Author: Jae, PANews

On January 14, the DFINITY Foundation officially released a new white paper on token economics titled "Mission 70," proposing a highly aggressive deflationary plan: to reduce the inflation rate of ICP by 70% by the end of 2026.

Following the announcement, the price of ICP performed strongly, with an intraday increase of over 30%, leading the market. This is not merely emotional speculation but a repricing of the fundamentals of the Internet Computer.

For DFINITY, which harbors the ambition of "reconstructing the internet," this is not just an adjustment of the economic model but may become a turning point for ecological development. It is attempting a high-difficulty "economic surgery" to make a thrilling leap from "money-burning infrastructure" to "self-sustaining value engine."

Shifting from Subsidy Expansion to Deflation Era, Aiming to Reduce Inflation Rate by Over 70%

This new white paper was personally crafted by founder Dominic Williams. It reads less like a typical project update and more like a "fiscal austerity bill" aimed at all token holders.

The core goal of this plan is to achieve a 70% or greater reduction in the nominal inflation rate of ICP tokens by 2026 through a dual leverage of "supply reduction" and "demand increase," steering ICP towards deflation.

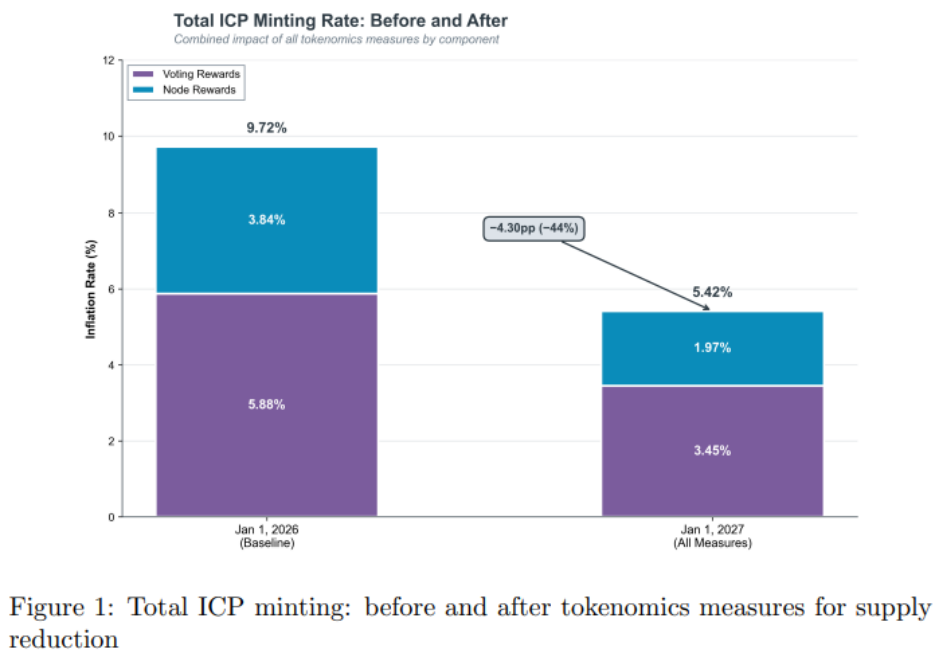

Currently, the annualized inflation rate of ICP is approximately 9.72%, primarily stemming from two major "bleeding points" on the supply side: governance voting rewards (5.88%) and node provider incentives (3.84%). This is akin to a machine that continuously prints money, diluting the asset value of early participants.

The Mission 70 proposal first aims to "stop the bleeding" on the supply side by modifying the incentive parameters of the NNS (Network Nervous System), expecting to achieve a 44% "absolute token reduction." The logic of this model lies in sacrificing part of the nominal yield in exchange for lower inflation and higher asset scarcity, thereby securing the long-term scarcity of the token, which is essentially a deep value game.

