Author: Chloe, ChainCatcher

In the world of traditional finance, stock buybacks are often seen as a "shot in the arm" for market confidence. When a company announces a buyback, it usually indicates that management believes the stock price is undervalued or that the company has ample cash flow. However, applying a similar strategy to Web3 projects has not yielded positive results.

Recently, Jupiter co-founder SIONG initiated a discussion on X, proposing to halt the buyback plan for the $JUP token. He stated that Jupiter has invested over $70 million in token buybacks over the past year, but the token price has performed poorly; meanwhile, Helium founder Amir Haleem directly announced the cessation of token buybacks, describing it as "throwing money into a black hole."

Why does tens of millions of dollars in real cash fail to make a splash in the crypto market? Is the issue rooted in the underlying design of the buyback strategy? Below is a summary of last year's project buyback data performance and market perspectives on project buybacks.

Data Performance: A Collective Waterloo for Buyback Projects in 2025

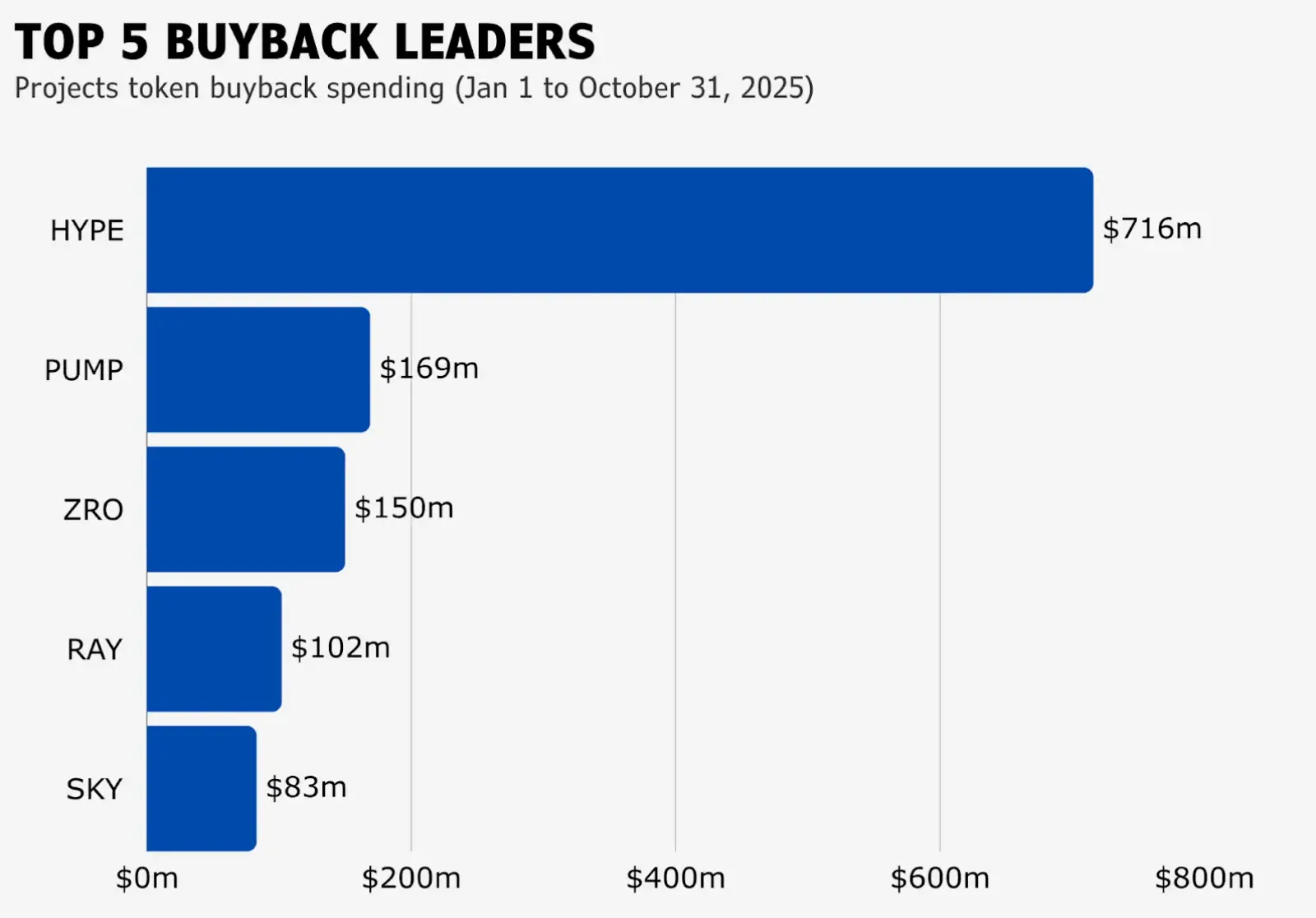

According to market research firm blockmates, tracking buyback projects from January to October 2025, the top five projects are Hyperliquid, Pump.fun, LayerZero, Raydium, and Sky. Among them, Hyperliquid's buyback amount reached $716 million, while Sky, in last place, invested $83 million.

