Written by: Niuske, Deep Tide TechFlow

Some dreams never die; they are just waiting for the right moment.

The Preemie of 1999

In March 1999, in Palo Alto, 27-year-old Elon Musk made a decision that seemed almost ridiculous at the time.

He bet all $22 million he made from selling Zip2 on a website called X.com.

At that time, Silicon Valley was still in the era of Yahoo and AOL, where the internet was synonymous with portal websites. Proposing the concept of "online banking" at this point was like selling rockets in the age of horse-drawn carriages. But Musk's ideal X.com was not just an online bank; he envisioned an online financial operating system: a platform where all financial services could be realized—transfers, investments, loans, insurance, and even everyday spending.

Silicon Valley thought this young man from South Africa was crazy.

It was the era of dial-up internet, where the shrill screams of modems accompanied the opening of a webpage, which sometimes took half a minute. Transferring money over a 28.8K slow network? That sounded like a joke.

The ambition was terrifying, but reality hit back harder.

A year later, X.com merged with Peter Thiel's Confinity (the predecessor of PayPal). What was supposed to be a "genius collaboration" turned into Silicon Valley's version of "Game of Thrones." Thiel and his elite Stanford crew couldn't stand Musk's chaotic radicalism, thinking this engineer-turned-CEO was a dangerous madman.

In September 2000, the crash came. Musk flew to Australia for his honeymoon. Just as the flight landed in Sydney, before he could even step out of the airport, the board called: you’re out.

Peter Thiel took over everything. A few months later, the "X.com" sign that Musk loved was taken down, and the company was renamed PayPal.

The foundation of the "financial empire" that Musk had spent a whole year building was flattened by a group of investment bankers in Brioni suits, leaving only the simplest function: payments.

In 2002, eBay acquired PayPal, and Musk received $180 million. He won in wealth, but at that moment, he felt like a child whose beloved toy had been taken away. A fishbone was deeply embedded in his heart.

In the following twenty years, he created the best electric cars, sent rockets into space, and vowed to die on Mars. But whenever PayPal was mentioned, he couldn't hide his loneliness.

X.com remained his inner demon.

Bringing the "Sink" to Wall Street

On October 27, 2022, Musk walked into Twitter's headquarters holding a sink.

This detail was later wildly reported by the media, but the real signal was the phrase he wrote on Twitter: "Let that sink in."

A pun. Let the sink in, and let everything settle down.

The outside world thought he bought Twitter for free speech or to vindicate Trump. They were all wrong. Musk wanted revenge, revenge for the betrayal from 25 years ago.

The first step was to rename it.

X. One letter, carrying all his anger and ambition. Those who mocked X.com for being too ahead of its time would now witness its resurrection on this platform.

But Musk was smart. He knew that transforming Twitter into a bank all at once would scare away users. So he chose a gradual transformation.

By early 2023, X was still primarily a lightweight social platform limited to 140 characters. Musk first adjusted the content strategy, encouraging more original content and real-time discussions. Then came paid subscriptions, getting users accustomed to spending money on the platform.

By mid-year, the long tweet feature was launched. Users could post longer, more in-depth content, and the platform began to shift from a short message square to an information center.

Next came a significant enhancement of video features. Musk wanted X to become a one-stop platform for information consumption, so users no longer needed to jump to YouTube or other video sites.

By the end of 2023, the creator revenue-sharing program was officially launched. The platform began to develop an economic ecosystem, allowing users to earn income through content creation. This was a crucial step in cultivating users' trading habits.

Then came the big moves in 2024.

Financial license applications, payment system construction… Musk was no longer hiding; he wanted to turn X into a financial platform.

