Written by: seed.eth

Over the past year, gold has left little room for doubt.

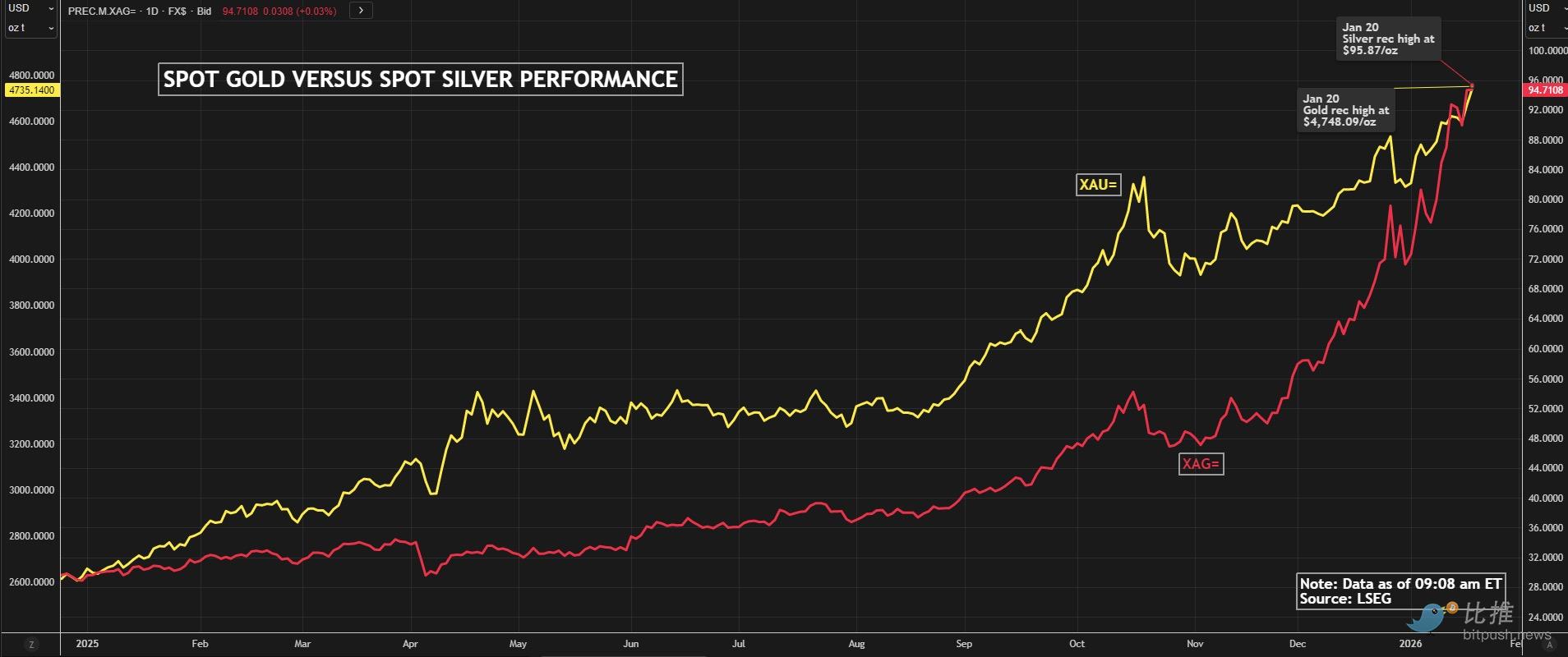

In less than 12 months, gold prices have risen nearly 70%, marking one of the strongest annual performances in nearly half a century. Repeated geopolitical conflicts, persistent shadows of tariffs and trade frictions, a phase of dollar weakness, and bets on future interest rate cuts have collectively pushed gold back to the center of global asset allocation.

Faced with such a clear trend, the real question in the market is no longer "whether to allocate gold," but rather "in what way to hold gold." In traditional sectors, funds continue to flow into gold ETFs or physical gold; meanwhile, in the crypto market, a rapidly rising sector—tokenized gold—is accelerating into the operational vision of mainstream institutions.

