Looking Ahead to 2026: A Review of 2025's Report Card

Author: Ignas

Translation: Baihua Blockchain

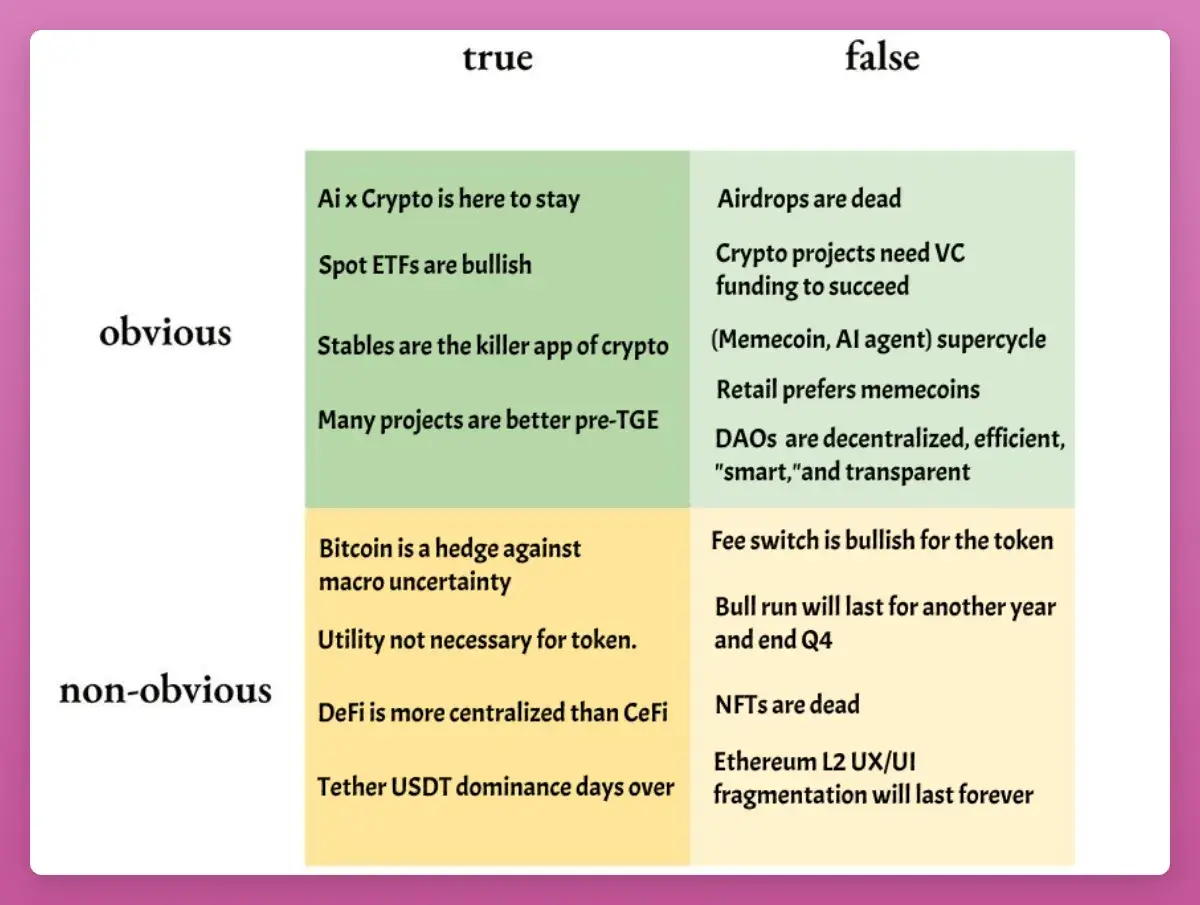

A year ago, I wrote "The Truth and Lies of the Crypto Market in 2025."

At that time, everyone was sharing higher Bitcoin price targets. I wanted to find a different framework to discover where the public might be wrong and make differentiated layouts. The goal was simple: to find ideas that already existed but were ignored, disliked, or misunderstood.

Before sharing the 2026 version, here’s a clear review of what truly mattered in 2025. What did we get right, what did we get wrong, and what should we learn from it? If you don’t examine your own thinking, you’re not investing; you’re just guessing.

Quick Summary

“BTC peaked in the fourth quarter”: Most people anticipated this, but it seemed too good to be true. As a result, they were right, and I was wrong (and paid the price for it). Unless BTC skyrockets from now on and breaks the 4-year cycle pattern, I concede this round.

