全球指数编制巨头MSCI的一纸技术性冻结,让以比特币“永动机”模式著称的加密金库公司们,失去了一台核心的自动资金补给引擎。

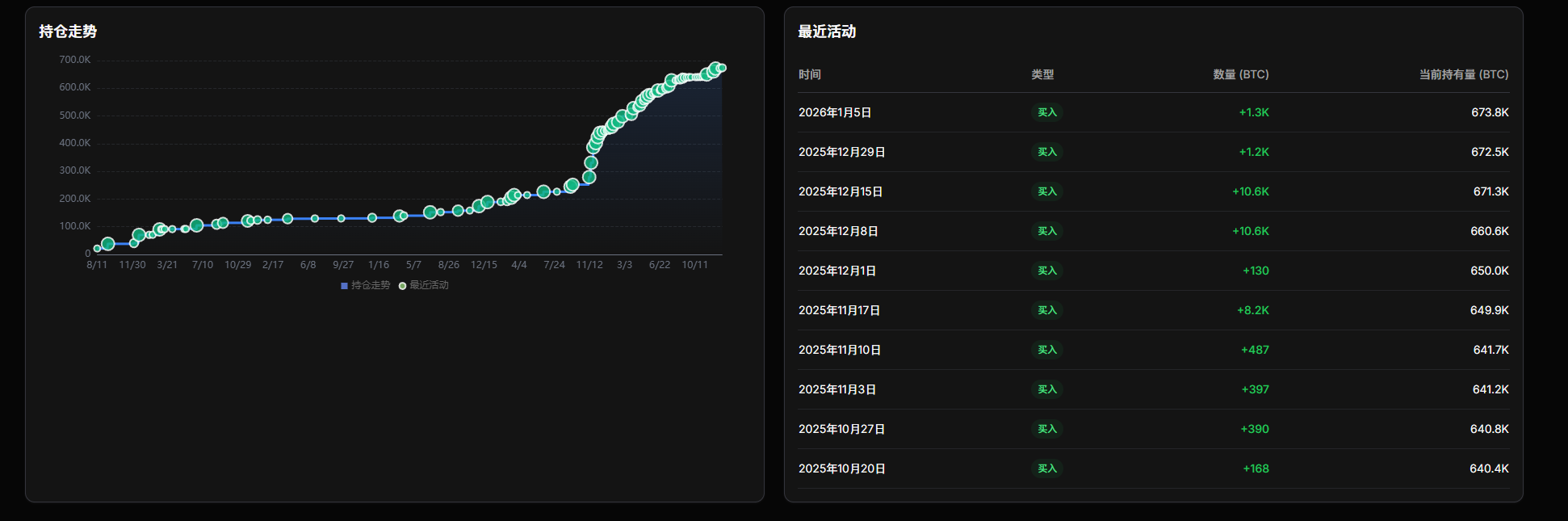

2026年1月8日,全球指数编制巨头MSCI宣布,在2月的季度评估中,将保留“数字资产财库公司”在其全球指数中的位置。同时,对这些公司的流通股数量等技术参数实施冻结,这意味着未来这些公司增发股票,将不再能自动吸引追踪指数的被动资金买入。

消息公布后,代表公司Strategy股价应声大涨超6%。

01 指数博弈

● 这场博弈的源头可追溯至2025年10月,MSCI当时提议将数字资产持有量占总资产50%或以上的公司从其全球可投资市场指数中剔除。以Strategy(前身为MicroStrategy)为首的数字资产财库公司陷入被“踢出群聊”的危机。

● 这一提议立即遭到以Strategy为代表的行业强烈反对。Strategy在致MSCI的公开信中尖锐质疑:石油巨头、房地产投资信托等企业同样高度集中持有单一类别资产,却未被特殊对待,仅针对数字资产企业设限涉嫌双重标准。

● 反对的声音击中了提案的软肋。数字资产价格的剧烈波动可能导致企业因资产价值变动而反复进出指数,加之会计准则差异,实际操作将困难重重。

02 平衡之策

面对反对声浪和现实的复杂性,MSCI最终选择了中间路线。它宣布将暂缓执行剔除提案,但同时对这类公司实施一系列技术性限制。

● 根据公告,MSCI将不会对这些证券实施基于“流通股数”、“外资纳入因子”或“国内纳入因子”增加的调整。同时,还将暂缓所有此类公司的“规模分段迁移”,并暂时不再接纳新的此类公司进入指数。

