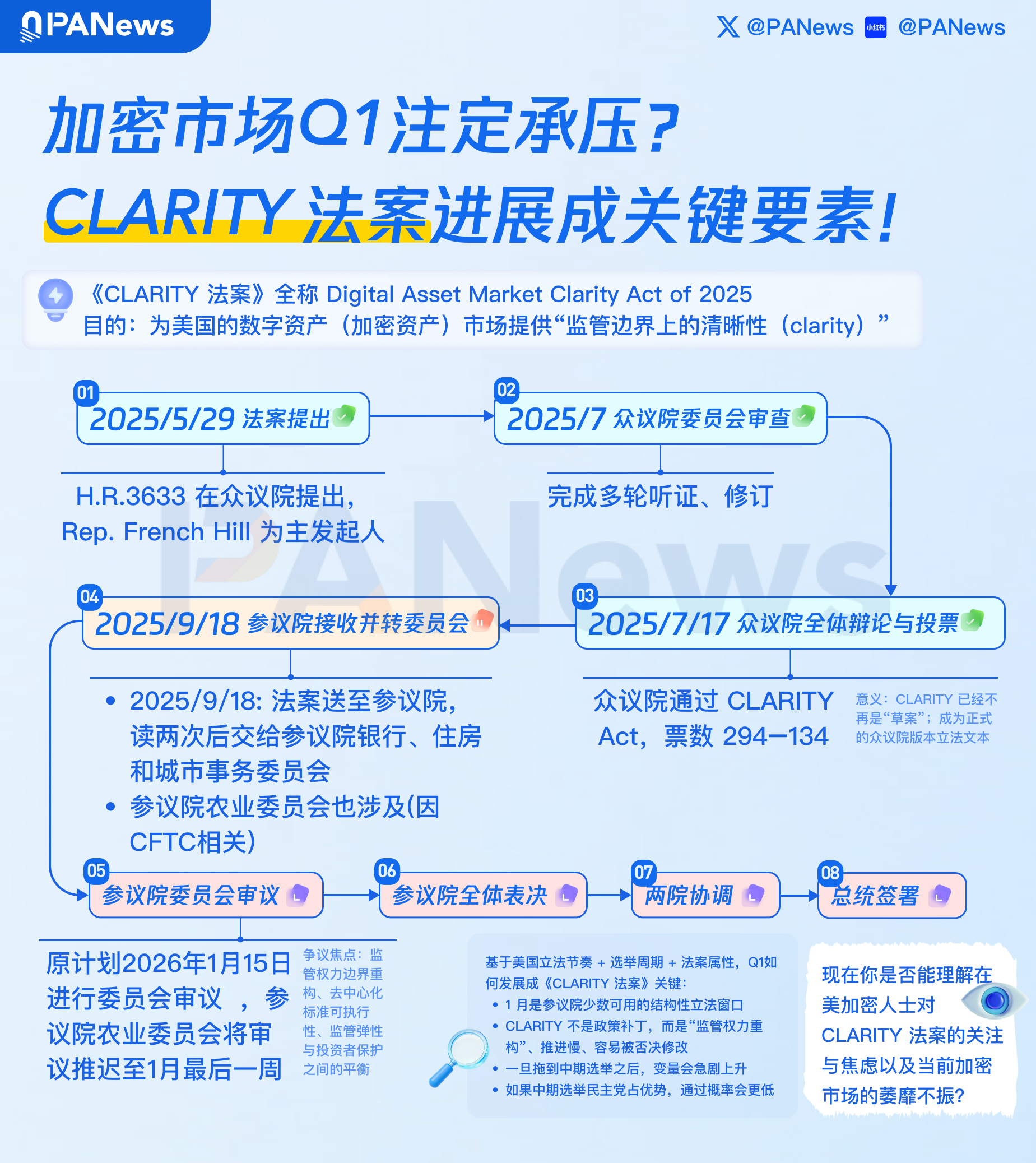

The purpose of the "CLARITY Act" is to provide "clarity on the regulatory boundaries" for the digital asset (cryptocurrency) market in the United States. It was introduced in the House on May 29, 2025, by Rep. French Hill as the main sponsor and is currently stuck in the "Senate reception and transfer committee." The market is increasingly worried that if the CLARITY Act does not make significant progress in Q1, the situation will become increasingly unfavorable!

The reasons are multiple:

January is one of the few available structural legislative windows in the Senate

Every year, January to March is the main period for the Senate to handle high-complexity, non-urgent bills. CLARITY falls into the category of "high complexity + high controversy + non-urgent" market structure legislation, which naturally places it lower on the priority list. If it fails to make substantial progress in January (such as clear actions at the committee level), it can easily be "naturally squeezed out" of the overall legislative agenda.

CLARITY is not a policy patch, but a "restructuring of regulatory power"

The characteristics of such bills are: slow progress, repeated requests for amendments, and high susceptibility to delays rather than outright rejection.

Once it drags into the midterm elections, the variables will increase sharply

Midterm elections = reset of congressional power structure. Bills that have been advanced but not completed will have their priorities reshuffled. The CLARITY Act, which is not yet effective, has not formed a strong bipartisan consensus, and is highly dependent on current committee support, is very likely to be "reassessed" or even redrafted after changes in the power structure.

If the Democrats gain an advantage in the midterm elections, the probability of passage will be lower The mainstream position of the Democrats tends to: strengthen the coverage of securities laws, retain flexibility in regulatory agency interpretations, and be highly cautious about "legislating to limit the enforcement agency's space."

The core effect of CLARITY is to preemptively define certain regulatory boundaries, limit "regulation by enforcement," and reduce the SEC's discretion in gray areas. Therefore, in a Senate environment where the Democrats are dominant, CLARITY is more likely to be: required to undergo significant amendments (essentially a rewrite), broken down into multiple sub-bills, or long-term shelved.

Can you now understand the concerns and anxieties of the crypto community in the U.S. regarding the CLARITY Act and the current sluggishness of the crypto market?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。