However, the investment does not correlate with returns; aside from Hyperliquid's token price maintaining strength in the first three quarters (which has since dropped from $45.5 at the end of October to $25.94 before publication), the other projects have almost all continued to decline. This phenomenon has raised market doubts: if buybacks cannot enhance token value, is this money essentially wasted?

Opinion Game: The Trade-off Between Buybacks, Staking, and Growth Incentives

Regarding whether projects should stop buybacks, there are starkly different voices in the market:

Jupiter and Helium founders lean towards halting token buybacks and redirecting that money to "acquire users," possibly through subsidizing transaction fees, rewarding new users, or enhancing product features to strengthen fundamentals. However, this shift still faces challenges: tokens will continue to unlock, and users may choose to sell due to a lack of long-term confidence, creating ongoing selling pressure and risking further significant declines in token prices.

DeFi OG CM states that the core significance of buybacks lies in reducing circulating supply and establishing a "regular deflation" model. Ultimately, token prices depend on market supply and demand and project fundamentals, rather than the buyback actions themselves. Buybacks are undoubtedly beneficial for token holders but do not guarantee short-term "price increases." Project teams should not easily stop execution due to low token prices or buyback costs.

Helius CEO Mert Mumtaz argues that buybacks are essentially a pessimistic mechanism, implying that project teams cannot find better uses for funds than short-term price boosts, attempting to initiate a growth cycle through price reflexivity rather than product growth. In a highly competitive market, buybacks are not the best strategy; the only effective edge case is opportunistic buybacks during market crashes (when equity is irrationally undervalued), combined with aggressive reinvestment during normal periods. This is a judgment from the founder's perspective rather than the investor's.

Former Aave institutional business head and ConsenSys fintech partner Ajit Tripathi states that the buyback narrative is the most value-destructive play after meme coins. This logic was initially promoted by Solana's marketing to claim superiority over Ethereum, but it ultimately harmed all tokens, even those with revenue, forcing everyone to engage in purely financial games.

Additionally, many viewpoints propose alternative solutions. For instance, Selini Capital founder Jordi Alexander observes that many projects fail not due to mechanisms but due to the "timing of execution" for token buybacks. Some star projects in this cycle (like HYPE, ENA, $JUP) executed large-scale buybacks during the market's most fervent and irrationally valued periods. When token price-to-earnings ratios rise to excessively inflated numbers due to over-speculation, project teams continue to execute buybacks, essentially buying from sellers at the peak, which is a poor decision. Therefore, Jordi suggests that project teams need more complex "financial engineering," with an ideal model based on dynamic buybacks tied to price-to-earnings ratios.

Solana founder Anatoly believes that projects should not pursue short-term price stimulation (buybacks) but should learn from traditional finance to establish a capital accumulation process lasting ten years. He favors staking mechanisms that allow long-term holders to gain more shares, thereby diluting short-term speculators. He suggests that profits should be stored as "future token entitlements" rather than consumed in market fluctuations.

Represented by Selini Capital founder Jordi Alexander, the view is that buybacks themselves are not wrong; the mistake lies in the "amateur execution." Projects should hire professional financial advisors to adjust buyback strategies based on token price-to-earnings ratios and market cycles, rather than blindly executing buybacks, which can lead to depleting reserves at market peaks and leaving no funds available for support during downturns.

Evolution from "Blind Buybacks" to "Strategic Value Management"

Token buybacks are essentially a "deflationary tool," not a guarantee of price increases. Amid various market fluctuations, buybacks often play a role of "passive defense," capable of reducing supply and establishing price support but unable to single-handedly reverse complex trends shaped by macro conditions, unlocking pressures, or market sentiment.

The path to token value growth should evolve from a singular buyback action to strategic value management. First, projects need to establish execution strategies with better financial judgment, such as following the logic of "buying undervalued, reserving overvalued": when token prices are far below intrinsic value, steadfastly executing buybacks to maximize capital returns; while in periods of excessive market heat and unreasonable valuations, halting buybacks and storing profits in reserves as treasury funds or aiding product growth.

Furthermore, buybacks can only address the "supply" issue and cannot create "demand." A project must provide users with continuous reasons to hold tokens. These reasons may stem from expected distributions of protocol earnings, governance powers within the ecosystem, or the product's irreplaceable competitiveness. Without solid fundamental support, any form of buyback ultimately becomes an exit channel for arbitrageurs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。