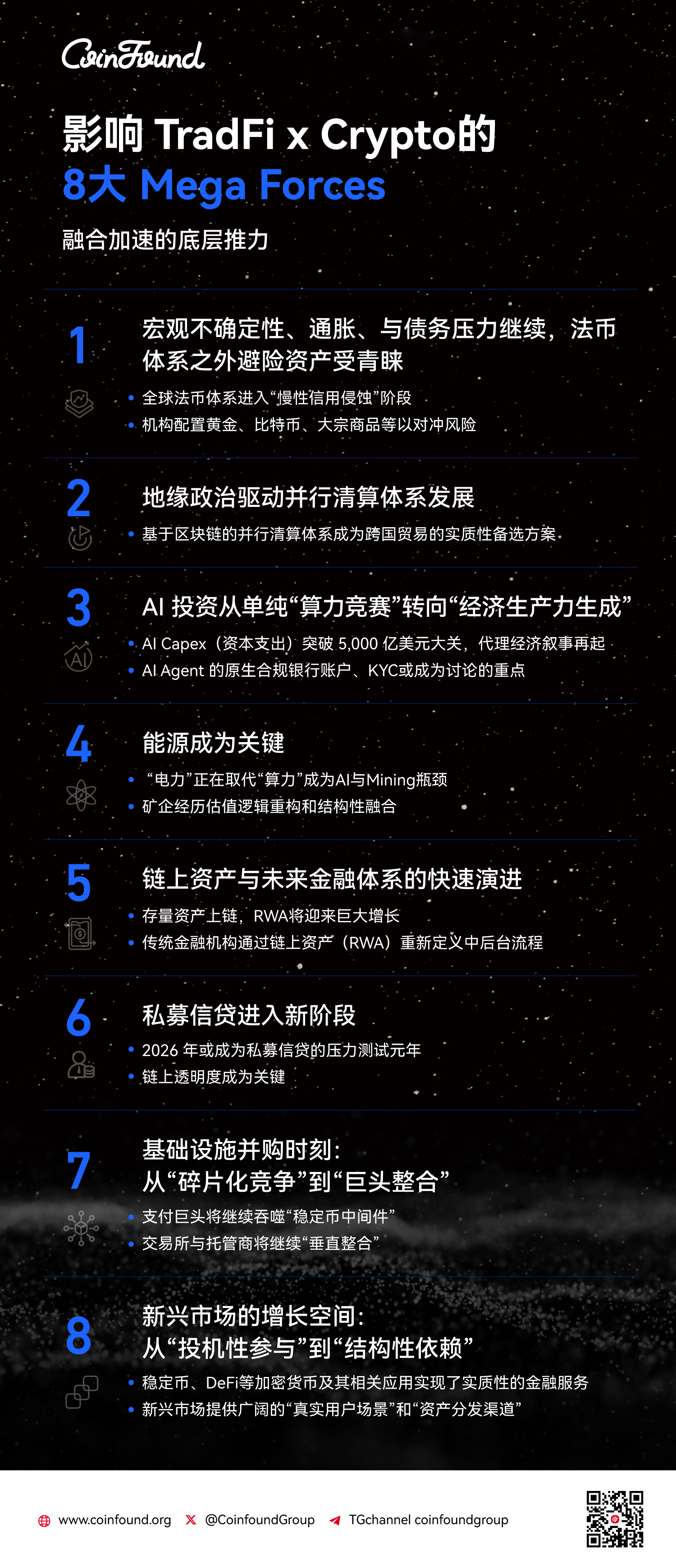

The report distills 8 Mega Forces and 7 trend outlooks: from the competition for global payment infrastructure with Stablecoin 2.0, to RWA moving from "issuance" to "utility," and key variables such as stock tokenization, DAT differentiation, and centralization.

