Highlights of This Issue

This week's newsletter covers the statistical period from January 2, 2026, to January 9, 2026.

This week, the total market capitalization of RWA on-chain has steadily grown to $19.8 billion, with the number of holders surpassing 600,000. The total market capitalization of stablecoins has slightly decreased, but the monthly transfer volume has surged by 29.04%, highlighting that large institutional settlements driven by "stock efficiency" have become the main engine of activity, contrasting with the sluggish activity of retail investors.

The regulatory framework in multiple countries continues to improve: The People's Bank of China has clearly stated its intention to steadily develop the digital yuan, with cross-border scenarios continuing to be implemented. MyBank has completed the first cross-border QR code payment between China and Laos; South Korea plans to require stablecoin issuers to be bank-led, and Russia is accelerating the application of the digital ruble in its budget system.

Projects are making frequent moves: Jupiter has launched a compliant reserve-backed stablecoin, JupUSD, and Tempo has released a TIP-20 token standard designed specifically for payments. Traditional financial institutions are accelerating the integration of on-chain settlement and asset tokenization processes: RAKBank in the UAE has been authorized to issue a dirham stablecoin, Lloyds Bank has completed the UK's first tokenized deposit bond transaction, and JPMorgan has expanded JPM Coin to the Canton network. Additionally, a former central bank official in Brazil has launched a revenue-sharing stablecoin, BRD, and Wyoming's official stablecoin, FRNT, has been officially issued, further enriching the forms and geographical distribution of stablecoins.

Data Insights

RWA Track Overview

According to the latest data from RWA.xyz, as of January 9, 2026, the total market capitalization of RWA on-chain reached $19.8 billion, a slight increase of 6.04% compared to the same period last month, maintaining a steady growth rate, indicating that on-chain native financial activities remain active. The total number of asset holders has increased to approximately 607,400, up 7.13% from the same period last month, showing strong growth and a continuously expanding investor base.

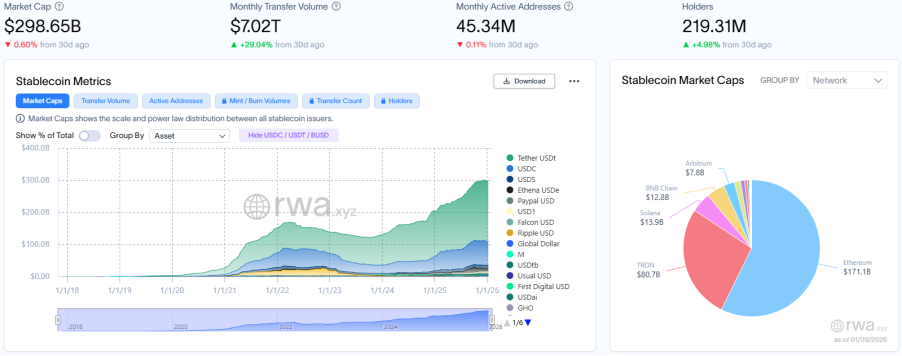

Stablecoin Market

The total market capitalization of stablecoins reached $298.65 billion, a slight decrease of 0.6% compared to the same period last month, with the overall scale continuing to contract; the monthly transfer volume has surged to $7.02 trillion, an increase of 29.04% compared to the same period last month, indicating a significant improvement in the turnover efficiency of existing funds; the total number of active addresses has decreased to 45.34 million, a slight decline of 0.11% compared to the same period last month; the total number of holders has steadily increased to approximately 219 million, a slight increase of 4.98% compared to the same period last month. The continued divergence between these two metrics indicates a structural differentiation in the market characterized by "institution-driven high-frequency settlements and stagnant retail activity."

The data reflects that the market has entered a phase of "stock efficiency-driven but weakened ecological foundation," with the high increase in transfer volume primarily supported by large institutional settlements, while retail participation remains sluggish.