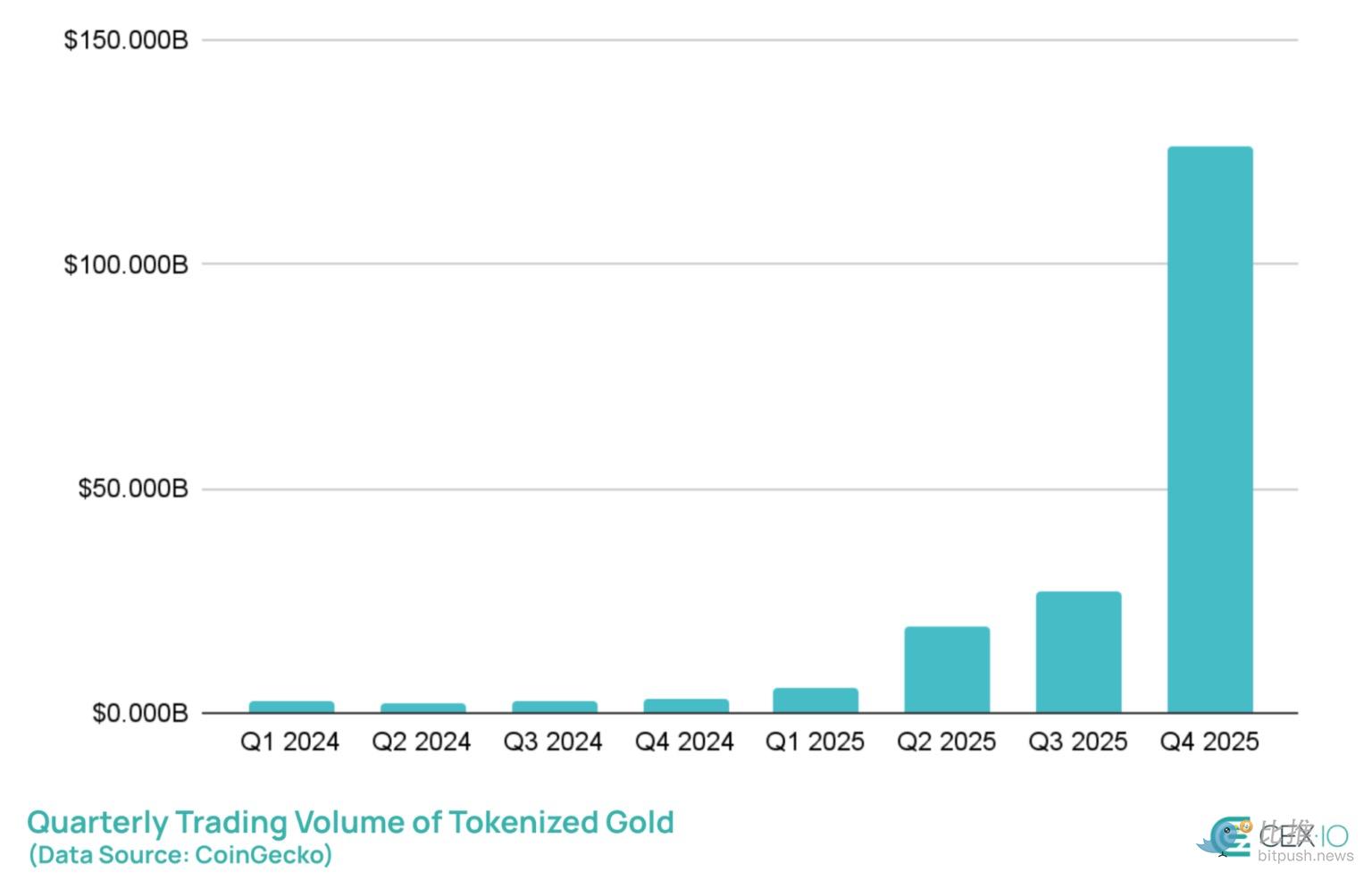

According to a research report from the crypto exchange CEX.io, the trading volume of tokenized gold is expected to explode in 2025, reaching approximately $178 billion for the year, with the trading volume in the fourth quarter alone exceeding $120 billion, surpassing that of most traditional gold ETFs.

From "holding" to "using," what has happened on-chain

If we only look at market capitalization, tokenized gold remains a relatively small market.