“Retail investors prefer memecoins”: The fact is retail investors do not prefer cryptocurrencies at all. They bought gold, silver, AI stocks, and anything that isn’t cryptocurrency. The super cycle of memecoins or AI agents also did not materialize.

“AI x Crypto remains strong”: Mixed results. Projects continued to deliver, the x402 standard kept evolving, and funding continued. But tokens failed to maintain any upward momentum.

“NFTs are dead”: Yes.

These are easy to review. The real insights lie in the following five larger themes.

1. Spot ETFs are a floor, not a ceiling

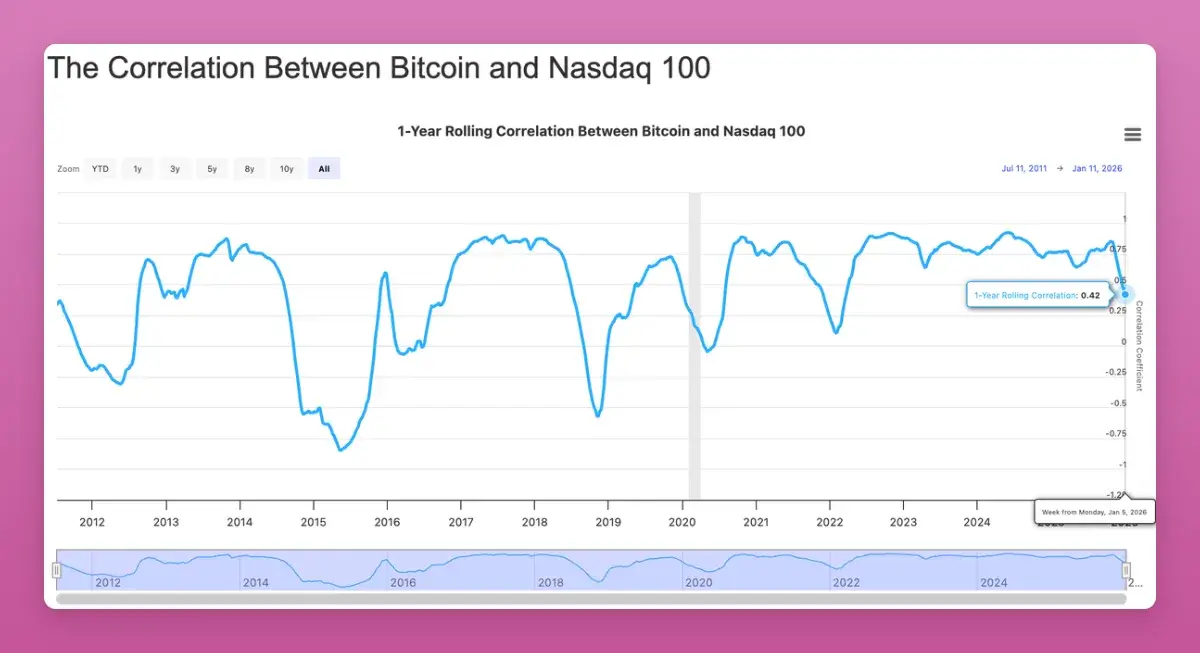

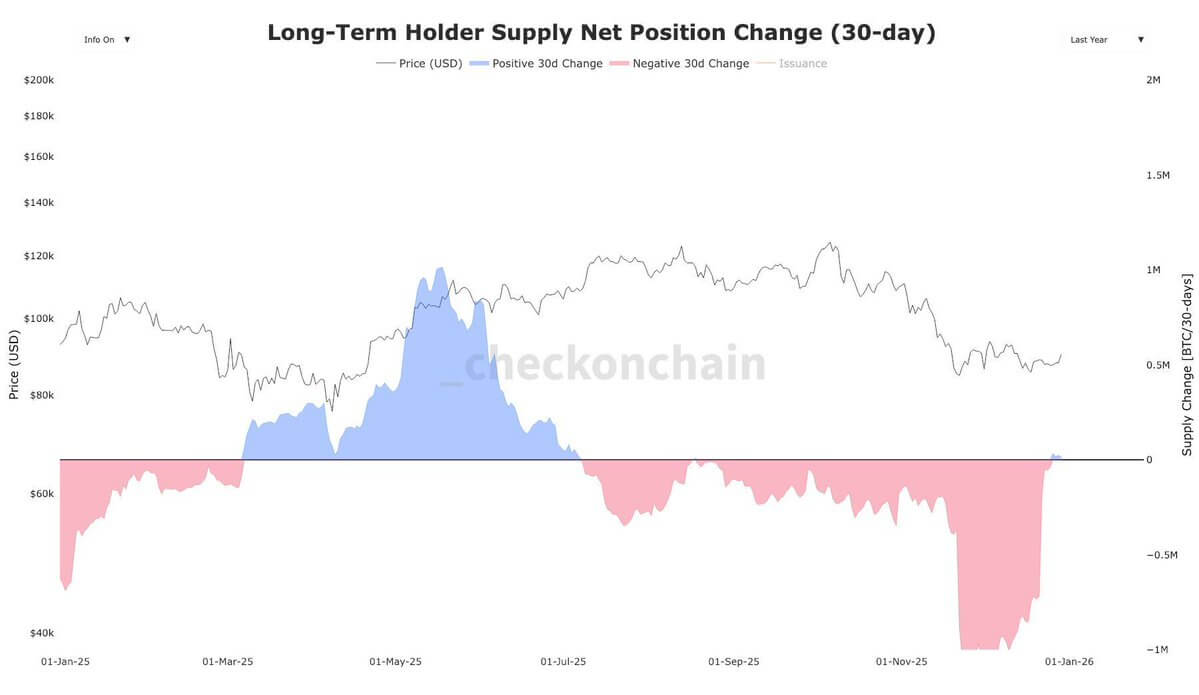

Since March 2024, Bitcoin long-term holders (OGs) have sold about 1.4 million BTC, worth approximately $12.117 billion.

Imagine how bloody the crypto market would be without ETFs: despite the price drop, the inflow of funds into BTC ETFs remained positive ($26.9 billion).

The approximately $95 billion gap is precisely why BTC has underperformed compared to almost all macro assets. There’s nothing wrong with BTC itself; it doesn’t even require delving into unemployment rates or manufacturing data to explain—this is simply the “great rotation” of large holders and 4-year cycle believers.

More importantly, the correlation between Bitcoin and traditional risk assets like the Nasdaq has dropped to its lowest since 2022 (-0.42). While everyone hopes for a breakout in correlation, in the long run, as a non-correlated investment asset sought by institutions, this is bullish.

There are signs that the supply shock has ended. Therefore, I dare to predict the BTC price in 2026 will be $174,000 (equivalent to 10% of gold's market cap).

