Author: Shen Hui, Yuanchuan Investment Review

Hong Hao's knowledge platform has officially announced a price increase, now priced at 1499 yuan/year, equivalent to a bottle of Moutai.

Before the price increase, the annual fee was 899 yuan. Based on 14,000 people recharging, in just two months, Hong Hao's GMV on the knowledge platform reached 12.586 million.

Coincidentally, Hong Hao's friend Li Bei has also ventured into paid knowledge, with 200 spots for a course valued at 12,888 yuan selling out in two days. This means that in just two days, Li Bei's course sales revenue reached 2.57 million.

It is well known that the media is recognized as a poor business. From the consistently low performance of the media sector among the 31 industries in Shenwan's first-tier classification, this conclusion is not hard to draw. However, in this sunset industry, private domains and course sales stand out, attracting countless financial professionals.

Former Chief of Fixed Income at Guohai, Jin Yi, has gained 1.6 million followers on Douyin in three months with his account "Bainian Talks Politics and Economics," where his 1V1 consulting service membership fee is 4,283 yuan per month; Tan Jun is about to launch the "Industry Decision-Maker Reference Circle," limited to 30 seats, priced at 159,880 yuan; and the seemingly more upscale "Bull and Bear Beast Club," where paid members can not only listen to Fu Peng's financial literacy courses but also ski with him in Changbai Mountain.

Among financial consumers, Americans have a stronger willingness to pay. Big short seller Michael Burry simply shut down his hedge fund and instead launched a newsletter on Substack for an annual fee of $379, attracting 187,000 subscribers in just two months—far easier than shorting Nvidia.

Suddenly, financial bigwigs are stepping into the arena, not competing on investment ideas but on subscriber numbers. Is it that investment money is too hard to earn, or is the business of gaining followers too easy to do?

Three Types of Leverage

Silicon Valley investor Naval has mentioned that to achieve financial freedom, one needs to use three types of leverage:

- The first is labor leverage, which means having others work for you;

- The second is capital leverage, like how Buffett uses capital leverage to expand influence, making money work for him;

- The third, which he considers the most important leverage—“replicating products with zero marginal cost,” mainly including code and media.

In Naval's view, the wealth of the new generation of millionaires is created through code and media.

Joe Rogan earns between $50 million and $100 million annually from his podcast[1], utilizing this new type of leverage. By simply increasing paid memberships and online course sales, he can amplify his labor results by hundreds or thousands of times. Its advantage is that the replication cost is almost zero; anyone with a computer and internet can easily earn passive income.

Both Hong Hao and Li Bei happen to possess all three types of leverage.

Li Bei founded Banxia in 2017, and by 2022, its scale surpassed 10 billion, having already achieved financial freedom through labor and capital leverage. As she herself stated, she does not lack the tens of millions generated from knowledge payments each year. However, it cannot be denied that these tens of millions are far more certain in the short term than waiting for a reversal in China's real estate market.

In contrast to Li Bei's colorful hobbies of baking, gardening, and playing tennis, Hong Hao's recent experiences have been somewhat tumultuous.

In his early years, Hong Hao was the Chief Global Strategist at CICC and worked at Citigroup and Morgan Stanley. After leaving Jiao Yin International in 2022, he jumped back and forth between buy-side and sell-side, successively joining Sire Group and Huafu International, and is now a partner and Chief Investment Officer at Lianhua Capital.

However, Hong Hao's performance has always been a mystery.

