Original Title: "Who Foots the Bill for the Bull Market"

Original Author: Wan Hui, Primitive Ventures

Rhythm BlockBeats Note: The author of this article is Dovey Wan, the founder of Primitive Ventures. She is one of the few figures in the Chinese cryptocurrency space who can engage in dialogue with mainstream Western institutions, known for her sharp commentary and keen insights. Most of the projects she has invested in have become the infrastructure of today's crypto world, including Cosmos, Celestia, Movement Labs, etc. However, she often finds herself in the public eye due to rumors of "conflicts of interest." Yesterday, Dovey Wan rarely published a long article discussing the cyclicality of Bitcoin and the current market discrepancies, providing a deep review of her article "A Clear Long Bull from the West" from six years ago. The original text is as follows:

"A Clear Long Bull from the West" has been nearly 6 years since its publication. After two cycles, Crypto has finally fulfilled many items on the "wish list" from the past decade. The events described in the article are happening rapidly: various institutional allocations are entering Bitcoin, and various products linked to TradFi are being fully integrated, Circle has gone public, and the U.S. President has publicly endorsed it and even created memes. According to the old script, this should be the standard opening for a "high β bull market." However, what we see after this round is a collapse in volatility, with market catalytic events being preemptively acted upon. The industry, which should have been filled with "surprises," has become less exciting as assets have become fully financialized and mainstreamed.

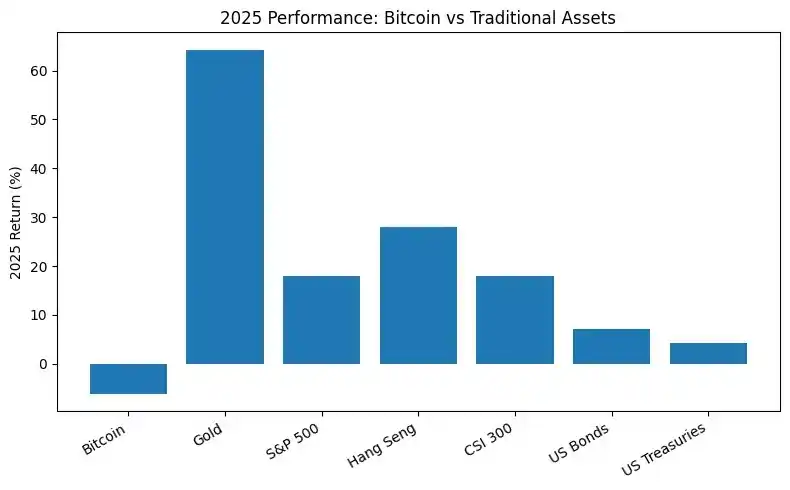

On a cross-asset level, even in the context of friendly policies and the release of institutional dividends, BTC has significantly underperformed gold, U.S. stocks, Hong Kong stocks, and A-shares in 2025, being one of the few assets that failed to create a new high in sync with global risk assets.

