Author: Common Sense Investor (CSI)

Translation: Deep Tide TechFlow

Deep Tide Introduction: With the drastic changes in the macro environment in 2026, market logic is undergoing a profound shift. Veteran macro trader Common Sense Investor (CSI) presents a contrarian view: 2026 will be a year when bonds outperform stocks.

Based on the heavy interest expenditure pressure on the U.S. government, deflationary signals released by gold, extremely crowded short positions in bonds, and imminent trade conflicts, the author believes that long-duration U.S. Treasuries (such as TLT) are at an inflection point with an "asymmetric game" advantage.

At a time when the market generally considers bonds "uninvestable," this article reveals through rigorous macro mathematical reasoning why long bonds may become the highest returning asset in 2026.

The main text is as follows:

Why I Overestimate TLT and TMF — And Why Stocks Will Underperform in 2026

I do not write this lightly: 2026 is destined to be a year when bonds outperform stocks. This is not because bonds are "safe," but because macro mathematics, position distribution, and policy constraints are converging in unprecedented ways — and this situation rarely ends with "Higher for Longer."

I have put my money where my mouth is.

TLT (20+ Year U.S. Treasury ETF) and TMF (3x Long 20+ Year U.S. Treasury ETF) currently account for about 60% of my portfolio. This article compiles data from my recent posts, adds new macro context, and outlines a bullish scenario for long-duration bonds (especially TLT).

Core Arguments Overview:

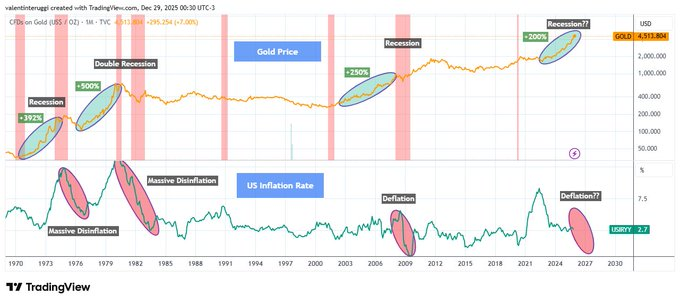

Gold's Movement: The historical performance of gold does not indicate sustained inflation — it signals deflation/deflationary risks.

Fiscal Deficit: The fiscal math of the U.S. is collapsing: approximately $1.2 trillion in interest expenditure per year, and still rising.

Issuance Structure: Treasury bond issuance is skewed towards the short term, quietly increasing systemic refinancing risks.

Short Squeeze: Long-term bonds are one of the most crowded short positions in the market.

Economic Indicators: Inflation data is cooling, sentiment is weak, and labor market pressures are rising.

Geopolitics: Geopolitical and trade headlines are shifting towards "risk-off," rather than "reflationary."

Policy Intervention: When cracks appear in certain areas, policy always shifts to lower long-end rates.

This combination has historically been rocket fuel for TLT.

Gold Is Not Always an Inflation Warning

Whenever gold rises more than 200% in a short period, it does not signal runaway inflation, but rather economic stress, recession, and falling real interest rates (see Figure 1 below).

Historical experience shows:

After the gold surge in the 1970s, a recession + disinflation followed.

After the surge in the early 1980s, a double-dip recession occurred, breaking inflation.

The rise in gold in the early 2000s signaled the recession of 2001.

After the breakout in 2008, a deflationary shock followed.

Since 2020, gold has risen again by about 200%. This pattern has never ended with persistent inflation.

When growth reverses, gold's performance resembles that of a safe-haven asset.