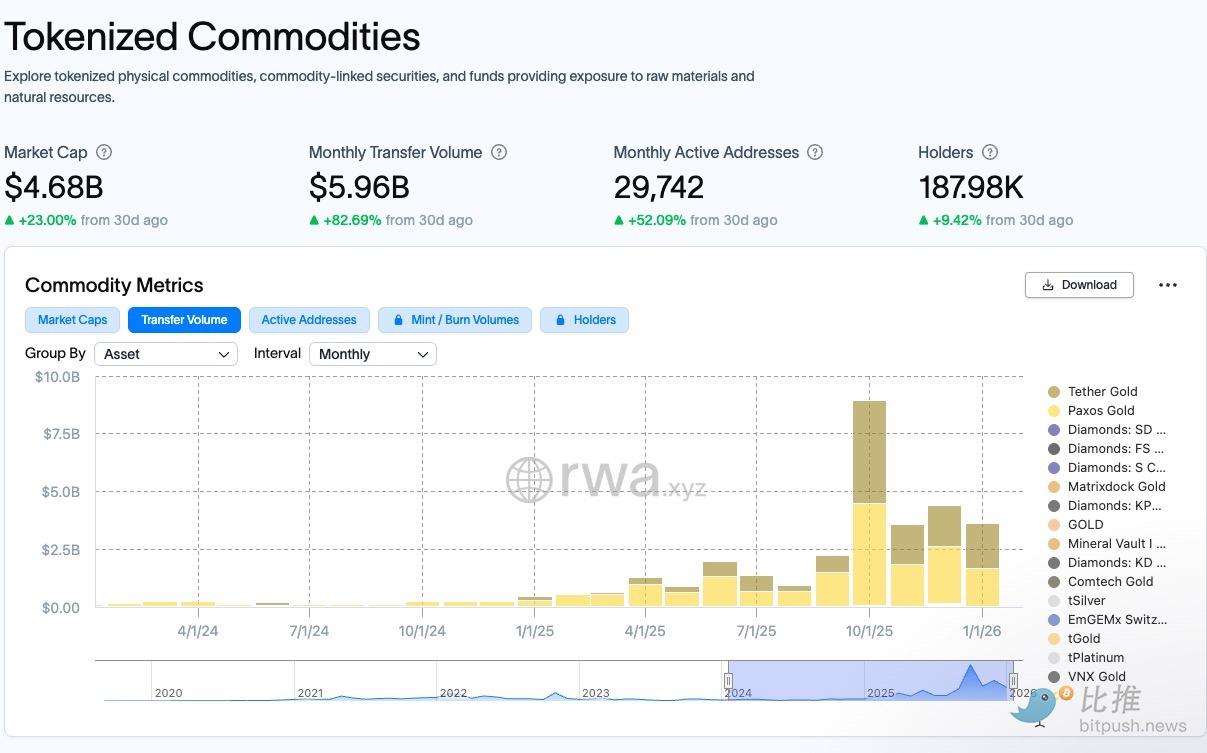

As of January 2026, the overall market capitalization of tokenized commodities (primarily gold) is around $4.5 billion, which is almost negligible compared to the global gold market. However, if we focus on on-chain behavior, the conclusion is entirely different.

According to the latest statistics from RWA.xyz, on-chain activity in the tokenized commodity sector has significantly accelerated over the past 30 days: monthly transfer volume reached approximately $5.96 billion, a month-on-month increase of 82.69%, clearly outpacing the 23% increase in market capitalization. At the same time, the number of monthly active addresses grew by 52.09%, while the number of holders only increased by 9.42%.

This is a very typical signal. The difference in the slope between these indicators suggests that this round of growth is not primarily driven by an expansion of the holder base, but rather by an increase in participation depth and usage frequency. In other words, the market is not simply "attracting more people to hold," but rather that both existing and new participants are using tokenized commodities more frequently for trading and rebalancing, resulting in a significant increase in asset turnover.

In the traditional financial system, gold is a "low-frequency asset"; however, on-chain, it is beginning to exhibit a relatively "high-frequency" characteristic.

To understand this change, we cannot look solely at crypto adoption for the reasons.

The macro environment at the beginning of 2026 is itself in an extremely delicate position:

On one hand, the narrative of falling inflation and AI enhancing productivity continues; on the other hand, geopolitical frictions have not eased, and the absolute safe status of the dollar is being repeatedly discussed, with U.S. stock valuations remaining in historically extreme ranges.

This is not a moment for "comprehensive de-risking," but rather a phase of not wanting to exit, yet needing to hedge.

In traditional markets, funds can hedge through futures, ETFs, and structured products; however, in the crypto market, if you do not want to completely switch back to fiat, there are not many options.

Stablecoins can avoid volatility but lack direction;

Bitcoin has a long-term narrative but remains highly volatile in the short term;

While tokenized gold sits perfectly between the two.

It inherits the safe-haven properties of gold while also possessing the characteristics of on-chain assets that are tradable, combinable, and can be quickly rebalanced 24/7. This is not "narrative innovation," but rather a functional complement.

A highly concentrated market

When we zoom in, we find that the tokenized gold market is almost monopolized by two names: XAUt and PAXG.

This is not a common "winner-takes-all" scenario in the crypto world, but rather a result imposed by the real world.

Unlike ordinary tokens, the underlying assets of tokenized gold are not on-chain. Where the gold bars are stored, who holds them, whether they meet LBMA standards, how they are audited, and under what conditions they can be redeemed—none of these questions can be replaced by smart contracts.

As a result, the market naturally tends to concentrate liquidity among a few issuers.

Not because they are "more decentralized," but because they are more verifiable in the real world.