The Huge Discrepancy Between Offshore and Onshore Funds

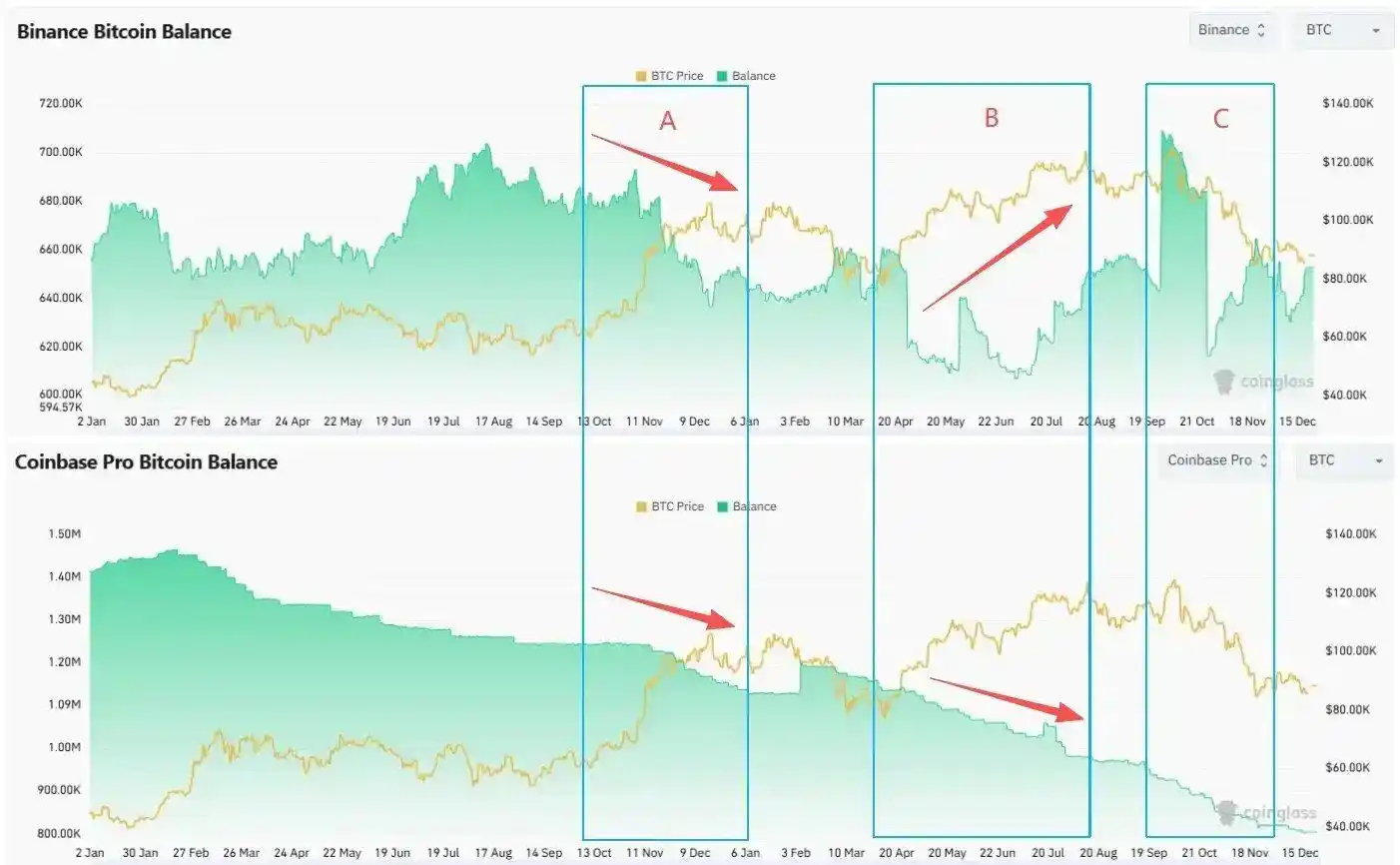

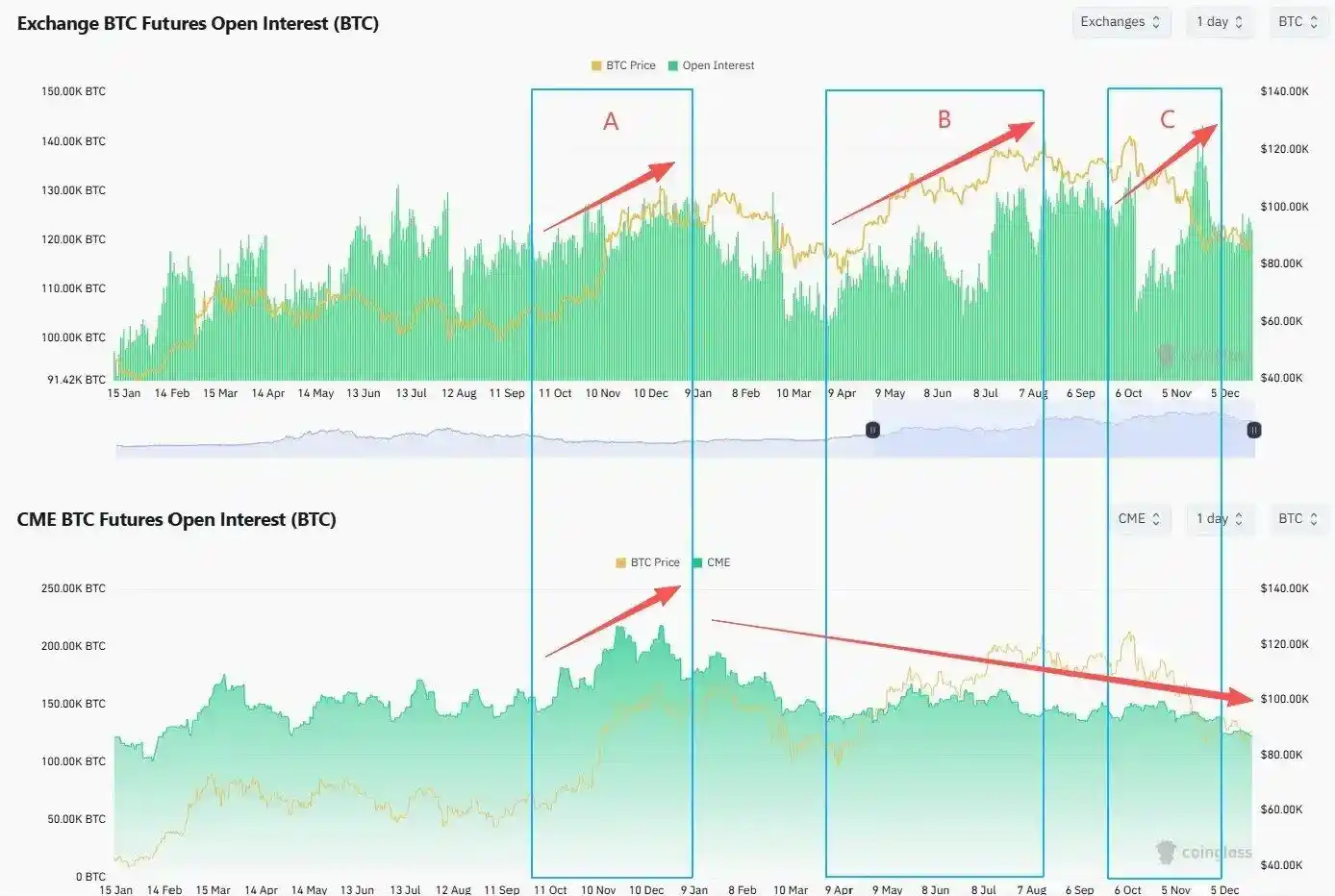

To understand the funding structure of this round, we first need to break down the three key peaks of BTC in this cycle:

Phase A (November 2024 – January 2025): Trump's election and improved regulatory expectations triggered FOMO across the onshore and offshore markets, with BTC breaking the $100,000 mark for the first time.

Phase B (April 2025 – Mid-August): After a deleveraging pullback, BTC surged again, breaking the $120,000 mark for the first time.

Phase C (Early October 2025): BTC recorded a local ATH for this round, shortly followed by the 10·10 flash crash, entering an adjustment period.

From the perspective of spot and derivatives combinations, the three phases share several common characteristics:

Spot: Onshore as the Main Buyer, Offshore More Likely to Reduce Positions at Highs

The Coinbase Premium maintained a positive premium during the A/B/C peak phases, indicating that high-level buying primarily came from onshore spot funds represented by Coinbase.

Coinbase BTC Balance has been continuously declining during the cycle, reducing the available chips on the CEX side. In contrast, Binance Balance significantly increased during phases B and C as prices rebounded, corresponding to increased potential selling pressure from offshore spots.