2. Airdrops clearly have “not” disappeared

The crypto community (CT) again claimed that airdrops are dead. But in 2025, we saw nearly $4.5 billion in large airdrop distributions:

Story Protocol (IP): ~$1.4B

Berachain (BERA): ~$1.17B

Jupiter (JUP): ~$7.91M

Animecoin (ANIME): ~$7.11M

The change is: fatigue from points, stronger witch detection, and downward valuation. You still need to “claim and sell” to maximize profits.

2026 will be a big year for airdrops, with heavyweight players like Polymarket, Metamask, and Base (?) preparing to issue tokens. This is not a year to stop clicking buttons, but rather a year to stop blind betting. Airdrop “farming” requires focused heavy betting.

3. Fee Switch is not the engine for price increases, but a floor

My prediction is: the fee switch will not automatically drive up token prices. Most protocols generate insufficient revenue to support their massive market caps.

“The fee switch does not affect how high a token can rise, but rather sets a ‘floor price’.”

Observe the projects ranked by “holder income” on DeFillama: except for $HYPE, all high-income sharing tokens have outperformed ETH (although ETH is now the benchmark everyone is trying to challenge).

Surprisingly, $UNI. Uniswap finally flipped the switch and even burned $100 million worth of tokens. UNI initially surged 75%, but then reversed all its gains.

Three insights:

Token buybacks set a price floor, not a ceiling.

This cycle is all about trading (refer to UNI's surge and subsequent drop).

Buybacks are just one side of the story; you must consider selling pressure (unlocking), as most tokens remain in low circulation.