The white paper points out that while reducing voting rewards lowers the nominal yield for stakers in the short term, the risk-adjusted returns for long-term holders will be optimized due to reduced liquidity risk through increased token value and decreased selling pressure.

Additionally, the reduction in node incentives is based on improved operational efficiency of providers and the multiplier effect brought about by rising ICP prices: when the price of ICP increases, the amount of ICP that needs to be issued to pay the same fiat value for node fees will be reduced.

Relying solely on "throttling" on the supply side makes it difficult to achieve the total reduction target of 70%. To fill the remaining 26% reduction target, DFINITY is betting on the AI track and has formulated a demand expansion strategy around the "Caffeine AI" platform.

Caffeine is positioned as the world's first commercial "self-writing internet" platform, utilizing on-chain large language models (LLM) to achieve natural language programming (NLP), allowing non-technical users to directly develop, deploy, and run full-stack applications on ICP through text descriptions, aiming to transform internet users from mere consumers into active builders.

In the economic model, all network activities driven by Caffeine, such as computation and storage, will consume "Cycles." Cycles are the unit used in the ICP ecosystem to quantify and calculate storage resources, representing the cost of executing a single instruction, created by destroying ICP.

DFINITY plans to attract more AI models and enterprise-level cloud engines to run directly on ICP, burning Cycles on a large scale through these high-computing, high-storage-demand applications, thereby generating a sustainable deflationary effect on ICP.

This also means that the value capture of ICP will no longer rely on speculation but will be directly linked to the real demand for decentralized AI computing globally.

Related reading: DFINITY Foundation Bets on AI, How Caffeine Drives ICP Surge?

The underlying logic of this economic surgery is DFINITY's precise judgment of its own development stage: the subsidy expansion period has ended, and it must enter the value capture period. It aims to address the value dilution issue that has been criticized since ICP's inception, shifting market attention from inflation to actual on-chain resource consumption.

Development Activity Ranks Second Globally, Building Three Major Competitive Barriers

The market is often easily misled by price fluctuations. DFINITY's major economic reform is built on a solid technical foundation.

The activity level of the codebase is usually the most objective and explicit indicator of a project's long-term viability.

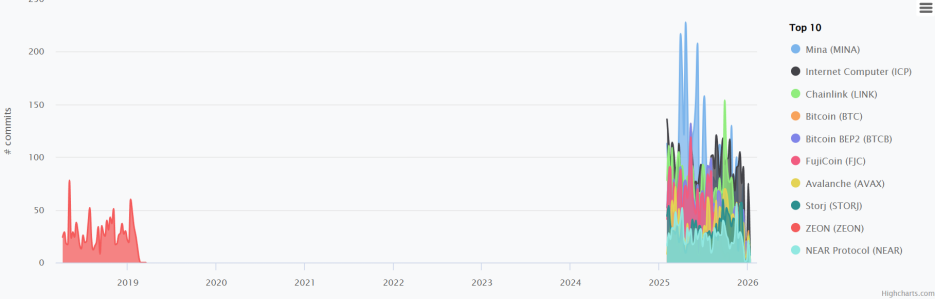

According to CryptoMiso data, in the past 12 months, Internet Computer has achieved 4,185 commits on GitHub, ranking second among all blockchain projects globally, ahead of established public chains like Bitcoin, Ethereum, and Solana.

This high-intensity development pace primarily stems from the large development team at the DFINITY Foundation. This development activity is not a blind accumulation but focuses on:

- Subnet Expansion: A series of upgrades in 2025 will increase the storage capacity of subnets to 2 TiB and introduce dynamic load balancing, significantly enhancing the network's ability to process massive amounts of data.

- Wasm Execution Efficiency Optimization: Continuously pushing the performance limits of WebAssembly, allowing ICP to execute complex smart contract computations at near-native speeds.

- Threshold Cryptography Iteration: Continuously strengthening Chain Fusion technology, enabling ICP contracts to directly manage native assets from external public chains like Bitcoin, Ethereum, and Solana without going through riskier cross-chain bridges.

