Author: Matty

Translation: Jiahua, ChainCatcher

In November 2025, more than 5 years after the $UNI airdrop, Uniswap finally activated the fee switch.

This process experienced years of delays and repeated governance battles, even witnessing an extremely awkward moment in 2024: a 'stakeholder' (widely believed to be a venture capitalist) attempted to block a proposal that was supposed to benefit token holders. Nevertheless, the UNIfication proposal ultimately passed with over 62 million votes.

As the largest DEX in the crypto space, the fact that it took so long to figure out how to reward its token holders speaks volumes about the current state of the relationship between equity and tokens. Although UNI token holders theoretically "own" the protocol, they can only watch from the sidelines as equity investors reap all the value from front-end fees.

While Uniswap is a typical representative of the equity-token divide, this issue has been worsening for years, affecting nearly every revenue-generating protocol. Equity holders and token holders often compete for the same pool of value while operating under fundamentally different legal, governance, and economic frameworks.

The solutions proposed in the industry are varied: from completely eliminating equity and transferring all ownership on-chain, to going to the other extreme—completely abandoning tokens. Both approaches have their supporters but also significant flaws.

Extreme Path One: Complete De-equitization

Completely eliminating equity and transferring all ownership concepts on-chain is undoubtedly a theoretical solution. In this vision, smart contracts replace shareholder agreements, on-chain balances replace equity structure tables, and governance tokens replace board votes.

Instant settlement. Transparent ownership. What’s not to like?

A major issue is: unless a company's assets, operations, and customers are entirely on-chain, the off-chain court system will always be the final arbiter for resolving disputes. You can try to make all your off-chain contracts and agreements reference on-chain logic, but this still does not change the fact that off-chain courts are the arbiters, and not everything within your control can be transferred on-chain.

For example, I can own a tokenized real estate NFT issued by a smart contract that states I own the corresponding property, but if the off-chain deed says otherwise, good luck showing your NFT when the sheriff comes to deliver an eviction notice. (Again, you can take steps to try to ensure the off-chain deed aligns with the on-chain status, but this does not negate the fact that off-chain enforcement has priority).

The "no equity, pure tokens" approach only applies to a small subset of projects:

Fully on-chain networks and protocols, such as Bitcoin, some public chains, and fully autonomous DeFi. These projects have no companies, no employees, no servers, and no external dependencies. After all, this is precisely what makes Bitcoin so wonderful! An uncensorable system and unconfiscatable assets.

But for the vast majority of projects (and the vast majority of potential on-chain activities), this is not feasible. Web2 and Web2.5 companies have off-chain assets, customers, payments, and operations.

Extreme Path Two: Complete De-tokenization

At the other extreme of the spectrum, some projects (in fact, the vast majority of companies) decide to completely abandon tokens. They raise equity, build products, and avoid all the headaches that tokens might bring—while also sacrificing all the benefits.

Benefits: No tokens mean no SEC knocking on your door. No worries about whether governance tokens are securities. No need to design token economics, worry about emissions, or explain buyback mechanisms.

Costs: Abandoning instant settlement, transparent ownership records, cost efficiency benefits, and the ability to coordinate global community incentives.

Traditional equity transfers are expensive, slow to settle, and most potential investors cannot access them. Gaining equity exposure in private startups remains costly, inefficient, and opaque. Even in 2026, the processes required to trade public stocks seem outdated compared to DeFi.

Despite their various flaws, tokens have the potential to solve these issues. They enable community ownership and user-owned products. Completely abandoning this is a regression.

To find the best balance between these two extremes, we need to understand what equity provides that tokens cannot.

