Author: Miles Deutscher

Translation: Jiahua, ChainCatcher

In this article, I will break down my top ten cryptocurrency predictions for 2026 in detail. This includes my price prediction for $BTC, top altcoin narratives, the prospects of crypto combined with AI, and more. This is an exercise I do every year, and it really helps me calibrate my direction for the new year. Even if you don’t agree with all the predictions here, I hope this inspires your thinking and prompts you to list your own predictions to prepare for capturing the biggest upside this year.

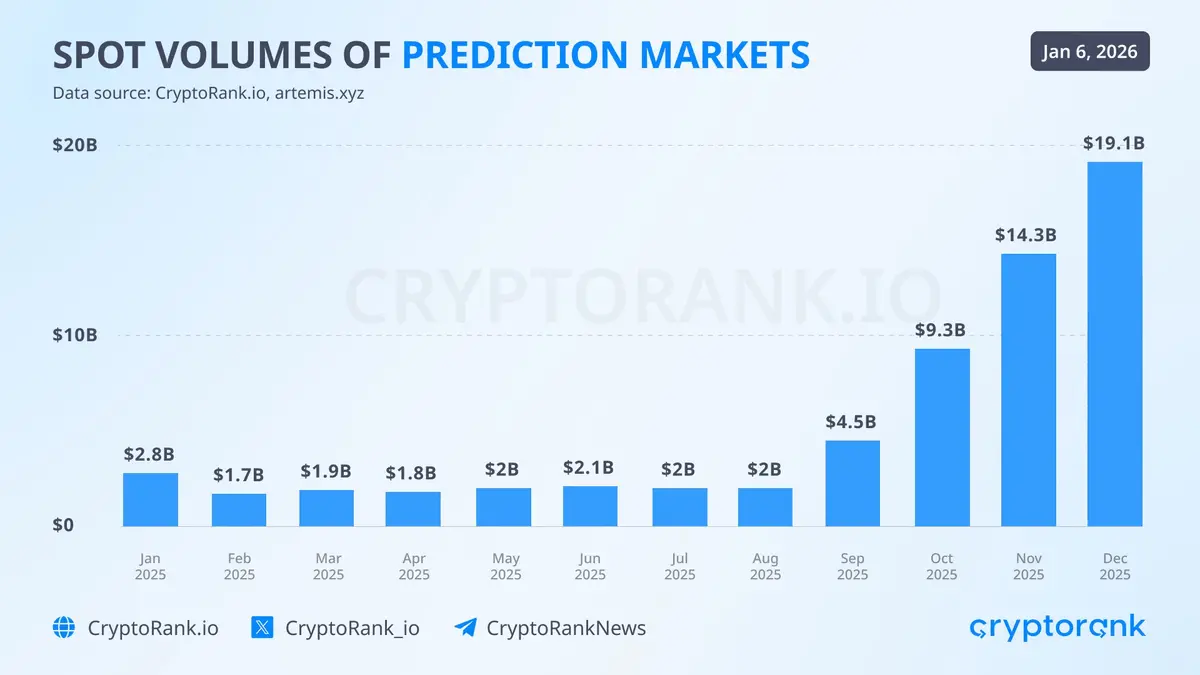

10. Predicting a 5x Growth in Prediction Market Trading Volume

From January 2025 to today, the trading volume in prediction markets has grown by about 10 times. I believe this trend will continue, and in 2026, we will see at least one month where the trading volume reaches 5 times the current level. A 5x increase in current trading volume would equate to approximately $95 billion per month. Another factor to consider is the rise of "adjacent protocols" built on prediction markets. For example, @intodotspace, which is building the first leveraged prediction market. This trend will further amplify trading volume.

9. Explosion of Stock/Metal Perpetual Contract Trading

The argument here is simple: we will continue to see the spread of perpetual contracts in mainstream areas—not just limited to cryptocurrency token trading. 2025 was the year when perpetual futures technology exploded in the crypto space—instant settlement, excellent UI/UX, decentralization, etc. Additionally, gold/metals/stocks are in a fierce bull market. Typically, as cycles approach their peak, people move further down the risk curve in pursuit of returns (perpetual contracts are well-suited to benefit alongside small-cap stocks/emerging markets).

