On the evening of January 9th at 21:30 in the UTC+8 time zone, the U.S. Department of Labor will release the non-farm employment report for December 2025. The market expects a moderate increase in new jobs, with the unemployment rate slightly falling to 4.5%.

This is the first report considered a return to normalcy after the U.S. government ended its longest shutdown in history. A Goldman Sachs team previously analyzed that the unemployment rate jumped to 4.6% in November, "mainly due to the impact of federal employees being forced to take leave during the government shutdown."

However, this delayed report is unlikely to resolve investors' confusion. Federal Reserve Chairman Jerome Powell admitted last December that official employment data may have "serious systemic overestimations," and the actual situation may have fallen into negative growth.

01 Data Review

● According to delayed data released on December 16th last year, the U.S. non-farm employment increased by 64,000 in November 2025, exceeding the market's general expectation of 45,000.

● However, the unemployment rate rose from 4.4% in September to 4.6% in November, higher than the expected 4.5%. This seemingly contradictory combination of "job growth and rising unemployment" reflects the complexity of a cooling labor market.

● Notably, the October data was significantly revised down by 105,000, marking the largest decline since the end of 2020. The sharp fluctuations in this report indicate that the market is undergoing some structural transformation.

02 Market Expectations

In December 2025, analysts have a cautious consensus on the employment market forecast. The market generally expects about 60,000 new jobs for the month, down from 64,000 in November; the unemployment rate is expected to fall from 4.6% to 4.5%.

● Other leading indicators provide mixed signals: The ADP report showed that the private sector added 41,000 jobs last month; the service sector employment index returned to the expansion zone for the first time in seven months.

This expectation is based on the gradual fading of the government shutdown's impact. However, market analysts point out that seasonal hiring distortions and statistical difficulties will persist, making the interpretation of tonight's data challenging.

03 Interpretation Challenges

Even if the data itself is labeled as "normal," the path to interpretation is fraught with thorns, primarily due to four core challenges, any of which could lead the market to entirely different conclusions.

● First, the statistical aftershocks of the government shutdown are the biggest source of interference.

○ The weeks-long shutdown not only directly affected the employment status of millions of federal employees but also severely disrupted the Bureau of Labor Statistics (BLS) regular data collection process.

○ The decline in survey response rates and fluctuations in data quality have lagging effects that may continue to ferment in the coming months, leading to initial data being more unstable than usual, with larger revisions possible. Therefore, the risk of over-interpreting single-month data is extremely high.

● Second, the reliability of the data itself has been questioned by authorities.

○ Federal Reserve Chairman Powell notably pointed out after the December meeting that there are "significant discrepancies" between survey data from businesses and households, suggesting that non-farm data based on business surveys may systematically overestimate job growth, while household surveys (used to calculate the unemployment rate) may show a weaker situation.

○ This skepticism from the top of policy-making undoubtedly casts a shadow of trust over tonight's report, forcing the market to scrutinize every number with greater caution, even skepticism.

● Furthermore, the structural differentiation within the labor market complicates judgment.

○ The phenomenon observed by T. Rowe Price's chief economist, Bleryna Uluch, where "small businesses are laying off while large enterprises continue to expand," is particularly critical. This differentiation may stem from varying financing capabilities in a high-interest-rate environment and differing resilience to future trade policy uncertainties.

○ Small businesses are the backbone of U.S. employment, and their willingness to hire is a micro thermometer for measuring the endogenous momentum and confidence of the economy. If new jobs continue to be driven by a few large companies, their broadness and sustainability will be called into question.

● Finally, seasonal distortions peak in December.

○ The year-end holiday season typically brings a surge of short-term hiring in industries such as retail, logistics, and dining. However, in the uncertain economic outlook of 2025, companies may have altered their hiring strategies, concentrating seasonal recruitment more heavily in December.

○ This surge in short-term jobs may temporarily inflate total employment numbers but offers limited help in assessing medium- to long-term employment trends and may even be misleading. Investors must peel back this seasonal layer to observe more core changes in full-time employment and wages.