The leading stablecoins are USDT, USDC, and USDS, with USDT's market capitalization slightly increasing by 0.44% compared to the same period last month; USDC's market capitalization decreased by 3.95% compared to the same period last month; and USDS's market capitalization slightly increased by 2.11% compared to the same period last month.

Regulatory News

The People's Bank of China held its work meeting from January 5 to 6, 2026, summarizing the work of 2025, which pointed out that in 2025, it actively promoted the reform and improvement of global financial governance, further enhanced financial management and service levels, and advanced precise governance of "funding chains" related to fraud and gambling. It emphasized strengthening the regulation of virtual currency trading, ensuring cash supply security, and optimizing the management system of the digital yuan. Key tasks for 2026 include: improving the infrastructure for cross-border use of the yuan, strengthening regulation of virtual currencies, and continuing to combat related illegal activities. It also aims to deepen technological management and innovative applications while steadily developing the digital yuan.

Additionally, Caixin has disclosed that only real-name authenticated digital yuan wallets can earn interest, meaning that Class 1, 2, and 3 wallets can earn interest, while Class 4 non-real-name wallets cannot (as the ownership cannot be confirmed). After January 1, participating banks' mobile banking apps and payment platforms like WeChat and Alipay will gradually gain the authority to open digital yuan wallets.

According to Techinasia, South Korea's plan to allow banks to issue stablecoins denominated in won has faced resistance from lawmakers, highlighting the divisions between the ruling party, financial regulators, and the central bank. The Financial Services Commission (FSC) has changed its stance and now supports the proposal from the Bank of Korea to limit stablecoin issuance rights to alliances led by banks with majority control.

According to the revised bill submitted to the National Assembly, stablecoins can be issued by alliances where banks hold a majority stake, but technology companies can become the largest single shareholder as long as banks maintain overall majority control. The proposal will also impose stricter requirements on cryptocurrency exchanges, such as raising information technology stability standards, mandating compensation for losses due to hacking, and imposing fines of up to 10% of annual revenue. Stablecoin issuers must have at least 5 billion won (approximately $3.7 million) in paid-in capital, and regulators may raise this threshold as the market develops. As the debate continues, lawmakers are expected to form a special task force to propose alternative legislative solutions.

Russia begins large-scale introduction of the digital ruble into the budget and banking system

According to Cryptopolitan citing RIA Novosti, Russia has begun to introduce the digital ruble on a large scale into the budget system and banking sector in preparation for comprehensive promotion in September this year. Since the beginning of this year, the digital ruble has been actively used for transactions related to the state, and it can now be used for transfers to the government budget and payments to federal agencies.

Russia has set a phased timeline and deadlines for the promotion of the digital ruble for banks and enterprises, stipulating that by September 1, 2026, the largest banks in Russia and their retail clients must allow customers to use the digital ruble for transactions. The Central Bank of Russia has also decided that, starting last week, transactions using citizens' and companies' digital ruble accounts for tax payments, fees, and government-related payments will be exempt from fees.

Local Developments

According to Zhito Finance, Yiatong stated on its interactive platform that currently, the company’s cross-border payment and domestic supply chain services do not involve digital yuan payment scenarios. The company will continue to track digital yuan policies and market dynamics, reserve relevant technical adaptation capabilities, and explore the feasibility of its application in cross-border settlement and other scenarios.

According to 21st Century Business Herald, under the guidance of the People's Bank of China, MyBank has completed the first digital yuan QR code payment at a merchant in Laos by connecting to the cross-border digital payment platform of the digital yuan international operation center. This marks the latest progress in the bilateral cross-border digital payment cooperation project between China and Laos, signifying that the digital yuan has achieved "internal use for external purposes" for the first time, providing a new payment method for Chinese residents consuming abroad and further reflecting the deepening cooperation between the central banks of China and Laos on digital currencies.