In many cases, accessing stocks/gold through the crypto route is easier and faster than purchasing them through traditional finance (TradFi). Due to this combination effect, I believe we will see explosive growth in trading volume for stocks/metals on perpetual DEXs, with perpetual contract trading far exceeding that of cryptocurrency tokens.

8. The "Renaissance" of ICOs Continues

Due to the significant shift in the regulatory environment, the public now has unprecedented access to participate in token sales. Participation in ICOs is at an all-time high, and I expect this overall upward trend to continue. If you are interested in profiting from ICOs, I recently published a complete tweet guide and a free Notion template to help you stay organized in this space—you can check it out below.

7. Altcoins with Strong Revenue Models Will Prevail

Market sentiment has clearly shifted to favor real businesses over mere speculation and hype. Of course, the latter will always have a place in the market, but more and more investors (big and small) are looking for real "flywheels" to support token prices (in a sea of token dilution).

I believe that protocols generating real revenue will continue to dominate. Simply put, protocols with real revenue mechanisms will perform better than those without. Keep an eye on companies/projects/teams that are actually generating revenue.

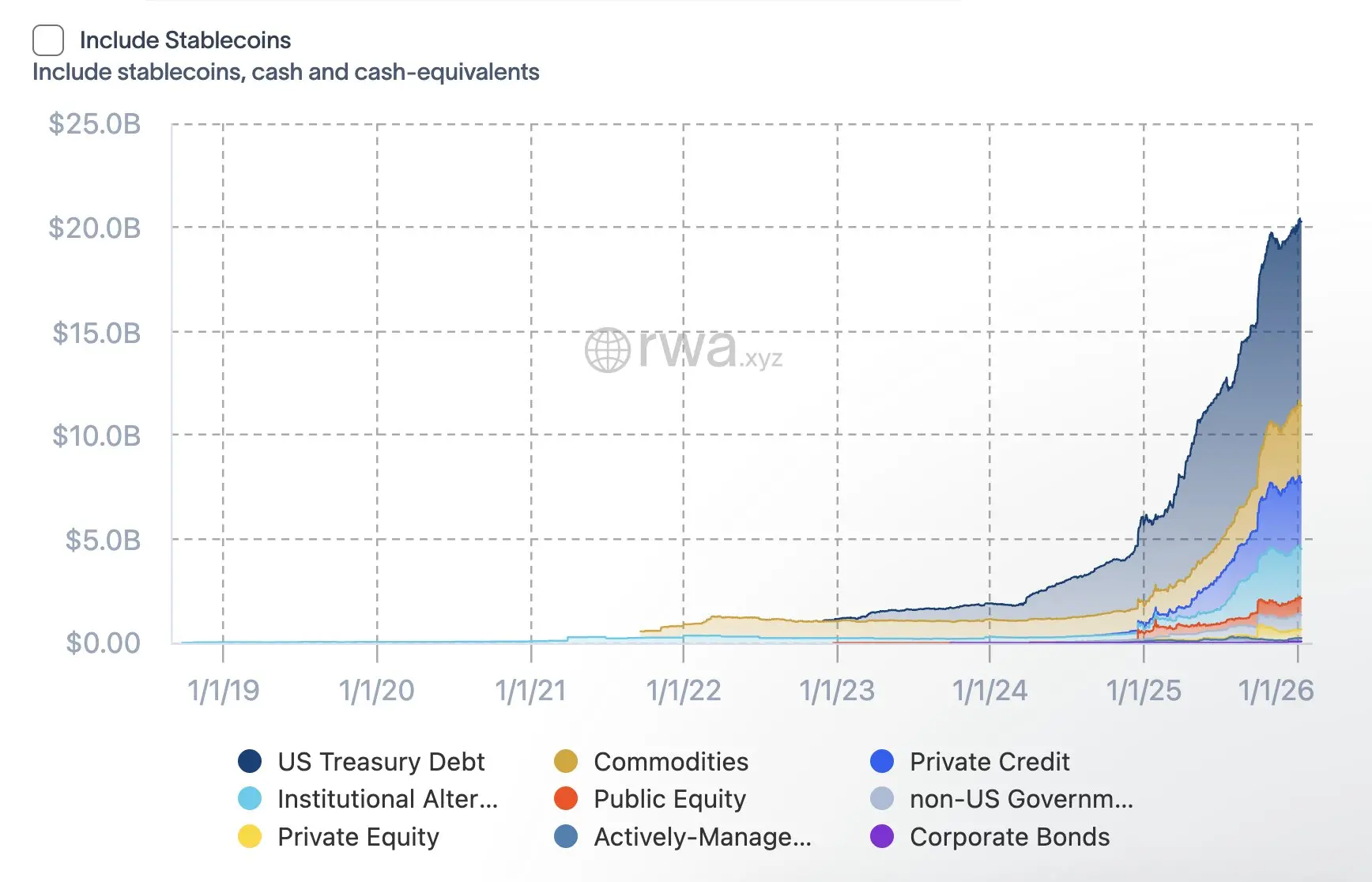

6. RWA Will Experience the Second Largest Year of Growth in History

I would love to say that RWA will have the largest year ever. However, technically, it will be difficult to break the $14 billion growth of 2025. I believe liquidity will continue to flow into this space, making it another bountiful year, but the percentage growth may be smaller than in 2025. 2026 may bring many yield/tokenization opportunities and a significant amount of altcoin trading layouts in this field.

5. Digital Banks (Neobanks) Become the Most Exponentially Growing Sector in Crypto

It feels like we have finally reached a turning point in the crypto/stablecoin banking sector. The infrastructure has finally caught up with demand, and we are seeing explosive growth in the adoption of many products. The ability to easily exchange cryptocurrencies with fiat in both directions is a much-needed solution. This sector has the largest potential market (essentially the entire financial world) and is actively addressing issues in developing countries and less convenient areas of traditional financial systems. This is a huge market, and I expect that this year we will finally (truly) conquer it.

4. AI / AI Agents Make a Real Comeback

Last January, we either experienced a crazy AI hype season that drove up the prices of Crypto x AI protocols—the only problem was that the technology hadn’t caught up at that time. Entering 2026, the situation is different; the technology can actually deliver on the promises of the hype. For me, 2026 is undoubtedly the most critical year for AI so far (as it is every year), as people speculate on the upside potential of AI, retail interest easily spills over into the crypto space. Crypto x AI is a perfect synergy. Crypto brings freedom to the financial rails, while AI brings automation, and I believe this is the future of finance. I think this will create opportunities in many AI subfields, including x402, robotics, agentic workflows, AI data/infrastructure, and more.