4. Stablecoins occupy the mind, but “proxy trading” is hard to profit from

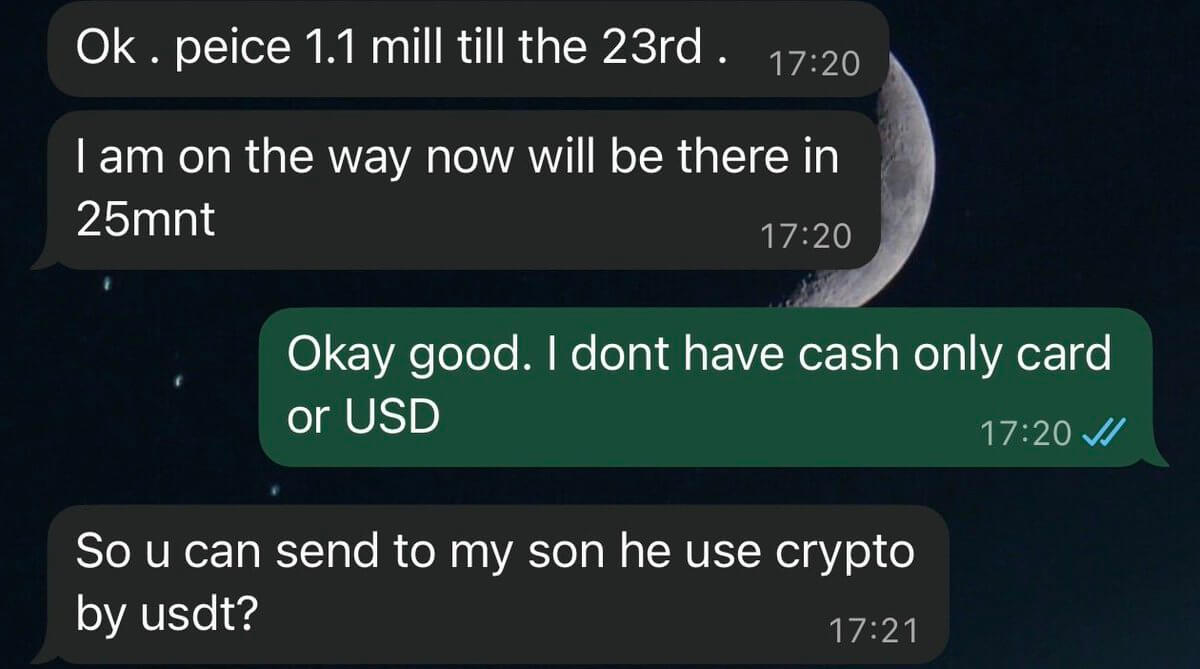

Stablecoins are entering the mainstream. When I rented a motorcycle in Bali, the vendor even requested payment in USDT on TRON.

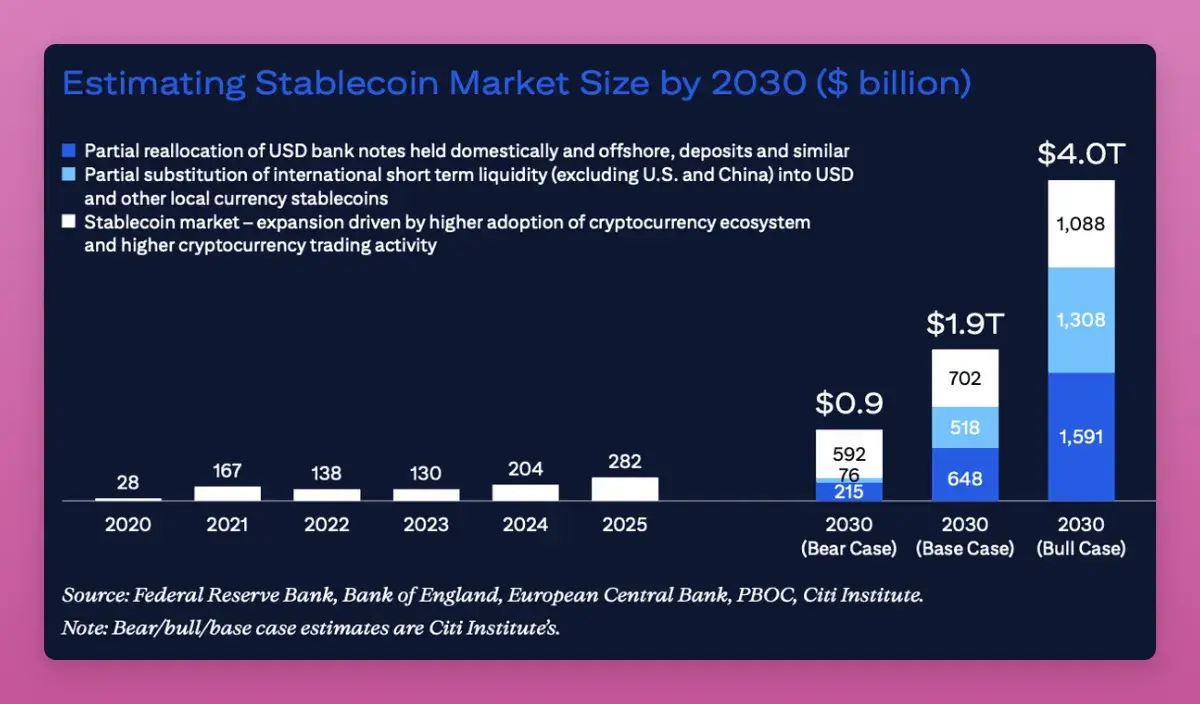

Although USDT's dominance has dropped from 67% to 60%, its market cap is still growing. Citibank predicts that the market cap of stablecoins could reach $1.9 trillion to $4 trillion by 2030.