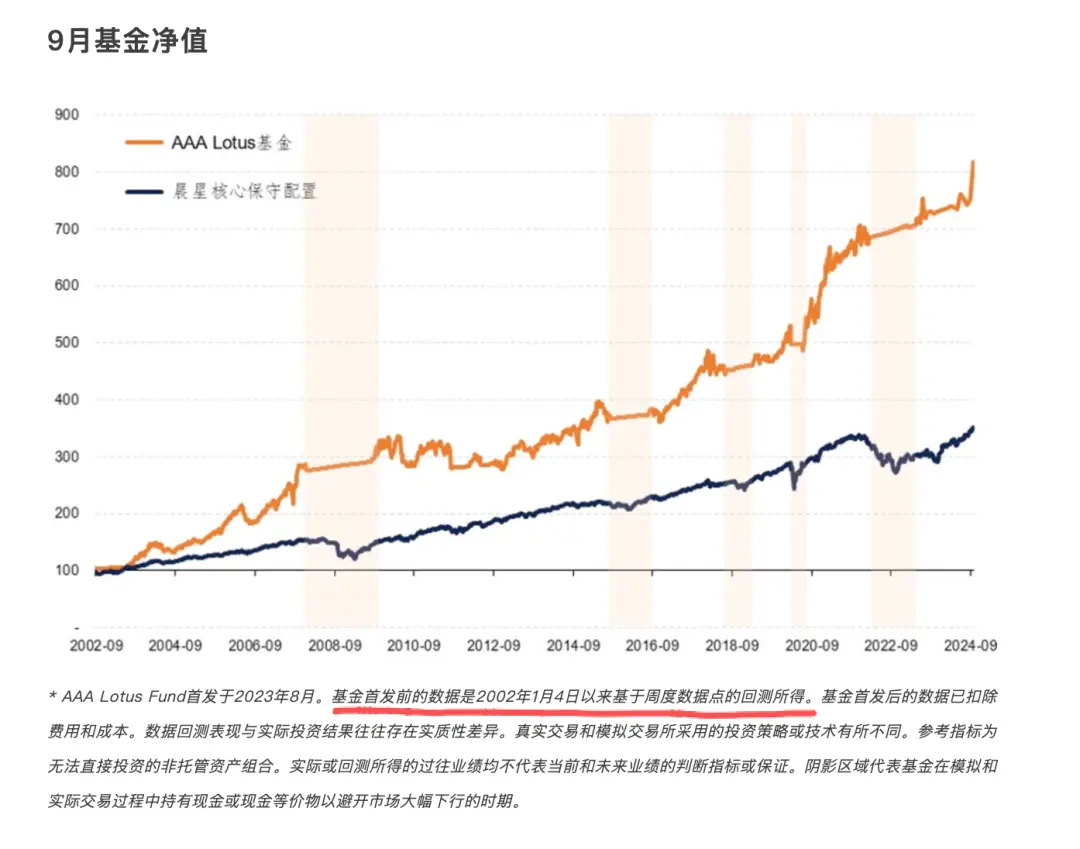

In August 2023, he launched the Lotus-AAA fund at Sire and Lianhua Capital, which, aside from a net value surge of 8.98% in September 2024, had previously shown lackluster performance. Perhaps due to the fund's short operation time, he included historical performance simulated back to September 2002 when showcasing results. At least the chart shows that Hong Hao seems to have achieved a cumulative investment return of 718.77% over 20 years.

You can question Hong Hao's actual performance, but you cannot question his ability to create charts.

Hong Hao and Li Bei excel at building IP and generating traffic. Their proficient use of the third type of leverage allows them to attract funds more effectively than their peers in the knowledge payment sector.

In terms of track selection, the macroeconomic track that Hong Hao and Li Bei are in naturally reaches a broader audience. Not everyone cares about the name of Nvidia's open-source VLA model, but everyone is concerned about whether gold will continue to rise and whether the stock market in the Year of the Red Horse and Red Sheep will experience a prosperous trend.

In terms of expression, compared to the vague opinions of economic experts at roundtable forums that can put people to sleep, people prefer to listen to Hong Hao predict the fifth wave of a bull market and Li Bei analyze how to escape the micro盘 fire scene with bright eyes. Even if they are vague, they will unexpectedly gain the artistic expression of "MaiMaiMai," as winning means buying, and losing means selling.

In terms of writing style development, Hong Hao is skilled at mixing classical Chinese and obscure characters in macro analysis, citing various references in an esoteric manner, providing readers with a reading experience that is both incomprehensible and profoundly shocking. Hong Hao has explained that the best articles seem to be nonsense but have some unexpected consequences[2]. Li Bei, on the other hand, cleverly combines her emotional journey with macro analysis, occasionally posting dating ads and providing low-barrier discussion topics.

Because people love to mix "fortune-telling" and "gossip" in macro literature, Hong Hao and Li Bei have captured a massive flow of traffic in the financial circle, creating a broader entry point for transforming into knowledge payments.

It's All Business

Fund managers typically use the third type of leverage cautiously.

Once fund managers start writing articles or selling courses, they are often seen as neglecting their primary duties, diverting time that should be spent on research and investment. Furthermore, transitioning to media does not garner more professional recognition, just as people often criticize financial influencers—if their investment abilities are strong enough, why would they take time to teach others how to make money?

Whether it's Hong Hao's knowledge platform or Li Bei's course sales, their foray into knowledge payments is not simply a transition to becoming self-media.

Compared to Li Bei, Hong Hao's transition to investment came later, and he cannot produce a continuous three-year net value curve, so he needs to continuously market the accuracy of his predictions on social media to endorse his investment capabilities.

On November 28 last year, Business Weekly invited Hong Hao, Li Bei, and Fu Peng to a roundtable. When discussing gold, Fu Peng's views were ambiguous, Li Bei was bearish, and only Hong Hao disclosed detailed selling points—selling all when the gold price reached $4,500 per ounce.

This led to skepticism, as at that time, the price of the Comex gold futures main contract had never reached $4,500 per ounce. While non-main contracts had briefly reached that price, it was nearly impossible for an institution like Hong Hao to escape the peak in such low liquidity contracts.

