Author: Zuo Ye Web3

Give money freedom, give information a price tag.

The economy devours society, technology distorts the economy, finance becomes the target of technology, and Meme ultimately nihilizes finance.

Every era's giant waves leave behind either real gold or silt; from the .ETH suffix to the crazy tutorials for starting Yap, all are inevitably washed into the realm of forgetfulness by time, especially in the cryptocurrency industry, which has always had an extremely short path to content monetization.

But what I observe is only fragmentation, the separation of information flow and capital flow, public chains will be divided by demographics, Meme isolates interconnection, and only entropy increases eternally.

The transformative years in human financial evolution are unprecedented, leading to the following situations that have become commonplace:

- In a typical crypto context, the fate of information is to become a tradable commodity;

- Nation-states are reclaiming authority; any investment target should not expect to leap over the boundaries of power;

- Value preservation focuses on lossless transmission; the flow of information can severely harm basic commercial value.

The madness of traffic diversion at Binance hides inherent concerns about high-energy-consuming Meme mining, and Twitter's seizure of financial traffic entry is also a form of overexploitation, continuing the two-way entanglement of capital and information.

Separation Anxiety: The Break of Information Flow and Capital Flow

Binance cannot enter the global order and can only continuously update and maintain its commercial value.

If we have some awareness of the early history of cryptocurrency, we would not doubt ICOs and Chinese Memes; this is indeed a precise, fated wealth creation movement, as long as one runs faster than the latecomers.

It’s just that 2017 tested hand speed, while 2026 will test network speed.

This is not irony; engaging in speculation has never hindered the dual gain of fame and fortune for "Bitcoin evangelists," and even the evangelists themselves are sources of hype. Betting everything on EOS and selling ETH at the right moment have all turned into late-night stories among friends, triggering traffic effects on Twitter.

Recalling the past hides an acknowledgment of the preservation of information value; celebrity stories and today's Ticker often trigger wonderful interactions, from the story of Wang Xin of Qvod to the Happy Sci Meme of YZi Labs researchers. I firmly believe they do not need to resort to such money-making tactics, but often find themselves helpless.

Binance's active acceptance of Meme is merely a timely change in marketing strategy; Binance angels are much more ferocious than these frenzied tactics. What is truly puzzling is why Binance, sitting atop the CEX ecological niche, still needs to stay grounded, creating illusions of traffic and wealth.

Using Binance as an example, extending to the entire exchange and industry, they are all facing the separation anxiety of information flow and capital flow.

Since Kaito, the amount of information accepted per person has skyrocketed, but the quality of information has plummeted. By the end of Vibe Coding, the content stock of the crypto industry that migrated overseas in 2021 has completely disappeared. Transitioning to AI or general traffic is merely a self-rescue measure.

After four years of newcomers in the crypto industry stopping their entry, the battle for traffic and the internal consumption of trading cannot be sustained—KOLs, media, and exchange employees can easily live abroad and access the internet, but for retail investors who truly bear the losses, this is akin to a chasm.

Image Description: The End of Growth

Data Source: @_businessofapps

The long-term growth of exchanges has ended and will not return. The entire industry's problem is the anxiety of insufficient new user acquisition; whether inside or outside the circle, everyone knows about the crypto space, but people's enthusiasm for trading is declining.

The more this is the case, the more difficult subsequent data growth becomes. This is also the main reason Binance is desperately promoting BSC; on-chain users are already the last incremental customers in the crypto circle, and next, they will face an influx of mainstream demographics.

Image Description: Theoretical Quantity of Crypto Information

Image Source: @zuoyeweb3

Referring to Irving Fisher's quantity theory of money, we can propose a quantity theory of crypto information, that is, the supply of information X the speed of viewpoint circulation = the exposure of each project X the total number of projects at a given time. We can use this to explain how the crypto information network operates.

In the era of Irving Fisher, the inflation problem of the dollar was never resolved, and ultimately, people chose to embrace the gold standard, the Great Depression, and World War II. If you think Meme and Yap make cryptocurrency hopeless, the good news is that it’s still much better than World War II.