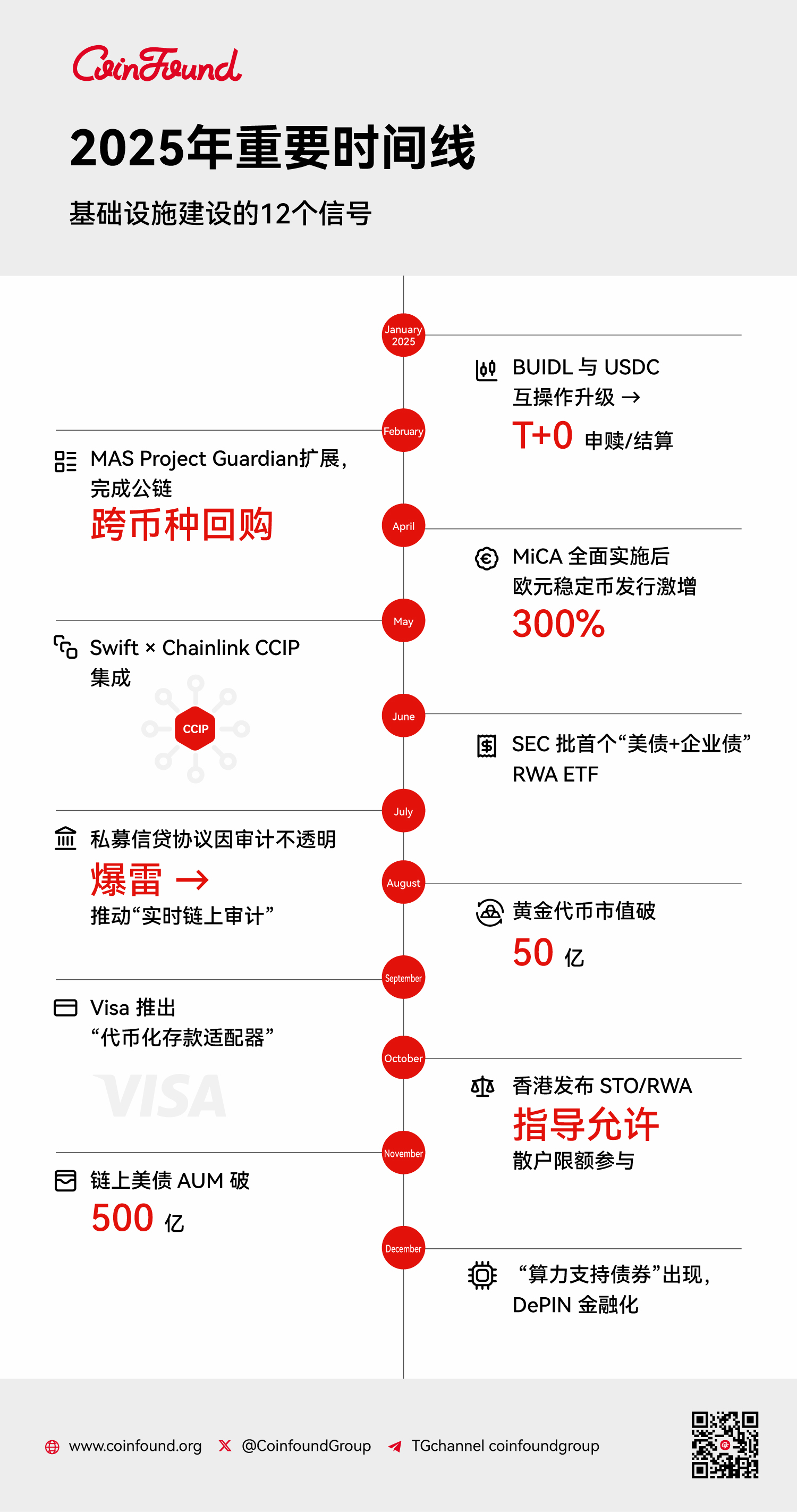

2025 Important Events Timeline for Traditional Finance x Crypto

In 2026, the following macro trends will impact the TradFi x Crypto field:

- Trust Crisis in Fiat Currency System and Return to Hard Assets: In the face of a global debt spiral and "fiscal dominance" risks, institutions are accelerating the allocation of "hard assets" such as gold, Bitcoin, and commodities to hedge against the erosion of fiat currency credit.