● 这意味着即便这些公司市值增长达到大盘股标准,也只能待在原来的位置,无法享受规模升级带来的权重提升。

03 核心机制

MSC这项冻结政策精准打击了数字资产财库公司,尤其是Strategy赖以扩张的核心资本运作模式——“无限资金循环”。

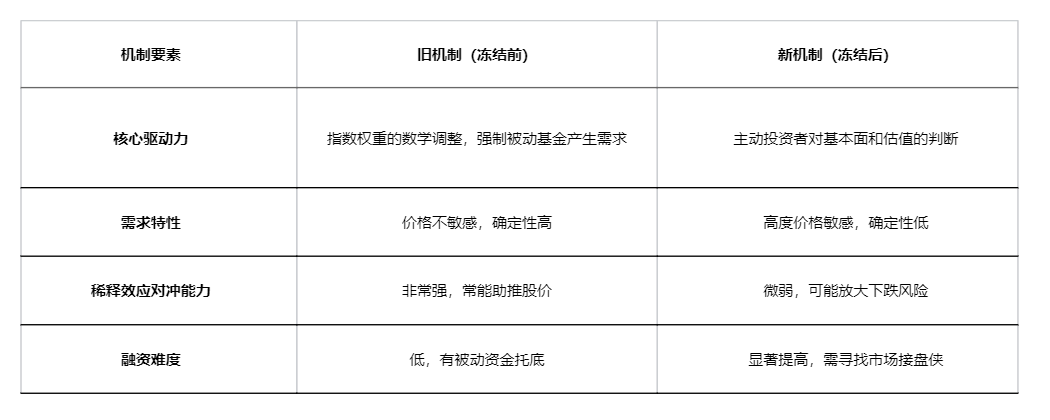

● 这一循环由三个关键环节构成。公司基于对加密货币的看好,通过资本市场增发股票或可转换债券筹集资金。增发通常导致股权稀释,理论上可能压制股价。

● 当流通股数量增加后,追踪MSCI等主流指数的被动基金,会被规则强制要求按比例增持,以匹配其在指数中应有的权重。这部分的买入需求是 “价格不敏感”的,为新股发行提供了确定性支撑。

● 股价的稳定或上涨使得公司下一次增发融资的成本降低。公司可以用更少的股份募集到更多资金,从而购买更多的加密货币,形成正向循环。

04 动力切换

● MSCI的冻结决策,精准切断了这个循环最核心的齿轮。即便Strategy未来再次大规模增发股票,MSCI在计算其指数权重时,将完全忽略新增的股份。

● 公司的指数权重被锁定,追踪指数的大规模被动资金也就没有义务去购买这些新发行的股票。

● 加密研究机构Bull Theory的模型量化了这一影响:假设一家数字资产财库公司增发2000万新股,在旧规则下,指数再平衡将迫使被动基金购买其中的10%。假设每股300美元,就意味着一笔高达6亿美元的、确定性的购买力。

而在新规下,这6亿美元的“机械买盘”将直接归零。Strategy等公司现在必须完全转向主动投资者,依赖他们对公司基本面的认可来筹集资金。

下表清晰展示了新旧机制的差异:

05 对手盘崛起

随着“自动买盘”的消失,市场结构正在发生深远变化,新的竞争者开始填补流动性缺口。

● 21 Capital等新兴公司正试图模仿MicroStrategy的模式,但他们更强调投资的 “纯净性” ,以此在竞争中脱颖而出。与此同时,现货比特币ETF作为“沉默的赢家”地位得到巩固。

● 对于大型资产配置者而言,将资金从需要承担企业特定风险的单一公司股票,轮动到结构更简单、流动性更好、费用透明的现货比特币ETF,正成为一个更顺理成章的选择。

● 迈克尔·诺沃格拉茨,这位被誉为“加密货币超级多头”的Galaxy Digital创始人兼CEO在2025年8月曾指出,效仿Strategy公司模式的金库公司热潮可能已经见顶。

● 他认为,真正的下一波数字资产浪潮将是现实世界资产代币化,即将股票、债券等传统资产迁移到区块链上的RWA运动。

06 未来挑战

对于Strategy及其同类公司而言,未来的发展路径必须进行深刻调整。依赖持续大规模股权增发进行扩张的模式已经难以为继。

● 公司管理层的重心需要从高超的“金融工程”操作,转向更坚实的“企业基本面”建设。这包括打造可持续的非比特币相关营收业务、改善公司治理、向股东提供更透明的财务沟通。

● Strategy需要探索债券、银行贷款等其他融资渠道,并真正说服主动型投资者,基于其内在价值而非指数套利机制来持有其股票。

● 加密金库公司的投资叙事可能需要从“比特币的高杠杆Beta工具”,向“精通比特币资产管理的卓越运营公司”转变。这意味着它们的价值将更多取决于对加密货币的主动管理能力,而不仅仅是资产负债表上比特币的绝对数量。

一位行业观察者将微策略模式的终结比作“印钞机卡壳”。这家公司曾通过精巧的资本运作,使其股票增发如同印钞,总有指数基金作为最终买家。

如今这台印钞机被MSCI的技术性调整卡住,微策略的股价虽然暂时避免了被动抛售的悬崖,但前方是必须依靠真实盈利能力和商业模式说服市场的漫漫长路。

华尔街的会议室里,分析师们正在重新计算数字资产公司的估值模型。那个简单的“比特币持有量×股价”公式旁,新增了“主动投资者接纳度”和“可持续融资能力”等复杂变量。

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:https://t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

OKX 福利群:https://aicoin.com/link/chat?cid=l61eM4owQ

币安福利群:https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。