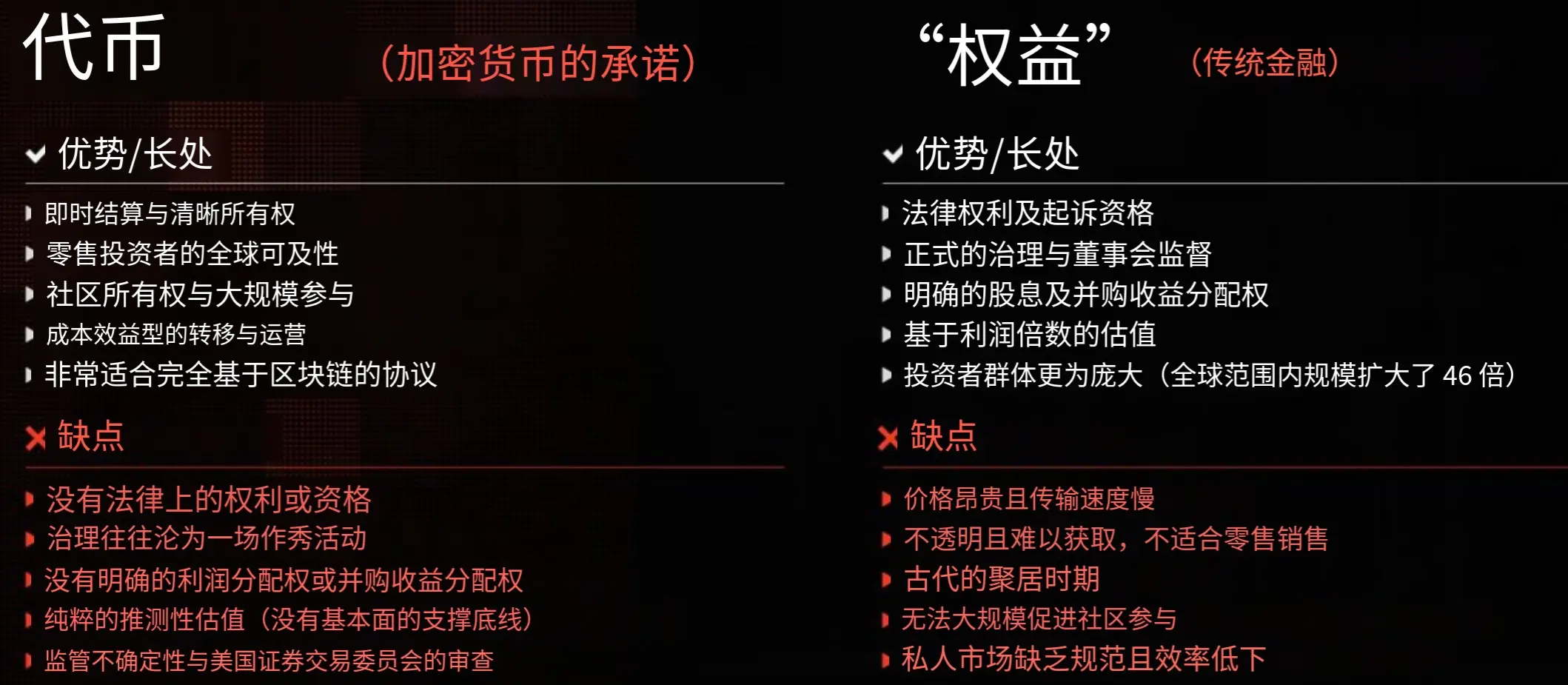

What Equity and Tokens Each Offer

1. Legal Rights and Recourse

When you own equity, you have legal standing. You can sue, enforce rights. If directors breach fiduciary duties or commit fraud, you have an established legal framework to recover losses.

Token holders (with very few exceptions) have almost no legally recognized rights or protections. They often can only hope that the market will save their investments.

While theoretically, a company's entire budget could be on-chain, without legal rights, having founders submit every decision to shareholder votes would introduce significant operational inefficiencies and contradict the purpose of investing—trusting the team's vision and capabilities.

2. Formal Governance Control

Equity shareholders elect the board, approve major transactions, and have codified rights. In contrast, governance tokens often give a sense of illusion of control.

As Vitalik noted, token governance has serious flaws: low voter turnout (10%), whale manipulation, and lack of expertise. More often than not, on-chain governance devolves into "decentralized theater," where teams can often ignore votes if they dislike the outcome, as execution still requires manual operation.

3. Legal Clarity of Value Accumulation

In M&A activities, equity holders have clear legal rights to receive benefits. As recent cases involving Tensor and Axelar have shown, token holders are often completely left out, even when the relevant projects have been acquired.

Due to this strong legal right to profit sharing, stocks trade more reliably based on multiples of expected future profits. In contrast, token valuations are often purely speculative, lacking fundamental support.

Even when projects generate revenue, due to regulatory risks and conflicts of fiduciary duty, most projects will not reliably route income to token holders. While off-chain agreements can be constructed to simulate this right, they are far less reliable than the legal foundation of equity.

4. Broader and Deeper Investor Pool

In short, the investor pool and total purchasing power in the equity market are significantly larger than in the token market.

The value of the U.S. stock market alone is more than 20 times that of the entire crypto industry.

The value of the global stock market is over 46 times that of the crypto industry.

Projects that choose tokens over equity are effectively only tapping into 2%-5% of the potential purchasing power they could have accessed.

2026: The Year of Equity Tokens

One thing is certain: from tokenized equity to new forms of on-chain governance, 2026 will be a year of innovation and experimentation for equity tokens.

DTC pilot projects (launching in the second half of 2026) will be the first in the U.S. to allow participants to hold tokenized securities rights on the blockchain. This represents a shift in the infrastructure backbone of U.S. capital markets towards on-chain:

Nasdaq has proposed trading tokenized securities.

Securitize offers real public stocks with fully on-chain legal ownership.

Centrifuge and others are tokenizing equity through SEC-registered agents.

The integration of traditional financial infrastructure with blockchain rails is no longer a daydream—it is happening.

For crypto-native projects, Uniswap's five-year journey to the fee switch serves as a warning. The divide between equity and tokens will not resolve itself automatically. It requires intentional design, clear protocols, and structures to resolve conflicts of interest.

Ultimately, this divide stems from regulatory uncertainty and the lack of a legal framework. Whether through the SEC's "crypto projects" or the Clarity Act, the U.S. is expected to gain the long-awaited regulatory certainty as early as this January.

By the end of this year, we will no longer be discussing equity versus tokens. We will be discussing ownership—transparent, transferable, legally protected, and natively digital ownership.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。