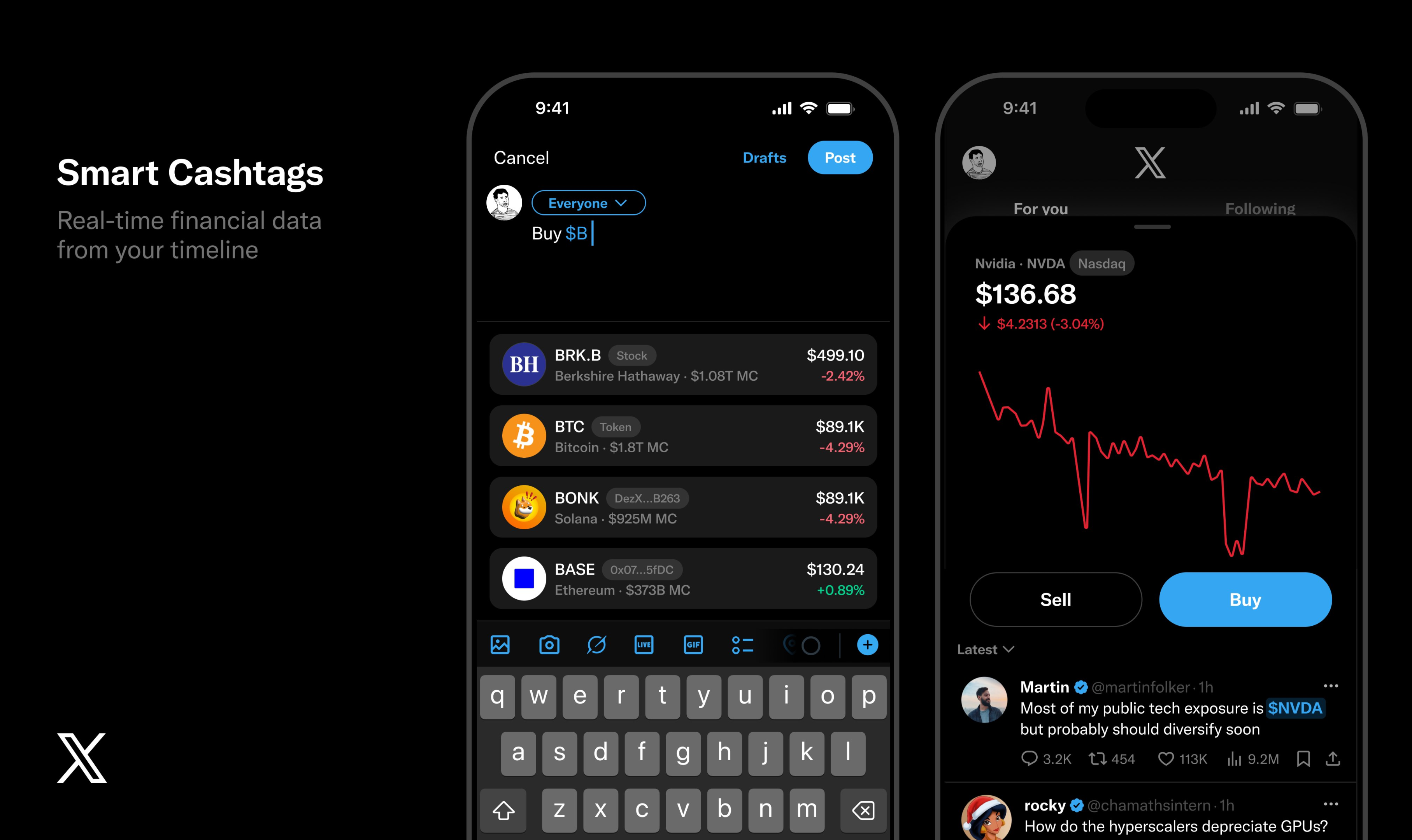

In January 2026, X product head Nikita Bier stated that the platform was developing the Smart Cashtags feature, allowing users to precisely point to specific assets or smart contracts when posting market codes.

Users could embed tags like $TSLA in tweets to display real-time stock prices. It seemed like just an information display feature, but it was the final piece of the puzzle for financialization.

Imagine this: you see a tweet about Nvidia's new chip on X, the stock price jumps 5% instantly, and then you click the $NVDA tag to place an order.

Social, information, trading—this is the vision Musk wanted to achieve at X.com.

From city square to information center, and then to trading hall. Musk took two years to gradually guide users to accept X's transformation.

To dispel users' doubts, Musk made an unprecedented decision: to open-source all algorithms.

On January 10, 2026, Musk announced on X that the latest content recommendation algorithm for the X platform would be officially open-sourced within a week, covering the recommendation code for natural and advertising content, with updates and developer notes every four weeks.