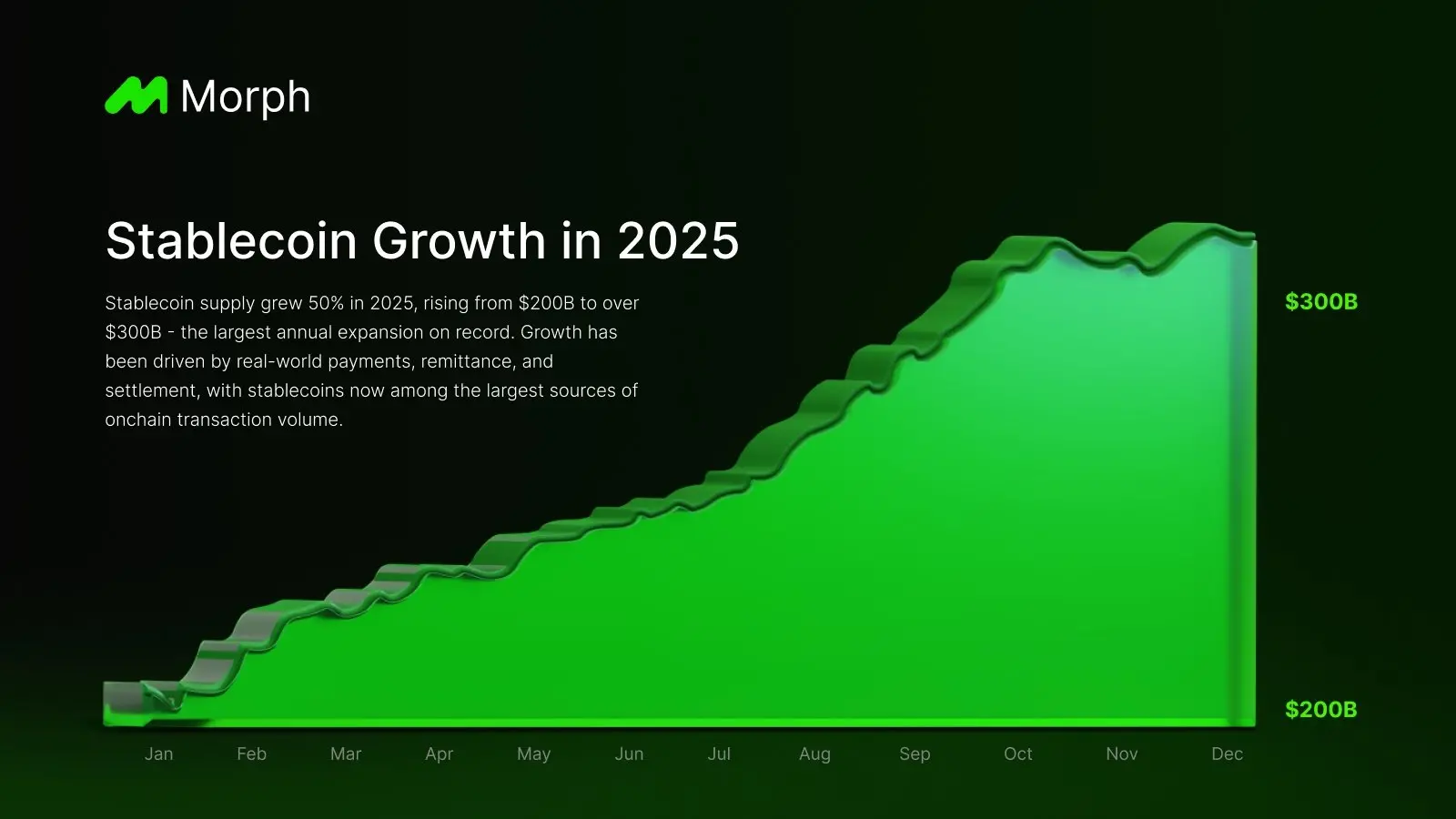

3. Stablecoin Supply Increases by Over 50%

Last year, the total supply of stablecoins grew by 50% (from $20 billion to $30 billion). I believe we will see similar growth in stablecoin supply this year, partly catalyzed by the U.S. "Genius Act" regulating stablecoins.

2. Institutional Drive in the Crypto Market Will Exceed Retail

This entire cycle has been driven by institutions (the push from DATs, ETFs, etc.). I expect this shift towards an institution-driven market to continue—which is why I focus on tokens/protocols that can attract institutional interest (returning to my point about focusing on real revenue projects).

1. BTC Price at Year-End Will Be Higher Than at Year-Start

Whether $BTC will see a crazy "peak and drop" above $150,000 this year depends on many factors. Capital flow/buyer demand, DATs, macro backdrop, and so on.

To be honest, I’m not sure if the market can align all the right conditions to trigger that extreme bull peak pattern. However, I believe Bitcoin will close 2026 with a bullish price candle. This means $BTC must close above the $90,000 range.

To summarize my bullish logic on this (which I may elaborate on in a later post): we are likely in the last year of the business cycle, and we are seeing price bottoming behavior similar to previous years, which makes me believe we will at least close in the green this year—over the next few weeks, I will delve deeper into my exact arguments on this, so stay tuned.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。