Futures: Offshore Leverage Active, Onshore Institutions Continuously Reducing Positions

The offshore OI (taking Binance BTC OI as an example) measured in BTC continued to rise during phases B and C, with leverage increasing. Even after the 10·10 liquidation, it quickly recovered to high levels, even setting new highs. In contrast, the CME-represented onshore futures OI has been continuously declining since early 2025, not rebounding in sync when prices reached new highs;

At the same time, BTC volatility diverged from price, especially when BTC first broke $120,000 in August 2025, Deribit DVOL was at a phase low, and implied volatility did not provide a premium for the new high, indicating that the options market was pricing trends with caution.

Spot trading is a reallocation behavior of major asset classes, and the divergence in behavior on both sides reflects a disagreement on long-term confidence in the asset. The CME and options players are the smart money most sensitive to bloodshed, with an acute sense of smell. The trading setups and timing control on both sides are clearly distinguishable.

"Foolish Money with Too Much Capital" Institutions?

At the beginning of 2025, two key policies laid the foundation for the structural entry of onshore buying:

· Abolishment of SAB 121: Banks no longer need to count BTC as liabilities on a one-to-one basis, enabling large custodial banks like BNY Mellon and JPM to feasibly conduct BTC custody business.

· FASB Fair Value Accounting Effective (January 2025): Companies holding BTC are no longer "only accounting for impairment, not gains," but can measure it at fair value based on market price. For CFOs, this transforms BTC from a "highly volatile intangible asset" into a "reserve asset option" that can genuinely reflect value in financial reports.

These two changes provided the accounting and compliance prerequisites for subsequent DAT, corporate treasuries, and some institutional capital allocation behaviors. Thus, we began to receive a large number of financing pitches from new DAT players starting in the first quarter of 2025. The core capability of the founding team of DAT is solely: financing ability. So-called institutions are not smarter than retail investors; they simply have lower capital costs and more financial tools for continuous financing.

According to Glassnode statistics, the number of BTC held by DAT companies increased from about 197,000 at the beginning of 2023 to about 1,080,000 by the end of 2025, a net increase of about 890,000 over two years, making DAT one of the most important structural buyers in this round. The operational logic of DAT can be summarized as NAV premium arbitrage:

· When the stock price has a premium relative to the net asset value of the crypto assets held, the company can issue new shares through ATM or convertible bonds to finance at a high valuation;

· The funds raised are used to purchase BTC and other crypto assets, pushing up the per-share value of the assets, further supporting the stock price premium;

· During the upward phase, the greater the premium, the easier the financing, and the more motivation the company has to "buy more as it rises";

Taking MSTR as an example, its large-scale accumulation from 2024 to 2025 and the largest issuance of convertible bonds were highly concentrated during the phases when BTC was strongly rising, approaching or breaking historical highs:

· In November-December 2024, when BTC was hitting the $100,000 range, MSTR completed the largest single issuance of $3 billion in 0% convertible bonds in history;

· Subsequently, it purchased over 120,000 BTC at an average cost of over $90,000, effectively forming significant structural buying around $98,000.

Therefore, for DAT, high-level accumulation is not chasing the price but a necessary result of maintaining stock price premiums and the structure of the balance sheet.