U.S. Interest Expenditure Is Compounding Explosively

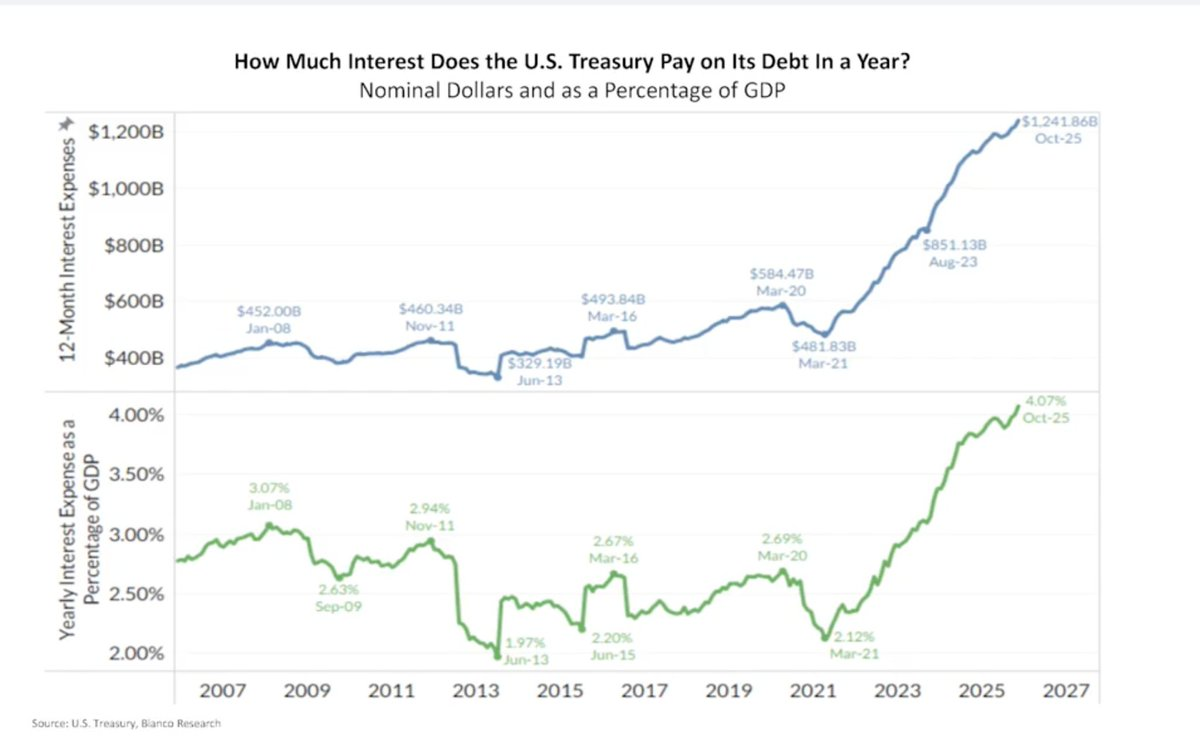

The U.S. currently has annual interest expenditures of about $1.2 trillion, approximately 4% of GDP (see Figure 2 below).

This is no longer a theoretical issue. This is real money flowing out — when long-term yields remain high, interest compounds rapidly.

This is what is known as "Fiscal Dominance":

High rates mean higher deficits.

Higher deficits mean more issuance.

More issuance leads to higher term premiums.

Higher term premiums lead to higher interest expenditures!

This vicious cycle will not resolve itself through "Higher for Longer." It must be addressed through policy intervention!