The high level of development activity and ongoing technical delivery indicate that, despite the volatile market cycles, the developer community of ICP has not diminished but is steadily moving towards the goals set by the DFINITY Foundation.

These technological accumulations are also the foundation for DFINITY to dare to launch "economic surgery."

With the iteration of the technical architecture, the Internet Computer has now evolved from a simple L1 into a cloud platform with sovereign computing capabilities. In the fierce market competition, its competitive advantages mainly manifest in three dimensions:

First, consolidating on-chain AI practical capabilities, the Internet Computer is currently one of the few public chains that can natively run AI inference models. Unlike other projects that run AI off-chain and return results via zero-knowledge proofs (ZKP), it can directly load neural network models. In the context of the explosion of AI + Web3, this advantage is hard to replace.

- End-to-end encryption and privacy: The Internet Computer achieves encrypted storage of sensitive data on-chain, ensuring that even node providers cannot peek at the content when AI models process users' private data.

- Cost-effectiveness: The comprehensive cost of running AI inference on the Internet Computer is over 20% lower than traditional SaaS giants like Palantir, giving it strong commercial competitiveness in the decentralized machine learning (DeML) field.

Second, building a seamless interoperable future, ICP contracts can operate as native addresses on other chains. In the context of frequent security incidents with cross-chain bridges, the "Chain Fusion" technology provided by the Internet Computer may represent the future direction of interoperability.

- Native integration of BTC and SOL: The Internet Computer has currently achieved direct operations on native assets on the Bitcoin chain (such as Ordinals, Runes) and Solana assets, without involving any wrapped tokens or centralized custodians, significantly enhancing the security of multi-chain asset management.

- Full-chain DeFi hub: This capability may allow the Internet Computer to become the "glue" connecting fragmented public chain ecosystems, enabling developers to build seamless multi-chain deployed DeFi applications.

Finally, eliminating barriers to large-scale adoption, ICP's "reverse Gas model" is a powerful weapon to attract mainstream developers. Under this model, users can use DApps without purchasing tokens or installing plugin wallets, significantly lowering the entry barrier for Web3, with a user experience comparable to Web2. Combined with Internet Identity 2.0, users can achieve seamless login through the fingerprint or facial recognition features of their smartphones, a functionality that far exceeds that of established public chains.

Price Plummets 99%, Centralized Historical Issues Lead to Market Trust Deficit

Despite the grand technical vision, DFINITY's path to becoming a "world computer" is still fraught with thorns, currently facing multiple challenges from market bias, ecological scale, and execution risks.

On one hand, since the mainnet launch in 2021, the price of the ICP token has plummeted from a peak of over $400 to single digits, leaving countless investors with significant losses. Although DFINITY insists this is due to market manipulation, long-term investor lawsuits and accusations of foundation sell-offs still linger.

Despite DFINITY's repeated requests for the court to dismiss related cases, the legal scrutiny regarding market manipulation remains a Damocles sword hanging over the project.

This stereotype of "centralized projects doomed to fail" may, to some extent, limit the willingness of new funds to participate.

On the other hand, ICP faces a phenomenon of technological and application inversion.

