Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

Despite the latest core inflation data from the U.S. showing signs of cooling, dropping to a four-year low of 2.6%, this has not changed the market's widespread expectation that the Federal Reserve will begin cutting interest rates in June this year. Federal Reserve officials seem to require more evidence of a weakening job market or continued easing of price pressures before considering adjustments to monetary policy, leading to a rapid decline in the initial optimism brought by the inflation data, putting pressure on U.S. stocks while strengthening the dollar.

In this uncertain backdrop, precious metals are increasingly highlighted as a "hedge against systemic risk." Spot gold briefly reached a historic high of $4,639, while silver was even stronger, first touching the $91 mark, with its total market capitalization surpassing $5 trillion, overtaking Nvidia to become the world's second-largest asset. Market analysts believe this round of price increases is more a repricing of the unclear monetary policy outlook, deepening fiscal dominance, and geopolitical risks. Several institutions reacted positively, with ANZ predicting gold prices will exceed $5,000 in the second half of 2026, and Citigroup raising its target price for the next three months to $5,000 for gold and $100 for silver. Analysts at VanEck even projected through modeling that under the assumption of a global return to the gold standard, the "real" price of gold would far exceed current levels.

The A-share market experienced its first decline after 17 consecutive days of gains on January 13, with January 14 being particularly dramatic. The morning session continued strong, with all three major indices opening higher, the ChiNext Index rising over 2%, and the Sci-Tech 50 Index surging over 4%. The market showed a broad upward trend, with over 4,700 stocks rising and hundreds hitting the daily limit, particularly in sectors like AI applications, semiconductors, and commercial aerospace. However, the afternoon saw a sudden change when a notice about increasing the minimum financing margin ratio for the Shanghai and Shenzhen North Exchanges from 80% to 100% triggered a brief market plunge, with all three major indices turning negative and the number of rising stocks sharply decreasing. This move aims to reduce market leverage levels through counter-cyclical adjustments, protect investors, and promote long-term stability.

After the CPI data was released, Bitcoin successfully broke through several key resistance levels at $92,000 and $94,000, briefly touching around $96,500. Michaël van de Poppe and Ali Charts both believe a bull market has begun, with the former noting that BTC has effectively stabilized above the 21-day moving average and expects it to challenge $100,000 next week, while the latter pointed out that breaking the $94,555 resistance level would target a prediction of $105,921; additionally, Ardi, Sykodelic, and Astronomer unanimously view $94,500 as a lifeline for bulls, with Ardi emphasizing that as long as this support holds, it will sweep through the $96,500-$97,200 distribution area and aim for $100,000. Astronomer further noted that the spot discount in the $80,000-$85,000 range has turned into a premium, which is a strong bullish signal, with subsequent targets reaching up to $112,000 and a new historical high.

Cautious voices cannot be ignored either. Murphy, through on-chain data analysis, pointed out that the market is in a "sentiment repair + low selling pressure" but "insufficient demand" weak equilibrium, with $98,000 as the true "bull-bear dividing line" for short-term holders, requiring strong intervention from U.S. funds to break through; Tradermayne believes there is a 70% probability of forming a secondary high point, and unless it stabilizes above $105,000, there remains a risk of a bear market; CrypNuevo and CJ worry that this is merely a liquidity raid targeting the inefficient area around $97,000, and caution against a potential pullback.

Ethereum is also attempting to break through and stabilize above $3,300 after responding in a key support area, but it has failed multiple times in the past two months. Analyst Man of Bitcoin pointed out that if it can successfully break through $3,300, it will confirm the validity of its bullish roadmap. Investors like Jelle and Max noted that with the Russell 2000 index reaching new highs, the market environment is favorable for ETH's catch-up, and if it can hold key support, $4,000 will be the next core target. From the derivatives data, Ethereum's open interest is rising, while leverage is decreasing, which typically indicates a healthier market position structure, with spot buying leading the recovery. Despite being troubled by L2 diversion and decreased DApp activity in the short term, Ethereum is expected to see a catch-up rally after Bitcoin stabilizes.

As the market warms up, Solana has gained attention due to the "cup and handle" pattern formed on its daily chart, with analysts believing its price structure indicates a potential breakout towards a target of $180 to $190. Additionally, the spot SOL ETF has recorded continuous net inflows in 2026, boosting market bullish sentiment. Inscriptions tokens like ORDI and SATS have also seen increases of over 20%. The meme coin sector is making a comeback, with tokens like PEPE, WIF, and BONK experiencing significant gains. In the privacy coin sector, Monero (XMR) has reached a historic high of over $700, driving similar tokens like DASH to rise over 30%. Furthermore, the performance of meme coins launched on Binance Alpha has been mixed, with a "dark horse" reaching a market cap of $15 million before falling back to $11.6 million, narrowing its increase to 500%, while "Laozi" has seen a decline, with its market cap shrinking to $8 million, down 35% in 24 hours; in contrast, "Binance Life" has become the biggest winner, with its market cap peaking at $289 million, breaking historical highs, and on-chain profits exceeding $2.63 million, with a return rate of 1,543 times. Some analysts believe "Binance Life" may become a barometer for sentiment towards altcoins on the Binance platform. (*Note: Content is for reference only and not investment advice; please conduct your own research.)