The Treasury's Short-Term Trap

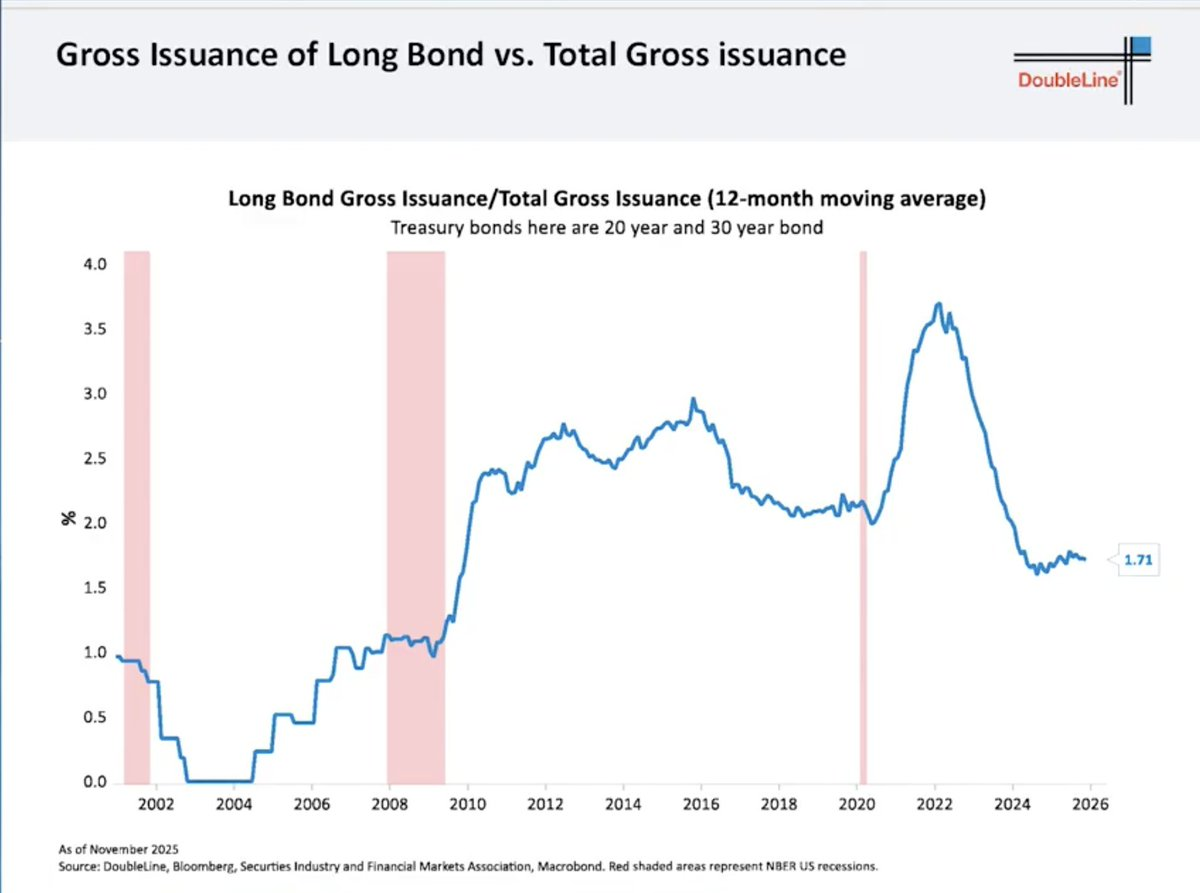

To alleviate immediate pain, the Treasury has significantly reduced long bond issuance:

20-year/30-year bonds currently account for only about 1.7% of total issuance (see Figure 3 below).

The remainder has all been pushed into short-term Treasury bills.

This does not solve the problem — it merely kicks the can down the road:

Short-term debt is continuously rolling over.

Refinancing will occur at future rates.

The market sees the risk and demands higher term premiums.

Ironically, this is precisely why long-end yields remain high… and why they will plummet sharply once growth collapses.

The Fed's Ace: Yield Curve Control

The Federal Reserve controls short-end rates, not long-end. When long-end yields meet the following conditions:

Threatening economic growth

Triggering an explosion in fiscal costs

Disrupting asset markets

… the Fed has historically done only two things:

Buy long bonds (QE - Quantitative Easing)

Cap yields (Yield Curve Control)

They do not act preemptively. They only intervene after pressure becomes evident.

Historical references:

2008–2014: 30-year yields fell from ~4.5% to ~2.2% → TLT surged +70%

2020: 30-year yields fell from ~2.4% to ~1.2% → TLT skyrocketed +40% in less than 12 months.

This is not just theory — it has happened in reality!

Inflation Is Cooling, Economic Cracks Are Emerging

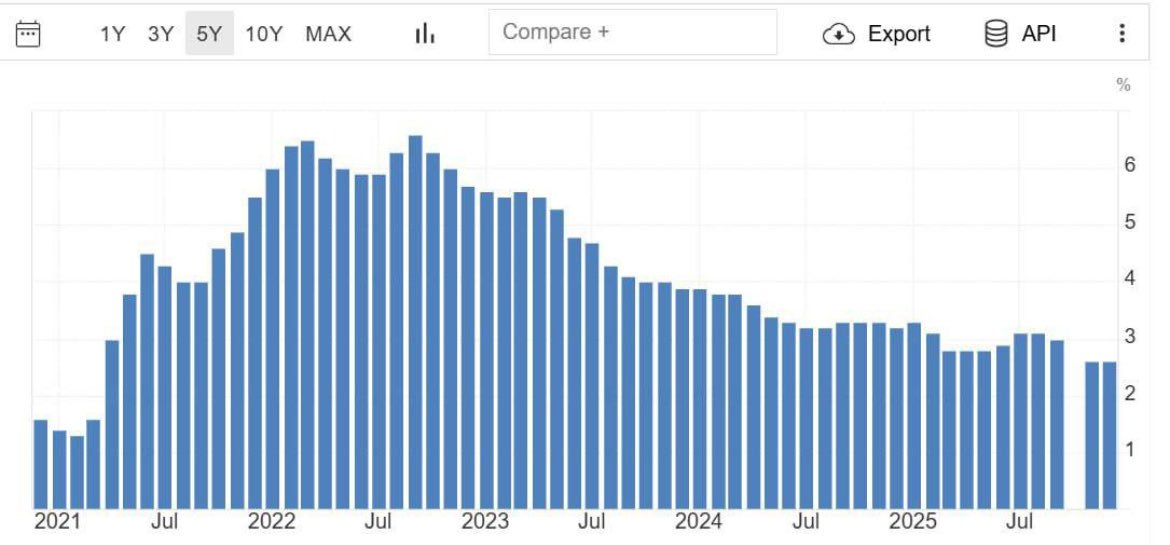

Recent data shows that core inflation is retreating to 2021 levels (see Figure 4).

CPI momentum is diminishing.

Consumer confidence is at a ten-year low.

Credit pressures are building.

Cracks are beginning to appear in the labor market.

The market is forward-looking. The bond market has already begun to sense these signs.

Extremely Crowded Short Positions

TLT's Short Interest Is Very High:

About 144 million shares are shorted.

Days to cover exceed 4 days.

Crowded trades do not exit slowly. They reverse violently — especially when the market narrative shifts.

And importantly:

"Shorts pile in after the rally starts, not before."