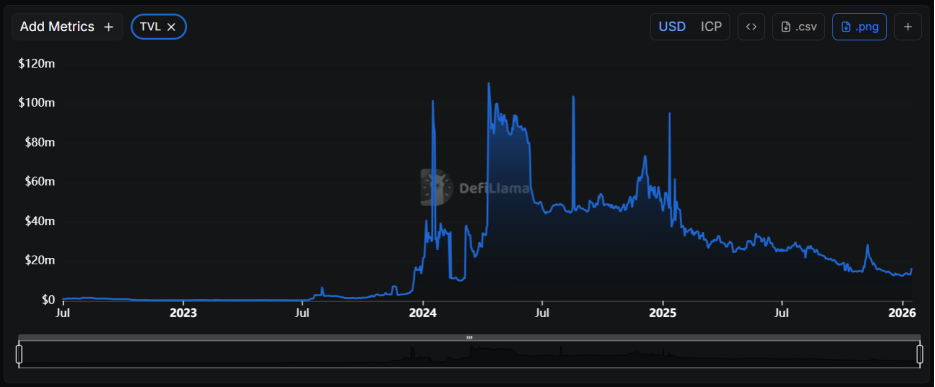

First, the scale of DeFi is lagging. Compared to Ethereum or Solana, the DeFi ecosystem of the Internet Computer still has a significant gap. As of January 16, its on-chain TVL is only about $16 million.

Second, there is insufficient liquidity depth. Although the protocol has strong cross-chain technology, the liquidity depth of on-chain native assets like ckBTC and ckETH is inadequate, posing high slippage risks for large transactions.

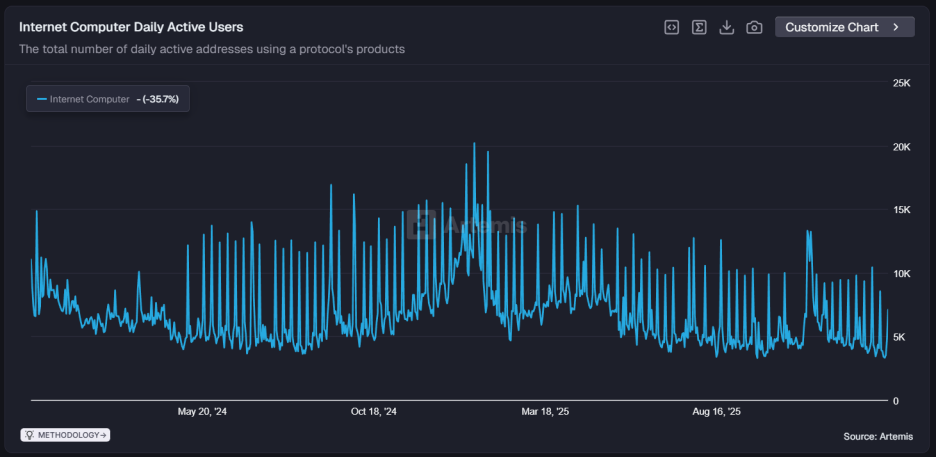

Third, the user base is weak. The number of daily active addresses on the Internet Computer is only around 7,000, which still shows a significant magnitude gap compared to the top ten public chains by market capitalization. How to convert the vision of a "self-writing internet" into real user traffic will be its top priority.

Third, the user base is weak. The number of daily active addresses on the Internet Computer is only around 7,000, which still shows a significant magnitude gap compared to the top ten public chains by market capitalization. How to convert the vision of a "self-writing internet" into real user traffic will be its top priority.

The area of highest uncertainty is the execution effect of the "inflation surgery." Mission 70 is a precise economic experiment, and its success mainly relies on the simultaneous realization of two prerequisites: first, that reducing rewards does not lead to a massive loss of node providers; second, that Caffeine AI can bring exponential growth in Cycle burning. If the AI platform's implementation falls short of expectations, mere reward reductions may evolve into a blow to ecological vitality, even falling into a vicious cycle of "price decline - increased inflation."

DFINITY is attempting to turn the tide with a new token economic model. If the ICP of 2021 became popular due to the vision of a "world computer," then the ICP of 2026 intends to prove its value creation and capture capabilities to the market through a precise deflation model and real data.

For investors, the underlying logic for judging ICP's price has changed; it is no longer vague ecological prosperity but focuses on two quantifiable, traceable hard indicators: the rate of Cycle burning and the frequency of on-chain AI inference calls.

Short-term price increases may just be a release of emotions, while the actual execution effect of the new token economic model Mission 70, and whether it can break the curse of "strong technology, weak ecology," will be key to determining whether ICP can return to the ranks of top public chains.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。