04 Federal Reserve Position

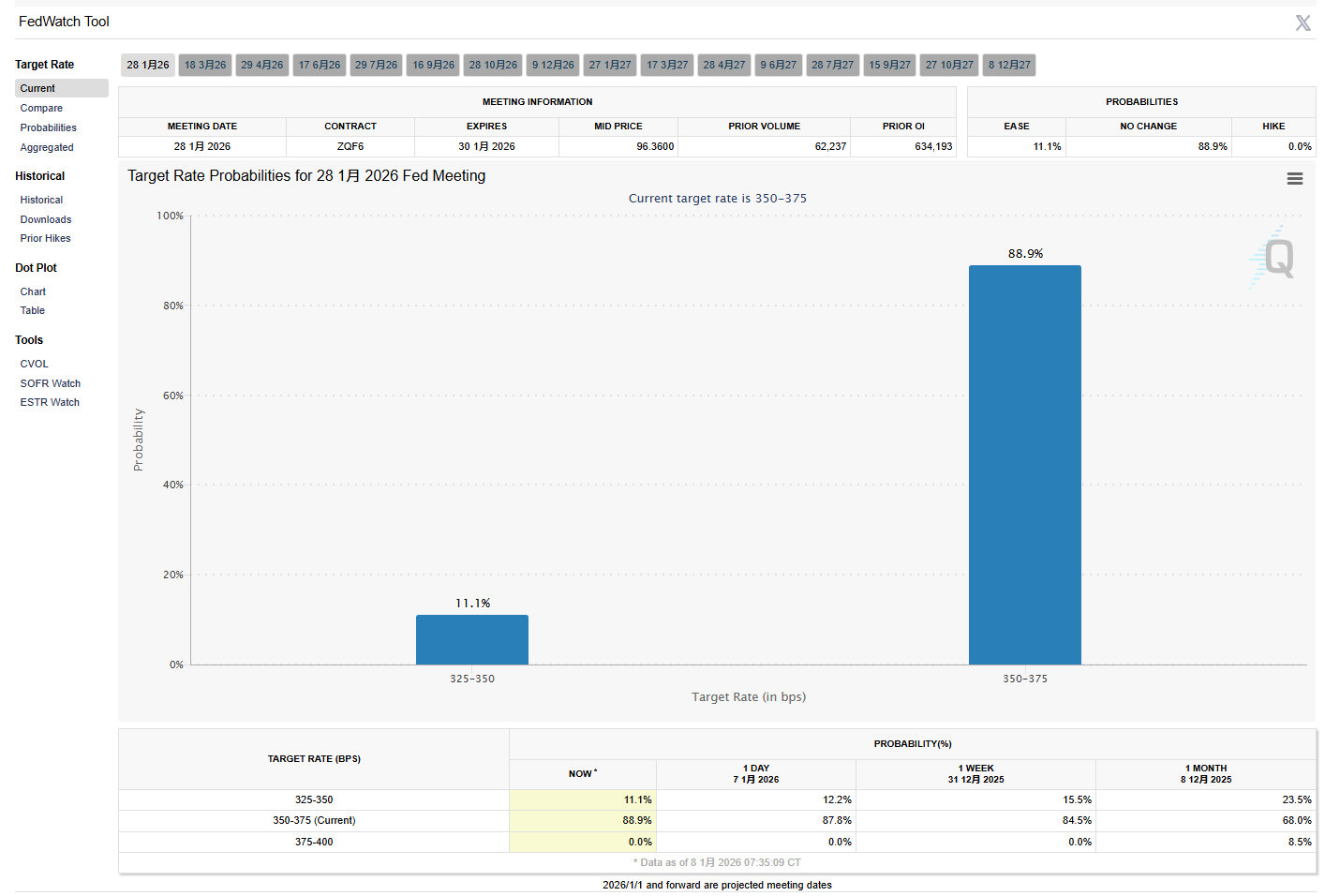

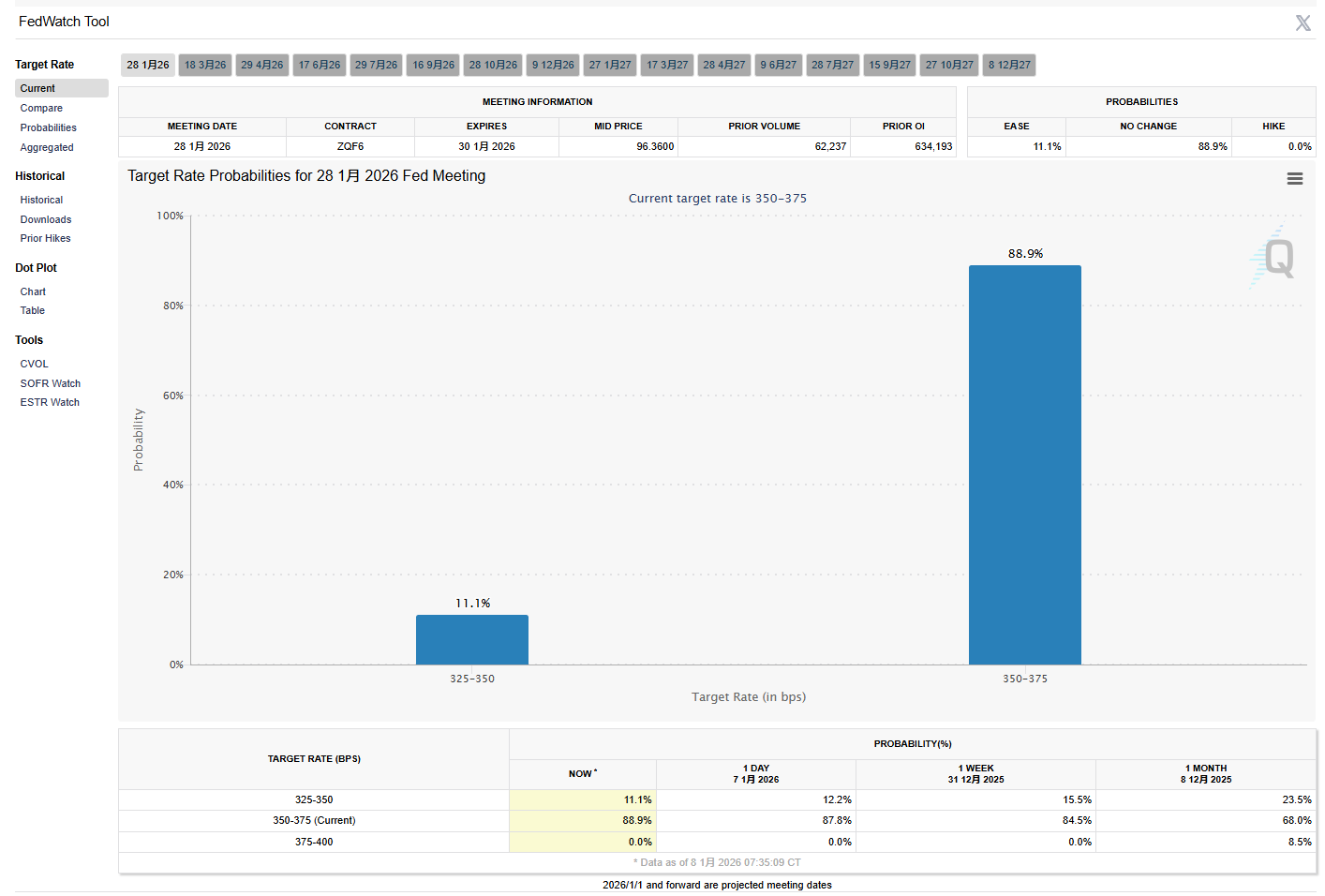

● The latest analysis from J.P. Morgan Asset Management indicates that the Federal Reserve implemented a "hawkish" rate cut in December last year, lowering the federal funds rate by 25 basis points to a range of 3.50%-3.75%.

● Internal divisions within the Federal Reserve have reached the most significant level in nearly a decade. The June dot plot shows that officials' predictions for the 2025 federal funds rate are highly polarized, with a gap of 50 basis points between the most common and the second most common predictions.

● The interpretation of tonight's data will directly influence market expectations for the Federal Reserve's next actions. According to the CME FedWatch tool, nearly 90% of traders believe the Federal Reserve will maintain the current interest rate range in January, while about 11% bet on a 25 basis point rate cut.

05 Market Reaction Logic

● The current market exhibits a typical "bad news is good news" trading logic. Morgan Stanley strategist Michael Wilson stated, "We are now clearly back to the situation where 'good news is bad news/bad news is good news.'"

● This logic means that a weak employment report, while indicating economic weakness, may increase the probability of a Federal Reserve rate cut, thereby supporting the stock market and U.S. Treasuries.

Market traders continue to bet that the Federal Reserve will cut rates twice in 2026. Meanwhile, the yield on the two-year Treasury, sensitive to policy changes, has recently fallen to 3.512%, and the yield on the ten-year Treasury has dropped to 4.159%.

06 2026 Policy Outlook

The Federal Reserve's policy path in 2026 is expected to exhibit characteristics of "moderate easing in the first half, followed by divergence with the change in administration in the second half." This judgment is based on multiple factors related to current economic trends and the policy environment.

