Bloomberg Intelligence senior macro strategist Mike McGlone shared on social media platform X on Jan. 18 a warning that bitcoin’s failure to sustain levels above $100K could mark a late-cycle turning point, raising the risk of a prolonged decline toward much lower price levels.

“$10,000 bitcoin path – 2025 fail may suggest prudent 2026 short,” he wrote. McGlone expanded on his view by tying BTC’s long-term performance to broader liquidity and risk-asset cycles, emphasizing its historical role in reflationary environments. He described how bitcoin’s trajectory since inception has closely mirrored periods of aggressive monetary stimulus and investor appetite for risk, while cautioning that current technical conditions differ materially from earlier cycles. In outlining the potential implications of price action below six figures, he wrote:

“Launched in 2009, bitcoin has led liquidity-pumped reflation in risk-assets and staying below $100,000 could signal an end-game, and normal reversion toward $10,000.”

The strategist also pointed to rolling over long-term moving averages during 2025 and a rebound attempt in early 2026 as evidence that BTC has entered what he characterized as a “prove-strength” phase rather than a renewed bull market. He highlighted poor risk-adjusted performance since 2021, elevated speculation, and long-term annual chart patterns as reinforcing the likelihood of mean reversion, while noting that a move toward $50,000 during the year would represent a typical retracement for an asset that previously rose too far, too quickly.

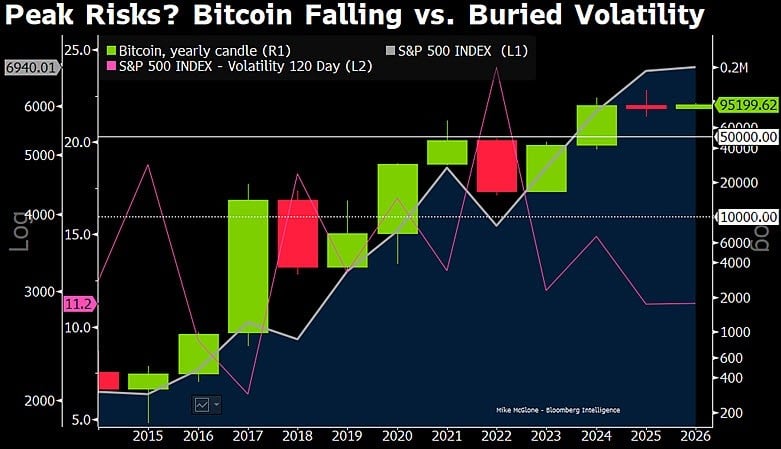

Chart shared by Bloombert strategist Mike McGlone

Read more: Bitcoin’s Calm Is a Trap: Strategist Sees Volatility Bull Market Ahead

In addition to his written comments, McGlone shared a chart titled “Peak Risks? Bitcoin Falling vs. Buried Volatility,” comparing BTC’s yearly candles with the S&P 500 index and 120-day equity volatility. The chart illustrates declining volatility alongside elevated equity benchmarks, a combination he views as historically unfavorable for sustained crypto upside.

He emphasized that a resilient stock market remains a prerequisite for bitcoin and its broader ecosystem to advance, noting that both BTC and gold delivered strong alpha for roughly a decade before recent market shifts. He suggested that cryptocurrencies became “up-too-much afflicted,” potentially allowing metals to outperform in the near term. Framing the discussion within a macroeconomic lens, McGlone added:

“ Bitcoin is a leading candidate to guide post- inflation deflation.”

While his outlook underscores downside risks, bitcoin continues to benefit from institutional participation, spot bitcoin exchange-traded funds (ETFs), and ongoing network security. Its fixed issuance schedule contrasts with concerns about unlimited supply, and past cycles show repeated recoveries following deep drawdowns, leaving long-term valuation debates unresolved even as end-game risks are increasingly discussed.

- Why is $100,000 a critical level for bitcoin?

Staying below $100,000 is viewed by Mike McGlone as a sign of late-cycle weakness and rising downside risk. - What price level does McGlone warn bitcoin could revert toward?

McGlone suggests a normal mean reversion could eventually point toward $10,000. - How does volatility factor into the bitcoin outlook?

Declining equity volatility alongside high stock benchmarks is seen as unfavorable for sustained bitcoin upside. - Does institutional adoption negate the downside risk?

Despite ETFs and institutional participation, McGlone argues macro cycles still dominate bitcoin’s trajectory.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。