In 2025, the narrative shifted from “trading” to “payment infrastructure.” However, trading stablecoins is not easy: Circle's IPO experienced a surge but then reversed all its gains, and other proxy assets also performed poorly.

One truth of 2025 is: everything is just trading.

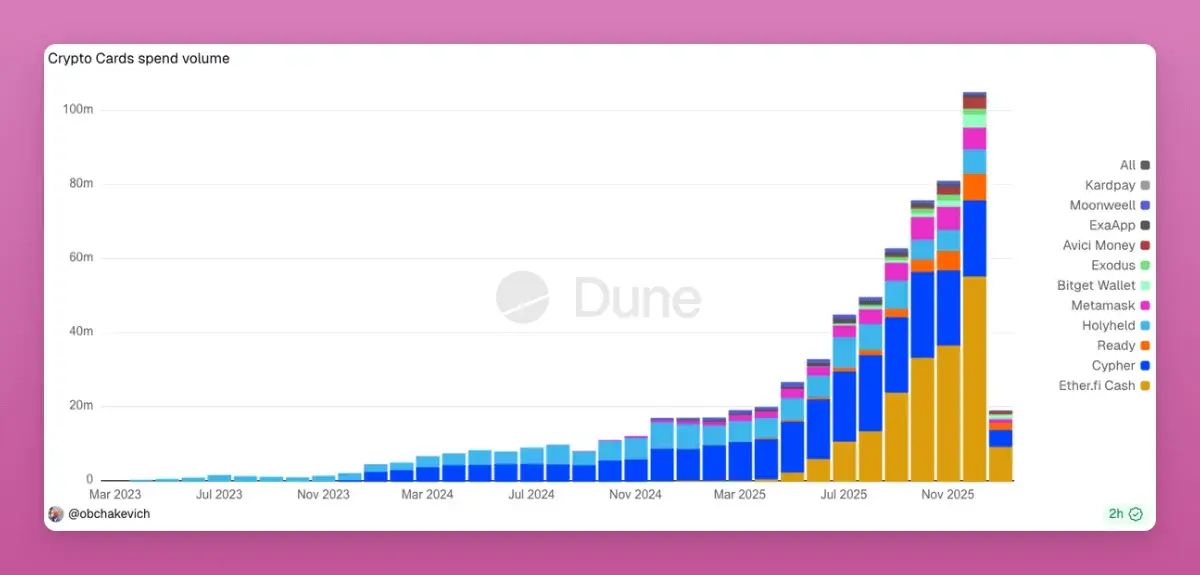

Currently, crypto payment cards have exploded due to their convenience in circumventing strict AML requirements from banks. Every swipe of the card is a transaction on-chain. If direct peer-to-peer payments that bypass Visa/Mastercard can emerge in 2026, it will be a thousandfold opportunity.

5. DeFi is more centralized than CeFi

This is a bold statement: DeFi's business and TVL concentration are higher than traditional finance (CeFi).

Aave holds over 60% of the borrowing market share (in contrast, JPMorgan only holds 12% in the U.S.).

L2 protocols are mostly unregulated multisigs worth billions.

Chainlink almost controls all value predictions in DeFi.

In 2025, the conflict between “centralized equity holders” and “token holders/DAOs” became apparent. Who truly owns the protocol, IP rights, and revenue streams? Aave's internal disputes show that token holders have fewer rights than we imagine.

If “labs” ultimately win, many DAO tokens will become non-investable. 2026 will be a key year for aligning equity with token holder interests.

Conclusion

2025 proved one thing: everything is trading. The exit window is extremely short. No token possesses long-term conviction.

The result is that 2025 marks the death of the HODL culture, DeFi has transformed into on-chain finance, and with the improvement of regulations, DAOs are shedding the disguise of “pseudo-decentralization.”

Article link: https://www.hellobtc.com/kp/du/01/6191.html

Source: https://www.ignasdefi.com/p/crypto-truths-and-lies-lessons-from

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。