- Geopolitical Drivers and Parallel Settlement Systems: The demand for "de-weaponization" of financial infrastructure is driving blockchain to become an alternative settlement solution independent of SWIFT, with atomic settlement mechanisms effectively reducing trust and counterparty risks in cross-border transactions.

- Monetization of AI Productivity and Rise of Machine Payments: The focus of AI investment is shifting from computing hardware to economic productivity generation, creating a rigid demand for AI Agents for compliant stablecoins and on-chain automatic settlement to achieve value rights confirmation between machines.

- Energy as a Core Asset and Mining Enterprises' Infrastructure Transformation: Power shortages are prompting mining companies to transform into "hybrid computing centers," with their scarce power access rights (Time-to-Power) triggering acquisitions by tech giants, driving the valuation of mining companies towards data center infrastructure reconstruction.

- On-chain Assets (RWA) Moving from Issuance to Utility: Asset tokenization is entering the "programmable finance" stage, where RWA is no longer just a digital certificate but significantly enhances the funding efficiency of the repurchase market and overall liquidity as a 24/7 core collateral.

- Private Credit Facing Stress Testing and Transparency Transformation: The wave of maturing debts in 2026 may trigger default risks, forcing the industry to shift from "black box" operations to real-time on-chain transparent audits based on zero-knowledge proofs (ZK) to avoid a cascading liquidation crisis in DeFi.

- Infrastructure Moving from Fragmented Competition to Giant Integration: The market is entering a consolidation phase similar to the telecommunications industry, where payment and financial giants complete track positioning through mergers and acquisitions of stablecoin middleware and custodians, eliminating redundancies and building compliance moats. Emerging markets are shifting from speculation to structural dependence: Crypto assets have deepened into the underlying tools for payments and remittances in emerging markets, with a vast array of real user scenarios making them a core hub connecting traditional financial assets and global retail liquidity.

The trend outlook for 2026 is as follows:

- Structural explosion in the RWA market, with stablecoins bottoming out at a $320 billion market, and equities and commodities becoming new growth points.

- Stablecoins entering the 2.0 era, from crypto payments to competing for global payment infrastructure.

- Liquidity in stock tokenization may grow rapidly, with DeFi integration becoming key.

- Private credit RWA shifting to "asset-driven," potentially accelerating differentiation under "default" risk pressure.

- Gold and commodity RWA ushering in a new era of "full asset collateralization."

- RWA liquidity will further concentrate, with three types of RWA assets favored by exchanges.

- The "rise" of crypto concept stocks, along with the "differentiation" and "centralization" of DAT.

Summary

2025 Summary: 2025 is a year of "de-mystification and integration" for TradFi and Crypto. Blockchain technology is being restored from the halo of "revolution" to an efficient accounting and settlement technology. The success of government bond RWA has proven the feasibility of traditional assets on-chain, while the comprehensive entry of giants like BlackRock provides an irreversible credit endorsement for the industry.

2026 Prediction: 2026 will be a year of "secondary market explosion and credit expansion." We judge that:

- Liquidity Explosion: As infrastructure improves, RWA will shift from "holding for yield" to "high-frequency trading."

- Credit Downward Pressure: Asset classes will shift from high-credit government bonds to corporate bonds, stocks, and emerging market credit, with risk premiums becoming a new source of returns.

- Risk Warning: As the scale of RWA expands, the complexity of off-chain defaults transmitting to on-chain liquidations will pose the greatest systemic risk.

In 2026, whether in TradFi or Crypto, both will unify under the banner of "On-chain Finance."

Complete report link for "CoinFound Annual Report: TradFi x Crypto 2026 Outlook": https://app.coinfound.org/zh/research/4

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。