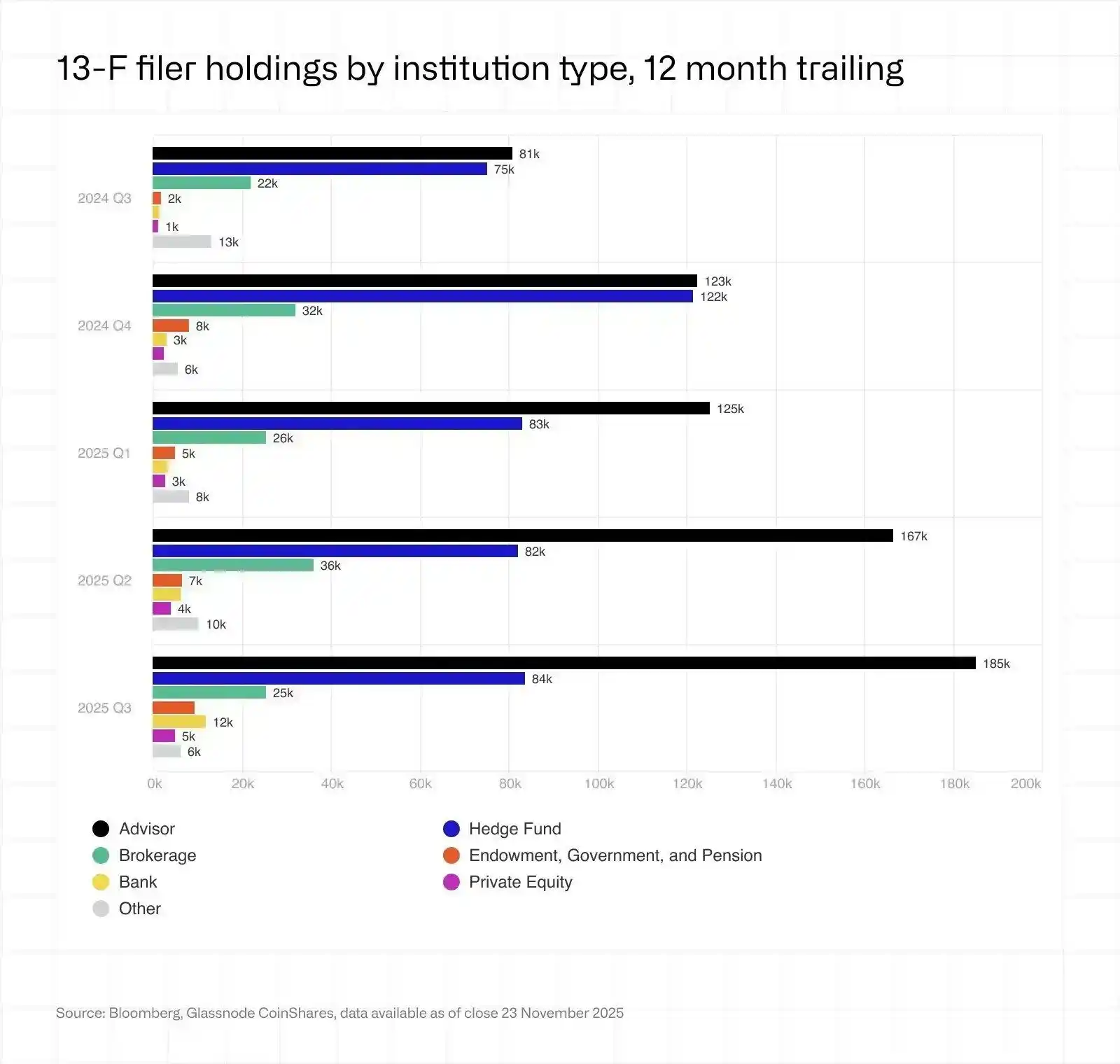

Another frequently misunderstood aspect is ETF flow. The structure of ETF investors has the following characteristics:

· Institutions (narrowly defined as 13F filers) hold less than a quarter, so the overall AUM of ETFs is still primarily composed of non-institutional funds;

· Among institutions, the main types are financial advisors (Advisors, including wrap accounts and RIAs) and hedge funds: Advisors primarily focus on mid-term asset allocation, with a smooth accumulation rhythm (passive funds);

· Hedge funds are more price-sensitive, leaning towards arbitrage and medium-high frequency trading, and have generally reduced positions after Q4 2024, highly consistent with the downward trend of CME OI (active funds).

By slightly breaking down the funding structure of ETFs, it becomes clear that institutions are not the major players; these institutions do not use their own balance sheet money, and wealth management and hedge funds are certainly not "diamond hands" in the traditional sense.

As for other types of institutions, they are not smarter than retail investors either. The business models of institutions are merely twofold: earning management fees and earning carry. Our industry's top VC from the 2016 vintage has a DPI of only 2.4x (meaning if you invested $100 in 2014, you would receive $240 in 2024). This significantly underperforms Bitcoin's growth over the past decade. The advantage of retail investors is always to follow the trend, quickly pivoting after understanding changes in market structure, without needing path dependency. Most institutional investors die from path dependency and regression in self-iteration ability, while most exchanges fail due to misappropriation of user assets and security vulnerabilities.

