Author: Nikka / WolfDAO (X: @10xWolfdao)

In 2026, the cryptocurrency market is expected to become more fragmented, with RWA, Meme, and privacy coins forming two major investment camps. Institutions are betting on the RWA tokenization revolution, with trillion-dollar market expectations, but face risks of low liquidity and regulatory delays; Meme coins are warming up but still represent a game of existing stocks, with hidden risks of unlocking selling pressure; privacy coins have limited rebounds, caught in a dilemma of compliance and ideology. The article points out that it is difficult to find Alpha in a single track, and opportunities lie in the intersection of the three innovative fields. The optimal strategy for retail investors may be to hold BTC/ETH and wait for signals, avoiding the risks of chasing highs and being unable to hold.

A Class Divide in Progress

Are you all in on the institutional narrative of RWA, or are you continuing to gamble for quick money in Meme/Privacy? This choice may determine whether you eat meat or drink soup in 2026.

Wall Street is betting on a "tokenization revolution." Bernstein predicts that 2026 will mark the beginning of a Tokenization supercycle, and Grayscale has even stated that RWA (Real World Assets) will achieve a thousandfold growth by 2030. The script for institutions is clear: real estate, bonds, and government bonds will be tokenized and connected to trillion-dollar traditional capital.

But the story on the other side of the market is completely different. Meme coins rose 23% at the beginning of the year, and the privacy coin QUAI, which had been suppressed by regulators, surged 261%. Retail investors in Discord groups are still looking for the "next hundredfold coin," dismissing the slow-money narrative of institutions.

This is not a simple investment divergence, but a collision of two worlds: suited institutional investors calculating the risk-reward ratio of RWA in conference rooms, while retail investors stare at candlestick charts chasing Meme coins at three in the morning.

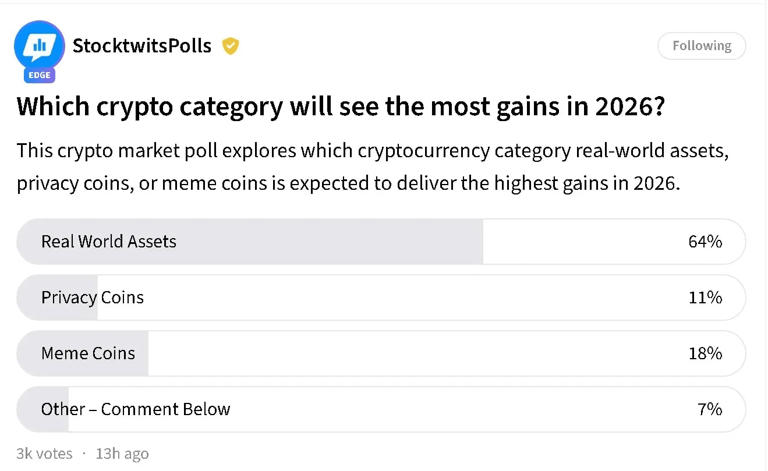

Recent polls on Stocktwits show that 64% of investors believe RWA will bring the strongest returns in 2026, far exceeding the 12% for Meme coins and 8% for privacy coins. But behind this number lies a question—when retail investors start shouting about allocating to RWA, is it a genuine cognitive upgrade, or just a PTSD reaction after the Meme crash in 2025?

RWA: The Promised Land for Institutions or an Overcrowded Tightrope?

Let’s first look at why Wall Street is so fascinated by RWA. The current total market capitalization of cryptocurrencies is about $3.2 trillion, with Bitcoin fluctuating around $95,000, and the market is searching for the next growth engine.

The logic of RWA seems flawless: tokenizing traditional assets like real estate, bonds, and government bonds onto the blockchain allows one to enjoy the efficiency advantages of blockchain while connecting to trillion-dollar capital pools in traditional finance. This is not speculation, but "infrastructure construction."

In its report "2026 Digital Asset Outlook: The Dawn of the Institutional Era," Grayscale lists RWA as a core theme, predicting its scale will grow from the current $21 billion level to a trillion-dollar level by 2030. Behind this growth curve is a gradually clarifying regulatory environment—the potential passage of the U.S. CLARITY Act and the fact that U.S. banks have already allowed wealth advisors to allocate 1-4% of crypto assets for clients.

Leaders have already emerged. Ondo Finance focuses on RWA lending, currently valued at about $1.5 billion; Chainlink, as an oracle infrastructure, supports RWA data on-chain, with a market cap exceeding $20 billion. Bernstein has clearly expressed optimism about these projects and views Coinbase and MicroStrategy as indirect beneficiaries of the tokenization wave.

But there is a paradox here: When everyone knows RWA is the "right answer," can it still provide excess returns?

The current overall market cap of RWA is only around $20 billion, with extremely low liquidity. This means that once institutional funds flood in, prices could indeed skyrocket; but the same logic applies to withdrawals—when the first batch of institutions starts to take profits, retail investors may find that the RWA tokens in their hands cannot be sold at all.

A more realistic risk is regulatory delays: if the CLARITY Act is delayed or if the Federal Reserve's rate-cutting cycle comes later than expected, the entire RWA narrative may need to wait another year or two amid volatility.

Institutions can bear this wait because they have funding cost advantages and long-term allocation needs. But can retail investors? This is the most easily overlooked dimension of RWA investment—it not only requires you to judge the right direction but also needs you to have enough patience and liquidity to endure the vacuum period before the narrative materializes.

Meme: A Cultural Renaissance or the Last Carnival?