Project Progress

Jupiter officially launches the stablecoin JupUSD built on Ethena technology

According to official news, Jupiter has announced the official launch of the stablecoin JupUSD, which is a reserve-backed stablecoin pegged to the US dollar, built on Ethena Labs technology, "aimed at powering the next chapter of finance." Initially, 90% of its reserves will consist of the compliant stablecoin USDtb, which meets GENIUS standards and is collateralized by BlackRock's BUIDL fund, along with 10% USDC as a liquidity buffer. Although JupUSD does not generate yield, it can be integrated with Jupiter Lend for deposits, loans, or leveraged operations, and enjoy exclusive benefits. By depositing funds into the Lend yield vault, users will receive jlJupUSD and can access unique promotional offers, providing additional liquidity and utility for JupUSD.

The Layer1 blockchain MANTRA, focused on RWA assets, has reminded on platform X that currently, less than 8% of the total OM token supply consists of ERC20 versions of OM tokens. All ERC20 versions of OM tokens will be officially deprecated on January 15, so please migrate as soon as possible.

According to Bloomberg, the digital bank Kontigo, focused on the Latin American market, announced on platform X that due to a hacking incident, some customers' stablecoins worth approximately $340,905 were affected, and the company plans to compensate over 1,000 customers. Kontigo stated in an earlier post: "We detected unauthorized access, and some users' funds were affected. User funds are protected, and any affected amounts will be compensated by Kontigo."

Kontigo is headquartered in San Francisco but focuses on cryptocurrency and payment operations in the Latin American region. Since its establishment in 2023, the company has rapidly developed and attracted numerous well-known partners. According to its website, Kontigo currently has over 1 million monthly active users, with total payments exceeding $1 billion. The company recently raised $20 million in seed funding from investors including Y Combinator.

Tempo Releases TIP-20 Token Standard Designed for Stablecoins and Payment Scenarios

According to an official announcement from Tempo, it has launched a new token standard, TIP-20, specifically designed for stablecoins and payment applications, extending from ERC-20 and compatible with the existing EVM ecosystem. TIP-20 integrates features such as payment memos (Transfer Memo), compliance strategy registries, revenue distribution mechanisms, and stablecoin payment gas, making it suitable for various scenarios including corporate finance, cross-border settlements, and interest-bearing stablecoins.

TIP-20 has received support from infrastructure partners such as AllUnity, Bridge, and LayerZero, aiming to build a unified on-chain payment standard that enhances the compliance, efficiency, and interoperability of stablecoins, accelerating the on-chain process of real-world payment scenarios. Tempo will provide developers with SDKs, test funds, and documentation support to facilitate the rapid deployment of TIP-20.

According to Cointelegraph, RAKBank has received in-principle approval from the Central Bank of the UAE (CBUAE) to issue a dirham-backed payment token and is preparing to join the UAE stablecoin ecosystem. The bank stated in a press release that the upcoming stablecoin will be fully backed 1:1 by dirhams held in a separate regulated account and managed by audited smart contracts, with real-time reserve proof. The launch of this stablecoin marks a new phase in RAKBank's digital asset strategy, following the bank's actions in 2025 to allow retail customers to trade cryptocurrencies through regulated brokerage partners.

Barclays Invests in Stablecoin Clearing Platform Ubyx

According to Cointelegraph, Barclays has made its first investment in a stablecoin-related company, the Ubyx stablecoin clearing platform in the U.S., although the specific scale of the investment has not been disclosed. Ryan Hayward, Barclays' head of digital assets and strategic investments, stated, "As the fields of tokens, blockchain, and wallets continue to evolve, specialized technology will play a key role in providing connectivity and infrastructure, enabling regulated financial institutions to achieve seamless interactions. This investment aligns with Barclays' approach to exploring opportunities based on new digital currencies such as stablecoins."

According to CoinDesk, Lloyds Banking Group has announced that it has completed the UK's first transaction using tokenized deposits to purchase UK government bonds. Lloyds Bank, the third-largest bank in the UK by market capitalization, stated that it completed the purchase of these government bonds using the crypto trading platform Archax and the privacy-focused Canton network, indicating that tokenization technology can transform traditional banking by converting real-world assets into digital forms for instant purchase, sale, or transfer.