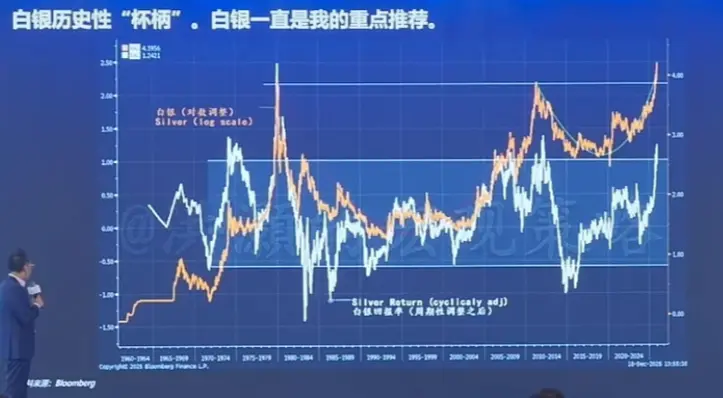

Hong Hao did not publicly disclose detailed gold trading closing orders but instead marketed "10,000 witnesses predicting the miracle of silver" on his platform, where he publicly predicted:

Silver has not finished its journey; the deeper the cup, the higher the target. If $4,500 is a fair price for gold, then for the rest, we need to use our imagination; new highs are for buying, and those afraid of heights are all unfortunate people.

As written in "The Crowd: A Study of the Popular Mind," mastering the art of influencing the imagination of the masses is to master the art of ruling them.

Hong Hao believes that silver has formed a giant "cup and handle" shape over 60 years.

Ultimately, Lianhua Capital is still relatively unknown. Posting positive reviews from fans on the platform, creating expectations for the price increase, and selling more "platform Moutai" can incubate more future private equity clients. Compared to collecting management fees and performance rewards, there are higher short-term economic benefits.

After all, putting forward a viewpoint of "optimistic about silver" is easy, like the two sides of a coin; if it rises, one can boast, but "heavily betting on silver" must face the multidimensional game of market, human nature, rules, and scale.

In contrast to Hong Hao, Li Bei is in a different situation. After Banxia crossed the 10 billion mark, its performance growth has been sluggish, and it fell out of the 10 billion private equity camp at the beginning of this year. In an environment where Bridgewater's Chinese dominance remains strong and quantitative macro competitors are looming, the urgent task is to stabilize old clients and avoid redemptions.

Li Bei's approach is to offer free online courses to all Banxia investors and provide offline courses to investors who have held the fund for over two years or invested over 5 million. Thus, before the course starts on January 24, investors wanting to redeem will have a cooling-off period.

In November, Mingceng's macro product was sold out upon launch; in December, the 2 billion quota for Two Sigma's "CTA+Index Increase" composite strategy product was snapped up across three major channels in an instant. These multi-strategy products produced by quantitative private equity inadvertently form a substitute for Li Bei's macro strategy.

Moreover, the subjective private equity on the distribution side is gradually declining, and mainstream channels are somewhat avoiding it. In the future, subjective managers will inevitably need to invest more effort in direct sales.

A clever way is to first filter out the paying customer base among fans at the price of 12,888, then use slogans promising over 10% long-term annualized returns from attending classes to lock in those dissatisfied with financial returns and eager for wealth.

Fans with purchasing power and desire, after attending Li Bei's offline classes for clarification and Q&A, can naturally achieve high conversion rates for private equity clients with minimal time cost.

A savvy manager not only makes good use of the third type of leverage but is also adept at combining all three types of leverage.

Conclusion

When discussing the trend of knowledge payments in the asset management industry, many people think of two aspects:

- One is the pressure on practitioners caused by salary cuts in the financial industry, prompting them to seek other sources of income;

- The other is that transitioning from investment to media is like a dimensionality reduction attack. For this reason, financial self-media is the first choice for most financial practitioners' side jobs.

But on a deeper level, this actually stems from the mutual needs of investors and managers—investors need reliable sources of information, and managers need long-term clients.

Just like Huang Renxun's speech at CES, the next day there were dozens of interpretations of which sectors the market would benefit, seemingly equalizing information, but in reality, it increased countless noise. The advancement of AI has allowed more noise to be produced at a low cost. For both investors and managers, attention and trust are the most scarce resources.

Who wouldn't want to spend some money to buy a professional fund manager's knowledge platform in exchange for information asymmetry, or even to follow their operations? Many people know that Hong Hao's predictions often go awry, but what they are buying is not a 100% success rate, but rather an emotional anchor and comfort through his repeated analysis and confirmations in a chaotic market.

Some subjective fund managers are also gradually realizing that they are no longer the first choice for institutions, distribution channels, or high-net-worth clients. Thus, they can only work harder to reach more precise clients through private domains and courses. Some powerful subjective private equity firms have already filtered their clients to be executives of invested companies or industry experts—helping clients make money while also obtaining cutting-edge information from them.

I asked him why he didn't consult the sell-side, and he replied that the sell-side can only be bullish on their own industry and mislead themselves, while invested clients can provide the most real and objective views on the industry.

As gold becomes increasingly difficult to mine and shovels become excessive, having a map of the mine becomes the important thing, and those selling the maps become the most profitable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。