Within a certain time frame, for example, observing the establishment of the XX Foundation, the announcement of massive financing news, everyone, including retail investors, will discern the prelude to listing. At this time, the research and interaction of Yap projects will explode, which will also affect the liquidity of information. You might think that the speed of information circulation is increasing rapidly, but "effective" information will be inversely proportional to the V/Y/Q in the above image.

Closed Information Links, Free Capital In and Out

Under financial hyperinflation, spending money and disseminating information are almost indistinguishable.

If I don’t like Binance, can I still use it? Can I still trade coins listed on Binance?

In fact, Binance does not like the crypto circle either; Musk does not consider Binance's feelings, and He Yi does not like Chinese, but this does not hinder their cooperation. Qualified investors hold themselves accountable for returns, not for preferences.

Today's crypto industry no longer discusses the ultimate dream of all problems—decentralization and privacy protection; instead, it studies which Meme Shandong Xue and a16z are more optimistic about, with the East not laughing at the West, and infrastructure not being greedy for applications.

Moreover, with the cooperation of capital inflow and outflow, CEX, and crypto banks, today's free capital has become the norm. However, the traffic on CT is declining, and the collapse of information seems to be everywhere. The crypto circle discusses AI, US stocks, robots, and commercial space, but no one cares about the future of crypto.

The interaction between information and capital is not rare; in fact, it is even more common:

- Information race: the ultimate Bot account is not a script, but endless human GM and account creation strategies;

- Exchanges: Aster's human-machine competition, Nof1's LLM trading competition, are all vying for crypto traffic.

The real difficulty lies in the process of information guiding capital. From any trading product in the industry to buyback mechanisms, it emphasizes that capital will align with users' information preferences. The ultimate form of this solution belongs to the transparent rebate of Hyperliquid's Builder Code.

Image Description: Binance Meme Movement Timeline

Image Source: @zuoyeweb3

Most rebate mechanisms and information dissemination are difficult to correspond directly. This does not mean that exchanges cannot distinguish the source and destination of rebates; for example, OKX can ban users' rebate accounts. However, is trading really related to KOL's content?

The medium is the message, and rebates are the content.

Combined with the IV=YQ formula, we can even "roughly" correspond to the information dissemination chain, and it can also correspond to a certain KOL having a strong ability to lead trades, but it is impossible to determine whether the KOL's content preferences will trigger trading growth.

If we understand this point, we can see the intermediate stages of capital flow, but we cannot track every link of information flow. Official hot searches, recommendation algorithms, and regional language preferences can all lead to "being popular," and Meme has actually become an unpredictable "feeling."

Thus, Binance or exchanges personally engage in marketing, simultaneously buying traditional crypto media and KOLs. The purpose of investing in traffic is not to acquire new users but to maintain a comprehensive, systematic distribution channel. The ultimate model of this is that Binance's two founders personally engage in leading Meme trades and continue to do so.

This is similar to Irving Fisher's equation; under the traditional currency issuance framework, the circulation speed of paper money cannot be accurately calculated. In the information interference of CT (Crypto Twitter community), we also cannot measure effective information or the speed of information circulation. Using statistical methods, we might derive some insights from KOL Agency data, but ultimately, it will turn into trading data from CEX or DEX.

This may be the source of Binance's anxiety; it is not surprising that information occurs outside the Binance system, but the loss of control over information circulation leads to Binance's inability to accurately measure trading effectiveness. This framework can also explain the disappearance of the listing effect.

It is important to know that traffic is not just a simple function of entry; it is also the site of public opinion generation, amplification, and crisis management. Information and capital intertwine, constituting the essence of the CEX era, and now all of this is to be taken by more people.

First is the "re-nationalization" after the failure of globalization, where various regional power centers are regaining expansion. Chen Zhi cannot maintain his nationality and title in Cambodia, and the crypto king hiding in the Middle East will face more sovereign strikes.

Secondly, public chains + exchanges were once the strongest form of information + capital networks. Whether the top is RWA, stablecoins, or Meme is not important; the core is the closed loop from information to capital, where transaction fees can continuously feed back into their own ecosystem.

However, from the evolution of product forms, we are likely to face a major upheaval not seen in a decade. On one hand, we really need to welcome the transformation of products with hundreds of millions of traffic; on the other hand, the entire crypto industry faces the crisis of being backend-oriented, losing its own brand.