● Li Chong, co-chief macro analyst at CITIC Securities, pointed out that Federal Reserve Chairman Powell repeatedly stated in the December meeting that the current "policy rate is in a good position to observe changes in the economic situation," and clearly indicated that no FOMC member views rate hikes as the baseline scenario.

● As Powell's term ends in the first half of 2026, the selection of the new chairman will become a key variable. Among the current candidates, Federal Reserve Governor Waller and White House Council of Economic Advisers Chair Hassett are the two most likely alternatives, and their differing stances will dominate the subsequent policy path.

● The latest forecast from Citigroup strategists indicates that by the end of 2026, the S&P 500 index could rise by 12% to 7,700 points, with the core support for this forecast being robust corporate earnings growth and expectations of monetary policy easing.

Tonight's report has been long awaited by the market. Bond traders are adjusting their positions, stock market investors are reassessing their holdings, and the foreign exchange market is holding its breath for the next direction of the dollar index.

Beneath the surface fluctuations of non-farm data, the real contest unfolds on a deeper level. Investors are no longer solely focused on the numbers themselves but are paying closer attention to the Federal Reserve's reaction function behind the numbers—whether a 4.5% or 4.7% unemployment rate will become the watershed for policy.

If the unemployment rate falls to 4.5% or lower, it will provide a basis for maintaining the status quo; if it rises to 4.7% or higher, it indicates a deterioration in the labor market, potentially prompting a rate cut; 4.6% is at the dividing line.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。