2. Key Data (as of January 14, 13:00 HKT)

(Data source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

Bitcoin: $94,942 (YTD +8.8%), daily spot trading volume $6.87 billion

Ethereum: $3,334 (YTD +12.1%), daily spot trading volume $3.611 billion

Fear and Greed Index: 48 (Neutral)

Average GAS: BTC: 1.75 sat/vB, ETH: 0.02 Gwei

Market share: BTC 58.7%, ETH 12.1%

Upbit 24-hour trading volume ranking: XRP, BTC, IP, ETH, SOL

24-hour BTC long-short ratio: 51.20% / 48.80%

Sector performance: The crypto market saw a broad rise, with NFT and GameFi sectors leading with over 8%

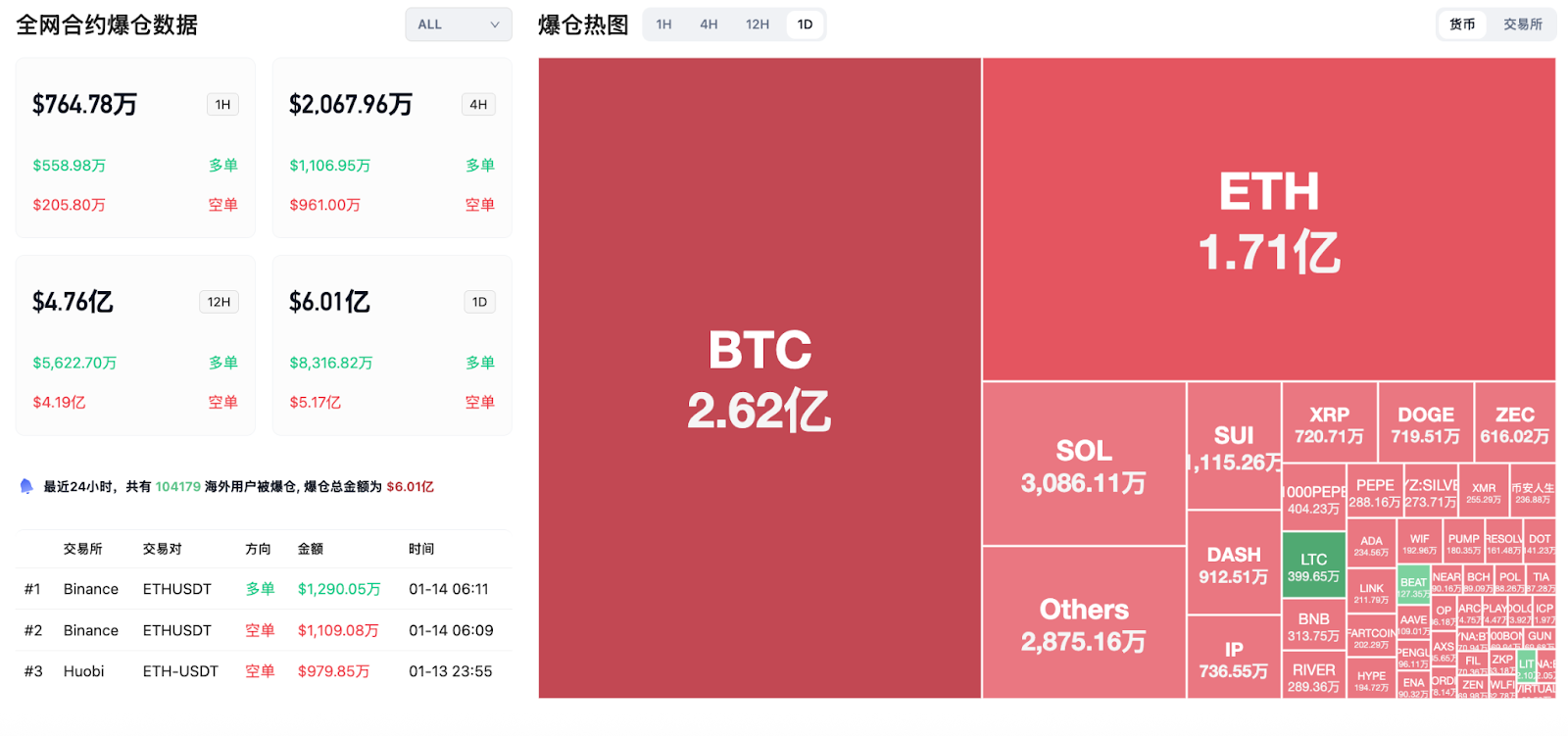

24-hour liquidation data: A total of 104,179 people were liquidated globally, with a total liquidation amount of $601 million, including $262 million in BTC, $171 million in ETH, and $30.86 million in SOL.

3. ETF Flows (as of January 13)

Bitcoin ETF: +$754 million, with no net outflows from twelve ETFs

Ethereum ETF: +$130 million, with no net outflows from nine ETFs

XRP ETF: +$12.98 million

SOL ETF: +$5.91 million

4. Today's Outlook

BSC mainnet Fermi hard fork will upgrade on January 14, 2026

Binance will launch FOGO spot on January 15 and mark seed tags

Aster: The third phase airdrop is now open for collection and will end on January 15, 2026

The U.S. Supreme Court has postponed its ruling on the Trump tariff case, with the next ruling scheduled for January 14

The Federal Reserve will release the economic conditions "Beige Book" (January 15, 03:00)

The largest gains among the top 100 cryptocurrencies today: Dash up 32.7%, Story up 30.7%, Pepe up 13.5%, Optimism up 12.7%, Internet Computer up 12.3%.

5. Hot News

Spot silver is approaching the $90 mark, reaching a new high

SharpLink staked earnings reached 500 ETH last week, with total earnings surpassing 11,000 ETH

Spot gold has risen above $4,620 per ounce, with spot silver increasing over 3.00% in a day

The U.S. December unadjusted CPI year-on-year is 2.7%, core CPI year-on-year is 2.6%

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。