Trump publicly threatened at the White House that if European countries do not cooperate with the U.S. in acquiring Greenland, tariffs would be imposed on products from Denmark, Sweden, France, Germany, and other countries. The news spread rapidly across global markets like ripples in a pond.

Several EU countries immediately considered retaliatory tariffs on U.S. goods worth €93 billion. The escalating tensions not only stirred traditional commodity markets like gold and oil but also caused ripples in the digital asset space, including Bitcoin.

This diplomatic dispute over the Arctic island is evolving into an economic war that affects global capital.

1. The Origin of the Dispute

● On January 16, Trump first linked tariffs to the Greenland issue during a White House roundtable on healthcare. He threatened to impose tariffs on European allies that do not support the U.S. in acquiring Greenland, even hinting at possible actions similar to previous threats against European pharmaceutical companies.

● The next day, Trump officially announced on social media that starting February 1, a 10% tariff would be imposed on U.S.-bound goods from Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland, with plans to raise the rate to 25% starting June 1.

● The public rationale for this decision pointed directly to the U.S. goal of “completely and thoroughly purchasing Greenland.” The U.S. ambition for Greenland is not a fleeting whim. The Trump administration has defined Greenland as a “national security priority,” particularly valuing the missile early warning base at Thule.

● This base serves as NATO's "outpost" for monitoring the Arctic and also controls a potential Arctic route that could shorten the Asia-Europe shipping distance by 7,000 kilometers.

● Beyond its strategic location, the vast mineral resources of Greenland are also a key attraction. The island contains at least 22 of the 34 critical raw materials defined by the EU, including a giant deposit with over 1 billion tons of rare earth oxides and uranium.

2. Europe's Counterattack

European countries reacted quickly and strongly to Trump's tariff threats. Leaders from multiple European nations emphasized in a joint statement that only Denmark and Greenland can decide their own affairs.

● Danish Prime Minister Mette Frederiksen publicly stated, “Europe will not be blackmailed,” and the Prime Ministers of Sweden and the German Finance Minister expressed similar views.

● Europe's countermeasures are equally ruthless. According to the Securities Times, several EU countries are considering imposing tariffs on U.S. goods worth €93 billion or restricting U.S. companies' access to the EU market.

● This tariff list was drafted last year but was postponed to avoid a full-blown trade war between the U.S. and Europe, with the postponement set to expire on February 6. An EU diplomat revealed that if no agreement is reached between the EU and the U.S., retaliatory tariffs will automatically take effect from February 6.

3. Market Reaction

The geopolitical "powder keg" has been ignited, and market funds are reacting. Gold, as the ultimate safe-haven asset, has strengthened due to geopolitical uncertainty.

● Gold has been a standout asset in 2025, with an annual increase of about 60%. The market's enthusiasm for gold stems from multiple factors, including high policy uncertainty and wavering investor confidence in traditional "safe assets" like U.S. Treasury bonds.

● Tariff policies may exacerbate inflationary pressures by raising U.S. import costs, and gold is viewed as an anti-inflation asset, thus increasing its appeal.

● The Federal Reserve Securities noted in its annual strategy report that the long-term core logic supporting gold remains unchanged and has been reinforced during this macro transition period. The U.S. dollar index is in a trend of decline, and Trump's policy direction has injected profound characteristics into this cycle.

4. Bitcoin's Test

The cryptocurrency market is also highly sensitive to Trump's tariff policies. Historical data from 2025 shows that tariff escalations have repeatedly triggered widespread sell-offs, with daily liquidation amounts reaching as high as $19 billion.

● Bitcoin fell to a three-week low, nearing $91,400, when Trump announced new tariffs on Mexico, Canada, and China in February.

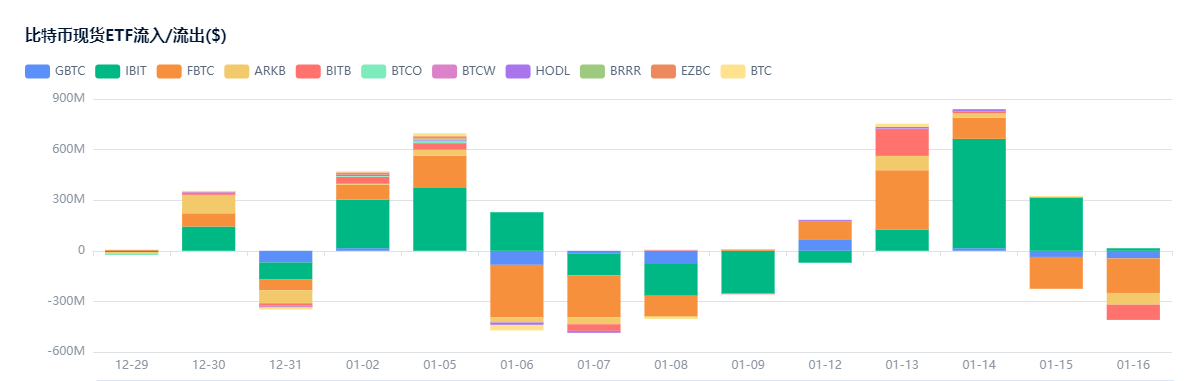

● The Bitcoin market is facing a clear test of macro risks. Analysts point out that as 2026 approaches, one of the core macro risks facing the Bitcoin market is President Trump's tariff agenda. Looking back at 2025, the cryptocurrency market has profoundly experienced the severe impact of tariff headlines on prices, with effects comparable to ETF fund flows.