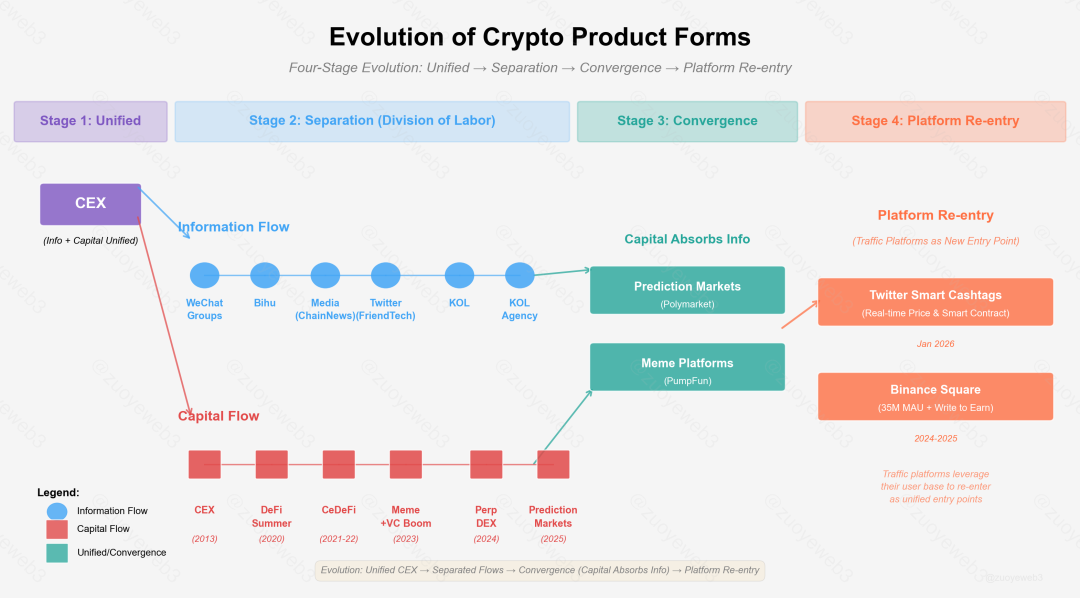

Image Description: Evolution of Crypto Products

Image Source: @zuoyeweb3

Starting from CEX as the starting point for traffic/capital, we seem to be experiencing a classic four-stage cycle:

1. Unification: CEX

2. Separation (Social Division of Labor)

- Information Flow

- Capital Flow

3. Uniformity (Capital Precedes Information)

- Prediction Markets

- PumpFun

4. Reconstruction: X hopes to become the financial product traffic entry

When Musk acquired Twitter, he favored the Super App model of WeChat, which is also his unfinished ambition after losing to Peter Thiel's PayPal at X.COM. In fact, WeChat's financial operations are not as smooth as the logic of public goods like Douyin; the relationships between people are more point-to-point interactions. If we look at Western financial products, there has yet to be a giant that integrates finance and social interaction.

I would consider Twitter's integration with cryptocurrency and CEX as a failed attempt at expectation; as long as the expectations are low enough, the hope brought will be great enough.

A more interesting perspective is that Twitter is regaining traffic directed towards crypto, rather than the "return path" of crypto directing traffic. We once thought that DeFi represented by DEX would swallow the world, just like the internet, but the reality is that stablecoins still need more merchant support, and BTC has completely become a golden substitute for the likes of Wanwan.

Conclusion

Words are power, and traffic is leverage.

A beginning usually only reveals the existence of another beginning.

Since the earliest CEX gathered information dissemination and capital interaction, we are experiencing a typical period of separation, where shouting orders and leading trades can constitute everything, seemingly without the need for high-quality content to guide traffic, or rather, high-quality content is no longer the beginning of everything.

Ultimately, the more difficult aspect is the process of capital guiding information. The vast majority of projects cannot start from here; perhaps only the seven sisters of US stocks can have this effect. If the crypto industry loses the ability to set topics, leaving only internal games of capital, crypto becomes a dying world, an island on the verge of extinction.

Even within a nutshell, Binance remains the king of the infinite universe until Musk's dark X arrives, welcoming truly world-class mainstream productization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。