In this transaction, Lloyds Bank plc issued tokenized deposits on the Canton network. Subsequently, Lloyds Bank Corporate Markets used these deposits to purchase tokenized government bonds from Archax. Finally, Archax transferred the underlying funds back to Lloyds Bank's conventional account.

JPMorgan Deploys JPM Coin to the Canton Network

According to The Block, JPMorgan's blockchain and digital payments division, Kinexys, has announced the deployment of JPM Coin (JPMD) to the Canton network, marking the second expansion following its launch on the Coinbase-supported Ethereum Layer 2 network, Base, in November 2025.

JPM Coin is a dollar deposit token issued by JPMorgan, providing institutional clients with an alternative stablecoin solution that supports 24/7 instant peer-to-peer transactions.

According to CoinDesk, former Central Bank of Brazil director Tony Volpon has launched a revenue-sharing stablecoin, BRD, linked to the Brazilian currency and backed by Brazilian government debt. Volpon stated on CNN Brazil's "Cripto na Real" program that the token will be supported by national government bonds, linking its value to sovereign debt, aiming to allow holders to benefit from local interest rates. The benchmark interest rate in Brazil is 15%, while the Federal Reserve's target rate is between 3.5% and 3.75%.

Volpon indicated that this move aims to make it easier for foreign investors to enter Brazil's high-yield environment. Although Brazil's interest rates have long attracted international attention, access to these yields is often limited due to regulatory restrictions, currency friction, and domestic infrastructure issues; BRD could increase demand for the country's debt and potentially lower borrowing costs by expanding the investor base.

According to the Wyoming Stable Token Commission announcement, the state of Wyoming has officially launched its government-backed fiat reserve stablecoin "FRNT" to the public through the Kraken exchange, becoming the first fully reserve-backed stablecoin issued by a public institution in the U.S. FRNT is deployed on the Solana chain and can be bridged to multi-chain networks such as Ethereum and Arbitrum via Stargate. The coin is available for individuals and institutions, supporting instant settlements with transaction fees as low as $0.01, and the interest from its reserves will be used to support education within the state.

OSL Global Launches Gold Stablecoin PAXG and Three Other Trading Pairs

OSL Group's global exchange, OSL Global, has announced the official launch of the dollar trading pair for the gold stablecoin PAX Gold (PAXG). Users can participate in trading PAXG/USD, and the recharge and withdrawal functions for the Ethereum network have been opened.

At the same time, OSL Global has also launched three dollar trading pairs for Worldcoin (WLD), Pump.Fun (PUMP), and Curve Dao Token (CRV). Users can participate in trading WLD/USD, PUMP/USD, and CRV/USD, with WLD and CRV having opened recharge and withdrawal functions on the Ethereum network, while PUMP's recharge and withdrawal can be completed via the Solana network.

Morgan Stanley Plans to Launch Digital Wallet This Year to Support Tokenized Assets

According to market news, Morgan Stanley plans to launch a digital wallet later this year to support tokenized assets.

RWA Trading Platform MSX Launches Spot and Contract Targets Across Multiple Tracks

According to official news, MSX has launched spot and contract trading for American aircraft carrier and strategic nuclear submarine manufacturer $HII.M, NASA technology and engineering solution provider $KBR.M, the largest independent oil and gas producer in the U.S. $COP.M, global oil service technology leader $SLB.M, as well as Vietnam ETF $VNM.M, Japan ETF $EWJ.M, and Korea ETF $EWY.M.

Insights Highlights

According to DL News, BlackRock pointed out in its "2026 Global Market Outlook" that stablecoins will challenge governments' control over fiat currencies. With the surge in stablecoin adoption, there is a risk of shrinking usage of fiat currencies in emerging market countries. Samara Cohen, BlackRock's global market development head, stated, "Stablecoins are no longer niche products; they are becoming a bridge between traditional finance and digital liquidity."