Platforms like Facebook, YouTube, and TikTok have recommendation algorithms that are black boxes; no one knows why they see certain content. When it comes to financial services, this opacity becomes a fatal flaw.

Musk broke the black box with open-source. Users can check the code, developers can audit security, and regulators can oversee compliance.

Everything is to pave the way for financialization.

Late Validation

X.com of 1999 died due to "being ahead of its time." The internet was still in the dial-up era, with broadband penetration below 10%, online payments requiring numerous security verifications, and users were filled with fear about putting money online.

More critically, the regulatory environment was extremely harsh. Banking regulators treated internet finance as a monster, and the government was cautiously exploring the waters. Musk's radical strategy seemed too risky in that conservative era.

But history proved his judgment was correct.

It just came too late, and from an unexpected place: China.

In 2011, WeChat was launched. Initially just a chat app, it quickly transformed into the super app Musk envisioned back in the day. Chatting, payments, ride-hailing, food delivery, wealth management—everything could be done. Alipay also evolved from a simple third-party payment service into a comprehensive financial platform.

Musk watched it all, anxious in his heart.

In June 2022, during his first all-hands meeting with Twitter employees, he publicly stated: "In China, people basically live on WeChat because it is very practical and helpful for daily life. I think if we can reach that level on Twitter, or even just get close to it, it would be a huge success."

This sounded like praise for WeChat and also regret for his failure 25 years ago. The Chinese achieved what he wanted to do back in 1999 in just ten years.

Now it was his turn.

Mobile payments have rewritten global consumer habits, and cryptocurrencies have transformed from geek toys to investment targets for retirement funds. Blockchain technology has made decentralized finance a reality. Regulators have also begun to embrace innovation.

The SEC approved Bitcoin ETFs, the EU launched the digital euro plan, and the People's Bank of China is piloting the digital yuan.

Musk waited 25 years, just waiting for this moment.

With this background, when you look at Smart Cashtags, you will understand that Musk's opponent was never Zuckerberg.

Meta controls social relationships, Google controls information indexing, and Apple controls hardware entry. But so far, no tech giant has truly controlled the global "flow of funds."

This is the ultimate goal of X. Finance is the underlying protocol of the business world. Whoever controls the flow of funds holds the throat of the digital economy. This is far more lethal than making a search engine or selling a phone.

Musk is reshaping a rapid chain from "information" to "decision" to "action." Imagine this: Musk tweets about Tesla's new technology. Within seconds, a hundred thousand people click the $TSLA tag. The algorithm predicts trends based on sentiment analysis, automatically pushing trading suggestions, and users place orders with one click. Influence instantly converts to trading volume.

This is the financialization of social media. The traditional model of Wall Street, with analysts writing research reports and brokers making phone calls, will seem clumsy and expensive in front of algorithms.

Returning to the initial question, why did Musk acquire Twitter?

The answer has long been public. On October 5, 2022, Musk tweeted that acquiring Twitter accelerated the creation of the super app "X."

Only now does everyone truly understand this statement.

Dreaming back to 1999, the ghost of X.com has finally found the moment for resurrection. This time, no one can stop him; he is no longer that 27-year-old entrepreneur who needed to rely on others, but the world's richest man with absolute authority.

Welcome to the X Universe

If we zoom out, stepping away from the ups and downs of Wall Street and the grudges of Silicon Valley, you will discover a more chilling pattern.

Musk's obsession with the letter "X" has long transcended the realm of commercial branding, becoming an almost pathological totem worship.

Look at what he has done over the past twenty years: when he tried to send humans to Mars, he named the company SpaceX; when he wanted to create a flagship SUV that defined Tesla's future, he insisted on calling it Model X despite opposition; when he left OpenAI to develop his own AI large model, he named it xAI.

He even named his most beloved son X Æ A-12, and in daily life, he simply calls him "Little X."

In mathematics, X represents the unknown, representing infinite possibilities. But in Musk's life script, X is the only constant.

Twenty-five years ago, the young man who was ousted by the PayPal board lost his X. Twenty-five years later, the richest man who owns rockets, cars, AI, and the largest public opinion platform in the world has finally picked up this piece of the puzzle.

Everything is to make X happen.

Welcome to Musk's X Universe.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。