● The market's four-year cycle model for Bitcoin is losing its relevance, with political developments and policy statements increasingly influencing prices. In the Bitcoin market, political developments and policy statements, rather than internal supply chain data, are becoming the main drivers of pricing.

5. Oil Under Pressure

● Compared to the complex reactions in gold and Bitcoin, the pressures facing the oil market are more straightforward. The core issue for the oil market in 2026 is the risk of oversupply. Non-OPEC oil-producing countries are expected to increase production by 1.2 million barrels per day, with Brazil, Argentina, and Guyana expected to contribute an additional 1.4 million barrels per day from global deep-sea resources.

● Meanwhile, demand is expected to grow by only 900,000 barrels per day, with the pace influenced by the interest rate cut cycle in the U.S. and Europe, expected to be lower initially and higher later. Geopolitics is one of the main driving factors for oil price fluctuations in 2025, and it will continue to bring significant uncertainty to the oil market in 2026. Russia has become a focal point for market attention, as the decline in refined oil exports from Russia in 2025 has a far greater impact than crude oil.

● The uncertainty of Trump's policies further amplifies the risks in the energy market. Some trade agreements he leads include commitments from other countries to significantly increase purchases of U.S. energy, but these commitments are often difficult to fulfill in reality.

● The EU's commitment to purchase $250 billion worth of U.S. energy annually is particularly typical. Based on the average price in 2025, the total value of crude oil, LNG, and coal imported by the EU from the U.S. is only about $82.3 billion, and the volume of crude oil imports has also decreased year-on-year.

6. Impact on the Supply Chain

● The impact of the Greenland dispute extends far beyond fluctuations in financial asset prices; it is reshaping the global supply chain landscape. Rare earths and other critical minerals may emerge as relative winners in 2026. Due to strategic security considerations, the Trump administration is likely to continue promoting the construction of a "de-China" supply chain for critical minerals, increasing investment and policy support for resources like lithium and cobalt.

● The copper market has already reacted to tariff expectations. In December 2025, copper reached an all-time high, largely not due to a sudden surge in demand, but because the market feared that Trump would impose tariffs on refined copper in early 2026, prompting a significant influx of copper into the U.S. ahead of time.

● The result is that the U.S. may have doubled its copper imports in 2025, leading to inventory accumulation, while inventories in other parts of the world have been significantly depleted.

● The trajectory for 2026 depends on whether the tariff policies are actually implemented. If tariffs are enacted, U.S. import demand may decline, shifting to consume inventory, which would create space for major buyers like China to re-enter the international market.

● As the capacity expansion cycle of the past two years comes to an end, the scale of new mines coming online globally in 2026 is expected to decline significantly, marking the beginning of a medium- to long-term structural bottleneck in mineral supply.

7. Future Projections

● Acquiring Greenland faces significant legal and public opinion obstacles. According to Greenland's 2009 Self-Government Act, changes in sovereignty must be approved by the local parliament and a national referendum. A poll shows that as many as 85% of Greenlanders oppose joining the U.S., and more than half of the U.S. public also expresses opposition.

● Therefore, the likelihood of a direct "purchase" or military annexation is low. A more realistic path may be to enhance existing defense agreements, strengthen resource development cooperation, or seek some form of long-term leasing arrangement to expand U.S. actual presence and control in Greenland.

● There are several possible development paths for this dispute:

○ One is to negotiate a security agreement to diplomatically strengthen the U.S. presence on the island;

○ Two is a long-term lease by the U.S., similar to historical lease models;

○ Three is a free association agreement, granting Greenland semi-independent status but subjecting its defense and foreign affairs to the U.S.;

○ Four is military coercion, which is a low-probability but existing tail risk.

● Deutsche Bank warns that the "Greenland issue" has become a potential "black swan," and its tail risks will continue to disrupt the market.

● The European Parliament was originally scheduled to vote on January 26-27 to eliminate many EU import tariffs, but it now seems likely to suspend its work on the U.S.-EU trade agreement. Manfred Weber, the chairman of the largest party group in the European Parliament, stated that it is currently impossible to approve the agreement.

Beneath the ice and snow of Greenland lies not only minerals and shipping routes but also the future landscape of great power competition. Trump's tariff threats and the EU's strong countermeasures have already made global markets feel the chill of the Arctic winds.

Gold and defense stocks are the most direct market responses to the turmoil, while the revaluation of critical minerals and self-sufficient technology supply chains represents a more enduring and profound transformation.

The €93 billion tariff list from the EU hangs over U.S. goods like the sword of Damocles, ready to fall at any moment.

Financial markets detest uncertainty, but this dispute over the Arctic island has brought the greatest uncertainty to global investors.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。