This is typical late-cycle behavior!

Smart Money Is Entering

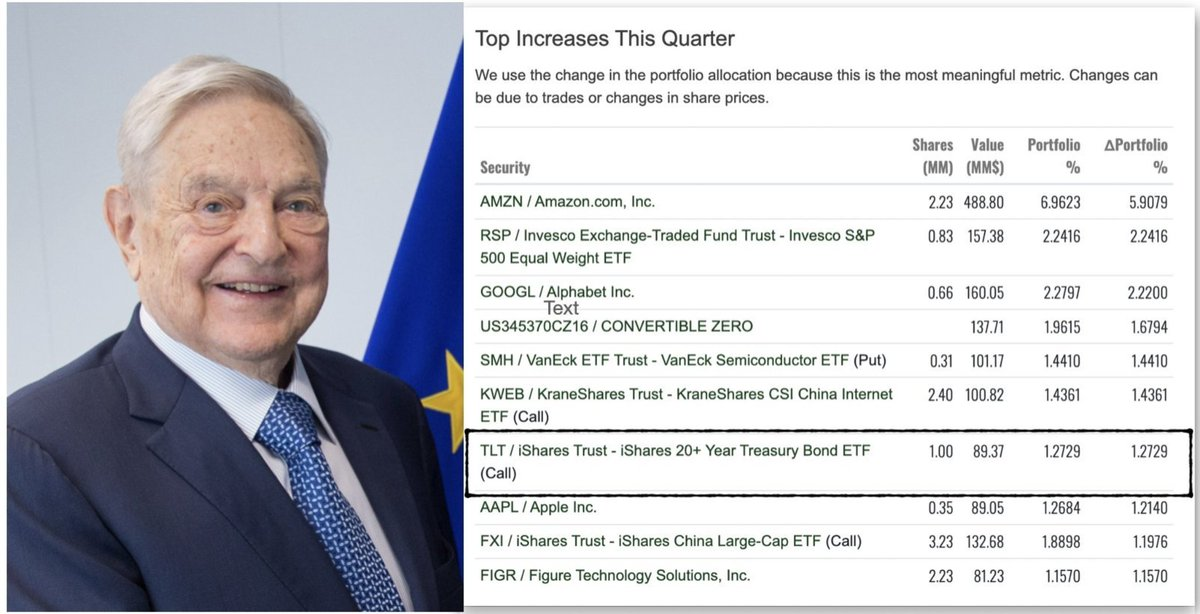

Recent widely circulated 13F institutional holding reports show that a large fund has significantly increased its holdings of TLT call options in the quarterly increase list.

Regardless of who is responsible, the message is clear: sophisticated capital is beginning to reposition duration. Even George Soros's fund holds TLT call options in the latest 13F disclosure.

Tariff Friction Leading to Deflationary Shock

Recent news is reinforcing the "risk-off" logic. President Trump announced new tariff threats regarding the Denmark/Greenland dispute, and European officials are now openly discussing freezing or suspending participation in the EU-U.S. tariff agreement in response.

Trade friction will:

Hit growth

Squeeze profit margins

Reduce demand

Push capital towards bonds rather than stocks

This is not an inflation impulse, but a deflationary shock.

Valuation Mismatch: Stocks vs. Bonds

Today's stock pricing reflects:

Strong growth

Stable profit margins

Moderate financing environment

While bond pricing reflects:

Fiscal pressure

Sticky inflation concerns

Permanently high yields

As long as there is a deviation in either of these narratives, returns will diverge sharply.

Long-duration bonds have "convexity," while stocks do not.

$TLT Upside Case Analysis

TLT Has:

An effective duration of about 15.5 years

You can earn ~4.4–4.7% yield while you wait

Scenario Analysis:

If long-end yields fall by 100 basis points (bps), TLT's price return would be +15–18%.

A 150 bps drop would yield a return of +25–30% for TLT.

A 200 bps drop (not extreme historically) would mean it would soar by +35–45% or more!

This does not even account for interest income, convexity benefits, and the accelerated effects of short covering. This is why I see "asymmetric upside potential."

Conclusion

To be honest: after the disaster of 2022, I swore I would never touch long bonds again. Watching duration assets get crushed is a very frustrating experience.

But the market does not pay for your psychological trauma — it only pays for probabilities and prices.

When everyone agrees that bonds are "uninvestable," when sentiment bottoms out, when shorts pile up, and when yields are already high with growth risks rising…

That is when I start to enter!

TLT + TMF currently account for about 60% of my portfolio. I achieved a 75% return in the stock market in 2025 and reallocated most of my funds into bond ETFs in November 2025.

I am "holding bonds for appreciation" (earning over 4% yield).

My positions are based on shifts in policy and growth, not on vacuous narratives.

2026 will ultimately become "The Year of Bonds."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。