Absent Retail Investors

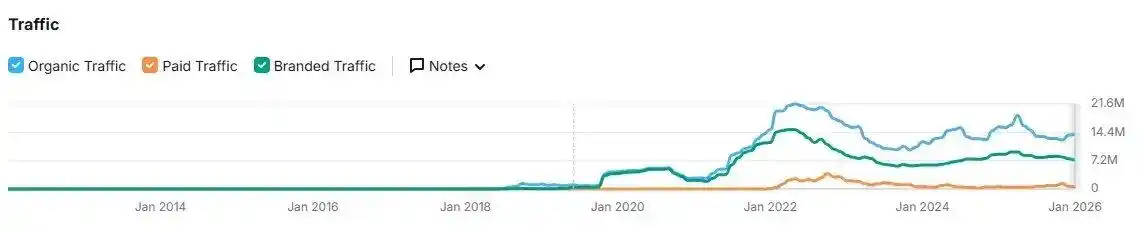

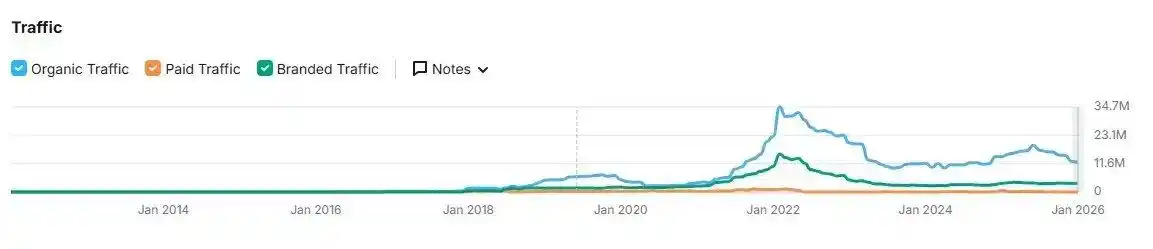

From the traffic of major CEXs like Binance and Coinbase, it can be seen that since the peak of the 2021 bull market, overall traffic has continued to decline, and even when BTC reaches new highs, it has not significantly recovered, in stark contrast to the popularity of Robinhood. More can be read in our article from last year, "Where are the Marginal Buyers."

Binance Traffic

Coinbase traffic

In 2025, the "wealth effect" is more concentrated outside of crypto. The S&P 500 (+18%), Nasdaq (+22%), Nikkei (+27%), Hang Seng (+30%), KOSPI (+75%), and even A-shares have risen nearly 20%, not to mention Gold (+70%) and Silver (+144%). Additionally, crypto has faced a "kill" in this cycle: AI stocks have provided a stronger narrative for wealth effects, while U.S. stocks' 0DTE Zero-Day Options offer an even more casino-like experience than perpetual contracts, with new retail investors betting on various macro-political events in Polymarket and Kalshi.

Moreover, even the retail investors in South Korea, known for high-frequency speculation, have retreated from Upbit in this round, turning to gamble on KOSPI and U.S. stocks. In 2025, Upbit's average daily trading volume fell by about 80% compared to the same period in 2024, while during the same period, the KOSPI index in the South Korean stock market rose over 70%–75%. South Korean retail investors' net purchases of U.S. stocks reached a record $31 billion.

Emerging Sellers

As BTC and U.S. tech stocks increasingly move in sync, a clear break appeared in August 2025: after BTC followed ARKK and NVDA to reach the August top, it quickly fell behind and faced the 10·11 crash, from which it has yet to recover. Coincidentally, at the end of July 2025, Galaxy disclosed in its earnings report and press release that it had completed the sale of over 80,000 BTC in batches on behalf of an early BTC holder within 7–9 days. These signs indicate that crypto-native funds are undergoing massive turnover with institutions.