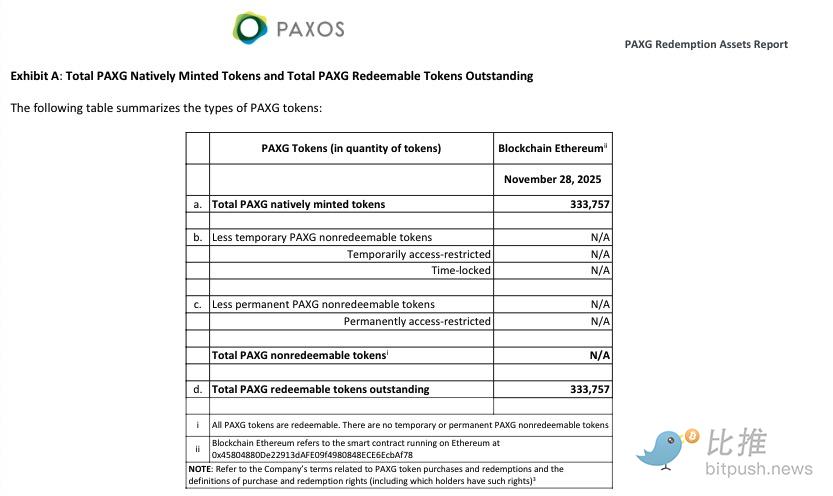

PAXG is issued by the regulated Paxos Trust Company, with gold custody meeting the standards of the London Bullion Market Association, and provides regular reserve and redemption statements; XAUt relies on the issuance and distribution system of Tether to quickly establish scale and liquidity advantages.

As trading frequency increases, this difference is further amplified.

High-frequency usage requires depth, depth requires consensus, and consensus ultimately points to trust and compliance pathways.

This is also why, during the explosive growth of trading volume over the past year, liquidity has not dispersed but has further concentrated at the top.

Who is buying on-chain gold? This is not a simple retail hedging story

If we only start from the word "hedging," it is easy to simplify the demand for tokenized gold as merely a reflection of retail sentiment. However, from the perspective of on-chain structure and product attributes, the composition of participants in this market is actually more complex than one might think.

First, tokenized gold does attract a portion of macro-sensitive funds. These funds do not necessarily want to completely exit the crypto market but are looking for an asset that can significantly reduce portfolio volatility while still remaining within the on-chain system during periods of rising uncertainty. For them, tokenized gold is more like a risk management tool rather than a directional bet.

At the same time, another significant force comes from trading and rebalancing funds. As the on-chain usage frequency of tokenized gold has significantly increased, it is gradually being viewed as an "intermediate asset" between stablecoins and high-volatility assets, used for position switching, hedging, and liquidity management. This demand explains why the growth in transfer volume and activity is clearly outpacing the expansion in the number of holders.

However, ignoring the role of retail investors is also incomplete. Unlike many tokenized assets that are restricted by accredited investor thresholds, gold tokens have low barriers to entry, are divisible, and have no minimum investment amount. This allows individual investors to gain exposure to gold with very little capital, without the need for accounts, limits, or geographical restrictions in the traditional financial system.

This structural advantage makes tokenized gold particularly attractive in emerging markets. In some regions, gold-related financial products are not easily accessible or are costly; on the other hand, on-chain gold provides an alternative with almost no entry friction. The retail demand here is not for short-term speculation but rather a natural allocation demand for gold as a traditional asset after accessibility has improved.

Tokenized gold ≠ zero risk

It must be made clear that tokenized gold is not a risk-free asset.

Its risks do not manifest in price but rather in counterparty and institutional structures.

All anchors must ultimately be realized through real-world custody, legal, and redemption chains, and these chains may be subject to regulatory, sanction, or operational shocks in extreme cases.

Moreover, even for top assets, their liquidity remains limited compared to the global gold market. In the event of a systemic shock, the stability of the anchor may still come under pressure.

This is why tokenized gold is better understood as a different risk profile asset rather than an "absolutely safe asset."

Prior to this, the crypto market had almost no truly meaningful "in-system hedging tools."

Now, for the first time, the market has an asset form that can complete risk buffering and hedging without exiting the system.

When Bitcoin pulls back, stablecoin scales rise, and the trading activity of tokenized gold simultaneously amplifies, this differentiation itself becomes a new risk thermometer.

In conclusion

Gold has not changed; what has changed is the way this era needs it.

When Ray Dalio of Bridgewater warns that Trump's policies could trigger a "capital war" and shake confidence in dollar assets, the market has already voted with its feet, and gold is becoming the most direct expression in this expectation game.

This consensus is forming rapidly. UBS strategists recently stated more directly: if the market continues to worry about the independence of the Federal Reserve, gold prices could challenge $5,000 in the first half of this year. Silver, copper, and other metals are also being repriced alongside gold in their respective supply and demand narratives.

In an era of persistent uncertainty, yet unwilling to completely exit, the market will ultimately choose those tools that are the least frictional, easiest to use, and have the lowest explanation costs.

And on-chain gold stands right at the intersection of this story.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。