Compared to the rational narrative of RWA, Meme coins are more like the emotional barometer of the crypto market. At the beginning of 2026, the total market cap of Meme coins rose from $150 billion at the end of 2025 to $185 billion, an increase of 23%.

This number is far from the madness of 2021 or early 2025, but it is enough to illustrate one fact: Meme is not dead.

Jesse Pollak, founder of the Base chain, provides an interesting perspective. He has repeatedly emphasized that Meme is not just a speculative tool but the "core of on-chain culture." Through images, videos, music, and other content forms, Meme can attract millions of new users to the chain, becoming an entry point for large-scale adoption of Web3.

Meme projects on the Base chain, such as TYBASEGOD, TOSHI, and BLOOFOSTERCOIN, are validating this logic—they are not just tokens but rather carriers of community culture.

However, we must admit that this "cultural argument" is more about finding legitimacy for the platform ecosystem rather than a genuine investment logic. The essence of Meme coins remains a zero-sum game: early participants profit through community consensus and viral spread, while later entrants pay for liquidity.

Only 12% of respondents in the Stocktwits poll are optimistic about Meme, reflecting a collective avoidance by institutions and rational retail investors. More critically, the crash of the Meme market in 2025 left deep scars—many retail investors were deeply trapped after chasing highs at the top and have yet to recover their losses.

So what does the Meme rebound in 2026 mean? One interpretation is that the low cost and high throughput of Layer 2 solutions like Base have lowered the barriers to creating and trading Meme, allowing this track to maintain activity with smaller amounts of capital.

But another, more pessimistic interpretation is that this is merely a "game of existing stocks"—old investors are harvesting each other, while new funds have not truly entered the market. If 2026 does not give birth to a new hundredfold myth (like Shiba Inu in 2021), Meme may gradually become a self-entertainment game for niche players.

What is even more concerning is the unlocking selling pressure brought about by the concentrated TGE (Token Generation Event) period in Q1. When a large number of tokens unlock, market liquidity may be drained, and Meme, as the most vulnerable asset class, often bears the brunt first. This structural risk is rarely discussed in the Meme community but could be a major reason for retail losses in 2026.

Privacy: The Last Bastion of Idealism or the Next Target of Regulation?

Privacy coins are in the most awkward position in this discussion. On one hand, Quai Network surged 261% at the beginning of the year, rising from $0.03 to $0.11, with a market cap of about $86 million; Monero and Zcash also saw rebounds of 10-50%.

On the other hand, the entire category of privacy coins has a market cap of only around $5-10 billion, which is almost negligible in the total cryptocurrency market cap of $3.2 trillion.

Supporters of privacy coins will tell you that this is because they represent the original intention of cryptocurrencies—financial freedom and transaction privacy. Privacy coins uphold the ideals of decentralization and resistance to censorship. The surge of Quai is partly due to the launch of new mining machines and DEX liquidity support, indicating that technological upgrades can still create short-term alpha for privacy coins.

But reality is much harsher than ideals. The EU's anti-money laundering laws are tightening regulations on privacy coins, and several exchanges have already delisted coins like Monero. Only 8% of respondents in the Stocktwits poll are optimistic about privacy coins, reflecting not only regulatory concerns but also indicating that privacy as an investment theme lacks sufficient market consensus.

A deeper question is: can privacy and compliance coexist in the current regulatory environment? If not, privacy coins will either be marginalized as tools for geeks and the dark web or compromise into "pseudo-privacy" projects.

This dilemma makes it difficult for privacy coins to become mainstream investment targets. Of course, for true believers in privacy, this is precisely an opportunity for long-term left-side positioning—waiting for the regulatory shoe to drop and bottoming out at historical lows could yield considerable returns. But this requires enduring 3-5 years of volatility and uncertainty, which is too long for most investors.

Fragmentation is a Foregone Conclusion, Where is Alpha?

So, RWA, Meme, Privacy—who will be the true source of Alpha in 2026?

The answer may disappoint you: none of the three, at least not in the way you imagine.

The essence of this fragmentation is the misalignment of time dimensions—RWA needs to be calculated annually, Meme weekly, and Privacy quarterly. Institutions have the patience to lock in RWA, while retail investors pursuing quick money are prone to repeatedly stop-loss during fluctuations. The biggest risk is not "choosing the wrong track," but "chasing highs + being unable to hold."

True Alpha may lie in these two places:

1. Intersection Zones: Innovations that Break Time Misalignment

True Alpha is not at the endpoint of a single track but in the intersection zones of narrative fusion:

- Privacy-Enhanced RWA: Tokenizing bonds and real estate on-chain, but encrypting all trading intentions and holdings, only disclosing during audits. Transitioning from "institution-exclusive" to "institution + high-net-worth retail investors" can play.

- Meme IP Tokenization: Once viral Meme IP is RWA-ified, it generates cash flows from copyrights, peripherals, and community shares. Transitioning from "casino" to "cultural fund."

- Compliance Privacy Layer: Default privacy + selective disclosure. Private stablecoins and private cross-chain bridges solve institutional pain points (data leaks) and retail pain points (being front-run).

The essence of these intersections: using institutional patience to satiate retail FOMO, and using retail viral spread to activate institutional liquidity. Pure track players are easily washed out by time misalignment; only cross players can find asymmetric opportunities.

2. Non-participation: The Most Underestimated Advantage for Retail Investors

If you cannot understand this fragmentation, the best strategy may be not to participate. Hold BTC/ETH and wait for the market to provide clearer signals. FOMO will lead you to lose money in every track, while patiently waiting will allow you to heavily invest at the right time. The greatest advantage of retail investors is flexibility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。