As BTC wrapper products (such as IBIT) gradually mature, improved financial facilities provide the best channels for BTC OG whales to exit with liquidity. The behavior of OGs has upgraded from "selling directly at market price on exchanges" to utilizing structured products to exit or rotate assets into a broader TradFi asset world. Galaxy's largest business growth in 2025 comes from helping BTC whales transition from BTC to iBit. The collateral mobility of iBit is far superior to that of native BTC, and it is safer to store. As assets mainstream, the high capital utilization of paper Bitcoin far exceeds that of real Bitcoin, which is an inevitable path for the financialization of other precious metals.

Miners: From "Paying Electricity Bills" to "Funding AI CAPEX"

From around the halving in 2024 to the end of 2025, miners have experienced the most sustained and significant down cycle in reserves since 2021: by the end of 2025, miner reserves were approximately 1.806 million BTC, with hash rates declining about 15% year-on-year, indicating signs of industry clearing and structural transformation.

More importantly, the motivation for miners to sell coins in this round has exceeded the traditional scope of "covering electricity bills":

Under the so-called "AI escape plan," some mining companies have transferred approximately $5.6 billion worth of BTC to exchanges to raise capital expenditures for building AI data centers.

Companies like Bitfarms, Hut 8, Cipher, and Iren are transforming their existing mining sites into AI/HPC data centers and signing long-term power rental agreements of 10–15 years, viewing electricity and land as "golden resources in the AI era."

Riot, which has consistently adhered to a "long-term holding" strategy, also announced a strategy adjustment in April 2025, beginning to sell the BTC produced each month.

Financialized Paper Bitcoin

Bitcoin and the crypto digital assets it represents are undergoing a slow migration from being dominated by crypto-native funds in value discovery active trading to passive allocation and balance sheet management represented by ETFs, DATs, sovereign and long-term funds, with managed positions often being financialized paper Bitcoin. The underlying asset, Bitcoin, is gradually becoming a risk asset component that is inserted into various portfolios and bought according to weight. The process of Bitcoin's mainstreaming is complete, but what follows is a leverage cycle and systemic fragility similar to traditional finance.

1. Funding Structure Level: Incremental buying is increasingly coming from passive funds, long-term asset allocations, and corporate/sovereign balance sheet management, with the marginal role of crypto-native funds in price formation declining, becoming net sellers at high points in most phases.

2. Asset Attribute Level: The correlation with U.S. stocks (especially high β tech and AI themes) has significantly increased, but due to the lack of a valuation system, it has become an amplifier of macro liquidity.

3. Credit Risk Level: With the help of DAT stocks, spot ETFs, structured products, and other proxies, cryptocurrencies have further become highly financialized, significantly improving asset turnover efficiency, while also exposing them more to risks of DAT unwind, collateral depreciation, and cross-market credit squeezes.

Where Do We Go from Here

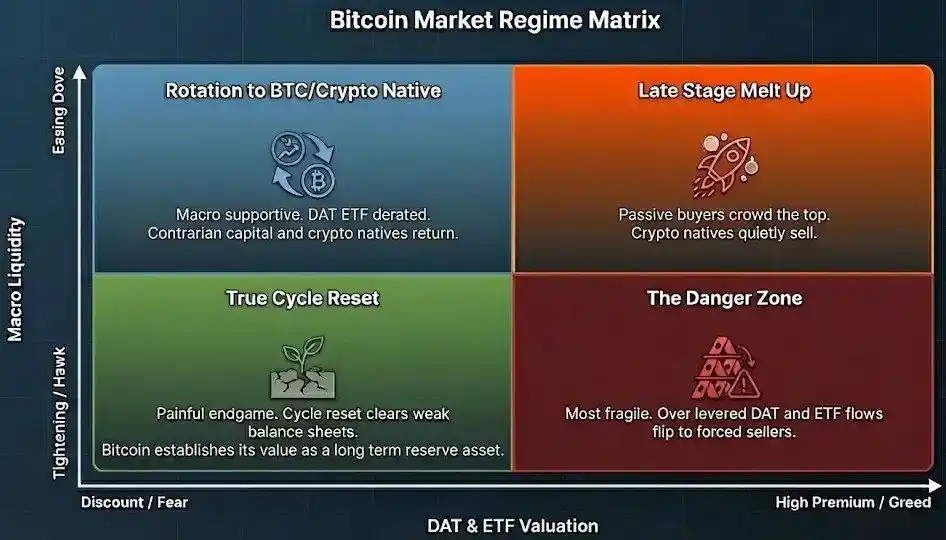

Under the new liquidity structure, the traditional narrative of "four-year halving = a complete cycle" is no longer sufficient to explain BTC's price behavior. The dominant variables in the coming years will come more from two axes:

Vertical Axis: Macro liquidity and credit environment (interest rates, fiscal policy, AI investment cycles);

Horizontal Axis: Premium and valuation levels of DATs, ETFs, and related BTC proxies;

In these four quadrants:

Loose + High Premium: High FOMO phase, similar to the environment at the end of 2024 to early 2025;

Loose + Discount: Macro relatively friendly, but DAT/ETF premiums are squeezed out, suitable for crypto-native funds to undergo structural reconstruction;

Tight + High Premium: Highest risk, DAT and related leverage structures are most likely to experience severe unwinds;

Tight + Discount: A true cycle reset;

In 2026, we will gradually move from the right quadrant to the left quadrant, getting closer to the "Loose + Discount" or "Slightly Loose + Discount" areas. At the same time, several key institutional and market variables will emerge in 2026:

· SFT Clearing Service and DTCC 24/7 Tokenization Implementation: Bitcoin will further complete its financialization, becoming part of Wall Street's foundational collateral; the liquidity gaps caused by time differences will be smoothed out, enhancing depth while also raising leverage limits and systemic risks.

· AI Trading Enters "High Expectation Consumption Period": In the second half of 2025, signs have already appeared that AI leaders "continue to perform well but stock prices react sluggishly," where simply exceeding expectations no longer corresponds to linear price increases. Whether BTC, as a high β tech factor, can continue to ride the coattails of AI capital expenditures and profit revisions will be tested in 2026.

· BTC Further Decouples from the Altcoin Market: BTC connects with ETF flows, DAT balance sheets, sovereign and long-term funds; while alts connect with smaller, higher-risk preference funding pools; for many institutions, reducing BTC holdings is more likely to mean returning to better-performing traditional assets rather than "shifting from BTC to alts."

Is price important? Of course, it is. Bitcoin, having crossed the $100,000 mark, has used its price to elevate this young asset, which is only 17 years old, to a national-level strategic reserve. Beyond price, the next journey for crypto assets remains long. As I mentioned in "Hello, Primitive Ventures," written when Primitive was founded in 2018,

"In our exploration of the crypto endeavor over the past few years, we have witnessed the immense power of distributed consensus achieved among individuals, along with the characteristic of information continuously dissipating, which gives crypto assets a strong vitality. It is precisely the fundamental desire of individuals for freedom and equality, as well as for certainty in assets and data, that has shown us the possibility of ever-increasing entropy and the immortality of crypto."

When capital markets and cultural trends intertwine, it will release economic and productive relationships that are more powerful than the cultural trends themselves. The populist finance represented by crypto is a typical product of the intersection of "capital markets + cultural trends."

If in the coming years we can see crypto rails as the only super-sovereign and global liquidity underlying structure, generating substantial cash flow, users, and balance sheet applications, allowing some of the victories of ETFs/DATs to flow back onto the chain, transforming passive allocations into active uses, then everything we discuss today will not be the end of a cycle, but rather the starting point for the next round of true adoption. From "Code is the law" to "Code is eating the bank," we have already traversed the most challenging 15 years.

The beginning of a revolution signifies the decline of old beliefs. The worship of Rome turned Roman civilization's dominance over the world into a "self-fulfilling prophecy." The process of the birth of new gods may be random, but the twilight of the old gods is already destined.

As a side note: This article is a deep review of the piece "A Clear Long Bull from the West" written six years ago. Thanks to all of you who have been with us since 2017, or even earlier. Together, we have witnessed Bitcoin's journey from narrative to sovereignty, from the margins to the mainstream, and we have experienced those beliefs that can only be understood by being present.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。