It is reported that Standard Chartered Bank in the UK warned in October that the proliferation of stablecoins could lead to a loss of over $1 trillion in deposits from emerging market bank accounts. Similar challenges also exist in the U.S. banking sector. The landmark stablecoin legislation, the "Genius Act," which took effect in July this year, allows crypto companies to offer yield-like products that traditional banks are prohibited from providing, posing a threat to traditional financial institutions.

Moody's 2026 Outlook: Stablecoins Will Become Core Market Infrastructure

According to Cointelegraph, Moody's latest cross-industry outlook report indicates that stablecoins are transitioning from crypto-native tools to core market infrastructure for institutions. The report released on Monday shows that, according to industry estimates of on-chain transactions (not merely interbank fund flows), stablecoin settlement volume is expected to grow by approximately 87% in 2025 compared to the previous year, reaching around $9 trillion. Moody's believes that fiat-collateralized stablecoins and tokenized deposits are becoming "digital cash" used for liquidity management, collateral transfer, and settlement in an increasingly tokenized financial system.

Moody's places stablecoins alongside tokenized bonds, funds, and credit products, viewing them as part of the integration of traditional and digital finance. By 2025, banks, asset management companies, and market infrastructure providers are expected to launch blockchain settlement networks, tokenization platforms, and digital custody pilots to streamline issuance, post-trade processes, and intraday liquidity management. As enterprises build large-scale tokenized and programmable settlement infrastructures, the report estimates that these initiatives will attract over $300 billion in investments in the digital finance and infrastructure sectors by 2030. In this landscape, stablecoins and tokenized deposits are increasingly becoming settlement assets for cross-border payments, repos, and collateral transfers. Moody's emphasizes that for stablecoins to become reliable institutional settlement assets rather than a new source of systemic fragility, security, interoperability, and clarity in governance and regulation are equally important.

PANews Overview: Due to hyperinflation, the national currency, the bolívar, has lost credibility, and USDT (the dollar stablecoin) has become the default "hard currency" in daily life, used for shopping, payments, and even 80% of oil sales settlements. At the same time, to evade U.S. sanctions, rumors suggest that the government is secretly converting gold and oil revenues into Bitcoin, potentially accumulating a Bitcoin "shadow reserve" worth hundreds of billions of dollars. This case starkly illustrates the dual role of cryptocurrency: for the public, it serves as a hedge and medium of exchange for survival; for sanctioned countries, it may become a secret weapon to bypass traditional financial blockades and store national wealth, indicating a new global financial game is unfolding.

PAnews Overview: The stablecoin market is expected to experience explosive growth in 2026, driven by large-scale deployments from technology and AI companies, clear regulatory legislation in the U.S. (the "Genius Act"), and the trend of "on-chaining" financial assets promoted by Wall Street. In this wave, the compliant stablecoin USD1 issued by World Liberty Financial (WLFI) will be the biggest beneficiary, as it possesses strong compliance (in line with the new U.S. legislation), transparent and reliable reserve custody, and backing from a strong background. It is expected to rapidly expand from the crypto market to traditional finance, internet payments, and offline scenarios, with the ultimate goal of building a panoramic financial ecosystem serving global users.

Mankiw Research | Is the Optimal Compliance Solution for Global RWA Actually in Dubai?

PAnews Overview: In the global RWA (Real World Asset Tokenization) field, traditional financial centers (such as the U.S., Singapore, Hong Kong, and the EU) face challenges as most income-generating RWA projects are classified as "securities," limiting them to professional investors and resulting in poor liquidity and high compliance costs. However, Dubai, with its VARA (Virtual Assets Regulatory Authority) framework, offers a unique "optimal solution": it does not have lenient regulations but innovatively treats RWAs as a separate category of "virtual assets" for regulation, rather than forcibly applying traditional securities laws. This allows eligible RWA projects to legally target retail investors, conduct public offerings, and list on compliant exchanges, thereby truly achieving asset liquidity and commercialization. As a result, Dubai is becoming a key hub for attracting global RWA projects, with its core value lying in providing a new regulatory paradigm that supports public offerings and global operations for RWAs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。